#1 of the Top 9 Valuation Mistakes: Overly Optimistic Revenue Forecasts

During my career, I built highly complex and detailed financial models early on as an analyst, but I later realized that the increased complexity surrounding such models rarely translates into increased accuracy. This series of articles is somewhat inspired by that revelation: I’m going to expand on the Top 9 Valuation Mistakes and reveal how you can avoid them. This is the first blog of that series on overly optimistic revenue forecasts.

Here’s the full list of Top 9 Mistakes.

The Top 9 Valuation Mistakes

- Overly optimistic revenue forecasts

- Underestimating expenses causing unrealistic profit forecasts

- Growing fixed assets slower than revenue

- Confusing growth with maintenance Capex

- Forecasting drastic changes in cash conversion cycle

- Underestimating working capital investment

- Valuing a stock using the calculated Beta

- Choosing an unreasonable cost of equity

- Not properly fading the return on invested capital

So, let’s get into it and talk about #1.

The #1 Valuation Mistake

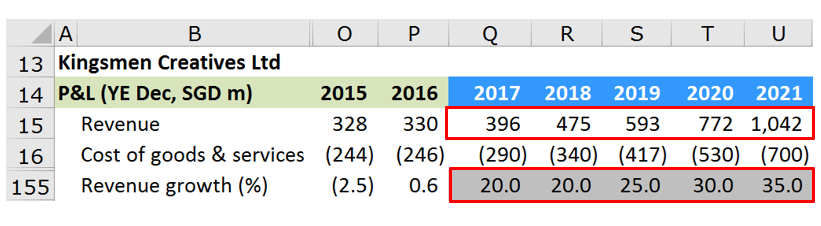

Analysts often make overly optimistic revenue growth forecasts. Below is a screenshot from my ValueModel for the company, Kingsmen Creatives Ltd. You can see that historically it had -2.5% revenue growth and then 0.6% revenue growth. The analysts have then forecasted growth of 20.0%, 20.0%, 25.0%, etc., which is significantly overly optimistic.

Fig. 1 Overly Optimistic Profit Forecasts

How Often Are Analysts Inaccurate with Their Forecasts?

To answer this, I’ll share my research which encompasses ‘How accurate are analysts’ revenue forecast in Asia?’ To be included in this research, the company had to have 10 years of actual data, and there must be at least 10 analysts covering the business. The result: 540 of the largest companies in Asia.

Here are the results of the research:

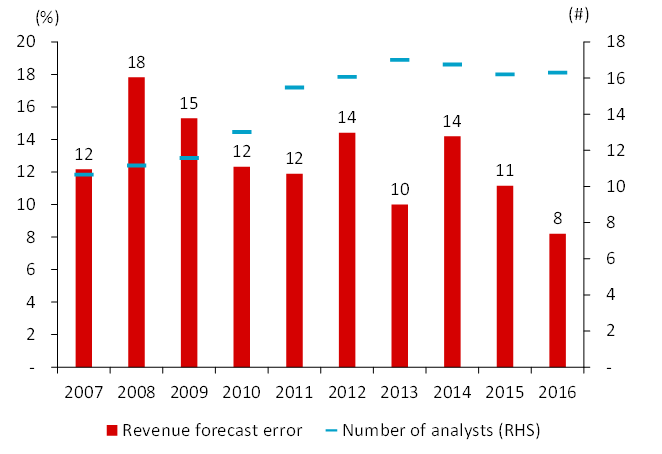

Fig. 2 Analysts Miss Revenue Forecasts by More Than 10%

The conclusion that we can see is that, on average, over the period, analysts were in error. This is absolute error, not above or below─just error. On average, it was about 10%.

What we can also see is that it seems like it’s getting more accurate as time goes on. But that can be deceiving. Usually, it gets more accurate when things are really stable; and then, things blow up. And when that happens, things are a mess.

I haven’t calculated the actual error from an above or below perspective. This is just absolute error. I would estimate, in this case, that analysts were about 15% overly optimistic in their revenue forecast. Consensus can’t predict revenue for cyclical sectors. It’s easier for non-cyclical sectors.

Why Does This Happen?

“The S&P 500 will gain 30% this year since it was up 20% last year and 10% the year before.” You’ve probably met somebody who has said something like this, and what you’re going to find is that they usually are suffering from recency bias. The problem with recency bias is that we can all suffer from it. So be careful.

Recency bias is when you believe that what has happened recently will continue to be the case in the future. You’ll stay in stocks because it’s a boom market even though you acknowledge the high valuation. But, when making decisions about the future, avoid using yesterday as your only reference point.

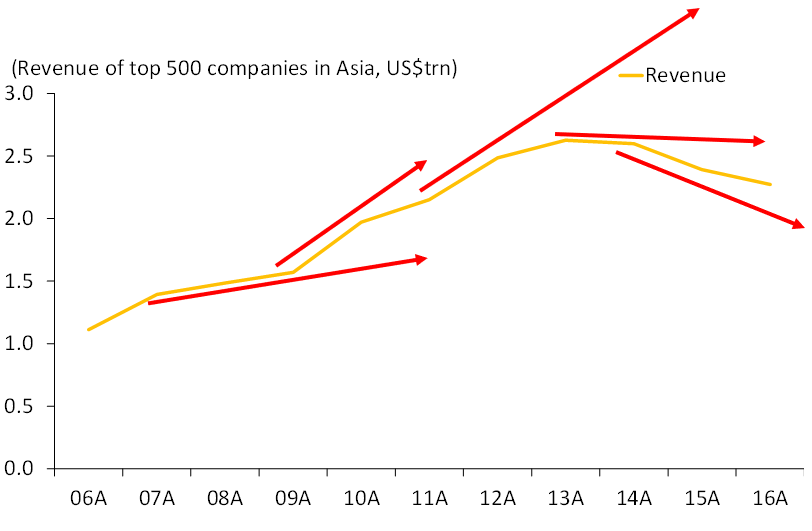

Check out the chart below:

Fig. 3 Revenue Growth – Why It’s Important

As the red arrows demonstrate, depending on when you begin to examine revenue growth would provide completely different forecasts of revenue growth. And if you get the revenue direction wrong, it’s impossible to get the rest of your forecast right.

How Do I Avoid Making Overly Optimistic Forecasts?

Revenue is the most important item in valuation because all businesses start with revenue. But a lot of revenue research needs to happen outside of the figures in front of you.

When I was an analyst, I just sat behind my computer most of the time. I didn’t get these things until I got older. And as you get older, you want to understand the factors that drive revenue growth; from marketing and sale efficiency to customer satisfaction levels and reorder rates. You can’t answer any of these questions from a spreadsheet, but they all impact revenue growth and the forecast you create for it. You’ve got to get out there and really look at the company.

Here are some critical example questions you’re going to want to ask when valuing a company:

- What are the constraints to sales growth?

- What’s the company’s growth plan?

- Is the company’s market share rising?

- Has the management team completed a thorough market analysis? How well do they understand the competitive landscape?

- Has the management team determined the attractiveness of markets and segments? What about size, trends, growth, and profitability?

- Does the brand clearly articulate what the company provides to the market?

The concepts behind these questions are what you need to ask to help you look in depth into a company. It’s not about the algorithms and calculations you’re using or even the complexity of the valuation framework you have. To make sure you don’t make the mistake of over-optimistic revenue forecast you need to do more research on the company you’re analyzing.

Conclusion

- If revenue forecast is wrong, the valuation will be wrong too.

- Understand a company’s marketing, branding, products and services, selling process, delivery, and after-sales service to understand its revenue growth potential.

- Curb your enthusiasm.

Check out the full video here:

In the next blog, I’ll be discussing how underestimating expenses causes unrealistic profit forecast. Check it out now!

The Valuation Master Class is an on-demand online course that trains attendees to become company valuation experts. Graduates can confidently value any company and possess the in-demand industry skills needed to succeed as investment bankers, asset managers, equity analysts, or value investors.

Click here to learn more about Valuation Master Class Foundation.

The Valuation Master Class Boot Camp presents the Valuation Master Class Foundation material in a 6-week guided online course format. Daily live sessions, teamwork, progress tracking, and the intensive nature help guide attendees to completion. The final company valuation project and presentation is tangible evidence of the attendee’s practical valuation experience and dedication to building a career in finance.