Is Mercedes-Benz’s Restructuring Enough to Close the Tech Gap with Tesla?

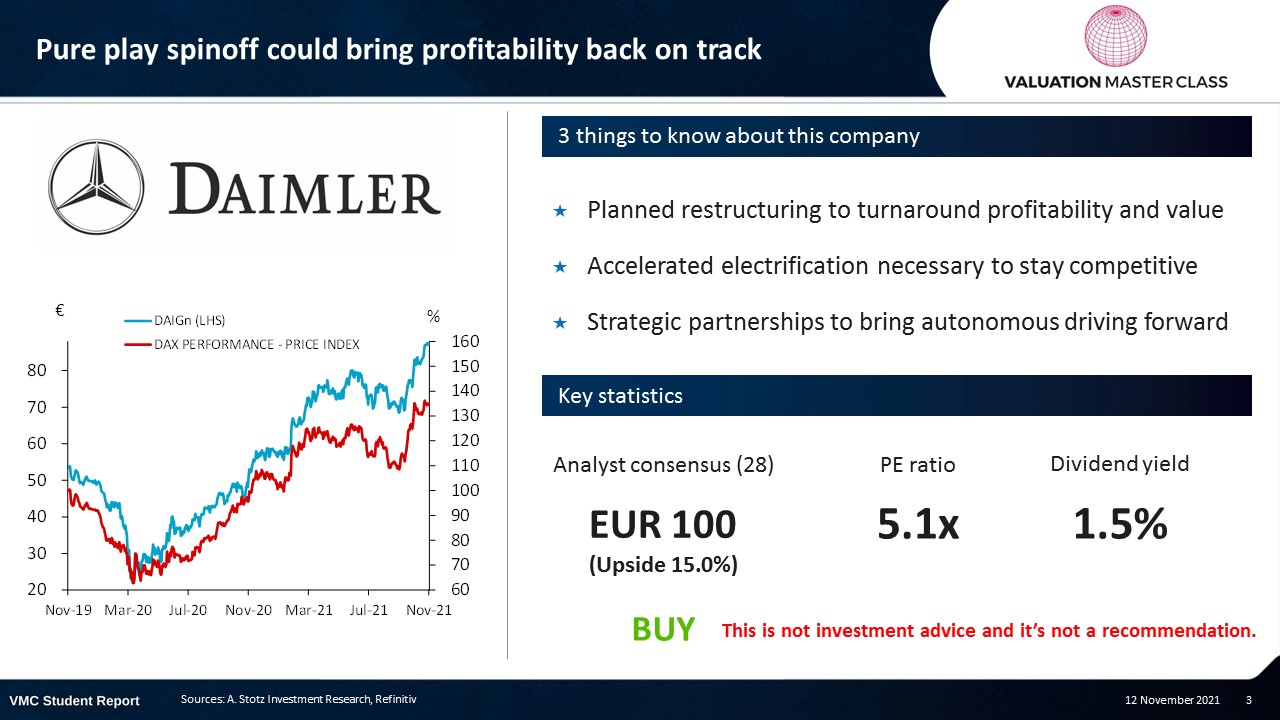

Pure play spinoff could bring profitability back on track

Highlights:

- Planned restructuring to turnaround profitability and value

- Accelerated electrification is necessary to stay competitive

- Strategic partnerships to bring autonomous driving forward

Download the full report as a PDF

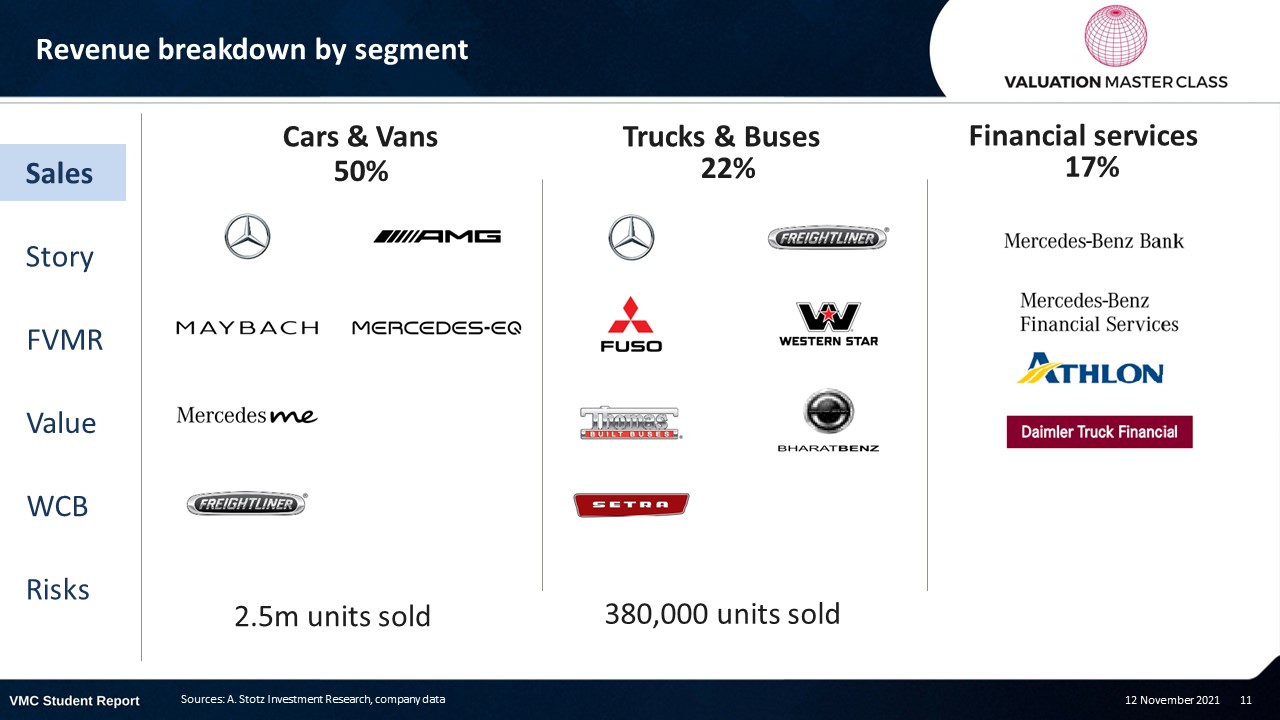

Daimler’s revenue breakdown by segment

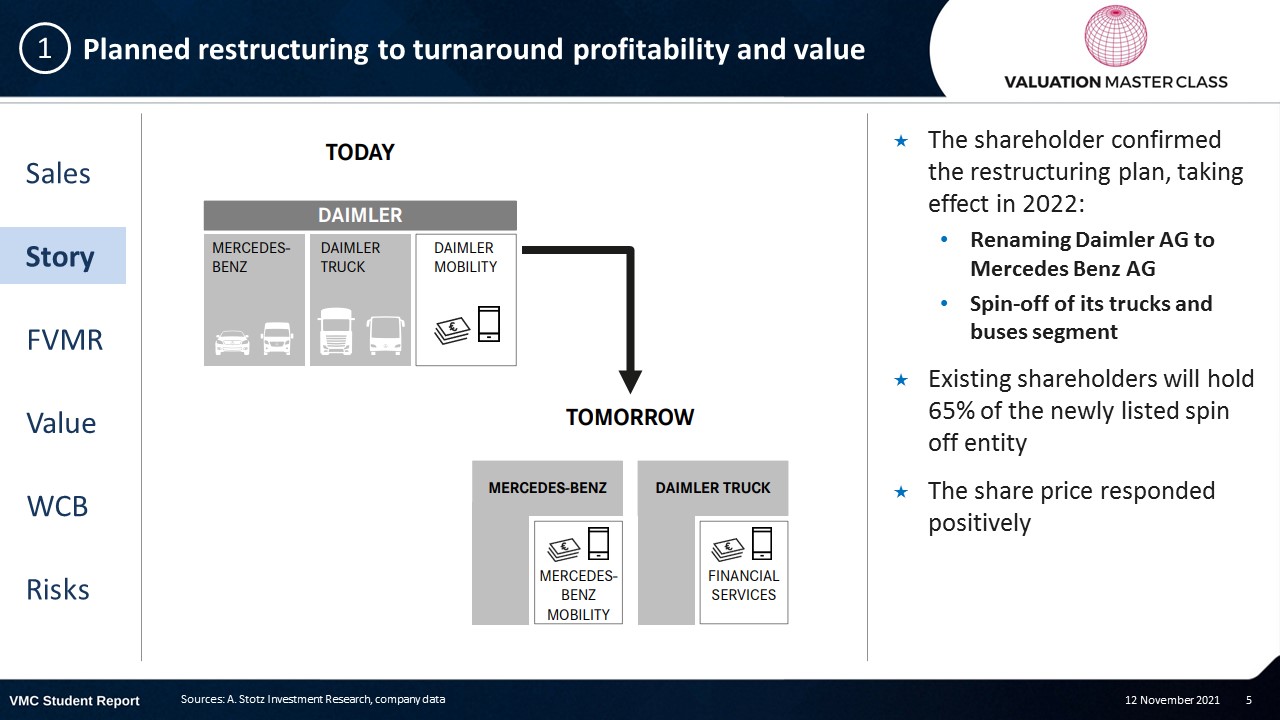

Planned restructuring to turnaround profitability and value

- The shareholder confirmed the restructuring plan, taking effect in 2022:

- Renaming Daimler AG to Mercedes Benz AG

- Spin-off of its trucks and buses segment

- Existing shareholders will hold 65% of the newly listed spin-off entity

- The share price responded positively

What is an equity spinoff?

- In an equity spinoff, a company decides to create a new listed entity out of its existing operating business

- The newly created shares are distributed to the existing shareholders (unlike in a carve-out where the company sells its share in an IPO and raises new capital)

- The idea is that two independent companies are worth more than the single entity

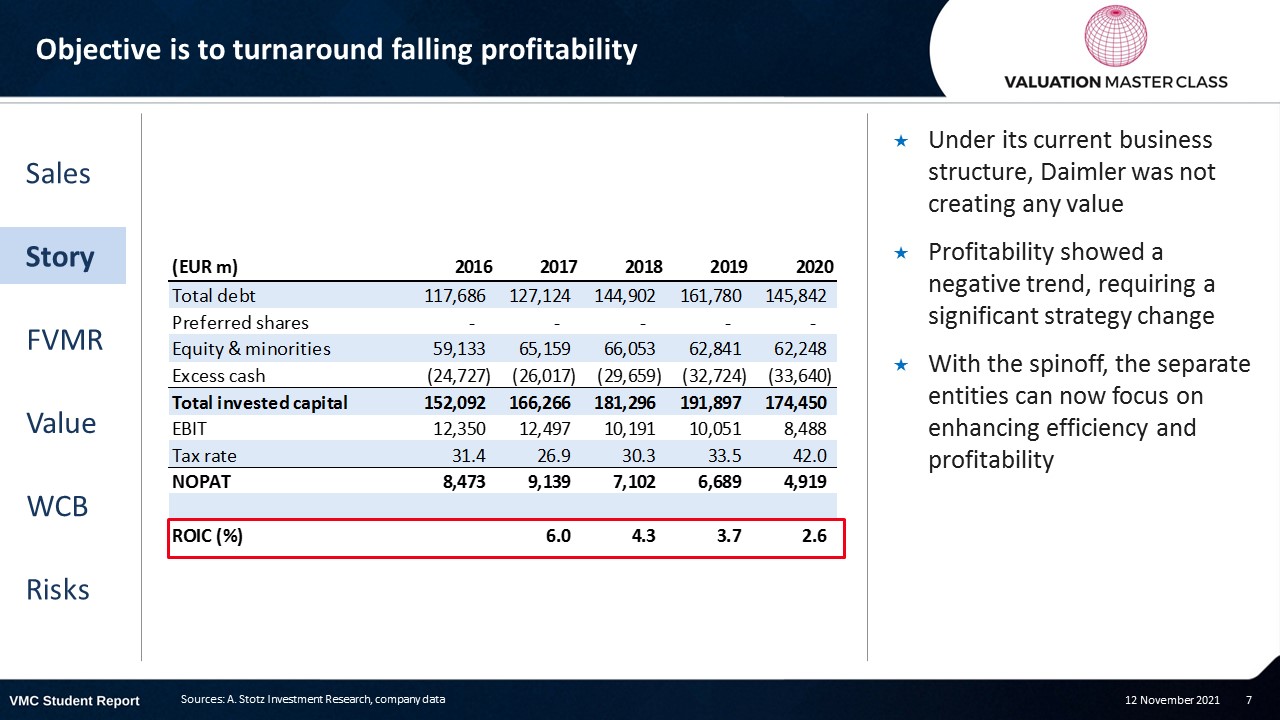

The objective is to turn around falling profitability

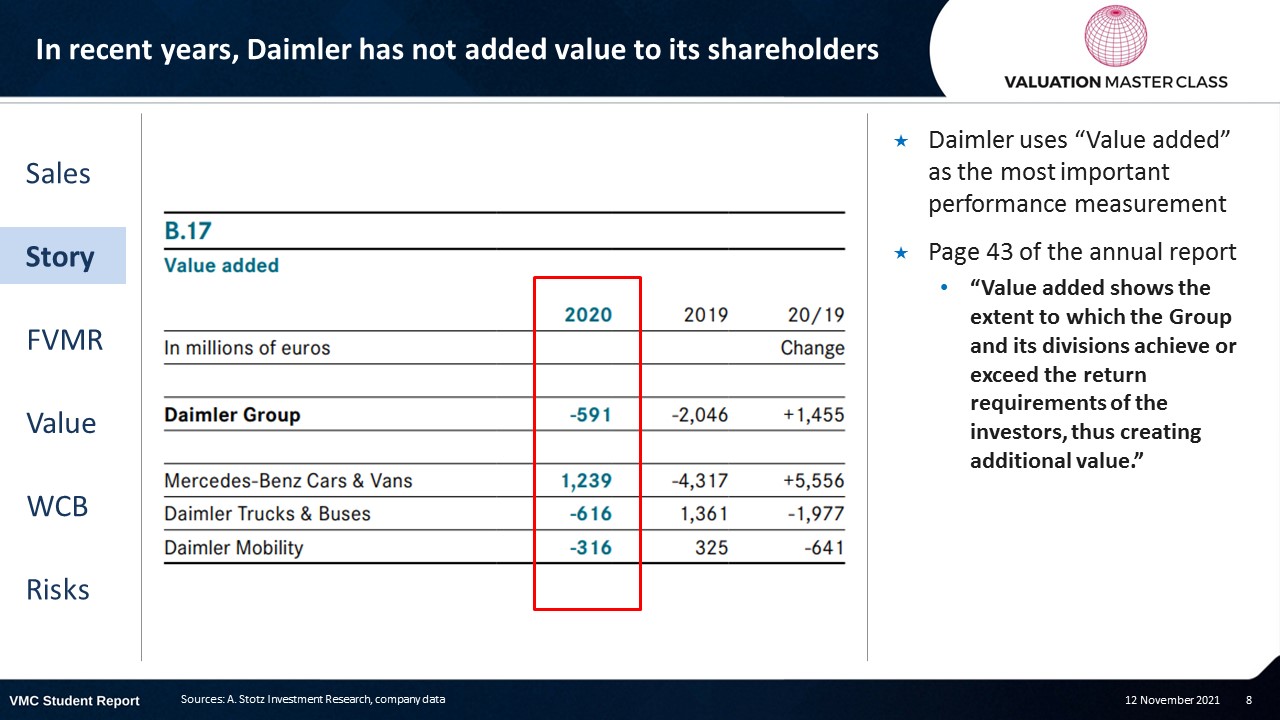

- Under its current business structure, Daimler was not creating any value

- Profitability showed a negative trend, requiring a significant strategy change

- With the spinoff, the separate entities can now focus on enhancing efficiency and profitability

In recent years, Daimler has not added value to its shareholders

- Daimler uses “Value added” as the most important performance measurement

- Page 43 of the annual report: “Value added shows the extent to which the Group and its divisions achieve or exceed the return requirements of the investors, thus creating additional value.”

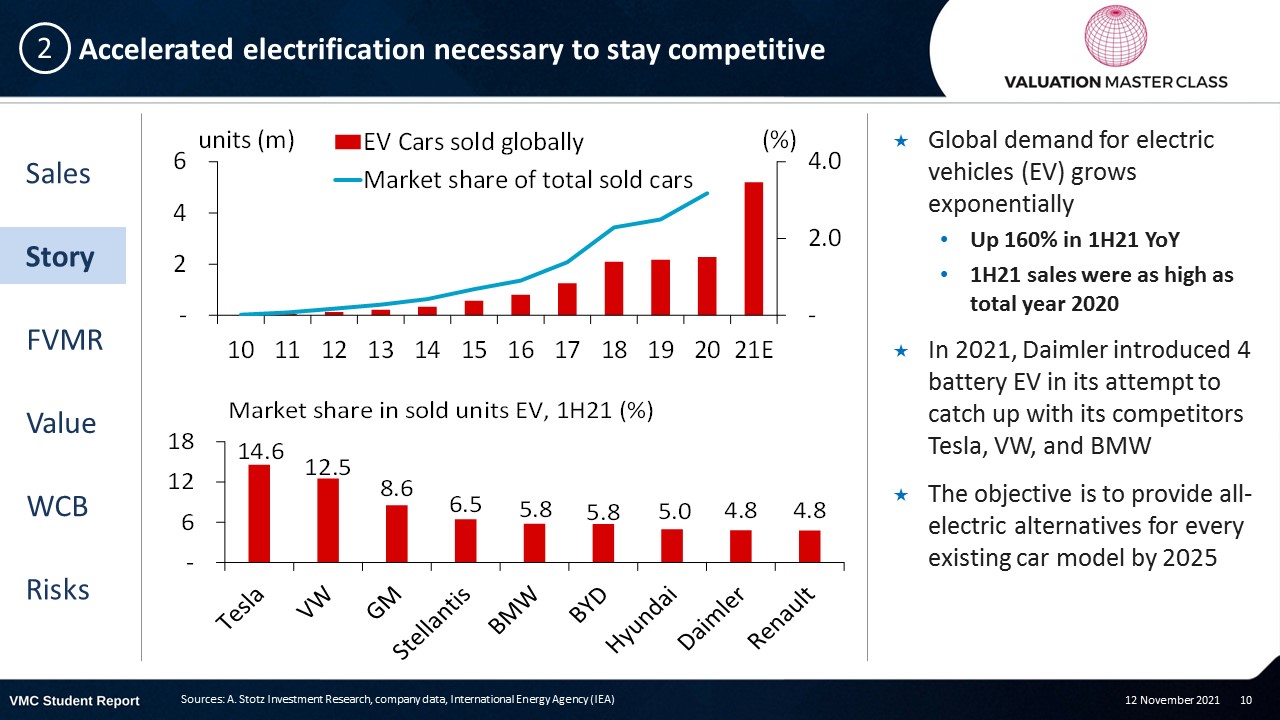

Accelerated electrification is necessary to stay competitive

- Global demand for electric vehicles (EV) grows exponentially

- Up 160% in 1H21 YoY

- 1H21 sales were as high as the full year 2020

- In 2021, Daimler introduced 4 battery EV in its attempt to catch up with its competitors Tesla, VW, and BMW

- The objective is to provide all-electric alternatives for every existing car model by 2025

Strategic partnership to bring autonomous driving forward

- In 2020, Daimler entered a strategic partnership with Nvidia, the world’s largest maker of AI chips

- Nvidia’s chips are currently the most advanced in the market

- From 2024 onward, the company will roll out a fleet with fully automated driving functions

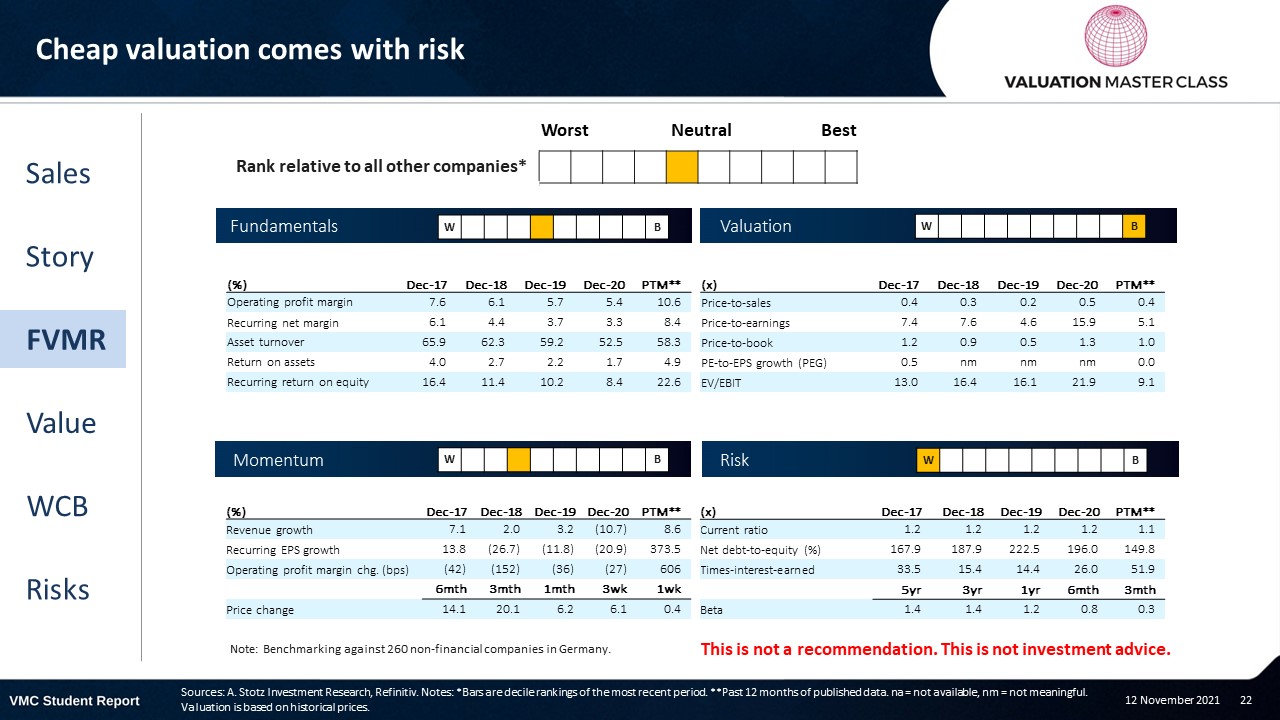

FVMR Scorecard – Daimler AG

- A stock’s attractiveness relative to stocks in that country or region

- Attractiveness is based on four elements

- Fundamentals, Valuation, Momentum, and Risk (FVMR)

- Scale from 1 (Best) to 10 (Worst)

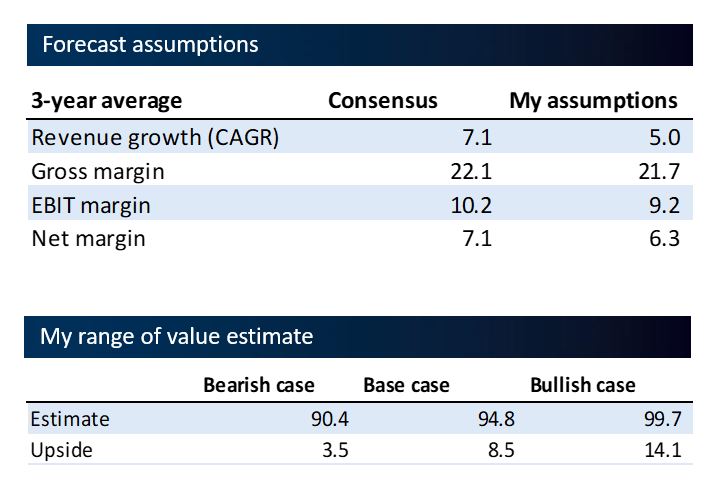

Consensus remains bullish on restructuring decision

- Analyst consensus still sees an upside of 15% despite the recent rally following the spin-off announcement

- They are bullish on 22E revenue growth and forecast excessive margins

P&L – Daimler AG

- The pandemic in 2020 has disrupted car sales, leading to a severe drop in revenue

- Falling profitability has resulted in a low bottom line

Balance sheet – Daimler AG

- The company has a solid cash position, holding around 10% of its assets in cash

- With the spinoff, the balance sheet in 2022 will decline by the assets that belong to the trucks segment

- As the company will hold 35% of the newly listed entity, LT investments are going to increase

- The company is relatively highly levered with a debt-to-equity ratio of 78%

Cash flow statement – Daimler AG

- Volatile operating cash flows were not able to cover the investing activities in 2018 and 2019

- Operating cash flow was boosted by falling accounts receivables, inventories, and other current assets; not net income

- We expect high CAPEX for the future as the company needs to catch up in electric vehicles to compete with Tesla, BMW, and VW

Ratios – Daimler AG

- Revenue was hit during the pandemic

- The demand in the German car industry rebounded; however, semiconductor shortages constraint growth in the short run

- This comprises a drag in margins

- Low ROE of 5.9% in 2020 is driving corporate actions (such as spinning off units)

- Daimler generates a low return on its assets

- Its profitability is still far below competitors

- Its closest competitor in the trucks segment, Volvo, has a 2x higher margin

- Daimler’s spinoff could lead to a convergence in margin

Free cash flow – Daimler AG

- The tax bill has risen to 42% from 30%

- FCFF turned positive in 2020 after a long time

- High investment expenditures require a consistent generation of strong operating cash flows

Value estimate – Daimler AG

- German car sales likely to see strong rebound over the next 3 years

- However, it takes time until the profitability converges to the industry average

- Spin-off decision is likely to not lead to immediate effects on margin

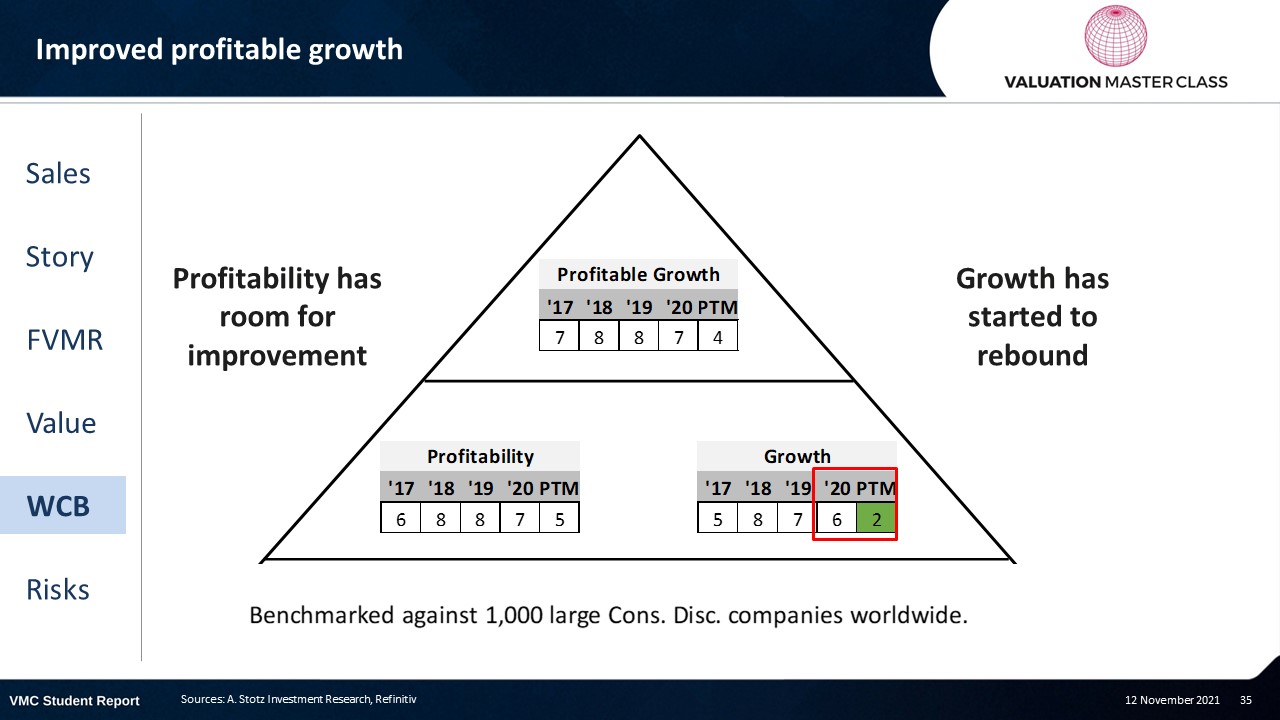

World Class Benchmarking Scorecard – Daimler AG

- Identifies a company’s competitive position relative to global peers

- Combined, composite rank of profitability and growth, called “Profitable Growth”

- Scale from 1 (Best) to 10 (Worst)

- Profitability has room for improvement

- Growth has started to rebound

The key risk for Daimler is to keep up with technology

- Ongoing supply chain disruptions create shortages (e.g., semiconductor chips) and increase production costs

- Failure to keep up with technological changes could result in loss of market share

- Labor shortage of specialist employees creates competition among car manufacturers

Conclusions

- Spin-off momentum might be already priced in

- It will take a long time to close the profitability gap to its peers

- Analysts forecast drastic changes in fundamentals too early

Download the full report as a PDF

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.