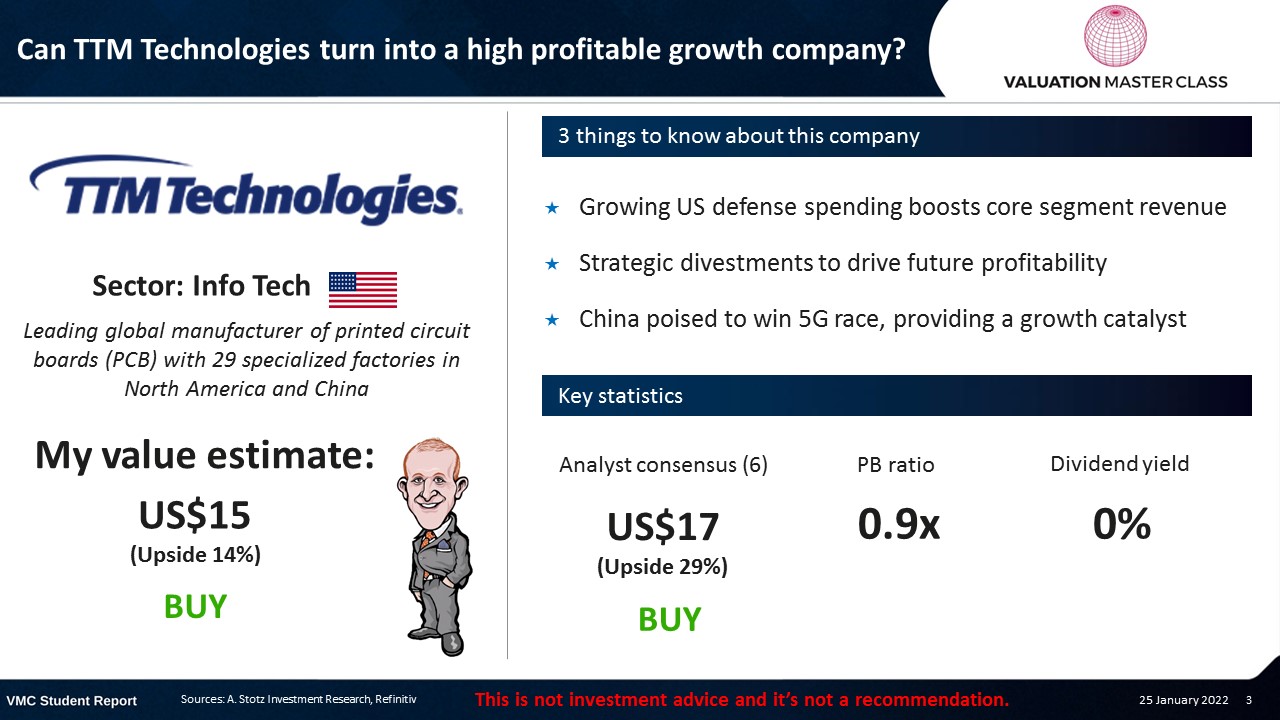

Can TTM Technologies Turn Into a High Profitable Growth Company?

Highlights:

- Growing US defense spending boosts core segment revenue

- Strategic divestments to drive future profitability

- China poised to win 5G race, providing a growth catalyst

Download the full report as a PDF

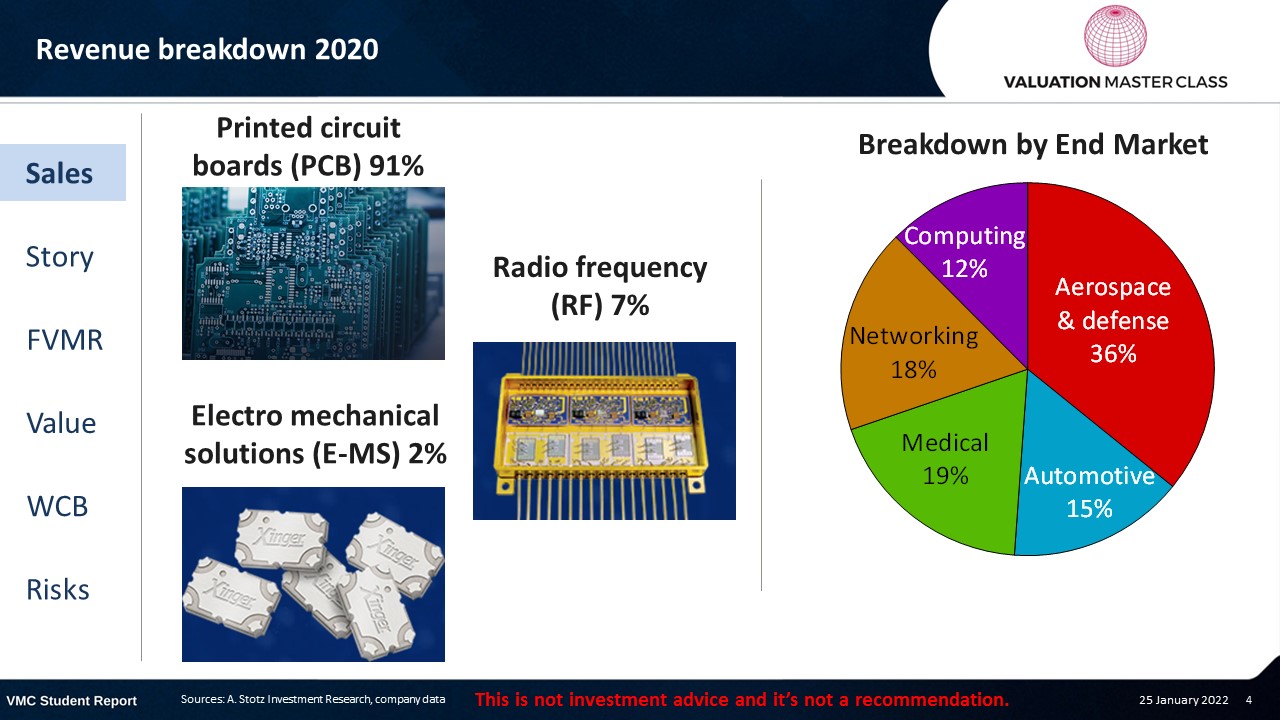

TTM Technologies’ revenue breakdown 2020

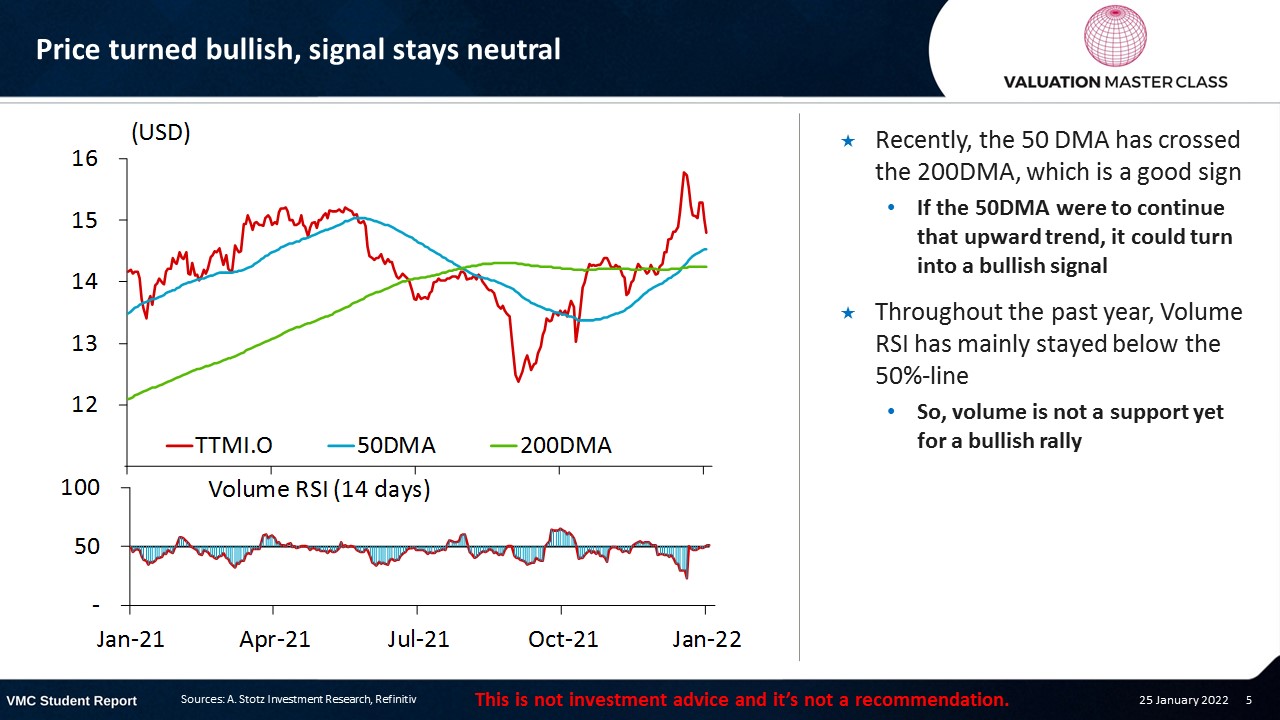

Price turned bullish, signal stays neutral

- Recently, the 50 DMA has crossed the 200DMA, which is a good sign

- If the 50DMA were to continue that upward trend, it could turn into a bullish signal

- Throughout the past year, Volume RSI has mainly stayed below the 50%-line

- So, volume is not a support yet for a bullish rally

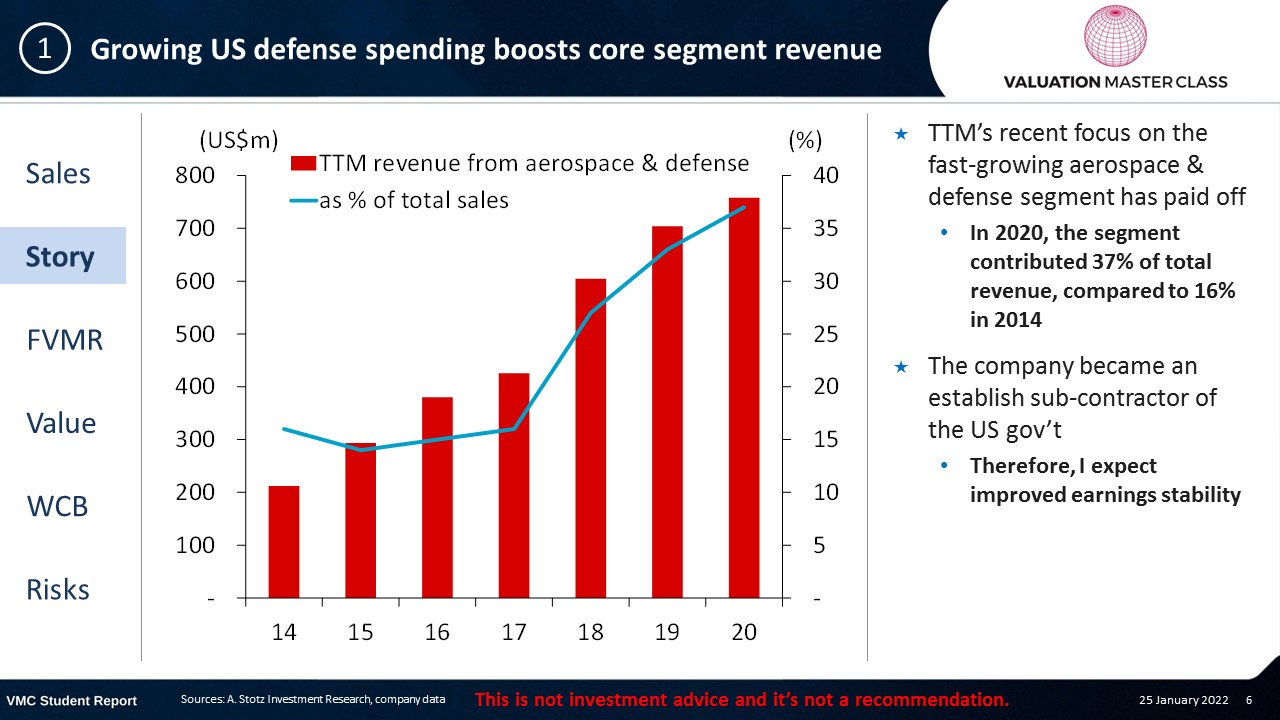

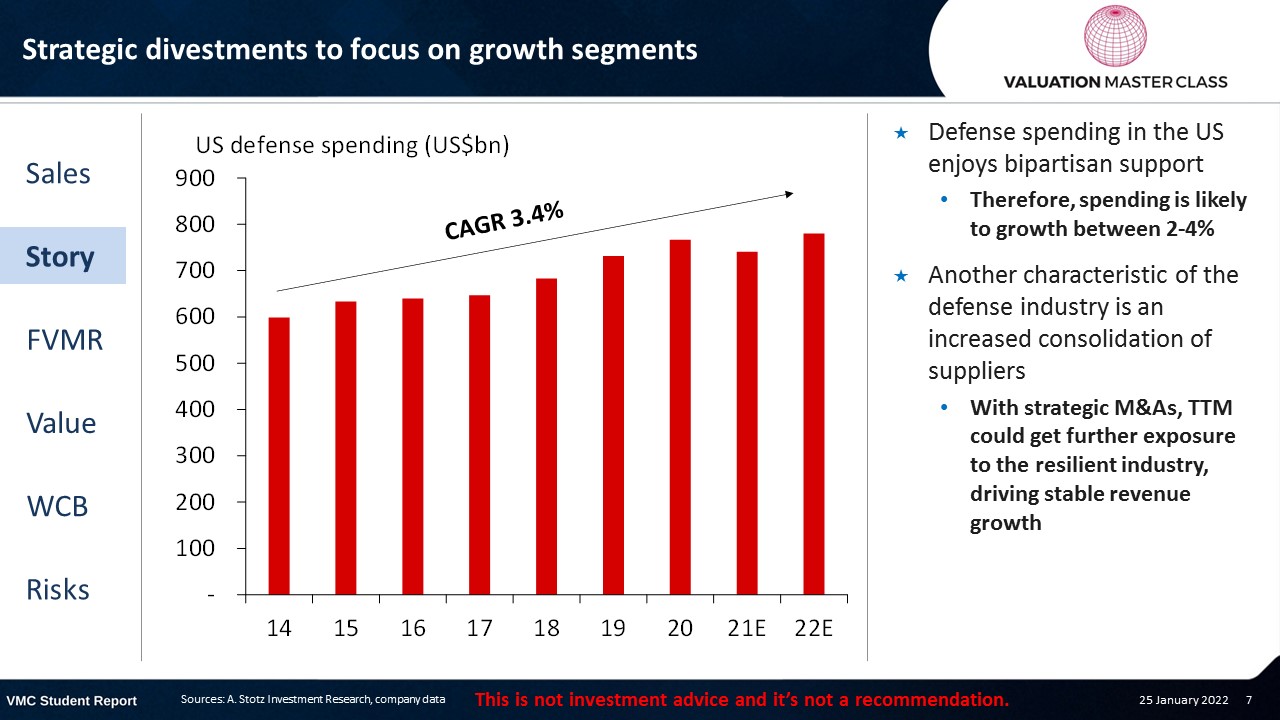

Growing US defense spending boosts core segment revenue

- TTM’s recent focus on the fast-growing aerospace & defense segment has paid off

- In 2020, the segment contributed 37% of total revenue, compared to 16% in 2014

- The company became an establish sub-contractor of the US gov’t

- Therefore, I expect improved earnings stability

Strategic divestments to focus on growth segments

- Defense spending in the US enjoys bipartisan support

- Therefore, spending is likely to growth between 2-4%

- Another characteristic of the defense industry is an increased consolidation of suppliers

- With strategic M&As, TTM could get further exposure to the resilient industry, driving stable revenue growth

Strategic divestments to drive future profitability

- TTM continues to reduce exposure to sensitive consumer and commodity segments to build a more resilient business

- In 2020, it divested its mobility business, which was highly capital-intensive

- Also, it shut down two of its low-margin electro mechanical solution (E-MS) plants

- As a result, 2020 revenue declined by 21% compared to its peak in 2017

-

- However, net fixed assets shrunk by 36%, providing capital for profitable investments

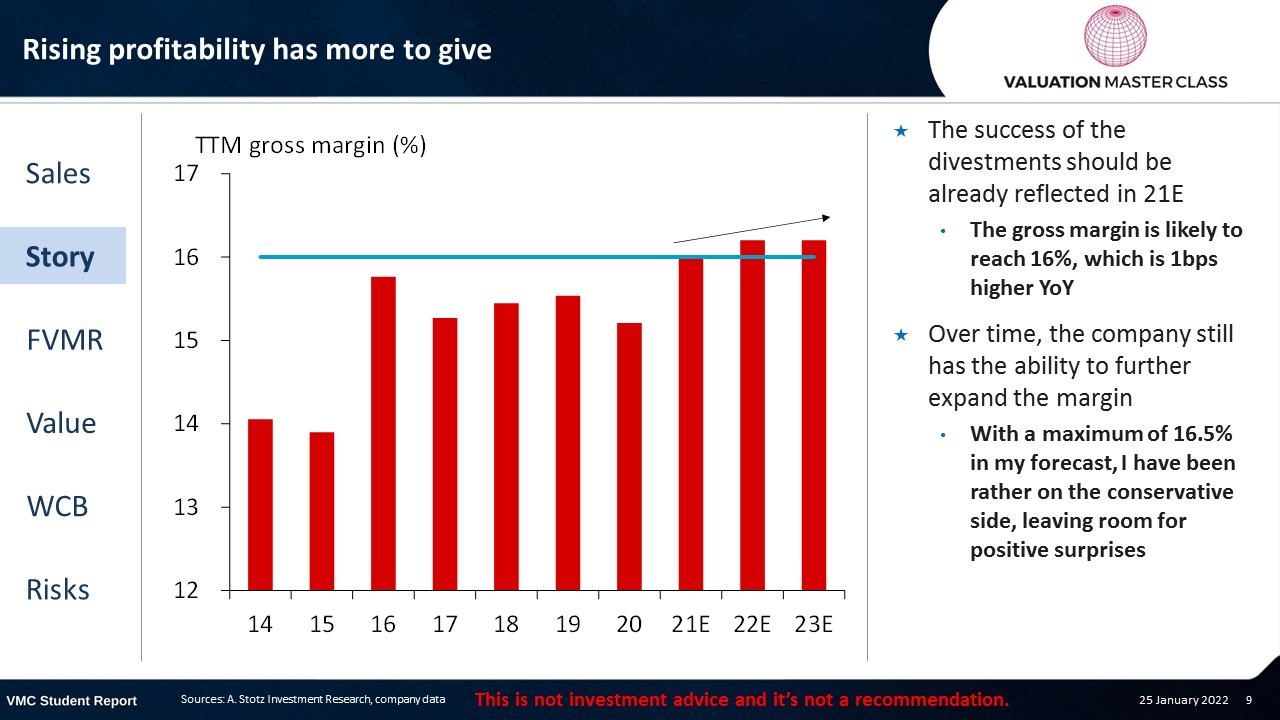

Rising profitability has more to give

- The success of the divestments should be already reflected in 21E

- The gross margin is likely to reach 16%, which is 1bps higher YoY

- Over time, the company still has the ability to further expand the margin

- With a maximum of 16.5% in my forecast, I have been rather on the conservative side, leaving room for positive surprises

China poised to win 5G race, providing a growth catalyst

- As of 2021, China has built more than 1.1m base stations for 5G, equaling around 70% of global stations

- Continued aggressive expansion of 5G network could already lead to nationwide coverage by 2025

- Therefore, we expect strong demand for TTM’s printed circuit boards (PCB)

- The management expects 5-8% growth rate for this end market, which seems realistic

Networking end market could become 2nd largest segment

- TTM has 5 factories in China specialized in the production of PCBs

- Besides aerospace & defense, its products applied in the network industry could provide a growth catalyst for the mid-term future

- I think it’s a great opportunity for TTM to beat current market expectations

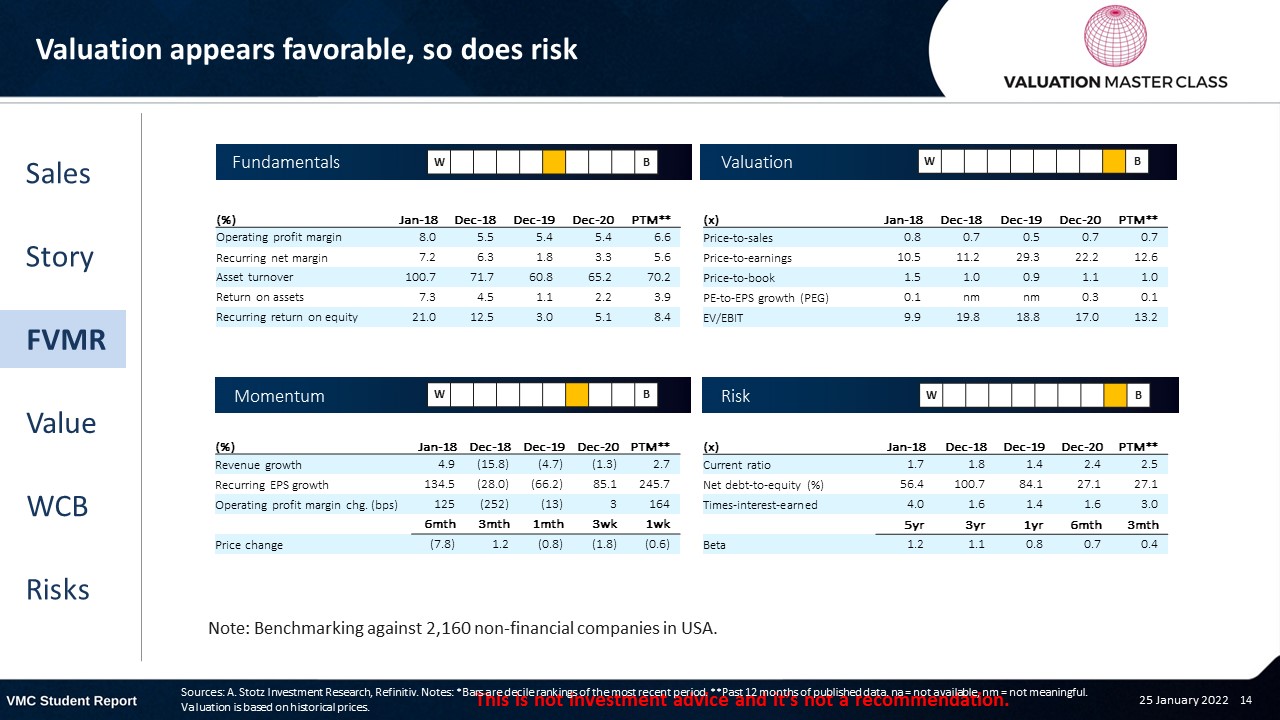

FVMR Scorecard – TTM Technologies

- A stock’s attractiveness relative to stocks in that country or region

- Attractiveness is based on four elements

- Fundamentals, Valuation, Momentum, and Risk (FVMR)

- Scale from 1 (Best) to 10 (Worst)

Analysts see a right time to buy

- All 6 analysts have a BUY recommendation with an average upside of 29%

- Consensus expects a robust revenue growth over the next few years

- Also, they believe that the company can expand its margin significantly

Get financial statements and assumptions in the full report

P&L – TTM Technologies

- The management plan to focus on more profitable and less cyclical end markets should pay off

- 2020 net profit is distorted by gains from divestiture

- I expect consistent growth in profits 21E onward

Balance sheet – TTM Technologies

- Net fixed assets decreased as a result of its divestments

- This leads to a solid cash position, providing funds for expansion of its core segments

- TTM has a healthy balance sheet

- Its net-debt to equity ratio stood at 0.3x in 2020 and should decrease further over time

Ratios – TTM Technologies

- TTM’s focus on higher segments translates into improved efficiency

- Gross margin in 21E and 22E could pass 16% and I expect the company to maintain it over time

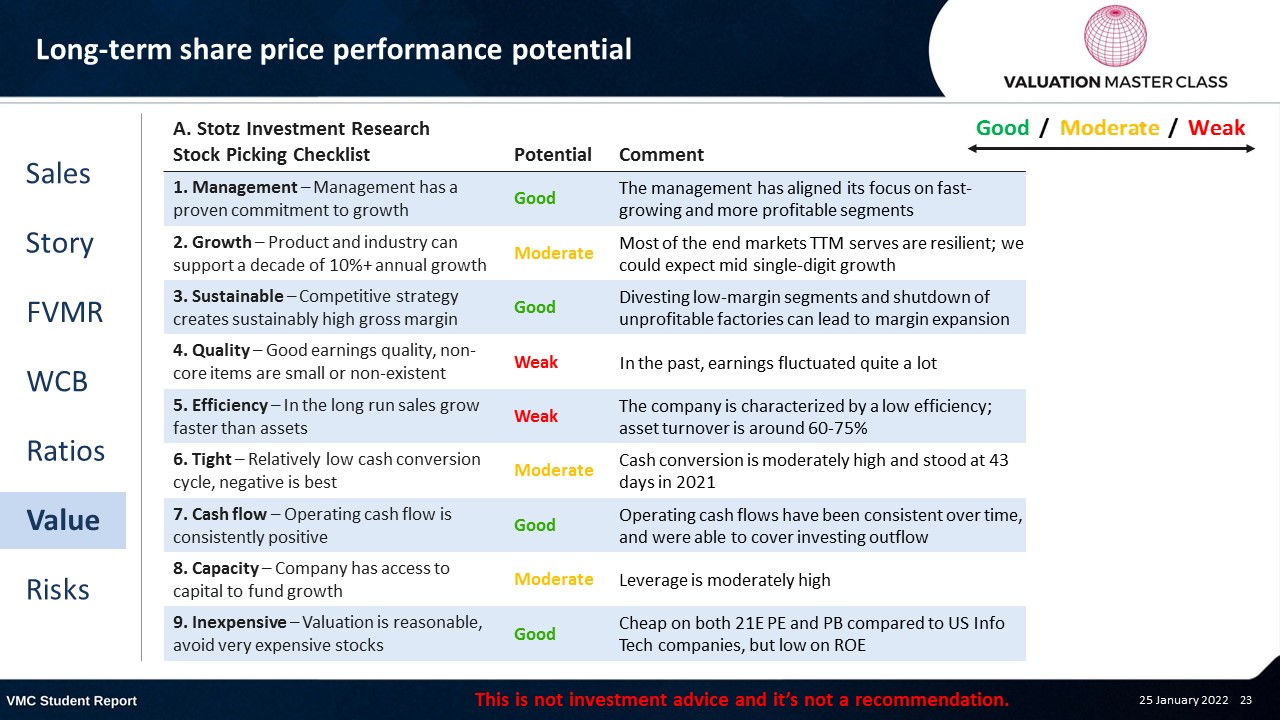

Long-term share price performance potential

Free cash flow – TTM Technologies

- FCFF likely to grow consistently over time in line with higher profits

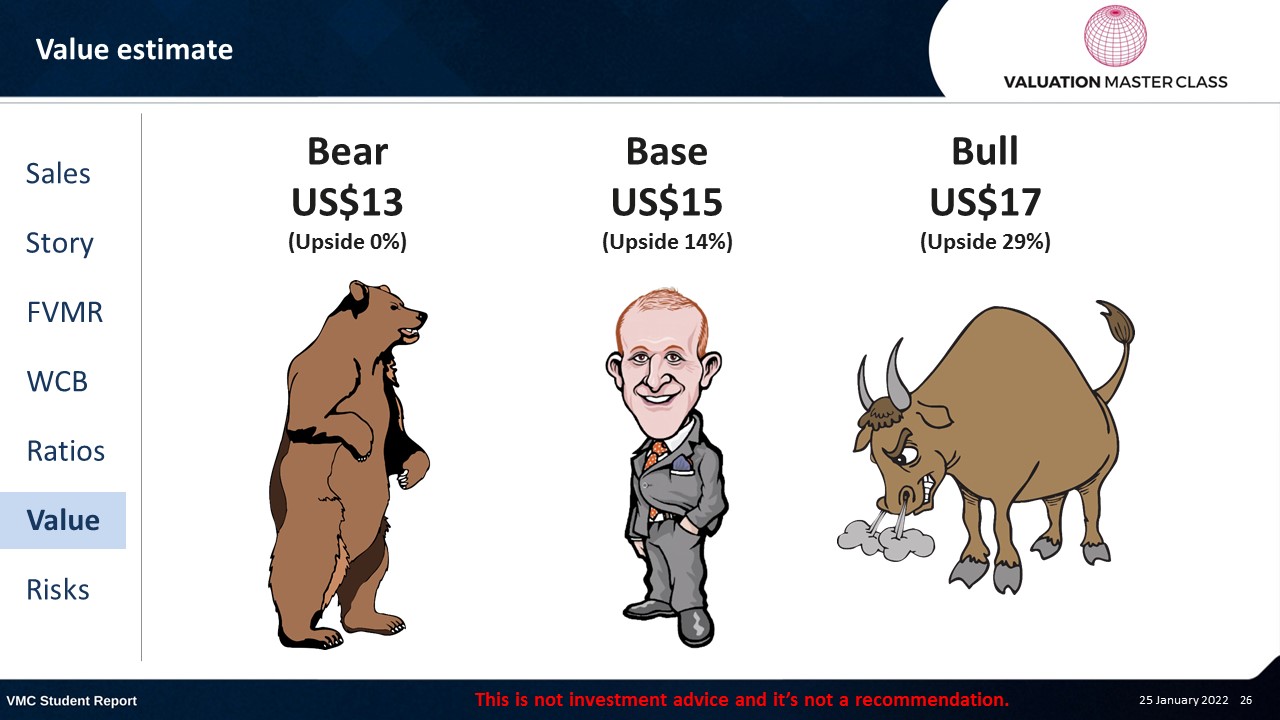

Value estimate – TTM Technologies

- Despite the management’s effort to become more profitable, I think it still has a long way to go

- However, my margin forecast is rather conservative

- Despite the management’s effort to become more profitable, I think it still has a long way to go

- Still, any positive surprise would add additional upside

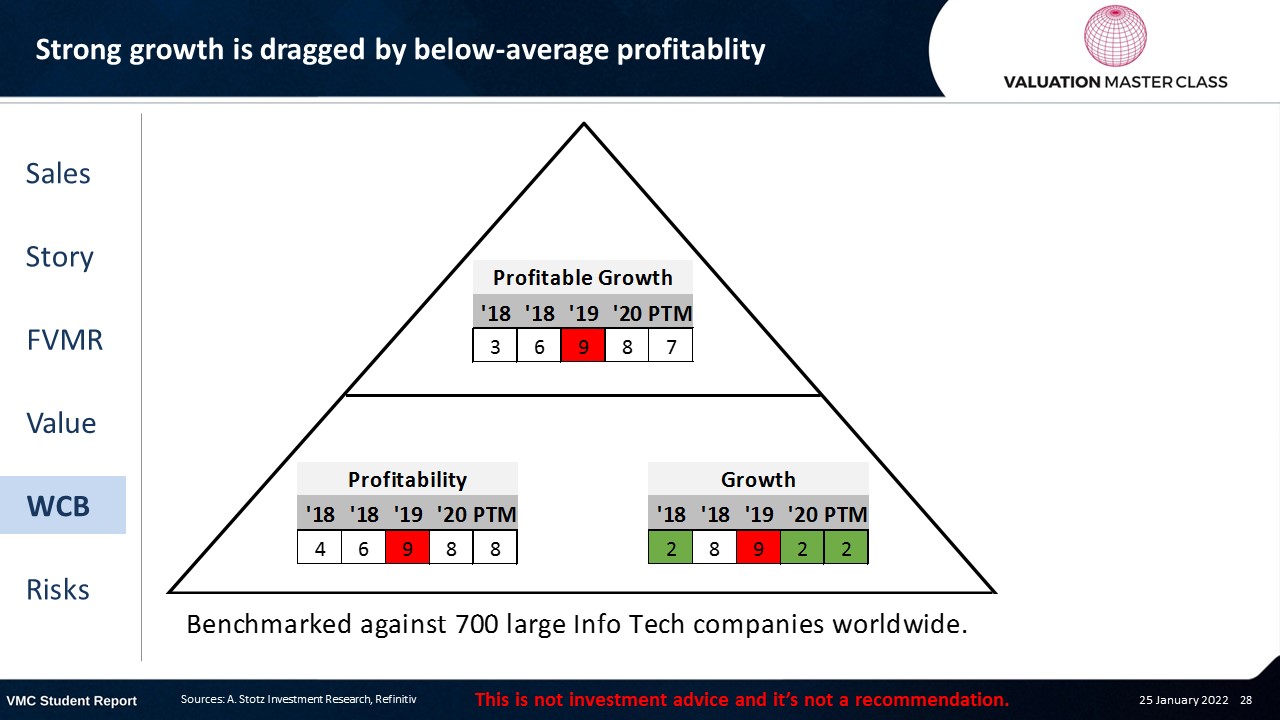

World Class Benchmarking Scorecard – TTM Technologies

- Identifies a company’s competitive position relative to global peers

- Combined, composite rank of profitability and growth, called “Profitable Growth”

- Scale from 1 (Best) to 10 (Worst)

Key risk is high dependency on demand side

- Adverse regulatory changes, especially in China, could hamper the business

- Failure to meet quality standards and reliance on suppliers

- Dependency on top 5 customers which make up 1/3 of total sales

Conclusions

- Management strategy could lead to higher profitable growth

- Healthy balance sheet can support expansion of core segments

- Valuation is attractive; might be a cheap opportunity to buy

Download the full report as a PDF

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.