Cost of equity

The ValueModel checks whether your cost of equity is reasonable.

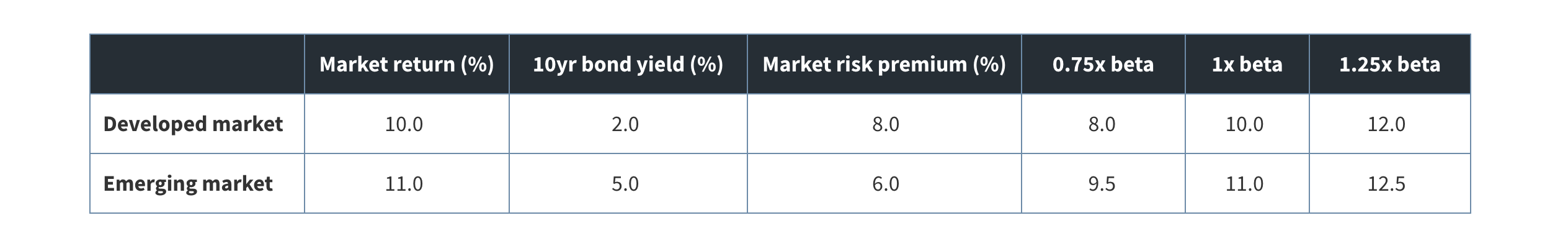

To make sure none of the cost of equity estimates is unreasonable, we studied the risk-free rates, the betas and the market risk premiums for emerging and developed markets and came up with a range for the cost of equity. The risk-free rate is based on the 10-year government bond yields and market risk premium is calculated based on the Gordon growth model using the implied equity premium. Based on the findings, we allow a cost of equity between 8% and 12.5%. Find the results in the table below.