Growth CapEx vs Maintenance CapEx: What’s the Difference?

Understanding the difference between growth CapEx and maintenance CapEx is essential for accurate company valuation and financial analysis. Confusing these two types of capital expenditure is one of the most common and costly valuation mistakes analysts make.

Growth CapEx expands a company’s productive capacity and drives future revenue. Maintenance CapEx simply keeps existing operations running at current levels. The distinction matters enormously: growth CapEx is discretionary and tied to expansion, while maintenance CapEx is essentially mandatory. In this guide, you’ll learn exactly how growth CapEx differs from maintenance CapEx, see real company examples, and understand how to calculate each for DCF valuations and financial modeling.

First, though, a quick recap of the full list of Top 9 Mistakes.

The Top 9 Valuation Mistakes

- Overly optimistic revenue forecasts

- Underestimating expenses causing unrealistic profit forecasts

- Growing fixed assets slower than revenue

- Confusing growth with maintenance CapEx

- Forecasting drastic changes in cash conversion cycle

- Underestimating working capital investment

- Valuing a stock using the calculated Beta

- Choosing an unreasonable cost of equity

- Not properly fading the return on invested capital

What is CapEx?

CapEx stands for capital expenditure. It is the money spent acquiring fixed assets or repairing or upgrading existing assets. Of course, CapEx is a long-term investment item.

If you bought a can of oil to work for a piece of capital equipment, it might be something that is necessary to keep the machine running, but it’s not a long-term addition to that asset. But if you build an extension onto a production line, then that is considered ‘upgrading an existing asset’ as it’s a long-term upgrade.

Because fixed assets last longer than one year, the CapEx cost is not fully charged as an expense in the year that it’s paid or incurred. So, CapEx is capitalized over the life of the asset. This appears as an annual depreciation charge in the P&L, which accumulates on the balance sheet.

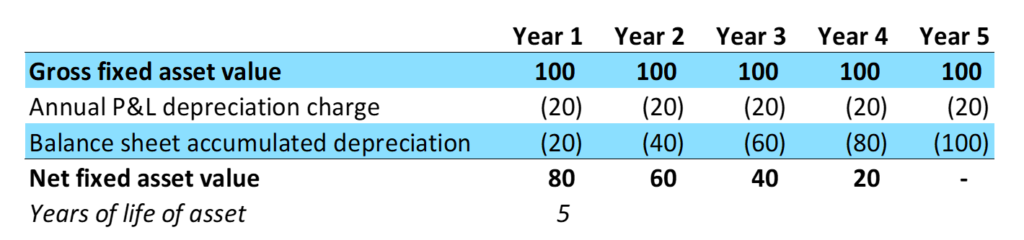

Let’s consider an example of a company that buys a 100-dollar asset with an estimated lifespan of five years (see Fig. 1). The gross value of that asset never changes; it’s one hundred dollars. That’s what you bought it for.

[Fig. 1 Example of a $100 Asset with an Estimated Life of 5 Years]

We can arrive at the annual P&L depreciation charge by taking $100 divided by 5 years and saying, “Every year, this is going to depreciate by $20.” And, therefore, we also have an accumulated depreciation that starts to build in the balance sheet. This is also how we end up with a net asset value that’s constantly falling. In this example, if this company really wanted to grow, the problem that it would have is that this asset is basically worth nothing at the end of five years.

Starting your finance career?

Our Starter Program gives you the foundational skills to land your first analyst role — valuation, financial modeling, and interview prep included.

That’s just an accounting concept.

But in an economic sense, let’s say that they were right. Five years have passed, and the machine is dead. To make the machine last those five years and still produce at the same level, we would have to invest how much?

Twenty dollars! If we invested $20 in that machine every year, we would offset the amount that’s depreciating. And that’s the concept of depreciation.

We can look at that in more detail. But let’s look at the difference between the change in gross fixed assets and CapEx.

Capital expenditure falls into two distinct categories with very different implications for valuation:

Maintenance CapEx (Replacement CapEx)

Maintenance CapEx is the spending required to sustain current operations at existing levels. This includes:

- Replacing worn-out equipment

- Repairing facilities

- Upgrading aging technology to maintain competitiveness

- Routine capital replacements

Without maintenance CapEx, a company’s productive capacity would gradually decline. Think of it as the minimum spending required just to stay in place.

Growth CapEx (Expansion CapEx)

Growth CapEx is spending that expands the company’s productive capacity or capabilities. This includes:

- Building new factories or facilities

- Acquiring additional equipment to increase production

- Entering new markets or geographies

- Developing new product lines

Growth CapEx is discretionary; management chooses whether and when to make these investments based on expected returns and strategic priorities.

Why the Distinction Matters for Valuation:

In free cash flow calculations and DCF models, the treatment differs significantly:

- Terminal value: Most analysts assume only maintenance CapEx continues in perpetuity (growth CapEx drops to zero at steady state)

- Forecasting: Growth CapEx should be tied to revenue expansion plans; maintenance CapEx to the existing asset base

- Cash flow sustainability: A company reporting high free cash flow while underspending on maintenance is borrowing from the future

Ready to advance?

The Advancer Program helps mid-career professionals sharpen their valuation skills and stand out for promotions or lateral moves into investment roles.

Change in Gross Fixed Assets and CapEx

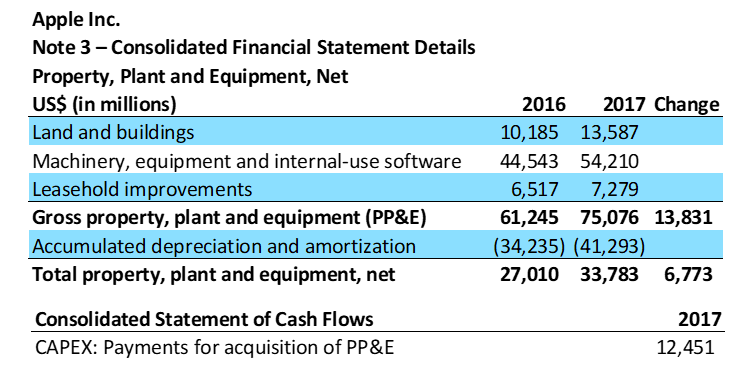

There are two CapEx items in the financial statements. Firstly, there is a change in gross fixed assets, and secondly, there is the CapEx line on the statement of cash flows. Let’s take a look at Apple Inc. as an example here:

[Fig. 2 Case Study – Apple Inc.]

As you can see, the 2017 change in gross fixed assets of US$13,831m does not match the CapEx in the cash flow statement of US$12,451m. For various reasons, these items almost never perfectly match. In fact, I’ve never seen it match completely, and I have a database of almost every listed company in the world that we work on in my business, as well as in the Valuation Master Class.

One simple reason is that, by definition, the statement of cash flows is only the cash that’s being spent currently.

Let me explain further. I went to visit a factory in Thailand once, and they showed me a lineup of these massive injection molding machines, and the guy told me he got two-year credit terms for them, meaning no cash was spent on the machines in the first two years.

Let’s consider the case of Apple Inc. again. In 2017, the change in gross fixed assets was US$13,831 million (as per the table above). If we look at the 2017 change in gross fixed assets, it does not match the CapEx item in the cash flow statement, which is US$12,451 million. It’s close, but there are many, many complicated reasons why it’s still different, and this is what it’s pertinent to remember. Both ways of looking at Capex have value.

When talking to company management, make sure you clarify which one they’re discussing. Ask, “Are we talking about the change in the gross fixed assets? Or are we talking about the CapEx amount that’s going to be the cash amount reflected in the CapEx?”

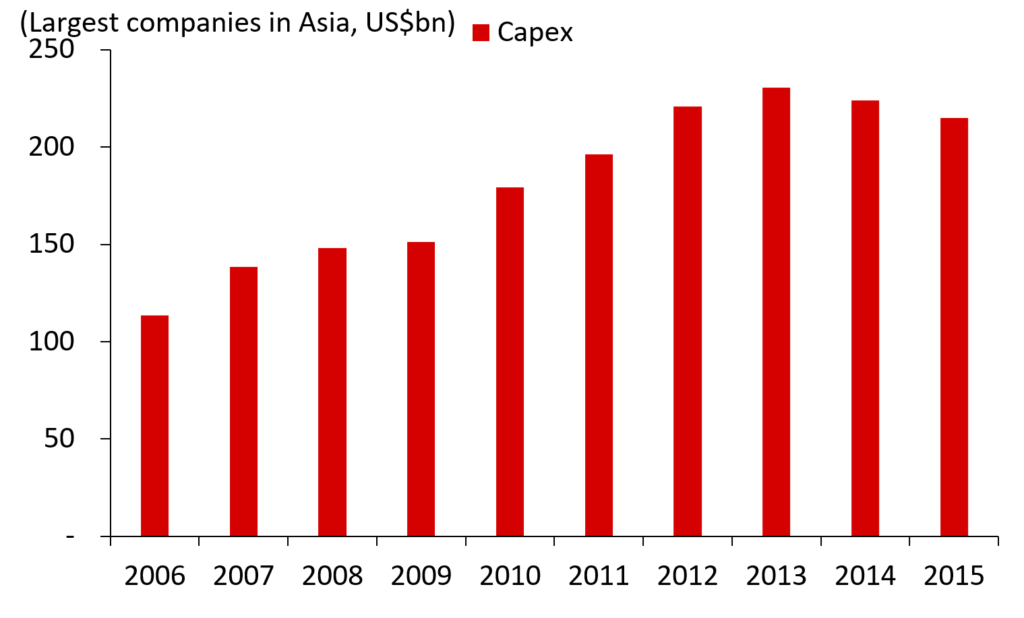

CapEx Across Asia

Let’s go back to my research on the 500 largest companies in Asia and their CapEx spending in their cash flow statement. We can see that it started to come down in 2014 and 2015. But that’s the total amount of CapEx that these companies are spending.

[Fig. 3 Total CapEx Across Asia]

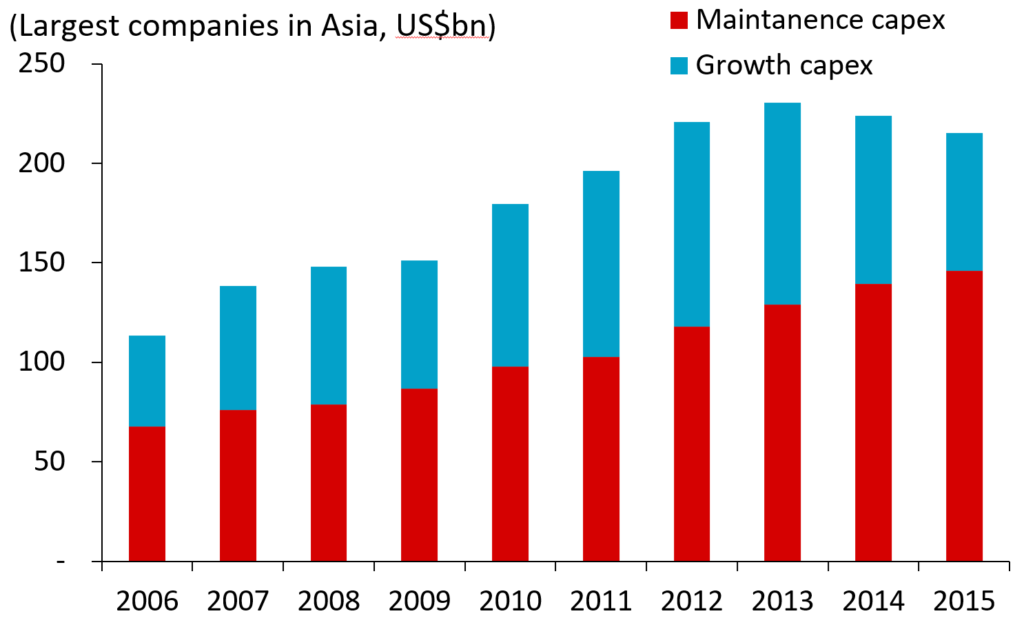

Now, let’s break that down into two parts. The first part is Maintenance CapEx. We already looked at that a little bit earlier by looking at that depreciation of 20 and saying, “We’d have to invest 20 to offset the amount that it’s depreciating.” The second is Growth CapEx.

[Fig. 4 Divided CapEx Across Asia]

Maintenance CapEx is spending to keep an existing asset producing at the same level; older machines will require a lot of additional work in this area. When a company builds a new part onto a machine, that would be an addition to or a Maintenance CapEx spending. There are short-term outgoings that will be required for machine upkeep, remember the can of oil from earlier, but these are expenses only.

Let’s look at Growth CapEx. That’s when a company buys a new additional machine entirely, increasing its fixed assets for growth purposes.

Now, if that happens, what would a company do with the old machine? It can be kept or sold. So, let’s say that the new machine cost $200 million, and the old machine sells for $50 million. Therefore, the Net CapEx amount for that year is $150 million.

In Maintenance CapEx, the annual P&L depreciation charge is a good rough estimate of what must be spent to keep an asset up and running. You could dispute the accounting standard related to depreciation by saying, “Wait a minute, why would you depreciate something over five or ten years when you have a machine that’s been running for much longer than that?”

Herein lies the difference between economic value and accounting value. The accounting value of the machine that runs past its projected lifespan is now zero. But is the economic value the same? No. And as financial analysts, we are always looking at the economic value rather than the accounting value. Sometimes, we’ll also make adjustments to the accounting value to factor in the economic one.

For additional growth, a company needs to invest more than just Maintenance CapEx. While Growth CapEx has much more volatility, it is essentially the key to the future success of a company.

Examples of Growth CapEx and Maintenance CapEx

Understanding the difference is easier with concrete examples from real industries.

Examples of Maintenance CapEx

| Industry | Maintenance CapEx Example |

|---|---|

| Manufacturing | Replacing a 10-year-old CNC machine with a similar capacity |

| Retail | Renovating existing store locations, replacing HVAC systems |

| Airlines | Engine overhauls, interior refurbishments on existing aircraft |

| Technology | Server replacements to maintain the current computing capacity |

| Utilities | Replacing aging power lines, transformer maintenance |

| Real Estate | Roof repairs, elevator upgrades in existing buildings |

Examples of Growth CapEx

| Industry | Growth CapEx Example |

|---|---|

| Manufacturing | Building a new production facility in a different region |

| Retail | Opening 50 new store locations |

| Airlines | Purchasing new aircraft to add routes |

| Technology | Building new data centers to expand cloud capacity |

| Utilities | Constructing new power plants or renewable facilities |

| Real Estate | Acquiring new properties or land for development |

Real Company Example: Amazon

Amazon provides a clear illustration of both types:

Maintenance CapEx:

- Replacing servers in existing fulfillment centers

- Maintaining warehouse equipment

- Upgrading existing AWS infrastructure

Growth CapEx:

- Building new fulfillment centers globally

- Expanding AWS data center footprint

- Investing in delivery infrastructure (planes, vans)

Amazon’s CapEx has historically been dominated by growth spending, reflected in its CapEx-to-depreciation ratio, which has often exceeded 2.0x.

How to Avoid the Common CapEx Mistakes?

Here are some general rules to help you avoid making this valuation mistake:

- For growth firms: The CapEx should be more than the annual P&L depreciation charge, maybe around 150% of it

- For very high growth firms: The CapEx should see more than 150% of depreciation

- For low or no-growth firms: The CapEx should be about equal to the annual depreciation charge

Additional Guidelines for DCF Models

For High-Growth Companies:

- Expect CapEx/depreciation ratios of 1.5x to 3.0x during the expansion phase

- Growth CapEx should correlate with projected revenue growth

- Eventually phase down to maintenance-only as growth slows

For Mature Companies:

- CapEx should approximately equal depreciation at the steady state

- Be skeptical of projections showing sustained high free cash flow with minimal CapEx

- Consider whether current CapEx levels are sustainable

For Declining Companies:

- CapEx may fall below depreciation as capacity is allowed to shrink

- Ensure your model reflects reality; don’t assume maintenance spending that won’t occur

- Watch for asset sales that mask true operating CapEx needs

Red Flags to Watch:

- CapEx consistently below depreciation: May indicate under-investment

- Sudden CapEx increases without revenue growth: Potential inefficiency or accounting issues

- Management capitalizing operating expenses: Artificially inflates earnings and overstates CapEx

Mistake #4 Conclusion

- Always consider both Growth and Maintenance CapEx

- Maintenance CapEx should be roughly the same as depreciation

- The starting point for overall CapEx forecasting is 100% of the annual depreciation charge

- Additional Growth CapEx depends on how fast you expect the firm to grow

To summarize the key differences:

| Aspect | Maintenance CapEx | Growth CapEx |

|---|---|---|

| Purpose | Sustain current operations | Expand capacity |

| Necessity | Required (non-discretionary) | Optional (discretionary) |

| Relationship to depreciation | Should approximate depreciation | In addition to depreciation |

| In the terminal value | Continues indefinitely | Drops to zero |

| Signal | Asset preservation | Management confidence |

| Risk if skipped | Declining capacity | Slower growth |

Don’t forget to watch the video that accompanies this chapter:

Up next in the series, I discuss forecasting drastic changes in the cash conversion cycle. Watch this space.

Switching into finance from another field?

Our Switcher Program is designed for career changers who need to build credibility fast — no finance background required.

Frequently Asked Questions About Growth and Maintenance CapEx

Q: What is maintenance CapEx?

A: Maintenance CapEx (also called replacement CapEx or sustaining CapEx) is capital expenditure required to maintain a company’s current productive capacity. It includes replacing worn-out equipment, facility repairs, and technology upgrades necessary to sustain existing operations. Maintenance CapEx is non-discretionary; without it, productive capacity declines. It typically approximates annual depreciation expense over time.

Q: What is growth CapEx?

A: Growth CapEx (also called expansion CapEx) is capital expenditure that increases a company’s productive capacity or capabilities. Examples include building new facilities, acquiring equipment to increase production, or entering new markets. Growth CapEx is discretionary; management chooses whether and when to invest based on expected returns. In DCF valuations, growth CapEx typically drops to zero in terminal value calculations.

Q: How do you calculate maintenance CapEx?

A: The most common method is to use depreciation as a proxy: Maintenance CapEx ≈ Depreciation. This assumes depreciation reflects the economic cost of maintaining assets. Alternatively, use industry benchmarks (maintenance CapEx as % of revenue) or analyze management guidance that separates sustaining from growth investments. For more precision, examine the CapEx-to-depreciation ratio over time.

Q: What is a good CapEx to depreciation ratio?

A: It depends on the company’s growth stage. High-growth companies typically show ratios of 1.5x to 3.0x, indicating significant expansion investment. Mature companies at steady state should be around 1.0x (CapEx equals depreciation). A ratio consistently below 0.8x is a warning sign; the company may be under-investing and shrinking its asset base.

Q: Should maintenance CapEx equal depreciation?

A: In theory, yes, over the long term, maintenance CapEx should approximate depreciation since both represent the economic cost of sustaining fixed assets. In practice, they may differ in any given year due to timing of replacements, asset price changes, or accounting choices. But if CapEx consistently falls well below depreciation, the company is likely under-investing.

Q: Where can I learn more about CapEx analysis for valuation?

A: Valuation Master Class offers practical training programs where you’ll analyze real companies’ capital expenditure patterns and build DCF models. Choose your track: Starters for those beginning their finance career, Advancers for mid-career professionals, or Switchers for career changers entering finance.