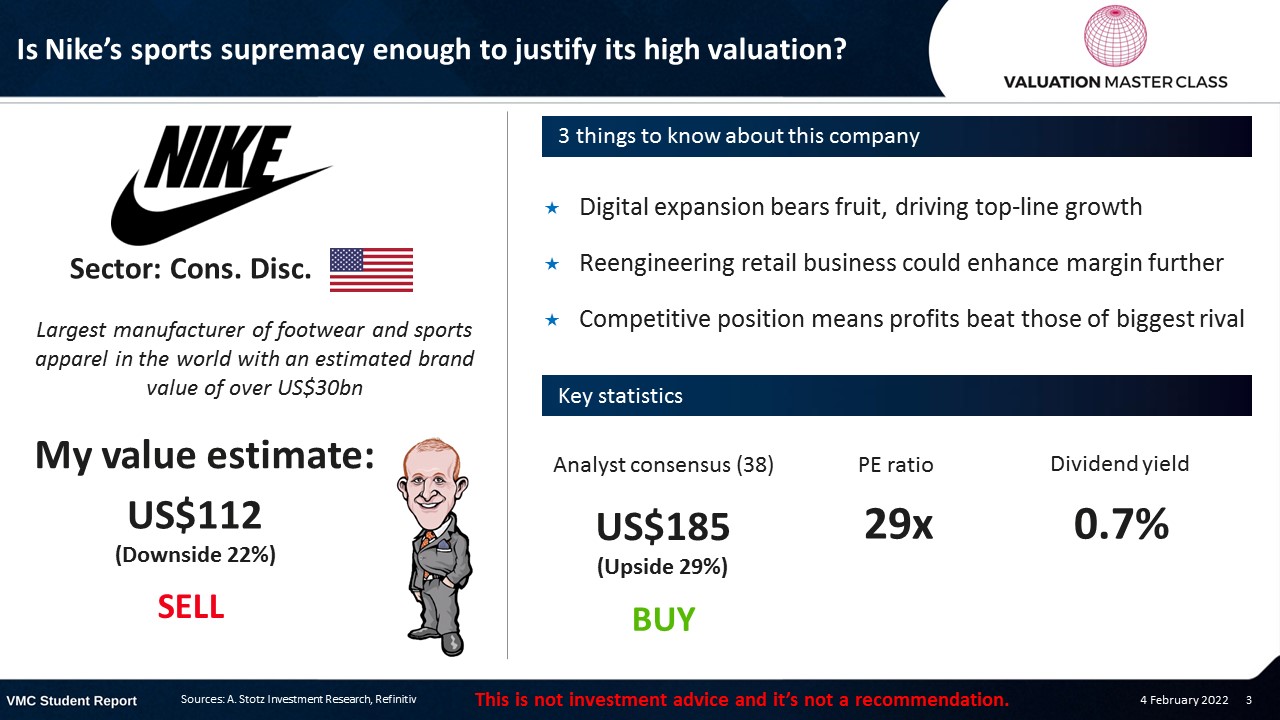

Is Nike’s Sports Supremacy Enough to Justify Its High Valuation?

Highlights:

- Digital expansion bears fruit, driving top-line growth

- Reengineering retail business could enhance margin further

- Competitive position means profits beat those of biggest rival

Download the full report as a PDF

Nike’s revenue breakdown 2021

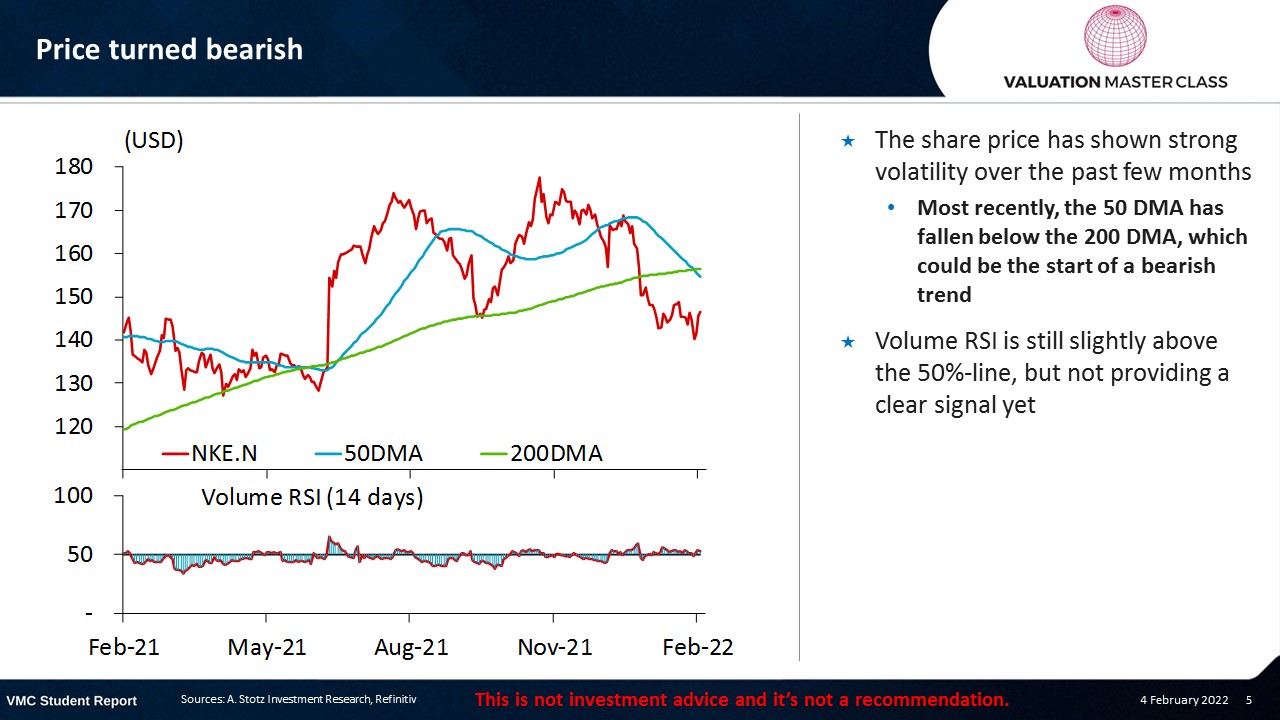

Price turned bearish

- The share price has shown strong volatility over the past few months

- Most recently, the 50 DMA has fallen below the 200 DMA, which could be the start of a bearish trend

- Volume RSI is still slightly above the 50%-line, but not providing a clear signal yet

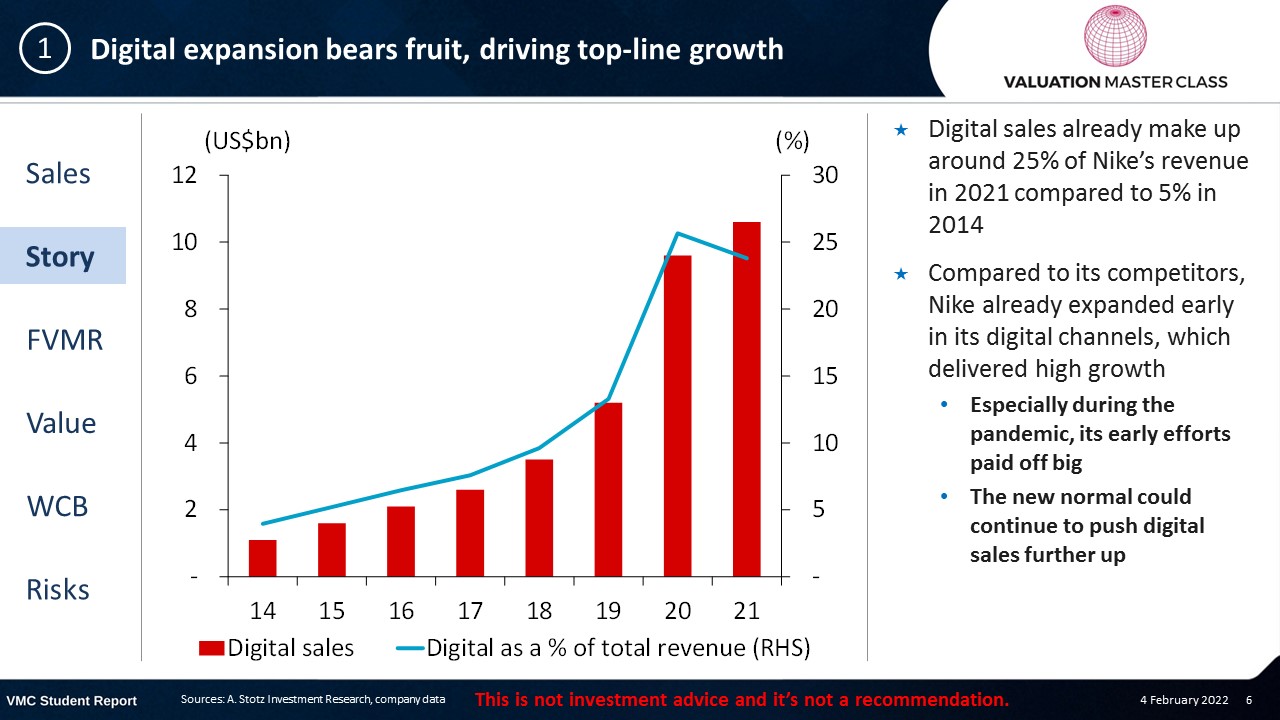

Digital expansion bears fruit, driving top-line growth

- Digital sales already make up around 25% of Nike’s revenue in 2021 compared to 5% in 2014

- Compared to its competitors, Nike already expanded early in its digital channels, which delivered high growth

- Especially during the pandemic, its early efforts paid off big

- The new normal could continue to push digital sales further up

Digital penetration is part of its strategy shift

- The company increasingly focuses on direct-to-customer sales

- Under its campaign “Nike Direct” it aims to promote its own retail stores and expand its online platform

- The objective is to create a monobrand experience and reduce the reliance on wholesalers

- As a result, Nike can yield a higher average selling price

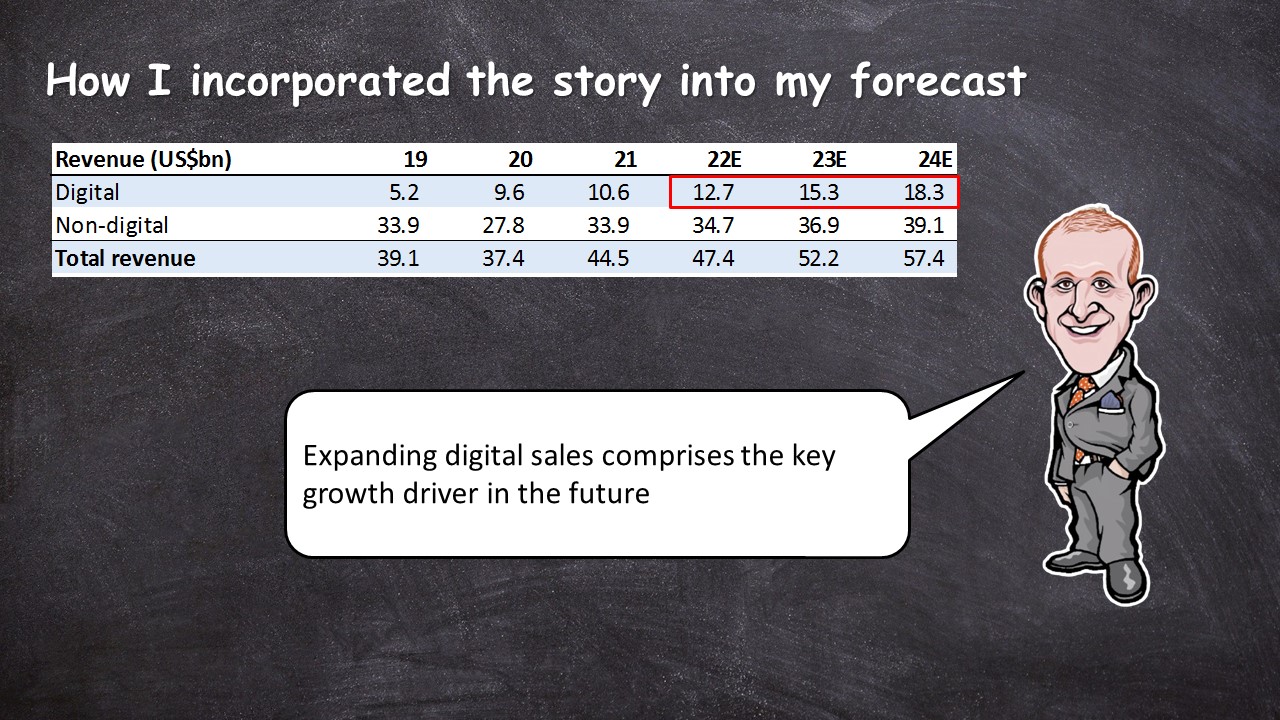

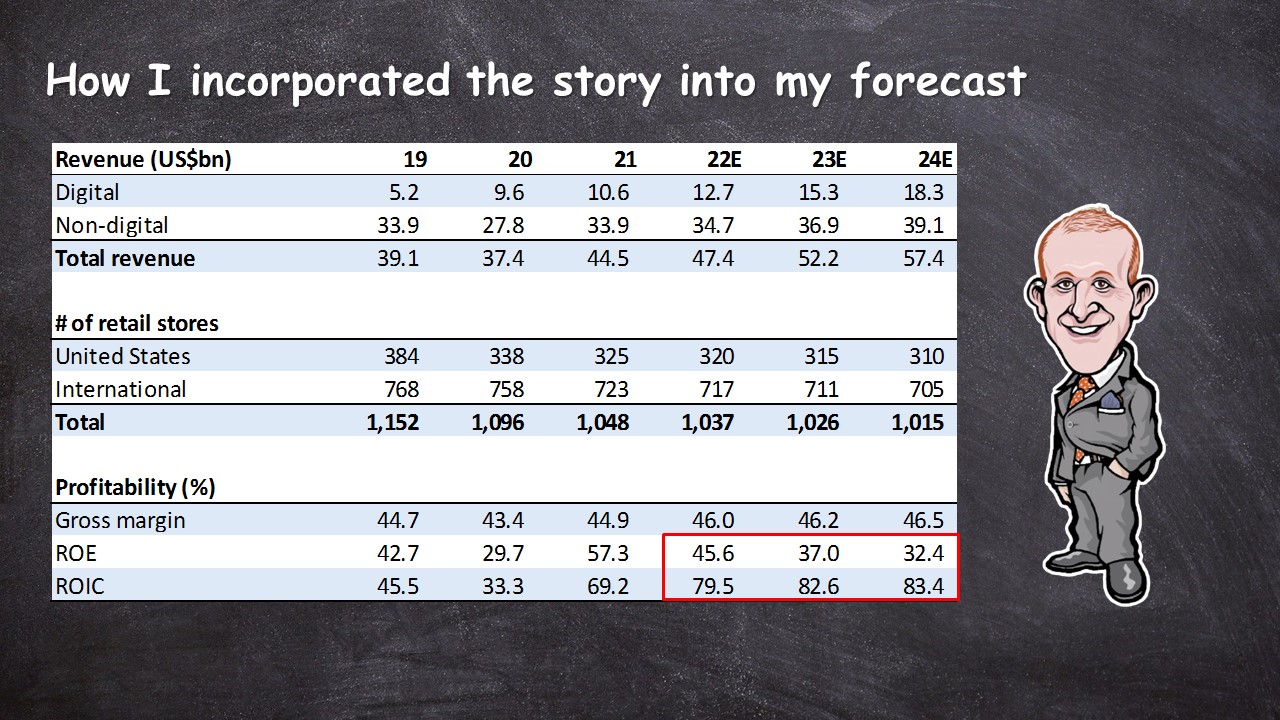

How I incorporated the story into my forecast

- Expanding digital sales comprises the key growth driver in the future

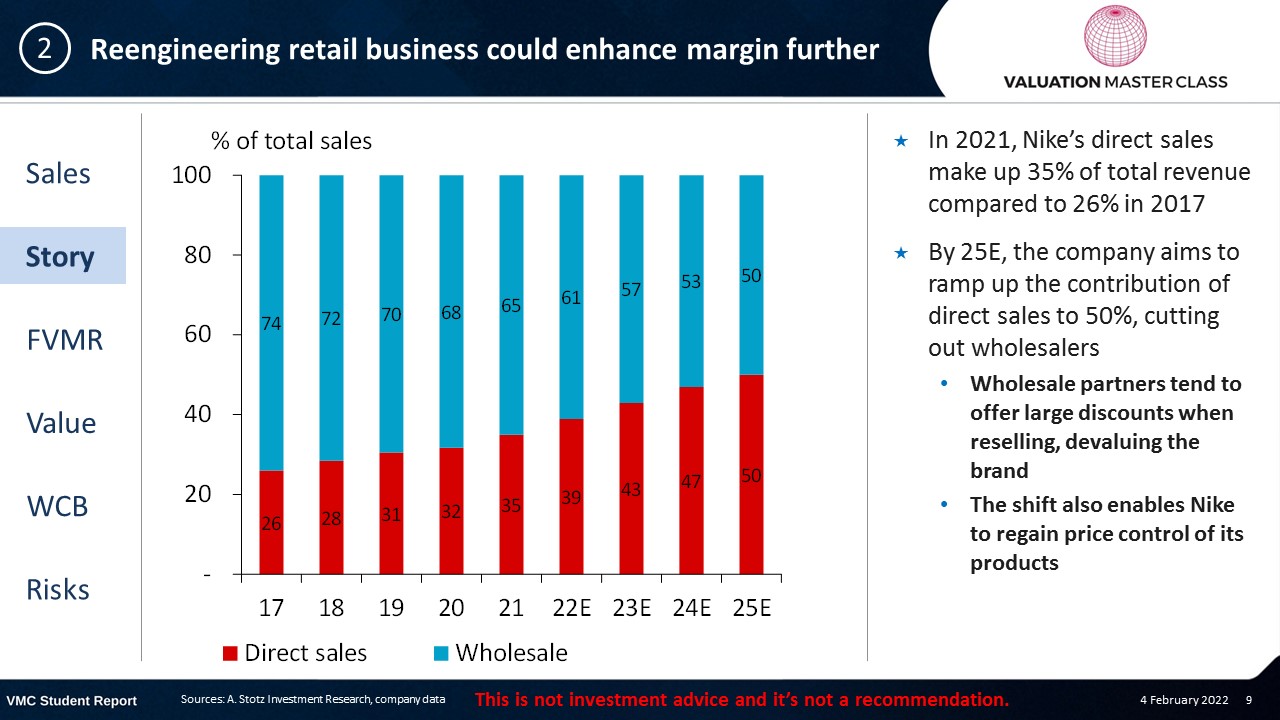

Reengineering retail business could enhance margin further

- In 2021, Nike’s direct sales make up 35% of total revenue compared to 26% in 2017

- By 25E, the company aims to ramp up the contribution of direct sales to 50%, cutting out wholesalers

- Wholesale partners tend to offer large discounts when reselling, devaluing the brand

- The shift also enables Nike to regain price control of its products

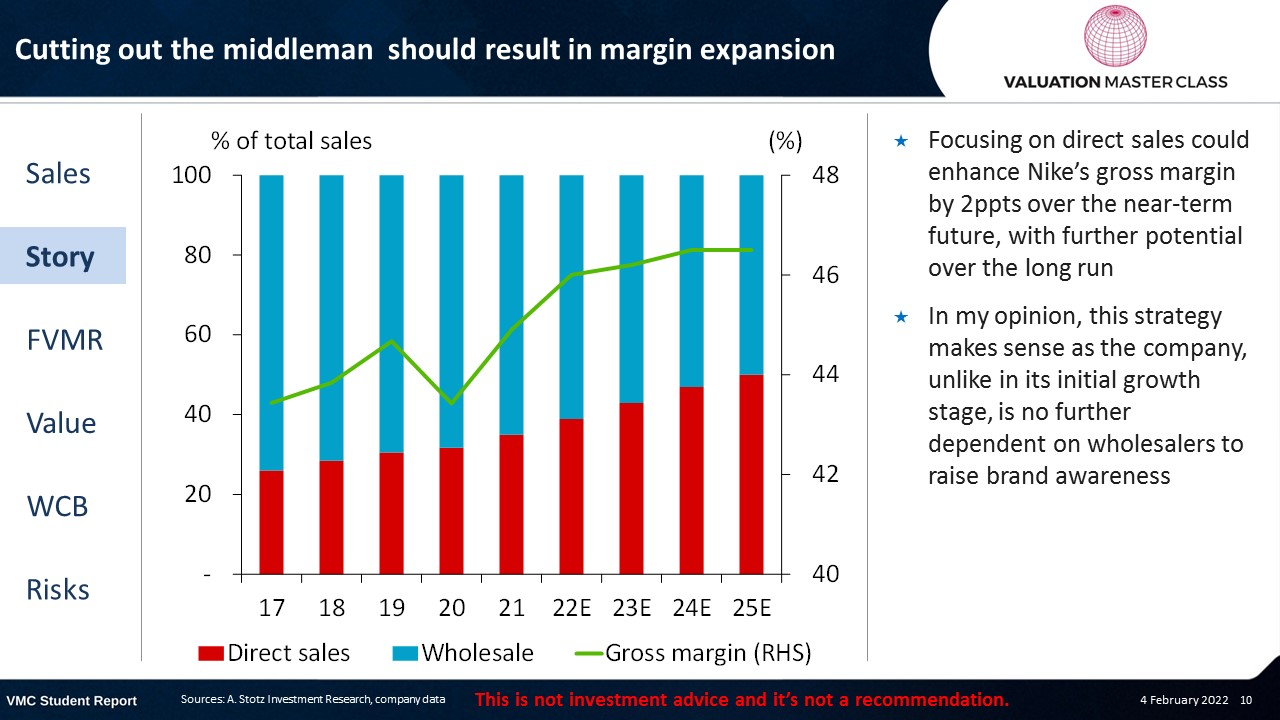

Cutting out the middleman should result in margin expansion

- Focusing on direct sales could enhance Nike’s gross margin by 2ppts over the near-term future, with further potential over the long run

- In my opinion, this strategy makes sense as the company, unlike in its initial growth stage, is no further dependent on wholesalers to raise brand awareness

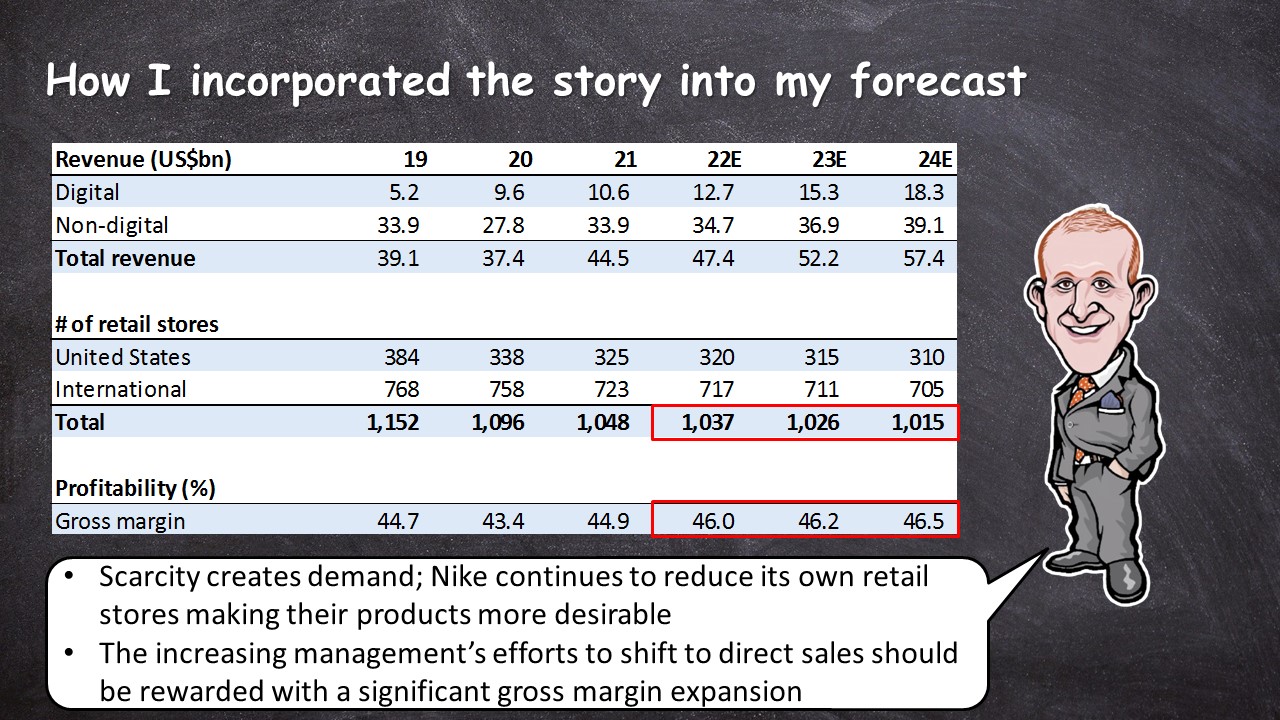

How I incorporated the story into my forecast

- Scarcity creates demand; Nike continues to reduce its own retail stores making their products more desirable

- The increasing management’s efforts to shift to direct sales should be rewarded with a significant gross margin expansion

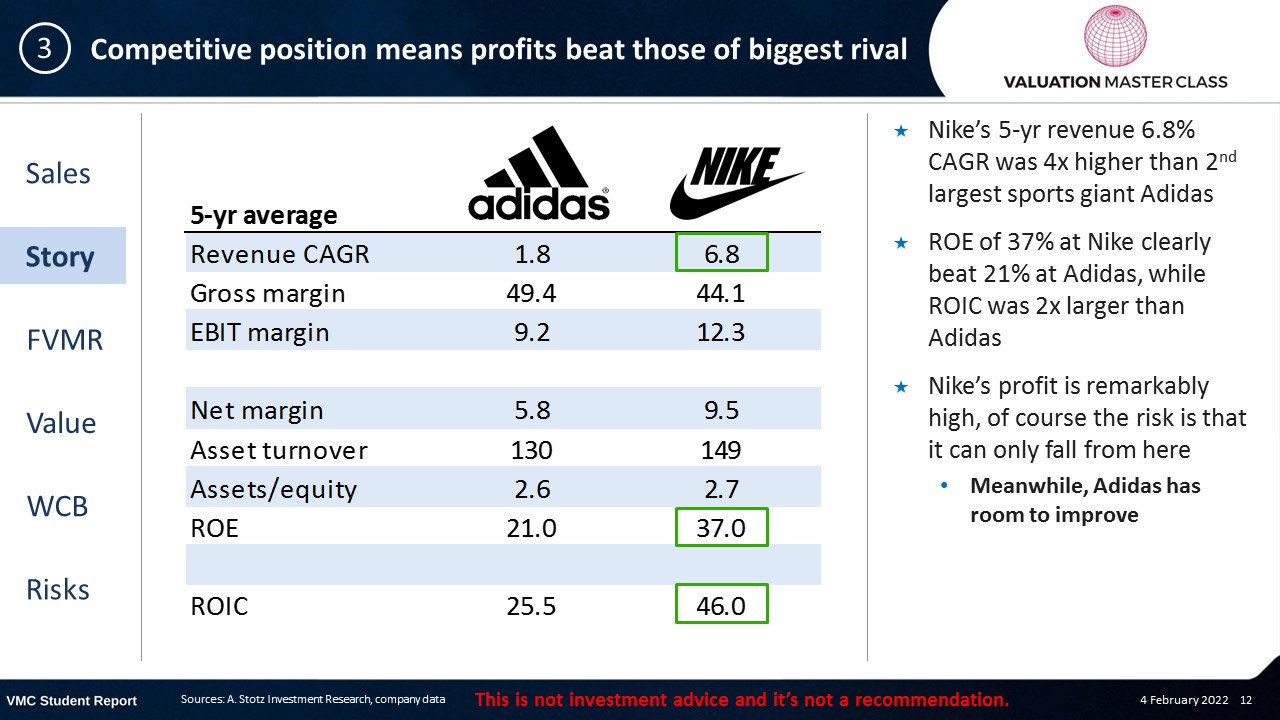

Competitive position means profits beat those of biggest rival

- Nike’s 5-yr revenue 6.8% CAGR was 4x higher than 2nd largest sports giant Adidas

- ROE of 37% at Nike clearly beat 21% at Adidas, while ROIC was 2x larger than Adidas

- Nike’s profit is remarkably high, of course the risk is that it can only fall from here

- Meanwhile, Adidas has room to improve

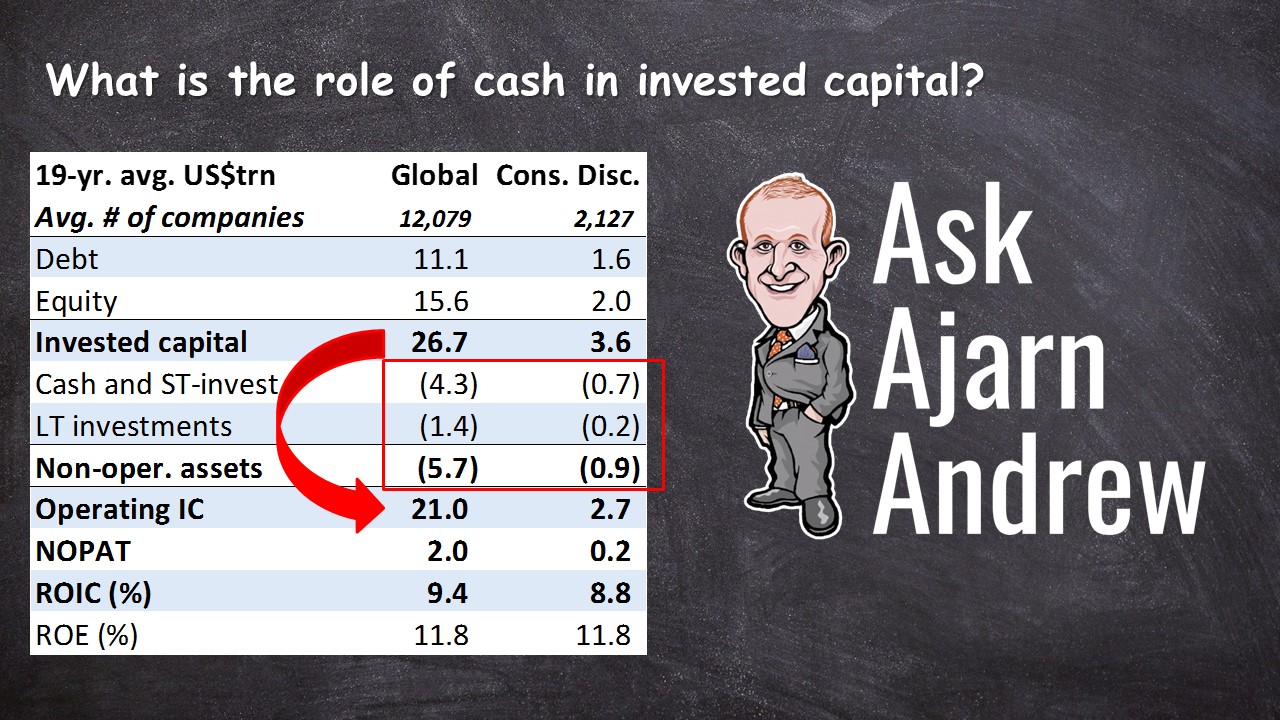

What is the role of cash in invested capital?

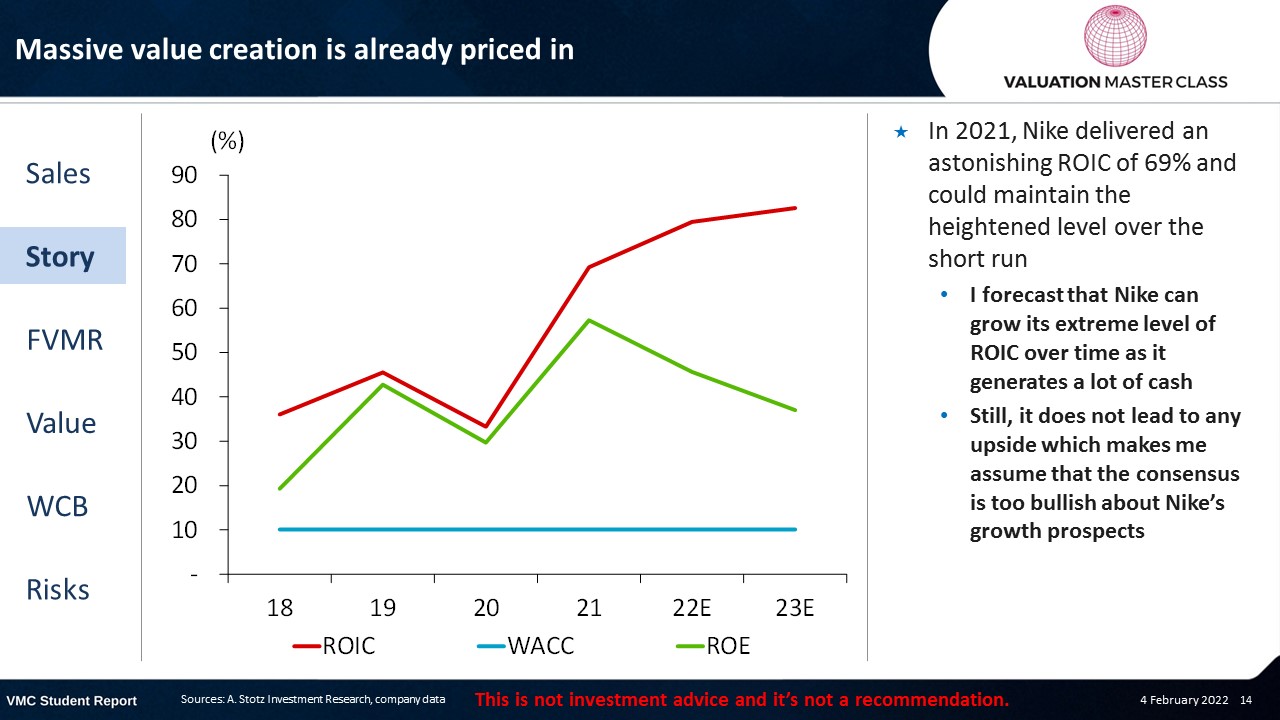

Massive value creation is already priced in

- In 2021, Nike delivered an astonishing ROIC of 69% and could maintain the heightened level over the short run

- I forecast that Nike can grow its extreme level of ROIC over time as it generates a lot of cash

- Still, it does not lead to any upside which makes me assume that the consensus is too bullish about Nike’s growth prospects

How I incorporated the story into my forecast

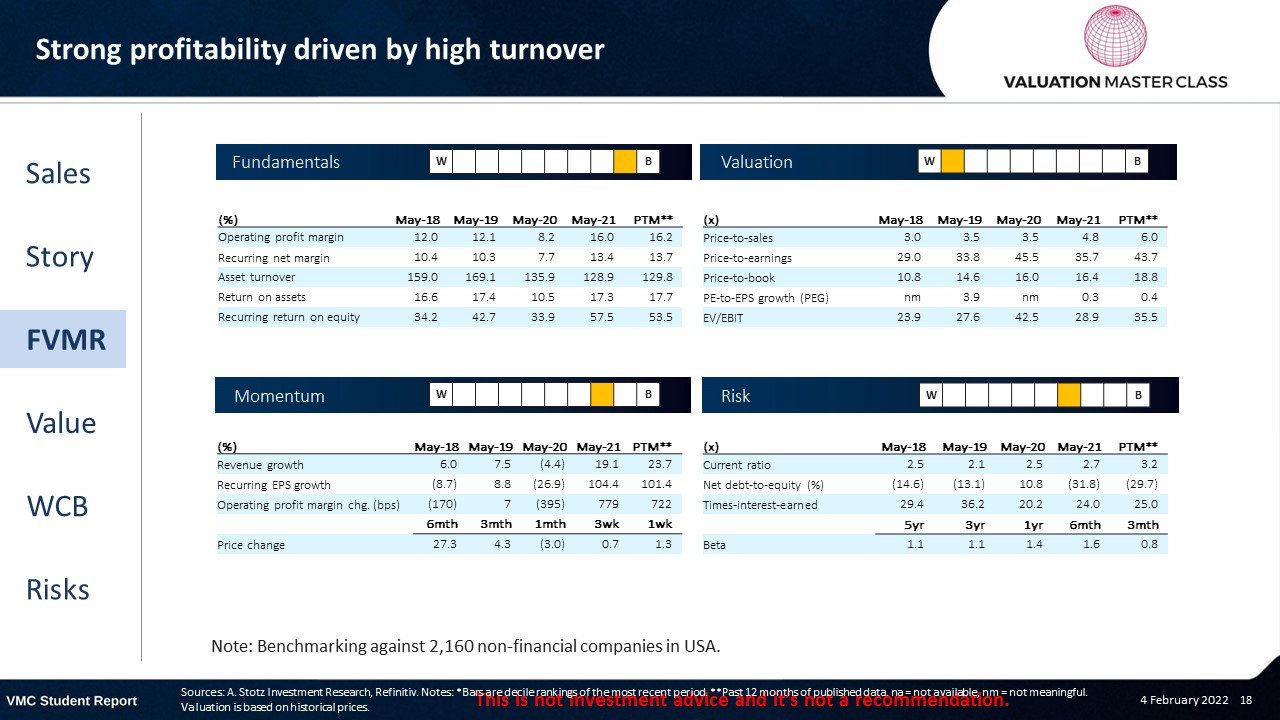

FVMR Scorecard – Nike

- A stock’s attractiveness relative to stocks in that country or region

- Attractiveness is based on four elements

- Fundamentals, Valuation, Momentum, and Risk (FVMR)

- Scale from 1 (Best) to 10 (Worst)

Consensus is strongly bullish

- Most analysts have a BUY recommendation, while 2 analysts issued a SELL

- Consensus is rewarding management’s efforts to focus on direct-to-customer sales

- They forecast a gross margin expansion of 3 ppts over the next 3 years, which might be a bit too optimistic

Get financial statements and assumptions in the full report

P&L – Nike

- Net profit is driven by both continued revenue growth and gross margin expansion

Balance sheet – Nike

- Defensive balance sheet with 1/3 of its assets in cash

- As CAPEX requirements are moderate, the company might decide to return part of its cash in form of share repurchases at some point in the future

- Balance sheet size is almost 2x bigger than its rival Adidas

Ratios – Nike

- Thanks to its margin expansion, Nike could see its EPS grow faster than its revenue

- Nike’s gross margin is below its competitor Adidas which averaged 49% over the past 5 years

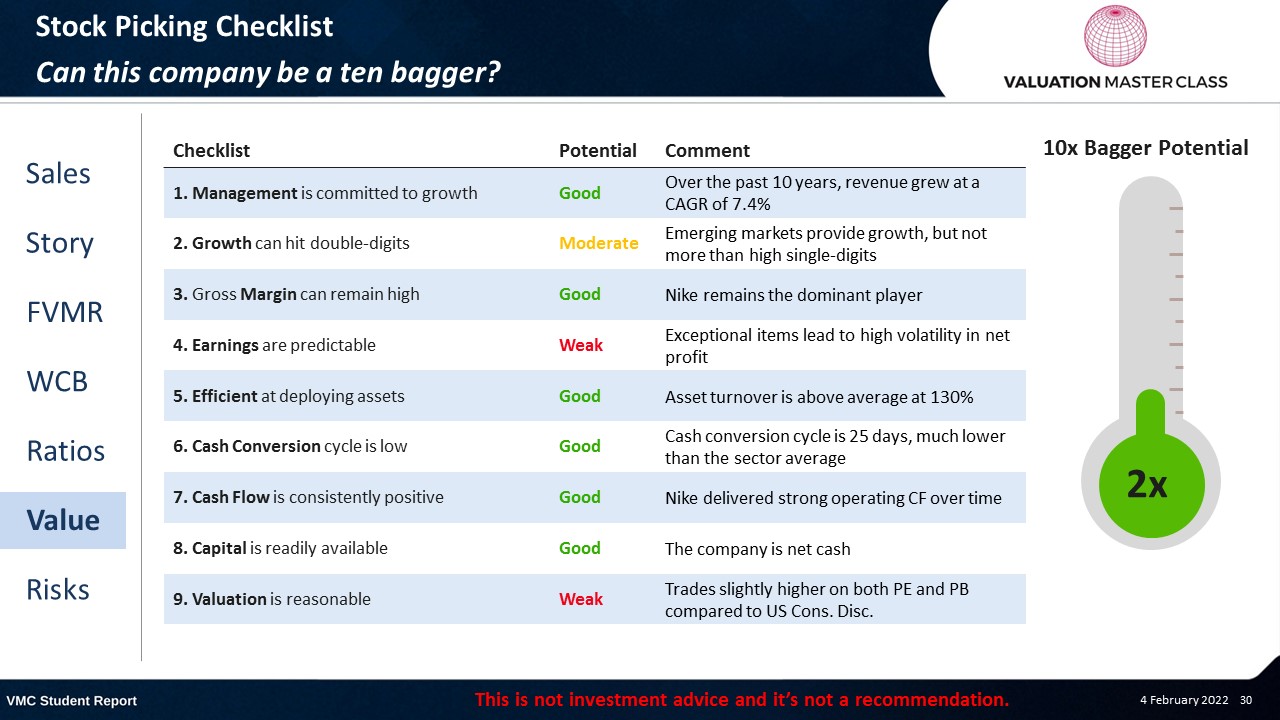

Stock Picking Checklist: Can this company be a ten bagger?

Free cash flow – Nike

- CAPEX requirements are low, leading to high sustainable FCFF

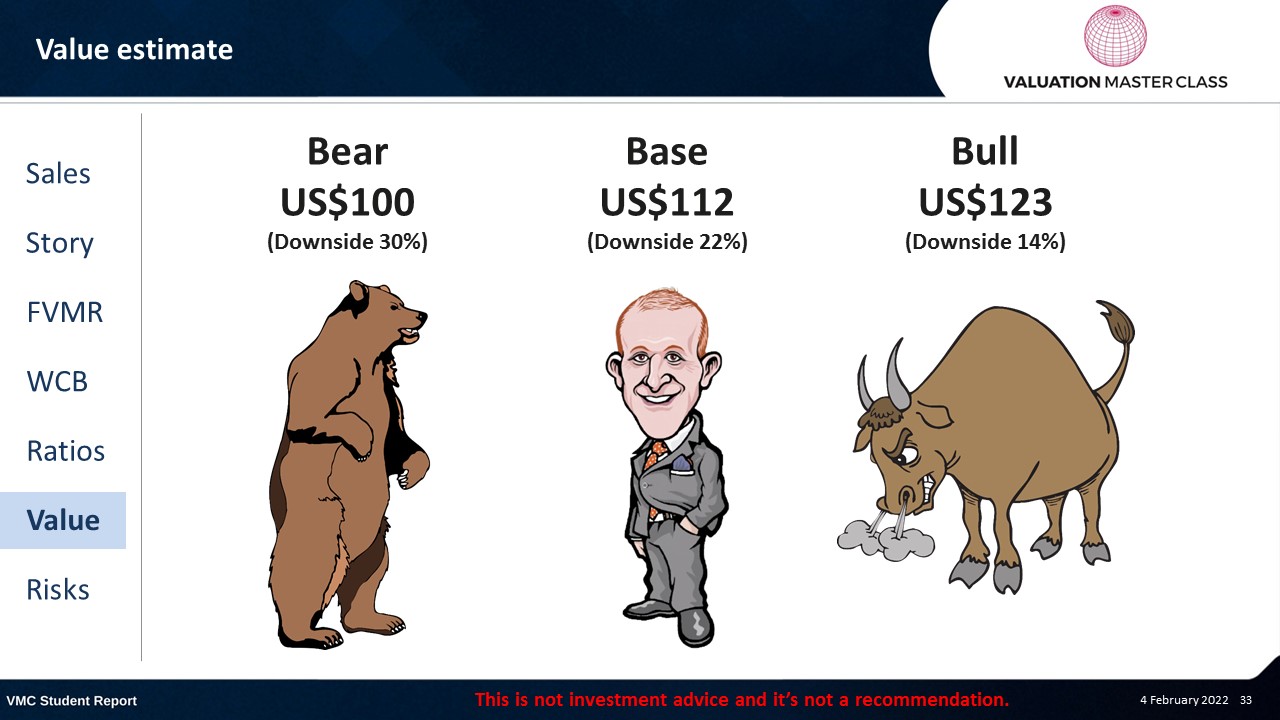

Value estimate – Nike

- I expect lower revenue growth than consensus but higher net margin, leading to similar earnings forecast

- With a 4% terminal growth rate, I am already on the optimistic side

- Also, I assume the company to maintain its massive ROIC over time

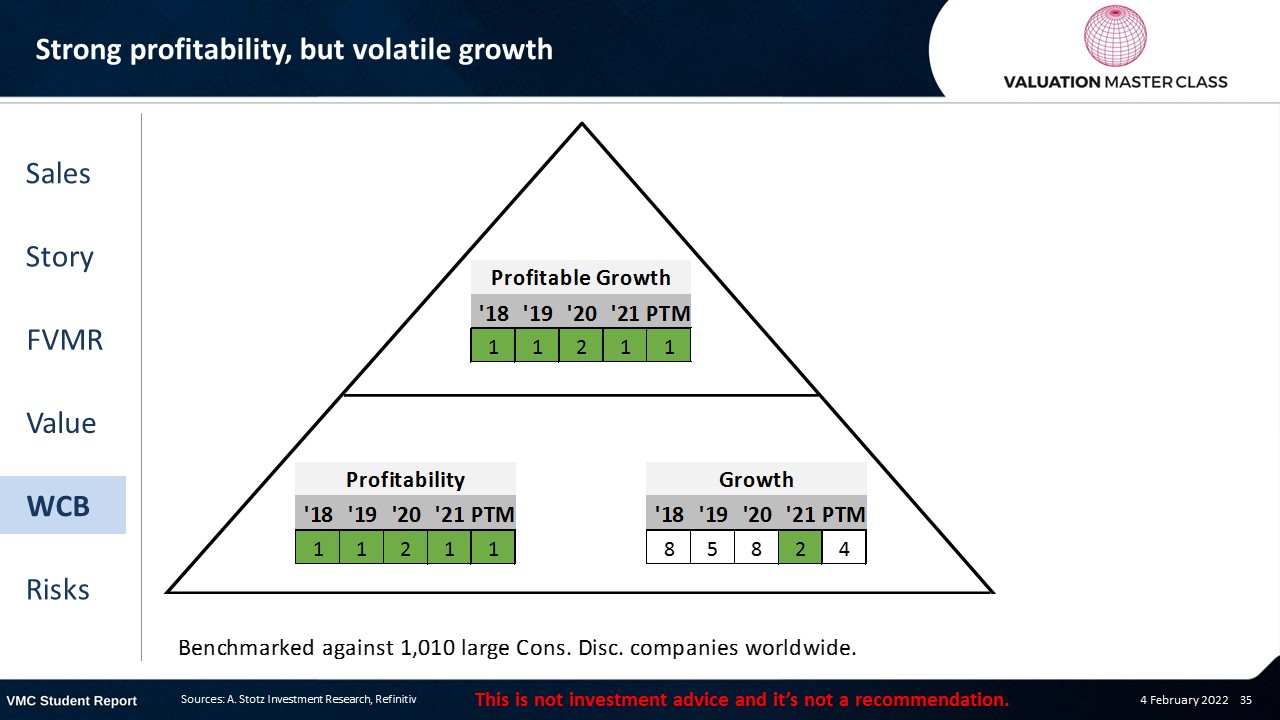

World Class Benchmarking Scorecard – Nike

- Identifies a company’s competitive position relative to global peers

- Combined, composite rank of profitability and growth, called “Profitable Growth”

- Scale from 1 (Best) to 10 (Worst)

Key risk is intense competition

- Entrance of new players joining the fitness and sports market with niche products

- Failure to meet local customer requirements, in particular emerging markets

- Consolidation of retail shops might impair ability to sell

Conclusions

- Direct-to-customer selling approach raises brand value and could enhance margin

- Early digital expansion gives it timing advantage over competitors

- Valuation is not cheap, bullish rally probably over

Download the full report as a PDF

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.