Starbucks Helps Us Better Understand ROA and ROIC

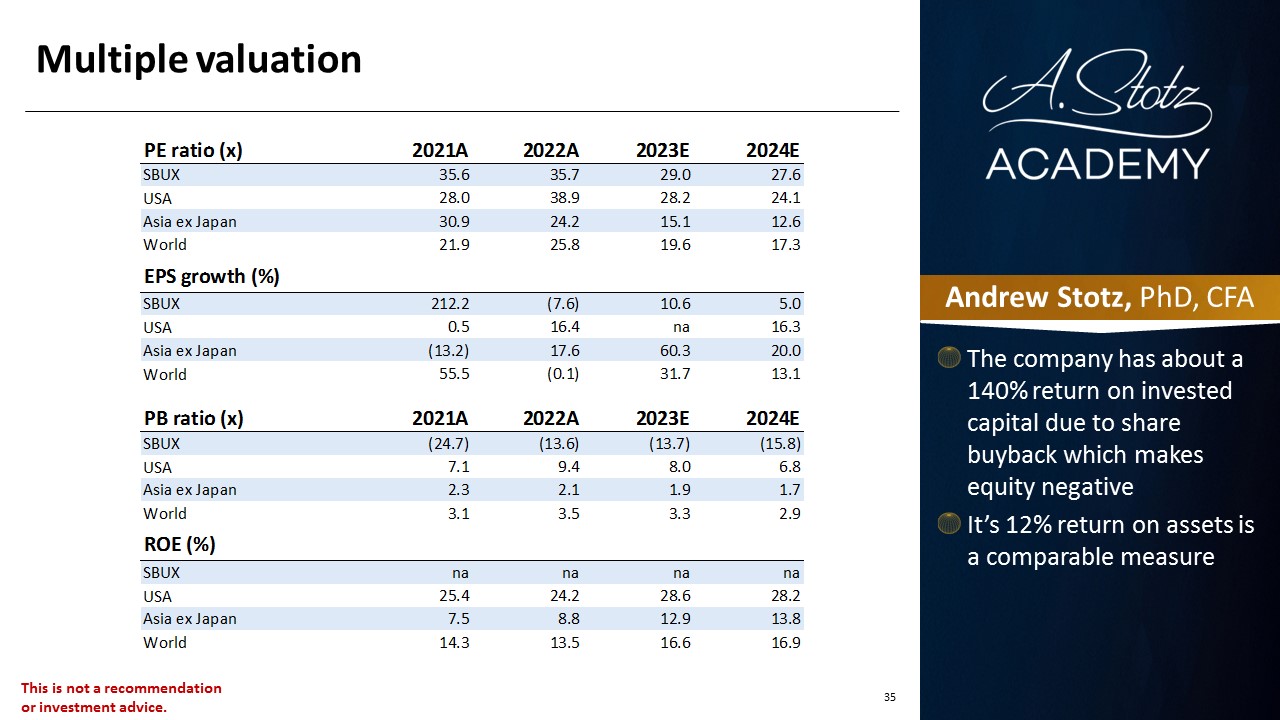

What’s interesting about Starbucks is that we can use it to better understand ROA and ROIC

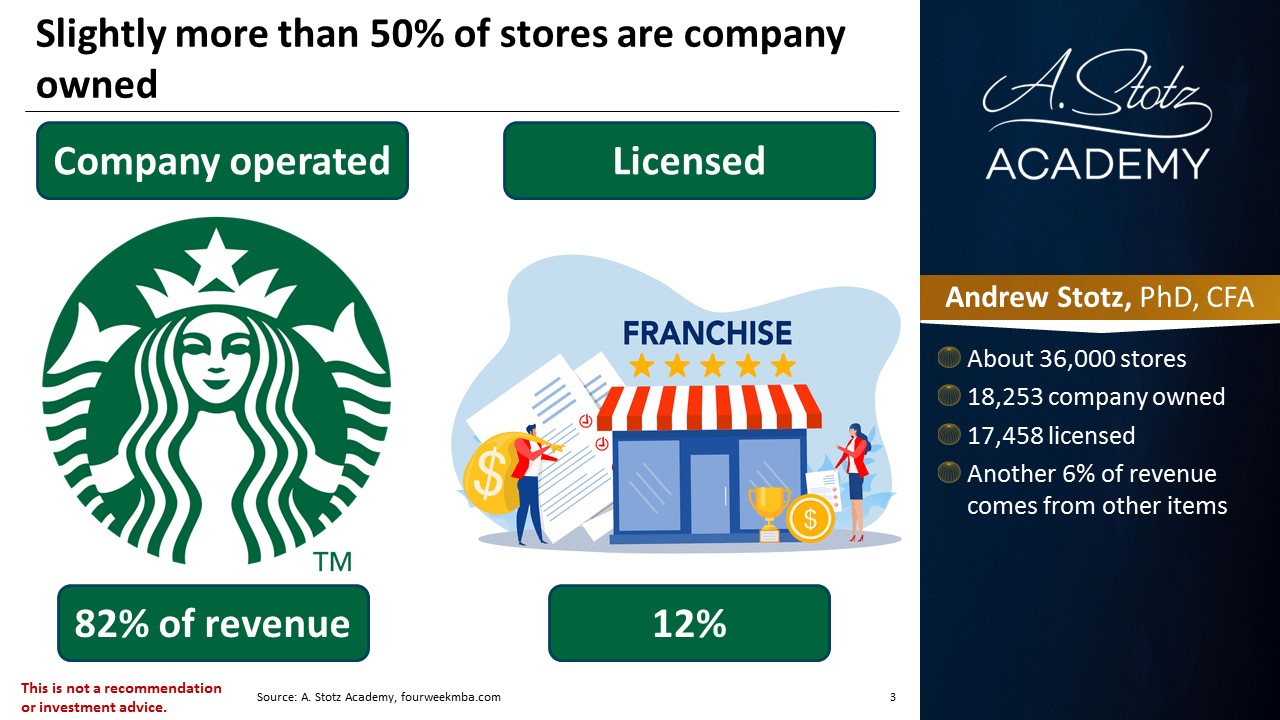

Slightly more than 50% of stores are company owned

- About 36,000 stores

- 18,253 company owned

- 17,458 licensed

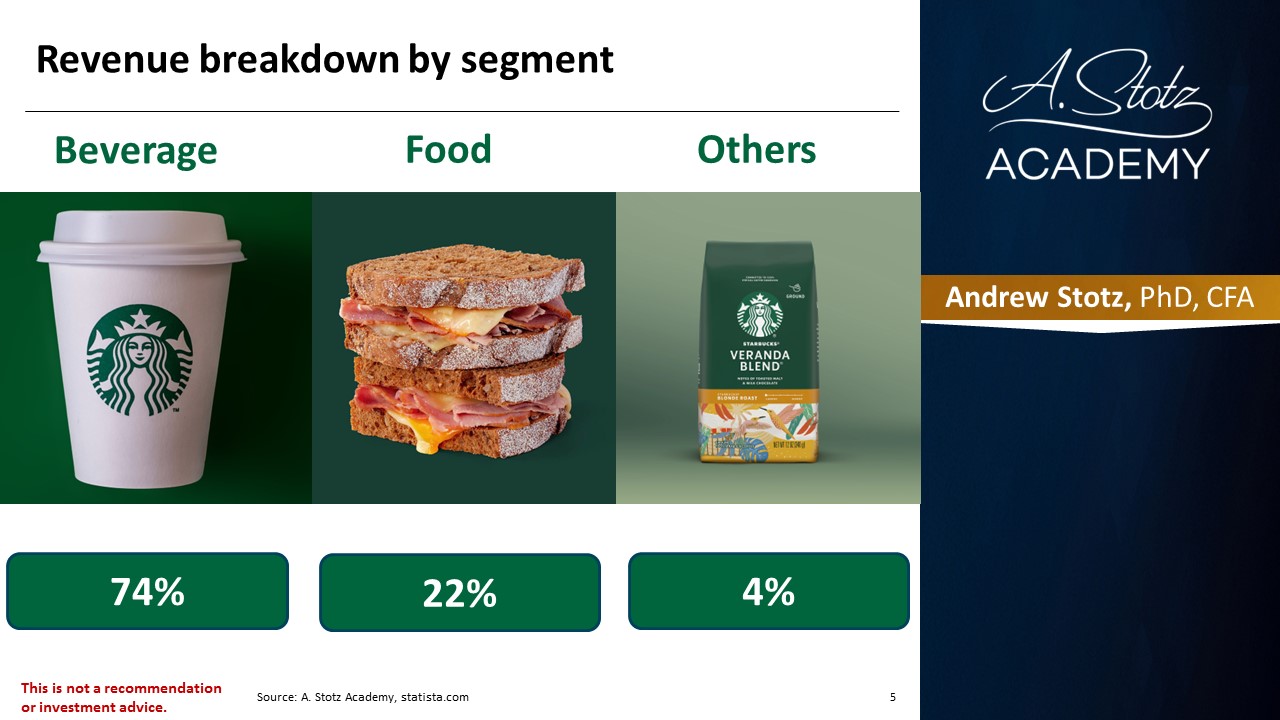

- Another 6% of revenue comes from other items

Number of stores worldwide in 2022

- Remainer from other locations

Download the full report as a PDF

Revenue breakdown by segment

Starbucks – US – Founded 1971

Cons. Disc. sector, 402,000 employees, US$27bn revenue

Main segments/products/divisions/brands

- Starbucks Coffee beverages

- Frappuccino blended beverages

- Starbucks Reserve Roastery and Reserve stores

Its competitive advantage

Competitive advantage through strong brand loyalty, premium coffee experience, and global expansion.

How it achieved its competitive advantage

Achieved by creating a unique coffeehouse atmosphere, focusing on high-quality beans, providing personalized customer experiences, and building a strong global presence through franchising and company-owned stores.

Howard Schultz (born 1953) Former CEO and chairman of Starbucks

- Joined Starbucks in 1982 and transformed it into a global brand

- Credited with popularizing the concept of the “third place” – a comfortable social gathering spot outside of home and work

- Stepped down as CEO in 2000 but returned in 2008 to guide Starbucks through the global financial crisis, finally stepped down in 2022

- He still owns nearly 2% of the company

The success of the Starbucks app

- 26% of sales from mobile apps alone

- Strong loyalty program

- Earn stars and redeem for free drink

- Added gift card to the app

- Customer convenience

- Order, pay, and skip the line

Aprons colors have meaning

- Green – Classic

- Black – Coffee master

- Pale blue – Happy Hour

- Orange – King’s Day celebration in the Netherlands

A journey from teachers to a global coffee icon

- Original store opened in 1971, Seattle, USA

- Founders: Jerry Baldwin, Gordon Bowker, and Zev Siegl

- Were teachers and a writer who all loved coffee

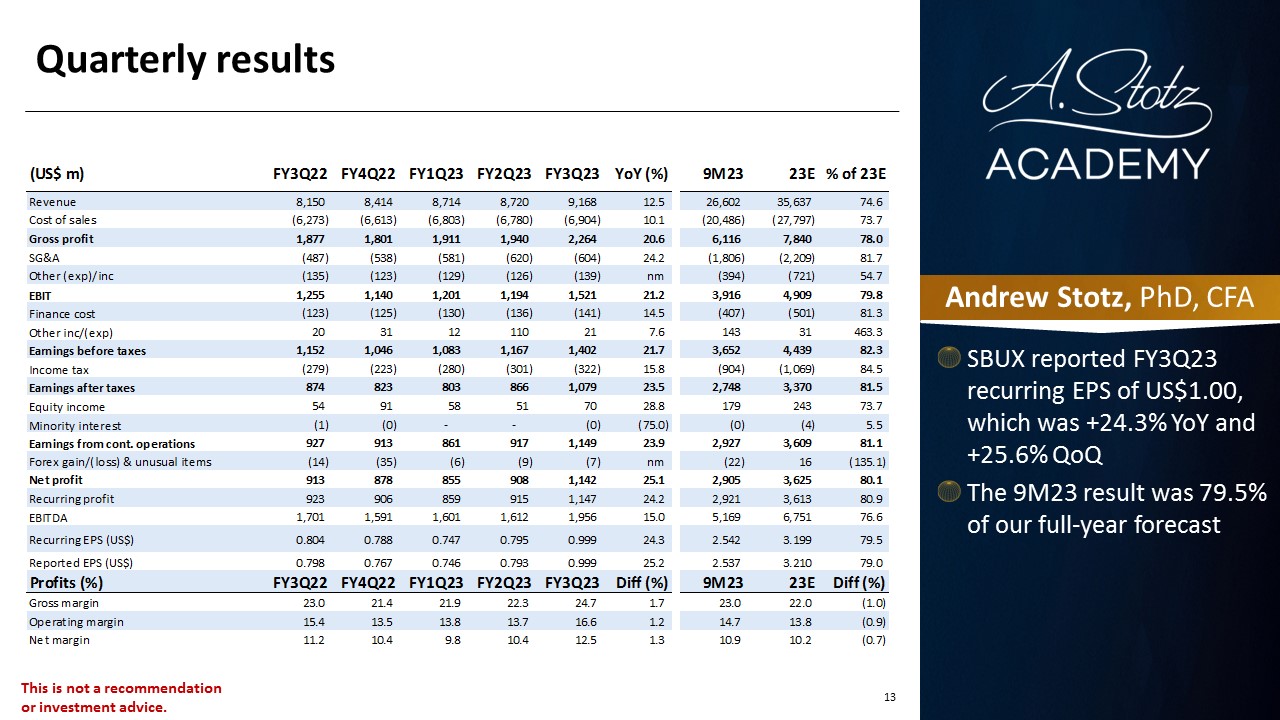

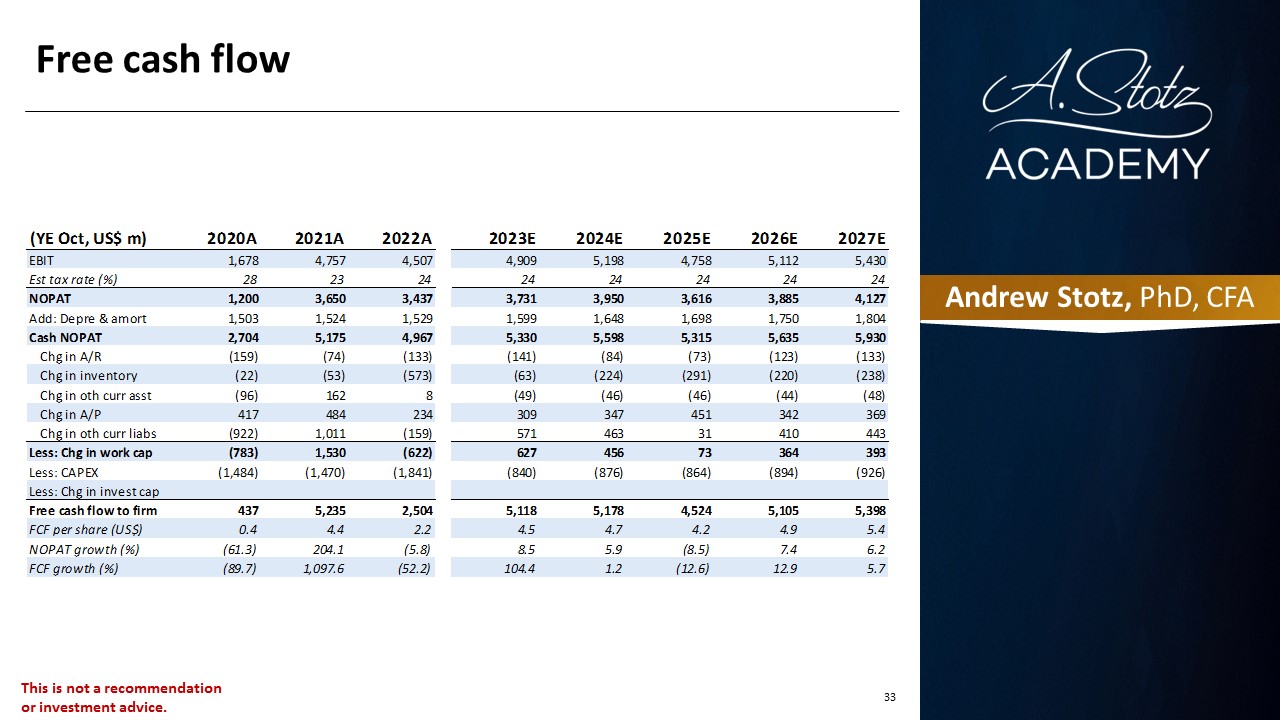

Quarterly results

- SBUX reported FY3Q23 recurring EPS of US$1.00, which was +24.3% YoY and +25.6% QoQ

- The 9M23 result was 79.5% of our full-year forecast

- About 1% of its sales and 4% of its net income

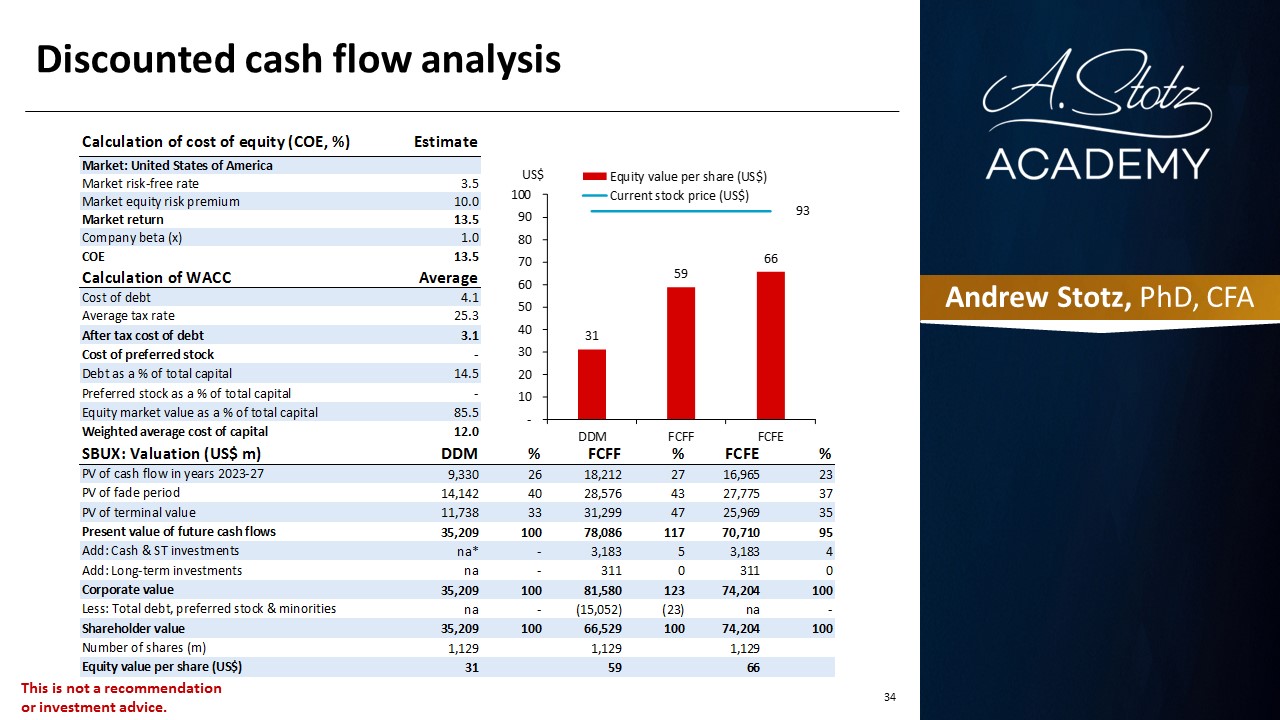

Valuation

Download the full report as a PDF

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.