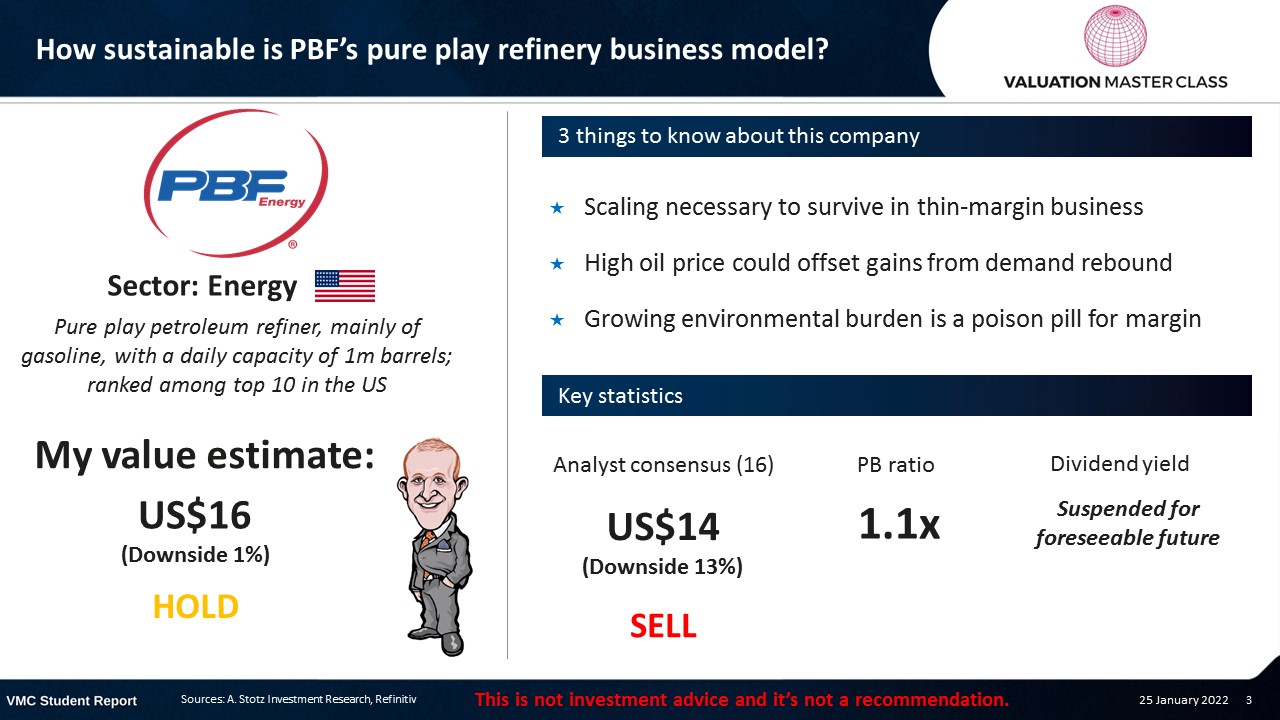

How Sustainable Is PBF Energy’s Pure Play Refinery Business Model?

Highlights:

- Scaling necessary to survive in thin-margin business

- High oil price could offset gains from demand rebound

- Growing environmental burden is a poison pill for margin

Download the full report as a PDF

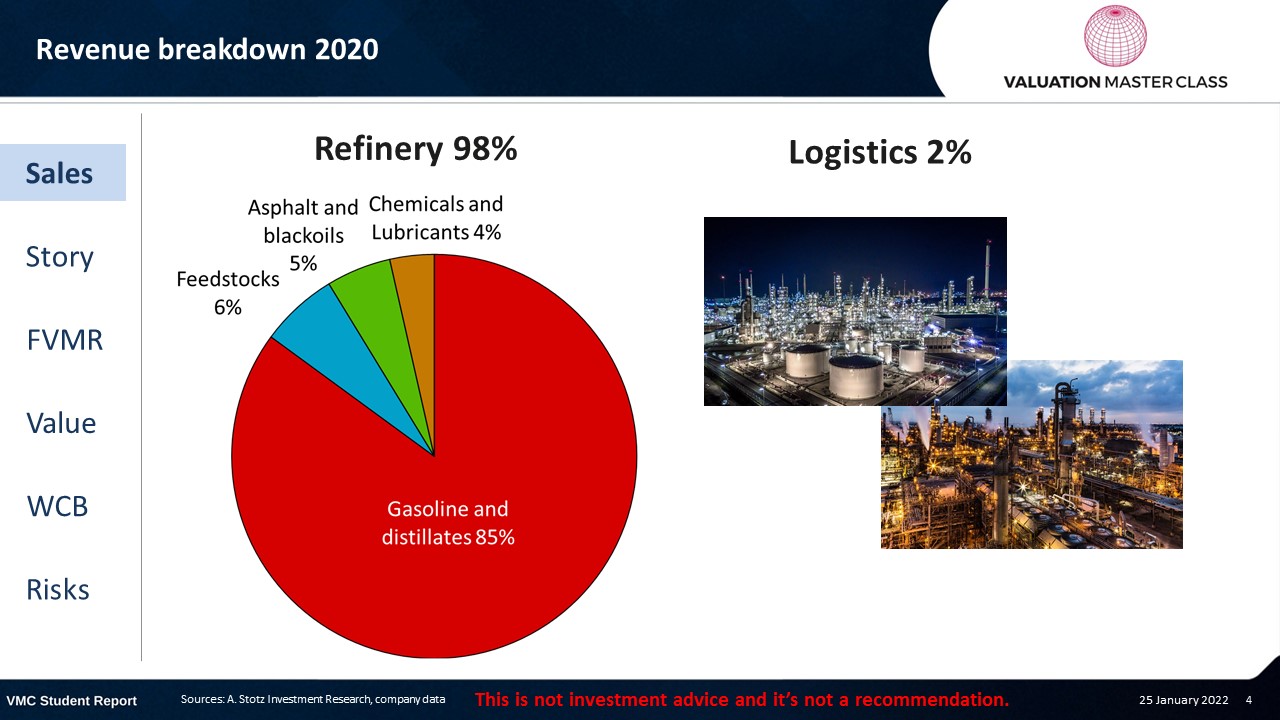

PBF Energy’s revenue breakdown 2020

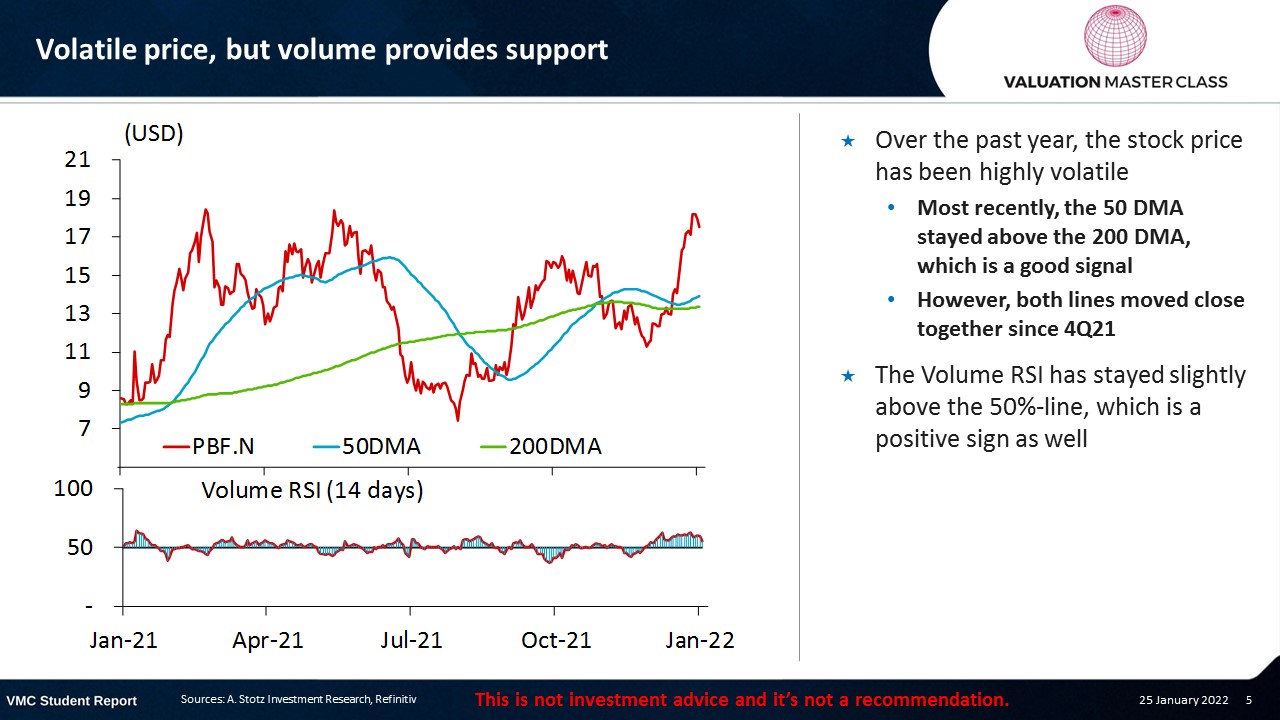

Volatile price, but volume provides support

- Over the past year, the stock price has been highly volatile

- Most recently, the 50 DMA stayed above the 200 DMA, which is a good signal

- However, both lines moved close together since 4Q21

- The Volume RSI has stayed slightly above the 50%-line, which is a positive sign as well

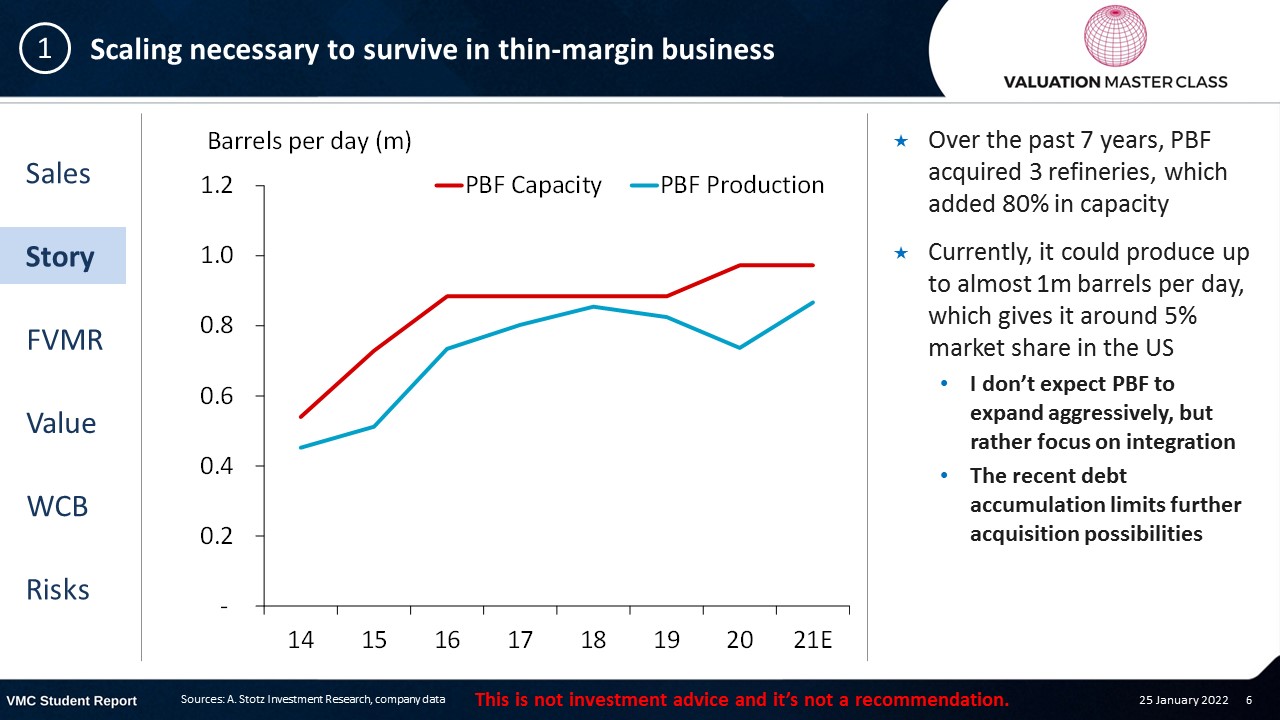

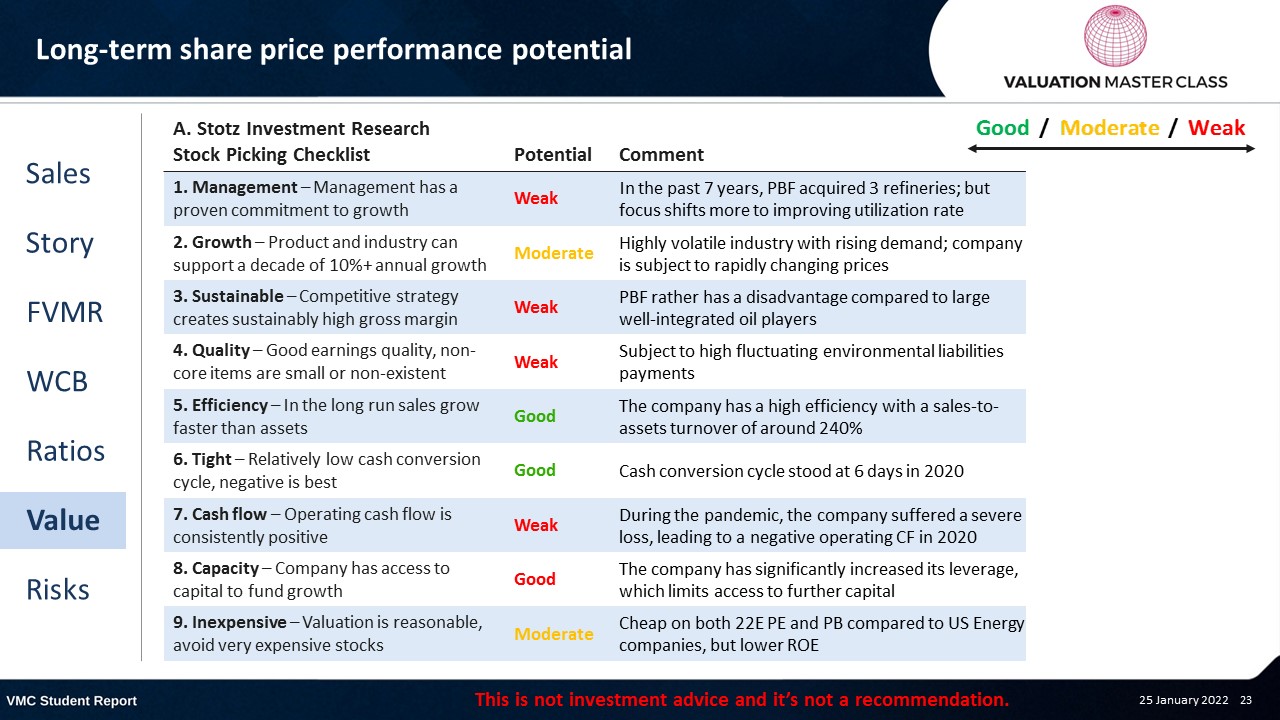

Scaling necessary to survive in thin-margin business

- Over the past 7 years, PBF acquired 3 refineries, which added 80% in capacity

- Currently, it could produce up to almost 1m barrels per day, which gives it around 5% market share in the US

- I don’t expect PBF to expand aggressively, but rather focus on integration

- The recent debt accumulation limits further acquisition possibilities

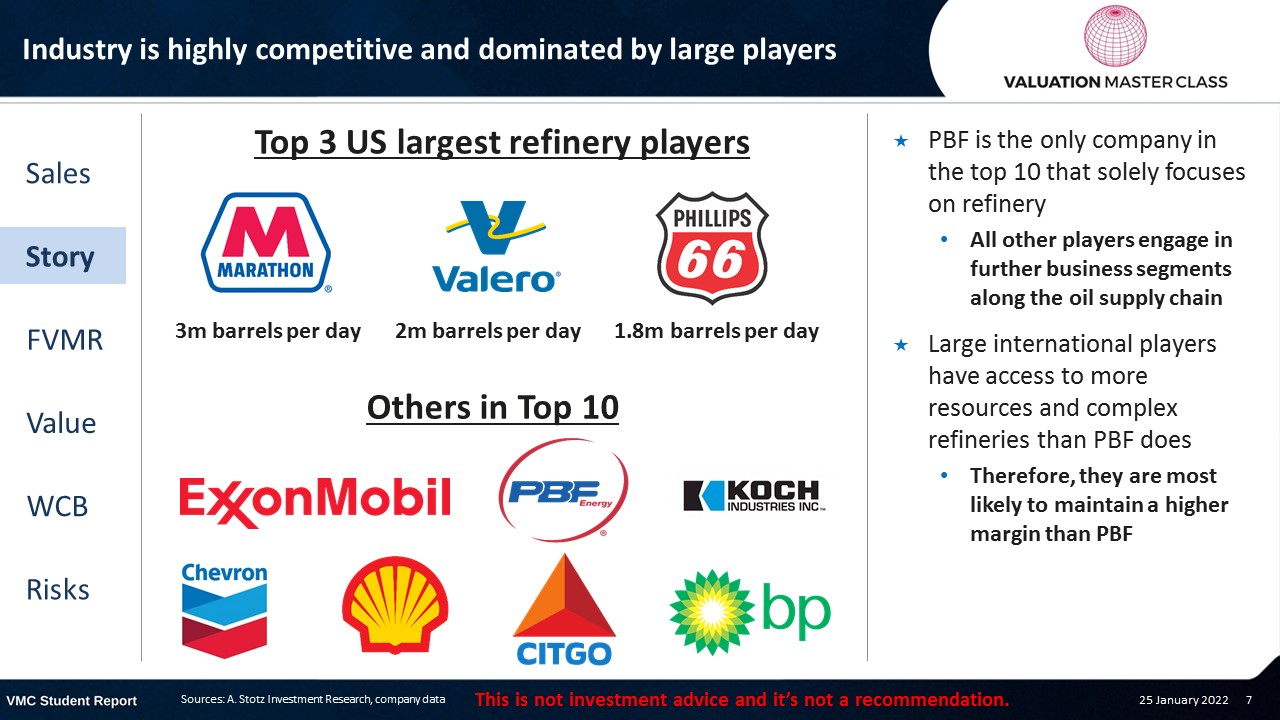

Industry is highly competitive and dominated by large players

- PBF is the only company in the top 10 that solely focuses on refinery

- All other players engage in further business segments along the oil supply chain

- Large international players have access to more resources and complex refineries than PBF does

- Therefore, they are most likely to maintain a higher margin than PBF

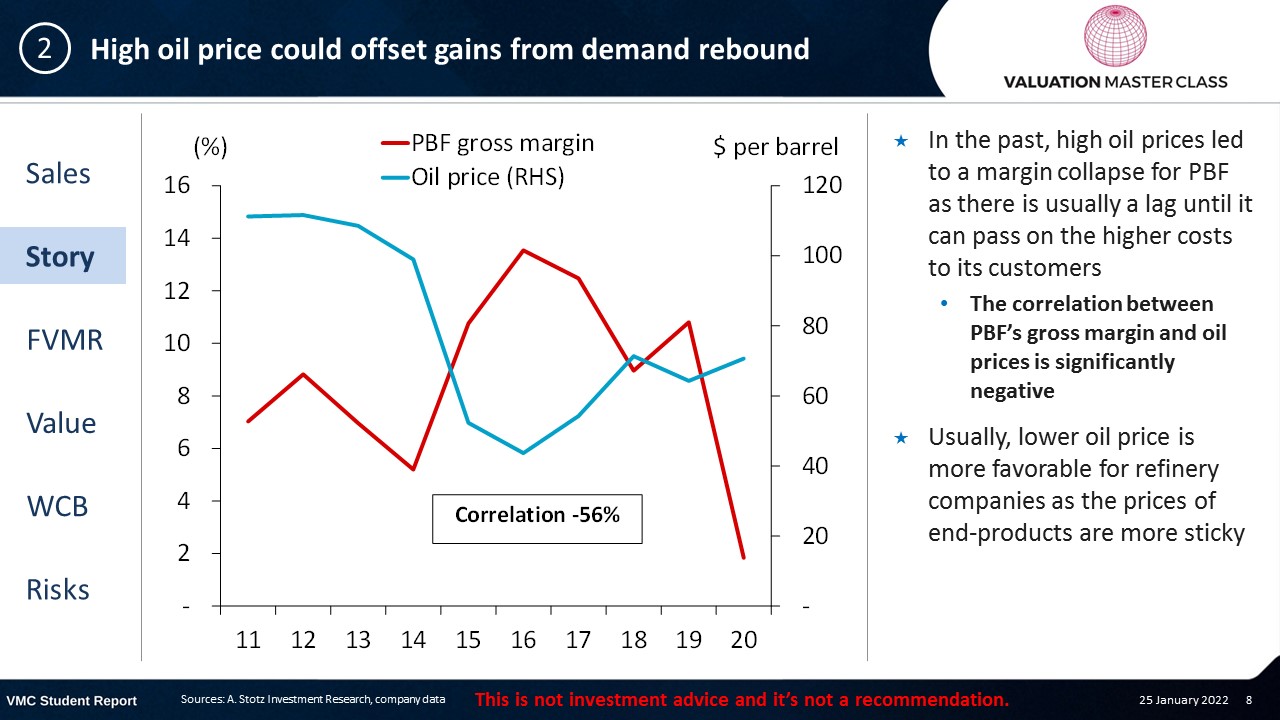

High oil price could offset gains from demand rebound

- In the past, high oil prices led to a margin collapse for PBF as there is usually a lag until it can pass on the higher costs to its customers

- The correlation between PBF’s gross margin and oil prices is significantly negative

- Usually, lower oil price is more favorable for refinery companies as the prices of end-products are more sticky

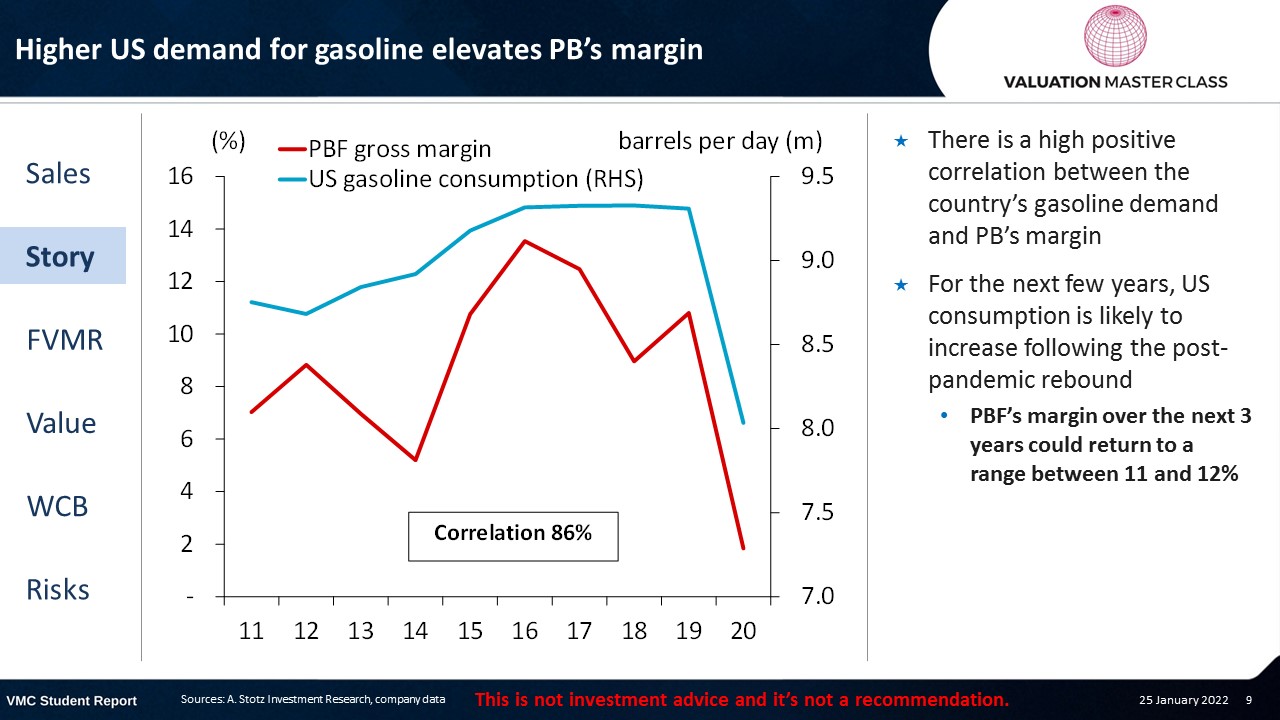

Higher US demand for gasoline elevates PB’s margin

- There is a high positive correlation between the country’s gasoline demand and PB’s margin

- For the next few years, US consumption is likely to increase following the post-pandemic rebound

- PBF’s margin over the next 3 years could return to a range between 11 and 12%

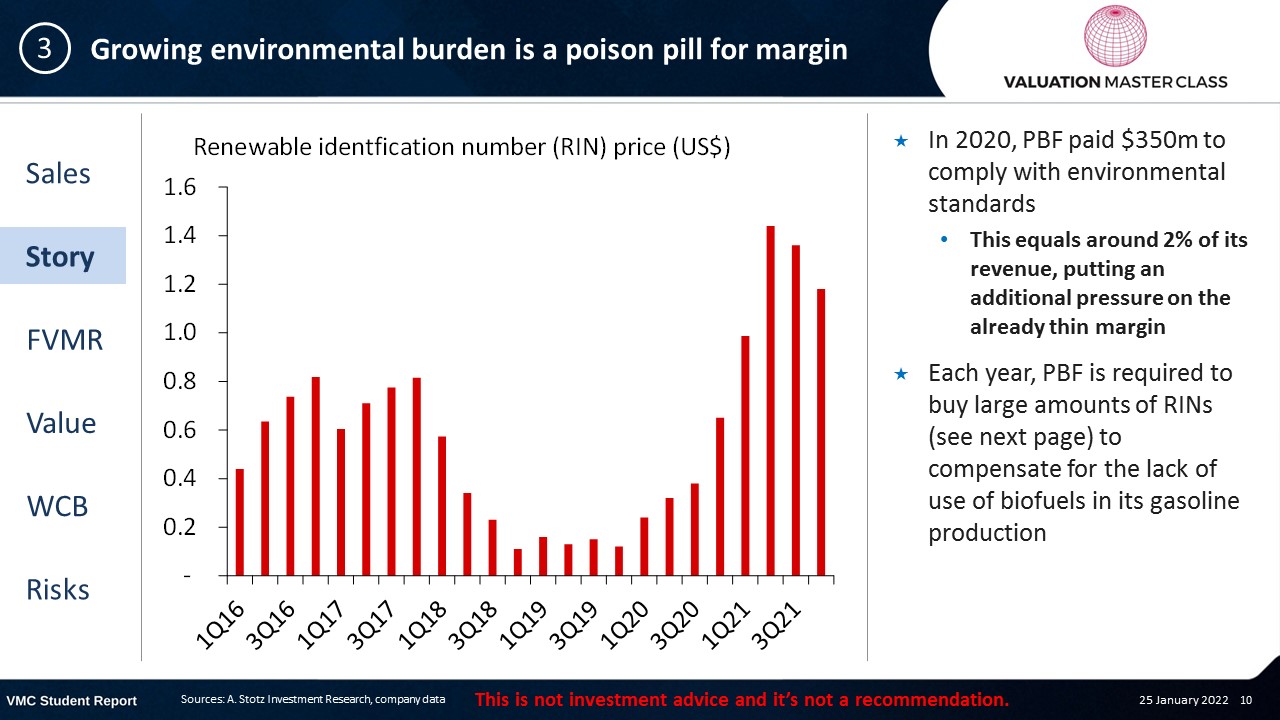

Growing environmental burden is a poison pill for margin

- In 2020, PBF paid $350m to comply with environmental standards

- This equals around 2% of its revenue, putting an additional pressure on the already thin margin

- Each year, PBF is required to buy large amounts of RINs (see next page) to compensate for the lack of use of biofuels in its gasoline production

What are renewable identification numbers (RIN)?

- RINs are tickets assigned to a produced gallon of biofuel to track its further use

- Each refinery is required to hold a certain number of tickets for compliance

- Those tickets can be traded

- If a company has used insufficient biofuels, it can buy RIN tickets from other companies

- In other words, refineries get penalized for excessive use of traditional fuels in their production

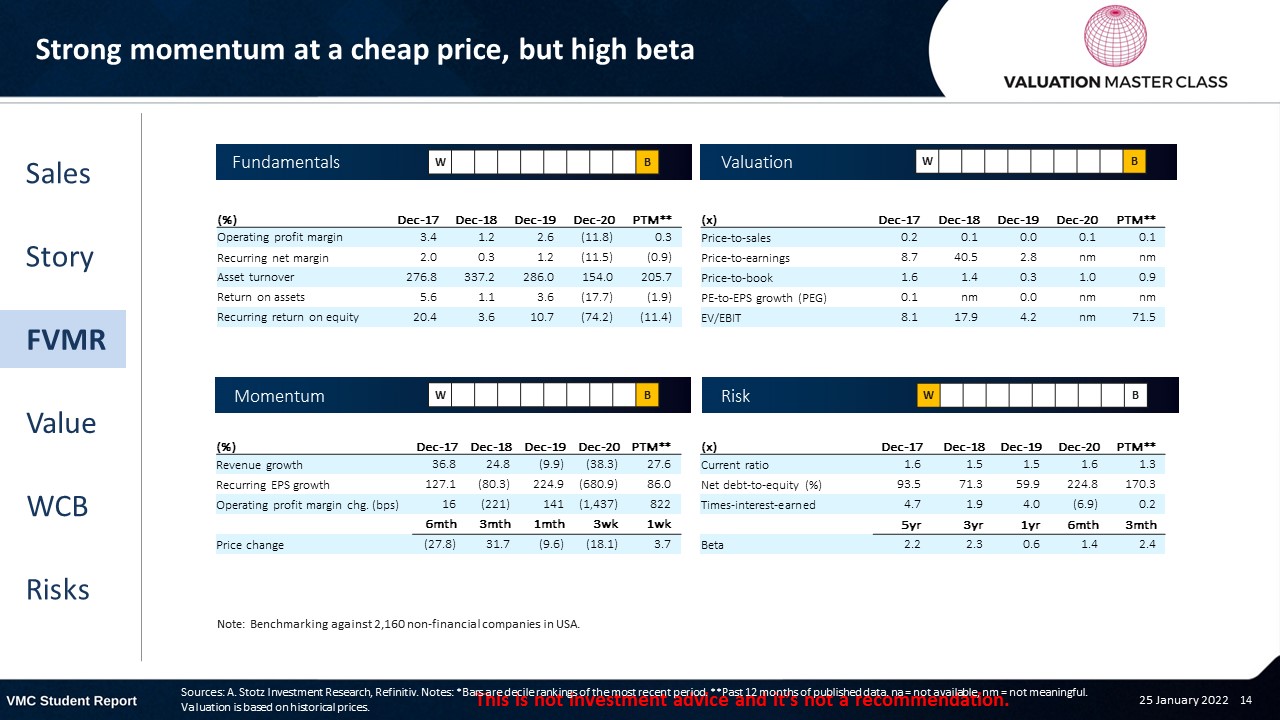

FVMR Scorecard – PBF Energy

- A stock’s attractiveness relative to stocks in that country or region

- Attractiveness is based on four elements

- Fundamentals, Valuation, Momentum, and Risk (FVMR)

- Scale from 1 (Best) to 10 (Worst)

Analysts are pessimistic about the company’s outlook

- Currently there is only 1 BUY recommendation

- 7 analysts recommend to HOLD, with another 8 recommending to SELL

- Consensus expects another year of loss in 21E and low margin for the subsequent two years

Get financial statements and assumptions in the full report

P&L – PBF Energy

- In contrast to the analyst consensus, I expect the company to record a small profit in 21E

- PBF was able to turn around losses and already recorded profits in 2Q21 and 3Q21

Balance sheet – PBF Energy

- Refinery companies face high working cap requirements and fluctuating inventories

- The company heavily increased its leverage during the pandemic

- Debt-to-equity ratio in 2020 stood at 2.9x compared to 1x in 2019

- The company is likely to spend almost all of its cash flow to repay debt over time

Ratios – PBF Energy

- PBF could return to a remarkable efficiency of 240%+ in 21E

- Growing demand for gasoline should leader to a higher gross margin in the next few years

Long-term share price performance potential

Free cash flow – PBF Energy

- CAPEX in 21E still expected to be half the usual budget

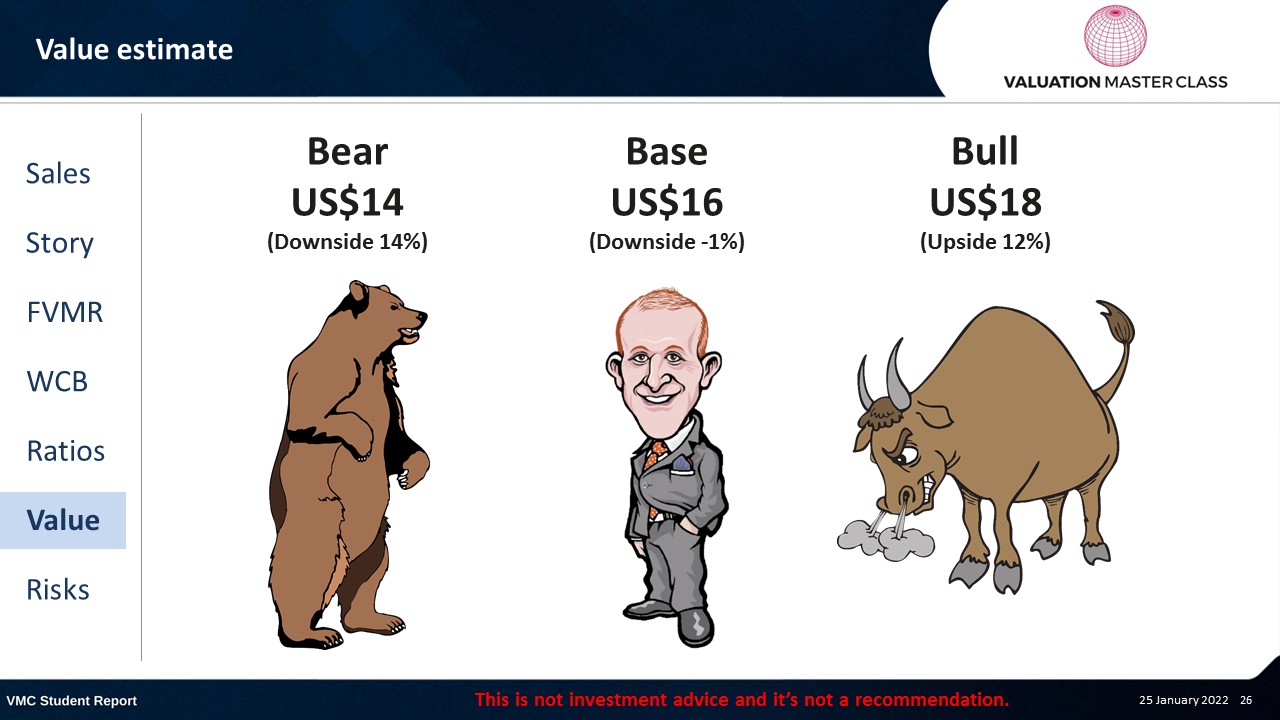

Value estimate – PBF Energy

- My revenue forecast is roughly in line with analyst’s consensus

- However, I expect that the company will record a profit in 21E, as 4Q21 results should be like the previous quarter

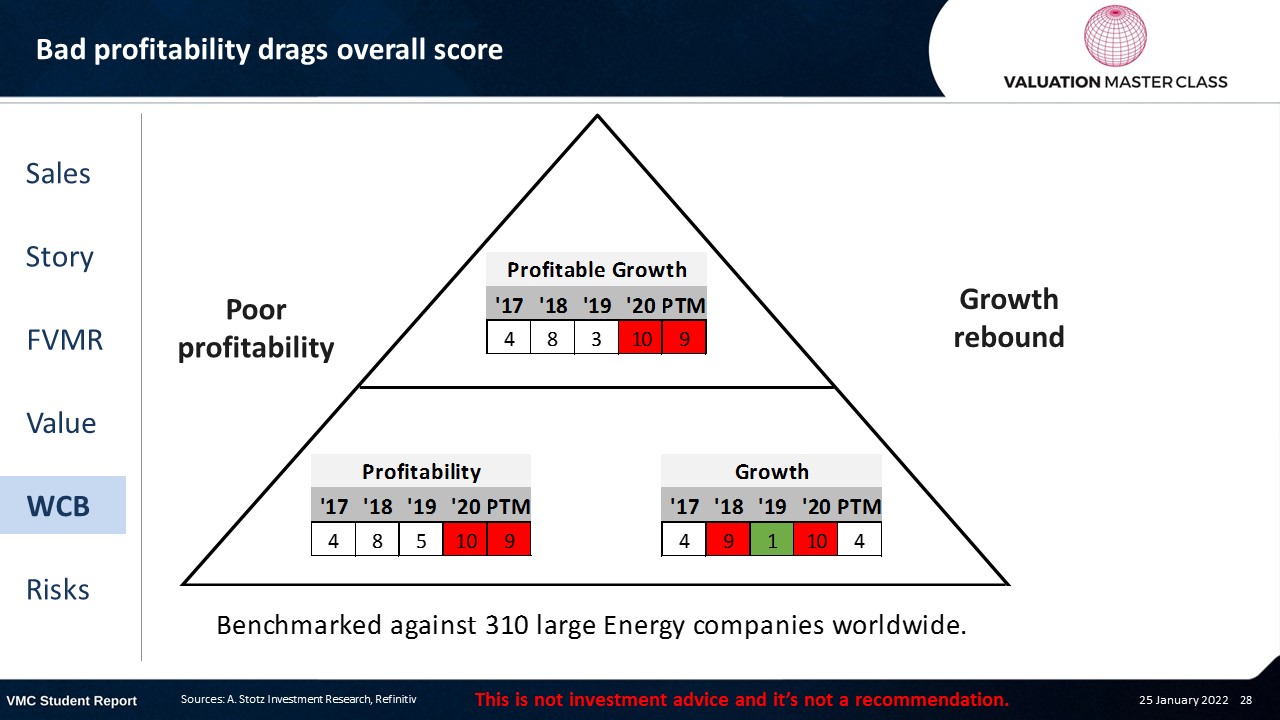

World Class Benchmarking Scorecard – PBF Energy

- Identifies a company’s competitive position relative to global peers

- Combined, composite rank of profitability and growth, called “Profitable Growth”

- Scale from 1 (Best) to 10 (Worst)

Key risk is fluctuations in oil price

- A heightened level of oil price has an adverse impact on margins

- Debt accumulation limits access to further capital

- Growing environmental pressure can make business model unattractive

Conclusions

- Margins under high pressure when oil price remains high

- Rising debt level might hinder growth acquisitions

- Future cash flow proceeds serve debt repayments; don’t expect any dividends in near term

Download the full report as a PDF

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.