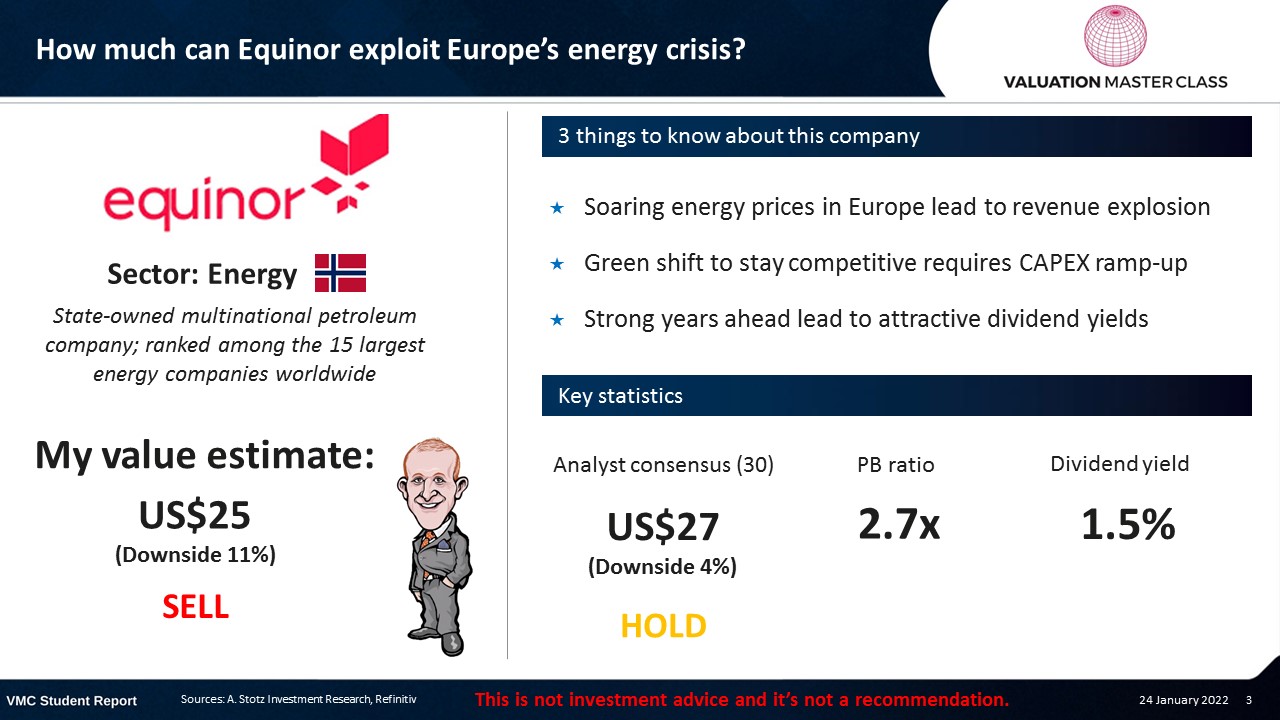

How Much Can Equinor Exploit Europe’s Energy Crisis?

Highlights:

- Soaring energy prices in Europe lead to revenue explosion

- Green shift to stay competitive requires CAPEX ramp-up

- Strong years ahead lead to attractive dividend yields

Download the full report as a PDF

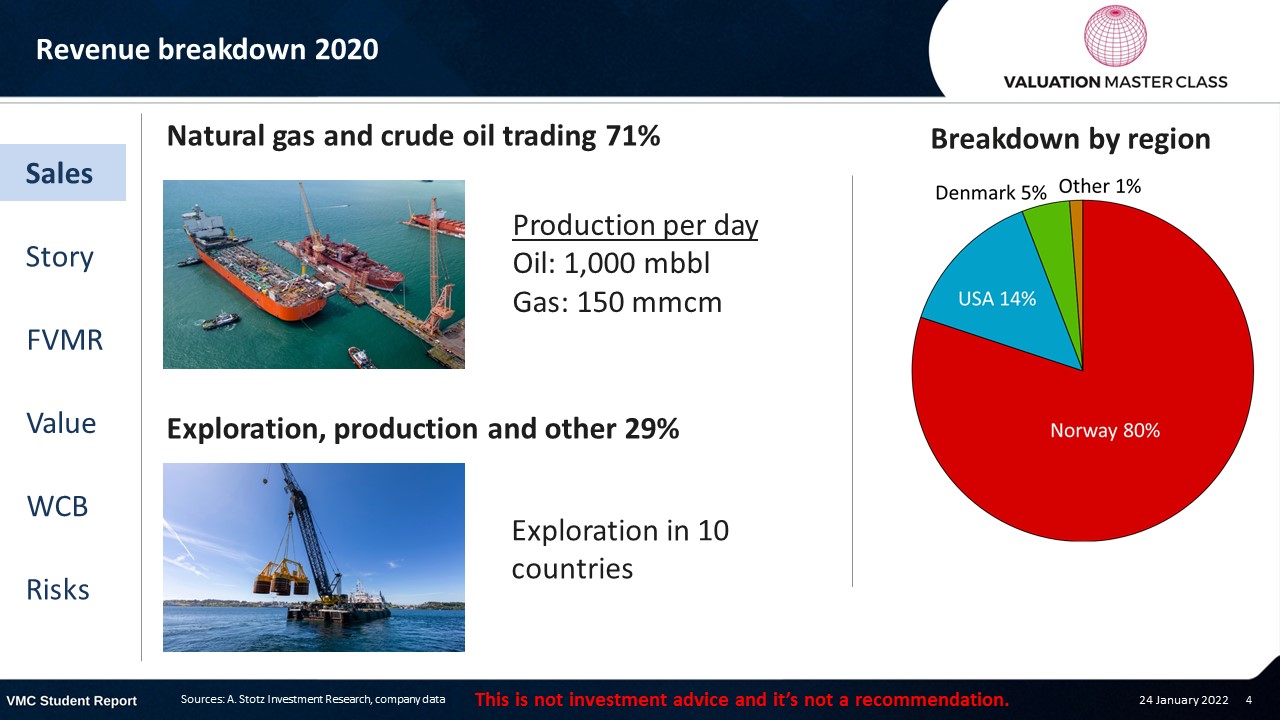

Equinor’s revenue breakdown 2020

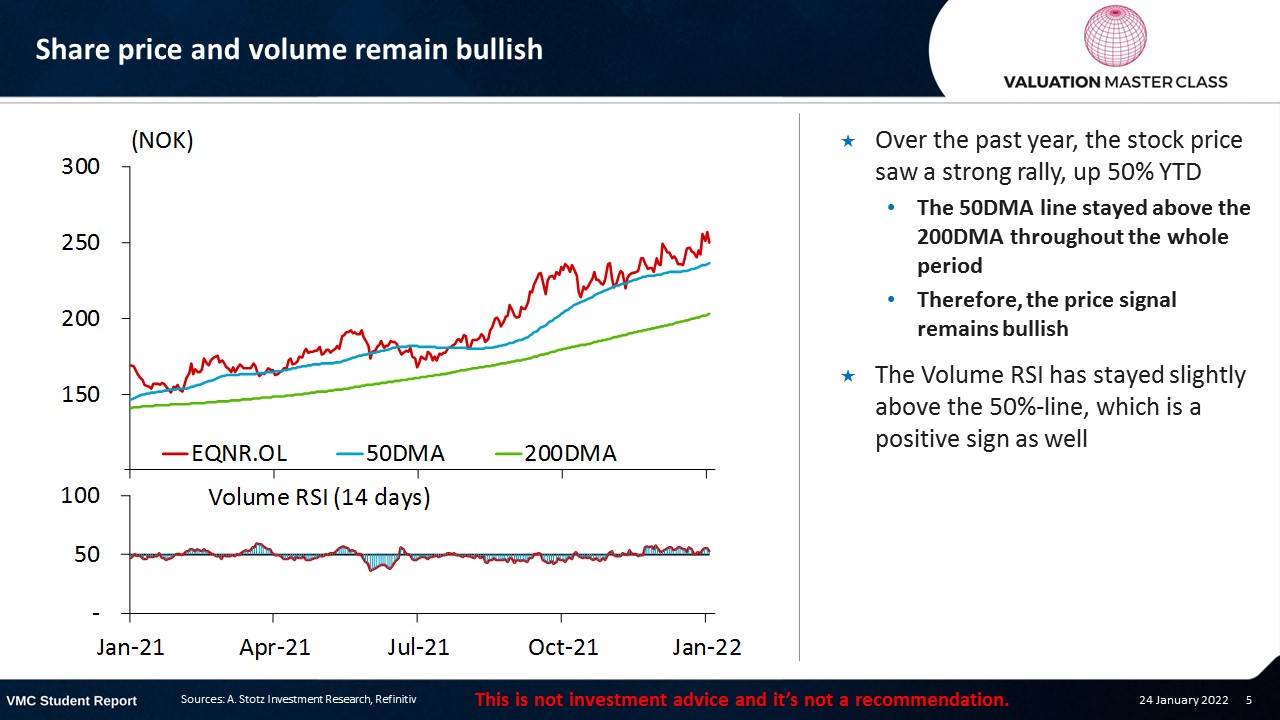

Share price and volume remain bullish

- Over the past year, the stock price saw a strong rally, up 50% YTD

- The 50DMA line stayed above the 200DMA throughout the whole period

- Therefore, the price signal remains bullish

- The Volume RSI has stayed slightly above the 50%-line, which is a positive sign as well

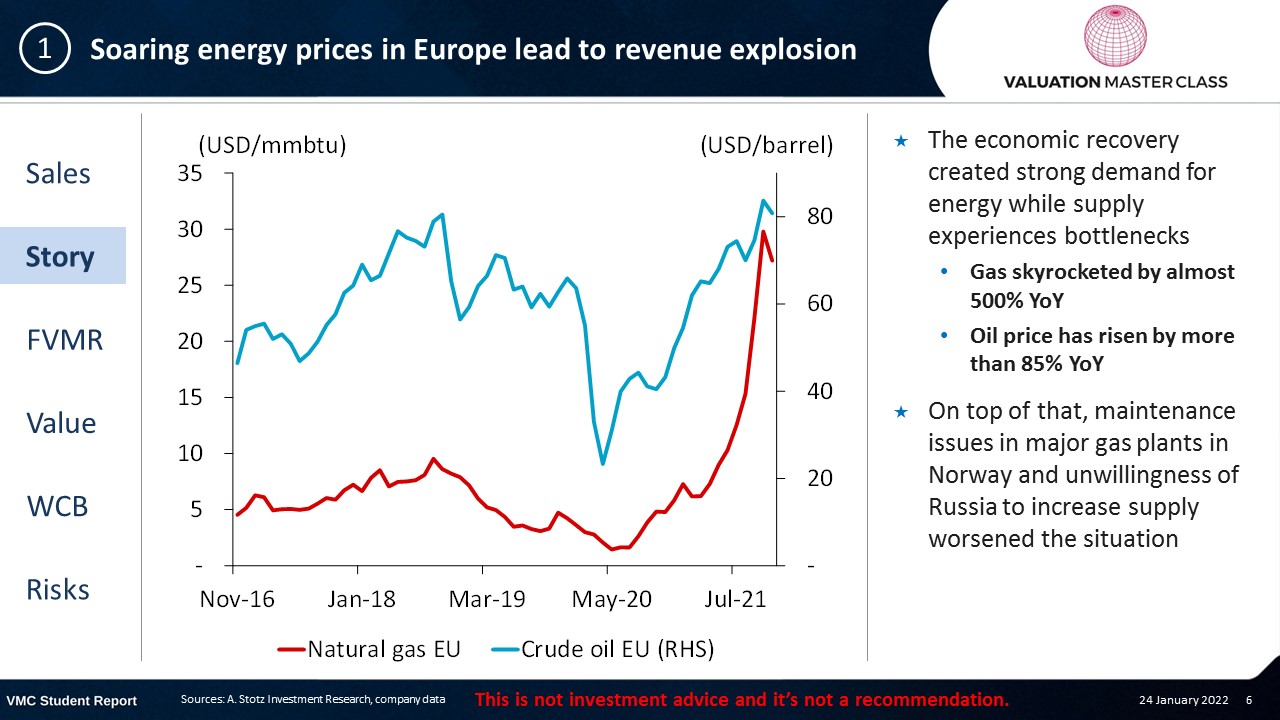

Soaring energy prices in Europe lead to revenue explosion

- The economic recovery created strong demand for energy while supply experiences bottlenecks

- Gas skyrocketed by almost 500% YoY

- Oil price has risen by more than 85% YoY

- On top of that, maintenance issues in major gas plants in Norway and unwillingness of Russia to increase supply worsened the situation

What’s actually going on in Europe?

- The EU ambitiously cut back traditional fuels without enough alternatives

- Renewable energy investments are increasing but too slow to compensate for the supply gap in the near-term future

- Therefore, you can call the current energy crisis self-inflicted

- The EU must now import oil and gas from other countries, increasing its dependency

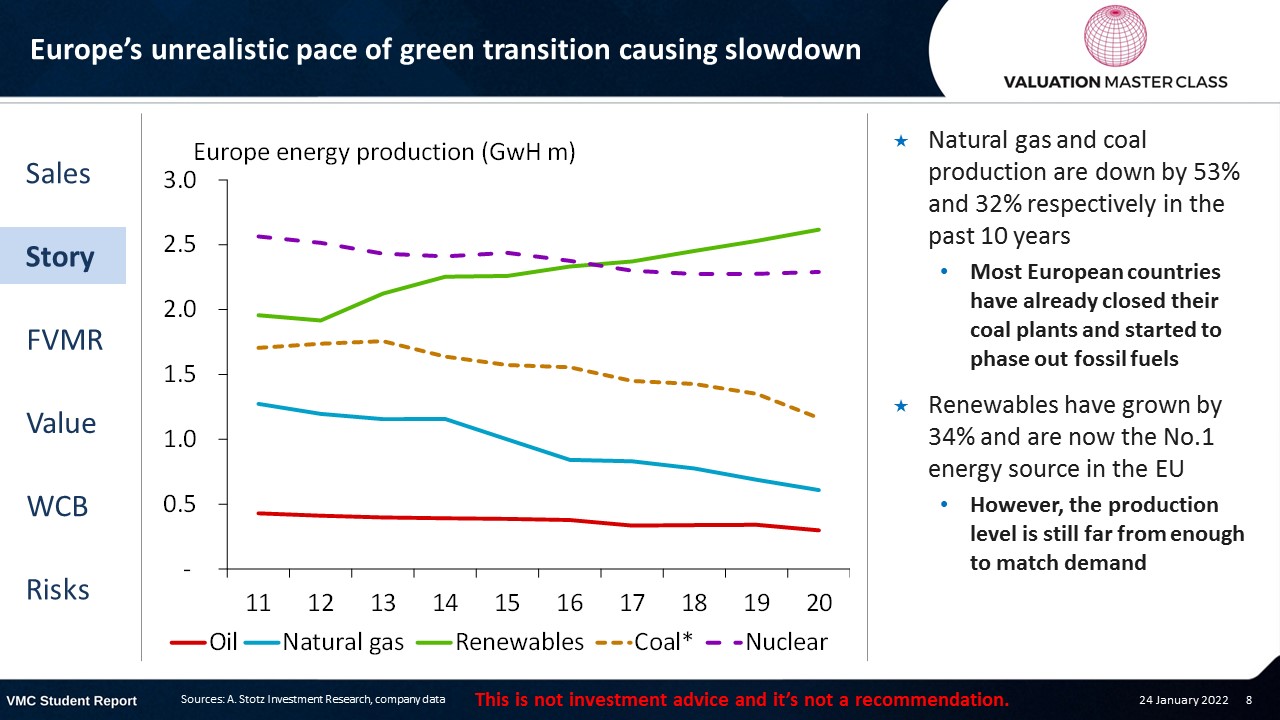

Europe’s unrealistic pace of green transition causing slowdown

- Natural gas and coal production are down by 53% and 32% respectively in the past 10 years

- Most European countries have already closed their coal plants and started to phase out fossil fuels

- Renewables have grown by 34% and are now the No.1 energy source in the EU

- However, the production level is still far from enough to match demand

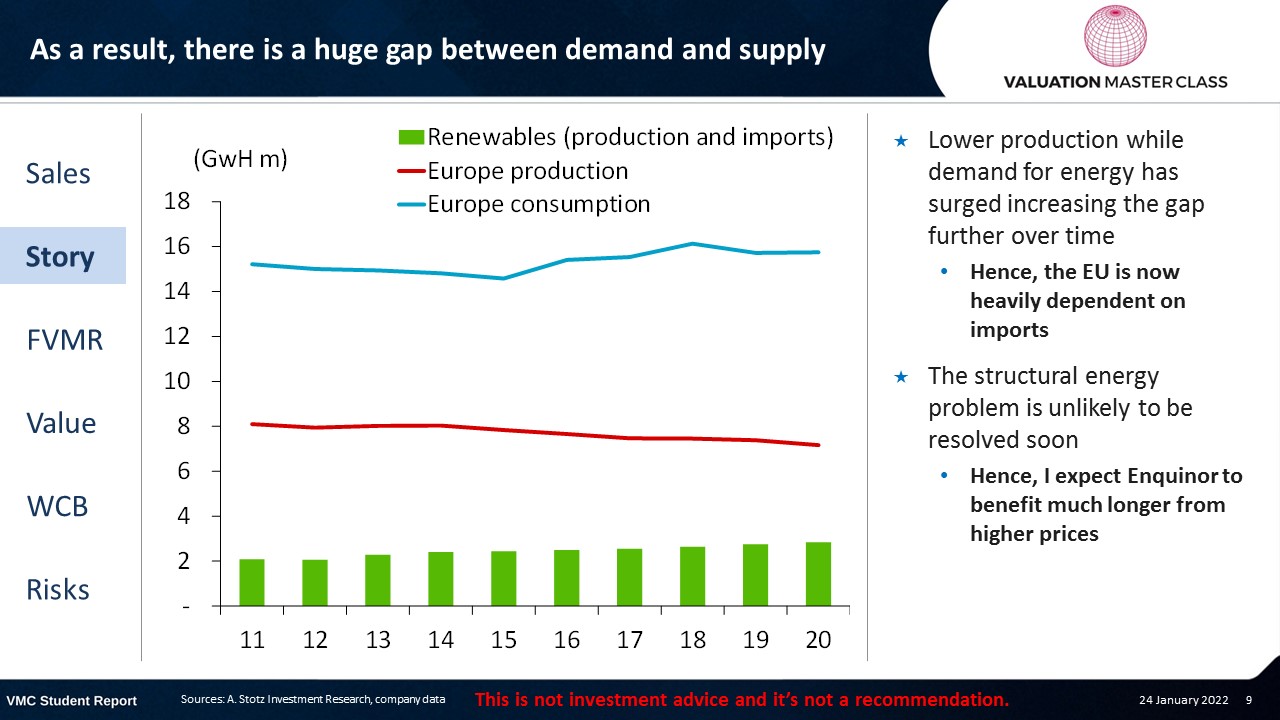

As a result, there is a huge gap between demand and supply

- Lower production while demand for energy has surged increasing the gap further over time

- Hence, the EU is now heavily dependent on imports

- The structural energy problem is unlikely to be resolved soon

- Hence, I expect Enquinor to benefit much longer from higher prices

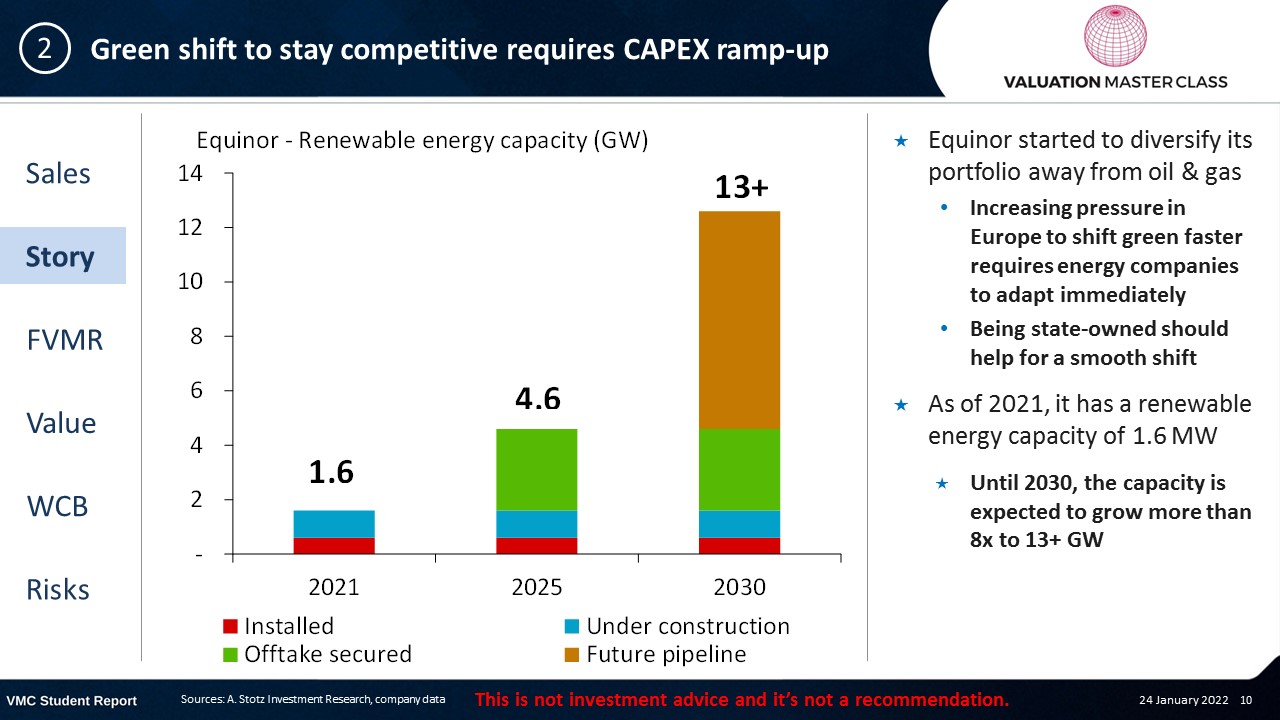

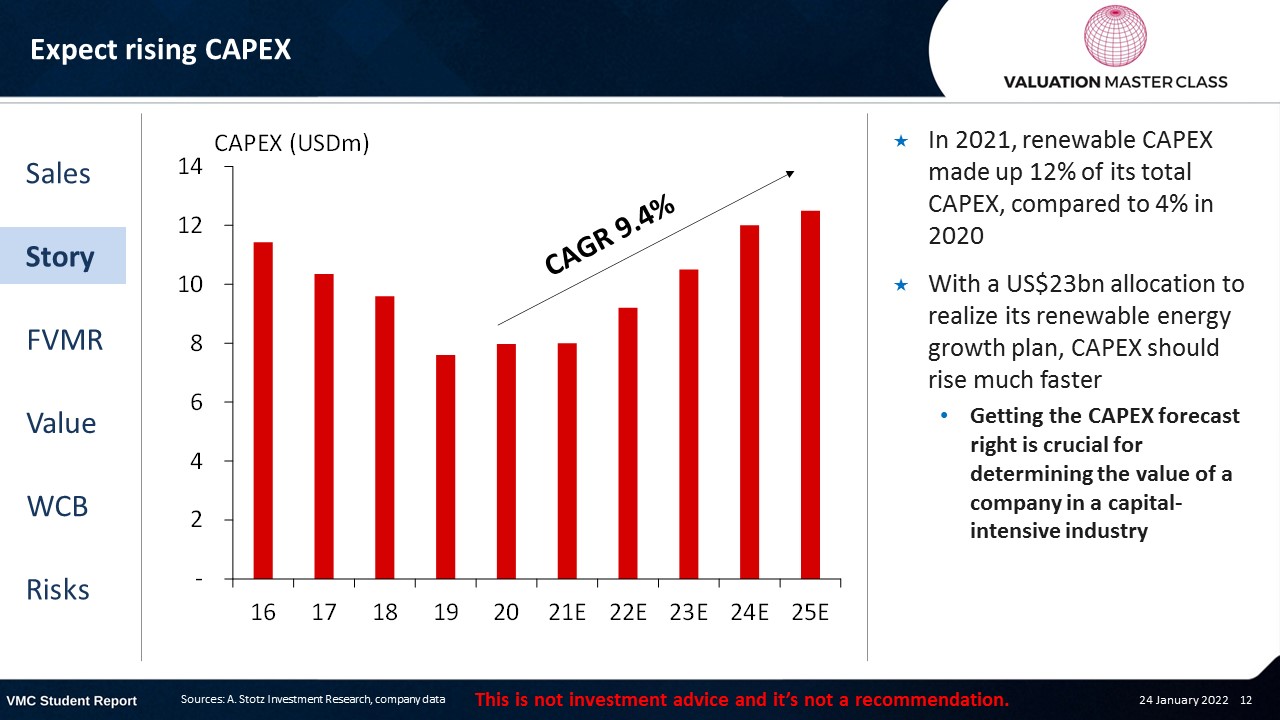

Green shift to stay competitive requires CAPEX ramp-up

- Equinor started to diversify its portfolio away from oil & gas

- Increasing pressure in Europe to shift green faster requires energy companies to adapt immediately

- Being state-owned should help for a smooth shift

- As of 2021, it has a renewable energy capacity of 1.6 MW

- Until 2030, the capacity is expected to grow more than 8x to 13+ GW

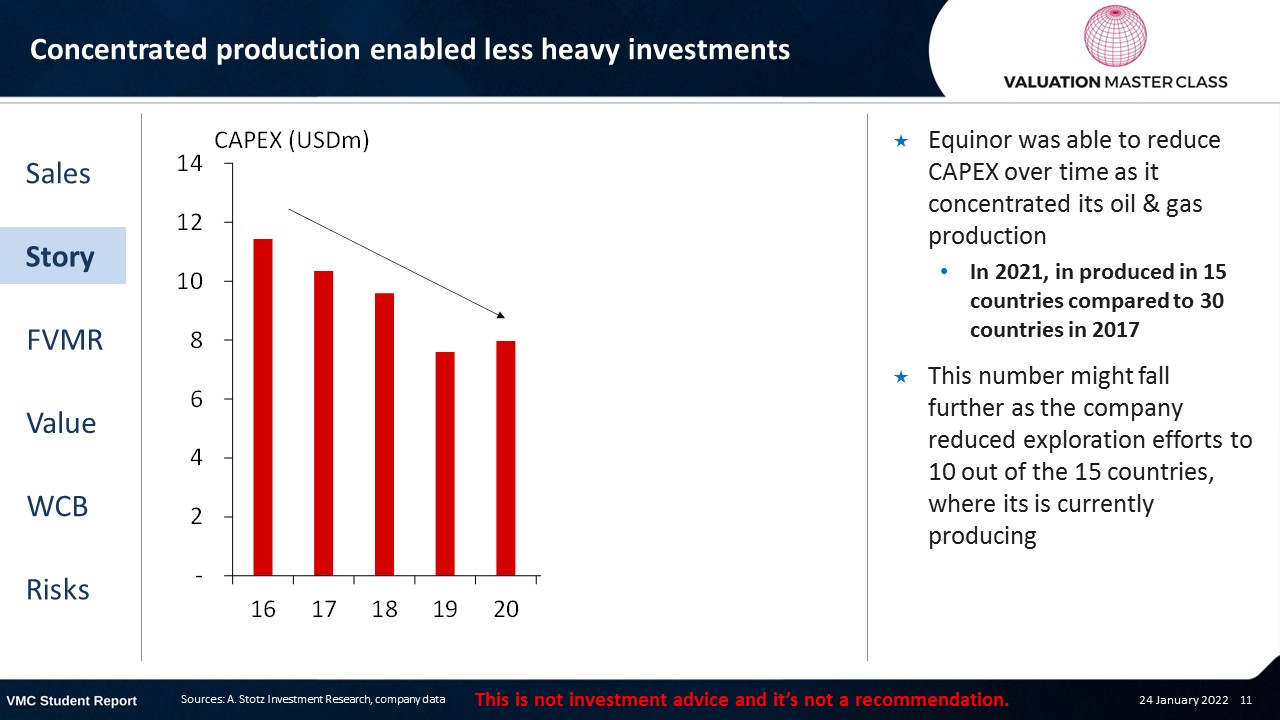

Concentrated production enabled less heavy investments

- Equinor was able to reduce CAPEX over time as it concentrated its oil & gas production

- In 2021, in produced in 15 countries compared to 30 countries in 2017

- This number might fall further as the company reduced exploration efforts to 10 out of the 15 countries, where its is currently producing

Expect rising CAPEX

- In 2021, renewable CAPEX made up 12% of its total CAPEX, compared to 4% in 2020

- With a US$23bn allocation to realize its renewable energy growth plan, CAPEX should rise much faster

- Getting the CAPEX forecast right is crucial for determining the value of a company in a capital-intensive industry

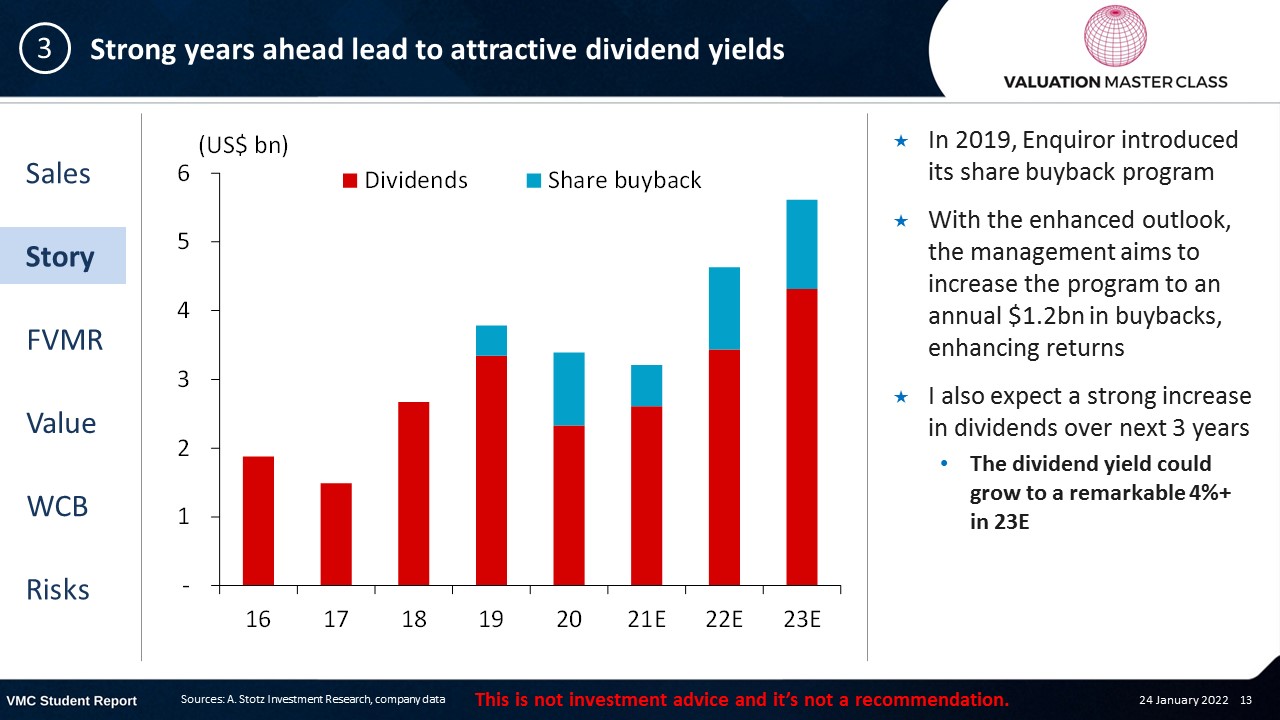

Strong years ahead lead to attractive dividend yields

- In 2019, Equinor introduced its share buyback program

- With the enhanced outlook, the management aims to increase the program to an annual $1.2bn in buybacks, enhancing returns

- I also expect a strong increase in dividends over next 3 years

- The dividend yield could grow to a remarkable 4%+ in 23E

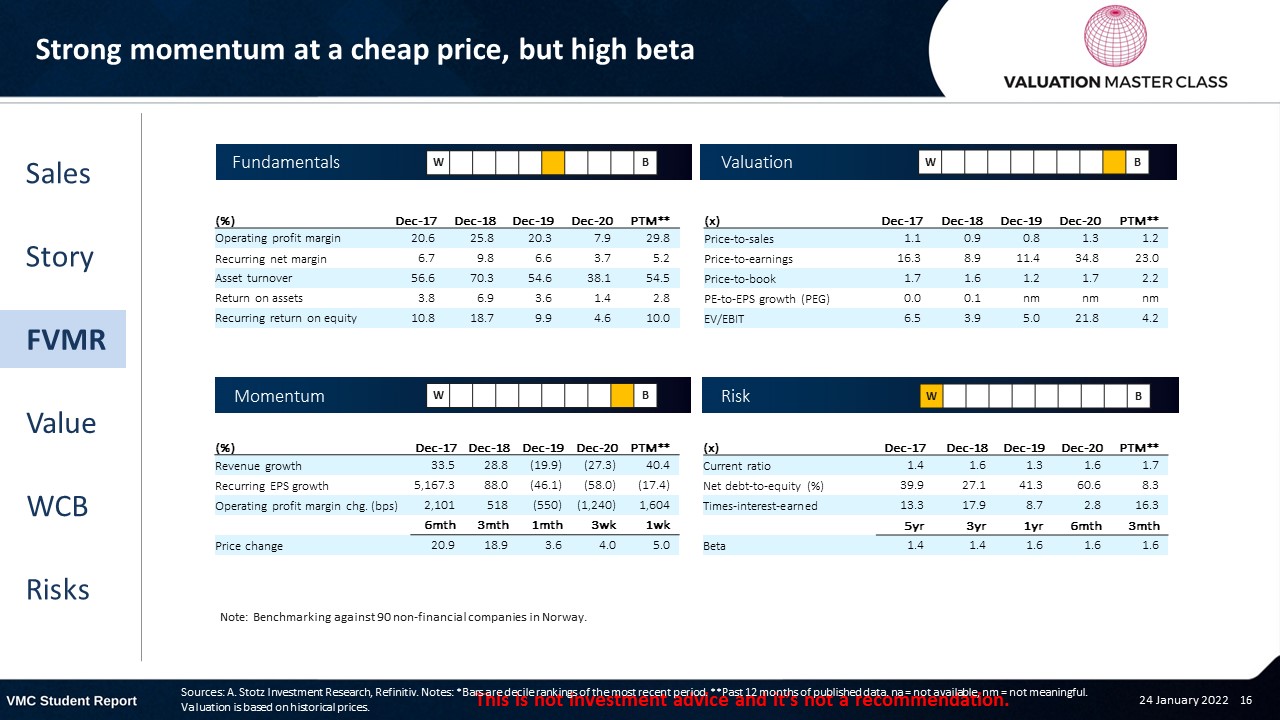

FVMR Scorecard – Equinor

- A stock’s attractiveness relative to stocks in that country or region

- Attractiveness is based on four elements

- Fundamentals, Valuation, Momentum, and Risk (FVMR)

- Scale from 1 (Best) to 10 (Worst)

Consensus sees small upside

- Most analysts stays at HOLD recommendation for now

- 4 analysts even issued a STRONG SELL (which they rarely do)

- Consensus expects two strong years in terms of revenue but then a drop in 23E due to normalization of commodity prices

- Equinor is engaged in a highly volatile industry

Get financial statements and assumptions in the full report

P&L – Equinor

- Elevated profit level of the next two years is solely driven by higher oil and gas prices

- Equinor did not aggressively expand its production

Balance sheet – Equinor

- Net fixed assets continue to decline as the company further narrows its production to a few locations

- It’s part of its strategy to concentrate production to highly profitable areas

- Still, I expect rising NFA in 23E onward due to renewable energy expansion

- The company slightly increased its LT-debt over the pandemic

- However, I expect that part of its elevated profits can be used to repay debt over time

Ratios – Equinor

- After making a loss in 2020, the company is likely to see a record net margin in 21E

- Still, don’t expect the company to be able to maintain such a margin over the long run

- Oil and gas prices can change directions easily

- Its low cash conversion cycle helps the company to manage its working capital efficiently

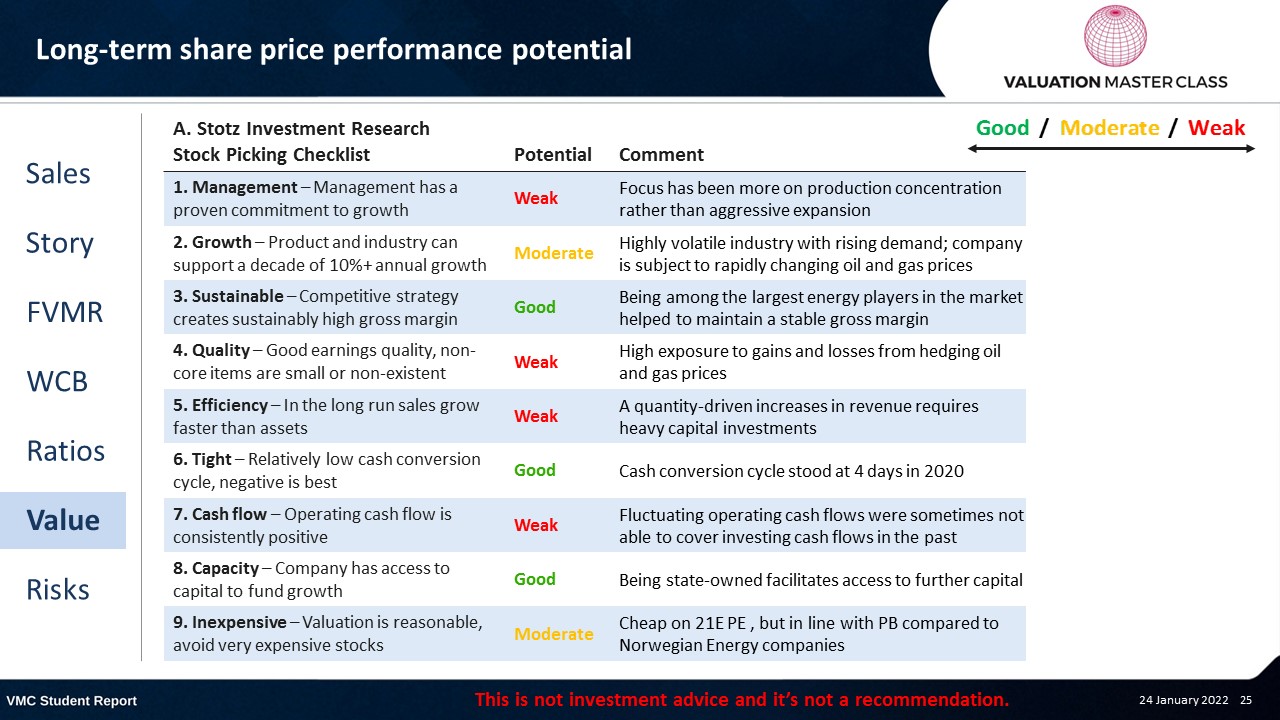

Long-term share price performance potential

Free cash flow – Equinor

- Equinor faces higher CAPEX over the next few years in line with its plans to slightly increase oil & gas production and to realize its renewable energy targets

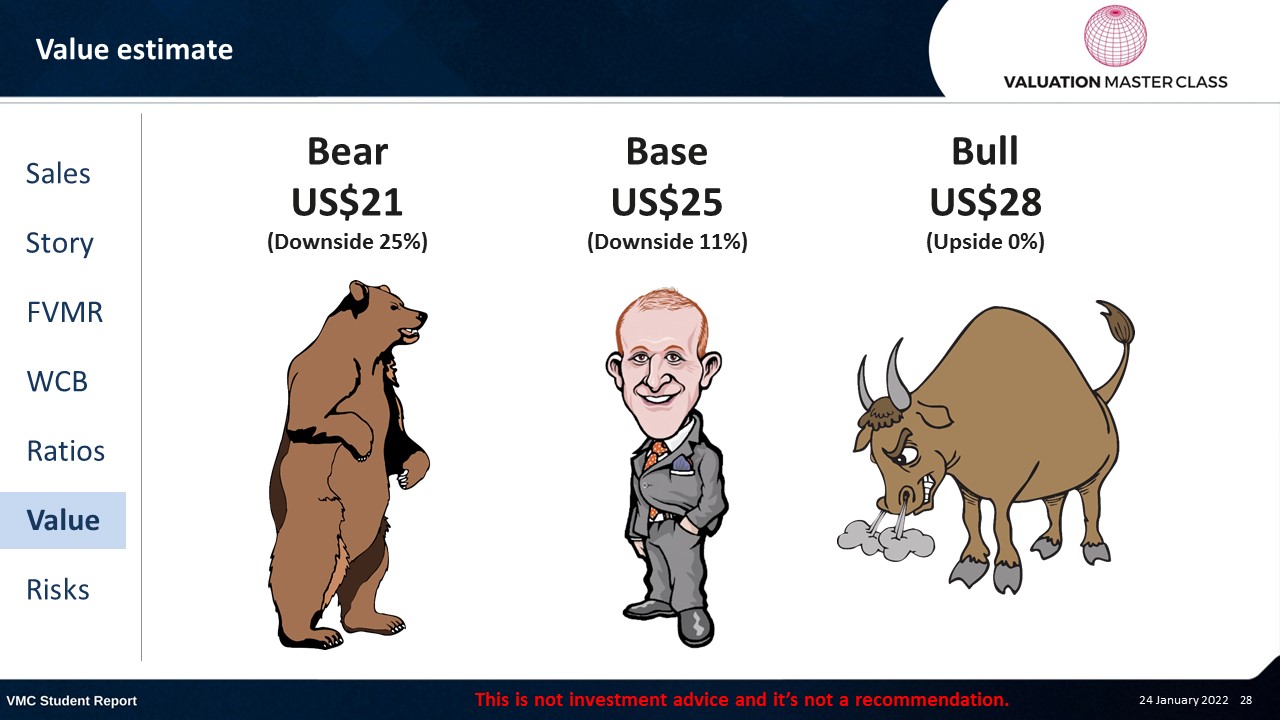

Value estimate – Equinor

- The ongoing energy crisis in Europe should support a higher price level than usual

- I expect the company to record high revenue over the next 3 years

- However, afterward, I forecast a decline in revenue than should also normalize profits

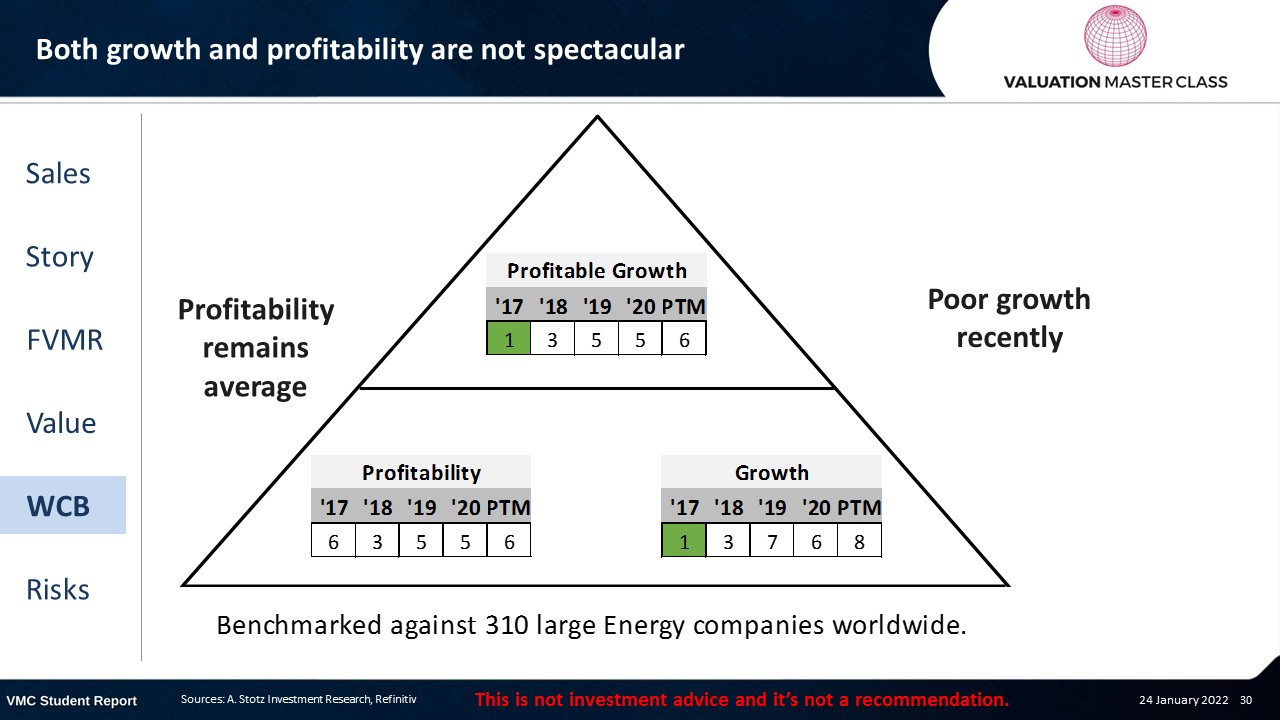

World Class Benchmarking Scorecard – Equinor

- Identifies a company’s competitive position relative to global peers

- Combined, composite rank of profitability and growth, called “Profitable Growth”

- Scale from 1 (Best) to 10 (Worst)

Key risk is a slowing economy

- Potential economic slowdown could lead to a rapid decline in energy prices

- Unexpected weather damages of gas and oil plants

- Failure to realize fast shift to green energy

Conclusions

- Revenue explosion is solely energy price-driven, while production is stable

- Falling energy prices could lead to negative market sentiment

- Attractive dividend yield and repurchases might not be enough to compensate a potential fall

Download the full report as a PDF

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.