Does SKF’s High Value Creation Deserve a Re-Rating?

Highlights:

- Consolidation of manufacturing sites drives margin expansion

- High single-digit industry growth mainly driven by Asia

- Consistent value creation while peers struggle

Download the full report as a PDF

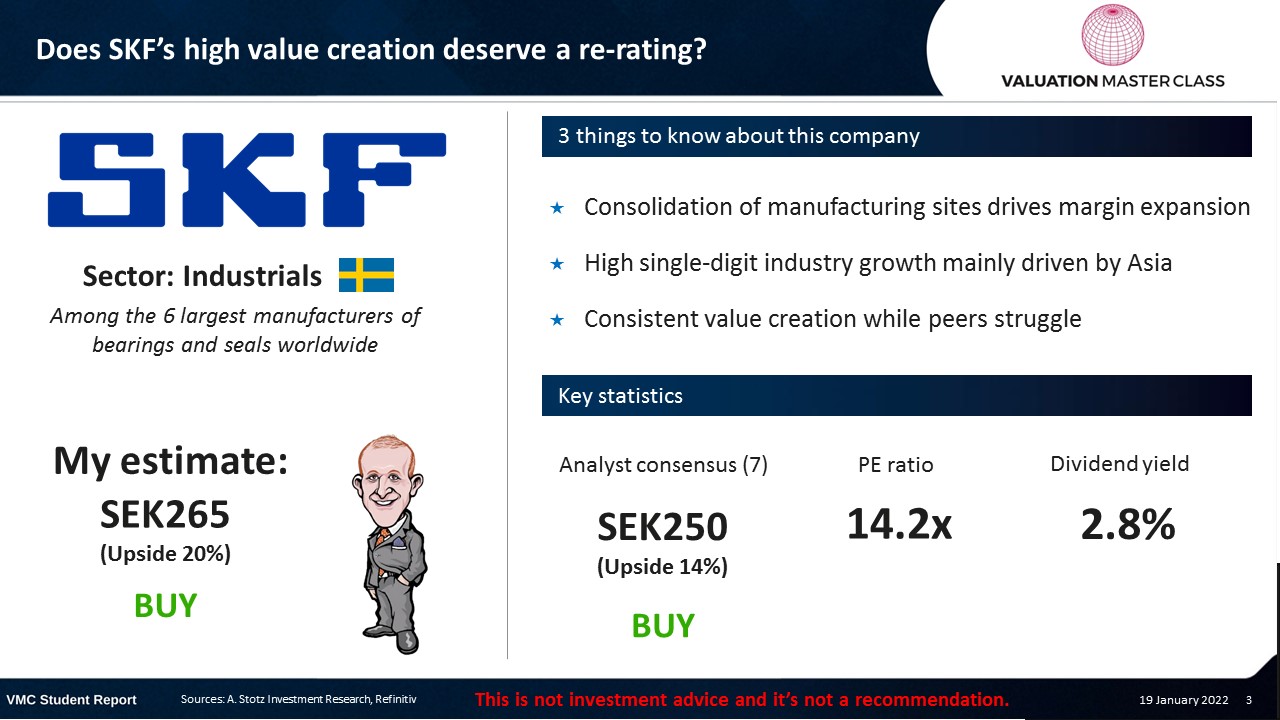

SKF’s revenue breakdown 2020

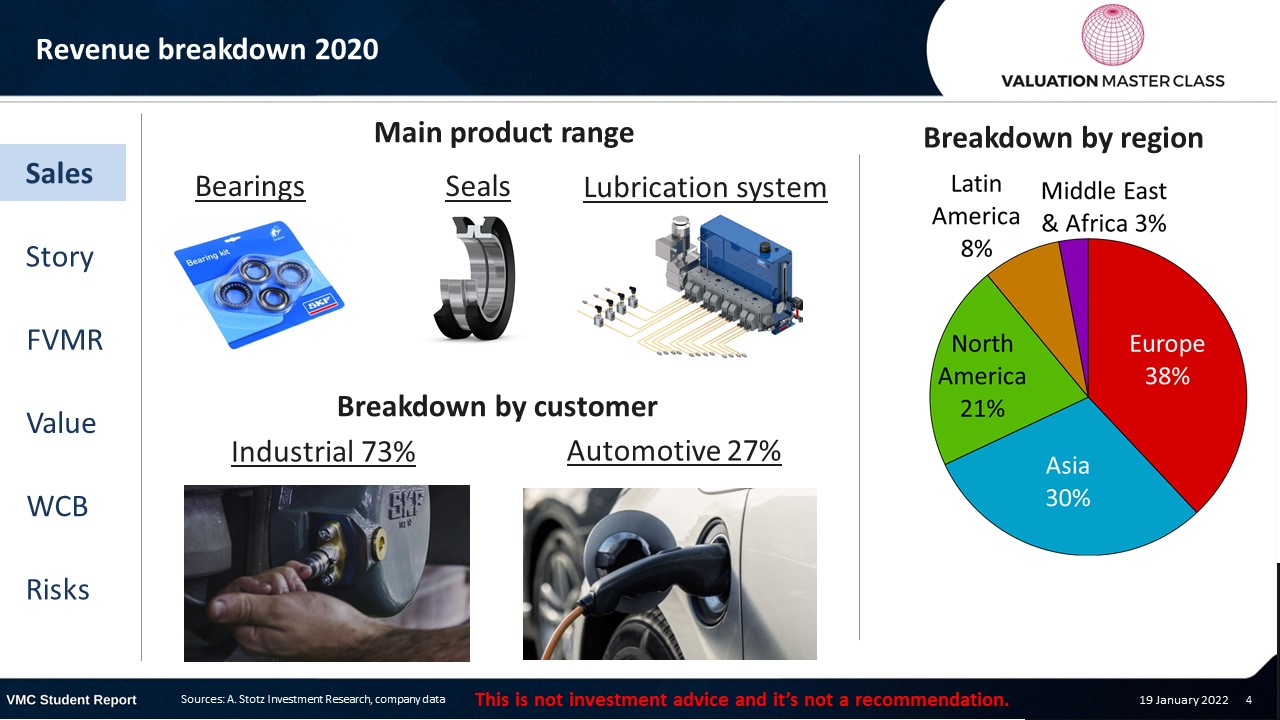

Price could turn bullish soon; but no support from volume

- Overall, the stock price stayed flat over the past year

- The 50DMA line stayed below the 200DMA since 2H21

- However, most recently, the 50DMA moved closer and could cross it soon, which would be a positive signal

- The Volume RSI has been weak recently, which we would interpret as bearish

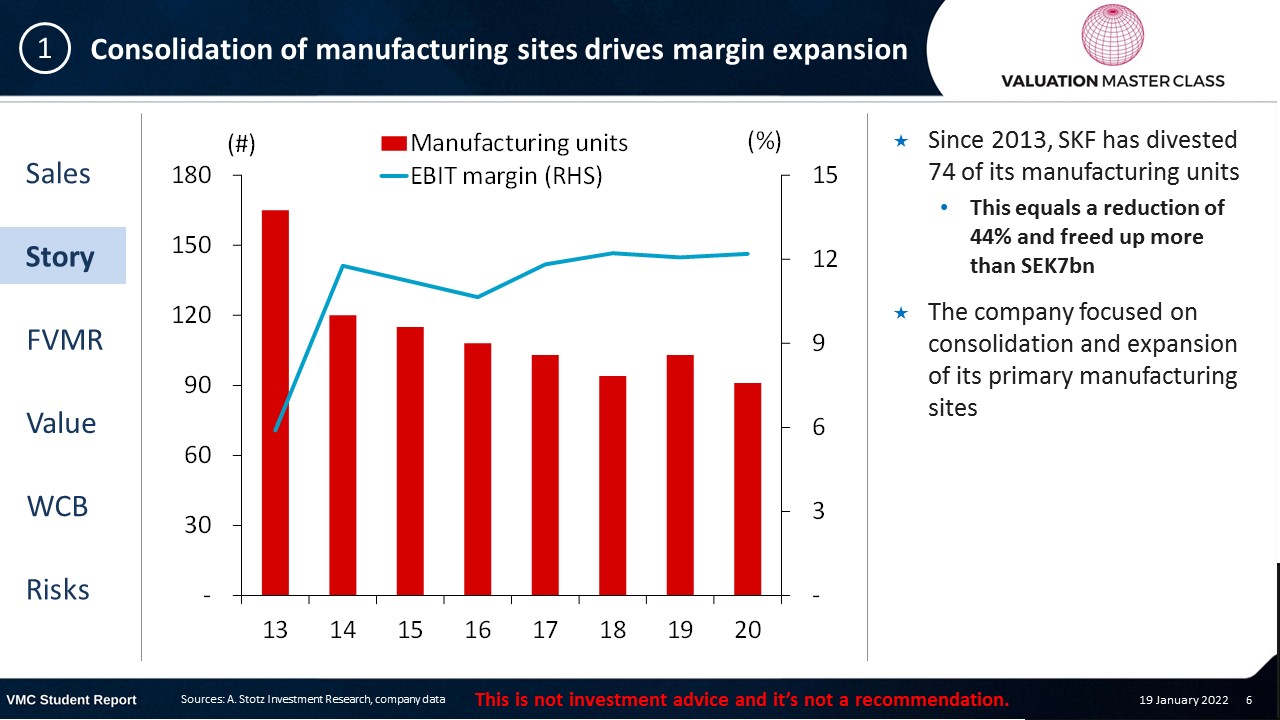

Consolidation of manufacturing sites drives margin expansion

- Since 2013, SKF has divested 74 of its manufacturing units

- This equals a reduction of 44% and freed up more than SEK7bn

- The company focused on consolidation and expansion of its primary manufacturing sites

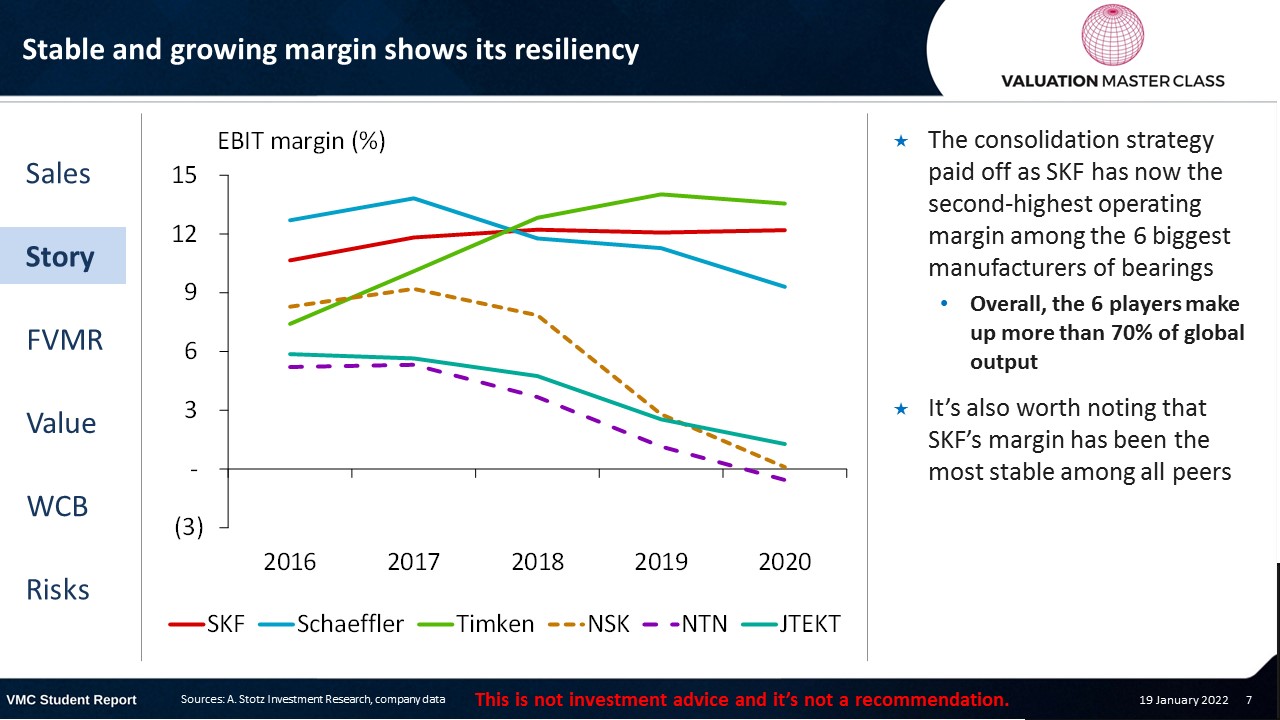

Stable and growing margin shows its resiliency

- The consolidation strategy paid off as SKF has now the second-highest operating margin among the 6 biggest manufacturers of bearings

- Overall, the 6 players make up more than 70% of global output

- It’s also worth noting that SKF’s margin has been the most stable among all peers

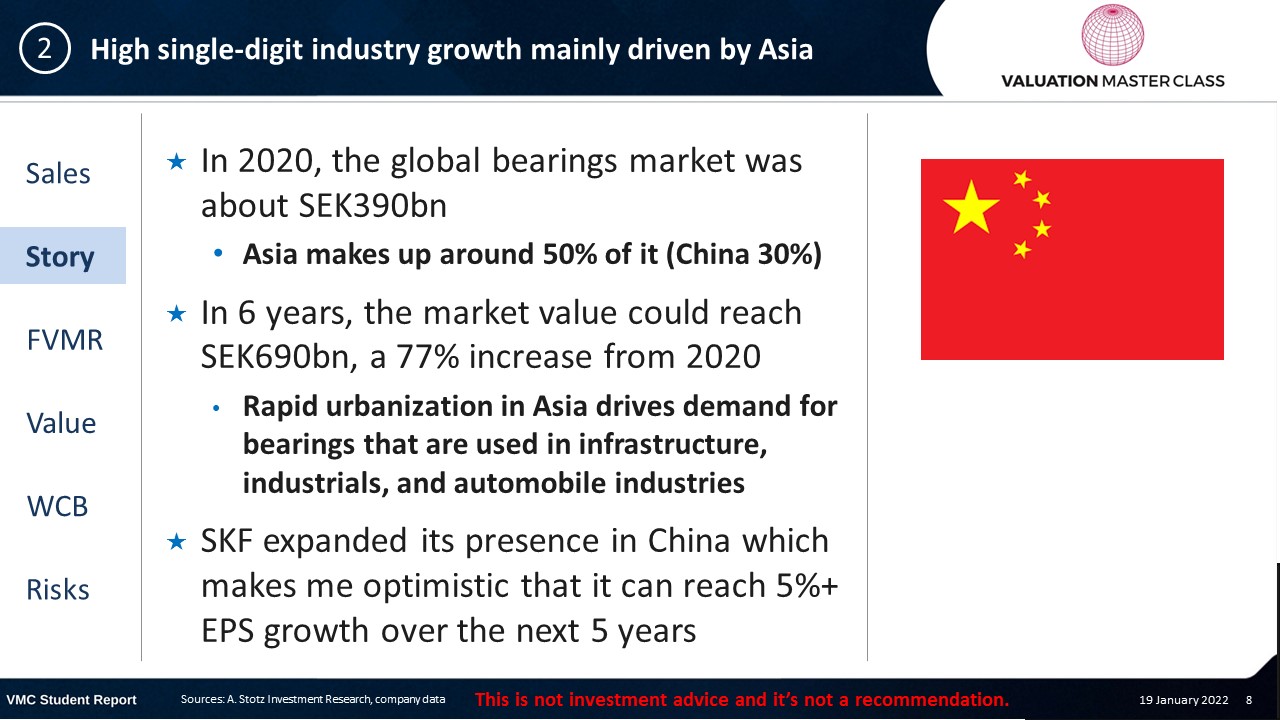

High single-digit industry growth mainly driven by Asia

- In 2020, the global bearings market was about SEK390bn

- Asia makes up around 50% of it (China 30%)

- In 6 years, the market value could reach SEK690bn, a 77% increase from 2020

- Rapid urbanization in Asia drives demand for bearings that are used in infrastructure, industrials, and automobile industries

- SKF expanded its presence in China which makes me optimistic that it can reach 5%+ EPS growth over the next 5 years

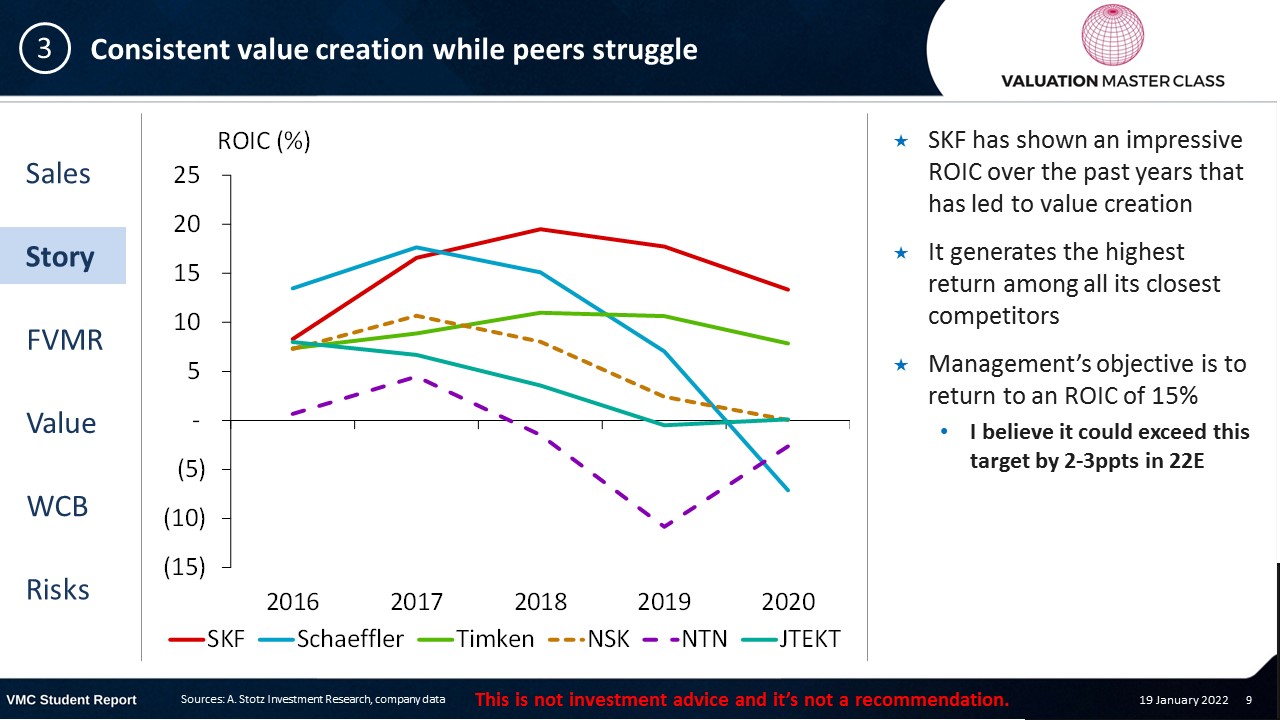

Consistent value creation while peers struggle

- SKF has shown an impressive ROIC over the past years that has led to value creation

- It generates the highest return among all its closest competitors

- Management’s objective is to return to an ROIC of 15%

- I believe it could exceed this target by 2-3ppts in 22E

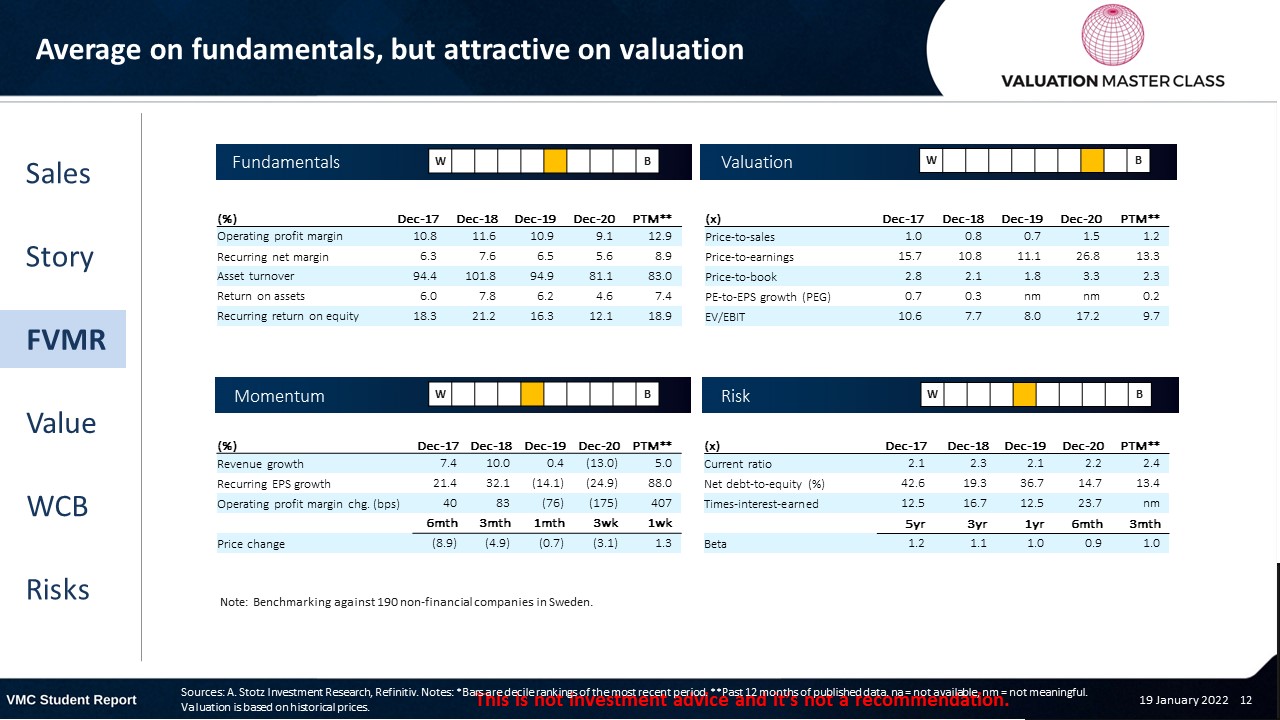

FVMR Scorecard – SKF

- A stock’s attractiveness relative to stocks in that country or region

- Attractiveness is based on four elements

- Fundamentals, Valuation, Momentum, and Risk (FVMR)

- Scale from 1 (Best) to 10 (Worst)

Consensus sees small upside

- Majority of analysts issued a BUY recommendation while 4 have a SELL

- Consensus expects two strong years in terms of revenue that make up for the decline in 2020

- 23E onward, analysts assume rather slow but steady growth

Get financial statements and assumptions in the full report

P&L – SKF

- Revenue could return to the pre-pandemic level in 22E

- Especially, demand from China contributes to a strong rebound

Balance sheet – SKF

- SKF recognized a larger inventory in 21E

- Inventory days have increased to 120 days in 3Q21, which is a 20% increase to the previous year

- The company did not significantly increase its LT-debt during the pandemic

- Net debt-to-equity is likely to stay around 0.2x in the near future

Ratios – SKF

- Record margin in 21E and 22E expected due to strong demand from the Industrials sector, where SKF makes a higher margin than from its automobile customers

- Increased working cap requirements lengthen the cash conversion cycle

- Bottlenecks in logistics and customer shutdowns have increased inventories

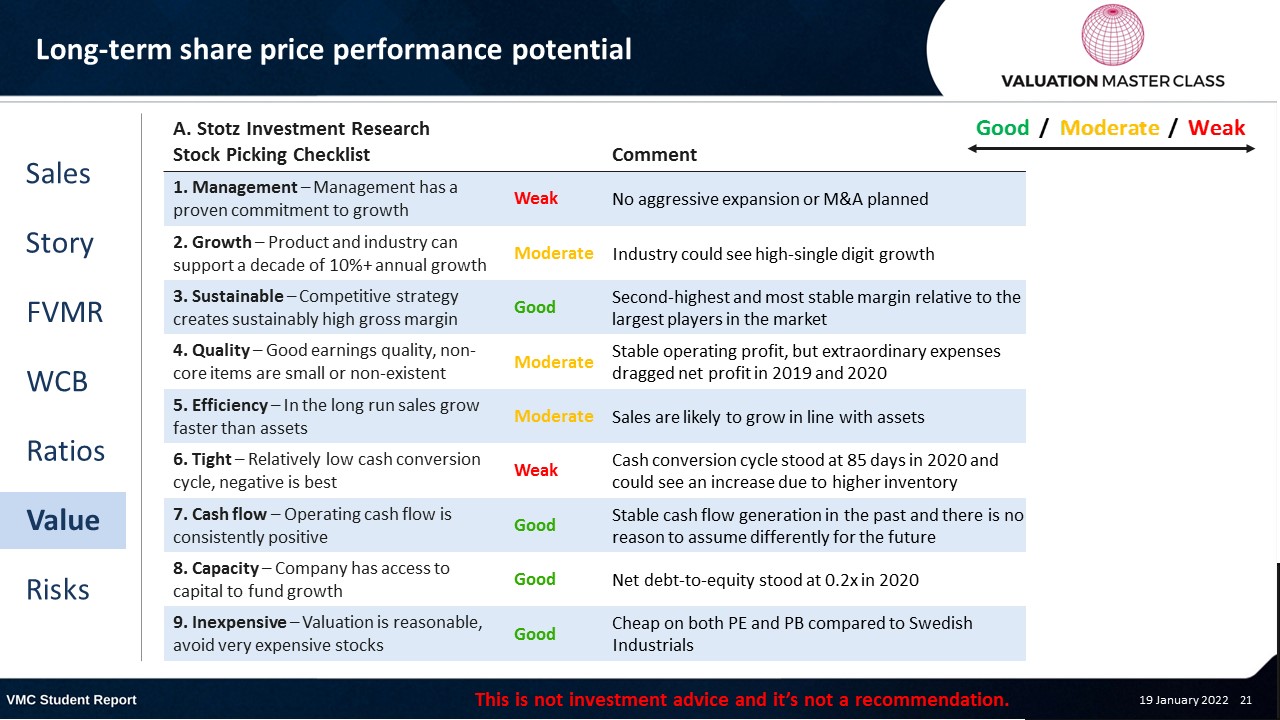

Long-term share price performance potential

Free cash flow – SKF

- SKF likely to record a negative FCFF in 21E due to an increase in inventory

- The company should be able to return to positive FCFF in 22E and maintain it over time

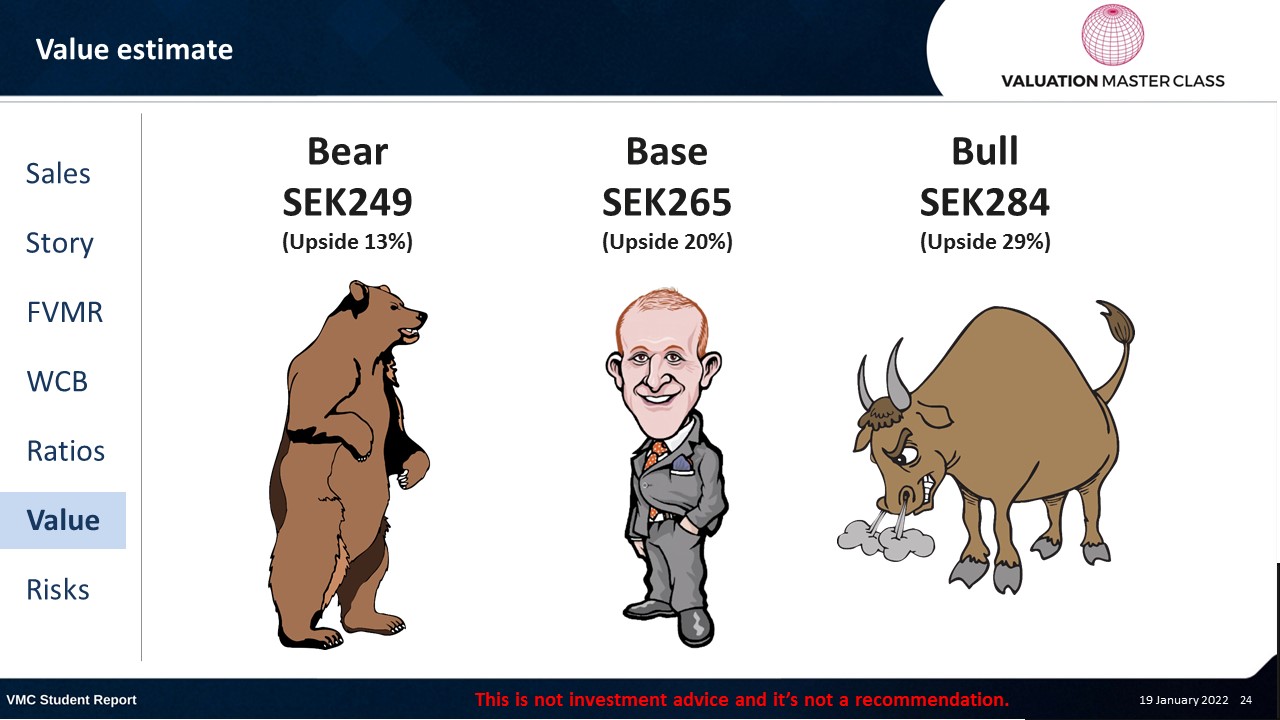

Value estimate – SKF

- I am a bit more optimistic about the growth outlook than consensus

-

- SKF should benefit from strong global demand for bearings over the next 5 years

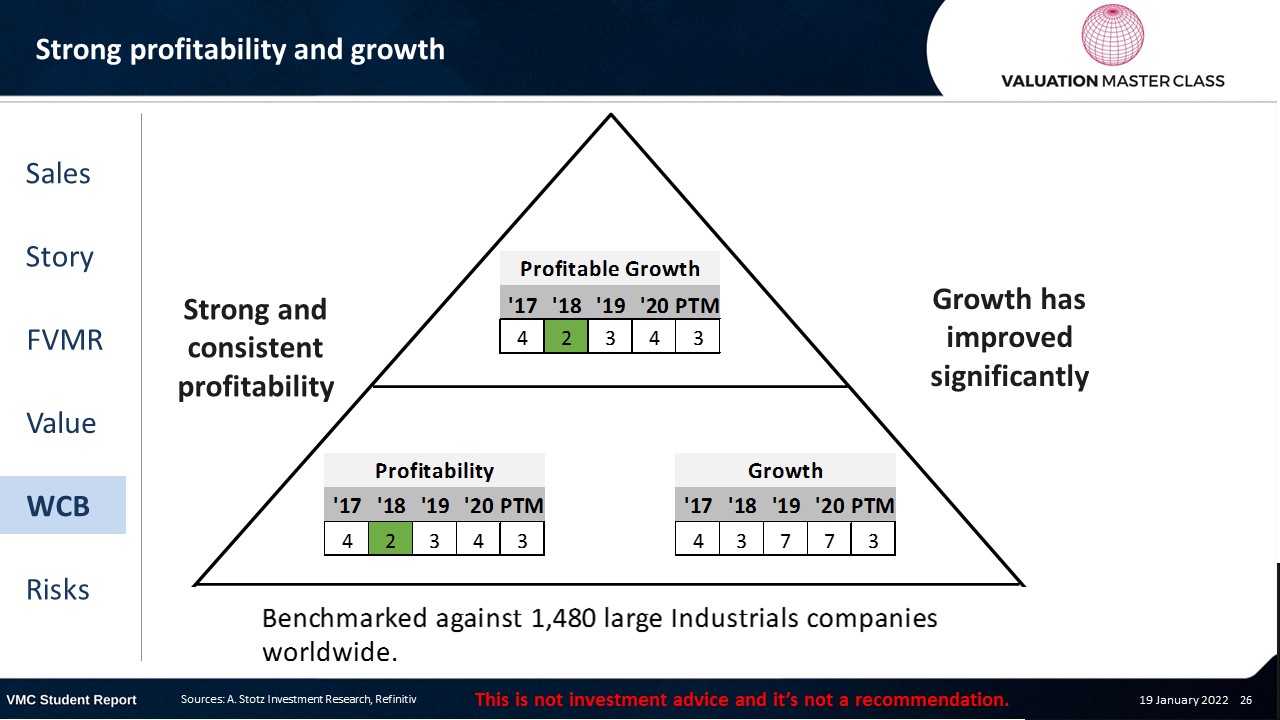

World Class Benchmarking Scorecard – SKF

- Identifies a company’s competitive position relative to global peers

- Combined, composite rank of profitability and growth, called “Profitable Growth”

- Scale from 1 (Best) to 10 (Worst)

Key risk is intensifying competition

- Market could become more fragmented with rising local manufacturers (e.g., China)

- Failure to adapt to changing product requirements by customers

- Fluctuating input prices and inflation could pressure margins

Conclusions

- Sector-leading margin results in ongoing value creation

- Industry faces good and stable growth prospects

- Valuation appears cheap; could be a good opportunity to buy

Download the full report as a PDF

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.