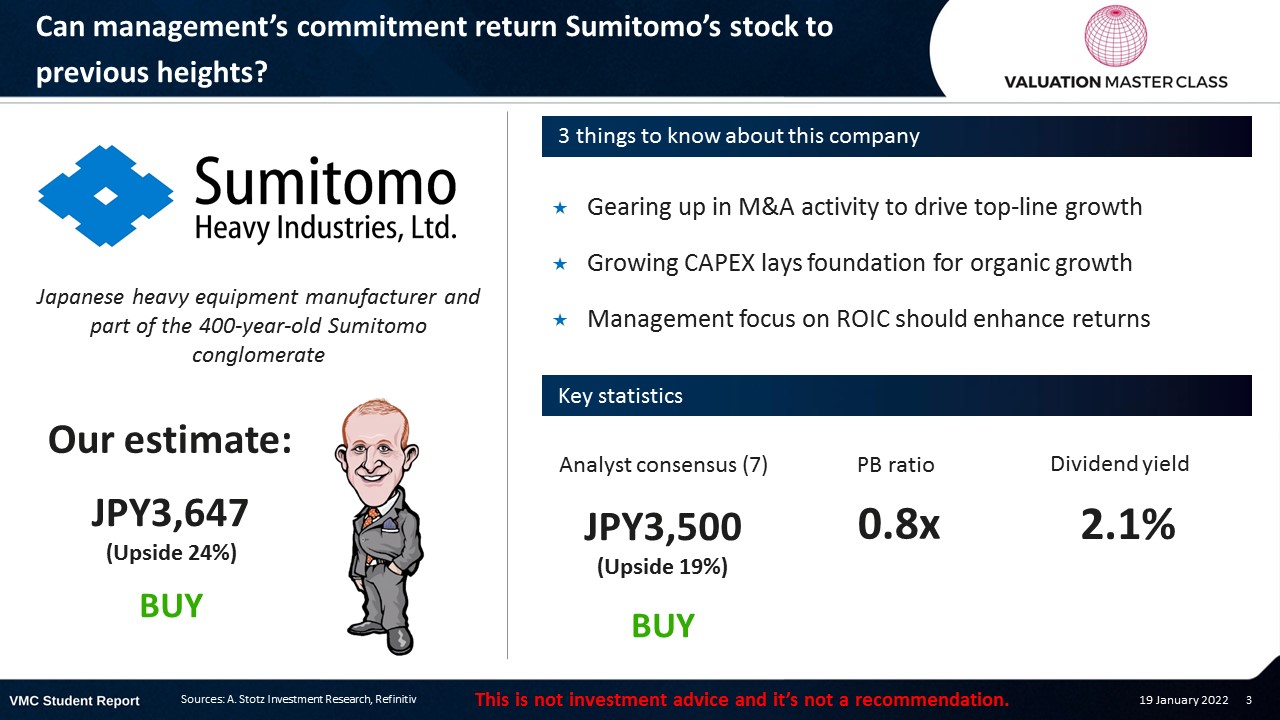

Can Management’s Commitment Return Sumitomo’s Stock to Previous Heights?

Highlights:

- Gearing up in M&A activity to drive top-line growth

- Growing CAPEX lays foundation for organic growth

- Management focus on ROIC should enhance returns

Download the full report as a PDF

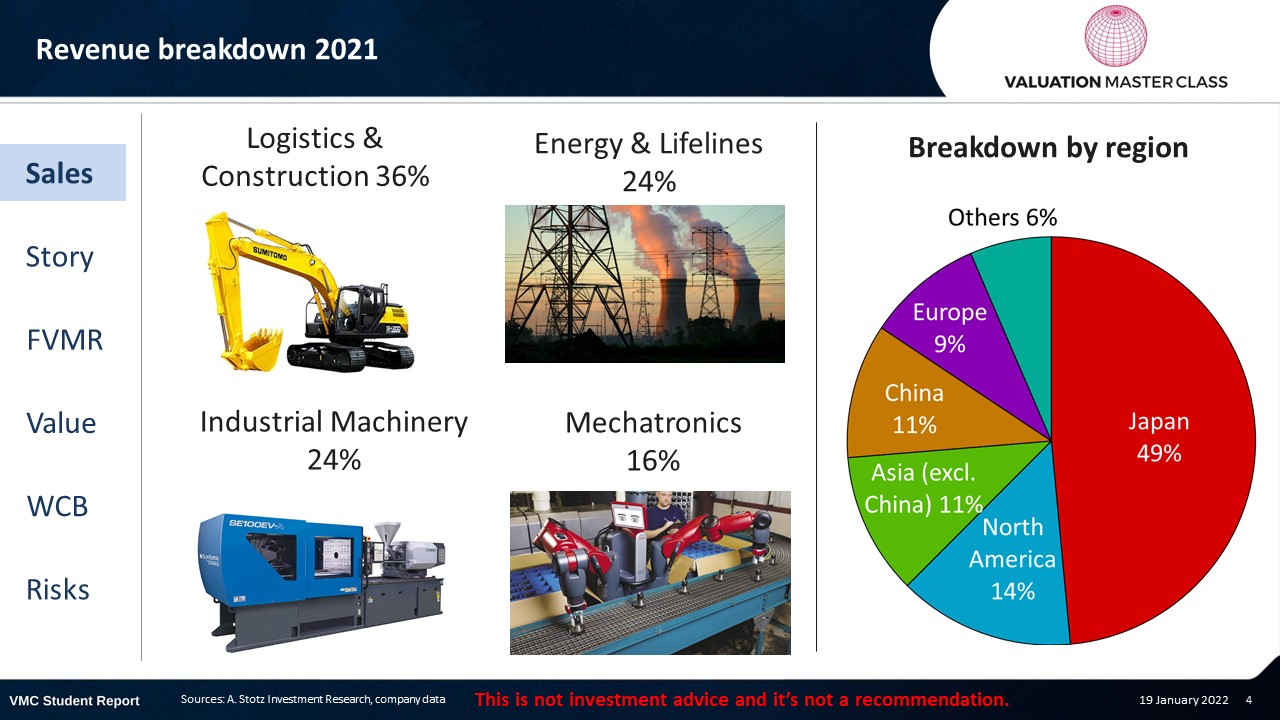

Sumitomo’s revenue breakdown 2021

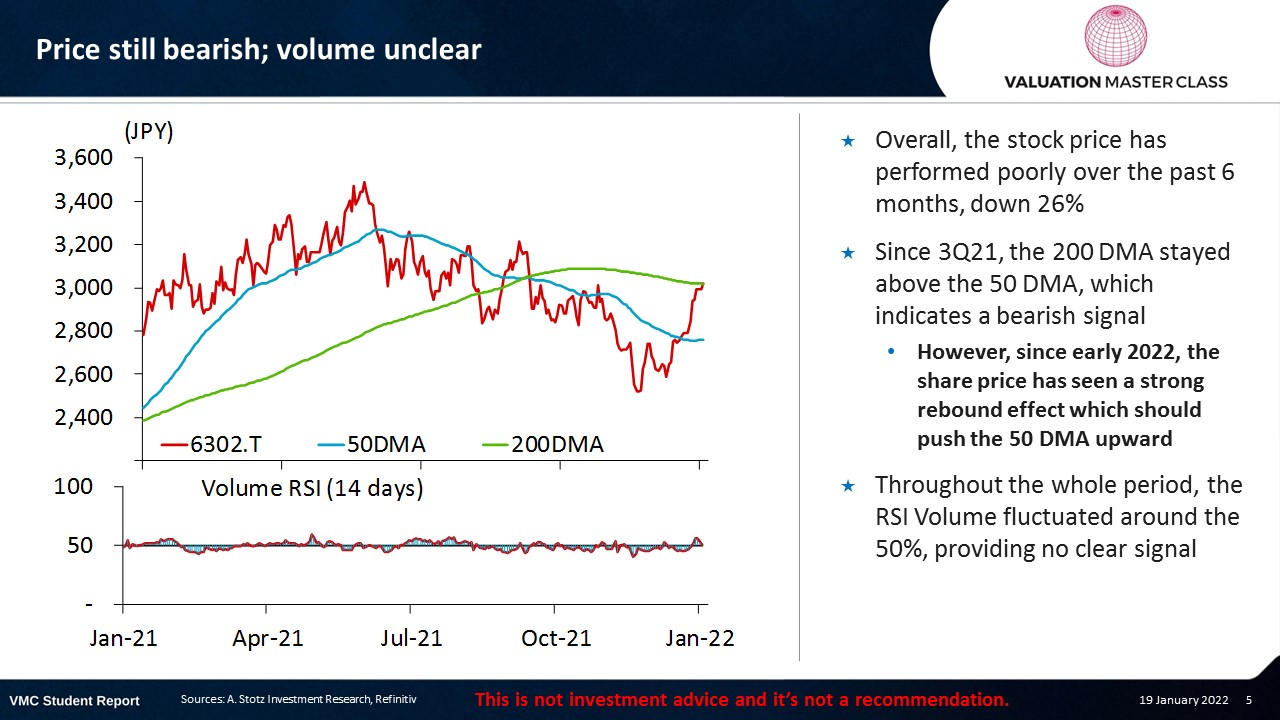

Price still bearish; volume unclear

- Overall, the stock price has performed poorly over the past 6 months, down 26%

- Since 3Q21, the 200 DMA stayed above the 50 DMA, which indicates a bearish signal

- However, since early 2022, the share price has seen a strong rebound effect which should push the 50 DMA upward

- Throughout the whole period, the RSI Volume fluctuated around the 50%, providing no clear signal

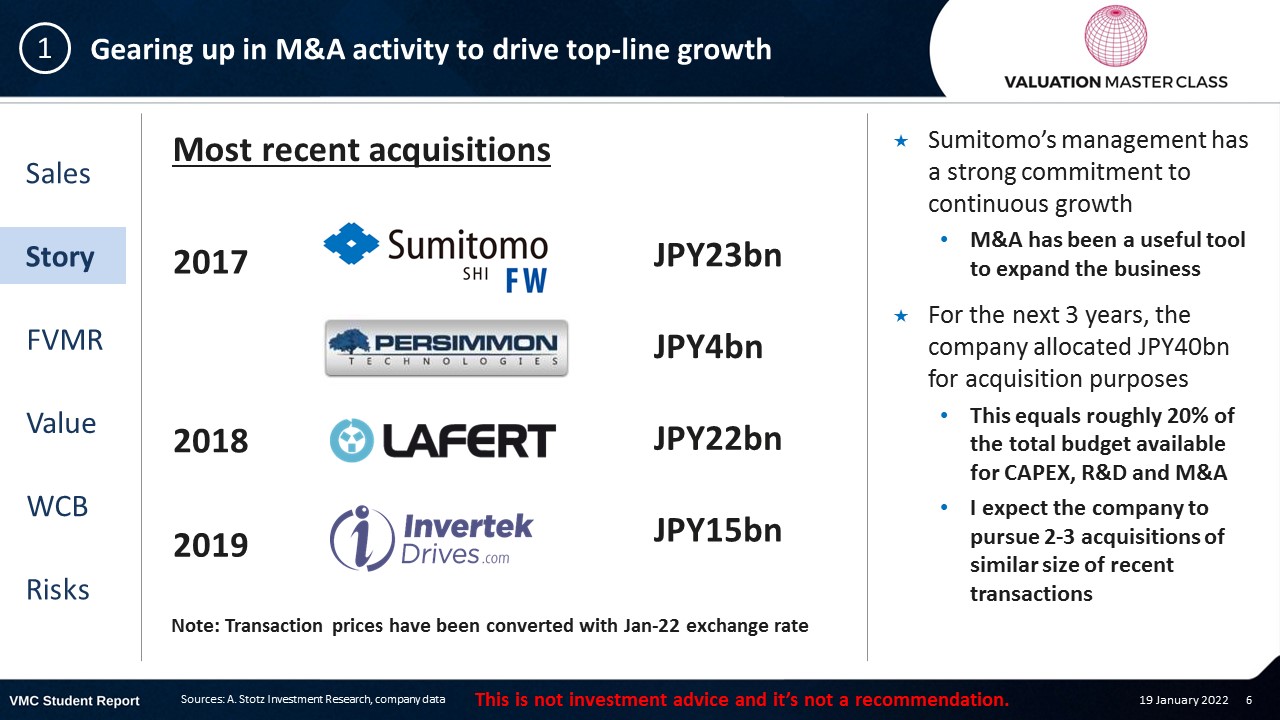

Gearing up in M&A activity to drive top-line growth

- Sumitomo’s management has a strong commitment to continuous growth

- M&A has been a useful tool to expand the business

- For the next 3 years, the company allocated JPY40bn for acquisition purposes

- This equals roughly 20% of the total budget available for CAPEX, R&D and M&A

- I expect the company to pursue 2-3 acquisitions of similar size of recent transactions

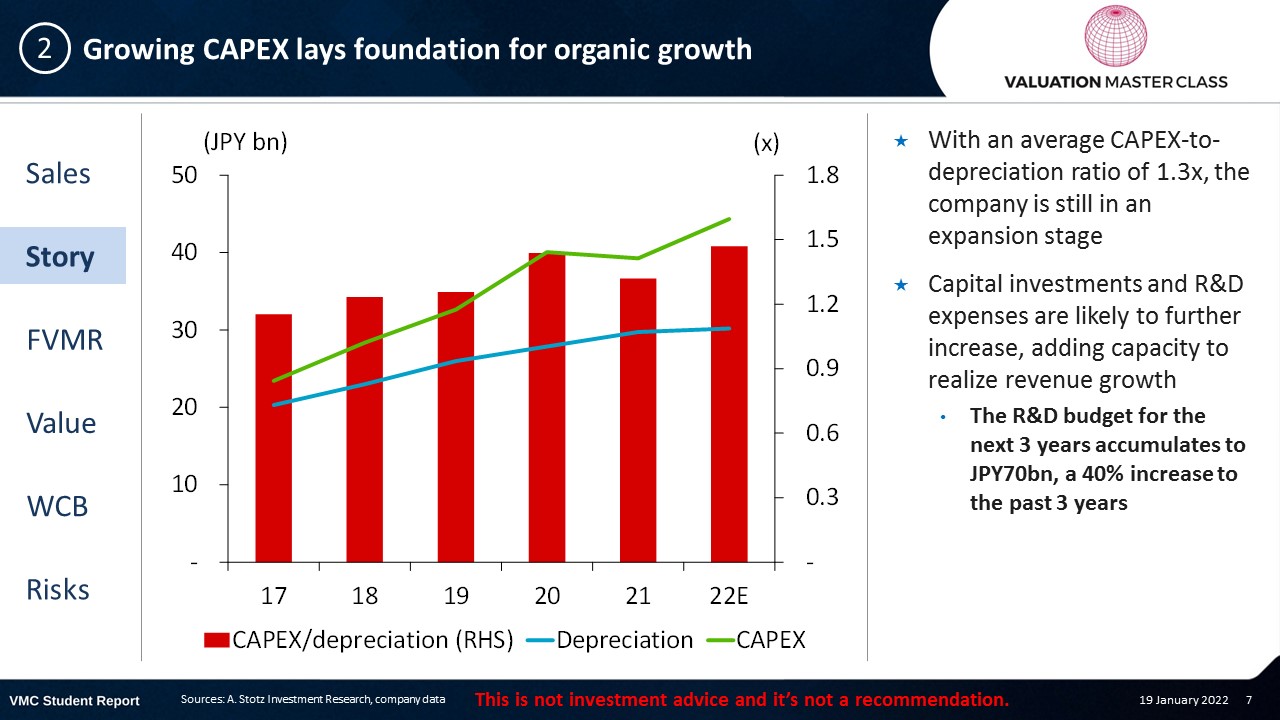

Growing CAPEX lays foundation for organic growth

- With an average CAPEX-to-depreciation ratio of 1.3x, the company is still in an expansion stage

- Capital investments and R&D expenses are likely to further increase, adding capacity to realize revenue growth

-

- The R&D budget for the next 3 years accumulates to JPY70bn, a 40% increase to the past 3 years

-

What can the CAPEX-to-depreciation ratio tell us?

- Growth firms

- Capex should be more than the annual P&L depreciation charge, maybe around 150% of it

- Very high growth firms

- Capex could much more than 150% of depreciation

- Low or no growth firm

- Capex about equal to annual depreciation charge

- It mainly covers maintenance

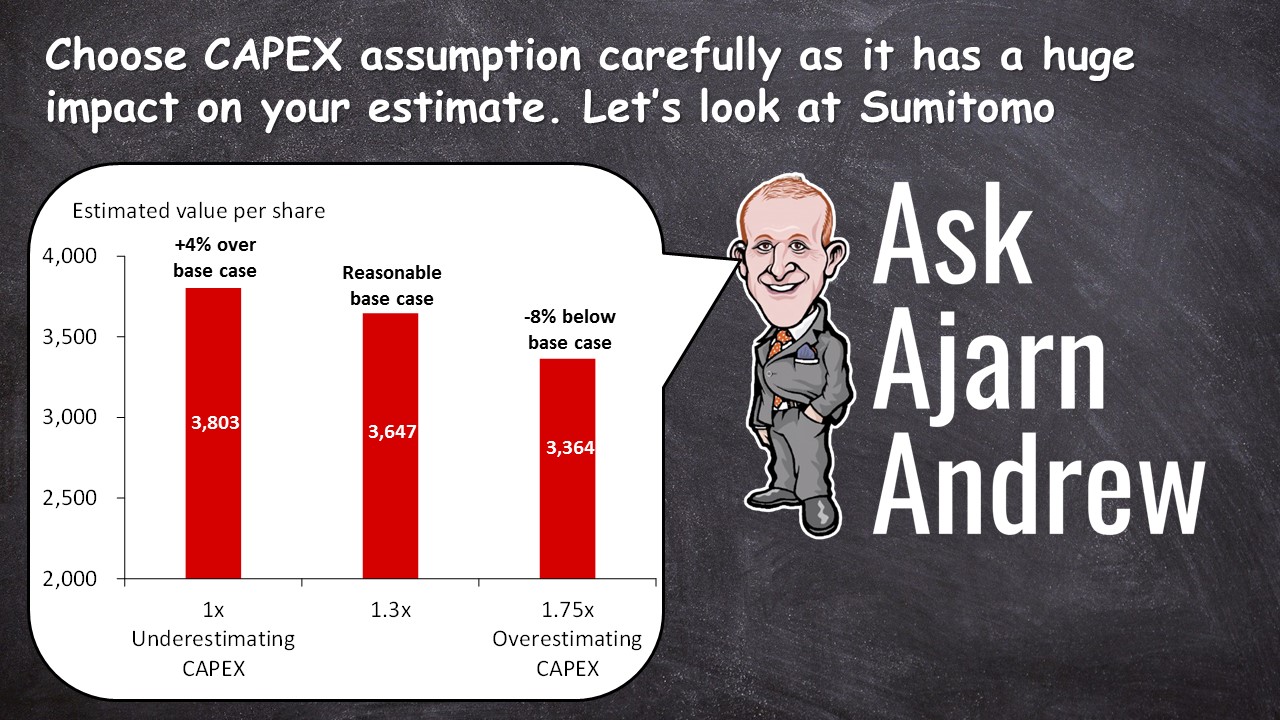

Choose CAPEX assumption carefully as it has a huge impact on your estimate. Let’s look at Sumitomo

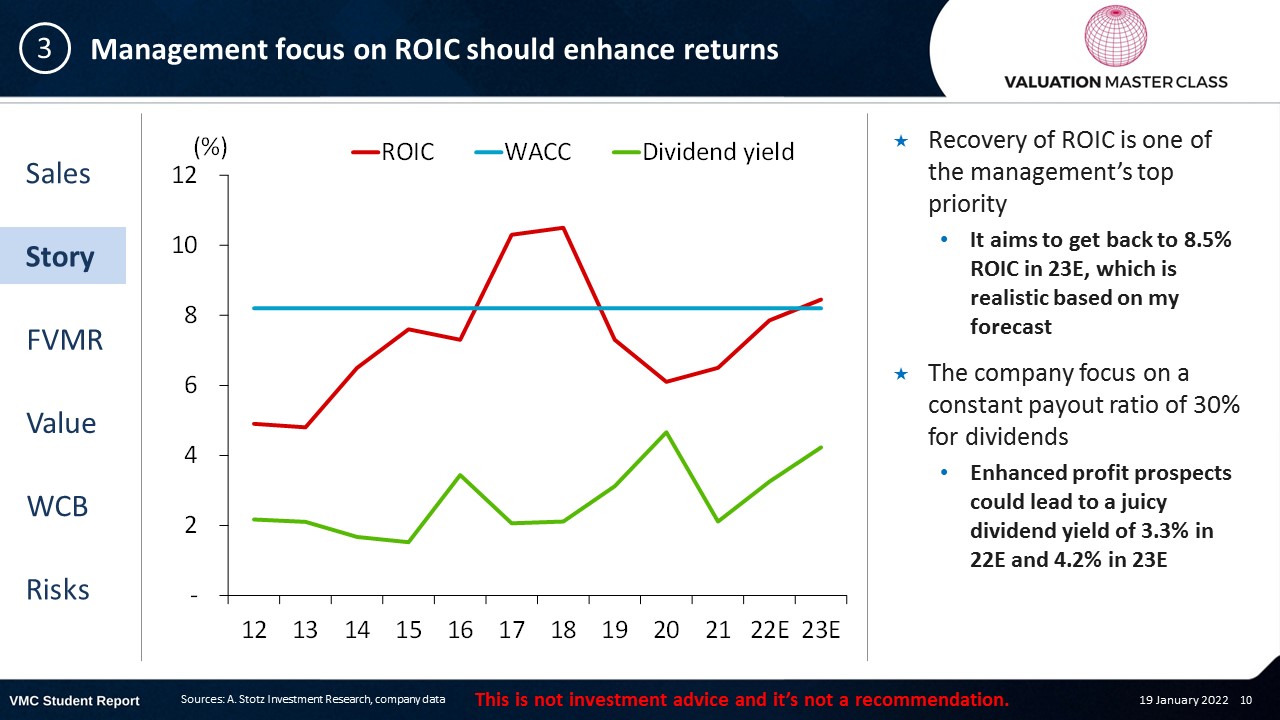

Management focus on ROIC should enhance returns

- Recovery of ROIC is one of the management’s top priority

- It aims to get back to 8.5% ROIC in 23E, which is realistic based on my forecast

- The company focus on a constant payout ratio of 30% for dividends

- Enhanced profit prospects could lead to a juicy dividend yield of 3.3% in 22E and 4.2% in 23E

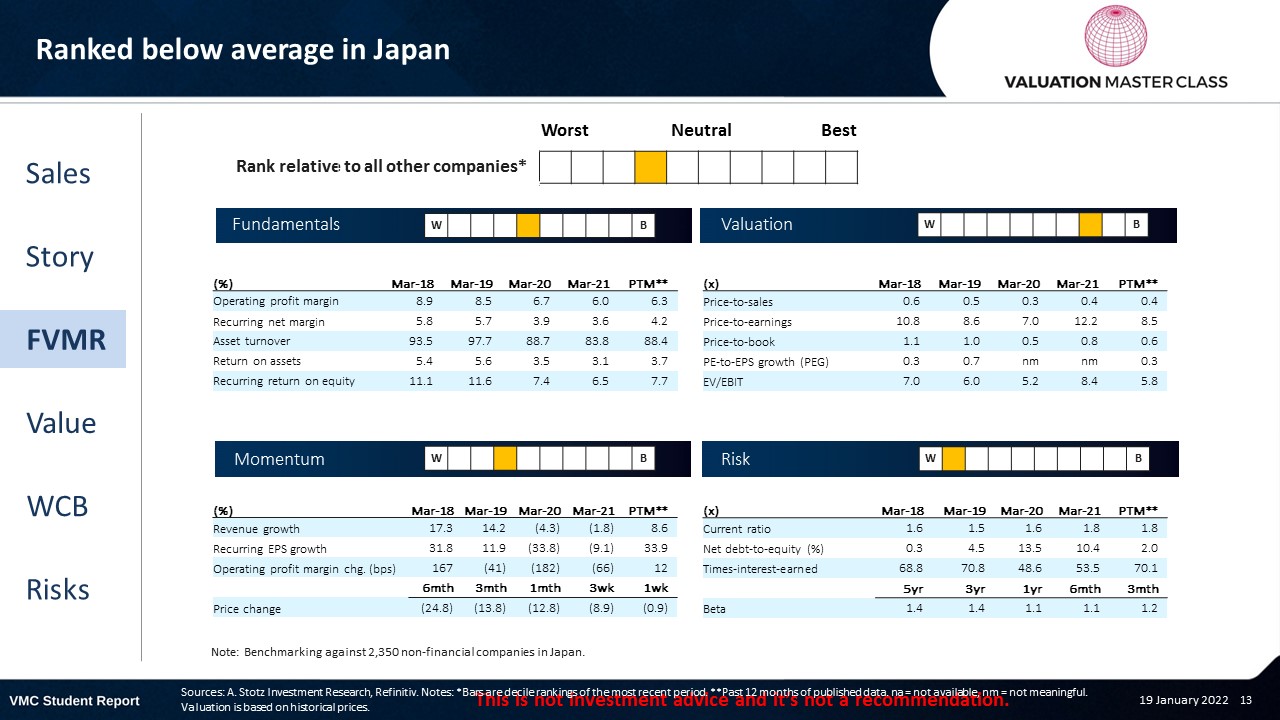

FVMR Scorecard – Sumitomo

- A stock’s attractiveness relative to stocks in that country or region

- Attractiveness is based on four elements

- Fundamentals, Valuation, Momentum, and Risk (FVMR)

- Scale from 1 (Best) to 10 (Worst)

Most analysts still on hold, but see upside

- 3 analysts issued a BUY recommendation while 4 stay on HOLD for now

- Consensus expects two strong years in terms of revenue but no growth in 23E

- I think that the company’s strong commitment to growth could lead to a positive surprise in 23E

Get financial statements and assumptions in the full report

P&L – Sumitomo

- Sumitomo has a strong ability to drive growth organically and through M&A

- Also, its product portfolio is well-equipped to ride the demand rebound

Balance sheet – Sumitomo

- Sumitomo has high working cap requirements, more than 40% of its total assets

- LT-debt has tripled between 2019 and 2021

- I expect the company to slowly repay it given its strong cash generation ability

Ratios – Sumitomo

- Revenue has been resilient throughout the pandemic

- The company only recorded a drop of 4% in 2020 and 2% in 2021

- The company has low leverage and could turn net cash in the future

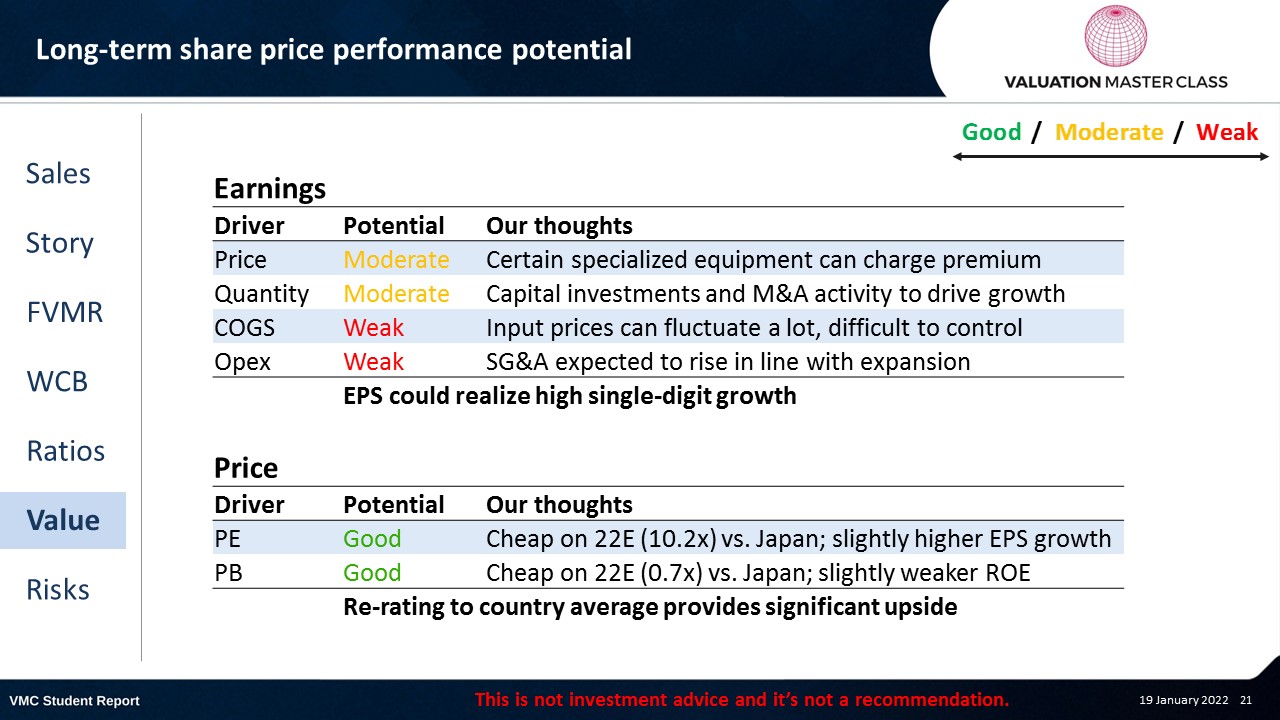

Long-term share price performance potential

Free cash flow – Sumitomo

- Cash flow should return positive from 22E onward

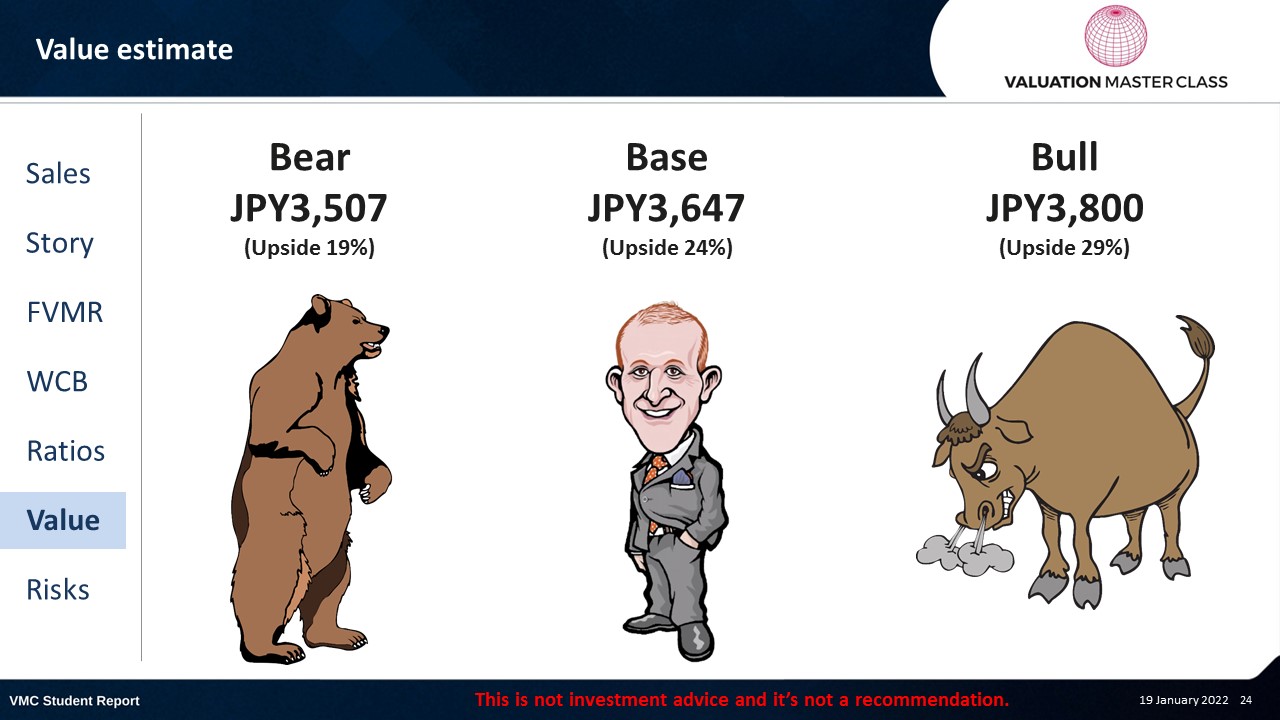

Value estimate – Sumitomo

- I am a bit more optimistic about the growth outlook

- Both, M&A and organic expansion should pay off in terms of revenue

- Sumitomo’s margin has been pretty stable over time

- Therefore, there is no reason to deviate significantly in the assumptions

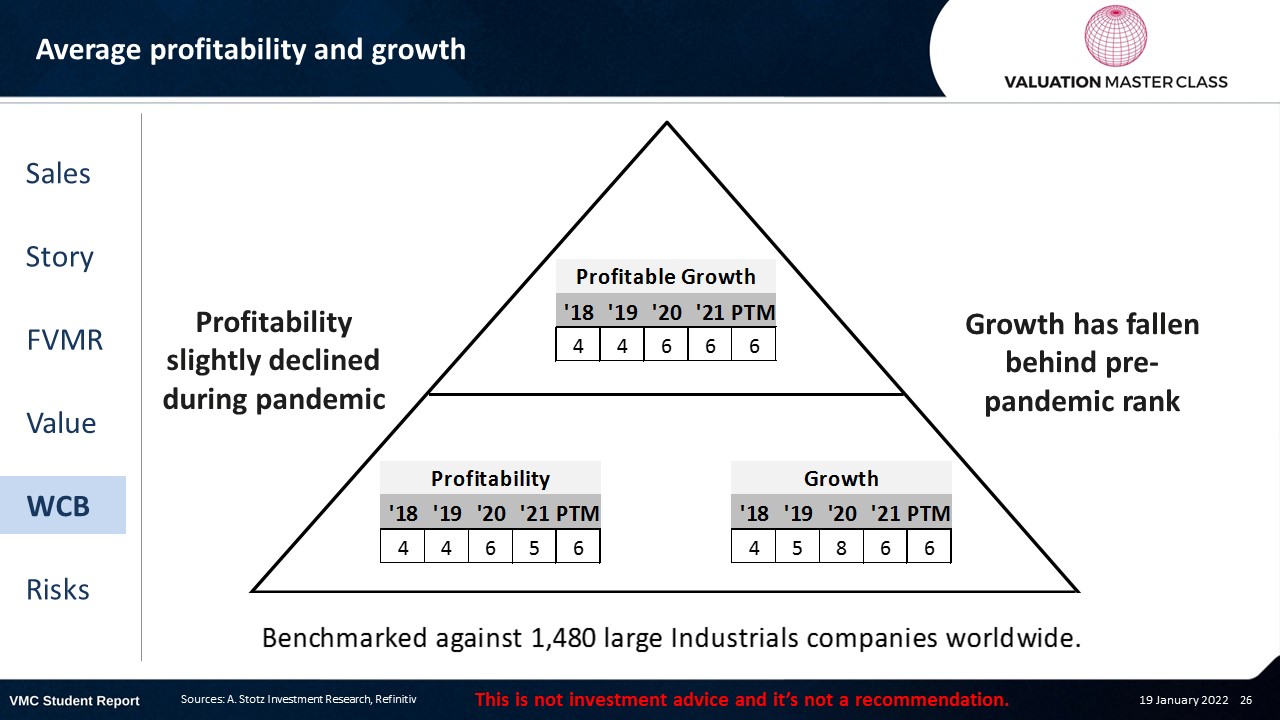

World Class Benchmarking Scorecard – Sumitomo

- Identifies a company’s competitive position relative to global peers

- Combined, composite rank of profitability and growth, called “Profitable Growth”

- Scale from 1 (Best) to 10 (Worst)

Key risk is falling behind competitors in capturing rebound

- Acquisitions could drag margins when integration takes time

- Potential overinvestment in capital-intensive industry could be harmful

- Environmental pressure to develop sustainable machineries requires high R&D

Conclusions

- Past has shown management’s commitment to growth and enhancing ROIC

- Valuation appears cheap, could be a good opportunity to buy

- Attractive dividend yield adds additional return

Download the full report as a PDF

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.