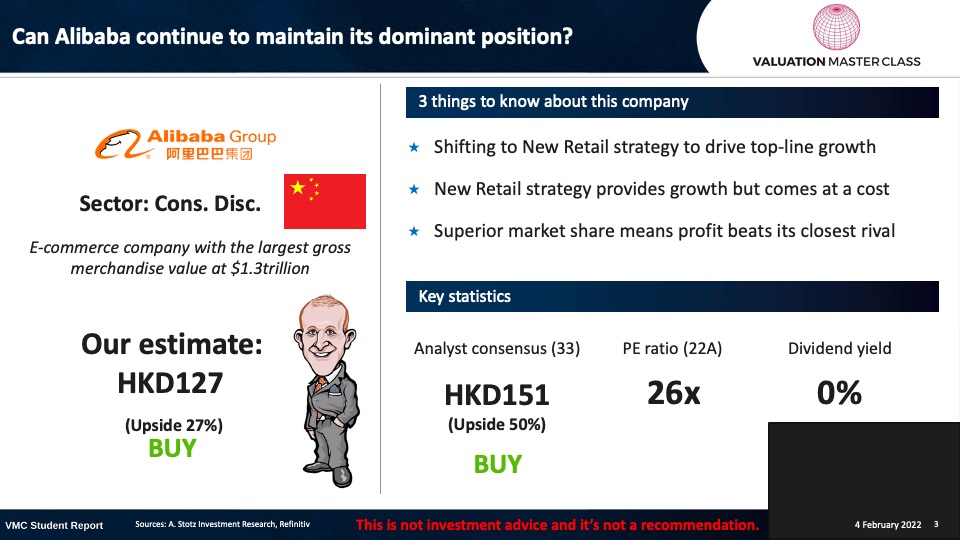

Can Alibaba Continue to Maintain Its Dominant Position?

What’s interesting about Alibaba is that its GMV is twice that of Amazon

Highlights:

- Shifting to New Retail strategy to drive top-line growth

- New Retail strategy provides growth but comes at a cost

- Superior market share means profit beats its closest rival

Download the full report as a PDF

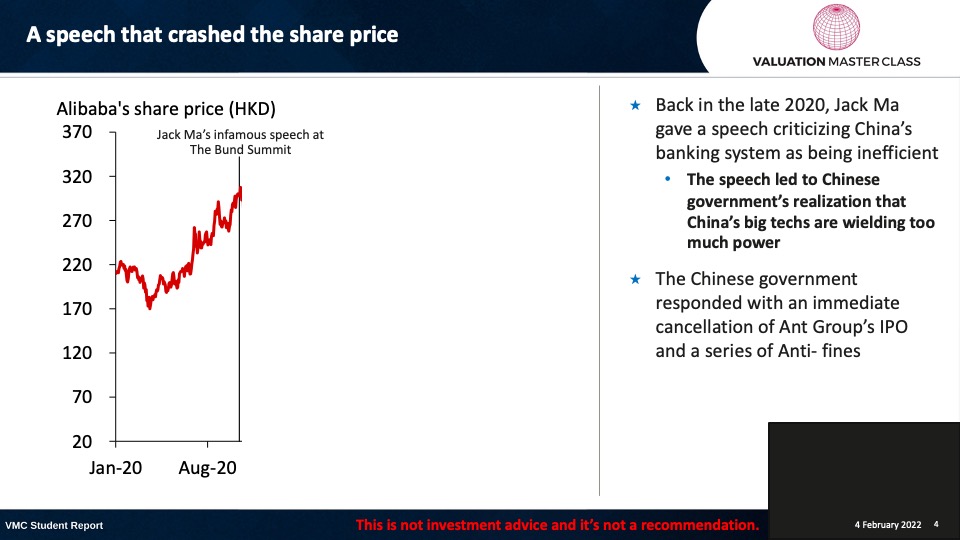

A speech that crashed the share price

- Back in the late 2020, Jack Ma gave a speech criticizing China’s banking system as being inefficient.

- The speech led to Chinese government’s realization that China’s big techs are wielding too much power.

- The Chinese government responded with an immediate cancellation of Ant Group’s IPO and a series of Anti- fines.

Recent updates on Alibaba

- Ant Group: The company has been restructured into a financial holdings company, which subjects the company to regulations that applies to financial institutions.

- Alibaba and Ant group has terminated data sharing agreement.

- There are no plans to revive the IPO of Ant Group.

- And Alibaba currently holds a 33% stake of Ant Group.

- Hong Kong primary listing: Hong Kong Stock Exchange has approved Alibaba’s primary listing.

- Gaining primary listing in Hong Kong would make Alibaba eligible to take part in stock connect with Mainland China.

- This would give access to qualified Mainland Chinese investors to access Alibaba’s shares.

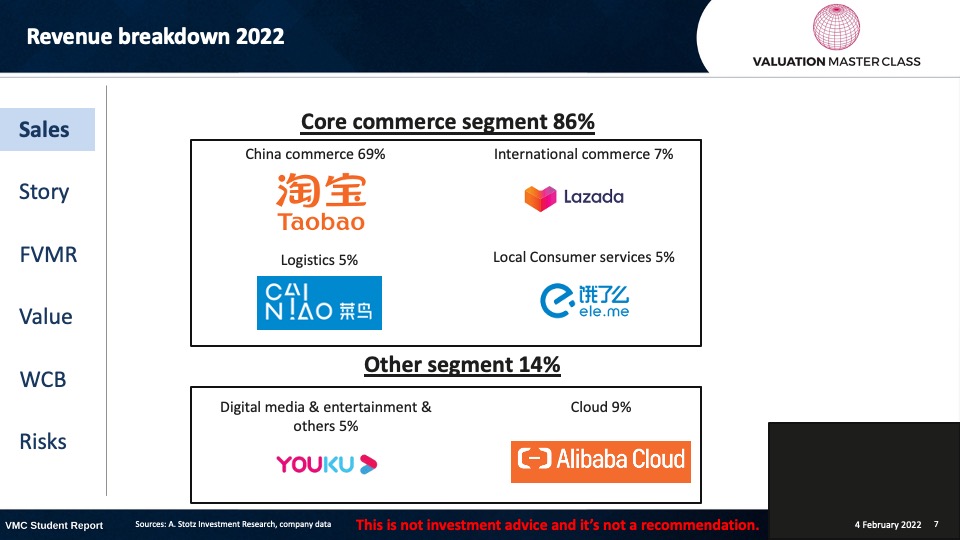

Revenue breakdown 2022

Business model summary

- The main revenue driver is the China Commerce segment and can be divided into:

- Customer management (E-commerce platform)

- Direct Sale (E-grocery)

- The China Commerce segment is supported by: Logistics, Local Consumer Service and Cloud segments which help build Alibaba’s ecosystem.

Shifting to New Retail strategy to drive top-line growth

- Alibaba’s Sun Art, Tmall Supermarket and Freshhippo subsidiaries are instrumental in driving the growth of New Retail strategy.

- The concept is to blur the line between online and offline retail.

- Today, all of Alibaba’s subsidiaries’ physical supermarkets and hypermarkets are integrated into Alibaba’s platform.

- This enables a less-than-one-hour delivery to customers through Alibaba’s ecosystem.

Direct sales to become a new revenue growth engine

- Direct sales already account for 45% of China commerce segment in 2022 compared to just 16% in 2019.

- The explosive growth was driven by the pandemic.

- Digital grocery sales in China reached nearly $200bn in 2021.

- And the market size is expected to almost double in 2025.

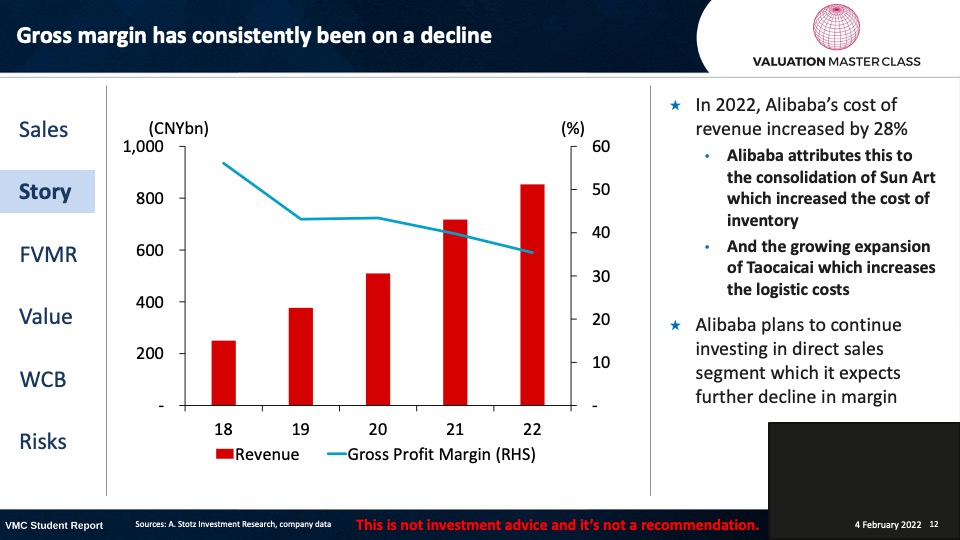

New Retail strategy provides growth but comes at a cost

- Alibaba’s traditional driver of revenue growth has been its e-commerce platforms.

- By being the facilitator of exchange between buyers and sellers, Alibaba traditionally has low inventory costs to its revenue.

- With the surge of revenue contribution coming from direct sale segment, Alibaba has increased its inventory cost that came from operating supermarkets.

- The consequence of this is the decline in gross profit margin.

Gross margin has consistently been on a decline

- In 2022, Alibaba’s cost of revenue increased by 28%.

- Alibaba attributes this to the consolidation of Sun Art which increased the cost of inventory.

- And the growing expansion of Taocaicai which increases the logistic costs.

- Alibaba plans to continue investing in direct sales segment which it expects further decline in margin.

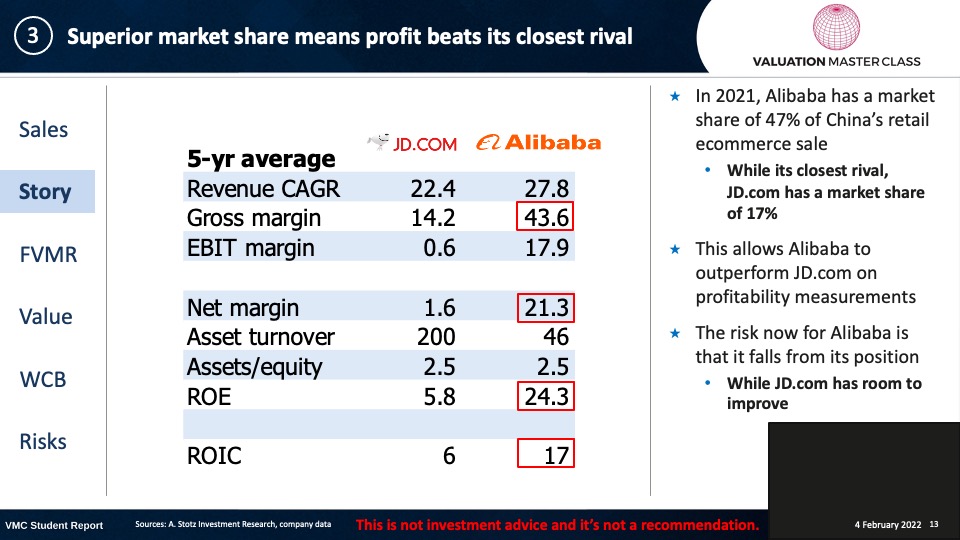

Superior market share means profit beats its closest rival

- In 2021, Alibaba has a market share of 47% of China’s retail ecommerce sale.

- While its closest rival, JD.com has a market share of 17%.

- This allows Alibaba to outperform JD.com on profitability measurements.

- The risk now for Alibaba is that it falls from its position.

- While JD.com has room to improve.

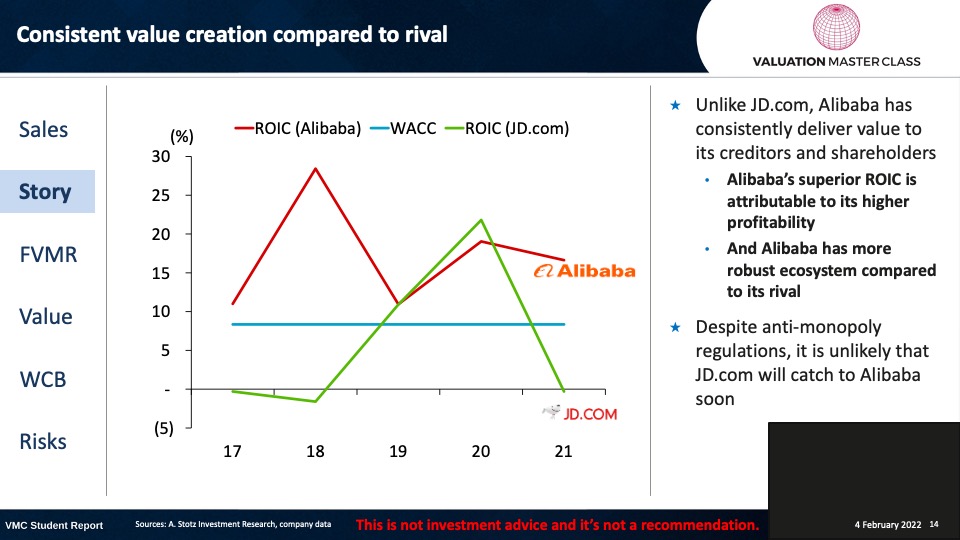

Consistent value creation compared to rival

- Unlike JD.com, Alibaba has consistently deliver value to its creditors and shareholders.

- Alibaba’s superior ROIC is attributable to its higher profitability.

- And Alibaba has more robust ecosystem compared to its rival.

- Despite anti-monopoly regulations, it is unlikely that JD.com will catch to Alibaba soon.

Consensus is bullish

- Most analysts are bullish on Alibaba.

- Analysts predict lower gross margin compared to historical average.

- This is in line with our forecast due to Alibaba consolidating subsidiaries with higher inventory costs.

Get financial statements and assumptions in the full report

P&L – Alibaba

- Revenue growth is expected to be disrupted by zero covid policy which disrupts supply chain and logistics.

Balance sheet – Alibaba

- Alibaba is expanding its ecosystems which means continuous expansion of net fixed assets.

- Alibaba has low proportion of debt to its capital, this gives Alibaba an ability to expand its ecosystem.

Ratios – Alibaba

- Alibaba is still not expected to pay dividends in order to continue pursuing growth.

- Alibaba is net cash giving it the ability to continue expanding its ecosystem.

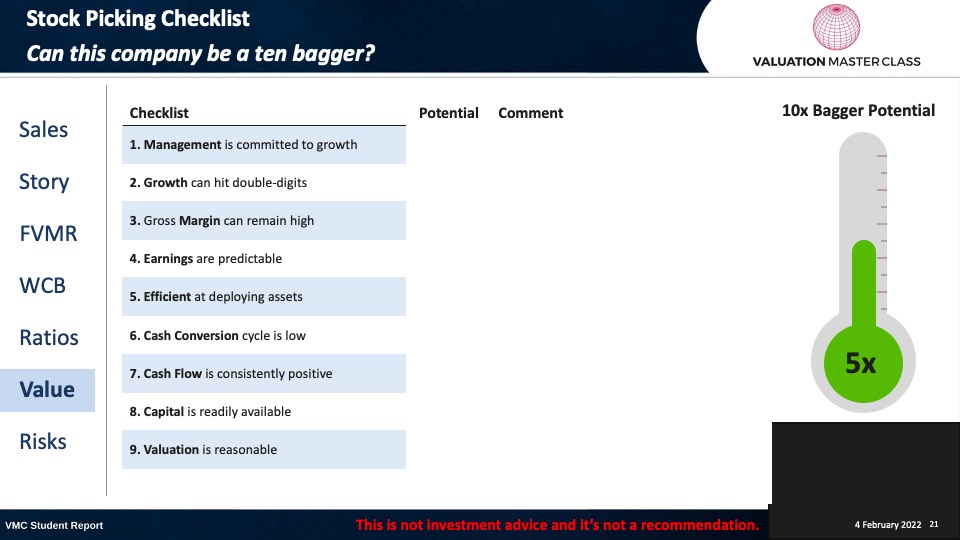

Stock Picking Checklist

Can this company be a ten bagger?

Free cash flow – Alibaba

- Alibaba is still pursuing growth, I expect increasing level of CAPEX.

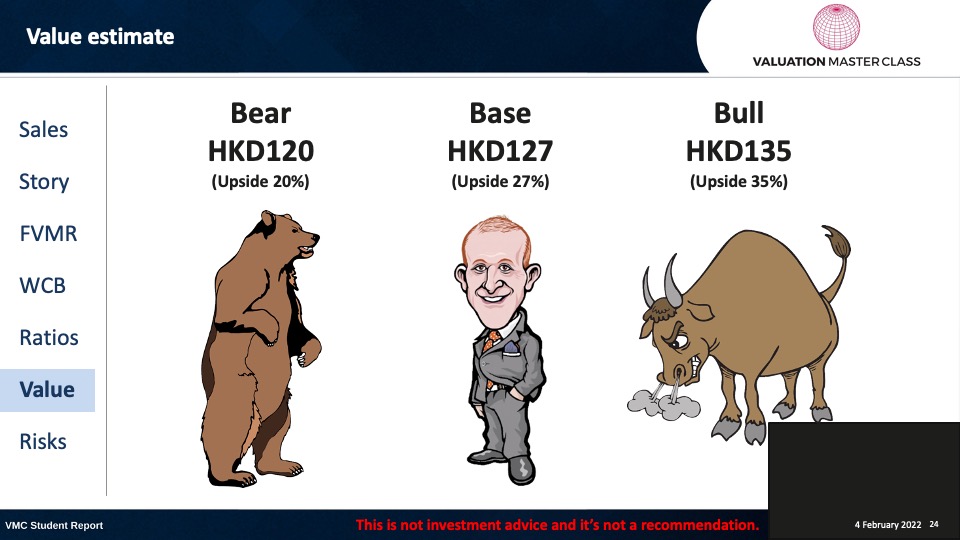

Value estimate

- Expect higher revenue growth than consensus but slightly lower gross margin.

- The terminal growth rate is put at 4% due to Alibaba still having a long growth runway.

Value estimate

Key risk is regulations

- Alibaba operates in an increasingly complex legal and regulatory environment.

- Failure to build successful ecosystem.

- Alliance risks; synergies between subsidiaries might not be successful.

Conclusion

- Direct sales to drive further growth.

- Decline in gross margin due to enhanced focus on direct sale.

- Dominant position likely to continue despite regulations.

Download the full report as a PDF

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.