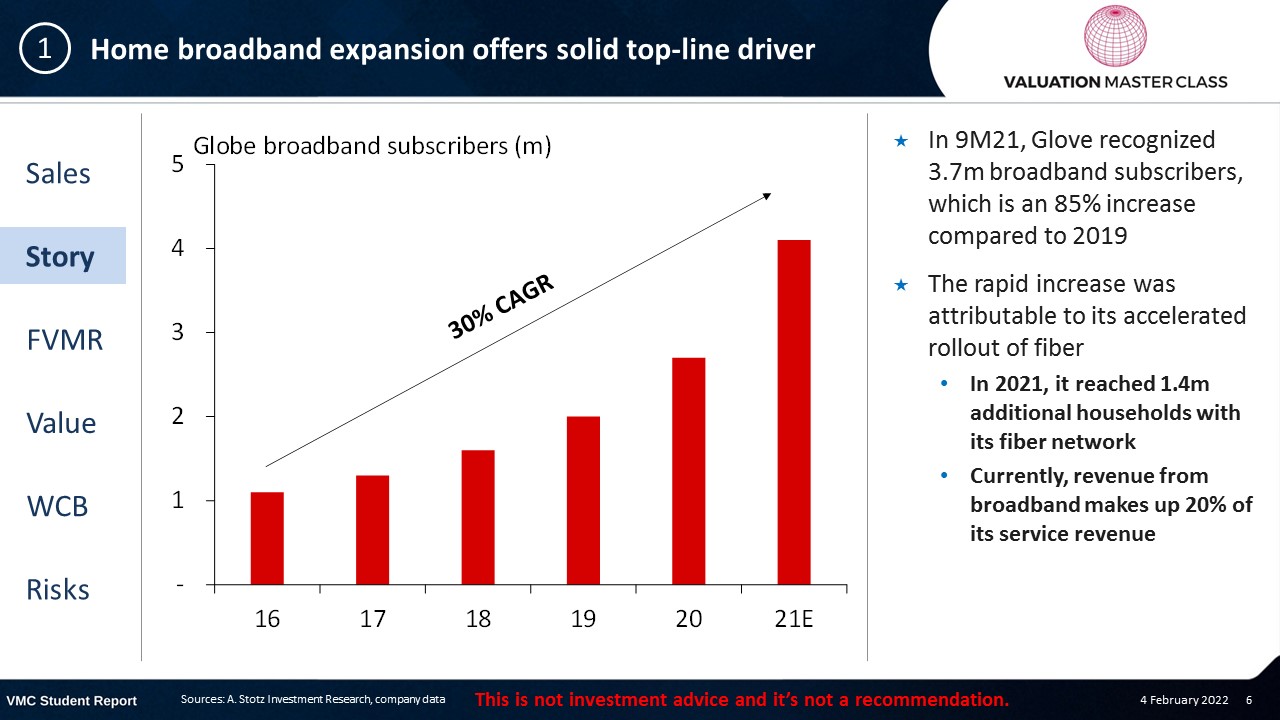

Can Philippine’s Largest Telco Company Globe Deliver on Its High Growth Prospects?

Highlights:

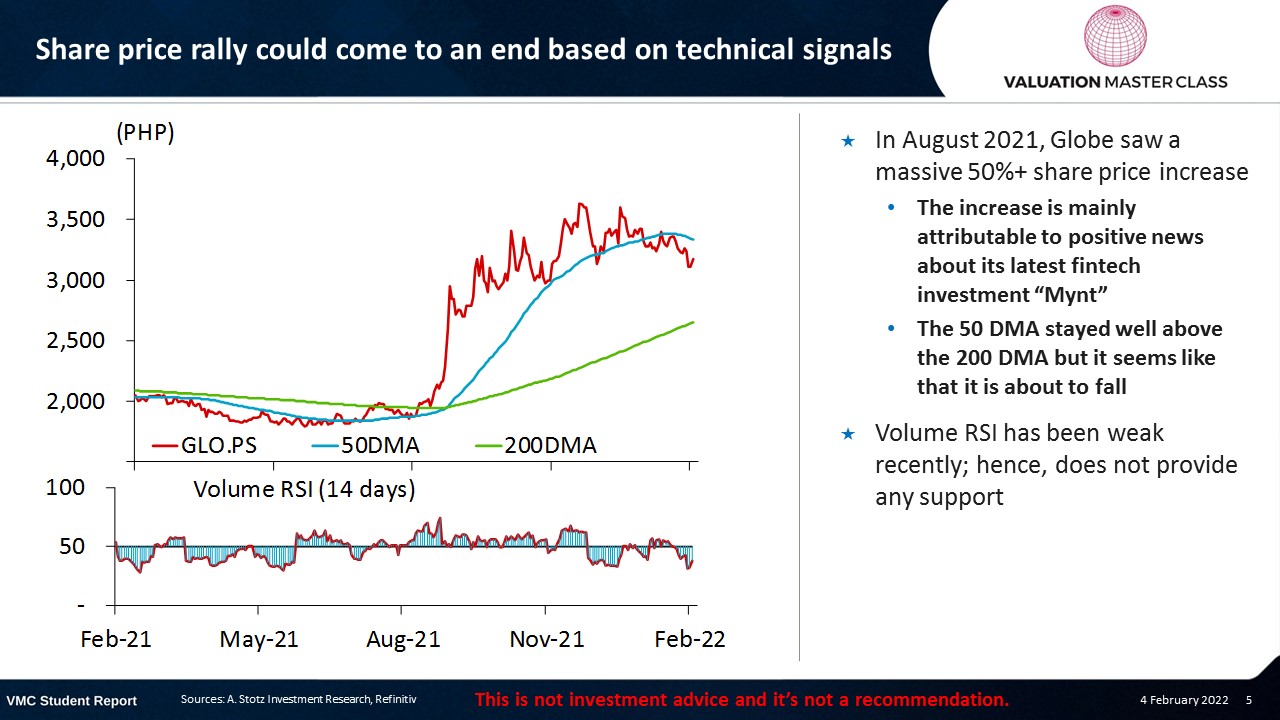

- Home broadband expansion offers solid top-line driver

- New entrant Dito challenges previous Filipino duopoly

- Investment in mobile payments could pay off big

Download the full report as a PDF

Globe Telecom’s revenue breakdown 2021

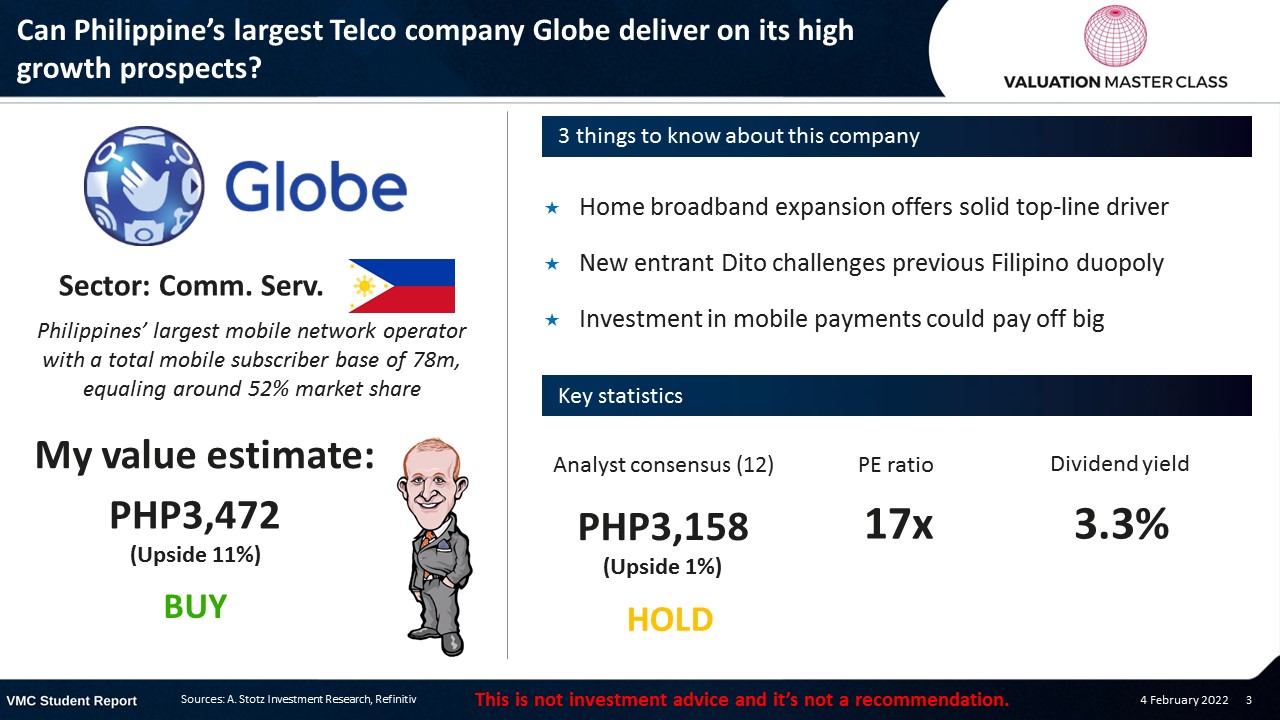

Share price rally could come to an end based on technical signals

- In August 2021, Globe saw a massive 50%+ share price increase

- The increase is mainly attributable to positive news about its latest fintech investment “Mynt”

- The 50 DMA stayed well above the 200 DMA but it seems like that it is about to fall

- Volume RSI has been weak recently; hence, does not provide any support

Home broadband expansion offers solid top-line driver

- In 9M21, Glove recognized 3.7m broadband subscribers, which is an 85% increase compared to 2019

- The rapid increase was attributable to its accelerated rollout of fiber

- In 2021, it reached 1.4m additional households with its fiber network

- Currently, revenue from broadband makes up 20% of its service revenue

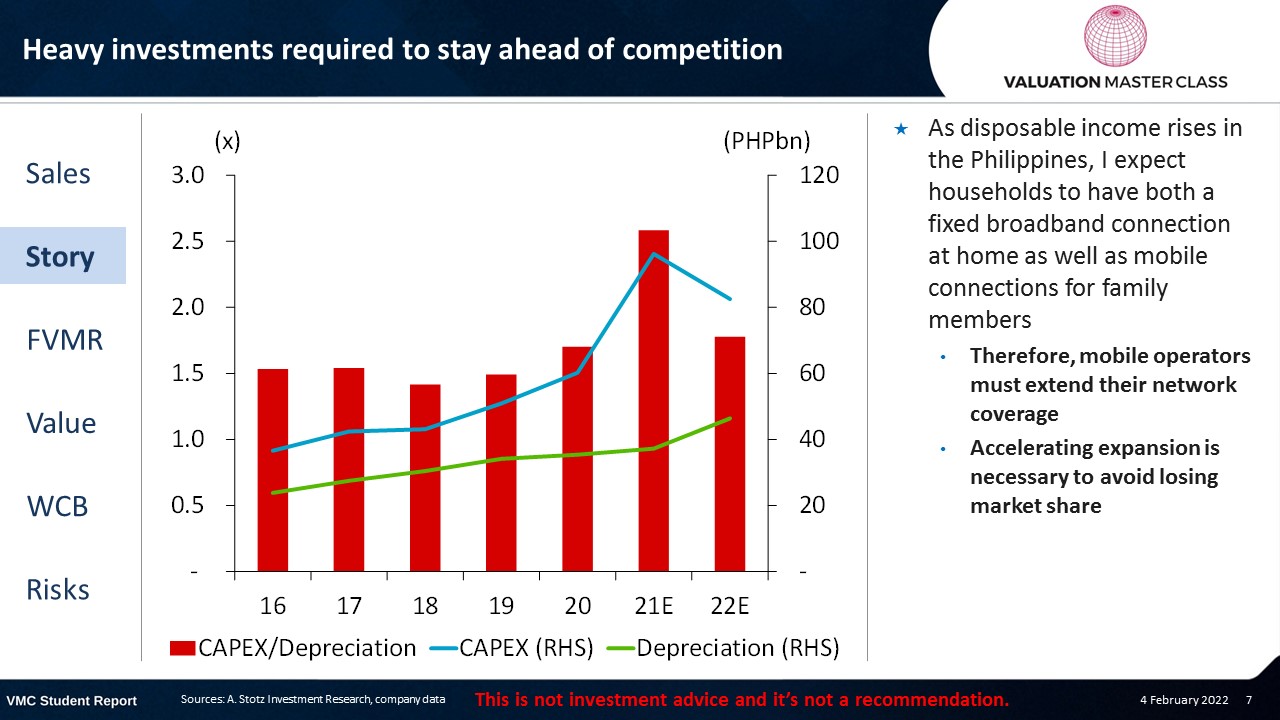

Heavy investments required to stay ahead of competition

- As disposable income rises in the Philippines, I expect households to have both a fixed broadband connection at home as well as mobile connections for family members

- Therefore, mobile operators must extend their network coverage

- Accelerating expansion is necessary to avoid losing market share

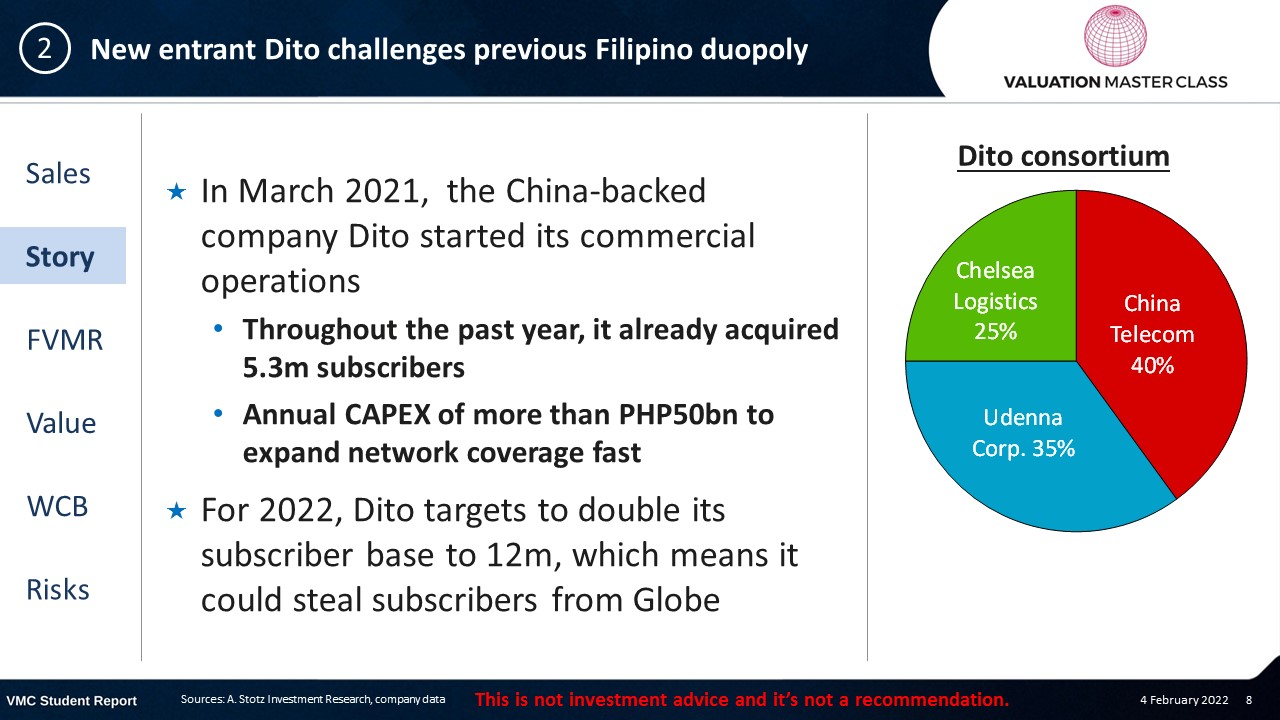

New entrant Dito challenges previous Filipino duopoly

- In March 2021, the China-backed company Dito started its commercial operations

- Throughout the past year, it already acquired 5.3m subscribers

- Annual CAPEX of more than PHP50bn to expand network coverage fast

- For 2022, Dito targets to double its subscriber base to 12m, which means it could steal subscribers from Globe

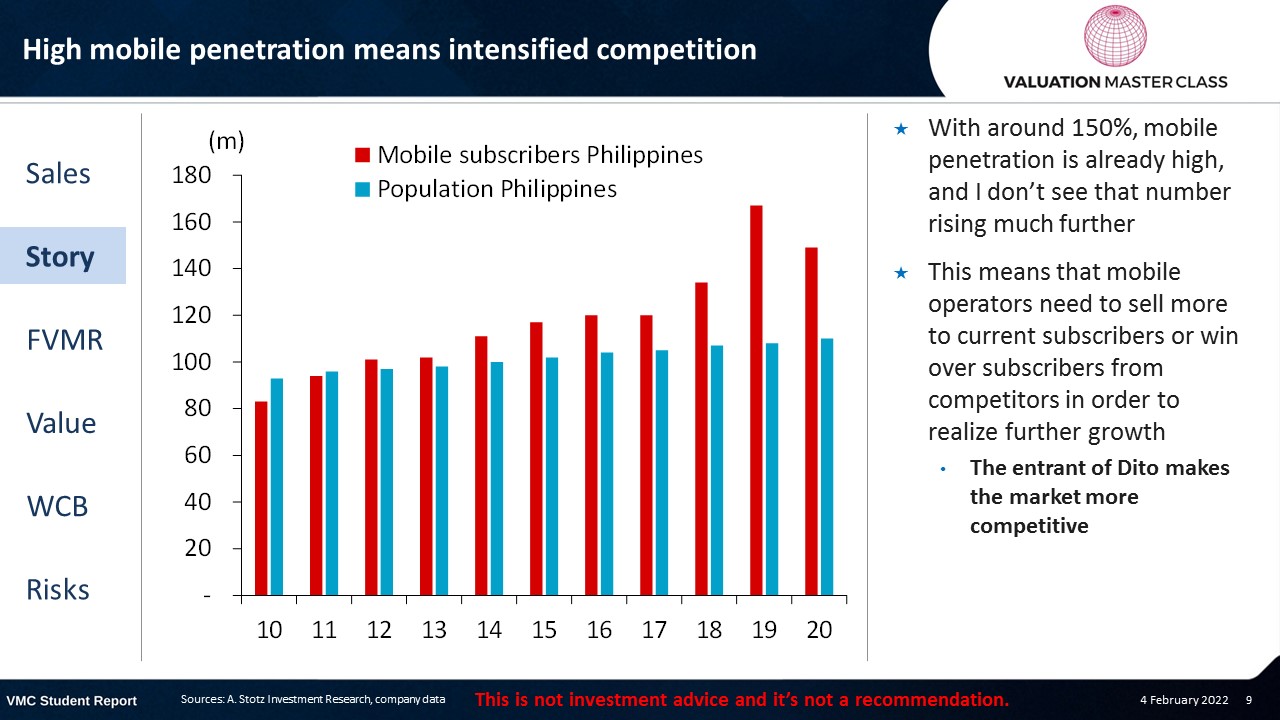

High mobile penetration means intensified competition

- With around 150%, mobile penetration is already high, and I don’t see that number rising much further

- This means that mobile operators need to sell more to current subscribers or win over subscribers from competitors in order to realize further growth

- The entrant of Dito makes the market more competitive

What are the ways to grow revenue?

- Revenue growth is a key success factor of any business

- Simply put, revenue equals price times quantity

- Therefore, to increase revenue a company must either sell more of its products or increase the price of its products, or some combination of both

- One way to increase quantity is to bring new products to the market, this is what cell phone companies did when the rolled-out fiber optics networks

Investment in mobile payments could pay off big

- Globe bought a 40% stake in Mynt, a fintech firm engaged in mobile payments, and microloans

- Mynt operates with GCash the largest e-wallet in the Philippines

- GCash’s user base and number of merchants is growing exponentially

- In 3Q21, it recorded 51m users, up 10x compared to 2019

- As a comparison, the aggregate of all e-wallet competitors is only 41m

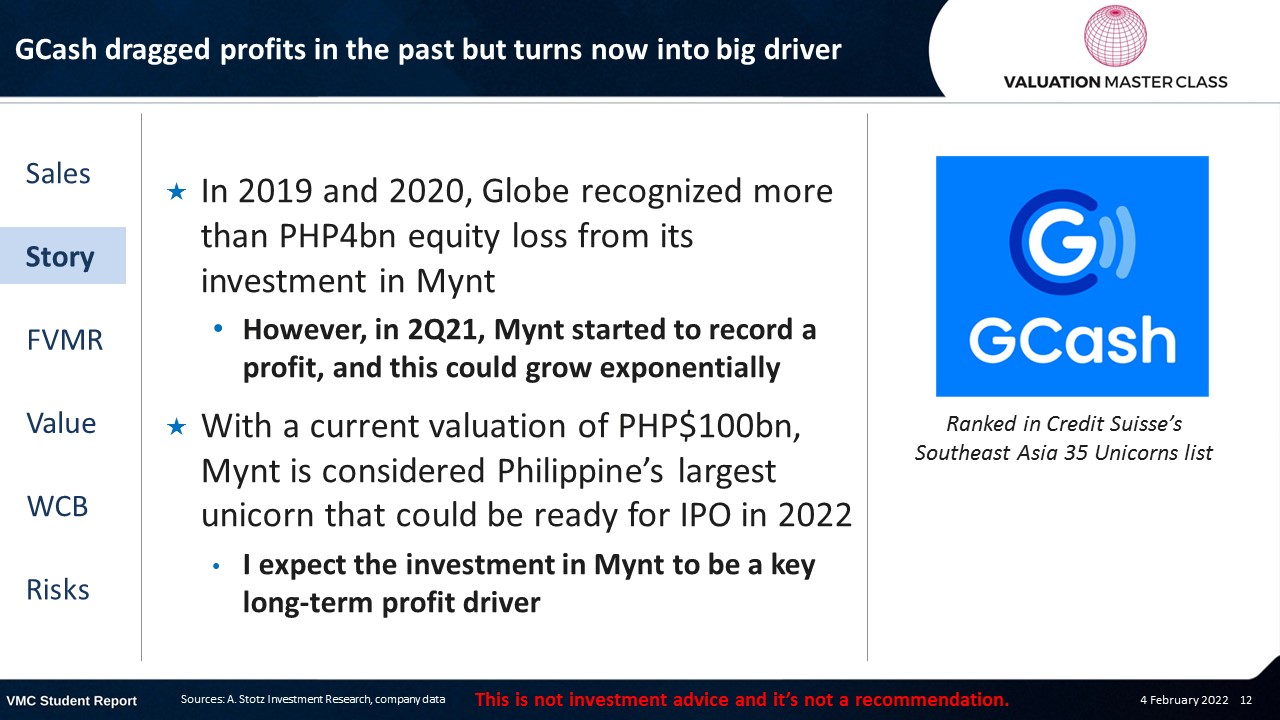

GCash dragged profits in the past but turns now into big driver

- In 2019 and 2020, Globe recognized more than PHP4bn equity loss from its investment in Mynt

- However, in 2Q21, Mynt started to record a profit, and this could grow exponentially

- With a current valuation of PHP$100bn, Mynt is considered Philippine’s largest unicorn that could be ready for IPO in 2022

- I expect the investment in Mynt to be a key long-term profit driver

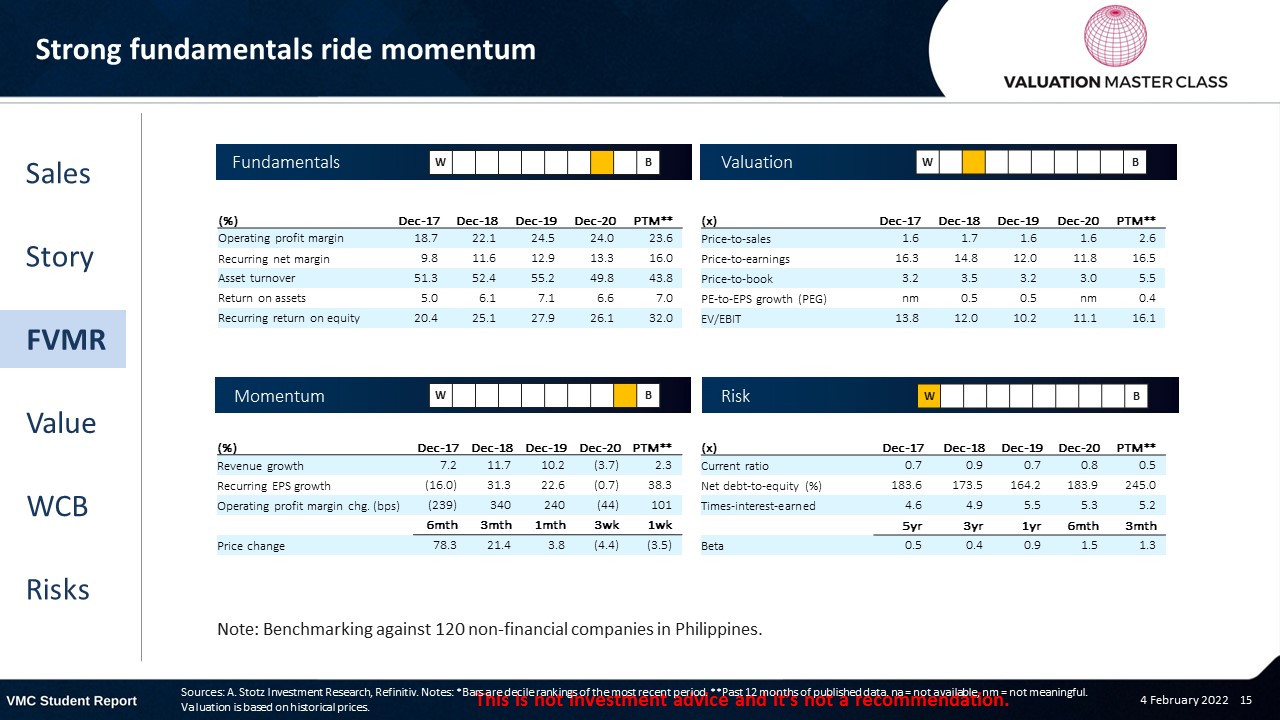

FVMR Scorecard – Globe Telecom

- A stock’s attractiveness relative to stocks in that country or region

- Attractiveness is based on four elements

- Fundamentals, Valuation, Momentum, and Risk (FVMR)

- Scale from 1 (Best) to 10 (Worst)

Consensus don’t see upside after recent share price rally

- The majority analysts stay with a HOLD, while 4 analysts issued a SELL

- Consensus expects solid single-digit revenue growth for the future

- Also, margins are expected to stay stable

Get financial statements and assumptions in the full report

P&L – Globe Telecom

- After recording more than PHP4bn in losses from its investment in Mynt, it is likely to record a profit in 2021

- Over time, it could evolve to a serious profit contributor

Balance sheet – Globe Telecom

- Heavy CAPEX required to expand network coverage and stay ahead of competitors

- Issuance of long-term debt necessary to fund expansion

- Operating cash flows are not sufficient to fund growth internally yet

Ratios – Globe Telecom

- Dividend payout is high which means it could continue to deliver a solid dividend yield of 3%+

- Leverage significantly increased over time

- Based on its debt covenants, it can not go beyond a debt-to-equity ratio of 3.1x

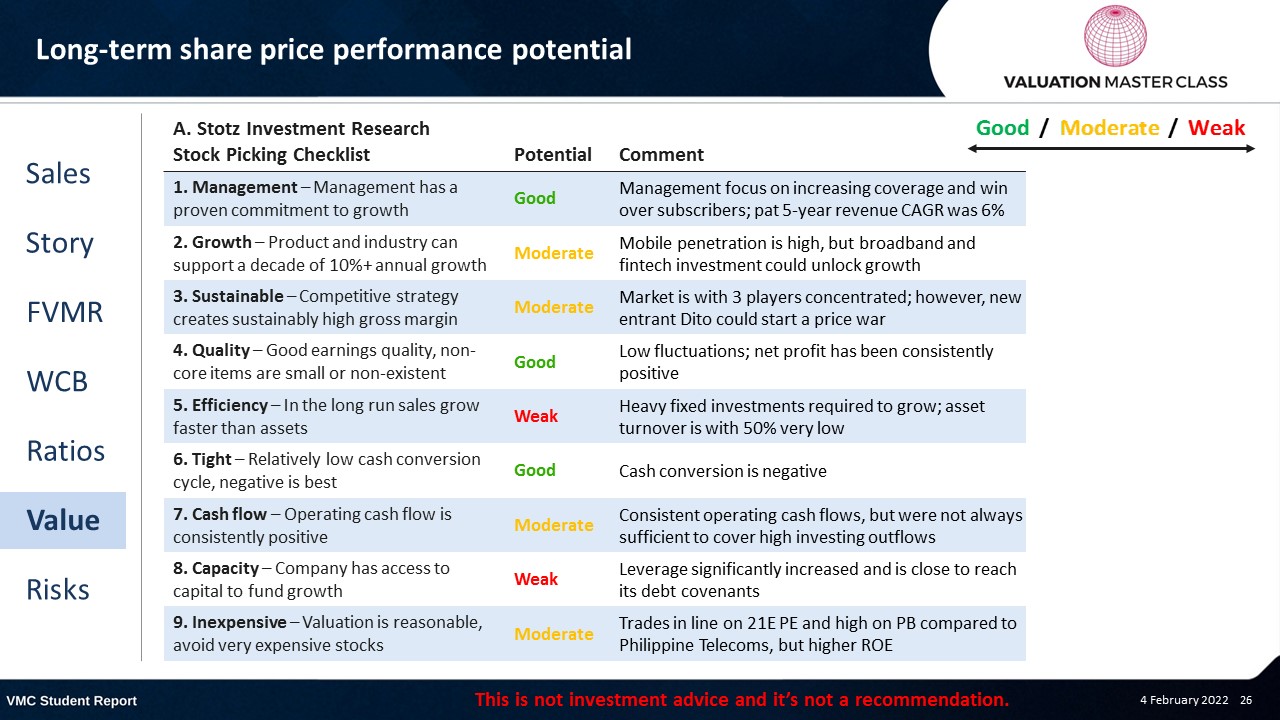

Long-term share price performance potential

Free cash flow – Globe Telecom

- FCFF in 2021 is likely to end up negative due to an increase in CAPEX

- However, it should be able to deliver positive FCFF again from 2022 onward

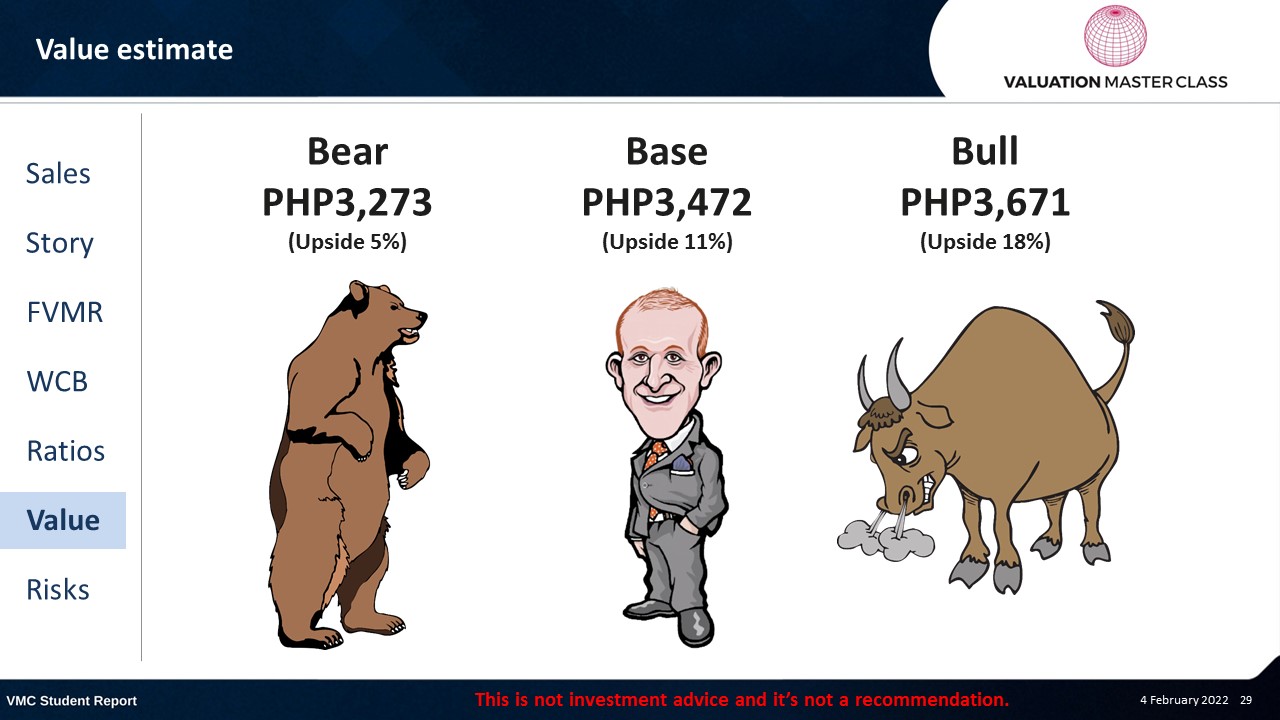

Value estimate – Globe Telecom

- Similar to consensus, I expect stable revenue growth over the next few years

- I am a bit more optimistic on margins as I expect the third competitor Dito will not be able to scale fast enough

- Over the long run, I assume Globe to grow in line with population growth, which is around 2%

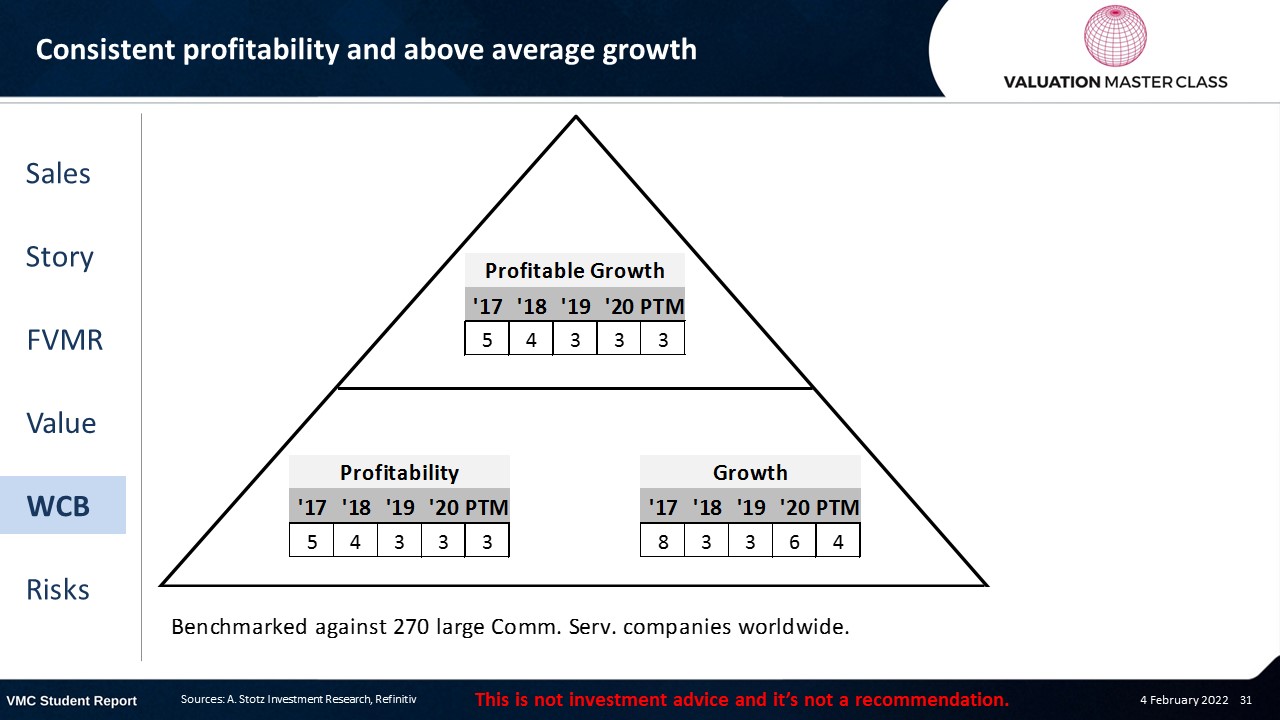

World Class Benchmarking Scorecard – Globe Telecom

- Identifies a company’s competitive position relative to global peers

- Combined, composite rank of profitability and growth, called “Profitable Growth”

- Scale from 1 (Best) to 10 (Worst)

Key risk is intensified price competition

- Less-than-expected return on CAPEX in a capital-intensive industry

- Overestimation of profit contribution from Mynt investment

- Failure to keep up with technological changes

Conclusions

- The company recognized the potential of broadband to provide solid growth opportunities

- With a potential IPO of its fintech investment Mynt, share price could see another surge

- High ROE could justify slightly expensive valuation

Download the full report as a PDF

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.