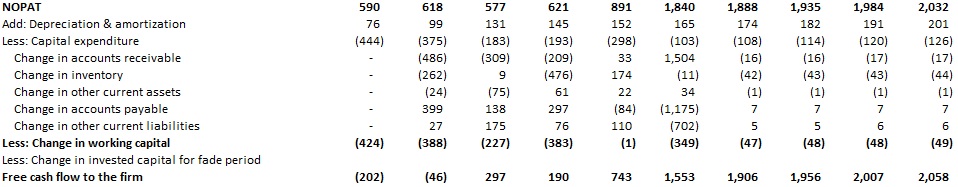

Change in working capital

The ValueModel checks whether your change in working capital is in line with historical figures.

Sometimes it can be difficult to forecast the change in working capital of a company. Therefore it is necessary to focus on the main idea of working capital. A question you need to ask yourself is whether the company is spending in advance of its growth. If it is, the change in working capital should be negative as a percent of the change in revenue. A typical example would be a retailer: it has to buy inventory before it sells it to its customers, so it is going to spend money on working capital before it can actually realize sales from spending that working capital. As a result, it needs more cash to grow as its sales grow. On the other hand, there are companies that have the opposite situation where they actually get money as a result of their growth. A classic example is any subscription company where it gets money from customers in advance before it delivers the service. If that is the case, the change in working capital will be positive as a percent of the change in revenue. As a company’s revenue grows, it gets additional cash from those business units (collection of cash from customers up front).

To forecast the change in working capital you can use several approaches:

1. Grow the last change in WC at the expected growth rate of earnings. 2. Measure WC as a percent of Revenues and use that ratio to forecast. 3. Measure WC as a percent of Revenues over a historic period and use that ratio to forecast. 4. Forecast based on the industry’s average working capital as a percentage of revenues.

If the change in working capital was negative in the past and you forecast it positive, the model will warn you automatically.

Related “Common valuation mistakes” articles

Forecasting the change in working capital

Sometimes it can be difficult to forecast the change in working capital of a company. Therefore it is necessary to focus on the main idea of working capital. A question you need to ask yourself is whether the company is spending in advance of its growth. If it is, the change in working capital should be negative as a percent of the change in revenue. A typical example would be a retailer: it has to buy inventory before it sells it to its customers, so it is going to spend money on working capital before it can actually realize sales from spending that working capital. As a result, it needs more cash to grow as its sales grow. On the other hand, there are companies that have the opposite situation where they actually get money as a result of their growth. A classic example is any subscription company where it gets money from customers in advance before it delivers the service. If that is the case, the change in working capital will be positive as a percent of the change in revenue. As a company’s revenue grows, it gets additional cash from those business units (collection of cash from customers up front).

To forecast the change in working capital you can use several approaches:

1. Grow the last change in WC at the expected growth rate of earnings. 2. Measure WC as a percent of Revenues and use that ratio to forecast. 3. Measure WC as a percent of Revenues over a historic period and use that ratio to forecast. 4. Forecast based on the industry’s average working capital as a percentage of revenues.