How Long before Carlsberg Recovers from Abandoning Russia?

What’s interesting about Carlsberg is that goodwill accounts for a massive 40% of assets.

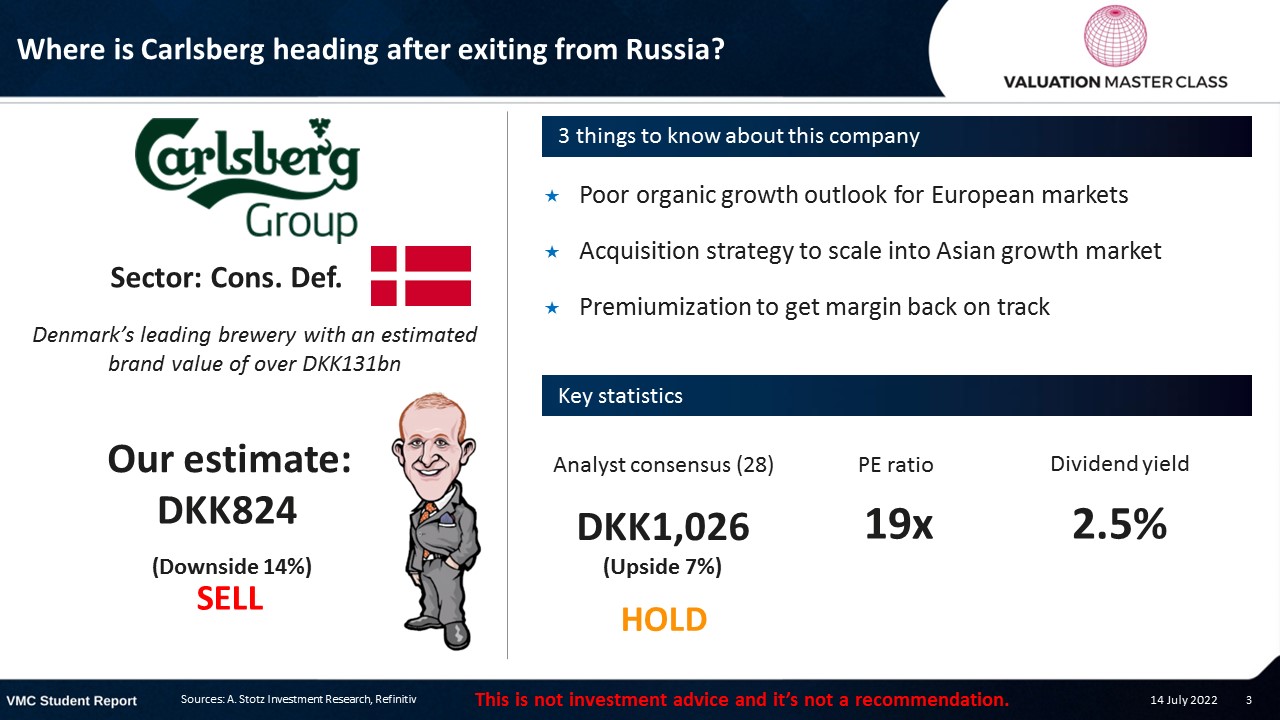

Highlights:

- Poor organic growth outlook for European markets

- Acquisition strategy to scale into Asian growth market

- Premiumization to get margin back on track

Download the full report as a PDF

Carlsberg to cease Russian operations

Carlsberg to cease Russian operations

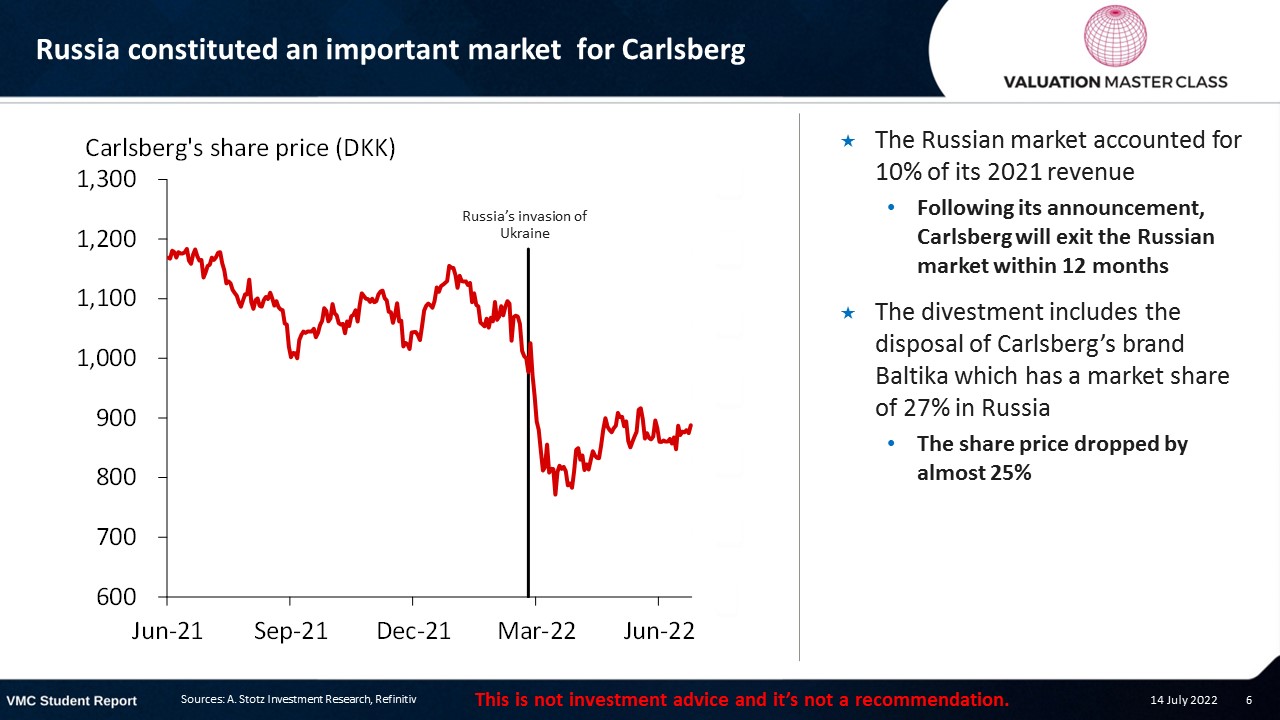

Russia constituted an important market for Carlsberg

- The Russian market accounted for 10% of its 2021 revenue

- Following its announcement, Carlsberg will exit the Russian market within 12 months

- The divestment includes the disposal of Carlsberg’s brand Baltika which has a market share of 27% in Russia

- The share price dropped by almost 25%

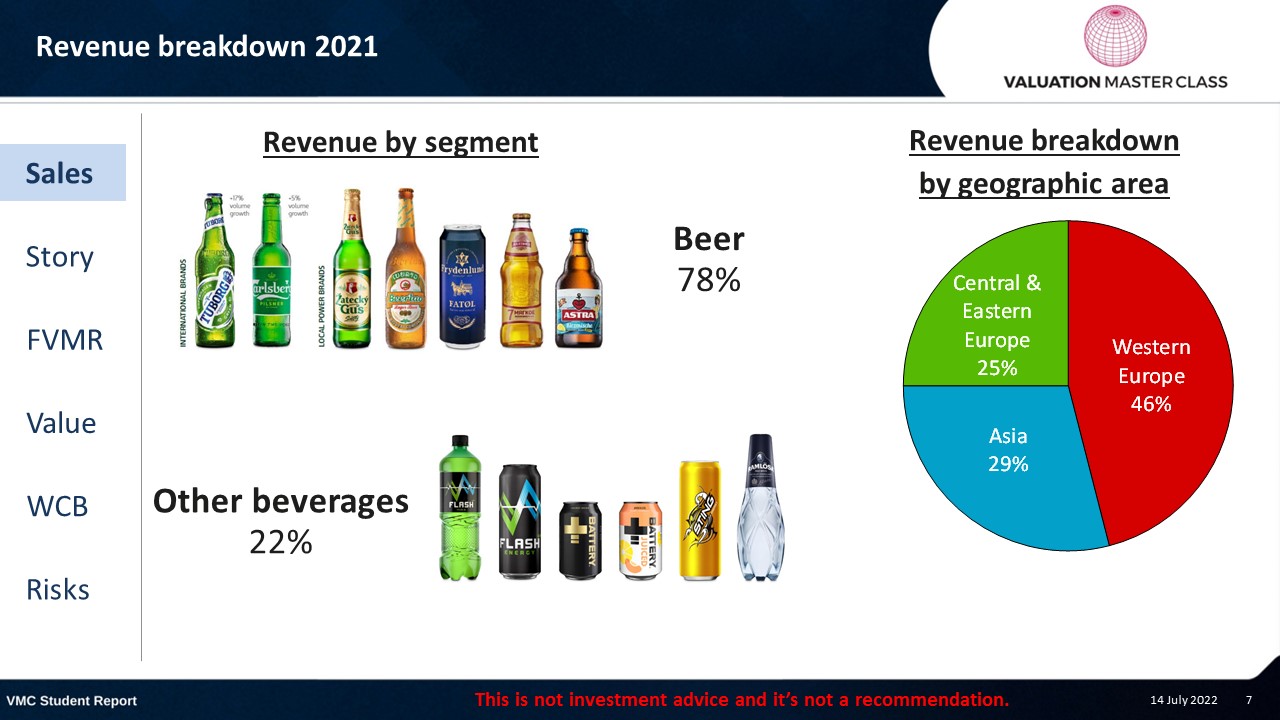

Revenue breakdown 2021

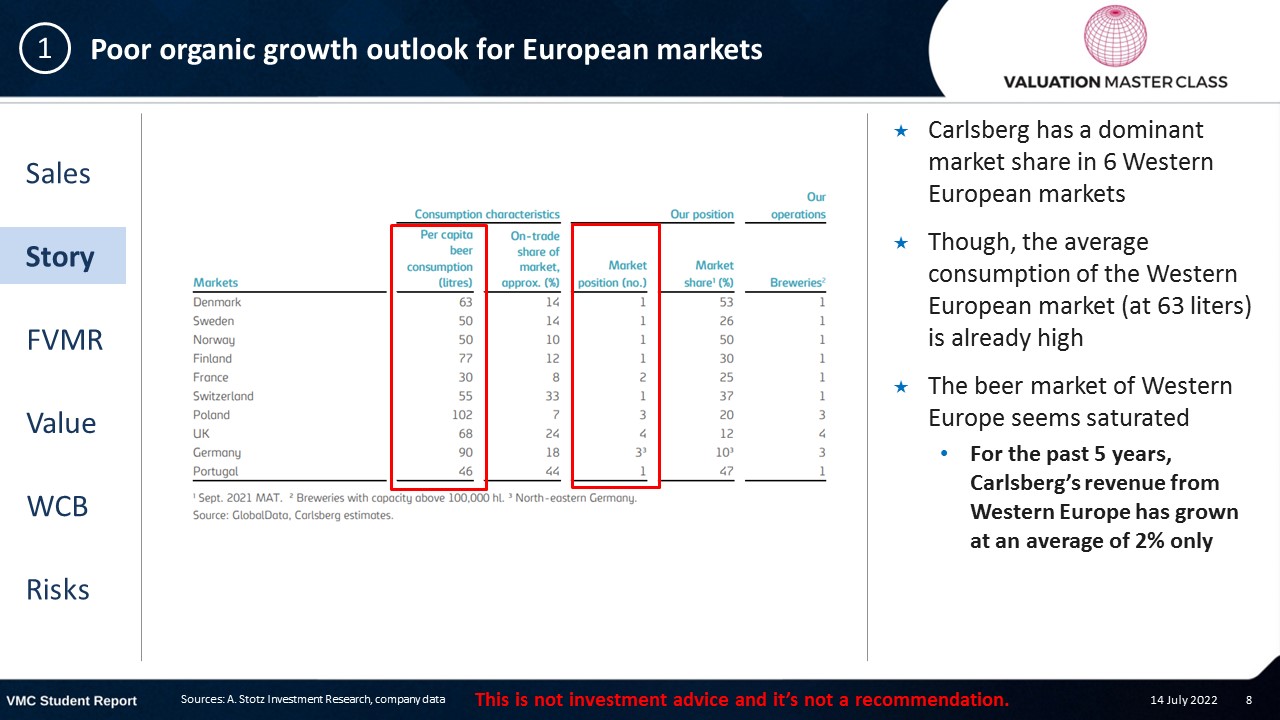

Poor organic growth outlook for European markets

- Carlsberg has a dominant market share in 6 Western European markets

- Though, the average consumption of the Western European market (at 63 liters) is already high

- The beer market of Western Europe seems saturated

- For the past 5 years, Carlsberg’s revenue from Western Europe has grown at an average of 2% only

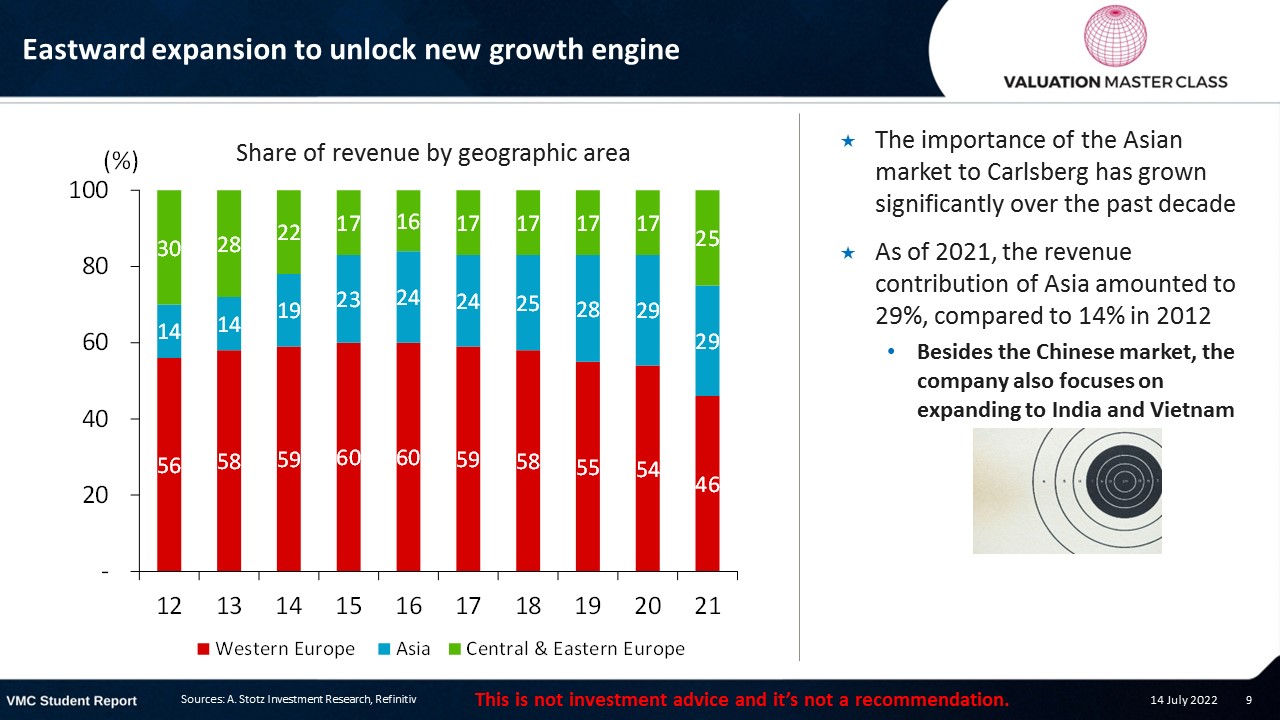

Eastward expansion to unlock new growth engine

- The importance of the Asian market to Carlsberg has grown significantly over the past decade

- As of 2021, the revenue contribution of Asia amounted to 29%, compared to 14% in 2012

- Besides the Chinese market, the company also focuses on expanding to India and Vietnam

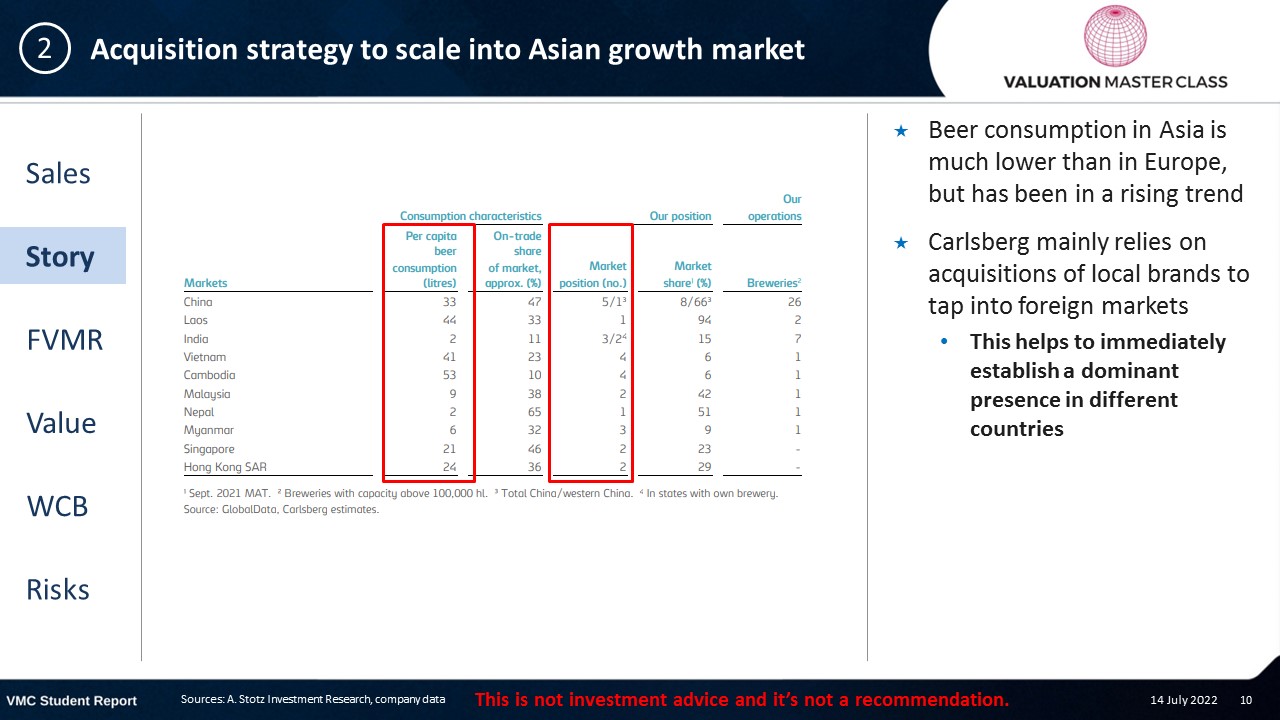

Acquisition strategy to scale into Asian growth market

- Beer consumption in Asia is much lower than in Europe, but has been in a rising trend

- Carlsberg mainly relies on acquisitions of local brands to tap into foreign markets

- This helps to immediately establish a dominant presence in different countries

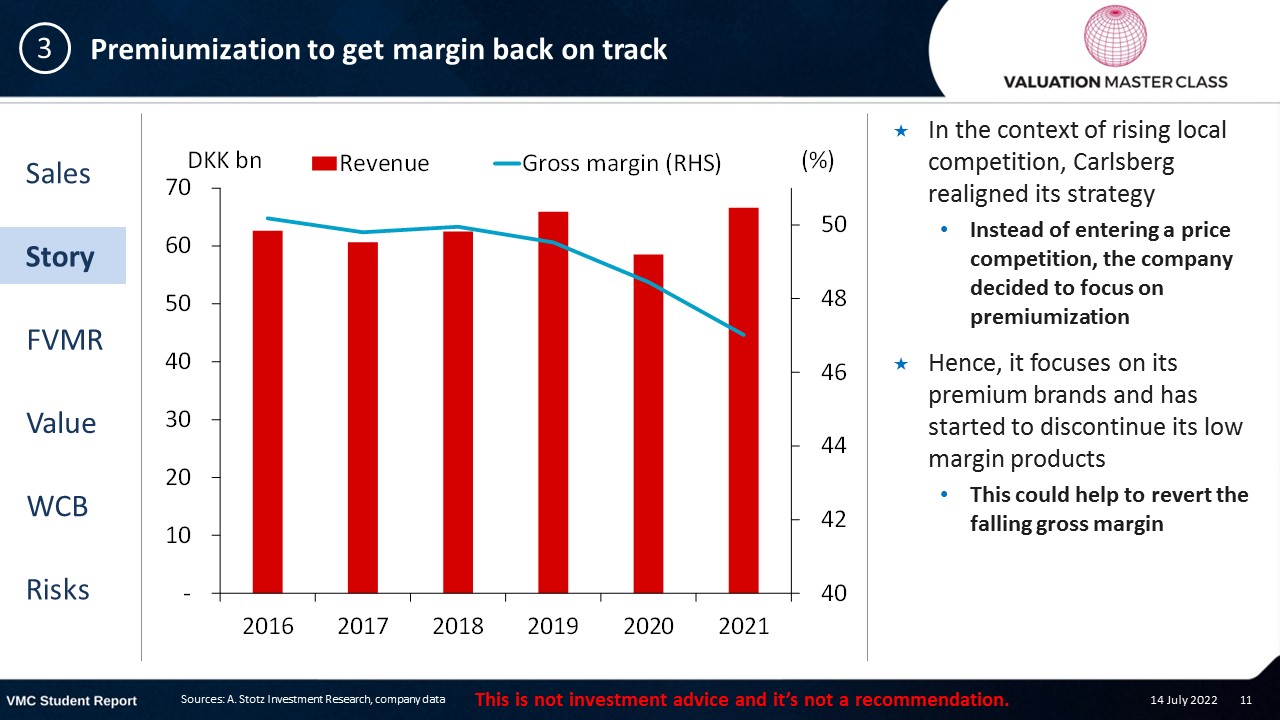

Premiumization to get margin back on track

- In the context of rising local competition, Carlsberg realigned its strategy

- Instead of entering a price competition, the company decided to focus on premiumization

- Hence, it focuses on its premium brands and has started to discontinue its low margin products

- This could help to revert the falling gross margin

Consensus is bullish

- Analyst consensus has a tendency toward a BUY recommendation

- Over the past 4 months, analysts have maintained their target price

- They believe that Carlsberg can maintain revenue growth despite exiting the Russian market

Get financial statements and assumptions in the full report

P&L – Carlsberg

- In contrast to the analyst consensus, I expect weaker net profit in 22E as Russia was a significant profit contributor in the past

Balance sheet – Carlsberg

- Increasing goodwill reflects ongoing acquisition strategy to tap into foreign markets

- I expect Carlsberg to reduce its long-term debt that it acquired mainly during the pandemic

Cash flow statement – Carlsberg

- Rising dividends following the management’s announcement to increase dividend per share

Ratios – Carlsberg

- Exiting the Russian market has been a drag on short-term revenue growth that can only be partly compensated by higher growth prospects in Asia

- Cash conversion cycle is negative due to long payables deferral period

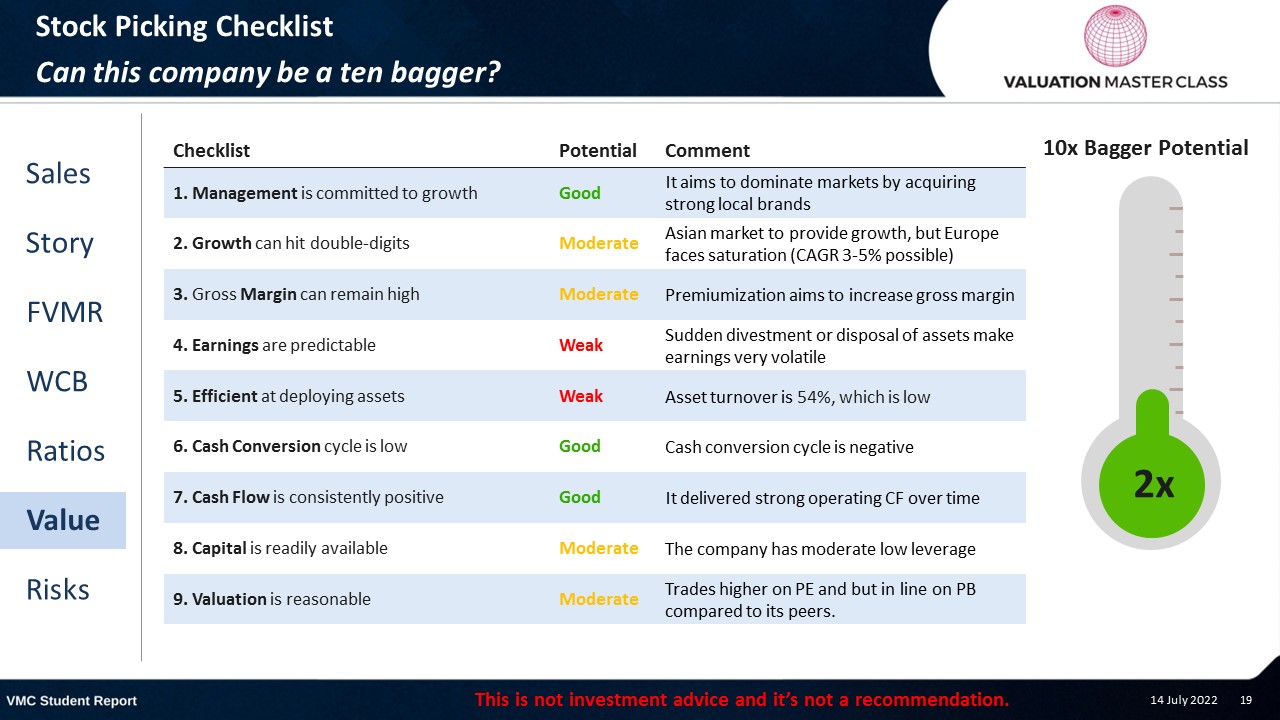

Stock Picking Checklist

Can this company be a ten bagger?

Free cash flow – Carlsberg

- In the past, free cash flow has been very volatile due to abrupt changes in working capital

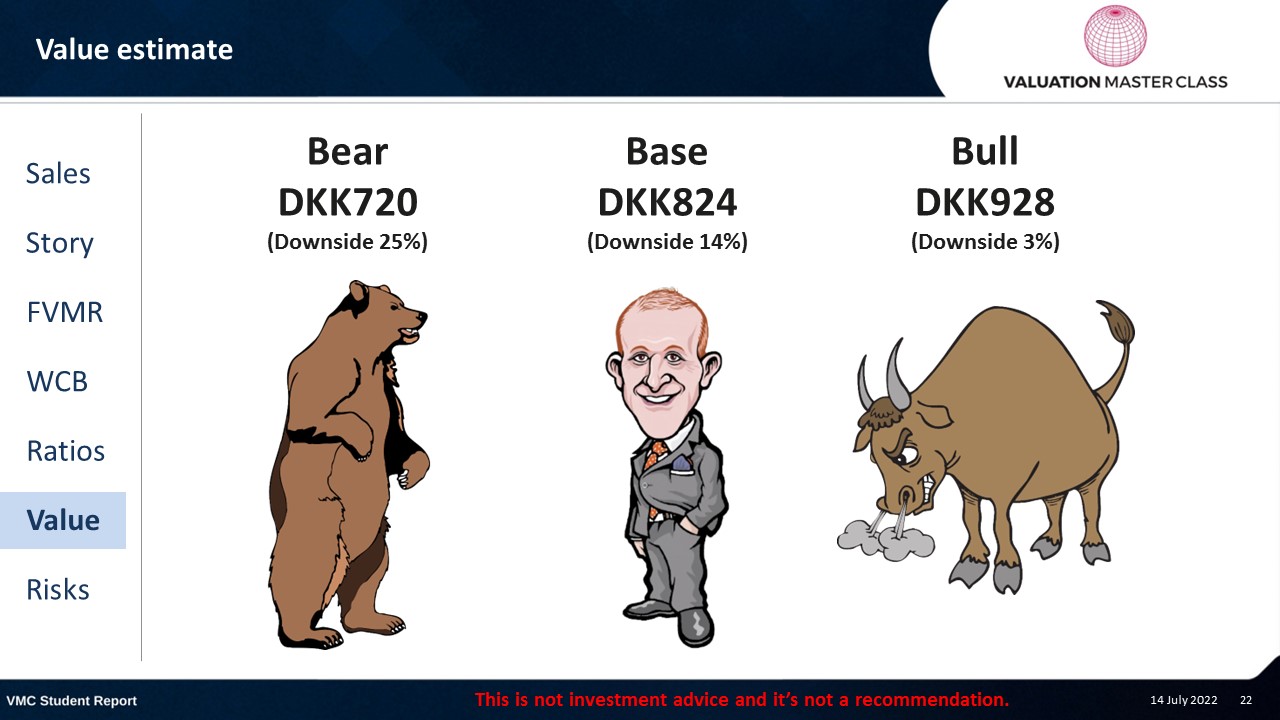

Value estimate – Carlsberg

- I expect weaker revenue growth than consensus, but similar margin

- To value the company, I use FCFF and a terminal growth rate of 2%

Key risk is legal issues in foreign markets

- Exposure to challenging legal environments especially in Asian markets

- Lower than expected return from acquisitions

- Failure to keep up with consumer trends

Conclusions

- European beer consumption is already high, leading to low growth expectations

- Growth engine Asia might take time to fully compensate for lost Russian revenue

- Focus on premium products to enhance margin

Download the full report as a PDF

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.