Airbus Has Outperformed the S&P500 Since 2016

What’s interesting about Airbus is…that since 2016 it has outperformed the S&P500

What is Airbus doing?

- Airbus designs, produces, and delivers aerospace products to its customers

- Its main customers are airlines around the world

- Airbus is a major player in the global aviation market and also a leading aerospace and defense company

Are the aviation and airline industries the same?

- Aviation is the operation of aircraft, including the design, development, production, and maintenance of aircraft

- All aspects of flying, including private, commercial, and military aviation

- Ex. Airbus, Boeing

- Airlines provide air transportation services for passengers and cargo from one location to another

- A subset of the broader aviation industry

- Ex. Delta, Emirates, American Airlines

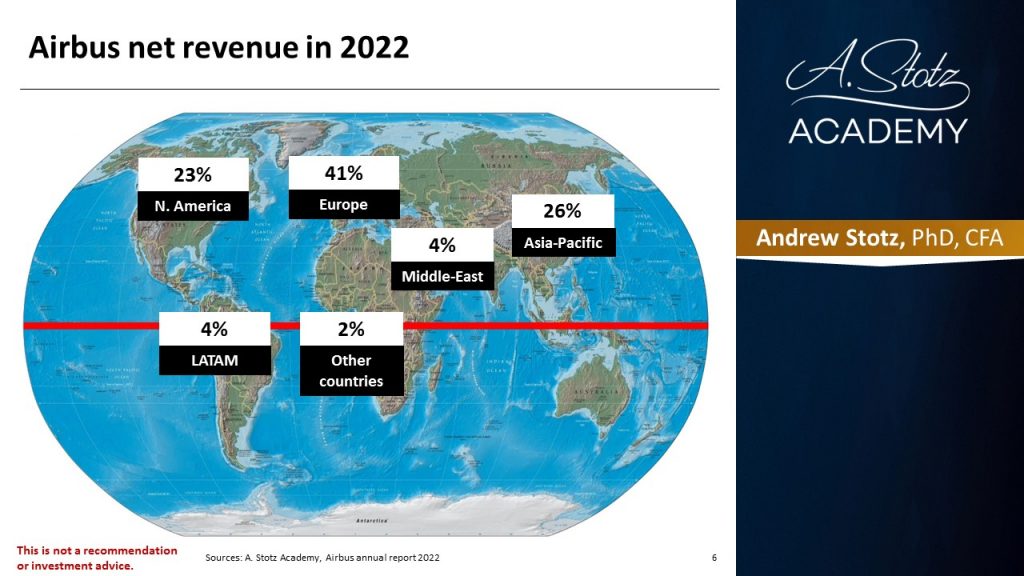

Airbus net revenue in 2022

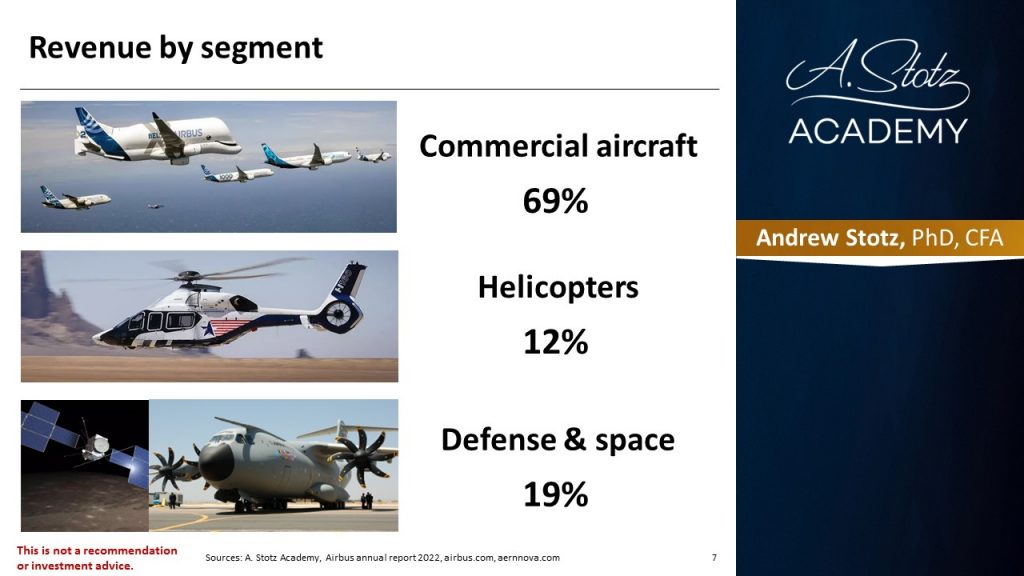

Revenue by segment

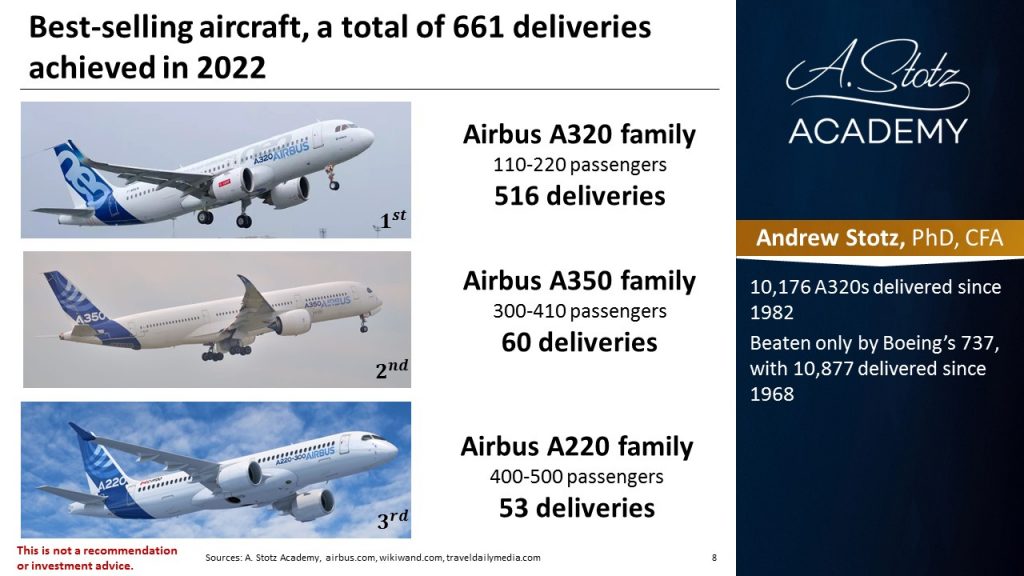

Best-selling aircraft, a total of 661 deliveries achieved in 2022

- 10,176 A320s delivered since 1982

- Beaten only by Boeing’s 737, with 10,877 delivered since 1968

Download the full report as a PDF

Top five aircraft orders from global airlines, since November 2023

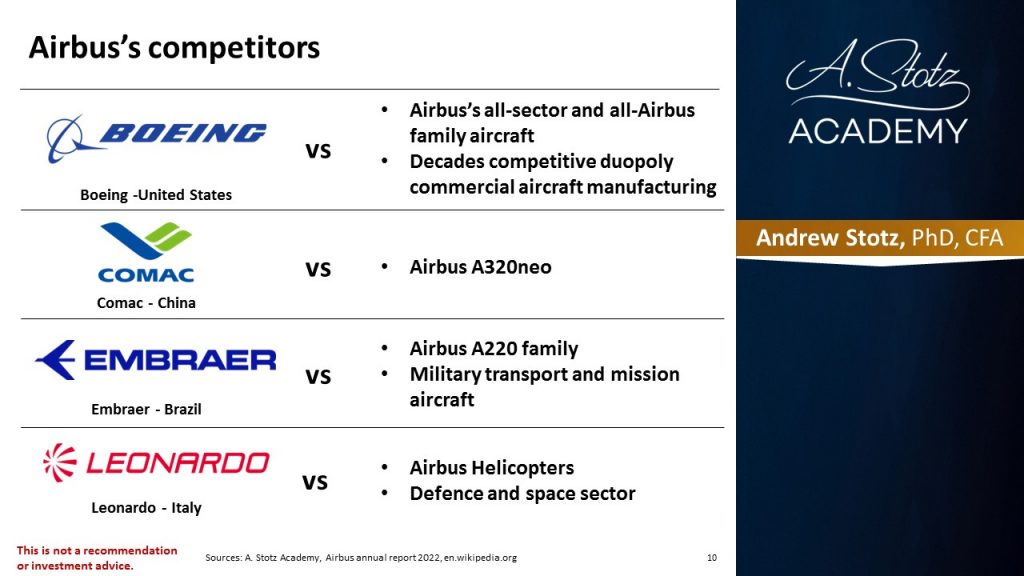

Airbus’s competitors

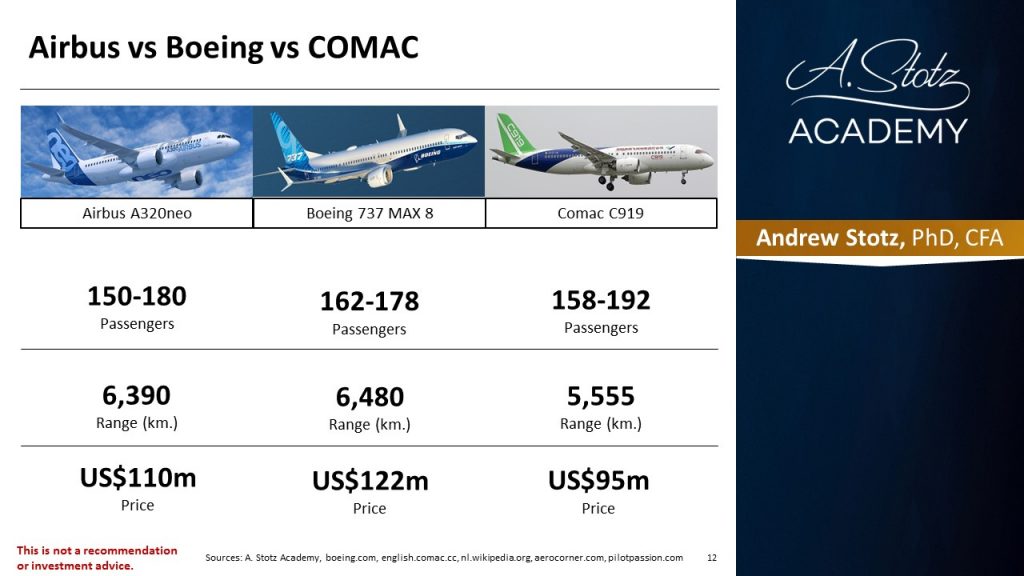

Will the new player from China, Comac, break the competitive duopoly?

- Comac C919, is a direct competitor to Airbus’s A320neo and Boeing 737

- Aims to compete with Airbus and Boeing

- A big Airbus customer, China Eastern Airlines, will order another 100 C919 airplanes

- Delivered in batches from 2024 to 2031

- Comac’s significant milestone in 2022 was the certification and first delivery of the C919

Airbus vs Boeing vs COMAC

Roger Béteille, one of the founding fathers of Airbus

- Contributed towards the airline company’s initial success from 1967 to 1985

- A driving force behind the A300 program

- Served initially as a Technical and Coordinating Manager, and became Managing Director in 1975

Airbus SE – France – Founded 1970

Industrials sector, 134,267 employees, €58.7bn revenue

Main segments/products

- Airbus commercial aircraft

- Airbus helicopters

- Airbus defense and space

Its competitive advantage

Competitive advantage through global presence, technological expertise, a wide range of aircraft, and government support.

How it achieved its competitive advantage

Competitive advantage through continuous investing in research and development, evolving advanced technologies, and collaborating with suppliers, airlines, and governments.

The beginning of Airbus, European nations to build an aircraft, A300

- In 1967, ministers from France, Germany, and Britain agreed to the joint development and production of an aircraft, the A300

- To strengthen European cooperation in the field of aviation technology

- To compete with the dominant American aircraft firms, like Boeing

- Britain withdrew from giving financial support to the Airbus program, due to escalating costs

Germany steps up

- Germany offered to contribute up to 50% of the costs if the French did the same

- Despite the British government’s withdrawal, British manufacturer Hawker Siddeley decided to invest £35 million in the A300

- In 1967, ministers of France, Britain, and Germany signed an MOU to launch the first A300

Remarkable milestone in the aviation industry

- In 1970, Air France signed to buy the first six A300s

- The A320, in 1987, proved to be one of the most successful aircraft families in the world

- Improved safety, increased efficiency, and reduced airline maintenance costs

The Airbus A380, a double-deck, wide-body, four-engine jet airliner, first flew in 2005

- World’s largest passenger airliner, carrying 525 people

- Faced production delays and cost overruns; initial costs at €11bn and totaled c. €30 bn

- Its large size required airport modifications, limiting flexibility and demand

- Introduction coincided with Boeing’s 787 and Airbus’s own A350, both more efficient.

- High oil prices hurt demand for large aircraft; breakeven was 750, sold only 251, end in 2021

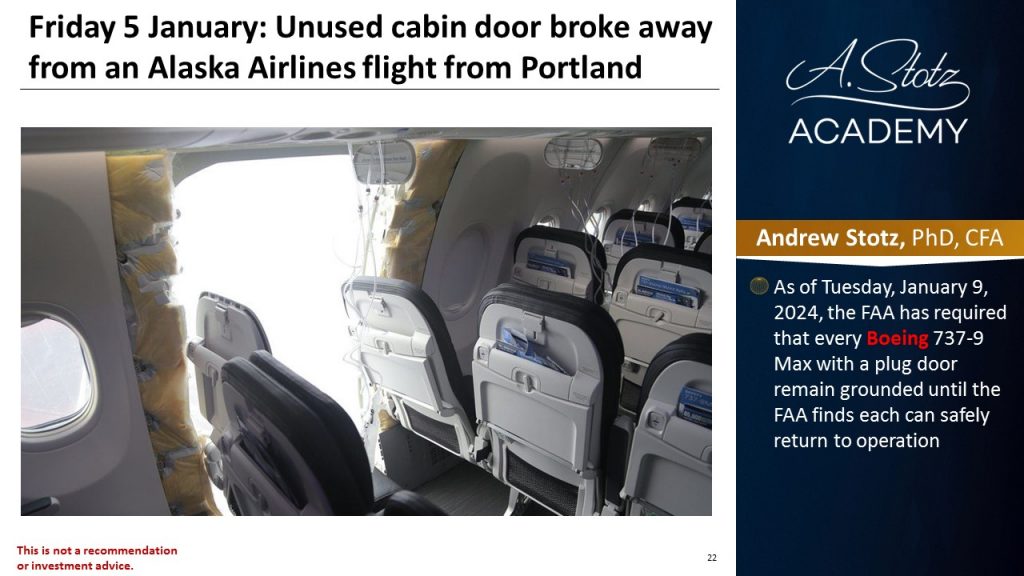

Friday 5 January: Unused cabin door broke away from an Alaska Airlines flight from Portland

- As of Tuesday, January 9, 2024, the FAA has required that every Boeing 737-9 Max with a plug door remain grounded until the FAA finds each can safely return to operation

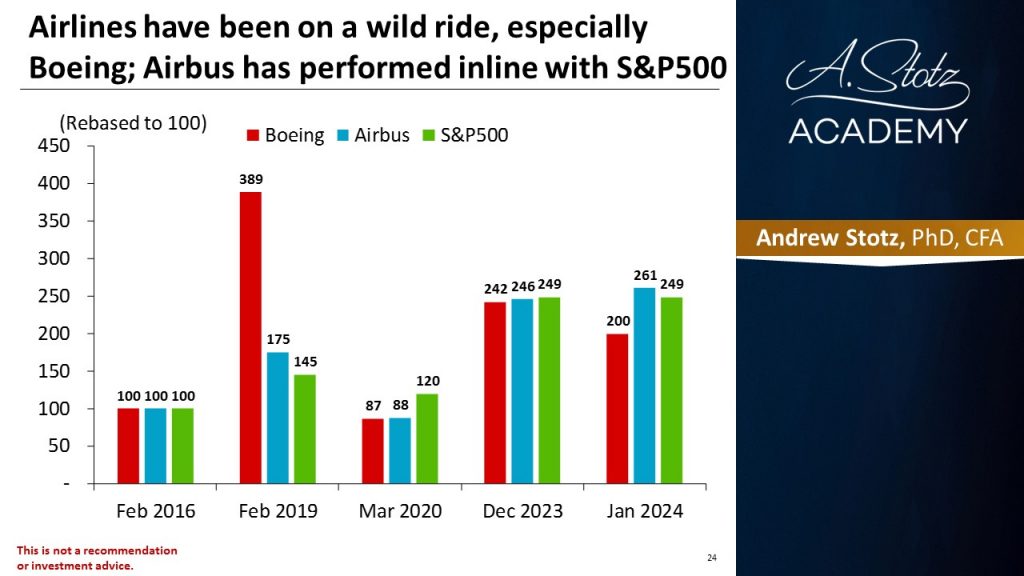

Airlines have been on a wild ride, especially Boeing; Airbus has performed inline with S&P500

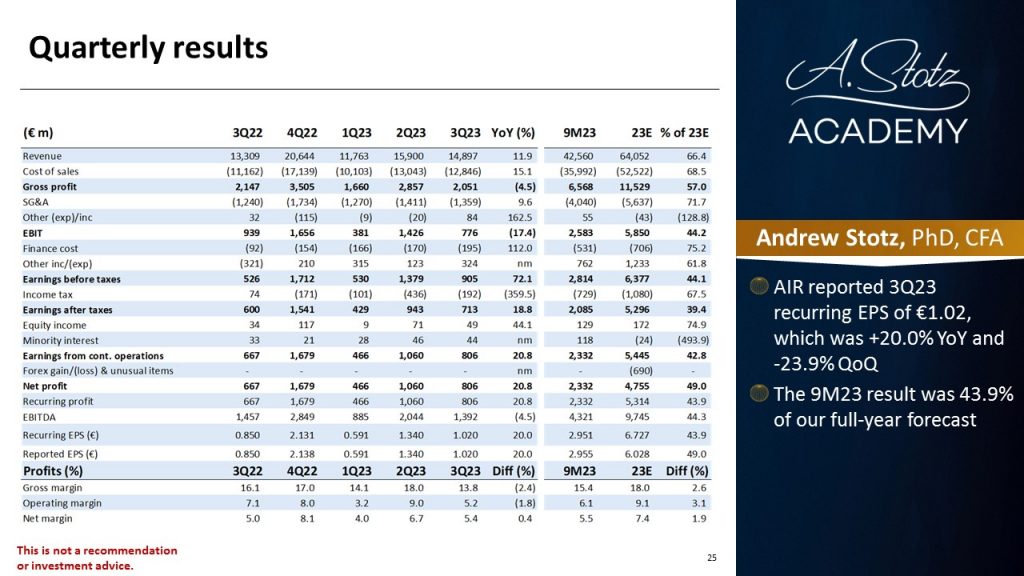

Quarterly results

- AIR reported 3Q23 recurring EPS of €1.02, which was +20.0% YoY and -23.9% QoQ

- The 9M23 result was 43.9% of our full-year forecast

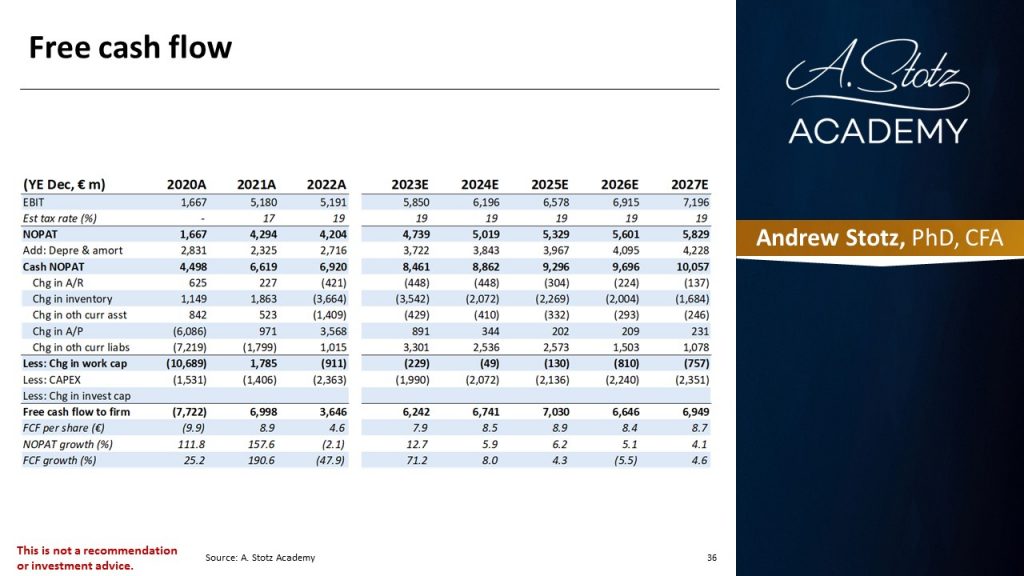

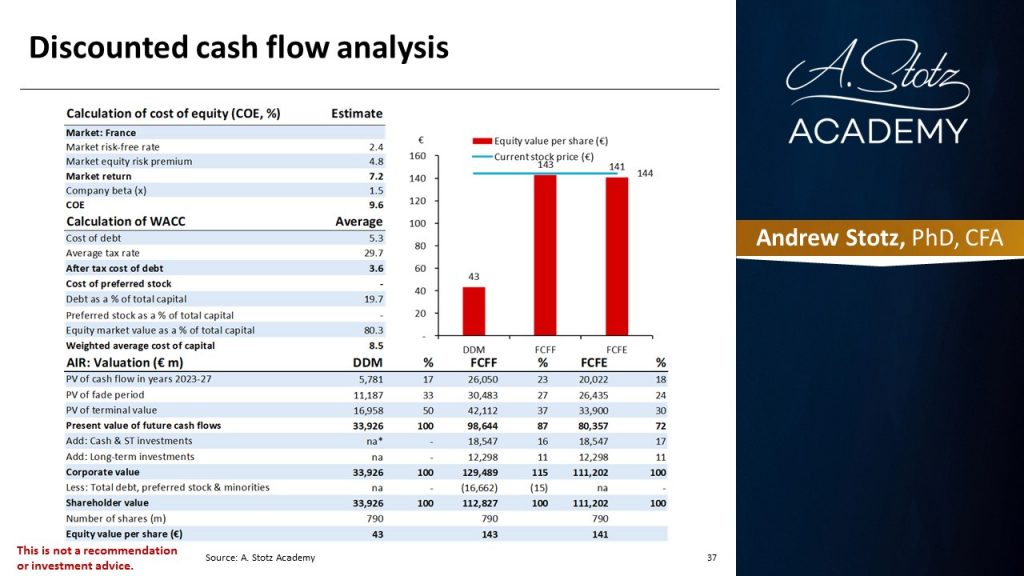

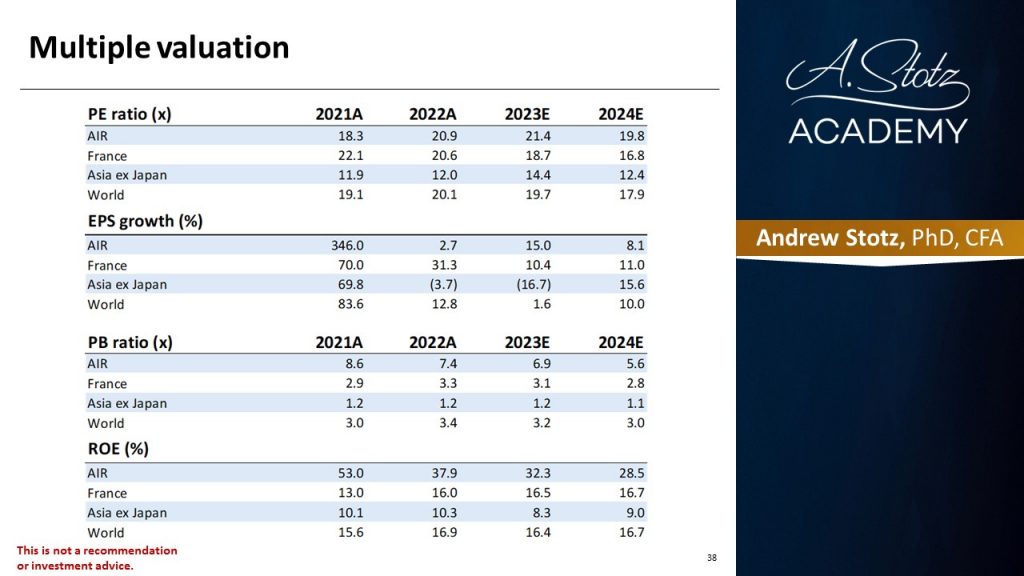

Valuation

Download the full report as a PDF

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.