Tesla – The Good Old Days Could Be Gone for a While

Our research shows that Tesla, Inc. is a SELL based on a target price of US$139, implying a downside of 31%. We derive our target price from a DCF-based valuation using a WACC of 10.6% and a terminal growth rate of 5%.

Highlights:

- The growing autonomous cars market is a revenue growth catalyst

- The new Redwood model could offset the Cybertruck’s potential setbacks

- The energy segment could transform into a major revenue source

Risks: Delays in launching and ramping up production, Supply shortages could harm Tesla’s production, High reliance on suppliers for lithium-ion battery cells, Full self-driving may get banned by law.

Download the full report as a PDF

Background: Tesla, Inc. is an American electric vehicle (EV) and clean energy company founded in 2003. Specializes in EVs, battery products, and clean energy technologies. It operates in 2 main segments: Automotive and Energy, with the former currently the main revenue source.

The company manufactures and sells a range of vehicles, including the Model Y, Model 3, Model X, etc. Model 3 and Y are the best-selling cars, with around 96% of 2023 revenues.

Telsa holds around 19% share of the global BEVs market as of 2023, selling around 1.8m cars. The carmaker serves many countries, but mainly the US and China.

The growing autonomous cars market is a revenue growth catalyst

The global autonomous car market is expected to experience significant growth, with projections indicating a rise from US$1.6bn in 2022 to US$20bn by 2029, according to Fortune Business Insights. Tesla, a prominent player in this market, offers its autonomous driving system called Tesla Autopilot. In 2023, Tesla’s Model 3 and Model Y, both offering Autopilot capabilities, accounted for 96% of the company’s automotive sales and were the top-selling electric vehicles worldwide. With this strong market presence as the first mover and the projected growth of the global autonomous car market, we expect Tesla to achieve high double-digit revenue growth in the next 5 years.

The new Redwood model could offset the Cybertruck’s potential setbacks

Tesla plans to launch a new car model called Redwood in the second half of 2025. Priced at around US$25K, it is expected to be highly sought-after due to its affordability. However, the production of Redwood may require Tesla to reallocate resources, potentially impacting the production of their leading models, Model 3 and Model Y. Still, we think they will be able to handle that. Tesla has not disclosed Cybertruck deliveries or commented on production volumes, suggesting that the Cybertruck may not have performed as expected. Hence, we anticipate that the Redwood model could generate positive results from 2025 onwards, offsetting potential bad results from the costly Cybertruck.

The energy segment could transform into a major revenue source

According to Precedence Research, the global energy storage market is projected to reach around US$170bn by 2032 (a CAGR of 14%). Tesla’s energy generation and storage (EGS) business contributed 6% to the company’s revenue in 2023. The EGS revenue grew by 54% YoY, driven by the deployment of the Megapack energy storage product, which reached 14.7 GWh, a 125% YoY rise. Megapack is a large-scale, lithium-based battery energy storage designed by Tesla to boost the stability of power grids and avoid outages. Each unit boasts a storage capacity of over 3 MWh, enough to power 3,600 homes for an hour. Also, McKinsey projected world li-on battery demand to grow by 27% yearly to reach 4,700 GWh by 2030 from 700 GWh in 2022, driven by China, US., and Europe. So, we see this segment as a great growth opportunity for Tesla in the upcoming years.

The automotive industry is shifting to the technology era

Download the full report as a PDF

China is a promising market for EVs

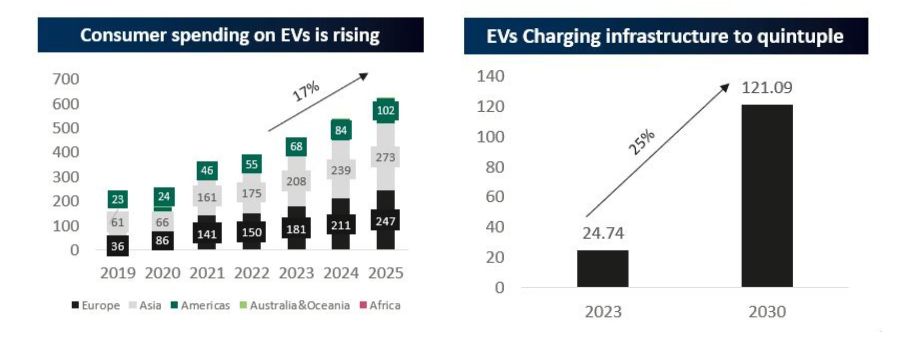

The automotive industry is shifting from hardware to software, emphasizing enhancing software functionalities and services. By 2025, consumer spending on EVs is expected to reach US$627bn, increasing by 17% compared to 2023. This dynamic has allowed new entrants in Europe and abroad—especially in China. Indeed, in 1Q23, China was by far the largest EV market with 55% of global EV sales, a total of 3.4m units. Moreover, thanks to China’s comprehensive supply chain advantages, low costs in logistics and labor, and beneficial policies promoting low-carbon vehicles, China is a competitive and crucial market for automotive manufacturers.

Technological and infrastructure enhancement benefits production efficiency

The EV market is expanding due to technological advancements, government policy, and infrastructure support. According to the McKinsey Global Institute, the progress in robotics and AI technologies could potentially replace 30% to 60% of tasks in various occupations. This technological advancement helps to enhance manufacturing and supply chain efficiency. Additionally, the industry also benefits from infrastructure support. According to Grandview Research, the EV charging infrastructure market could reach US$121bn by 2030, growing at a 25% CAGR. These factors should foster the growth of EV production and sales.

Batteries are the new industry control points when EVs become the norm

More than a third of the value of a BEV is associated with the battery. China was the largest supplier of materials for the lithium-ion batteries used in Tesla’s EVs, based on Nikkei’s supply chain analysis. This means that increased geopolitical tensions between the US and China could eventually make it difficult for Tesla to buy batteries. Therefore, to mitigate the impact of geopolitical tensions, especially in Europe, automotive manufacturers need to diversify their inputs and production or put factories in areas where they sell products to customers to avoid supply chain disruption.

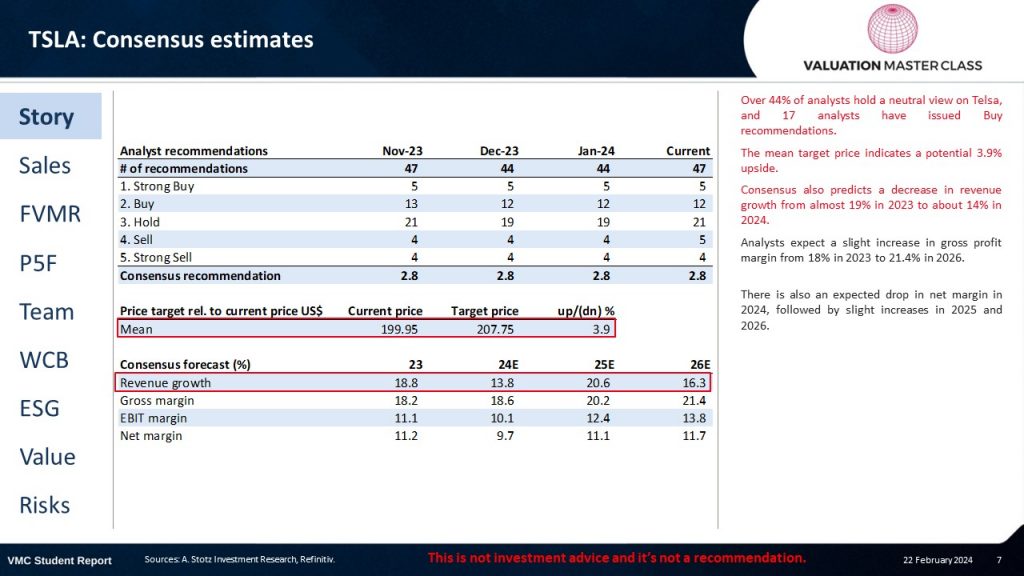

Tesla – Consensus estimates

Over 44% of analysts hold a neutral view on Tesla, and 17 analysts have issued Buy recommendations.

The mean target price indicates a potential 3.9% upside.

Consensus also predicts a decrease in revenue growth from almost 19% in 2023 to about 14% in 2024.

Analysts expect a slight increase in gross profit margin from 18% in 2023 to 21.4% in 2026.

There is also an expected drop in net margin in 2024, followed by slight increases in 2025 and 2026.

Download the full report as a PDF

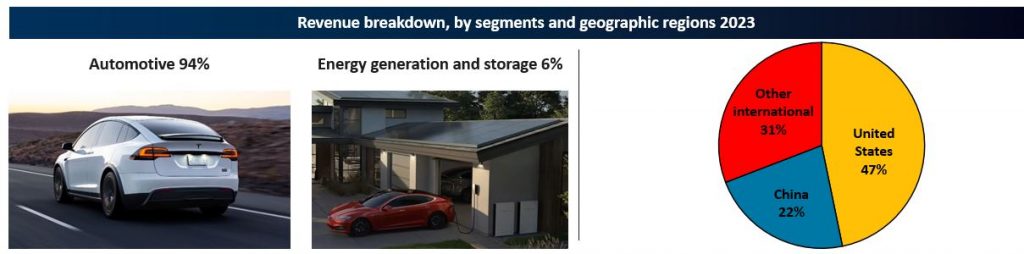

Tesla – Revenue breakdown

In 2023, Tesla reported a revenue of almost US$97bn, with the automotive segment contributing 94% of sales. Tesla offers four primary EV models, namely Model 3, Y, X, and S, targeting different customer segments. The energy segment accounted for 6% of revenue, driven by products such as Powerwall, Megapack, and solar energy solutions.

Tesla’s revenue is derived from various geographic regions, with the US, China, and other countries representing 47%, 22%, and 31% of total revenues in 2023, respectively. The company sold 1.8m cars that year, with production facilities located in the US, China, and Germany. Model 3 and Model Y were the best-selling models, contributing approximately 96% of the total revenues.

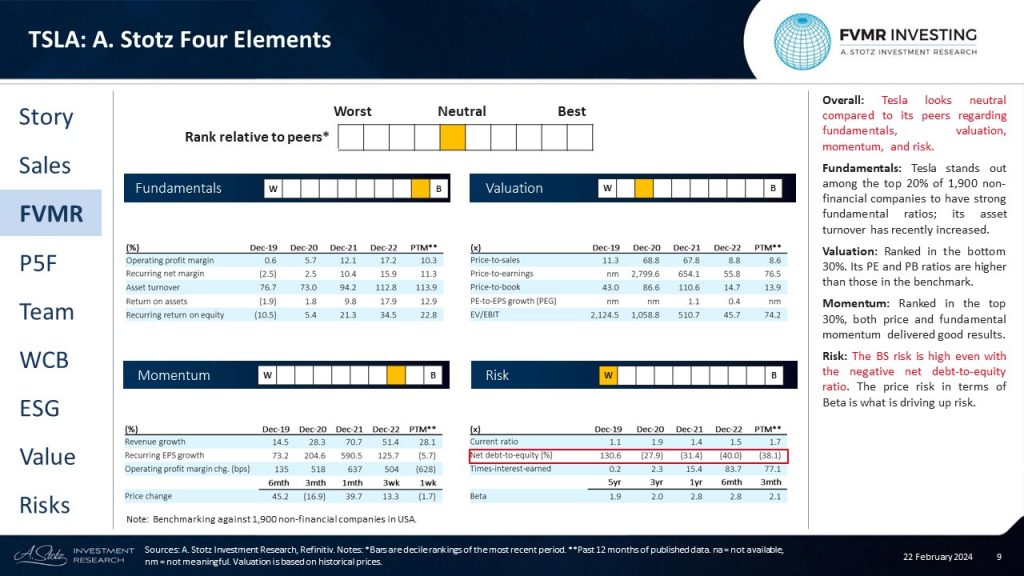

Tesla – A. Stotz Four Elements: FVMR

Overall: Tesla looks neutral compared to its peers regarding fundamentals, valuation, momentum, and risk.

Fundamentals: Tesla stands out among the top 20% of 1,900 non-financial companies to have strong fundamental ratios; its asset turnover has recently increased.

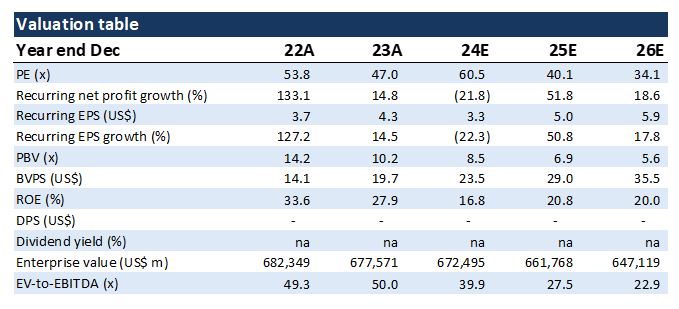

Valuation: Ranked in the bottom 30%. Its PE and PB ratios are higher than those in the benchmark.

Momentum: Ranked in the top 30%, both price and fundamental momentum delivered good results.

Risk: The BS risk is high even with the negative net debt-to-equity ratio. The price risk in terms of Beta is what is driving up risk.

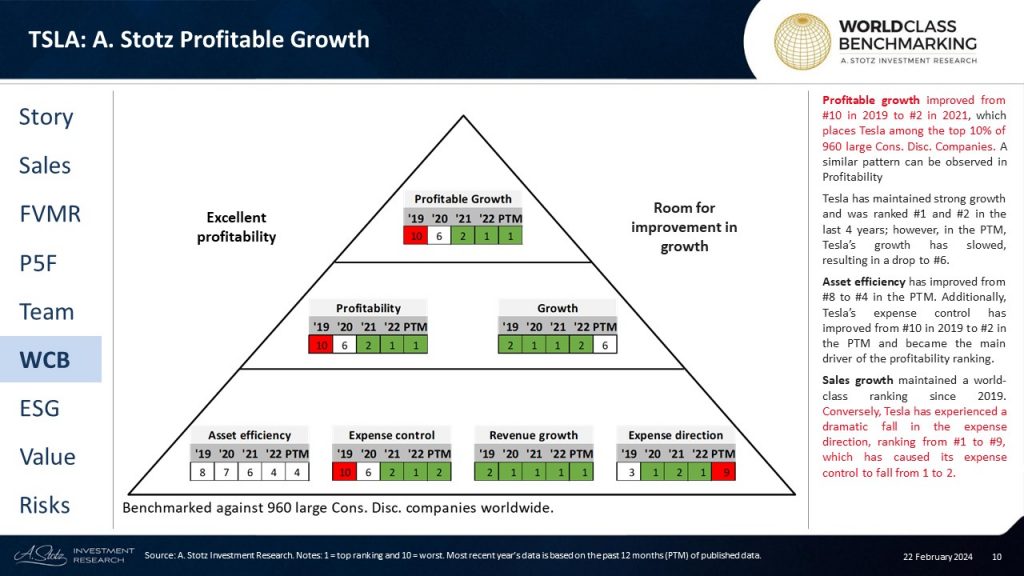

Tesla – A. Stotz Profitable Growth: World Class Benchmarking

Profitable growth improved from #10 in 2019 to #2 in 2021, which places Tesla among the top 10% of 960 large Cons. Disc. Companies. A similar pattern can be observed in Profitability

Tesla has maintained strong growth and was ranked #1 and #2 in the last 4 years; however, in the PTM, Tesla’s growth has slowed, resulting in a drop to #6.

Asset efficiency has improved from #8 to #4 in the PTM. Additionally, Tesla’s expense control has improved from #10 in 2019 to #2 in the PTM and became the main driver of the profitability ranking.

Sales growth maintained a world-class ranking since 2019. Conversely, Tesla has experienced a dramatic fall in the expense direction, ranking from #1 to #9, which has caused its expense control to fall from 1 to 2.

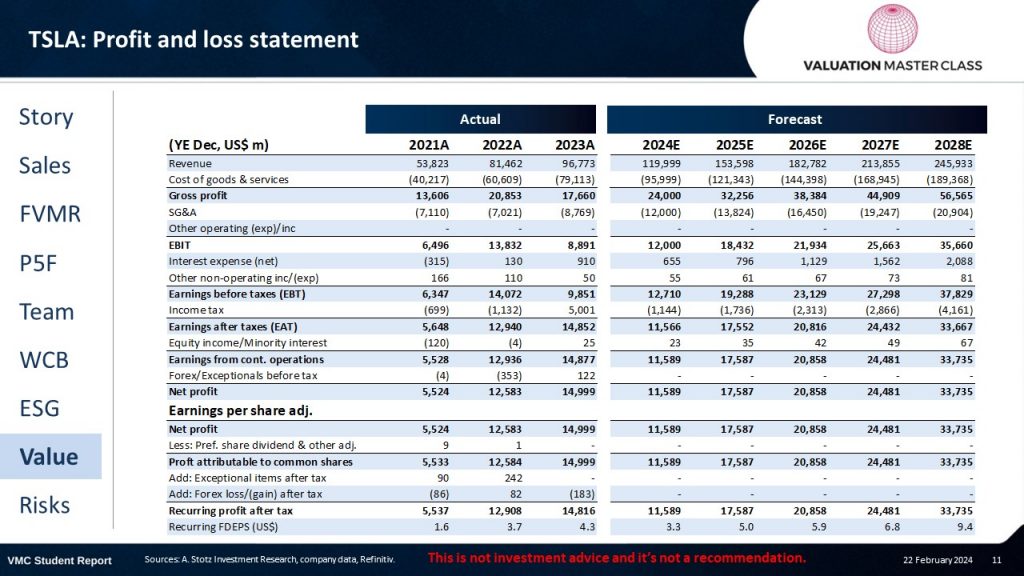

Tesla – Profit & Loss statement

Download the full report as a PDF

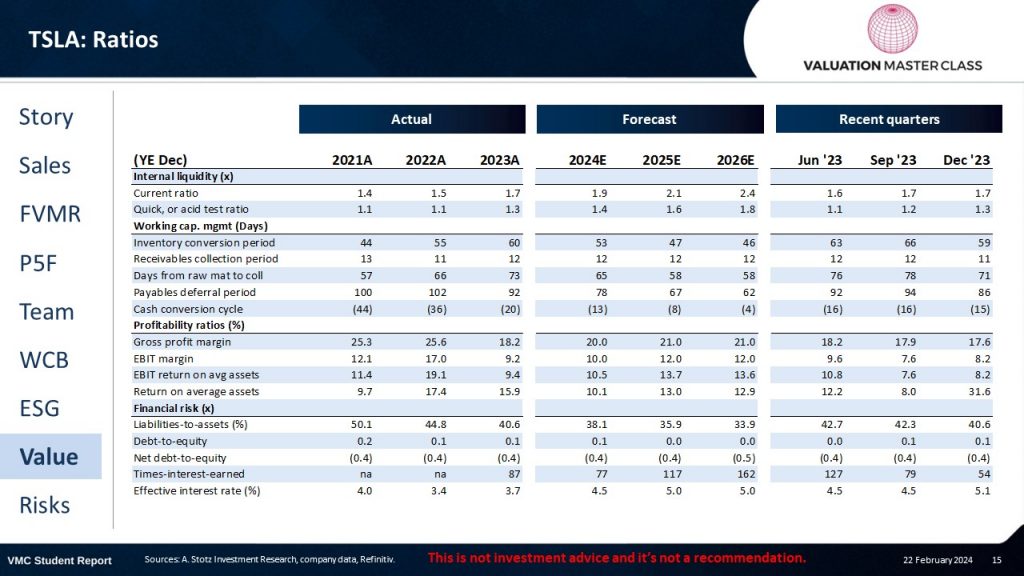

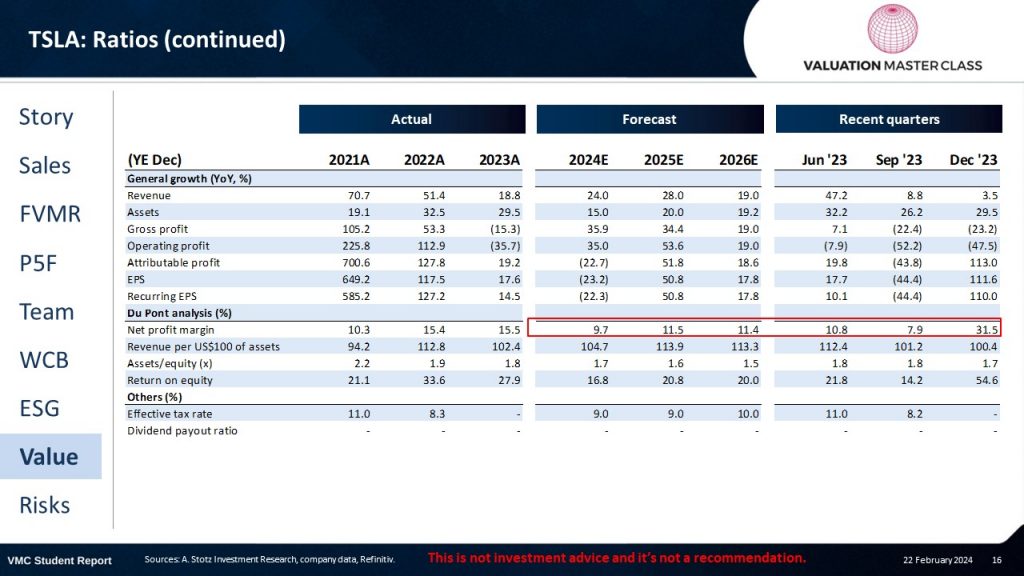

Tesla – Ratios

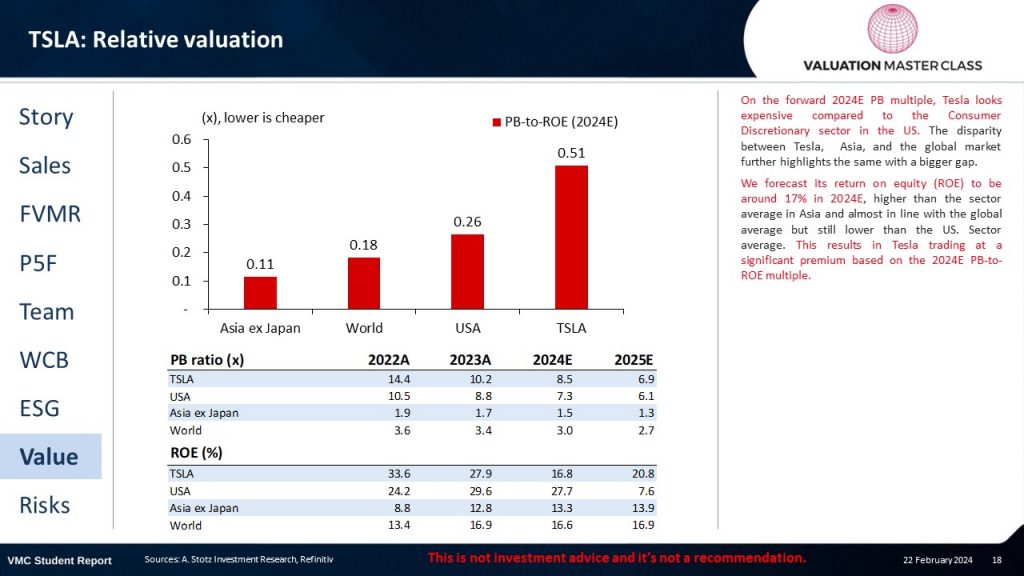

Tesla – Relative valuation

On the forward 2024E PB multiple, Tesla looks expensive compared to the Consumer Discretionary sector in the US. The disparity between Tesla, Asia, and the global market further highlights the same with a bigger gap.

We forecast its return on equity (ROE) to be around 17% in 2024E, higher than the sector average in Asia and almost in line with the global average but still lower than the US. Sector average. This results in Tesla trading at a significant premium based on the 2024E PB-to-ROE multiple.

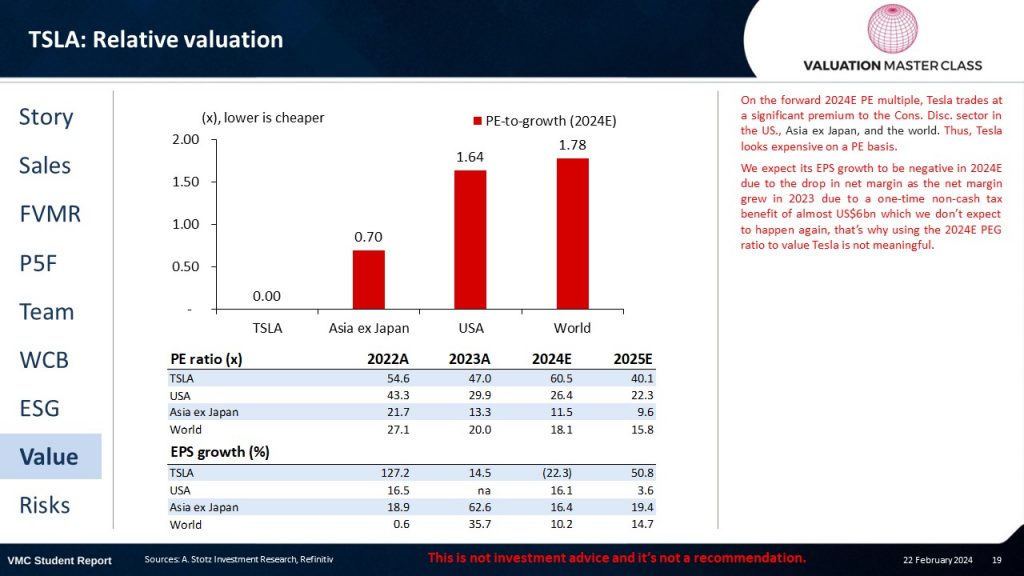

On the forward 2024E PE multiple, Tesla trades at a significant premium to the Cons. Disc. sector in the US., Asia ex Japan, and the world. Thus, Tesla looks expensive on a PE basis.

We expect its EPS growth to be negative in 2024E due to the drop in net margin as the net margin grew in 2023 due to a one-time non-cash tax benefit of almost US$6bn which we don’t expect to happen again, that’s why using the 2024E PEG ratio to value Tesla is not meaningful.

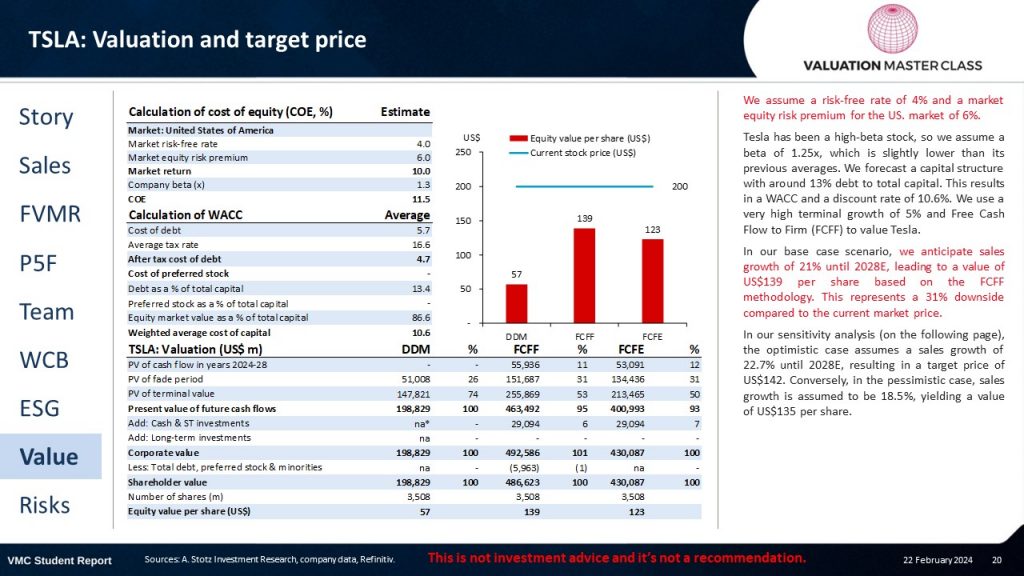

Tesla – Valuation and target price

We assume a risk-free rate of 4% and a market equity risk premium for the US. market of 6%.

Tesla has been a high-beta stock, so we assume a beta of 1.25x, which is slightly lower than its previous averages. We forecast a capital structure with around 13% debt to total capital. This results in a WACC and a discount rate of 10.6%. We use a very high terminal growth of 5% and Free Cash Flow to Firm (FCFF) to value Tesla.

In our base case scenario, we anticipate sales growth of 21% until 2028E, leading to a value of US$139 per share based on the FCFF methodology. This represents a 31% downside compared to the current market price.

In our sensitivity analysis (on the following page), the optimistic case assumes a sales growth of 22.7% until 2028E, resulting in a target price of US$142. Conversely, in the pessimistic case, sales growth is assumed to be 18.5%, yielding a value of US$135 per share.

Main risk is the delay in launching and ramping up production

Delays in launching and ramping up production

Tesla’s business depends on how the company ramps up production to deliver products on time. Tesla has experienced and might also experience future delays in launching or ramping up production of the Redwood model, the Cybertruck, and some energy storage products in the future. Any delays could harm Tesla’s brand or the company’s ability to fulfill unearned revenue, therefore, affecting operating results.

Supply shortages could harm Tesla’s production

Tesla’s supply chain, sourcing 1,000 parts from numerous suppliers, faces risks from external factors like material pricing, geopolitical events, or natural disasters. In 2021-2022, Tesla’s manufacturing costs are hugely affected by semiconductor shortages from Taiwan and China. Moreover, with the new global manufacturing facilities, Tesla may face issues due to the increased level of localized procurement. Inaccurate timing of component purchases and inadequate automation in supply chain management could lead to production disruptions and manufacturing cost overruns, harming the business results.

High reliance on suppliers for lithium-ion battery cells

Tesla relies on suppliers such as Panasonic and Contemporary Amperex Technology Co. Limited (CATL) for battery cells and has limited flexibility in changing suppliers. Any disruption in the supply of battery cells from Tesla suppliers could limit the production of our vehicles and energy storage products. Moreover, the prices for these materials fluctuate and their available supply may be unstable which might incur unexpected production disruption, storage, transportation, and write-off costs, which may harm the business and the operating results.

Full self-driving may get banned by law

Although the software has various benefits, there are many safety concerns among users and the law. The overall fatal accident rate for auto travel, according to the NHTSA, was 1.35 deaths per 100m miles traveled in 2022. In other words, Tesla’s FSD system is likely ten times more dangerous at driving than humans. Many states are currently debating whether they should ban this technology. If they are banned, many new income streams would fail.

Download the full report as a PDF

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.