Let’s Understand Why Tesla Owner Elon Musk Is No Longer Laughing About BYD…

I estimate BYD’s value at RMB277 per share, implying an upside of 30% from today’s price. This is derived from my DCF-based valuation using a WACC of 9.7% and a terminal growth rate of 3%.

Highlights:

- Expect sales to surge due to the rising demand and effective pricing strategies

- Lower cost for EV batteries could lead to gross margin improvements

- Strategic investments set the stage for sustainable long-term growth

Risks: Battery leakage, inadequate EV infrastructure investment, rising geopolitical tensions with China, and manufacturing factory disruptions.

Download the full report as a PDF

Background: Chinese BYD (Build Your Dreams) is a leading global technology company. It was founded in 1995 as a rechargeable battery maker, and now is a leading automaker and has business in rail transit, new energy, and electronics.

The company is one of the world’s leading rechargeable battery manufacturers, with major consumer electronics manufacturers clients such as Samsung and Dell.

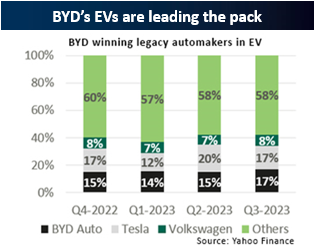

BYD sold 3 million cars in 2023, which, according to Visual Capitalist, made it the second-largest company in the global battery electric vehicle (BEV) market with a 17% market share, second to Tesla’s 20%. It is the best-selling car brand in China, with a 35% market share, mainly from EVs. Over 70% of revenue is generated in China.

Expect sales to surge due to the rising demand and effective pricing strategies

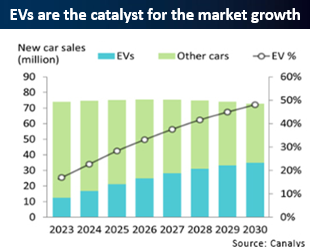

In 2023, BYD sold more than 3m new energy vehicles (NEVs), which included battery-only vehicles and hybrids. During 4Q23, BYD sold more than 525k battery-only vehicles, surpassing Tesla’s 485k units during the same period. This made BYD the world’s top electric car manufacturer for the first time. Of course, demand for EVs keeps rising, with Morningstar predicting it to account for 40% of global auto sales by 2030. This is partially driven by the expected lower price of EV cars due to falling battery costs. BYD cut prices by 15% in the European market in 2023. Due to increasing demand and competitive prices, expect sales to show an annual growth rate (CAGR 2024-2028) of over 22%.

Lower cost for EV batteries could lead to gross margin improvements

Goldman Sachs predicts a significant decline in global battery prices, with an expected decrease to US$99 per kWh by 2025, representing a 40% reduction from 2022. Falling prices of EV raw materials such as lithium, nickel, and cobalt drive this decrease. Batteries are one of the most critical and expensive components of EVs; lithium-ion (Li-ion) batteries represent most of the batteries used. According to BloombergNEF, China will be the number one global lithium-ion battery supplier by 2025. BYD was the world’s second-biggest lithium-ion battery producer in 2023, holding a 16% market share. This should help drive down the cost of raw materials related to lithium-ion batteries and could lead to a gross margin above 2023’s 19%.

Strategic investments set the stage for sustainable long-term growth

BYD aims to strengthen its competitive position by investing US$14bn in developing innovative features to support the shift towards intelligent vehicles. Building on its success in Kenya, the company plans to enter the Rwandan EV market. According to Mordor Intelligence, the Africa EV market is expected to grow by 17% CAGR from 2024 to 2029. BYD recently built a factory in Hungary, making it a major player in EV cars and battery production in Europe. Europe is the second-largest EV market and is expected to grow at a 10% CAGR from 2024 to 2029. These moves should drive long-term revenue growth, enhance BYD’s competitiveness, and create new market opportunities.

EVs charging the automotive industry’s outlook

Download the full report as a PDF

Despite a broader industry slowdown, EVs are expected to be the growth driver

According to McKinsey & Company, the 2022 US$2.8trn global auto market is projected to grow by 4% annually to reach US$3.9trn by 2030. Despite the anticipated slowed growth of the automotive industry in 2024 due to economic headwinds and high living costs in developing regions, EV sales are expected to surge by 21% to 15m units globally, led by China. McKinsey predicted that the share of EVs in new vehicle sales could range from 10% to 50% by 2030, heavily influenced by local regulations and consumer preferences.

Chinese automakers are challenging the legacy players

While traditional leaders like Volkswagen and Toyota retained the top revenue spots in 2023, seven Chinese automakers disrupted the top 20 rankings, with BYD taking second place in EV market sales in the first three quarters of 2023. The Chinese automakers are leveraging lower costs, government support, and increased R&D investments to compete on price and features. This new dynamic pressures traditional players to innovate to uphold their dominance.

Supply chain complexity remains the top challenge, particularly for EVs

The EV battery is a true global supply chain depending on primary raw materials from countries like China, Indonesia, and Australia. This centralization makes it susceptible to disruptions. The EU’s Carbon Border Adjustment Mechanism, applying a carbon tax to selected goods from 2026, is expected to increase input costs for EU carmakers. A complex and sensitive supply chain gives more leverage to the battery suppliers; an example of mitigating the bargaining power is Tesla’s partnership with Panasonic. Additionally, stricter regulations around the environmental, social, and governance impact of mining could further tighten the already delicate supply chain. Securing a stable battery supply is a top priority for the industry or car manufacturers if they want to be successful.

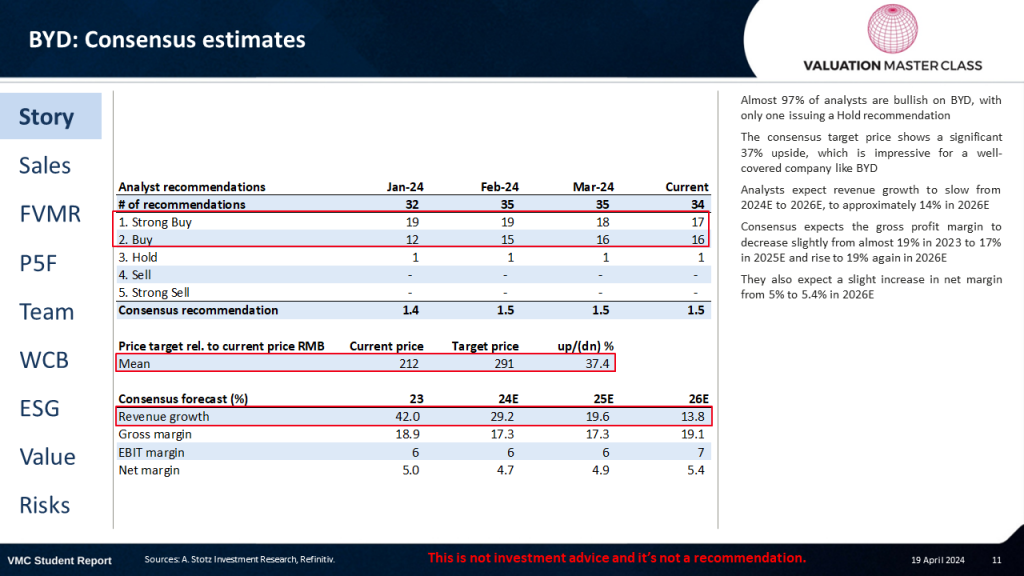

BYD: Consensus estimates

Almost 97% of analysts are bullish on BYD, with only one issuing a Hold recommendation

The consensus target price shows a significant 37% upside, which is impressive for a well-covered company like BYD

Analysts expect revenue growth to slow from 2024E to 2026E, to approximately 14% in 2026E

Consensus expects the gross profit margin to decrease slightly from almost 19% in 2023 to 17% in 2025E and rise to 19% again in 2026E

They also expect a slight increase in net margin from 5% to 5.4% in 2026E

Download the full report as a PDF

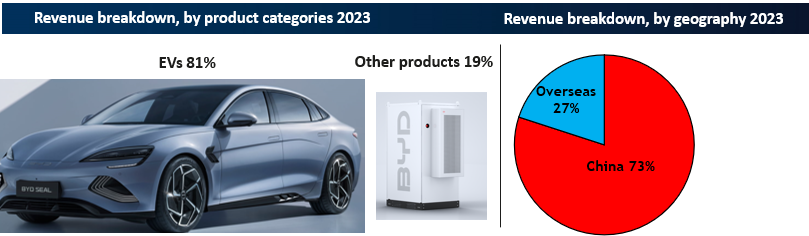

BYD: Revenue breakdown

BYD’s total 2023 revenue was RMB602bn, with EVs contributing around 81%. Chinese demand now accounts for 73% of total revenue, showcasing its strong domestic presence. The remaining 27% comes from its growing overseas expansion.

BYD offers three distinct personal EV brands tailored to different market segments. Dynasty and Ocean are two of BYD’s series targeting the conservative and youthful markets. Whereas Denza and Yangwang brands serve the high-end segment. The company also produces electric buses and urban rail transport, primarily for companies, universities, and local governments.

Mobile handset components, assembly services, and other products contributed 19% of sales. The company manufactures rechargeable batteries for clients such as Samsung and Dell.

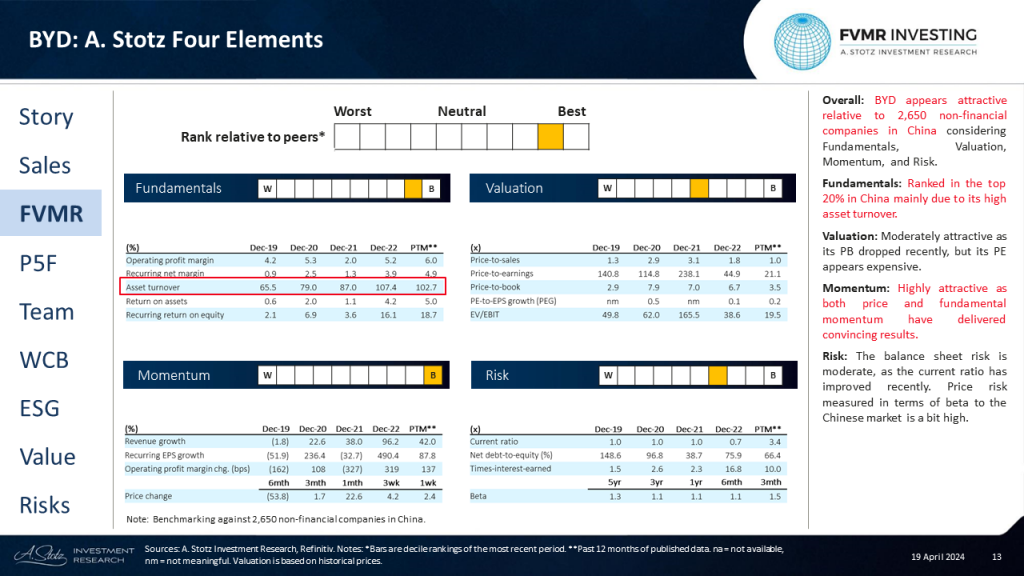

BYD: A. Stotz Four Elements: FVMR

Overall: BYD appears attractive relative to 2,650 non-financial companies in China considering Fundamentals, Valuation, Momentum, and Risk.

Fundamentals: Ranked in the top 20% in China mainly due to its high asset turnover.

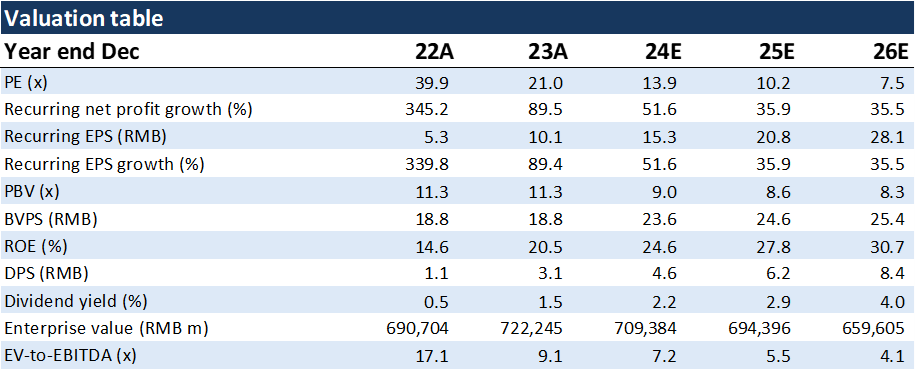

Valuation: Moderately attractive as its PB dropped recently, but its PE appears expensive.

Momentum: Highly attractive as both price and fundamental momentum have delivered convincing results.

Risk: The balance sheet risk is moderate, as the current ratio has improved recently. Price risk measured in terms of beta to the Chinese market is a bit high.

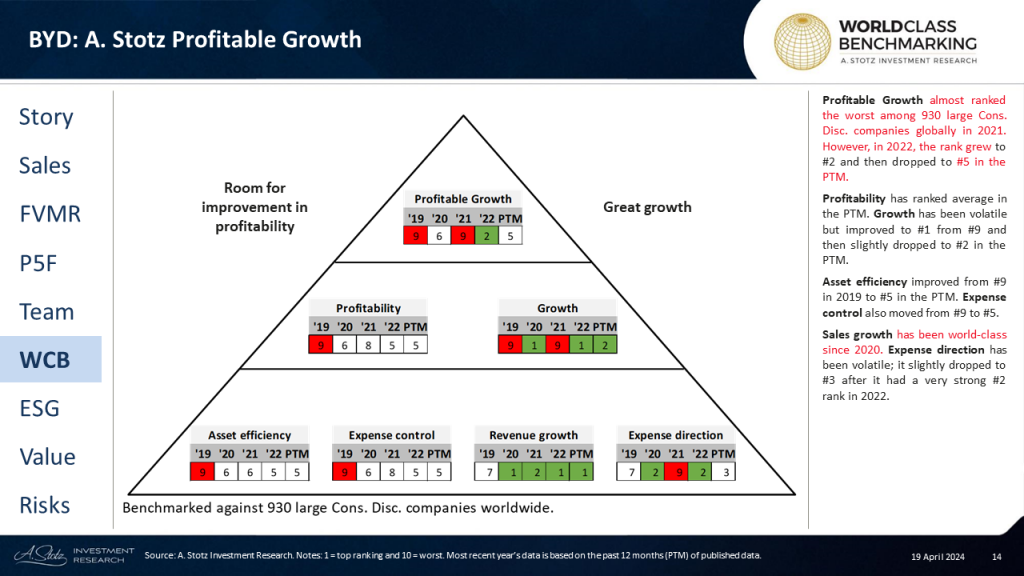

BYD: A. Stotz Profitable Growth: World Class Benchmarking

Profitable Growth almost ranked the worst among 930 large Cons. Disc. companies globally in 2021. However, in 2022, the rank grew to #2 and then dropped to #5 in the PTM.

Profitability has ranked average in the PTM. Growth has been volatile but improved to #1 from #9 and then slightly dropped to #2 in the PTM.

Asset efficiency improved from #9 in 2019 to #5 in the PTM. Expense control also moved from #9 to #5.

Sales growth has been world-class since 2020. Expense direction has been volatile; it slightly dropped to #3 after it had a very strong #2 rank in 2022.

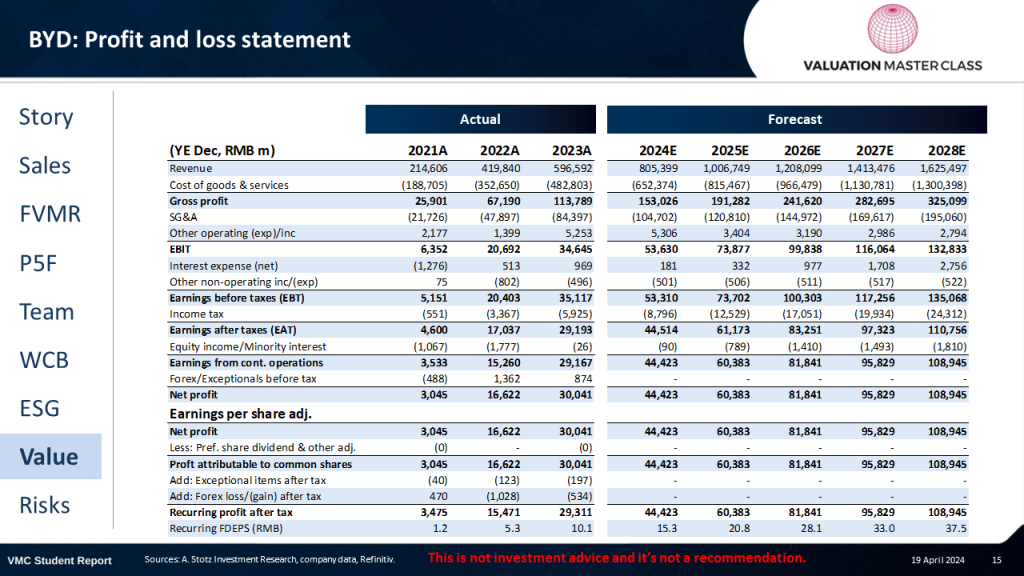

BYD: Profit and loss statement

Download the full report as a PDF

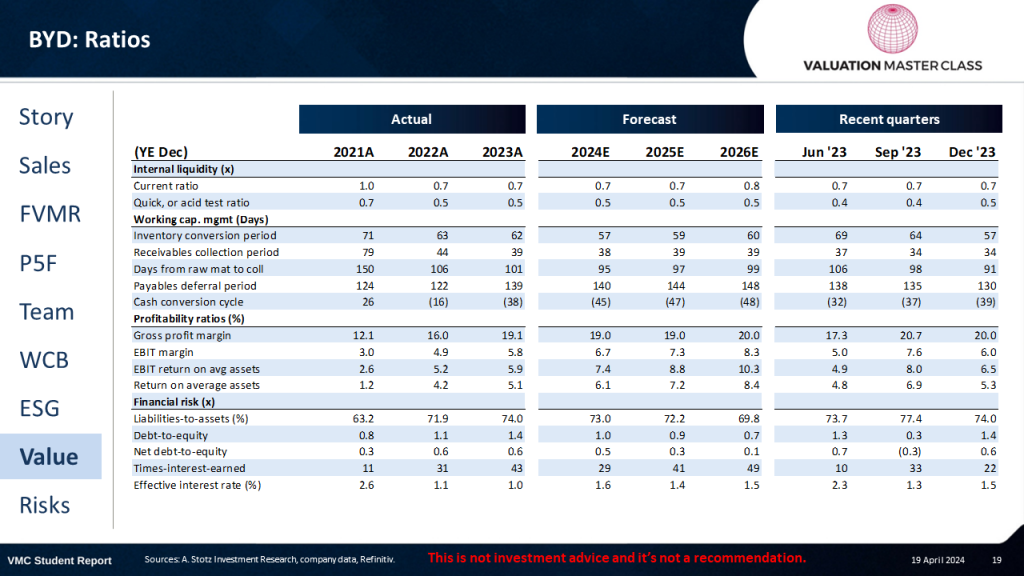

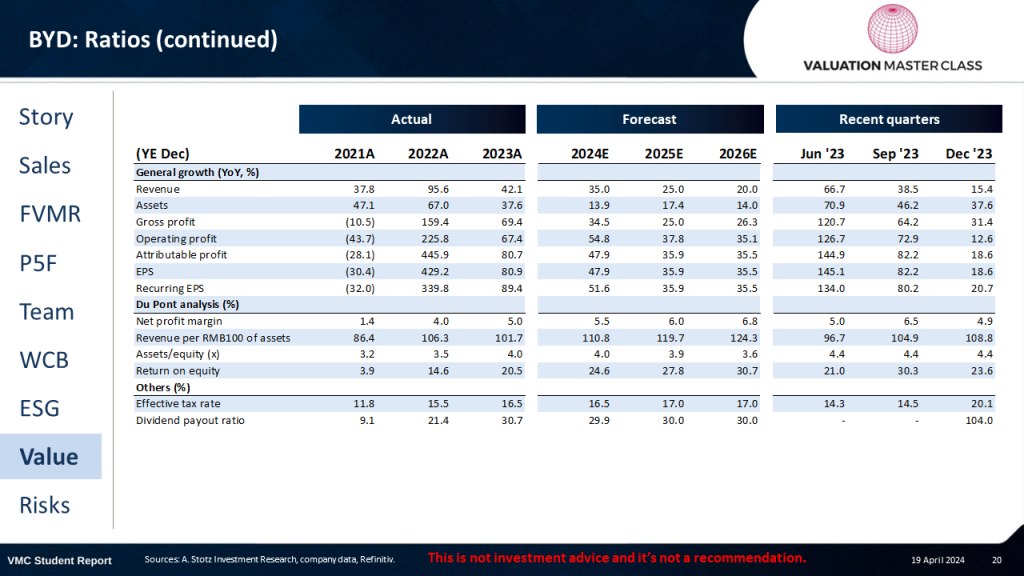

BYD: Ratios

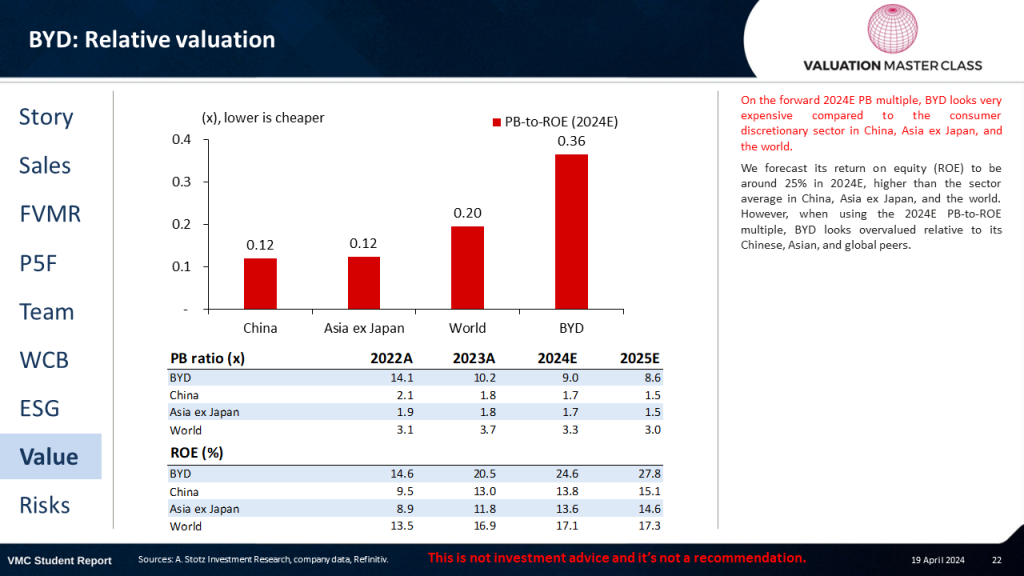

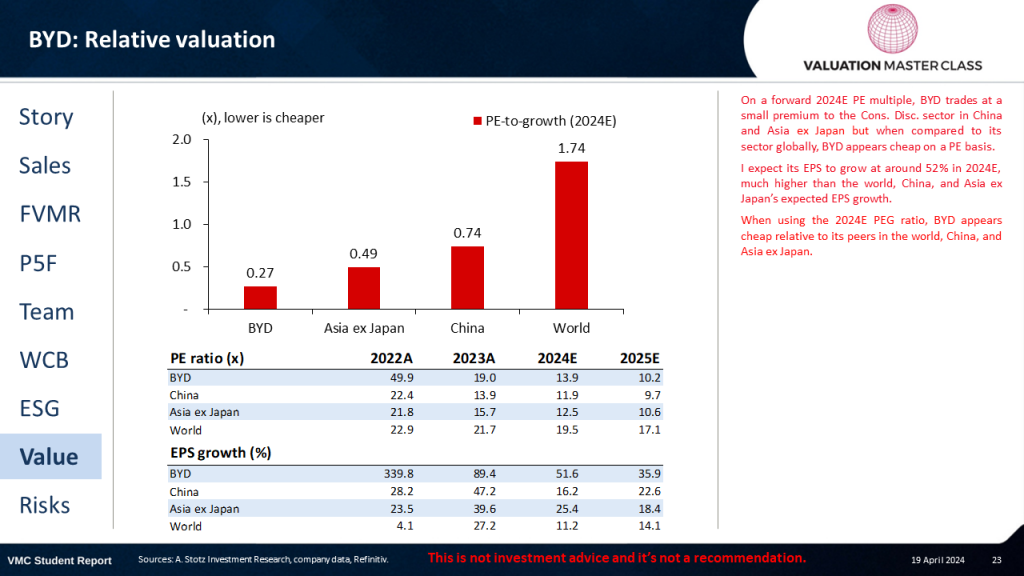

BYD: Relative valuation

On the forward 2024E PB multiple, BYD looks very expensive compared to the consumer discretionary sector in China, Asia ex Japan, and the world.

We forecast its return on equity (ROE) to be around 25% in 2024E, higher than the sector average in China, Asia ex Japan, and the world. However, when using the 2024E PB-to-ROE multiple, BYD looks overvalued relative to its Chinese, Asian, and global peers.

On a forward 2024E PE multiple, BYD trades at a small premium to the Cons. Disc. sector in China and Asia ex Japan but when compared to its sector globally, BYD appears cheap on a PE basis.

I expect its EPS to grow at around 52% in 2024E, much higher than the world, China, and Asia ex Japan’s expected EPS growth.

When using the 2024E PEG ratio, BYD appears cheap relative to its peers in the world, China, and Asia ex Japan.

BYD: Valuation and target price

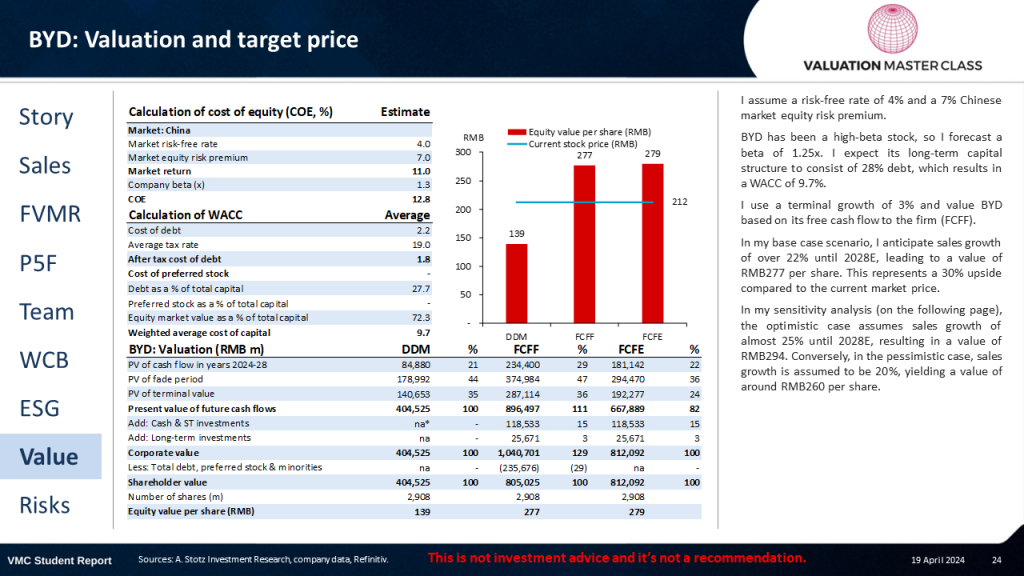

I assume a risk-free rate of 4% and a 7% Chinese market equity risk premium.

BYD has been a high-beta stock, so I forecast a beta of 1.25x. I expect its long-term capital structure to consist of 28% debt, which results in a WACC of 9.7%.

I use a terminal growth of 3% and value BYD based on its free cash flow to the firm (FCFF).

In my base case scenario, I anticipate sales growth of over 22% until 2028E, leading to a value of RMB277 per share. This represents a 30% upside compared to the current market price.

In my sensitivity analysis (on the following page), the optimistic case assumes sales growth of almost 25% until 2028E, resulting in a value of RMB294. Conversely, in the pessimistic case, sales growth is assumed to be 20%, yielding a value of around RMB260 per share.

BYD: Main risk is battery leakage

Risks of battery leakage

The pouch-type batteries that have been used in BYD best-selling hybrids have a risk of leaking. Though BYD is reportedly planning to phase out, it continues to make this type of battery to minimize disruptions to production. Its reputation and consumer trust could be severely damaged if there is a risk of leakage in its battery products. This could lead to safety concerns, product recalls, and potential legal liabilities, impacting its image and financial performance.

Lack of EV infrastructure investment

The widespread adoption of EVs also depends on developing adequate charging infrastructure. This includes access to a stable and affordable electricity supply and a network of conveniently located charging stations. Many countries are still lagging in terms of EV infrastructure investment, making it difficult for consumers to consider EVs as a viable option.

Rising geopolitical tensions with China

The recent increase in geopolitical tensions between China and other countries, such as the United States, has made it more difficult for Chinese electric vehicle (EV) manufacturers to do business overseas. Some countries have imposed tariffs on Chinese EVs, citing security concerns or unfair subsidies the Chinese government provides. These tensions also make it more difficult for Chinese EV manufacturers to build relationships with foreign partners and suppliers, especially with the increasing uneven trade balance.

Manufacturing factory disruptions

BYD’s manufacturing facilities are critical to its operations. Any disruptions from natural disasters, labor disputes, supply chain issues, or regulatory compliance issues could lead to production delays, increased costs, and potential reputational damage for the company.

Download the full report as a PDF

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.