Nestlé, the M&A Leader, Even Acquired Starbucks (Sort Of)

What’s interesting about Nestle is…that it is the M&A leader, even acquired Starbucks (sort of)

What is Nestle doing?

- Some major brands you know

- KitKat, Nespresso, and Maggi

- Sells products across 188 countries

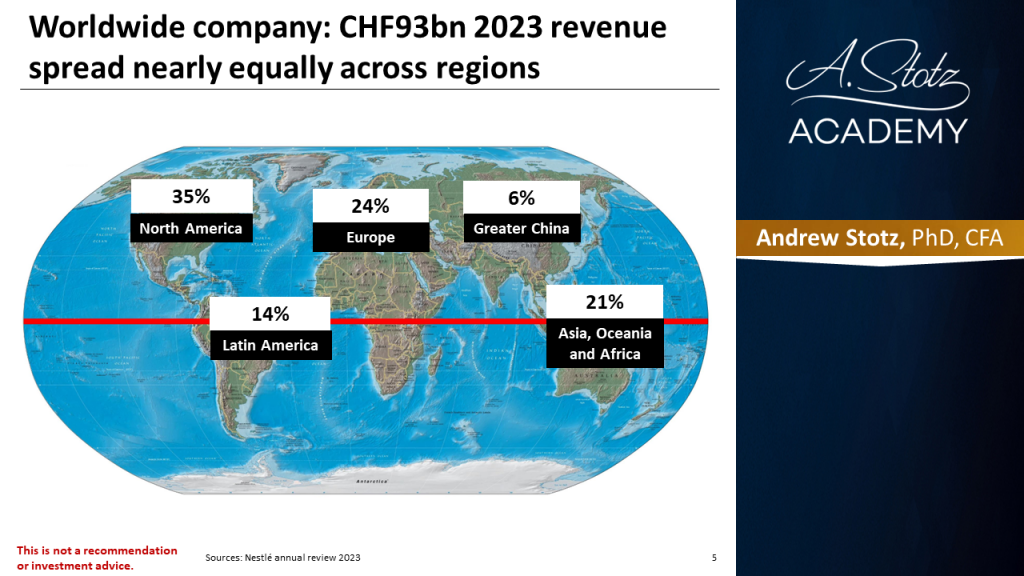

Worldwide company: CHF93bn 2023 revenue spread nearly equally across regions

Revenue by segment

All about diversifications

Download the full report as a PDF

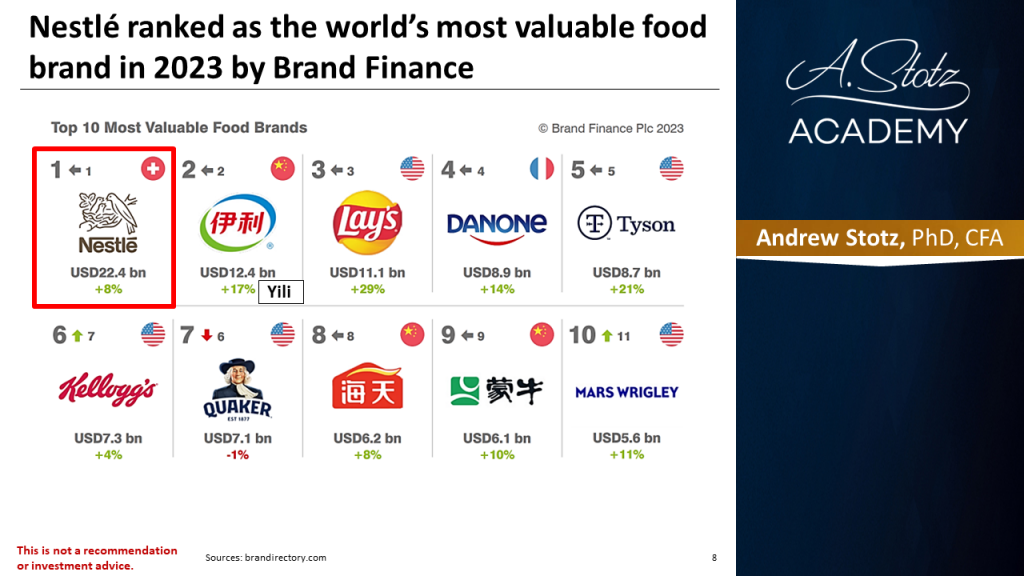

The world’s most valuable food brand

Nestlé S.A. – Switzerland – Founded 1905

Cons. Staples sector, 270,000 employees, US$102bn revenue

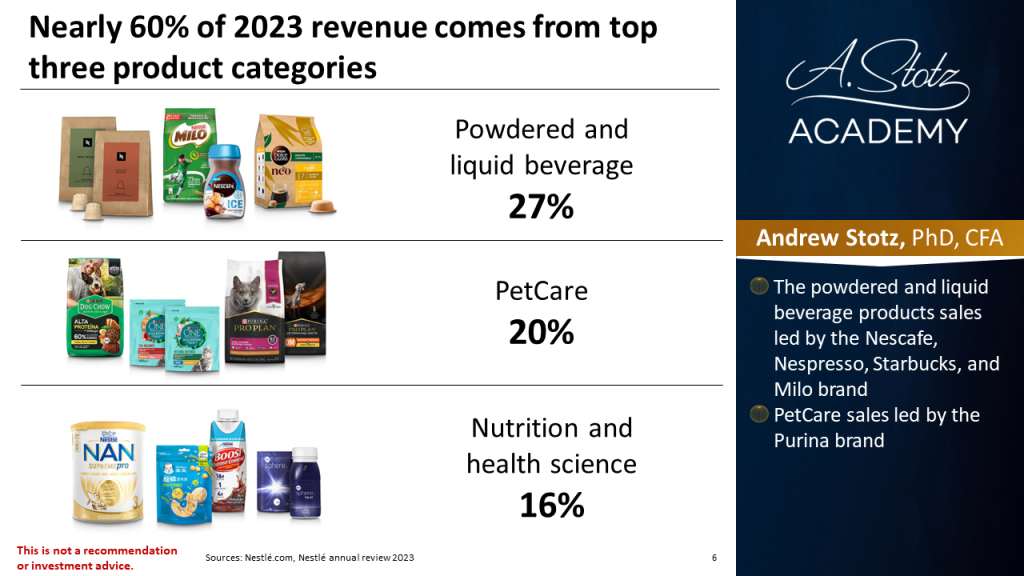

Main segments/products

- Nescafe

- Nestlé Pure Life

- KitKat

Its competitive advantage

Competitive advantage through diverse brand portfolio, global reach, and acquisitions.

How it achieved its competitive advantage

By building a diverse brand portfolio and expanding globally, it solidified its position in the consumer goods market.

Key M&A milestones (1929 to 1988)

- 1929 – Bought Switzerland’s largest chocolate company Peter-Cailler-Kohler

- 1947 – Merged with a Swiss company Alimentana, which produces Maggi products

- 1962 – Bought the Findus frozen food brand from Swedish manufacturer Marabou

- 1988 – Bought a UK confectionery company

- Adding KitKat, After Eight, and Smarties brands

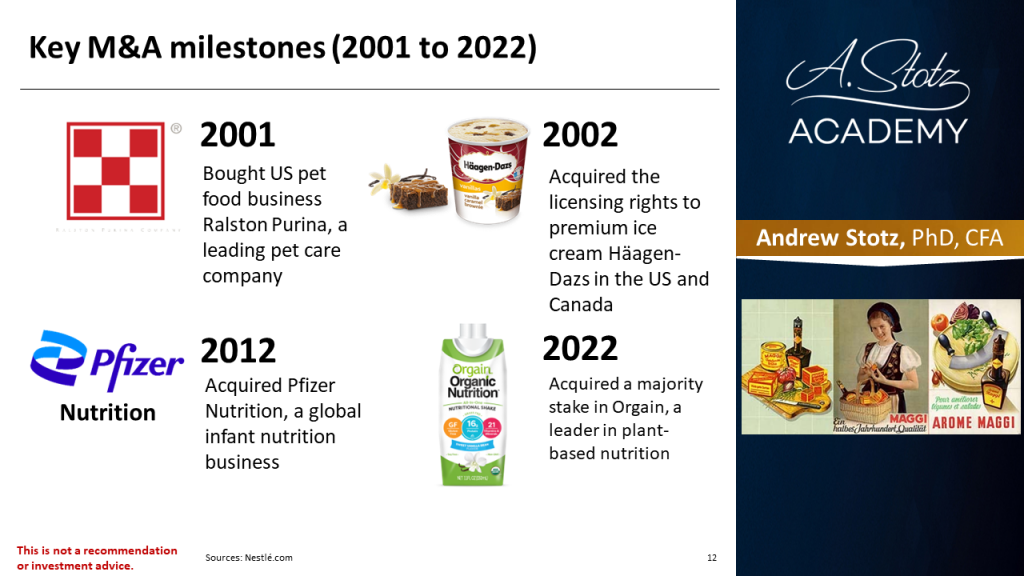

Key M&A milestones (2001 to 2022)

- 2001 – Bought US pet food business Ralston Purina, a leading pet care company

- 2002 – Acquired the licensing rights to premium ice cream Häagen-Dazs in the US and Canada

- 2012 – Acquired Pfizer Nutrition, a global infant nutrition business

- 2022 – Acquired a majority stake in Orgain, a leader in plant-based nutrition

Nestlé’s deal of a lifetime

- In mid-2018, Nestlé gained perpetual global rights to sell Starbucks consumer and food service products (adding RTD in 2021)

- Nestlé paid Starbucks US$7.15bn upfront cash (Which came in handy for Starbucks during Covid lockdowns)

- Nespresso & Dolce Gusto can sell Starbucks

- Nestlé also acquired rights for Starbucks teas

- Boosted Nestlé’s premium coffee profile

Let’s understand recent transactions

- JAB Holdings paid

- 3.1x price-to-sales for Keurig Green Mountain

- 2.5x price-to-sales for Peet’s Coffee and Tea

- 2.8x price-to-sales for DE Master Blenders

- Nestle paid 3.6x price-to-sales for limited, by perpetual rights to Starbucks

Innovate, innovate and innovate

- In 2017 alone, Nestlé launched 1,000 new products

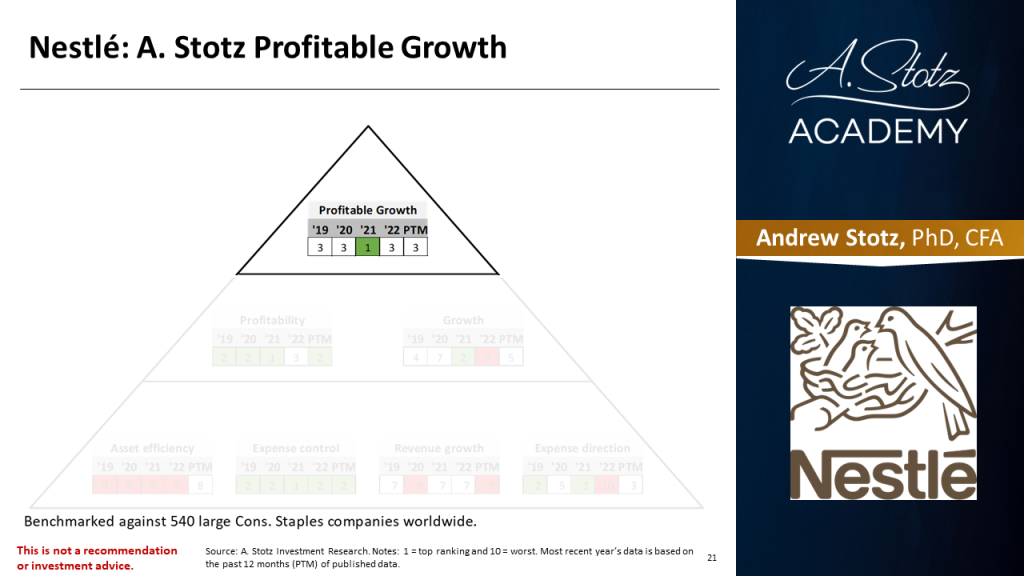

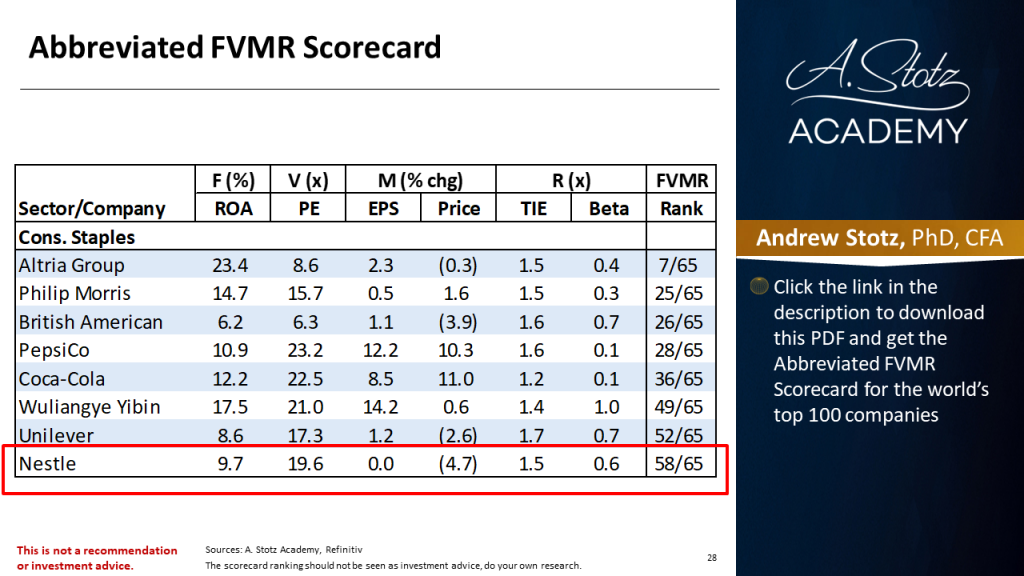

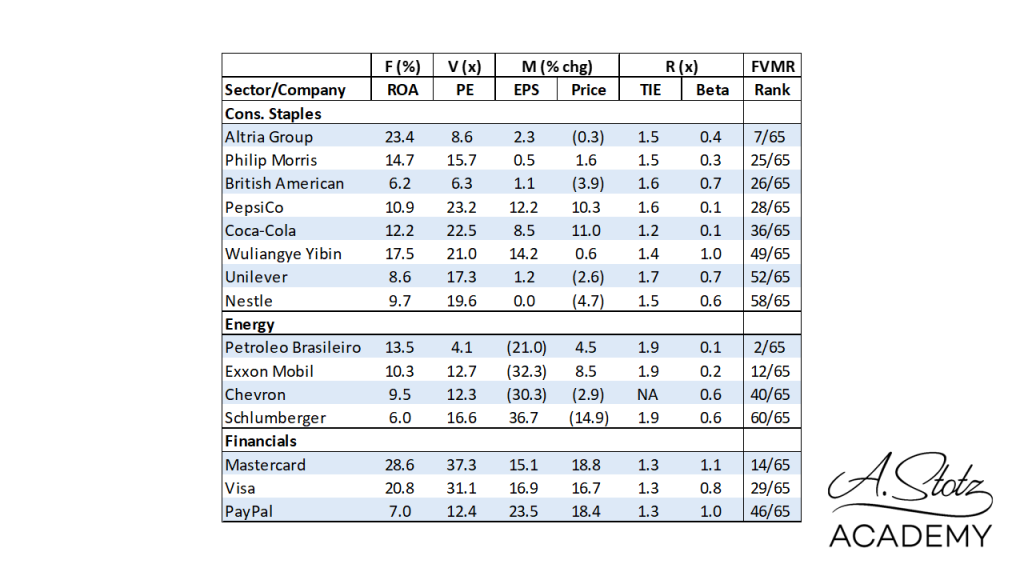

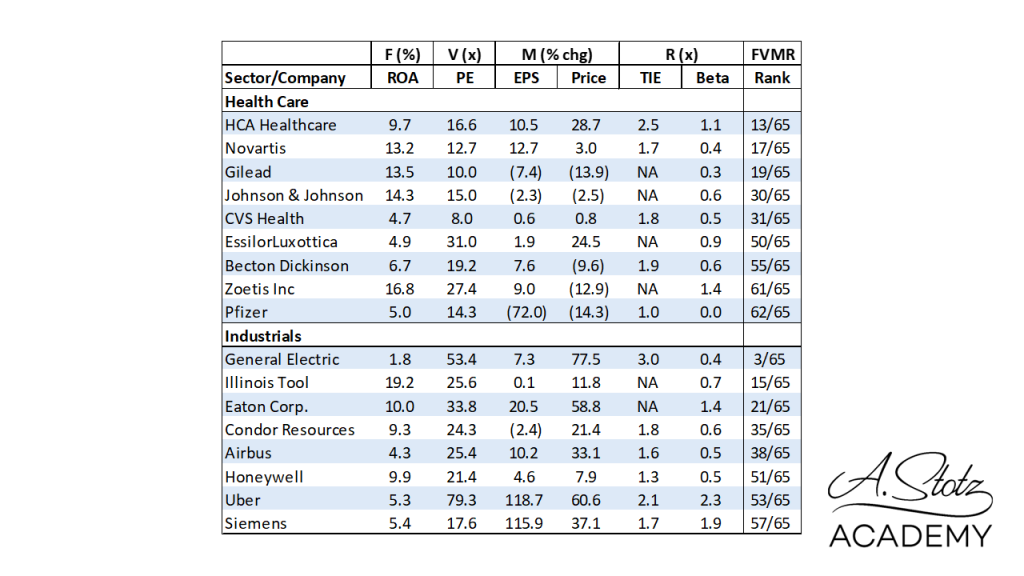

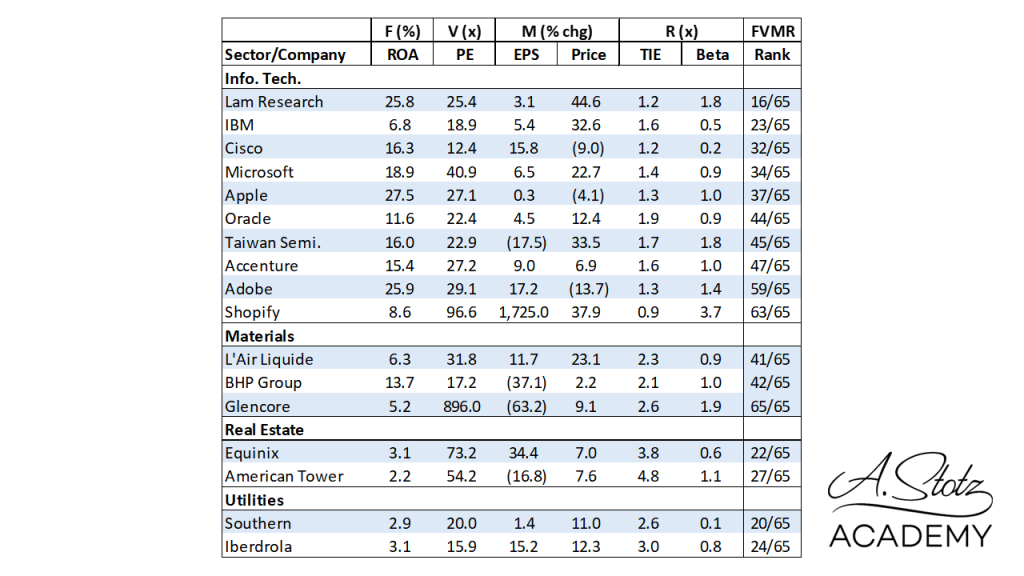

Is the company financially world class?

I use my World Class Benchmarking scorecard to measure if a company has a competitive advantage

I developed this scorecard ten years ago; here’s how we construct it

- My team gathers the yearly and quarterly financial data of 26,000 companies worldwide

- We then calculate each company’s Profitable Growth score

- Which is a composite measure of both profitability and growth

Download the full report as a PDF

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.