Did China Put the Last Nail in Under Armour’s Coffin?

What’s interesting about Under Armour is that its share price has dropped by 50% over the past 6 months

Download the full report as a PDF

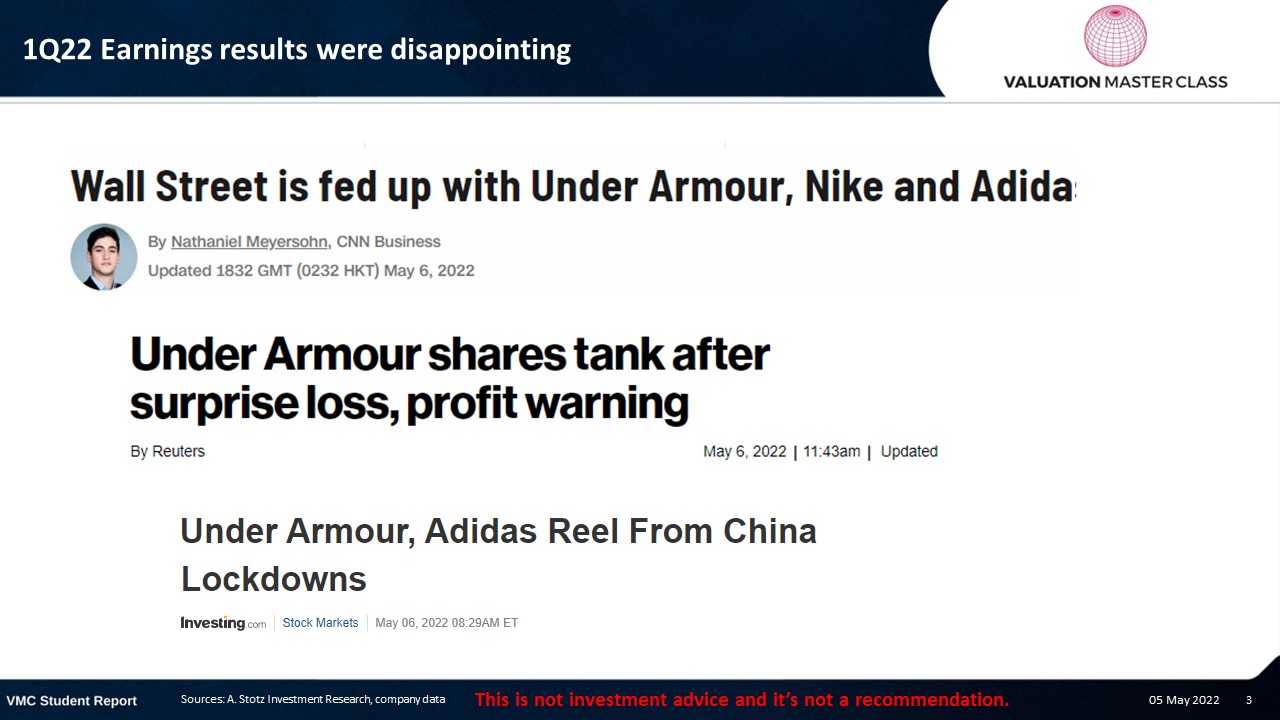

1Q22 Earnings results were disappointing

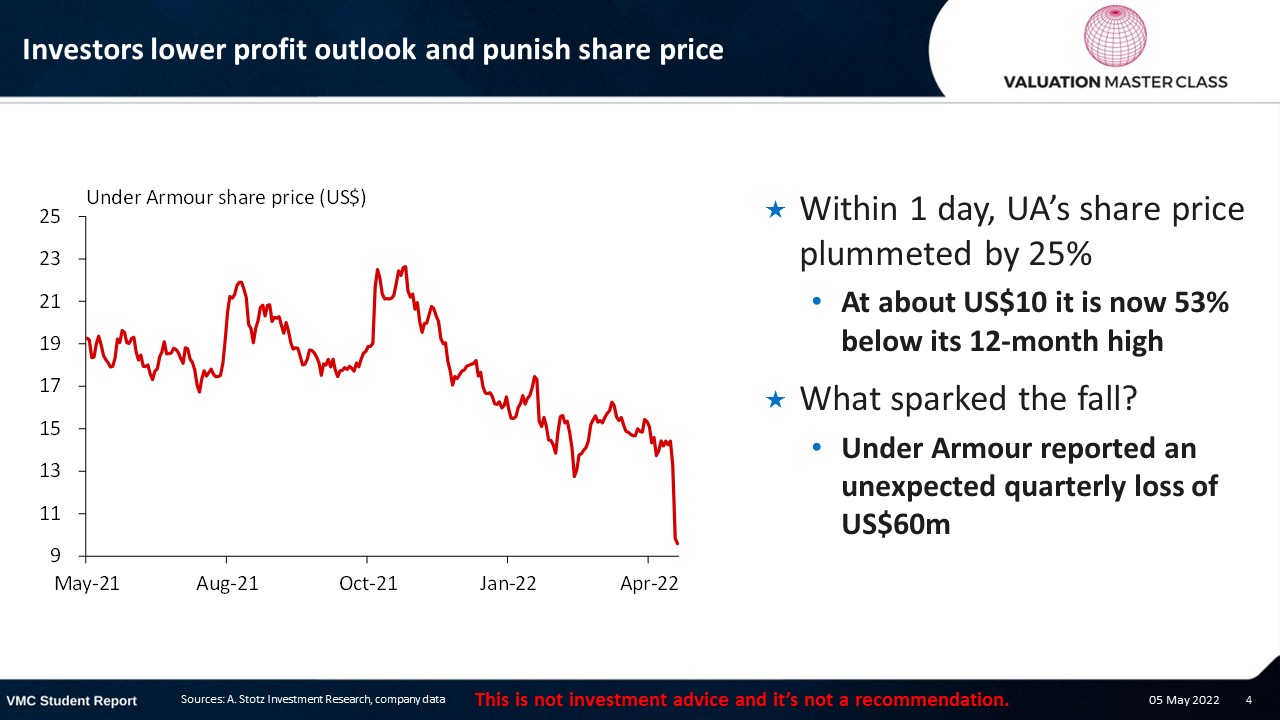

Investors lower profit outlook and punish share price

- Within 1 day, UA’s share price plummeted by 25%

- At about US$10 it is now 53% below its 12-month high

- What sparked the fall?

- Under Armour reported an unexpected quarterly loss of US$60m

Under Armour has been involved in several scandals

Strategy shift under new CEO hampered by external shocks

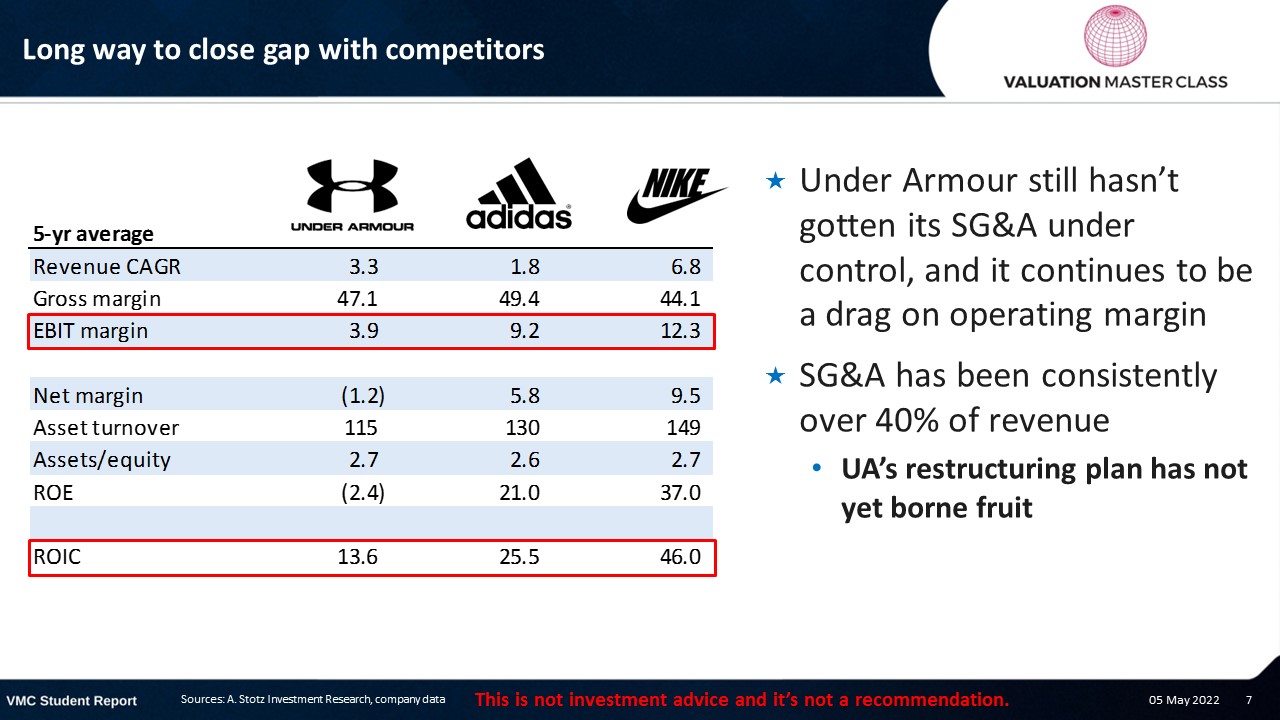

Long way to close gap with competitors

- Under Armour still hasn’t gotten its SG&A under control, and it continues to be a drag on operating margin

- SG&A has been consistently over 40% of revenue

- UA’s restructuring plan has not yet borne fruit

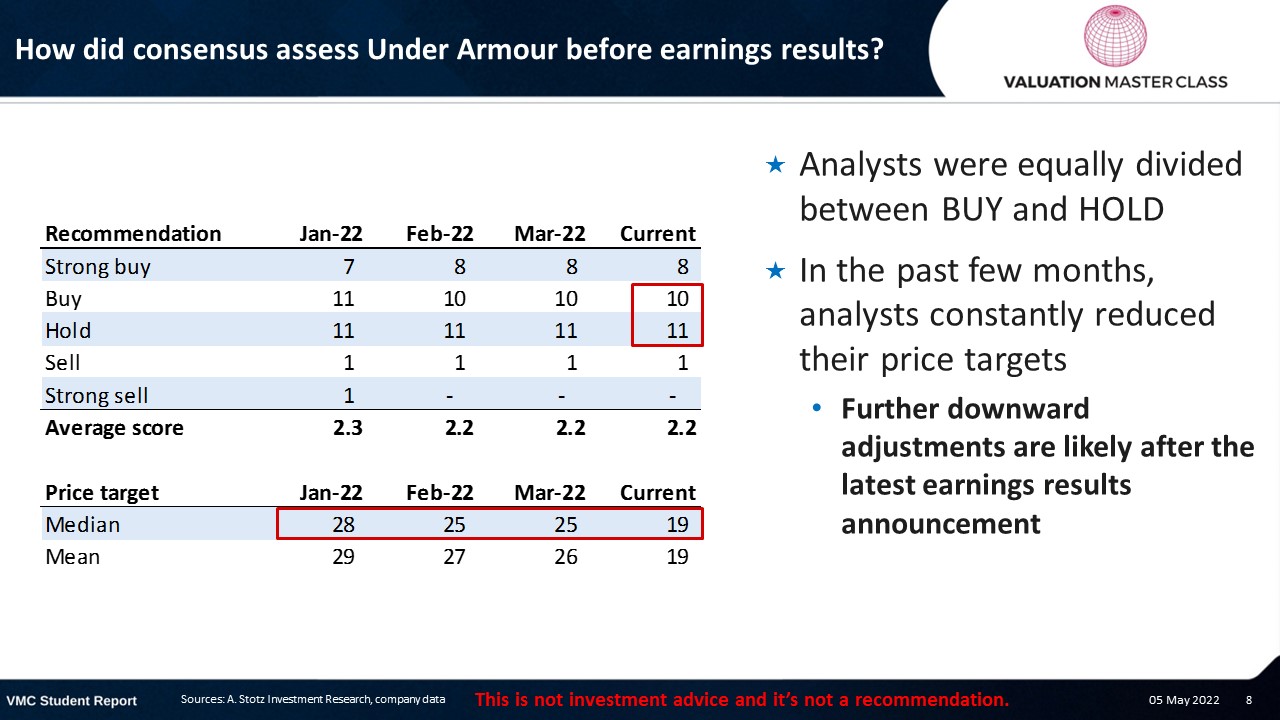

How did consensus assess Under Armour before earnings results?

- Analysts were equally divided between BUY and HOLD

- In the past few months, analysts constantly reduced their price targets

- Further downward adjustments are likely after the latest earnings results announcement

Download the full report as a PDF

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.