Why Did Warren Buffett Significantly Increase His Stake in Chevron?

Why Did Warren Buffett Significantly Increase His Stake in Chevron?

When Warren Buffett acts, the world listens

Download the full report as a PDF

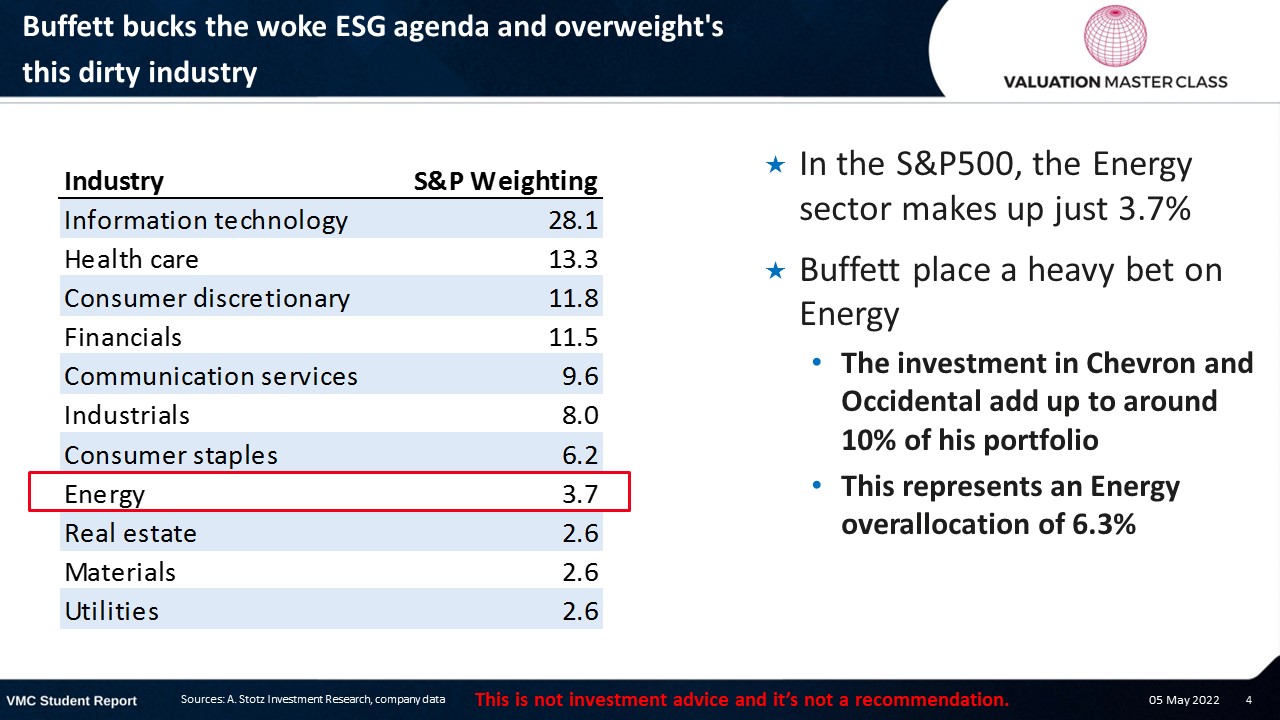

Buffett bucks the woke ESG agenda and overweight’s this dirty industry

- In the S&P500, the Energy sector makes up just 3.7%

- Buffett place a heavy bet on Energy

- The investment in Chevron and Occidental add up to around 10% of his portfolio

- This represents an Energy overallocation of 6.3%

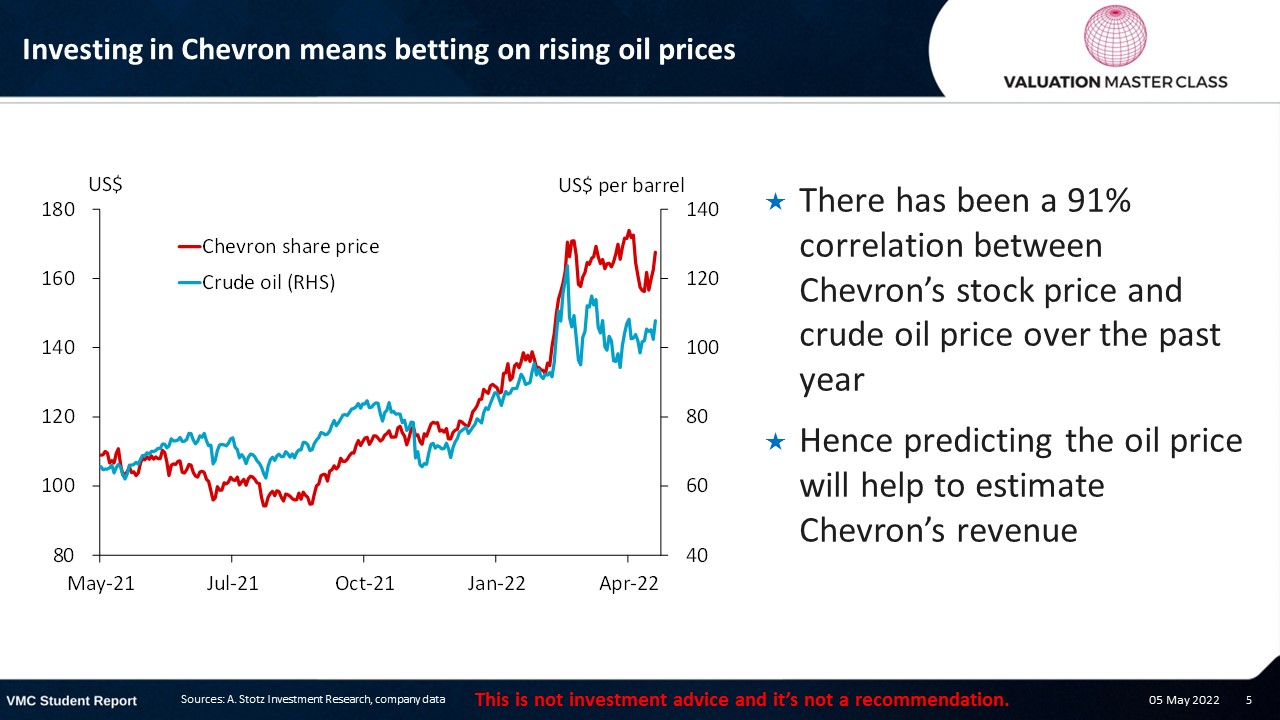

Investing in Chevron means betting on rising oil prices

- There has been a 91% correlation between Chevron’s stock price and crude oil price over the past year

- Hence predicting the oil price will help to estimate Chevron’s revenue

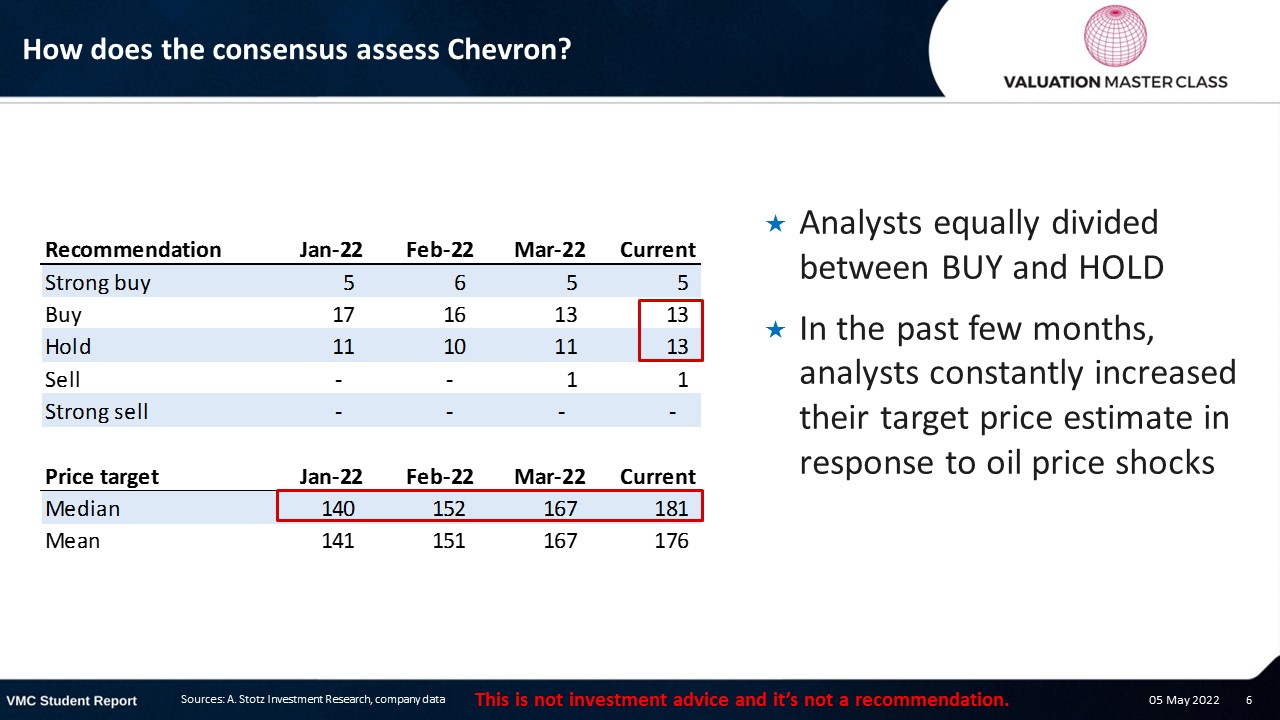

How does the consensus assess Chevron?

- Analysts equally divided between BUY and HOLD

- In the past few months, analysts constantly increased their target price estimate in response to oil price shocks

Download the full report as a PDF

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.