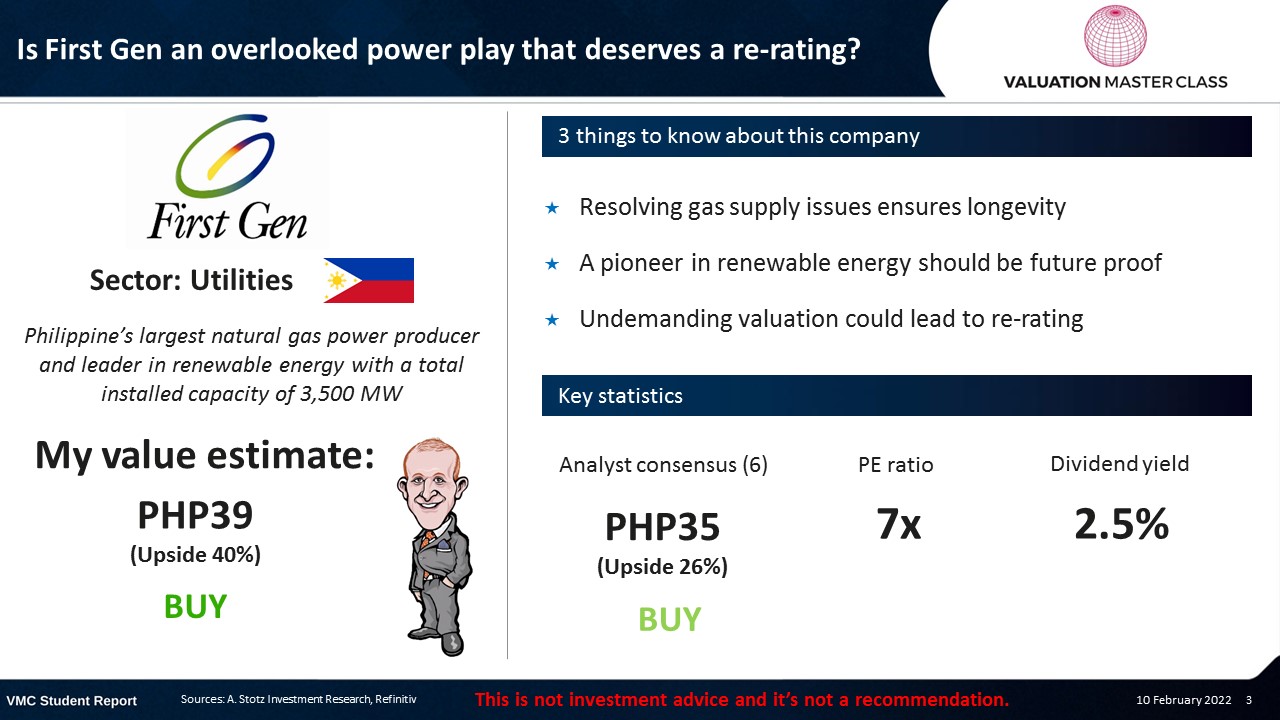

Is First Gen an Overlooked Power Play That Deserves a Re-Rating?

Highlights:

- Resolving gas supply issues ensures longevity

- A pioneer in renewable energy should be future proof

- Undemanding valuation could lead to re-rating

Download the full report as a PDF

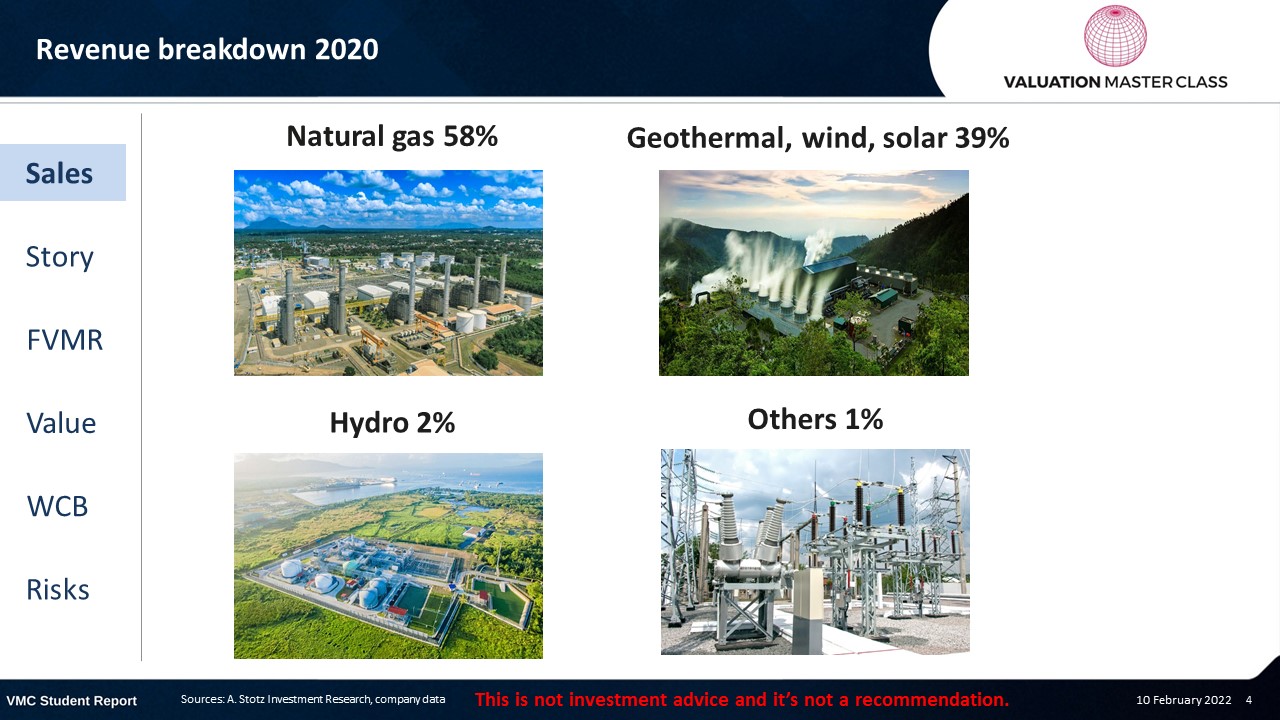

First Gen’s revenue breakdown 2020

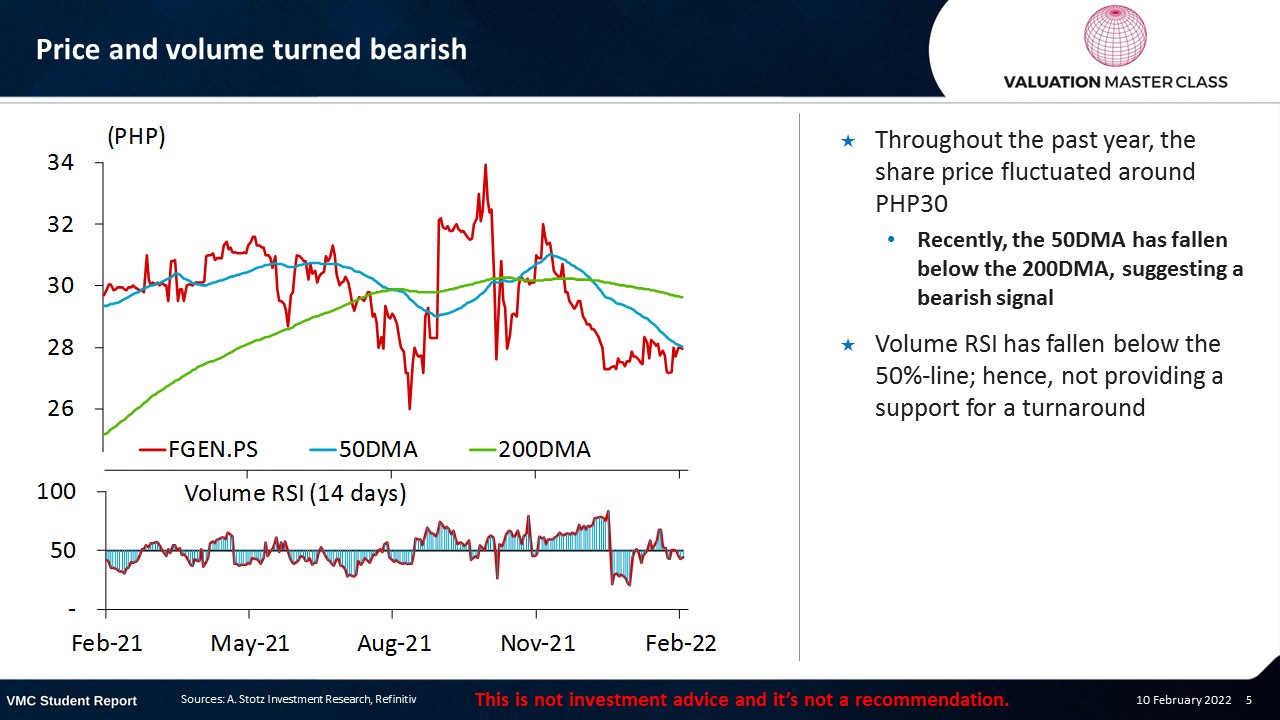

Price and volume turned bearish

- Throughout the past year, the share price fluctuated around PHP30

- Recently, the 50DMA has fallen below the 200DMA, suggesting a bearish signal

- Volume RSI has fallen below the 50%-line; hence, not providing a support for a turnaround

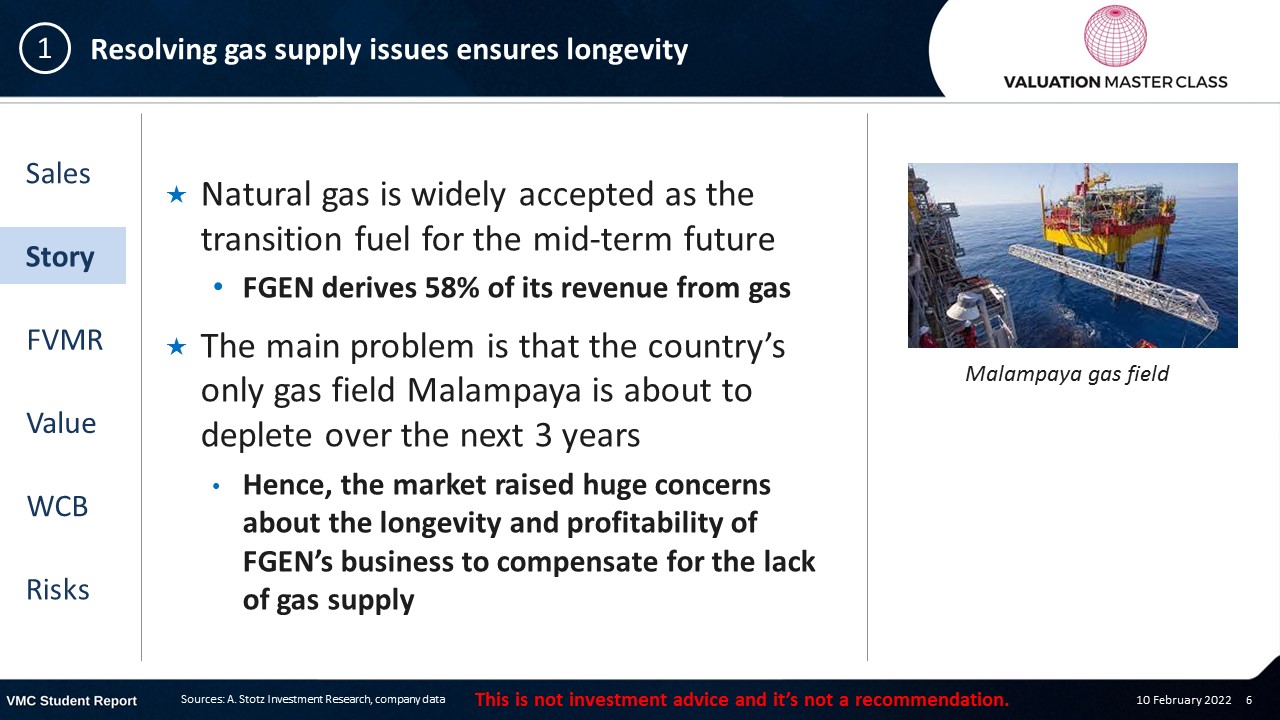

Resolving gas supply issues ensures longevity

- Natural gas is widely accepted as the transition fuel for the mid-term future

- FGEN derives 58% of its revenue from gas

- The main problem is that the country’s only gas field Malampaya is about to deplete over the next 3 years

- Hence, the market raised huge concerns about the longevity and profitability of FGEN’s business to compensate for the lack of gas supply

FGEN substitutes domestic gas with imported LNG

- FGEN currently constructs the country’s first liquefied natural gas (LNG) terminal with a capacity of 5.2m metric tons

- The terminal allows to store imported LNG and turn it back to gaseous form to generate energy

- So far, the construction progress is on track and the terminal could start operations by late 2022 already

- By resolving the supply issue, FGEN dispels any doubts about its longevity

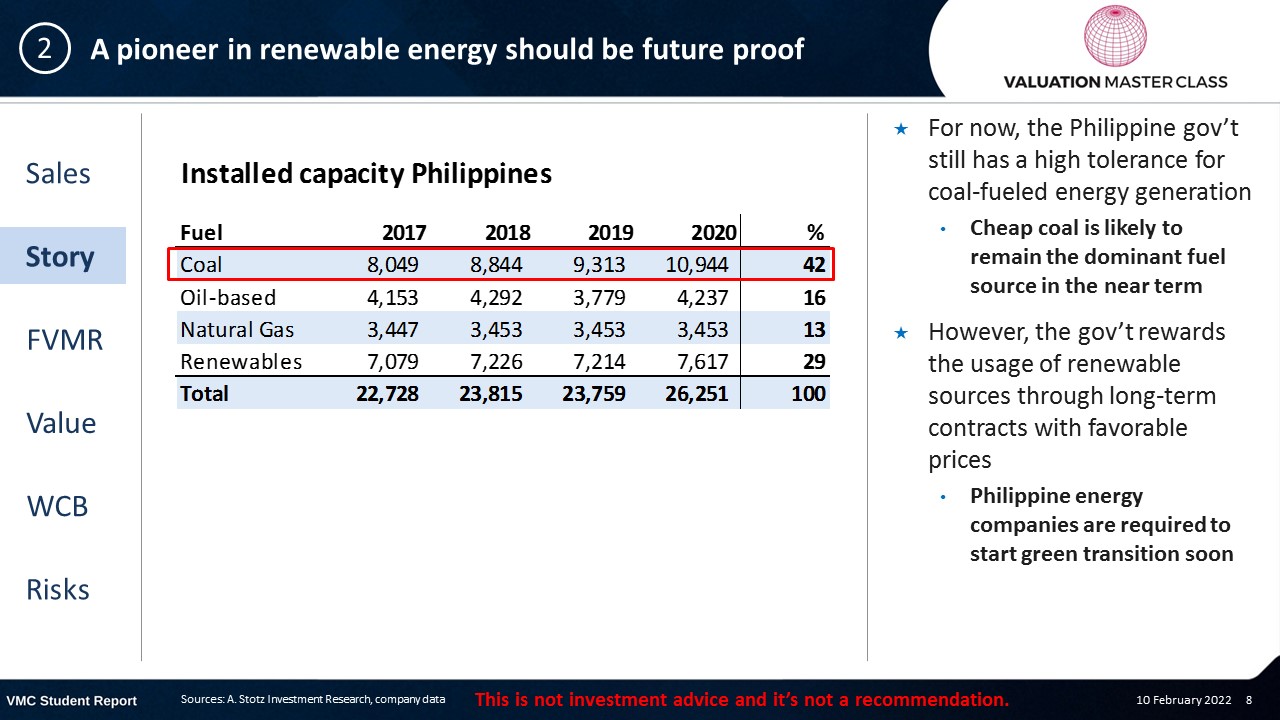

A pioneer in renewable energy should be future proof

- For now, the Philippine gov’t still has a high tolerance for coal-fueled energy generation

- Cheap coal is likely to remain the dominant fuel source in the near term

- However, the gov’t rewards the usage of renewable sources through long-term contracts with favorable prices

- Philippine energy companies are required to start green transition soon

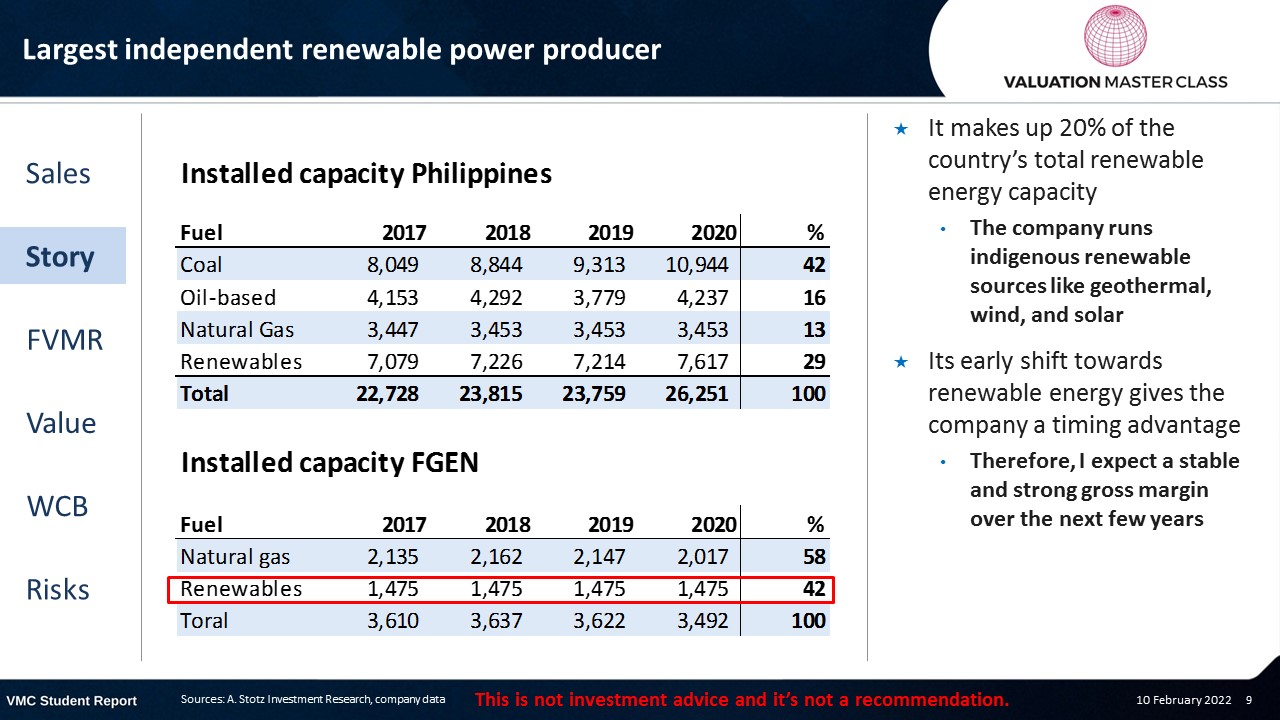

Largest independent renewable power producer

- It makes up 20% of the country’s total renewable energy capacity

- The company runs indigenous renewable sources like geothermal, wind, and solar

- Its early shift towards renewable energy gives the company a timing advantage

- Therefore, I expect a stable and strong gross margin over the next few years

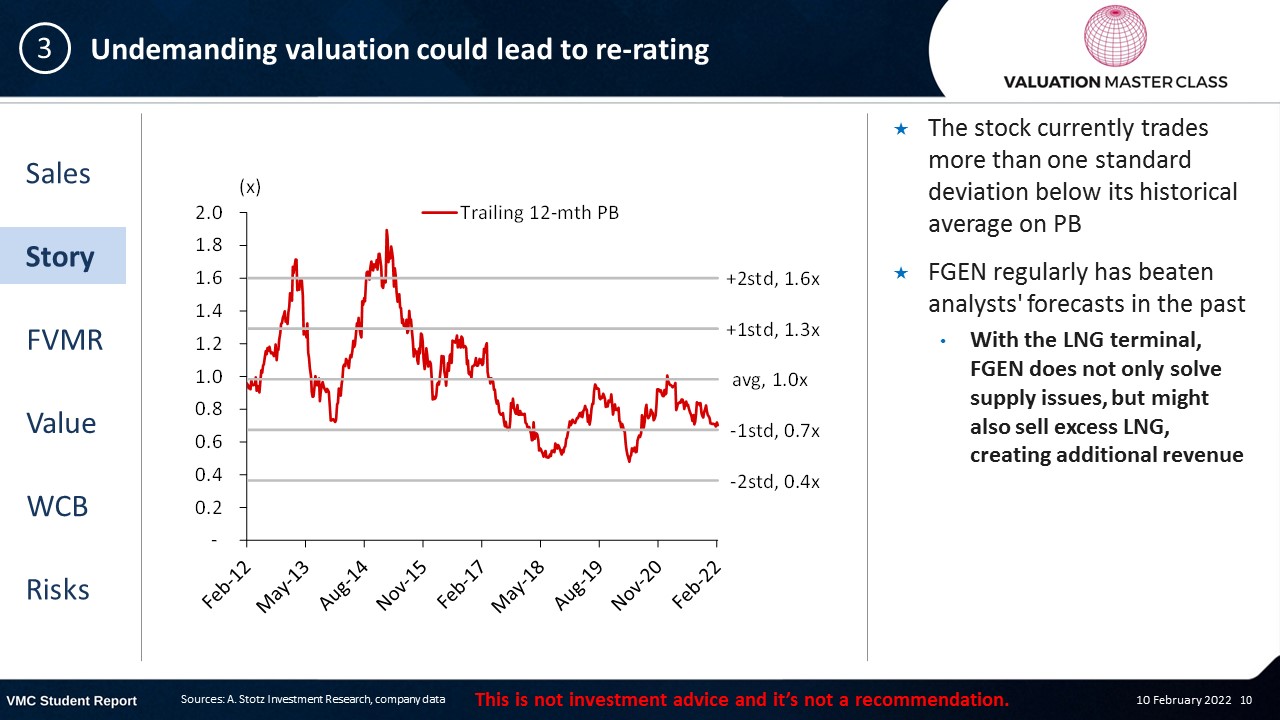

Undemanding valuation could lead to re-rating

- The stock currently trades more than one standard deviation below its historical average on PB

- FGEN regularly has beaten analysts’ forecasts in the past

- With the LNG terminal, FGEN does not only solve supply issues, but might also sell excess LNG, creating additional revenue

Interest of institutional investor could provide support

- In 2020, the US-based investment company KKR acquired a 12.6% stake in FGEN

- In October 2021, KKR announced to acquire another 7.3% stake for PHP33 per share, which is a 20% premium to market price

- I consider the follow-on investment of KKR as a positive signal that the share price could provide further upside

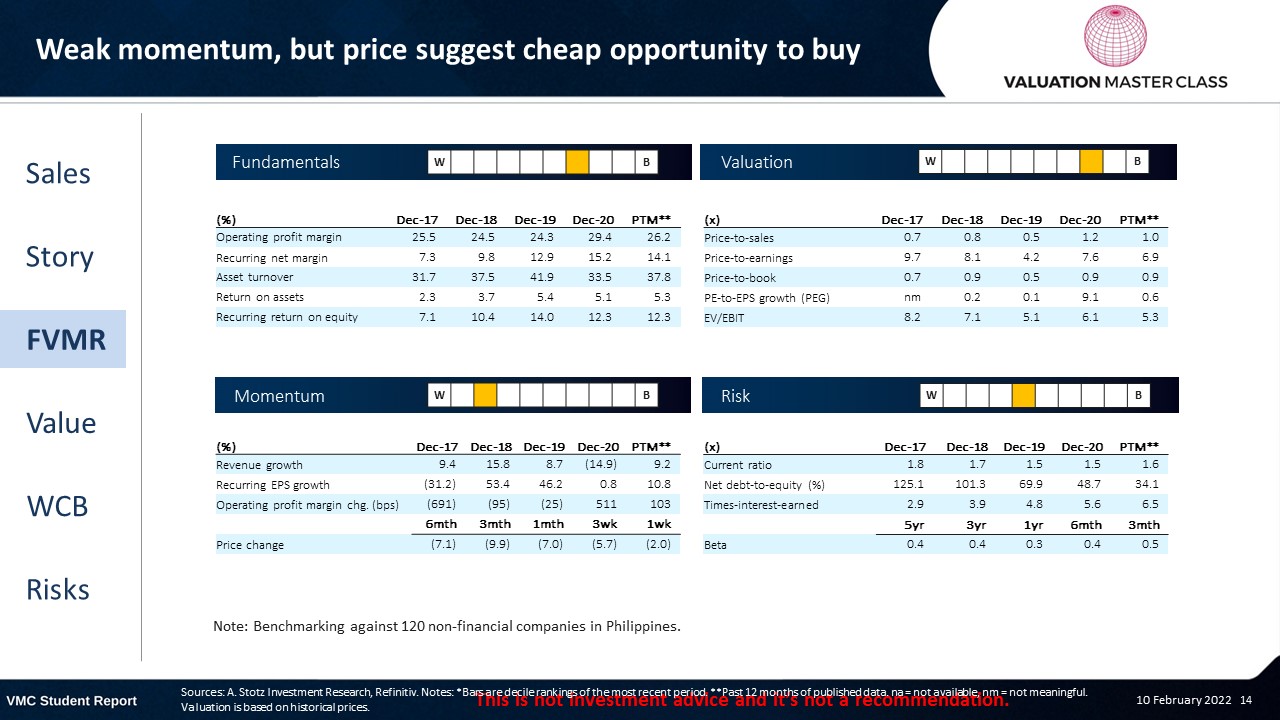

FVMR Scorecard – First Gen

- A stock’s attractiveness relative to stocks in that country or region

- Attractiveness is based on four elements

- Fundamentals, Valuation, Momentum, and Risk (FVMR)

- Scale from 1 (Best) to 10 (Worst)

Analysts see strong upside

- Almost all analysts have a BUY recommendation, with only 1 analyst staying on HOLD

- Consensus expects solid revenue growth for the future given the growing demand for energy

- Also, margins are expected to stay stable at a high level, meaning that analysts are positive about the LNG substitution

Get financial statements and assumptions in the full report

P&L – First Gen

- FGEN has delivered remarkably stable profits and there is no reason to assume differently in the future

- Long-term take-off agreements ensure stable margins

Balance sheet – First Gen

- Currently, there are no concrete expansion plans in place

- I believe that FGEN might add a few smaller renewable energy projects over time but does not undergo aggressive acquisitions

- Its strong cash flow generation allows FGEN to reduce its debt over time and fund CAPEX internally

Ratios – First Gen

- FGEN paid out stable and growing dividends

- The small payout ratio of less than 15% still delivers a dividend yield of around 3%, which is above Philippine average

- There is potential to pay out more and it could turn into a dividend play over the next few years

- Strong margins translate into stable return on assets

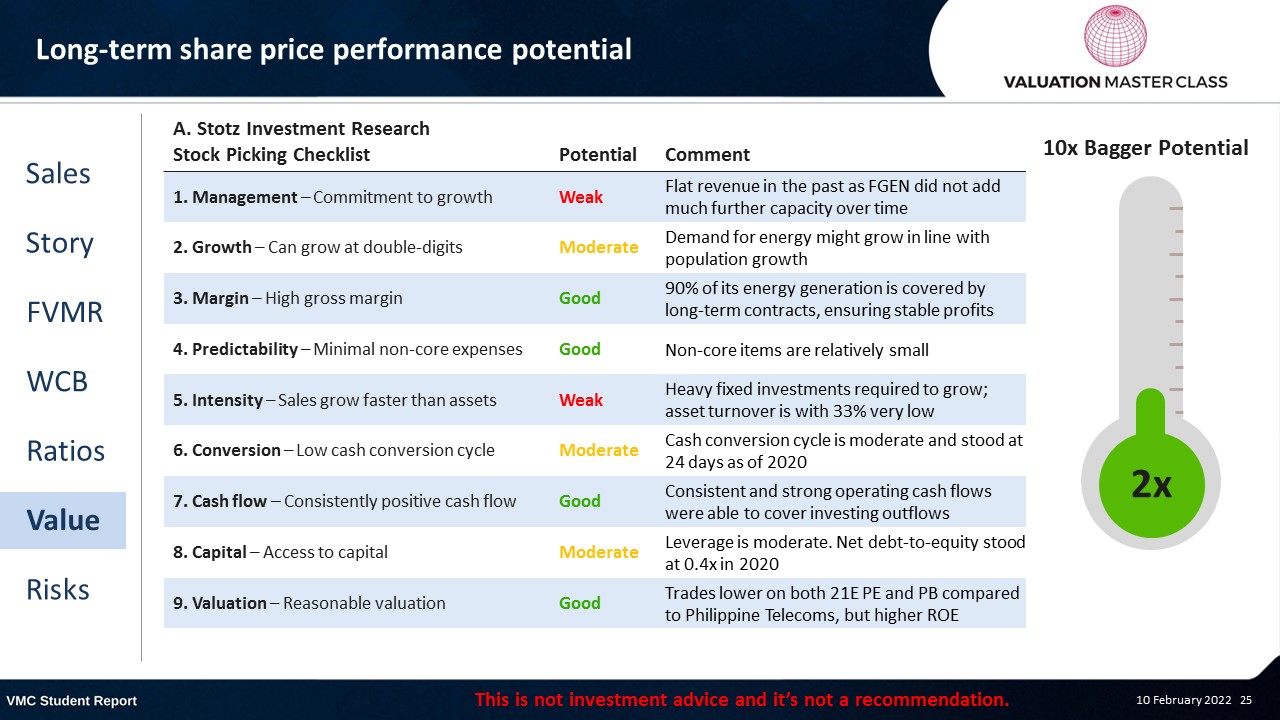

Long-term share price performance potential

Free cash flow – First Gen

- FGEN cash flows on a consistent basis and the market might not have appreciated that fact yet

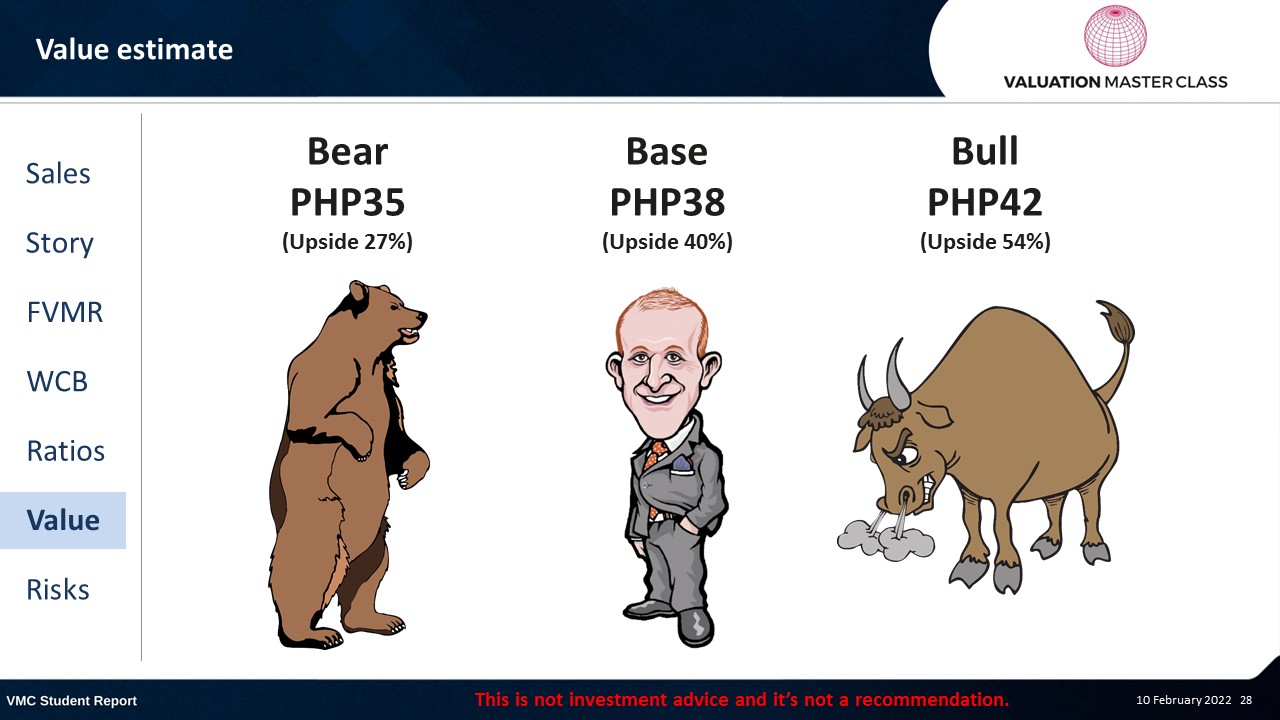

Value estimate – First Gen

- My short-term outlook is roughly in line with consensus

- I am bit more optimistic on the long-term future and believe the company to maintain a great ROIC of 10-12% over time

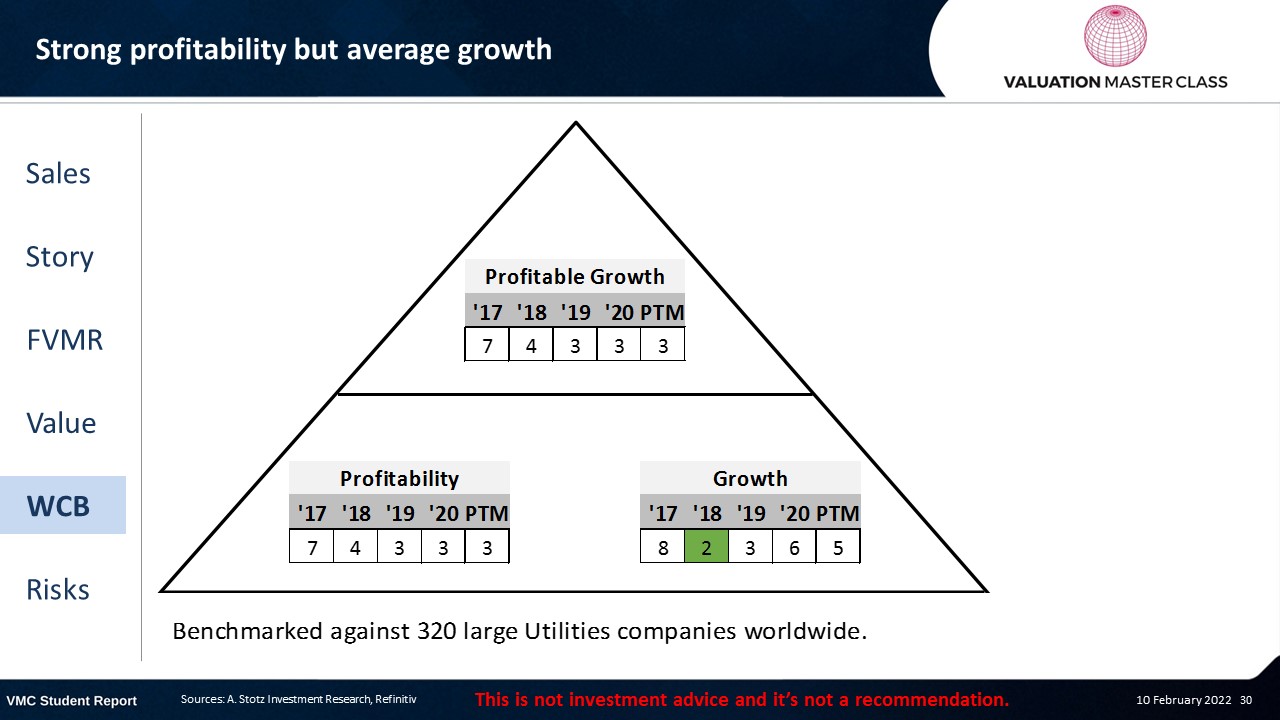

World Class Benchmarking Scorecard – First Gen

- Identifies a company’s competitive position relative to global peers

- Combined, composite rank of profitability and growth, called “Profitable Growth”

- Scale from 1 (Best) to 10 (Worst)

Key risk is delay in resolving gas supply

- Delay in building the LNG terminal could disrupt its gas production

- Unexpected outages of production (e.g., weather conditions, transmission constraints)

- High dependency on Meralco, which makes up 50% of its revenue

Conclusions

- FGEN to remain a cash flow machine as supply problem seems to be resolved

- Early shift to green energy fives it a timing advantage in a coal-dominant country

- Valuation is cheap; institutional interest could unlock upside

Download the full report as a PDF

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.