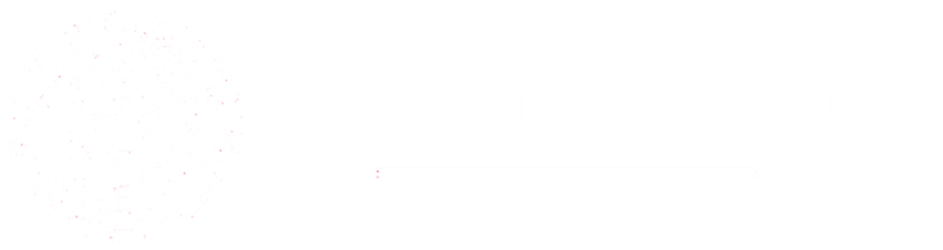

Is LG Display a Deep Value Play or Cheap for a Reason?

Highlights:

- Intensified price competition leads to loss of market share

- End markets for displays face maturity, expect low growth

- Focus on premium products to turnaround margin

Download the full report as a PDF

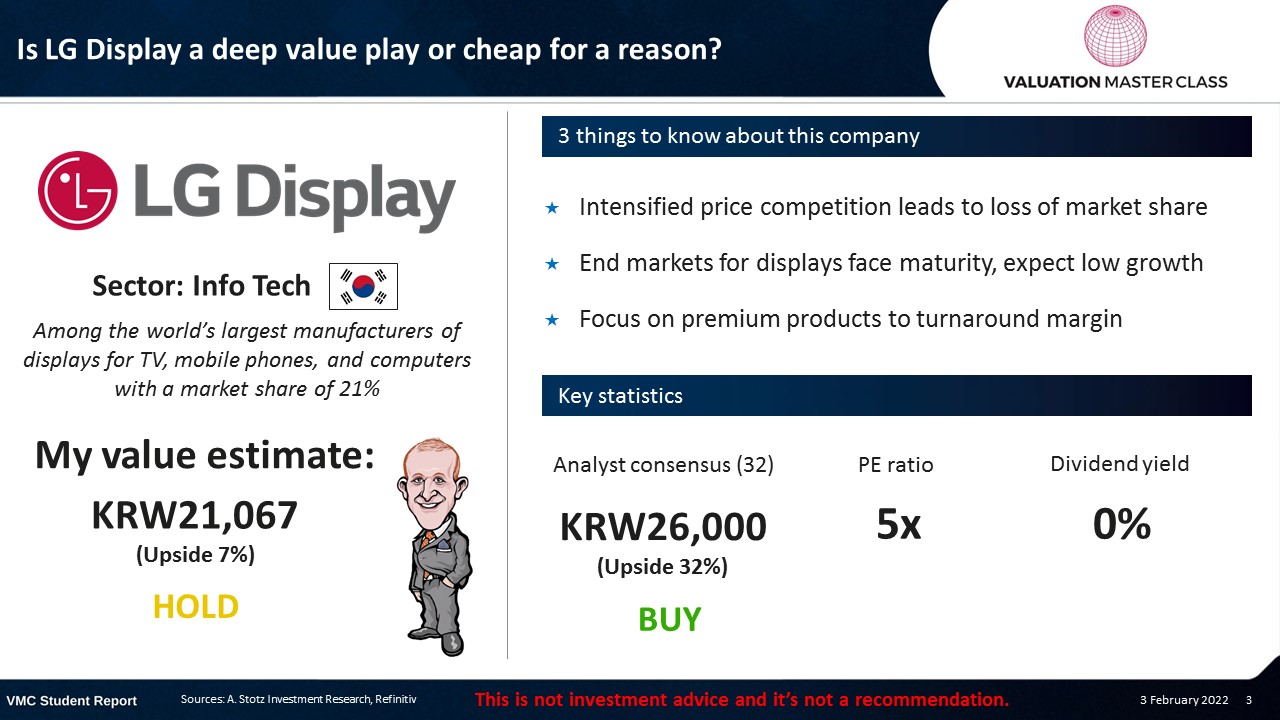

LG Display’s revenue breakdown 2020

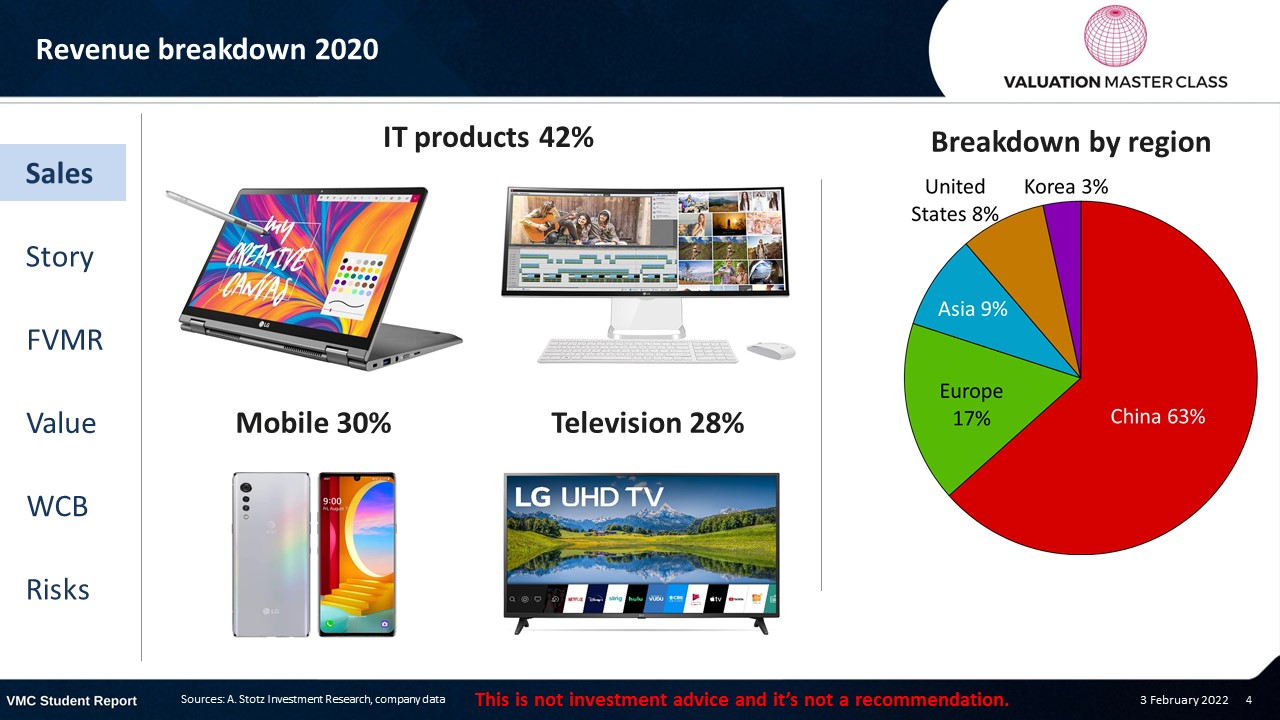

Price recently turned bullish, but low volume support

- In early 2022, the 50DMA has crossed the 200DMA, which is a positive signal

- However, the share price seems to cross the 50DMA soon, which could turnaround the trend

- Volume RSI has been strong in 4Q21

- Recently, it moved to the 50%-line, providing no clear signal going forward

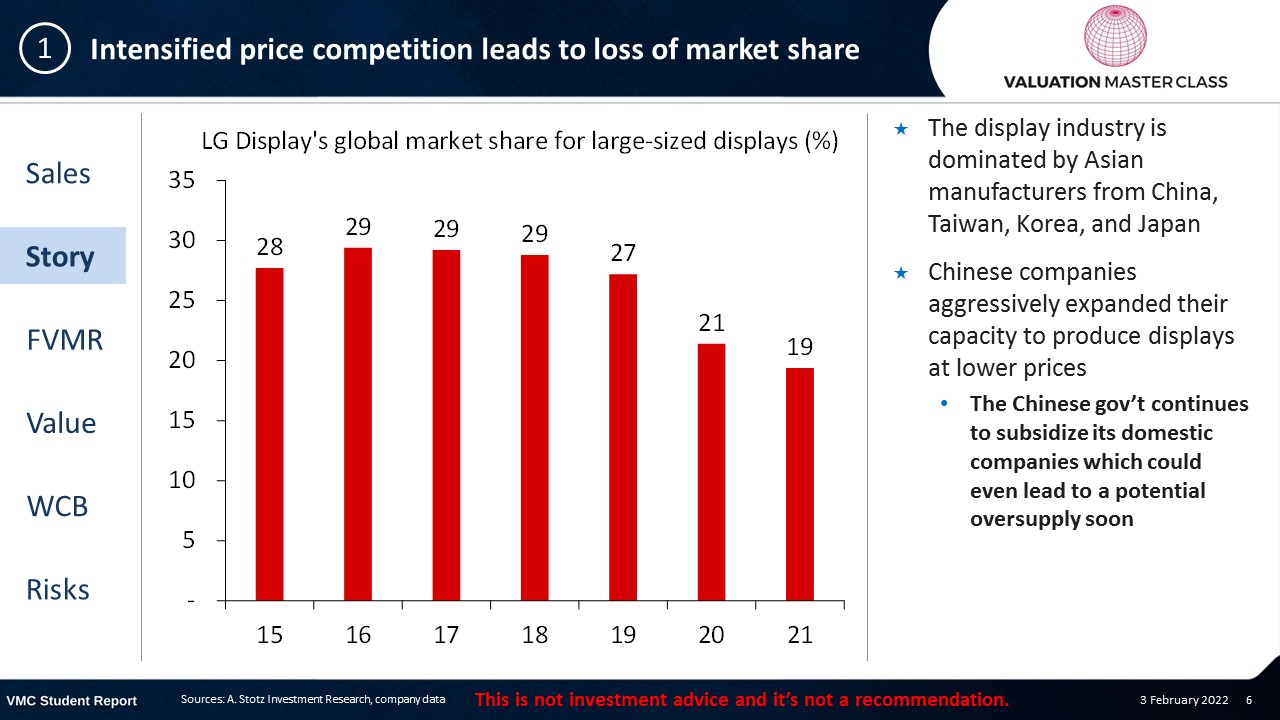

Intensified price competition leads to loss of market share

- The display industry is dominated by Asian manufacturers from China, Taiwan, Korea, and Japan

- Chinese companies aggressively expanded their capacity to produce displays at lower prices

- The Chinese gov’t continues to subsidize its domestic companies which could even lead to a potential oversupply soon

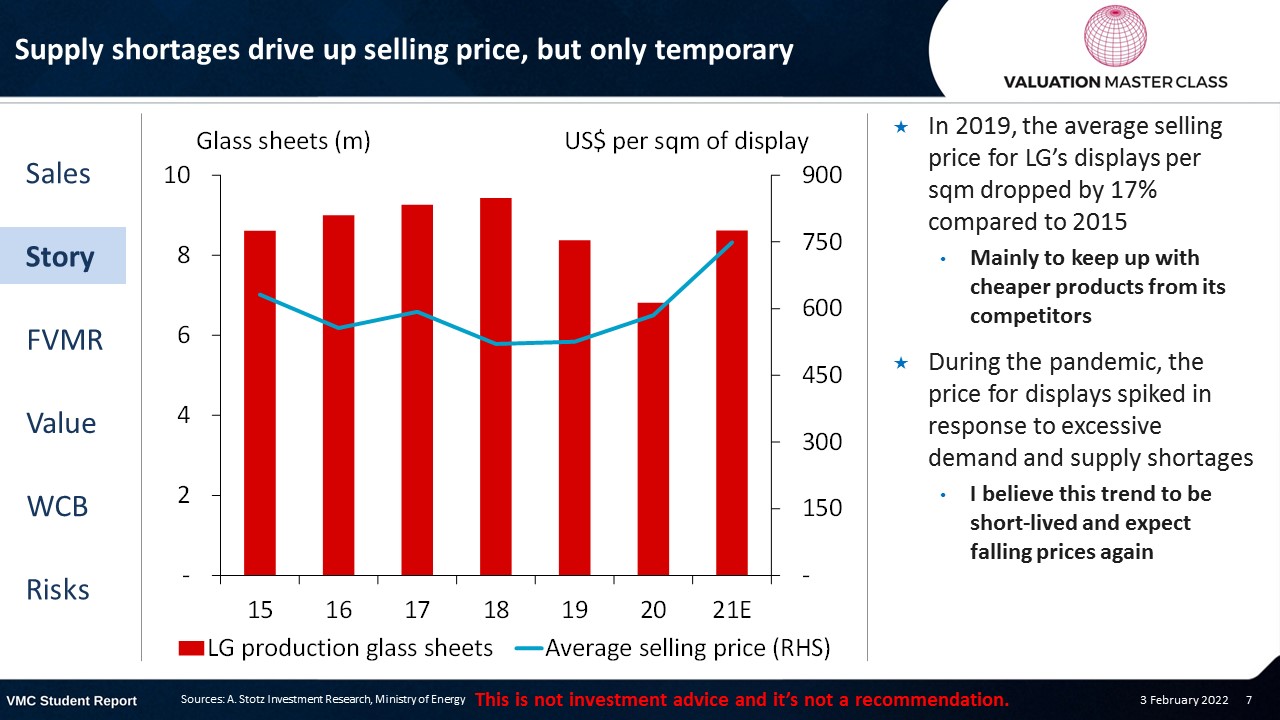

Supply shortages drive up selling price, but only temporary

- In 2019, the average selling price for LG’s displays per sqm dropped by 17% compared to 2015

- Mainly to keep up with cheaper products from its competitors

- During the pandemic, the price for displays spiked in response to excessive demand and supply shortages

- I believe this trend to be short-lived and expect falling prices again

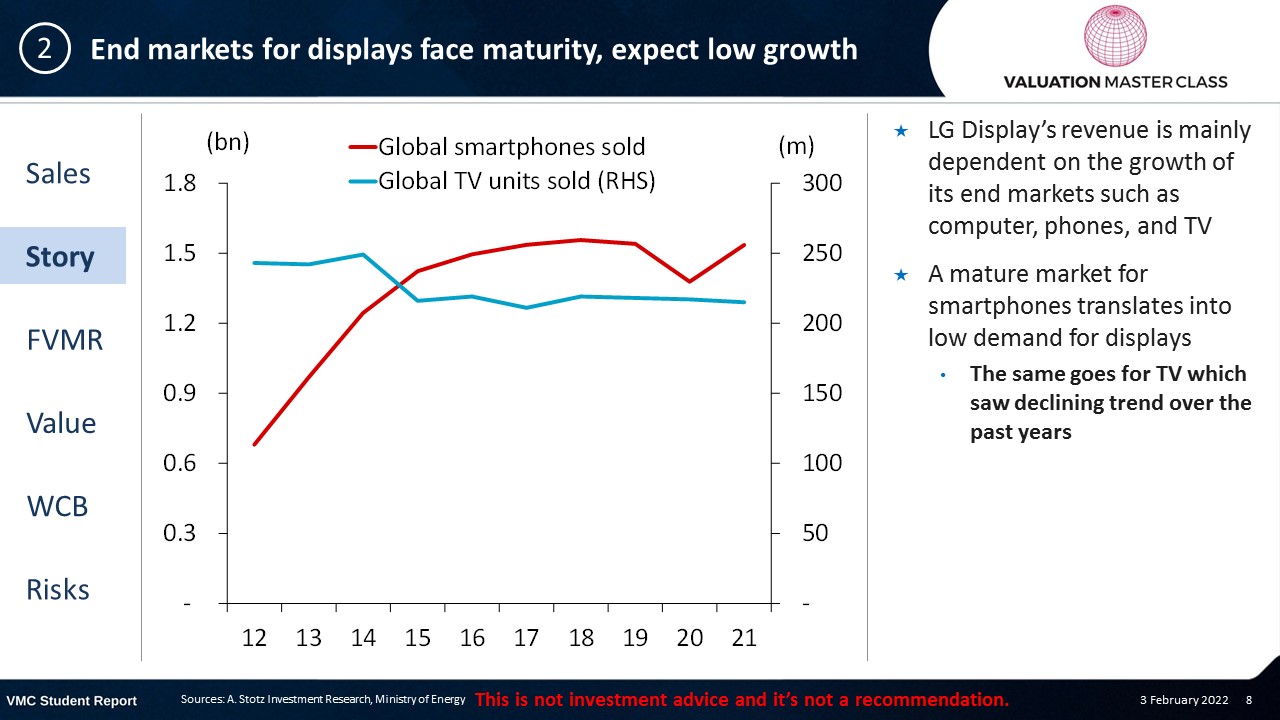

End markets for displays face maturity, expect low growth

- LG Display’s revenue is mainly dependent on the growth of its end markets such as computer, phones, and TV

- A mature market for smartphones translates into low demand for displays

-

- The same goes for TV which saw declining trend over the past years

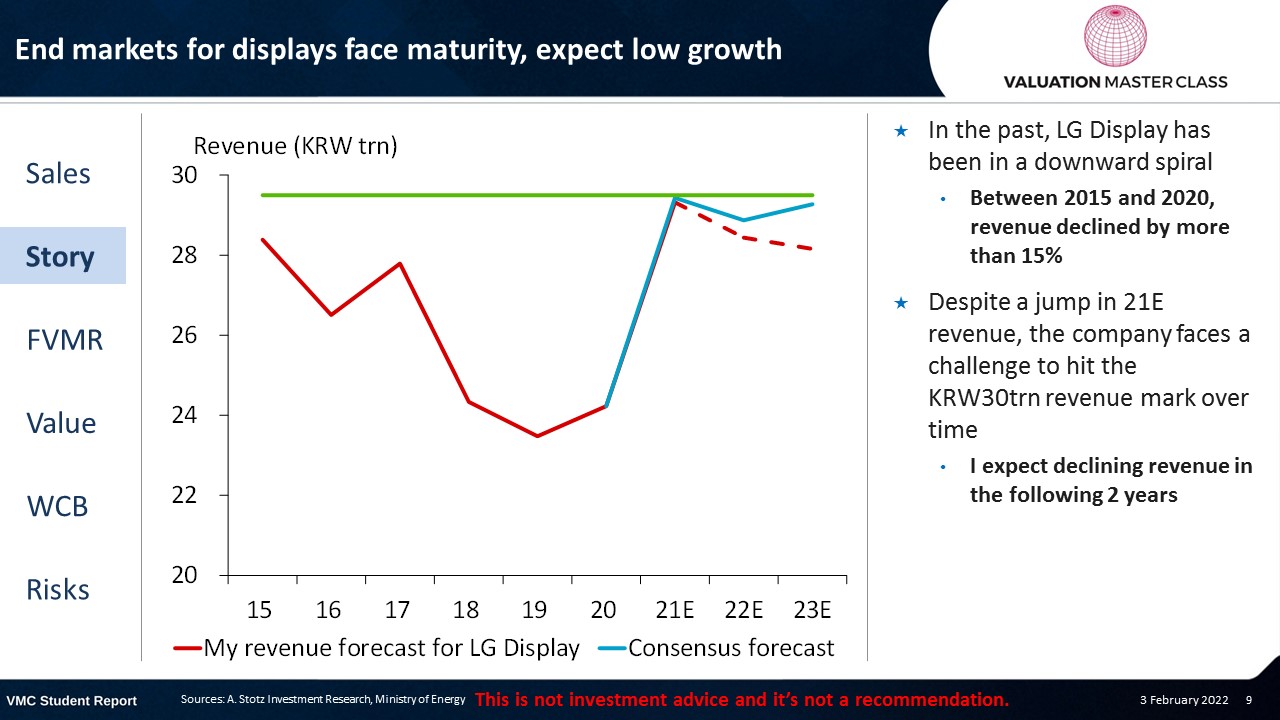

End markets for displays face maturity, expect low growth

- In the past, LG Display has been in a downward spiral

- Between 2015 and 2020, revenue declined by more than 15%

- Despite a jump in 21E revenue, the company faces a challenge to hit the KRW30trn revenue mark over time

- I expect declining revenue in the following 2 years

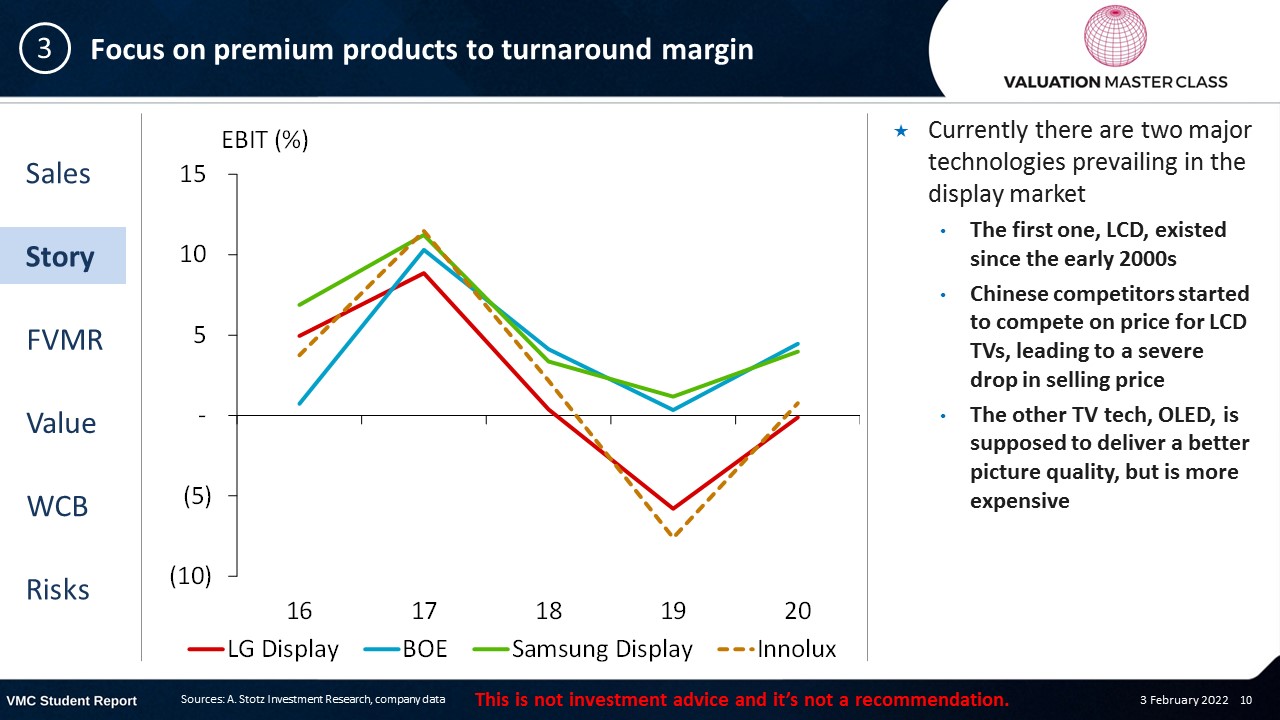

Focus on premium products to turnaround margin

- Currently there are two major technologies prevailing in the display market

- The first one, LCD, existed since the early 2000s

- Chinese competitors started to compete on price for LCD TVs, leading to a severe drop in selling price

- The other TV tech, OLED, is supposed to deliver a better picture quality, but is more expensive

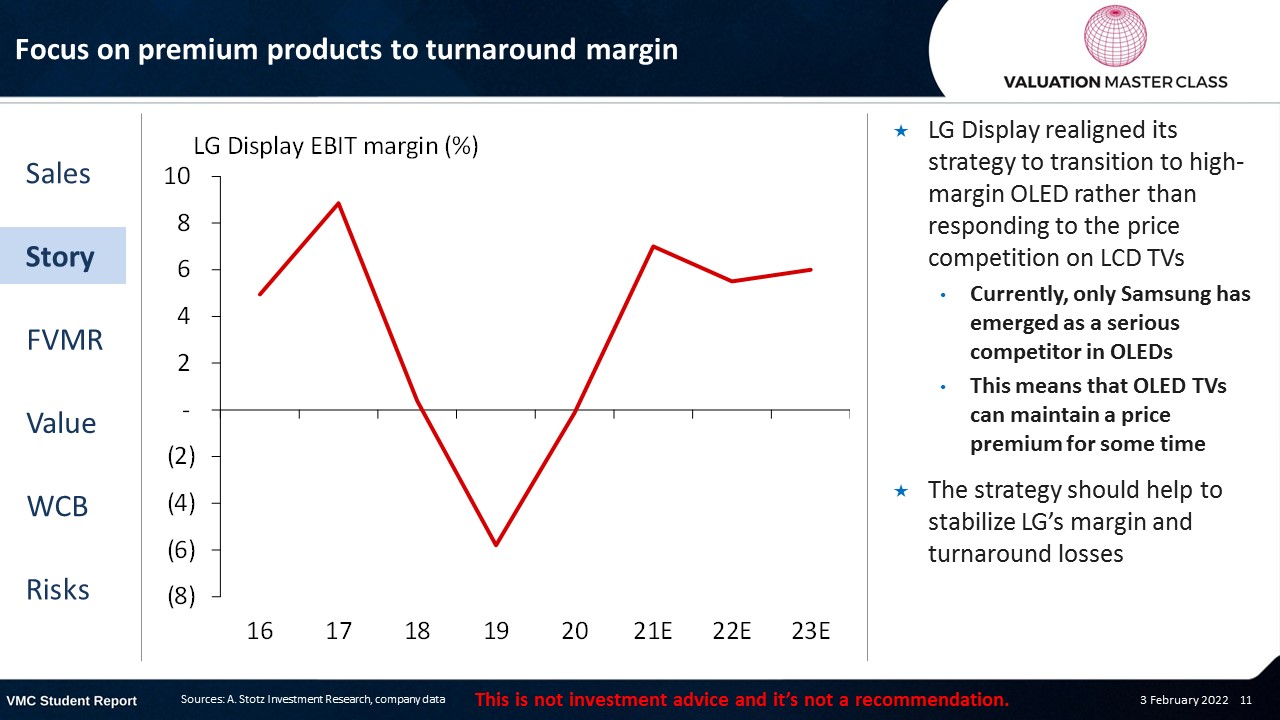

Focus on premium products to turnaround margin

- LG Display realigned its strategy to transition to high-margin OLED rather than responding to the price competition on LCD TVs

- Currently, only Samsung has emerged as a serious competitor in OLEDs

- This means that OLED TVs can maintain a price premium for some time

- The strategy should help to stabilize LG’s margin and turnaround losses

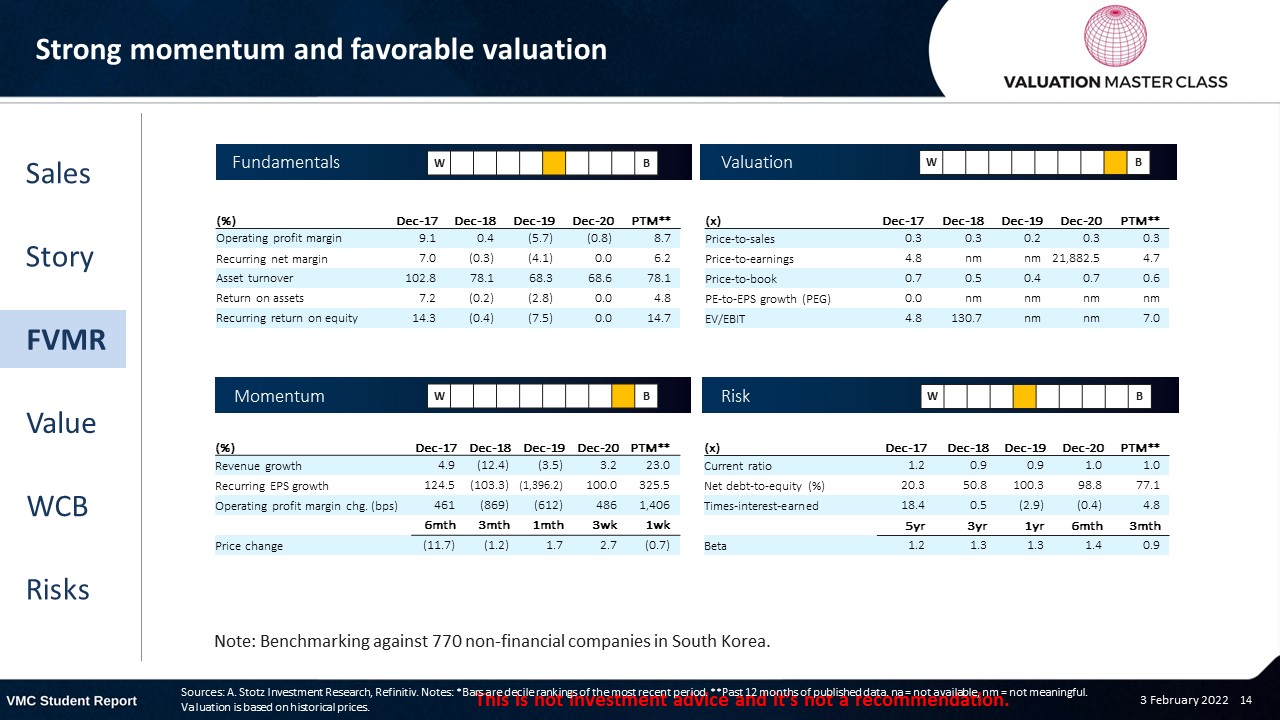

FVMR Scorecard – LG Display

- A stock’s attractiveness relative to stocks in that country or region

- Attractiveness is based on four elements

- Fundamentals, Valuation, Momentum, and Risk (FVMR)

- Scale from 1 (Best) to 10 (Worst)

Consensus sees a cheap opportunity to buy

- Most analysts have issued a BUY recommendations, while 5 analysts recommend a SELL

- Consensus expects a strong revenue boost in 21E, but flat revenue afterward

- They expect the company to turn around its losses and achieve a higher level of margin

Get financial statements and assumptions in the full report

P&L – LG Display

- The company is likely to benefit from supply shortages and excessive demand in 21E

- The average display selling price per sqm has reached its highest level ever

- I consider this effect only temporary

Balance sheet – LG Display

- Contrary to its Chinese competitors, I don’t expect LG Display to pursue an aggressive expansion plan

- The company started to reduce its long-term debt in 21E

Ratios – LG Display

- The company is characterized by rather weak efficiency

- This means that the company needs to increase investments to drive revenue growth

- With the increased focus on producing higher-margin displays to escape the price competition on LCD TVs, I expect the company to maintain a higher margin over time

- However, the competitive advantage is likely to diminish over time which is also incorporated in my forecast

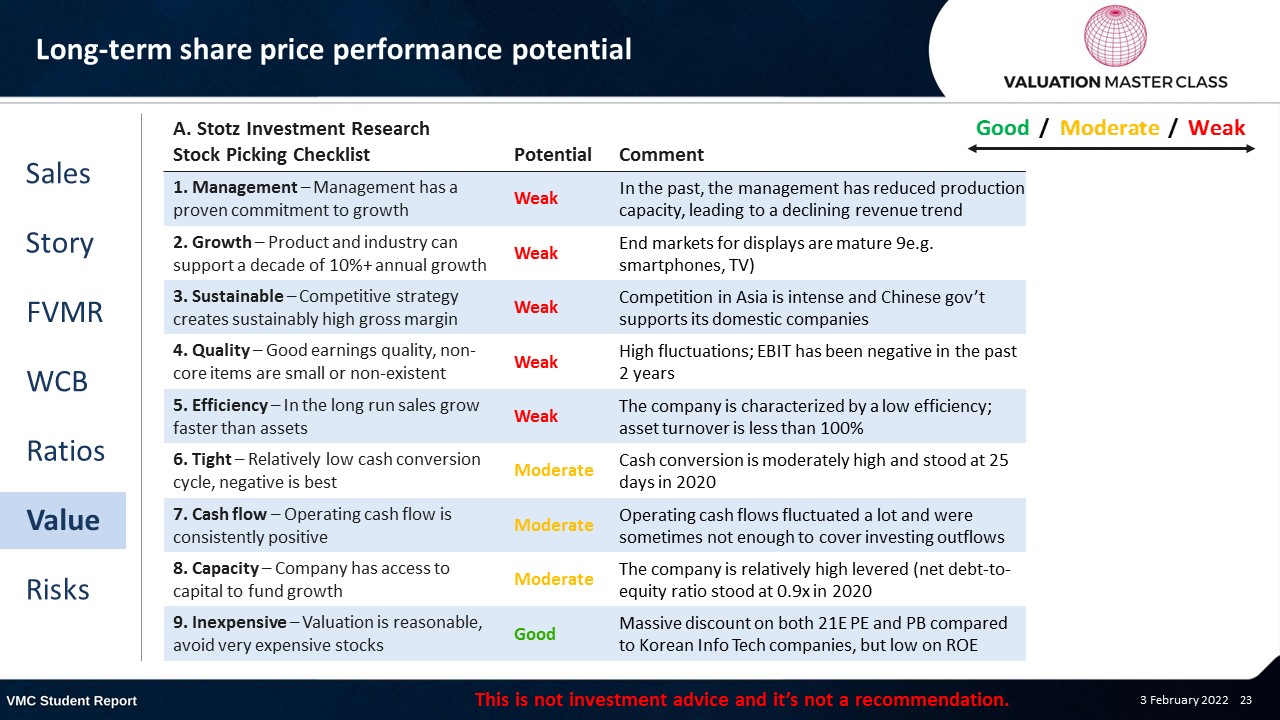

Long-term share price performance potential

Free cash flow – LG Display

- FCFF in 21E was dragged down by massive changes in net working capital, but should stay positive

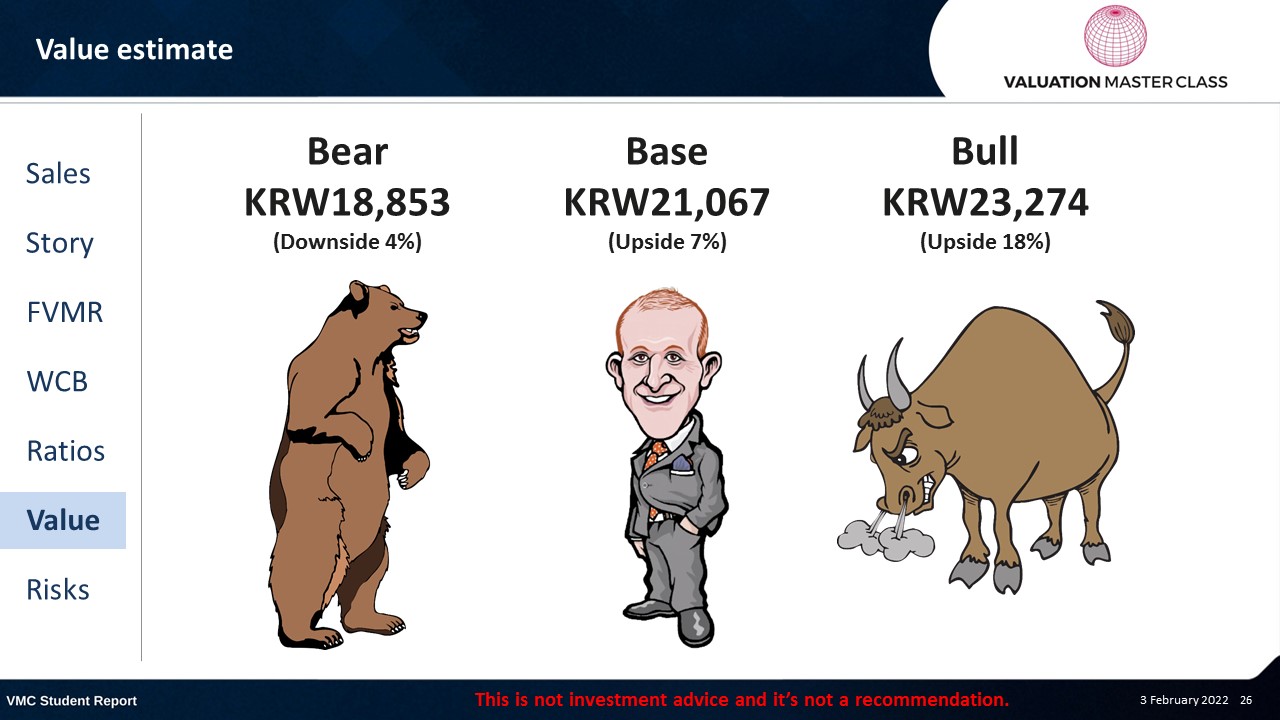

Value estimate – LG Display

- I expect a lower revenue growth than consensus as I assume the temporary price-driven revenue boost to not last much longer

- Quantity sold has been on a declining trend before the pandemic and might continue going forward

- A reasonable terminal growth rate of 2%

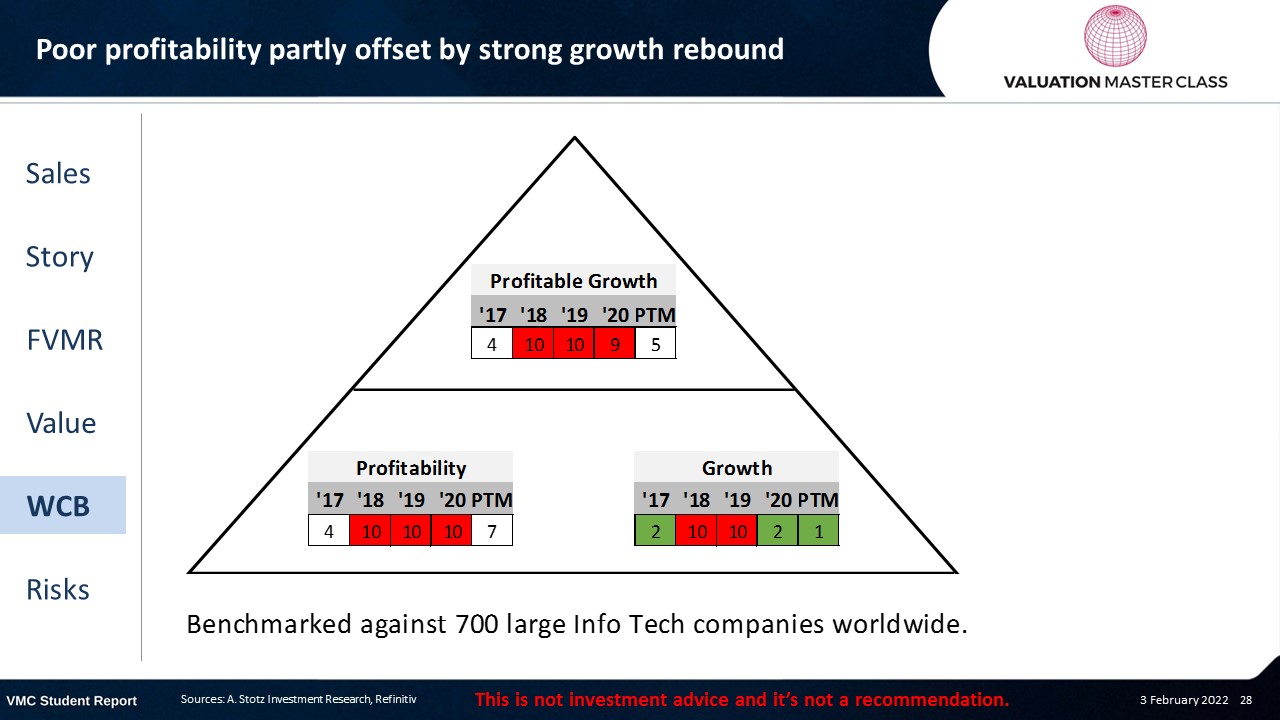

World Class Benchmarking Scorecard – LG Display

- Identifies a company’s competitive position relative to global peers

- Combined, composite rank of profitability and growth, called “Profitable Growth”

- Scale from 1 (Best) to 10 (Worst)

Key risk is intensified price competition

- Failure to keep up with latest technology to maintain competitive advantage

- High concentration of key customers

- Fluctuations in demand as end markets are sensitive to market conditions

Conclusions

- Markets for displays is mature; expect flat or declining revenue

- Focus on OLED technology could bring sustainable higher margin

- Valuation is cheap; but probably for good reasons

Download the full report as a PDF

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.