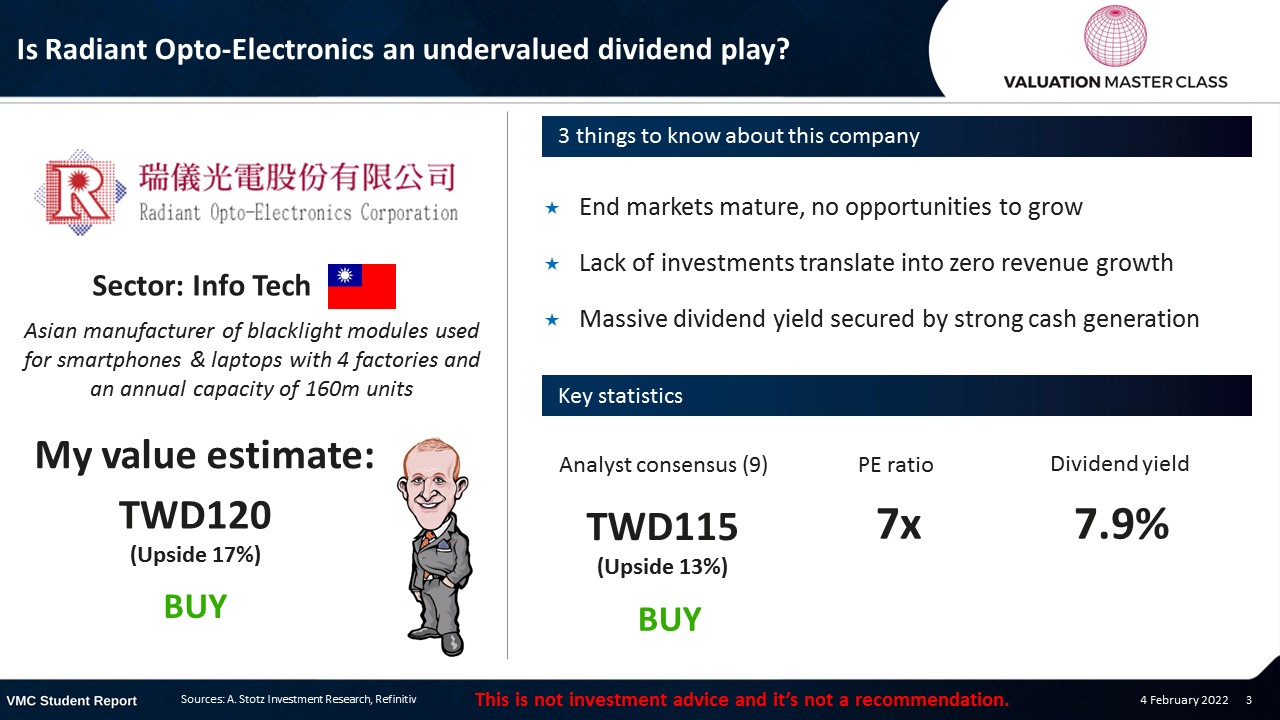

Is Radiant Opto-Electronics an Undervalued Dividend Play?

Highlights:

- End markets mature, no opportunities to grow

- Lack of investments translate into zero revenue growth

- Massive dividend yield secured by strong cash generation

Download the full report as a PDF

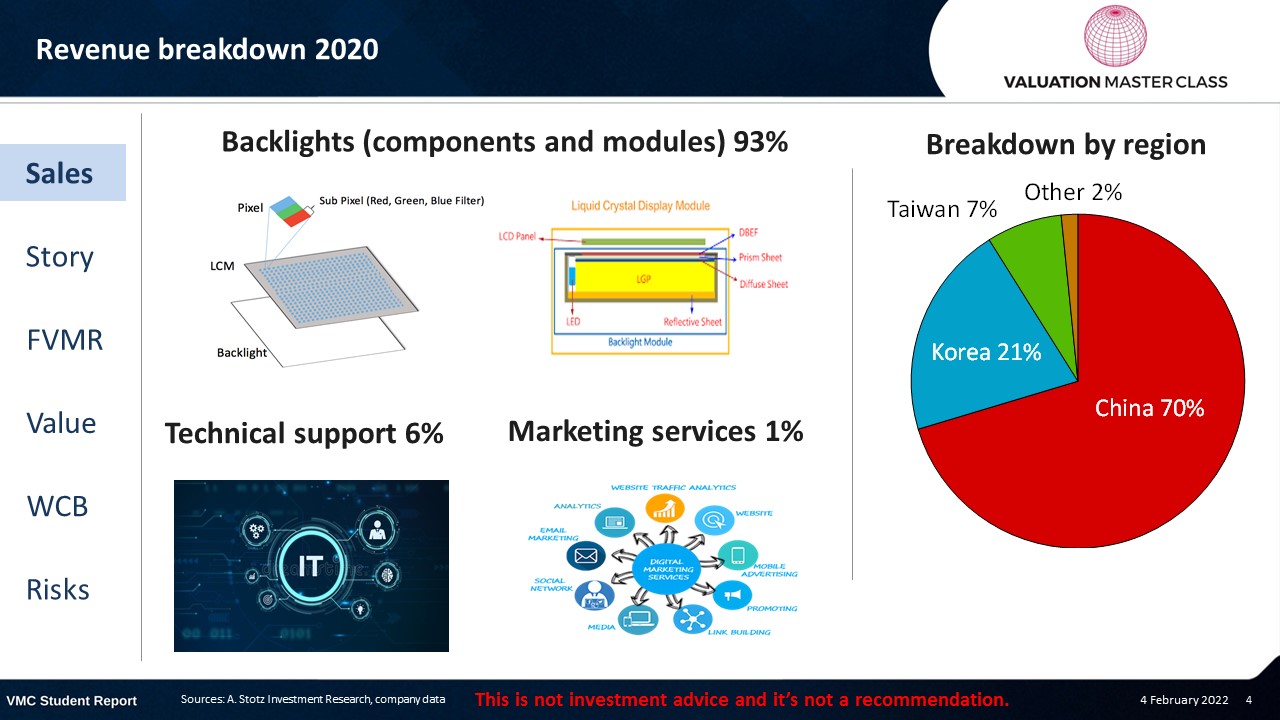

Radiant Opto-Electronics Corporation’s revenue breakdown 2020

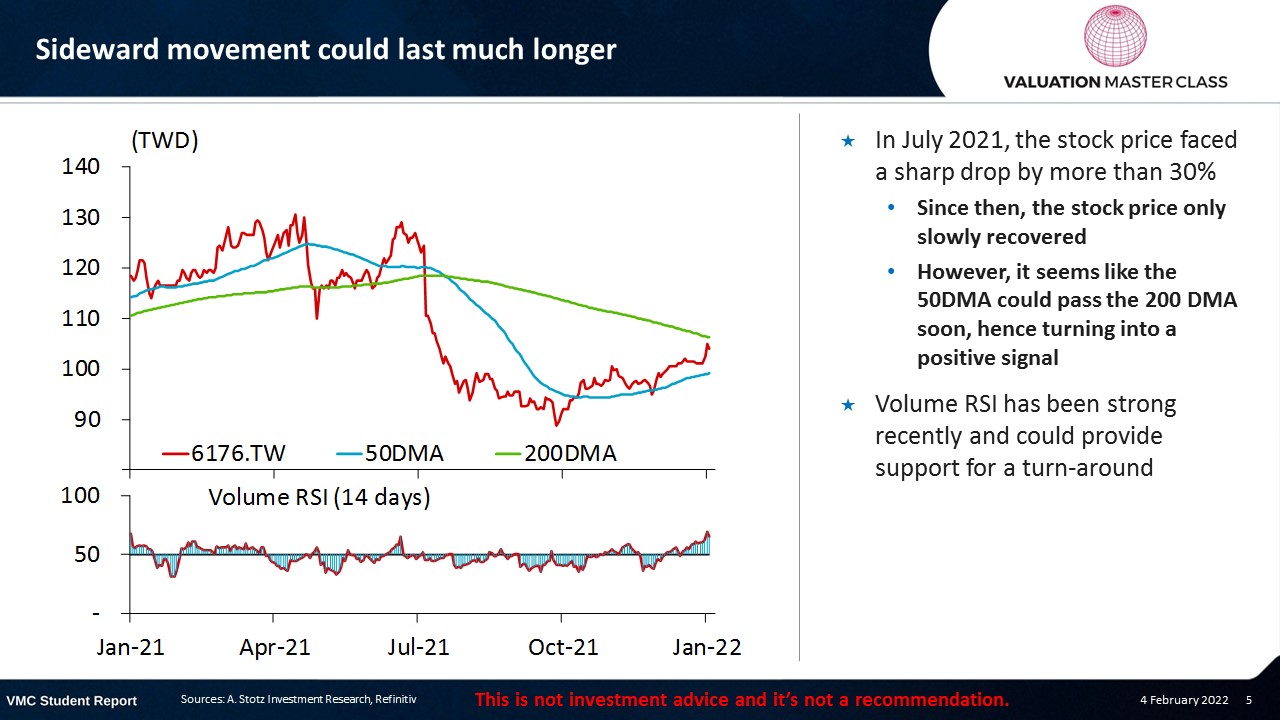

Sideward movement could last much longer

- In July 2021, the stock price faced a sharp drop by more than 30%

- Since then, the stock price only slowly recovered

- However, it seems like the 50DMA could pass the 200 DMA soon, hence turning into a positive signal

- Volume RSI has been strong recently and could provide support for a turn-around

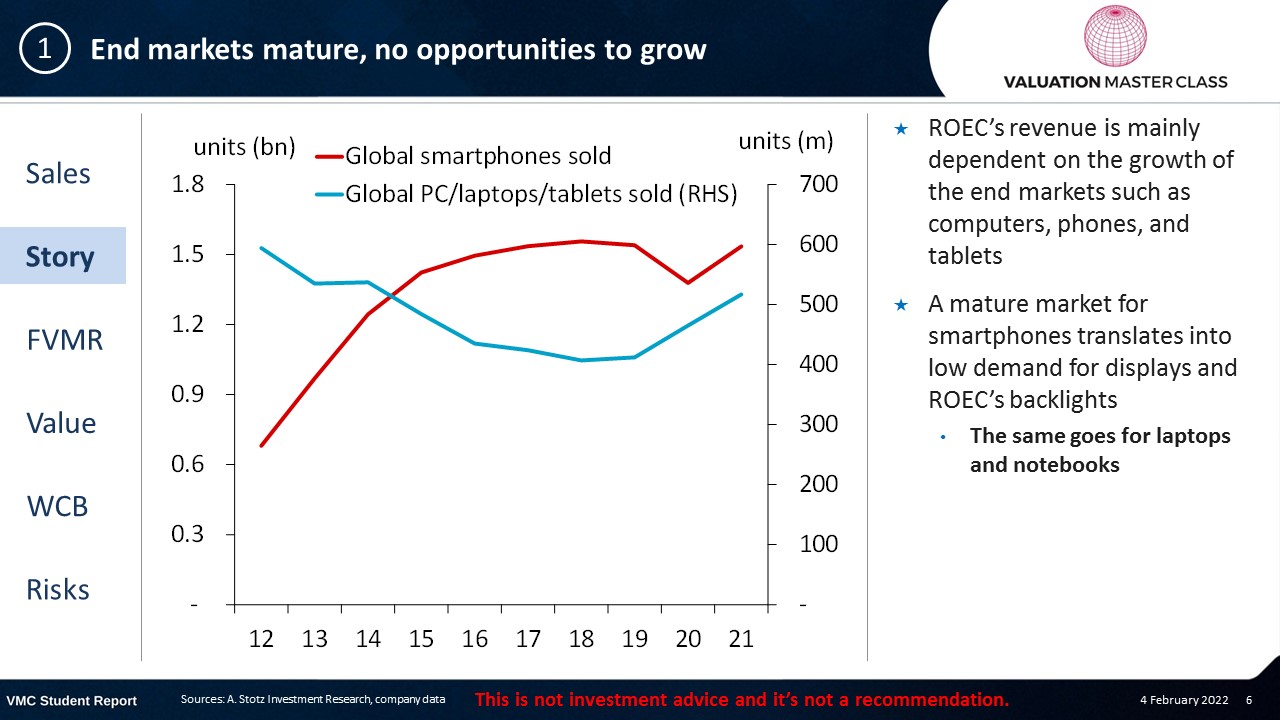

End markets mature, no opportunities to grow

- ROEC’s revenue is mainly dependent on the growth of the end markets such as computers, phones, and tablets

- A mature market for smartphones translates into low demand for displays and ROEC’s backlights

- The same goes for laptops and notebooks

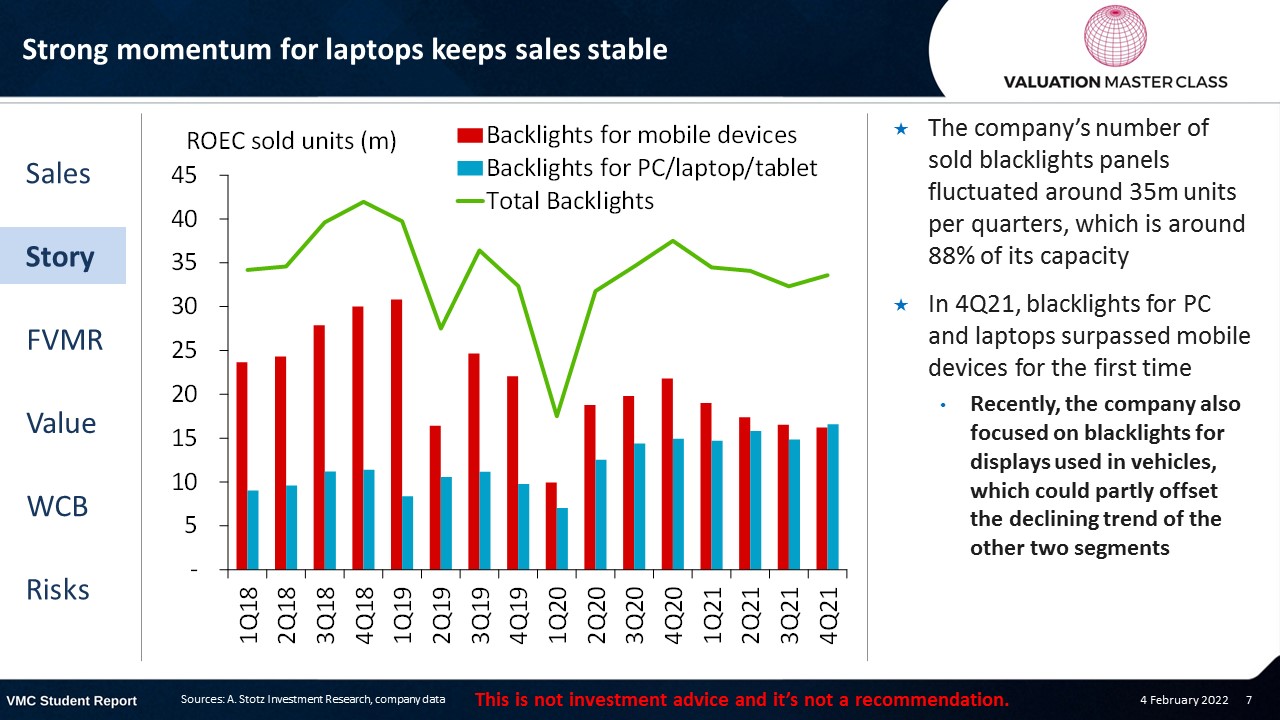

Strong momentum for laptops keeps sales stable

- The company’s number of sold blacklights panels fluctuated around 35m units per quarters, which is around 88% of its capacity

- In 4Q21, blacklights for PC and laptops surpassed mobile devices for the first time

- Recently, the company also focused on blacklights for displays used in vehicles, which could partly offset the declining trend of the other two segments

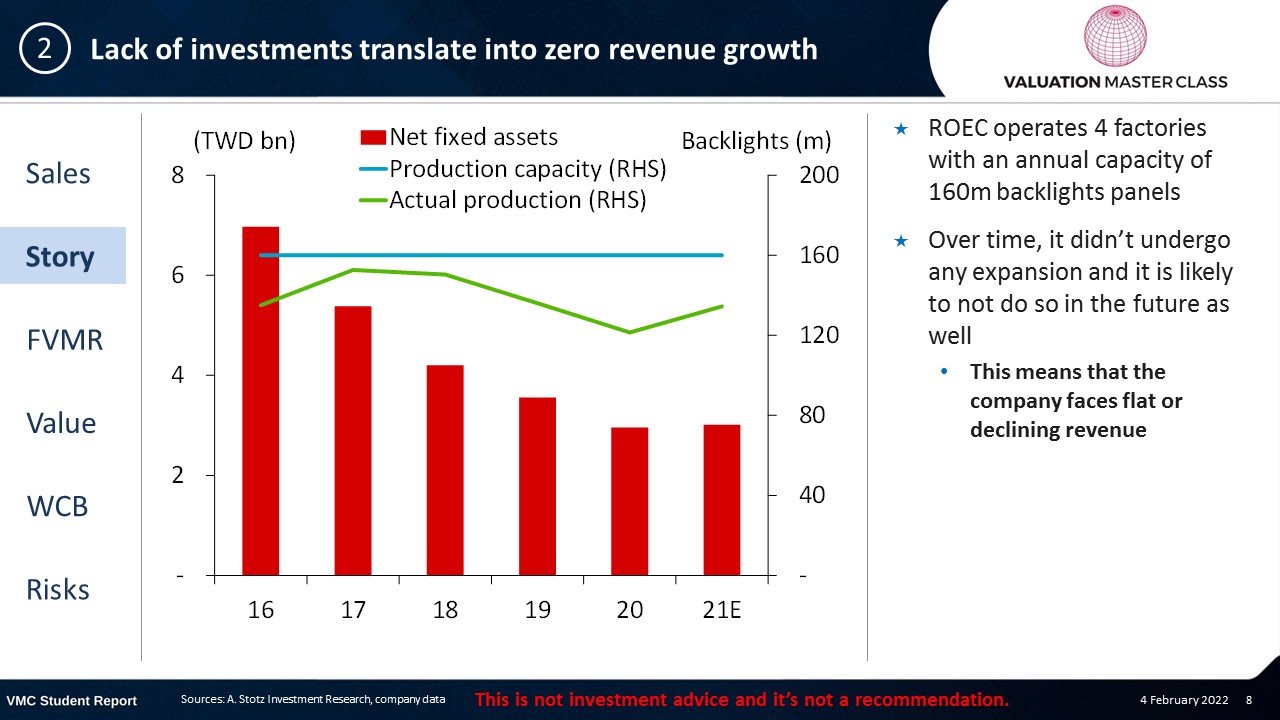

Lack of investments translate into zero revenue growth

- ROEC operates 4 factories with an annual capacity of 160m backlights panels

- Over time, it didn’t undergo any expansion and it is likely to not do so in the future as well

- This means that the company faces flat or declining revenue

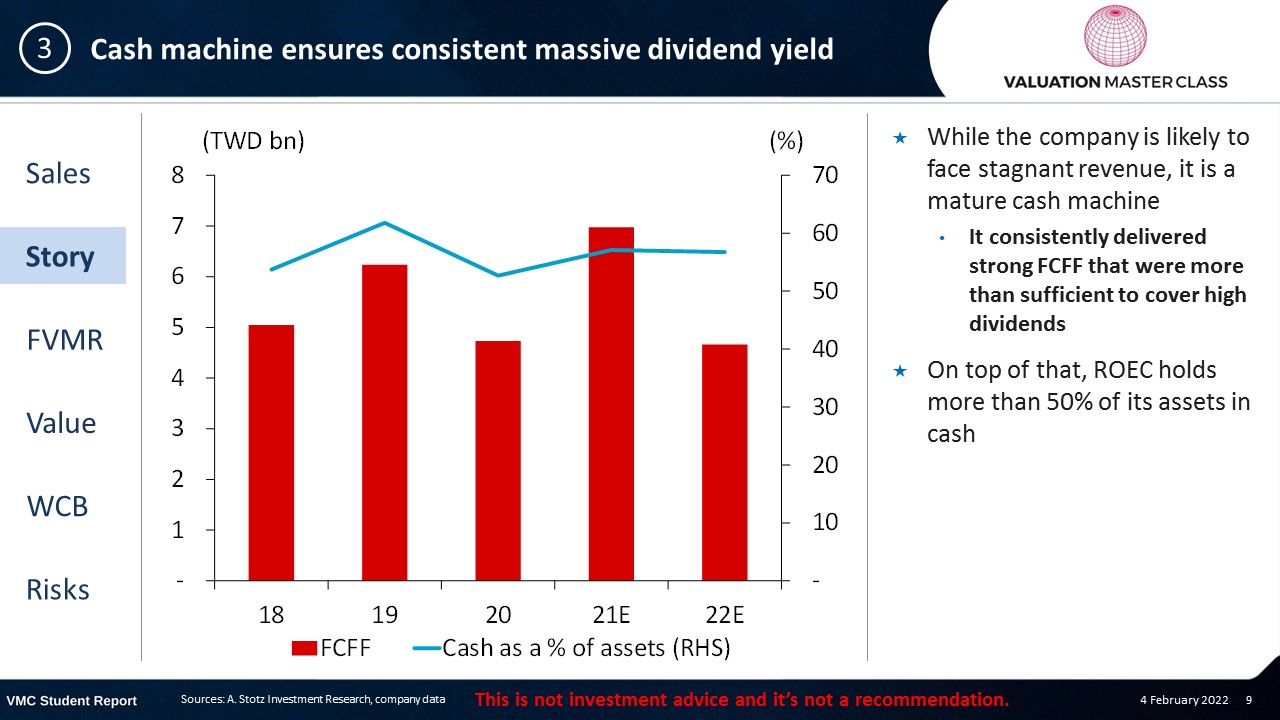

Cash machine ensures consistent massive dividend yield

- While the company is likely to face stagnant revenue, it is a mature cash machine

- It consistently delivered strong FCFF that were more than sufficient to cover high dividends

- On top of that, ROEC holds more than 50% of its assets in cash

What is the free cash flow yield?

- It measures of how much free cash flow the company generates annually relative to the company’s size as measured in market capitalization.

- Here’s the calculation for ROEC

- FCF Yield = FCFF/MarketCap=5bn/47bn=11%

- The FCF yield shows ROEC’s dividend-paying potential

- With 8% dividend yield, the company is paying slightly below its potential

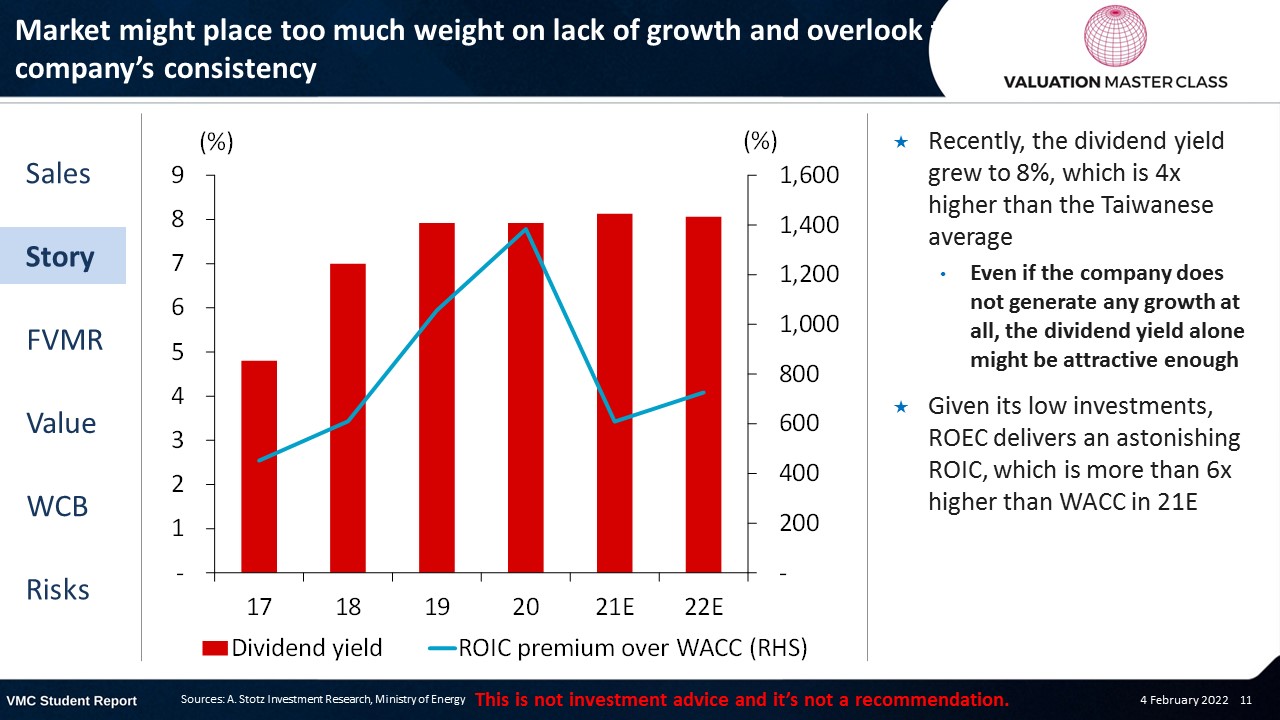

Market might place too much weight on lack of growth and overlook the company’s consistency

- Recently, the dividend yield grew to 8%, which is 4x higher than the Taiwanese average

- Even if the company does not generate any growth at all, the dividend yield alone might be attractive enough

- Given its low investments, ROEC delivers an astonishing ROIC, which is more than 6x higher than WACC in 21E

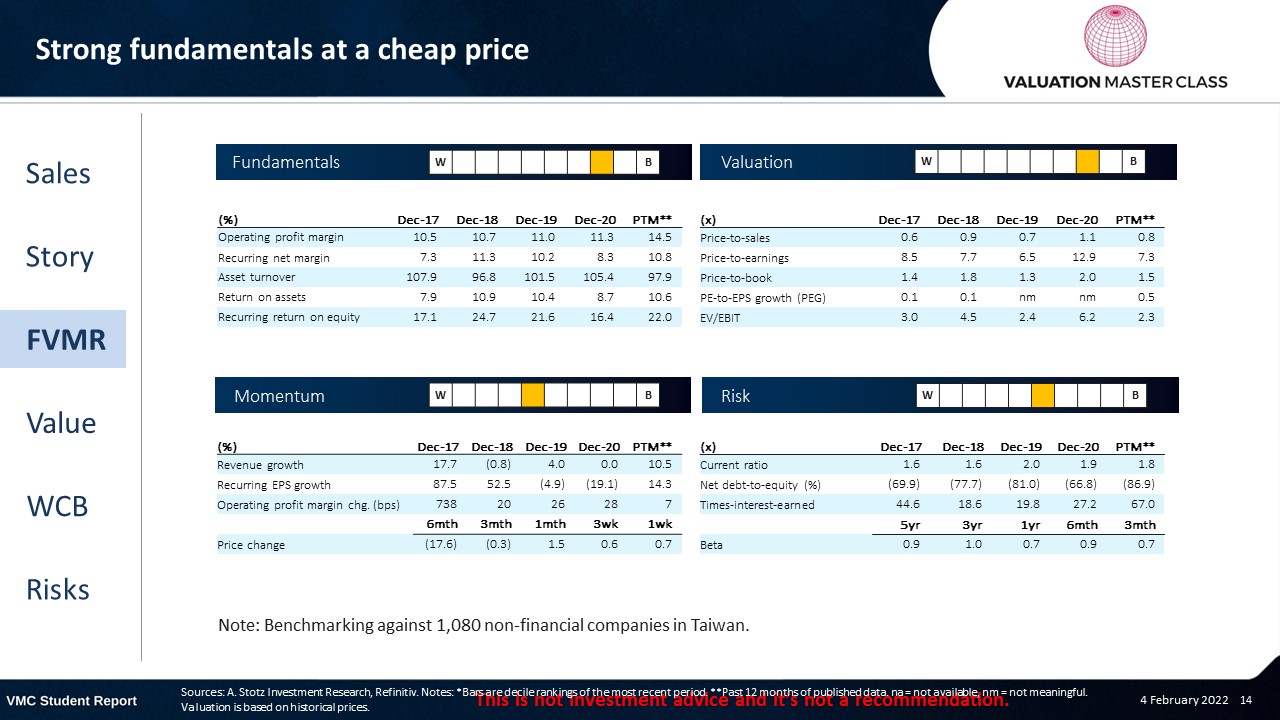

FVMR Scorecard – Radiant Opto-Electronics Corporation

- A stock’s attractiveness relative to stocks in that country or region

- Attractiveness is based on four elements

- Fundamentals, Valuation, Momentum, and Risk (FVMR)

- Scale from 1 (Best) to 10 (Worst)

Consensus sees small upside

- Most analysts issued a HOLD recommendation, while 4 recommend a BUY

- Consensus expects declining revenue from 21E onward

- Still, they expect ROEC to maintain its great margin, delivering consistent profits over time

Get financial statements and assumptions in the full report

P&L – Radiant Opto-Electronics Corporation

- The company is likely to continue delivering strong and stable profits

- Revenue could decline slightly as some display manufacturers (e.g., LG) shift to OLED technology

Balance sheet – Radiant Opto-Electronics Corporation

- Cash holding of 50% of total assets is massive

- Still, the company has no plans to use the cash for investments

- The company has almost no long-term debt, thought is does have short term debt, leading to a negative net debt-to-equity ratio of 0.7x

Ratios – Radiant Opto-Electronics Corporation

- Dividend payout is high which means it has an attractive dividend yield

- EBIT margin on a slightly lower level given an increase of low-cost manufacturers

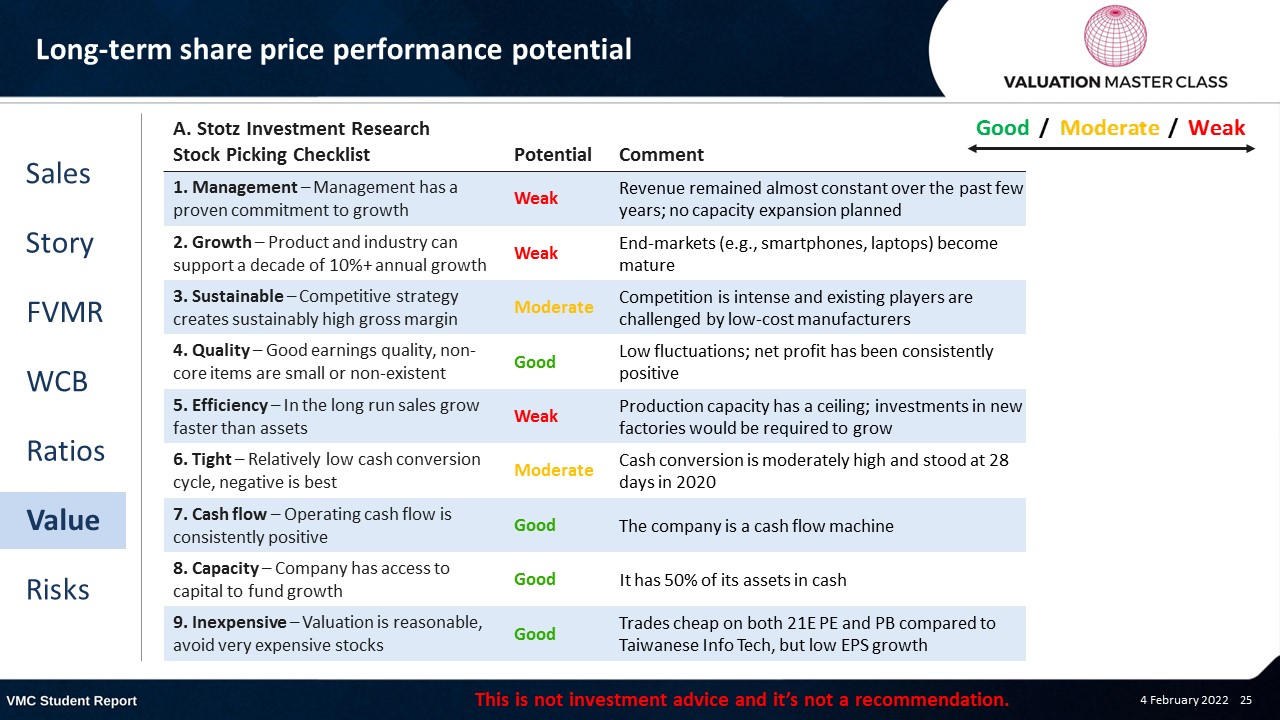

Long-term share price performance potential

Free cash flow – Radiant Opto-Electronics Corporation

- FCFF has been consistently positive, which is important to secure the attractive dividend yield

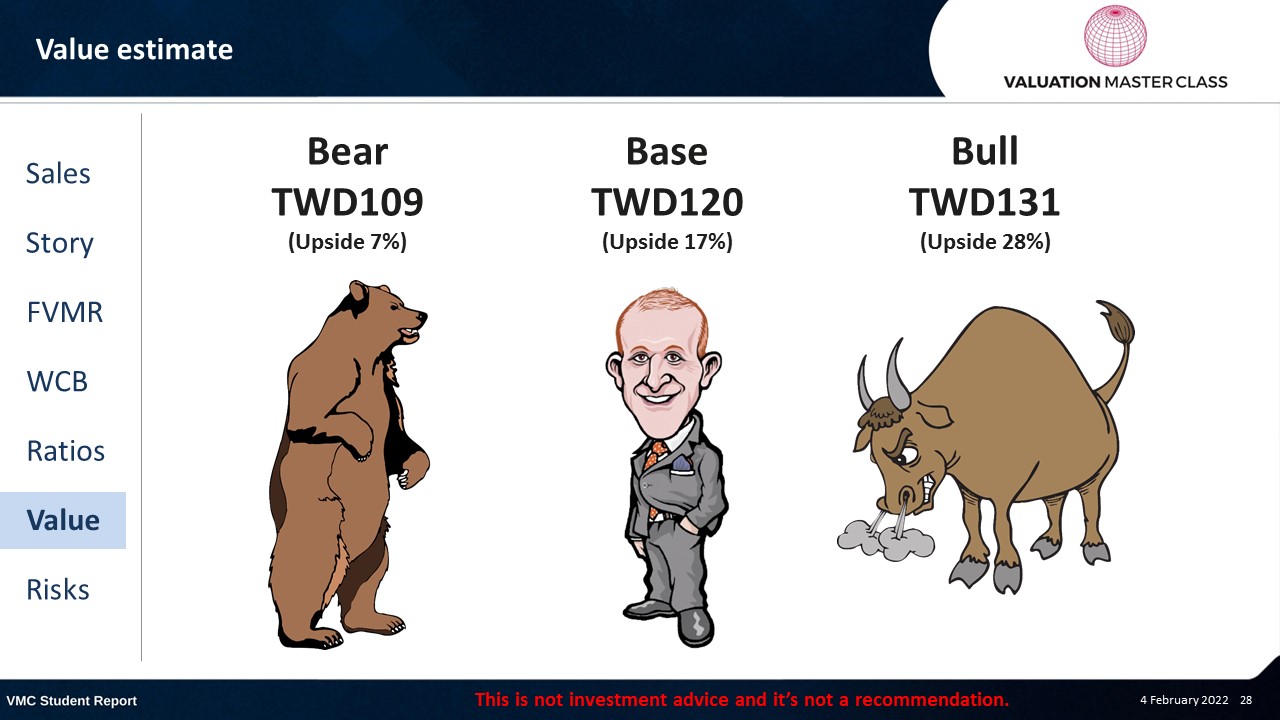

Value estimate – Radiant Opto-Electronics Corporation

- Similar to consensus, I expect declining revenue but a strong margin

- Given the lack of investment plans, I set the terminal growth rate to 0%

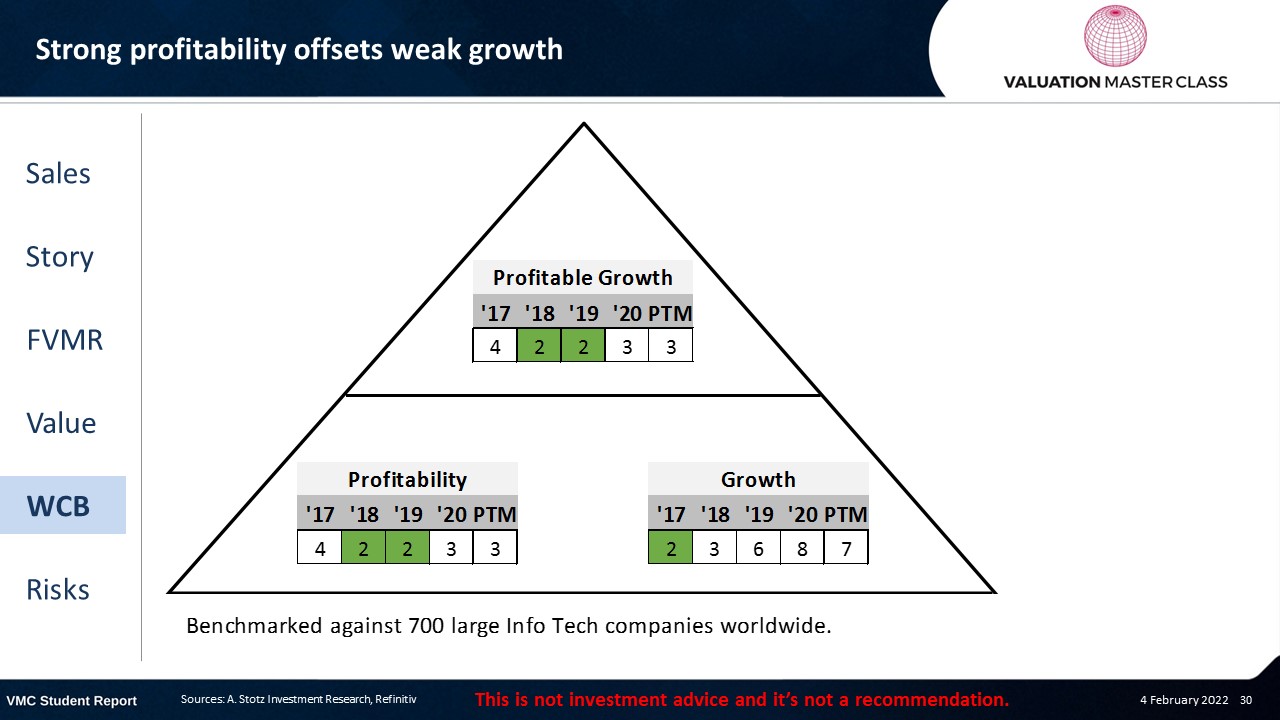

World Class Benchmarking Scorecard – Radiant Opto-Electronics Corporation

- Identifies a company’s competitive position relative to global peers

- Combined, composite rank of profitability and growth, called “Profitable Growth”

- Scale from 1 (Best) to 10 (Worst)

Key risk is intensified price competition

- Low-cost competitors from China could pressure the company to reduce prices

- High customer concentration

- Failure to keep up with technological changes

Conclusions

- Management has no alignment to growth; revenue remains flat

- Strong balance sheet and cash flow generation secure massive dividend yield

- Valuation is expensive, making it an interesting dividend play

Download the full report as a PDF

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.