Is Ralph Lauren’s Polo Shirt Worth More Than Its Share Price?

Strong profitability but low growth in a competitive industry

Highlights:

- Sector-leading margin reaching a peak

- Shifting away from wholesale increases brand value

- With profits back on track, expect rising share repurchases

Download the full report as a PDF

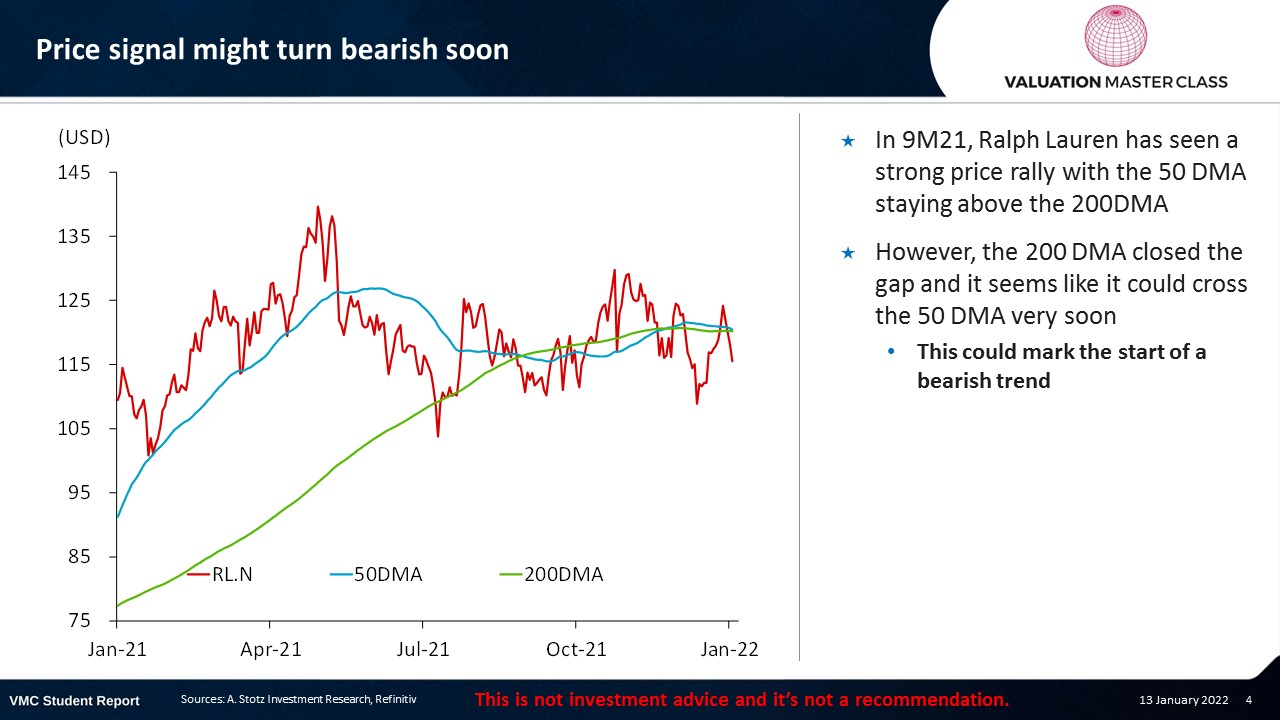

Price signal might turn bearish soon

- In 9M21, Ralph Lauren has seen a strong price rally with the 50 DMA staying above the 200DMA

- However, the 200 DMA closed the gap and it seems like it could cross the 50 DMA very soon

- This could mark the start of a bearish trend

Ralph Lauren’s revenue breakdown 2021

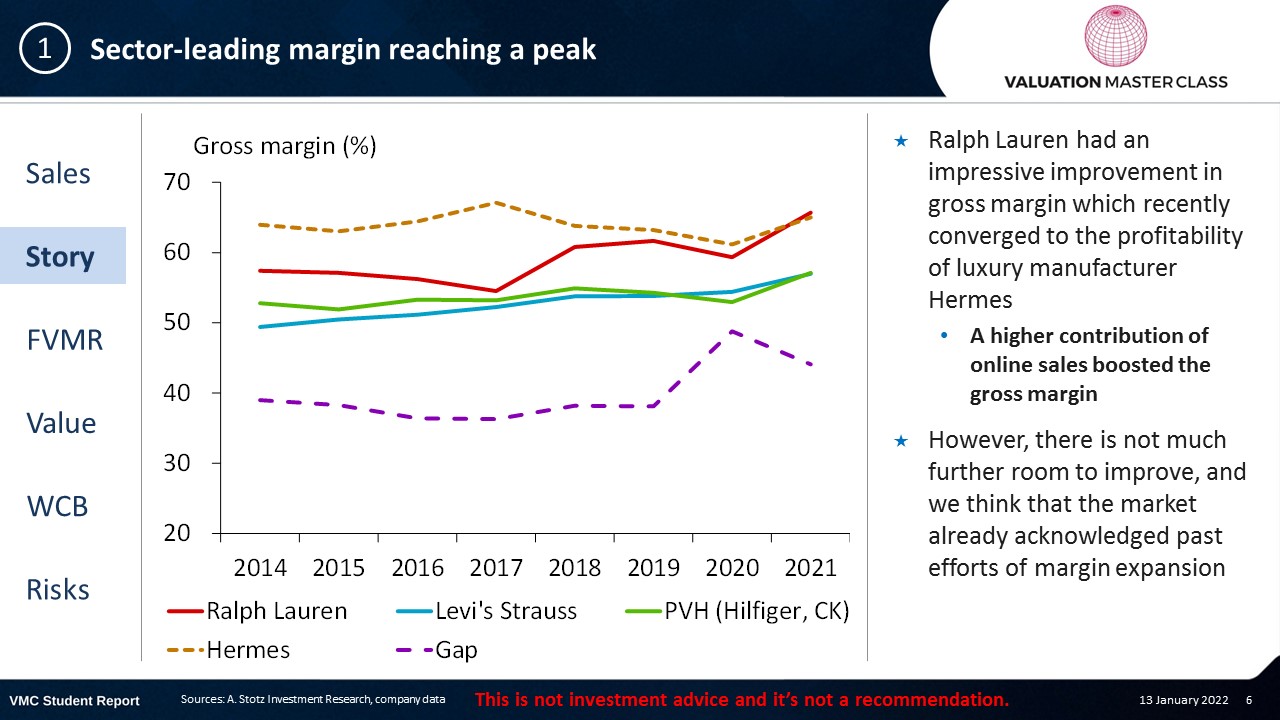

Sector-leading margin reaching a peak

- Ralph Lauren had an impressive improvement in gross margin which recently converged to the profitability of luxury manufacturer Hermes

- A higher contribution of online sales boosted the gross margin

- However, there is not much further room to improve, and we think that the market already acknowledged past efforts of margin expansion

Avoid overly optimistic gross margin forecast

- Analysts generally tend to be overly optimistic and forecast a high, or rising, gross margin

- However, at some point, companies face a ceiling where they can not further improve their margin

- In the case of Ralph Lauren, it seems like that the company converges closely to that point

- Be careful when forecasting gross margin, because a small percentage change, like even a 1% increase, can have a massive impact on net profit

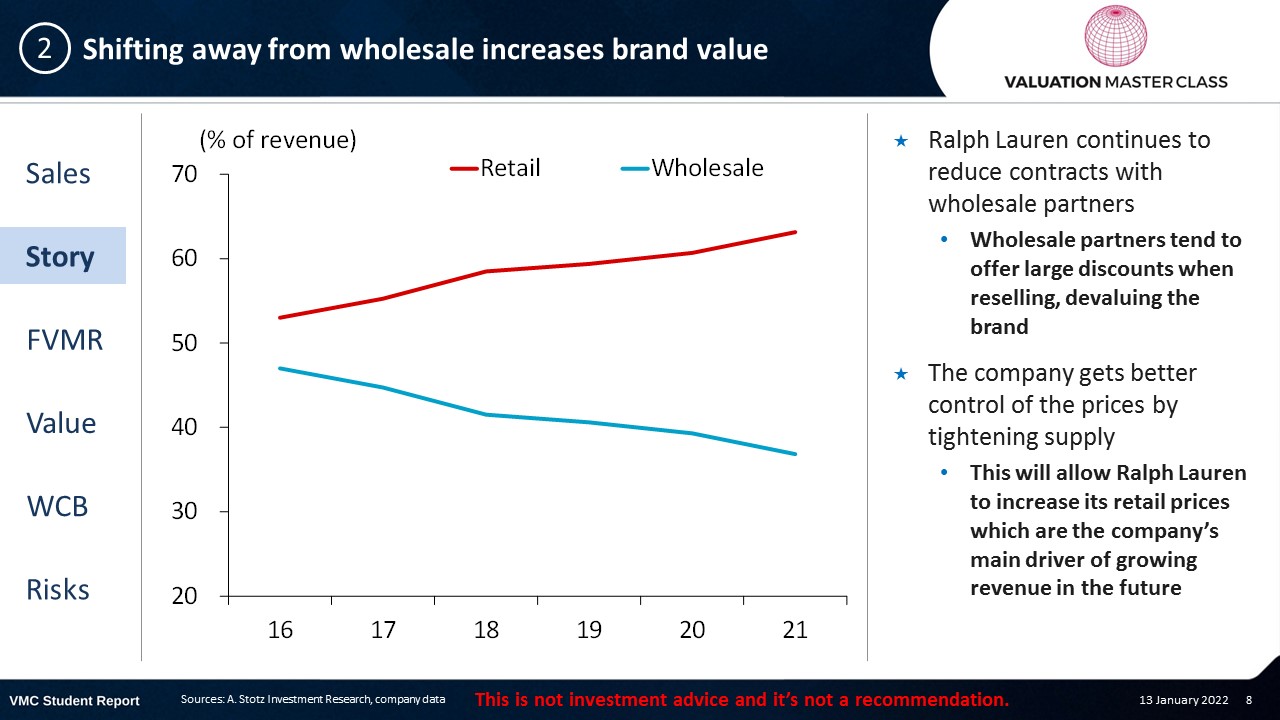

Shifting away from wholesale increases brand value

- Ralph Lauren continues to reduce contracts with wholesale partners

- Wholesale partners tend to offer large discounts when reselling, devaluing the brand

- The company gets better control of the prices by tightening supply

- This will allow Ralph Lauren to increase its retail prices which are the company’s main driver of growing revenue in the future

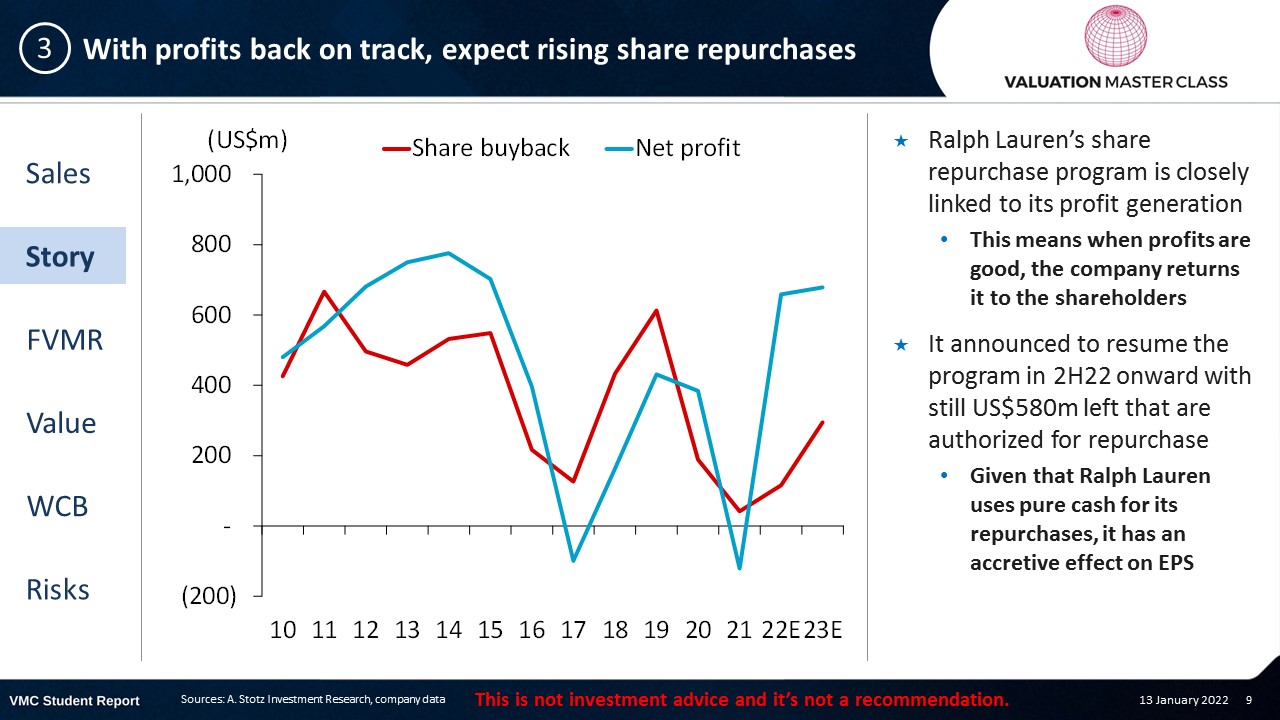

With profits back on track, expect rising share repurchases

- Ralph Lauren’s share repurchase program is closely linked to its profit generation

- This means when profits are good, the company returns it to the shareholders

- It announced to resume the program in 2H22 onward with still US$580m left that are authorized for repurchase

- Given that Ralph Lauren uses pure cash for its repurchases, it has an accretive effect on EPS

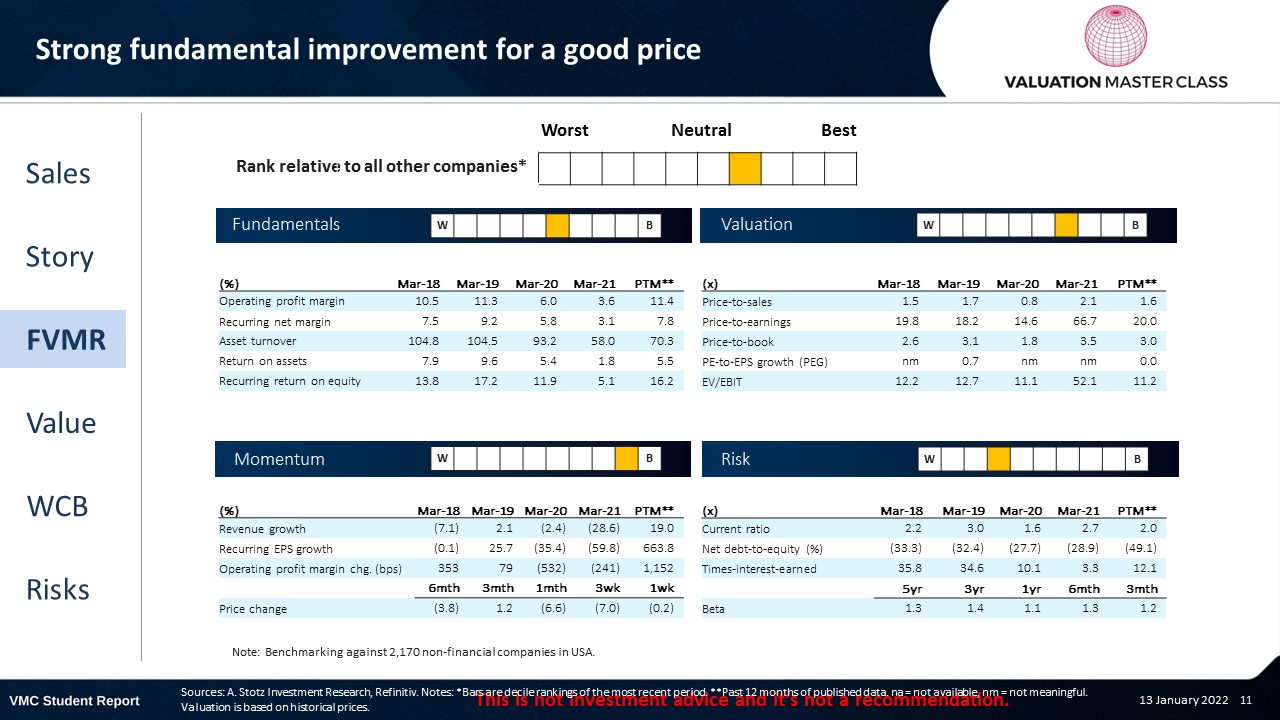

FVMR Scorecard – Ralph Lauren

- A stock’s attractiveness relative to stocks in that country or region

- Attractiveness is based on four elements

- Fundamentals, Valuation, Momentum, and Risk (FVMR)

- Scale from 1 (Best) to 10 (Worst)

Consensus remains optimistic regarding profitability turnaround

- Analysts’ consensus sees upside but most of them are still have HOLD recommendations

- What does a HOLD mean these days anyways?

- They expect the company to maintain the increased gross margin and even expand it by 50bps until 2023

Get financial statements and assumptions in the full report

P&L – Ralph Lauren

- Net profit sees a strong rebound and exceeds its pre-pandemic level

- Both higher revenue and margin expansion contributed to the strong bottom-line

Balance sheet – Ralph Lauren

- The company has a massive cash position, holding around 33% of its assets in cash as of 2021

- The strong cash generation ability makes us assume that Ralph Lauren can resume its previous share repurchase program

- Large profits in 22E and 23E allow the company to repay part of its previous issued debt

Cash flow statement – Ralph Lauren

- Strong operating cash flow allows the company to pay out dividends which are in line with its pre=pandemic policy

- We expect that the dividend yield over the near-term to range between 2-3%

Ratios – Ralph Lauren

- After the revenue rebound in 22E, we assume revenue growth to normalize

- Going forward, we see the revenue growth potential between 3-4%

- EBIT margin is likely to expand significantly through better cost control

- We see an EBIT margin around 15% as a maximum for this Ralph Lauren

- So, we already have an optimistic bias

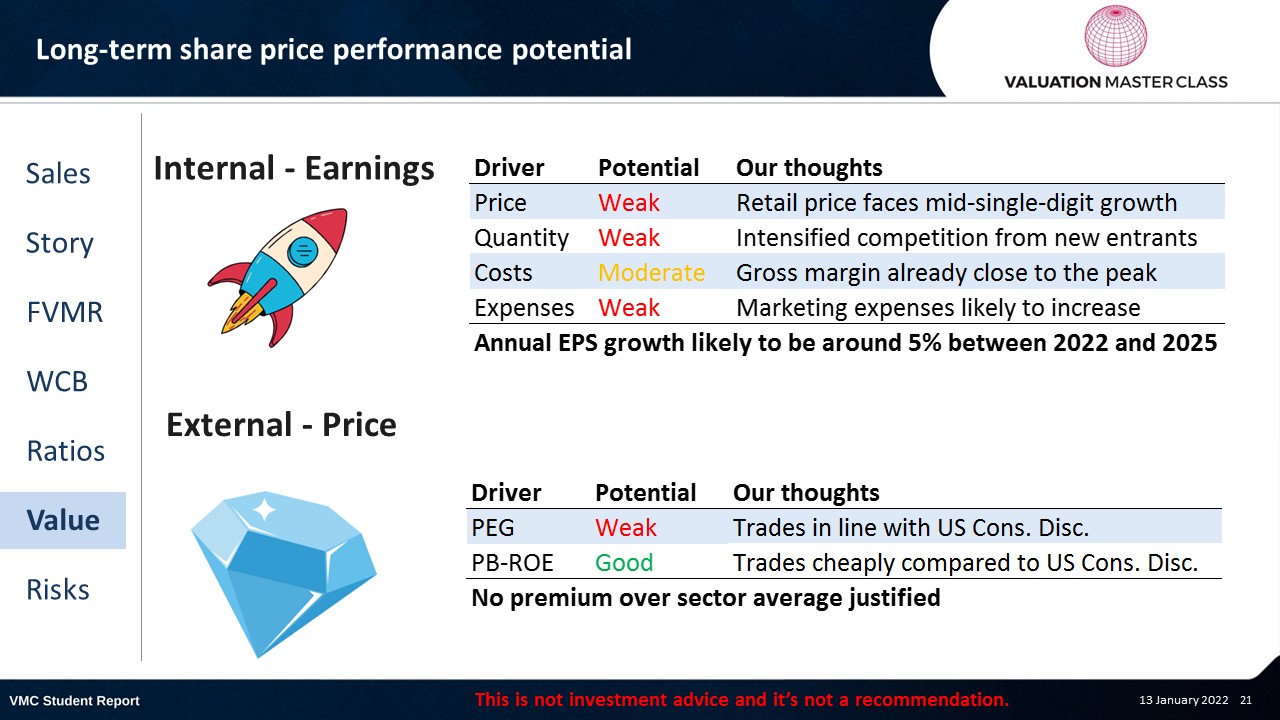

Long-term share price performance potential

Free cash flow – Ralph Lauren

- Over the past years, Ralph Lauren has proven its consistent cash generation ability

- There is no indicator to assume differently for the future

Value estimate – Ralph Lauren

- Similar to consensus, we expect a stronger margin compared to the past

- The revenue growth CAGR might appear huge but is mainly driven by a rebound effect in the current year

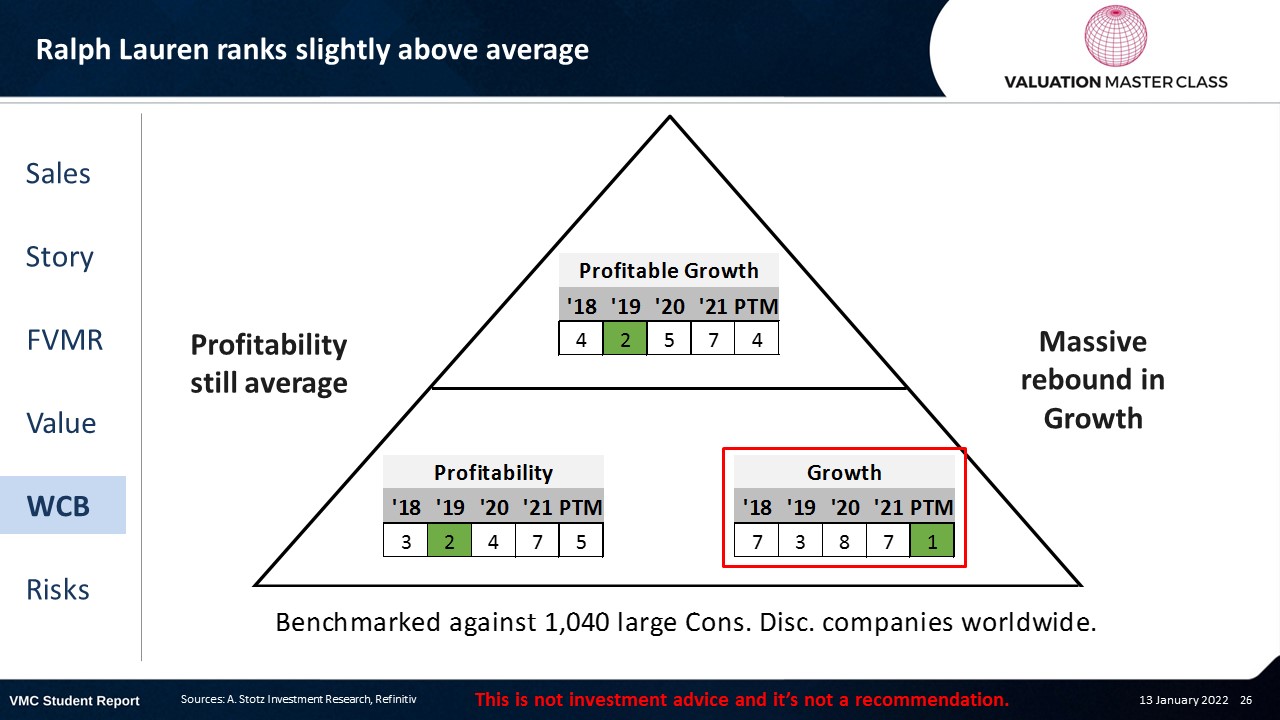

World Class Benchmarking Scorecard – Ralph Lauren

- Identifies a company’s competitive position relative to global peers

- Combined, composite rank of profitability and growth, called “Profitable Growth”

- Scale from 1 (Best) to 10 (Worst)

Key risk is falling behind in online sales

- Intensified competition from new entrants and urban-lifestyle brands

- Adverse economic conditions could hamper the cyclical Consumer Discretionary sector

- Failure to meet growing demand for e-commerce

Conclusions

- Weak potential to drive earnings growth internally

- Strong margin expansion already acknowledged by the market

- Dividend yield and share repurchases are not sufficient to compensate lack of upside

Download the full report as a PDF

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.