Let’s Help Elon Musk Take a Deep Dive into Twitter’s Valuation

What’s interesting about Twitter is that it makes a better toy for Elon than an investment

Download the full report as a PDF

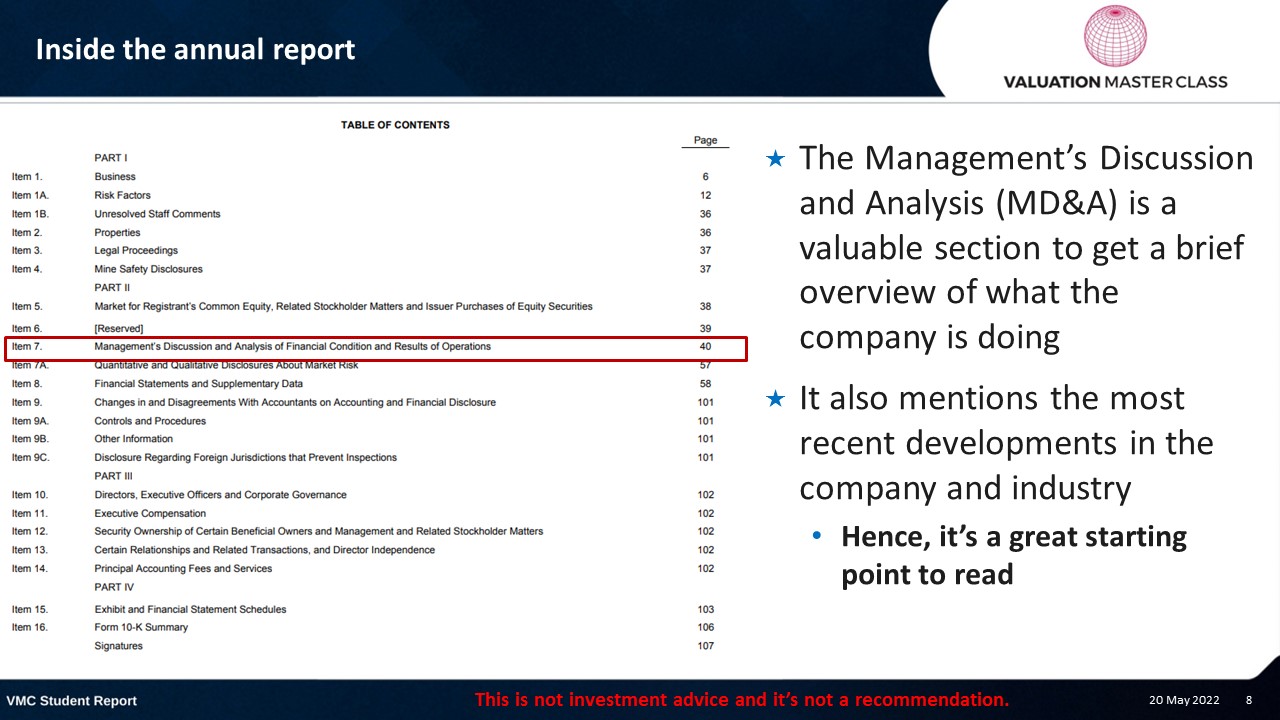

Let’s go to the latest annual report

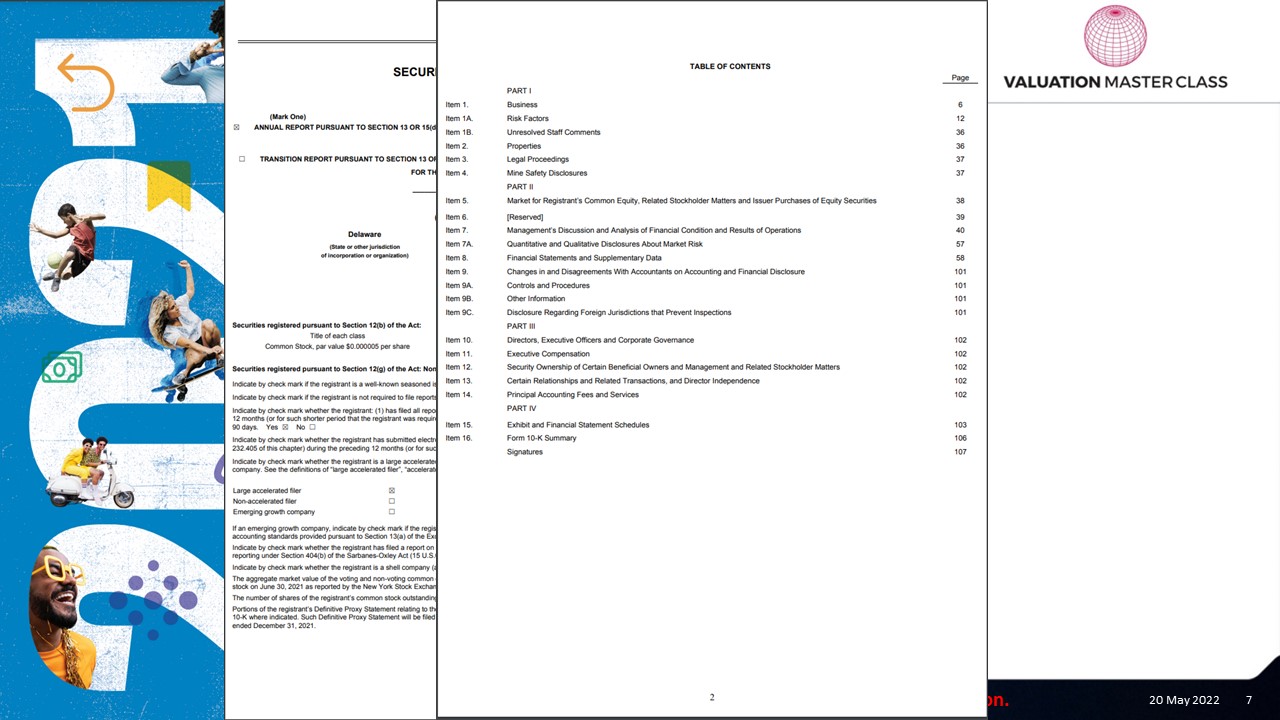

Inside the annual report

- The Management’s Discussion and Analysis (MD&A) is a valuable section to get a brief overview of what the company is doing

- It also mentions the most recent developments in the company and industry

- Hence, it’s a great starting point to read

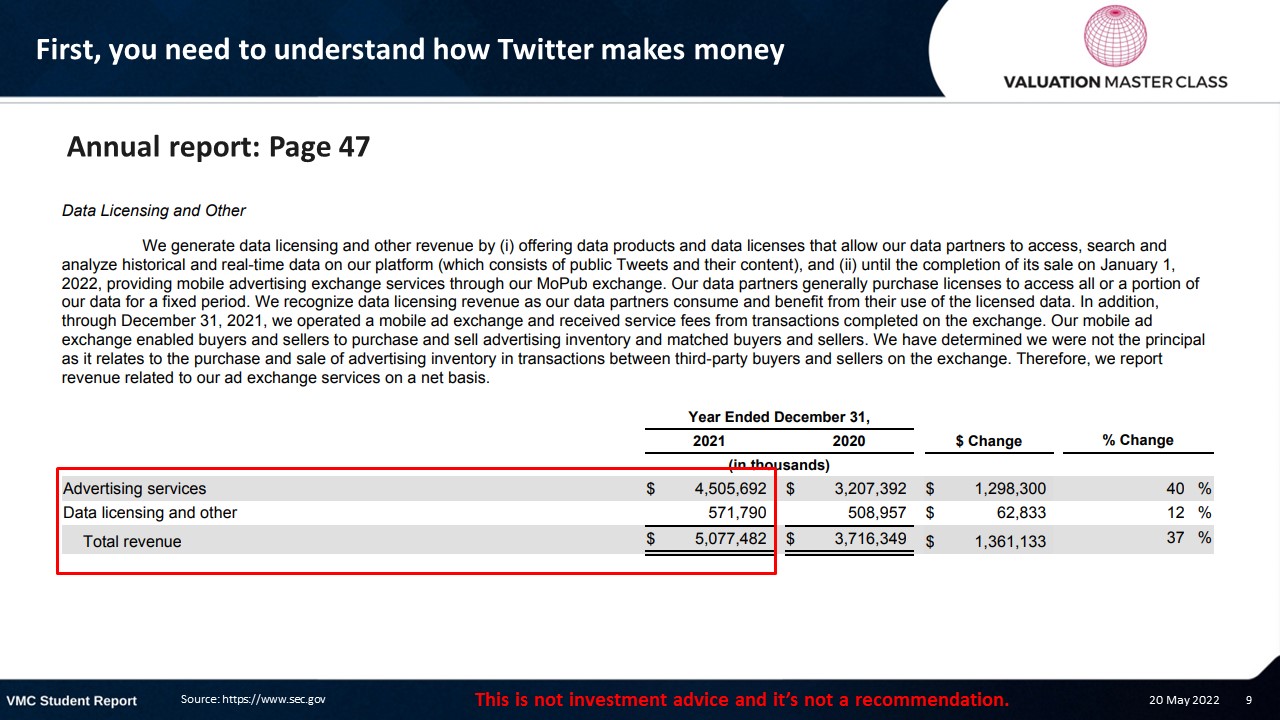

First, you need to understand how Twitter makes money

Let’s do a revenue breakdown of Twitter together

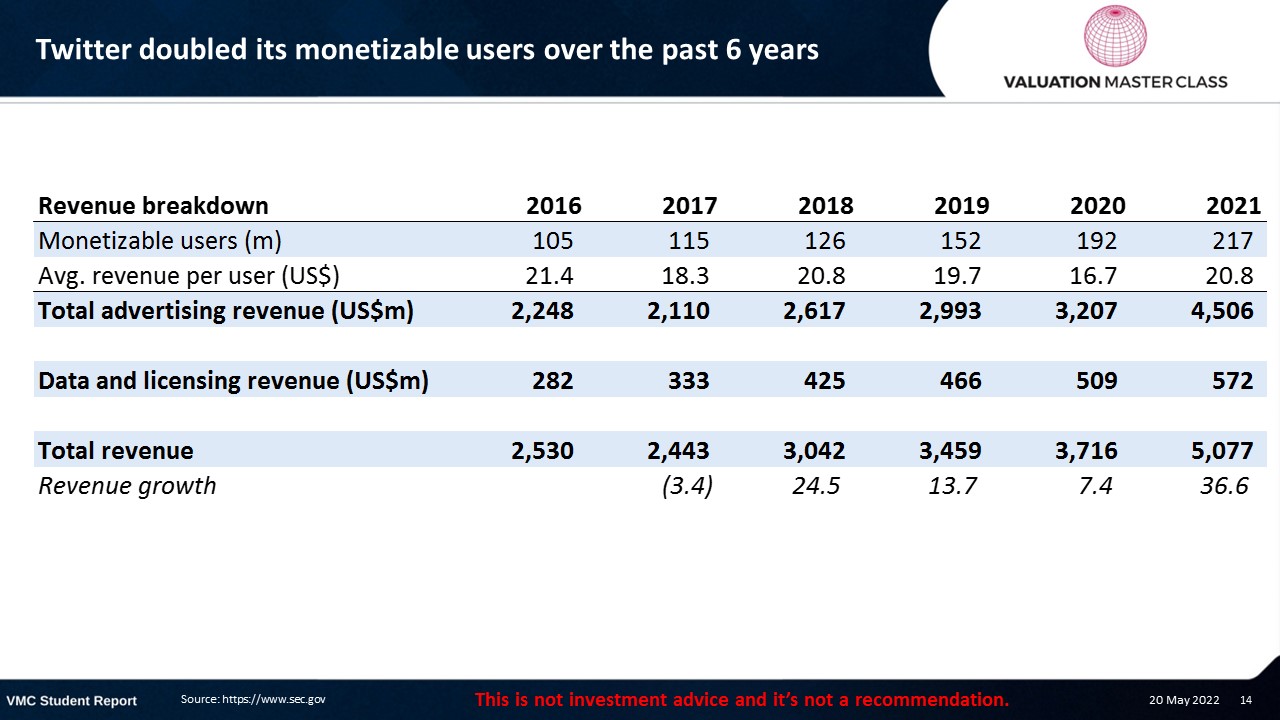

Main driver of Twitter’s revenue is quantity

Twitter doubled its monetizable users over the past 6 years

Twitter had difficulties getting more money out of its users

Twitter doubled its monetizable users over the past 6 years

Start at the company’s website

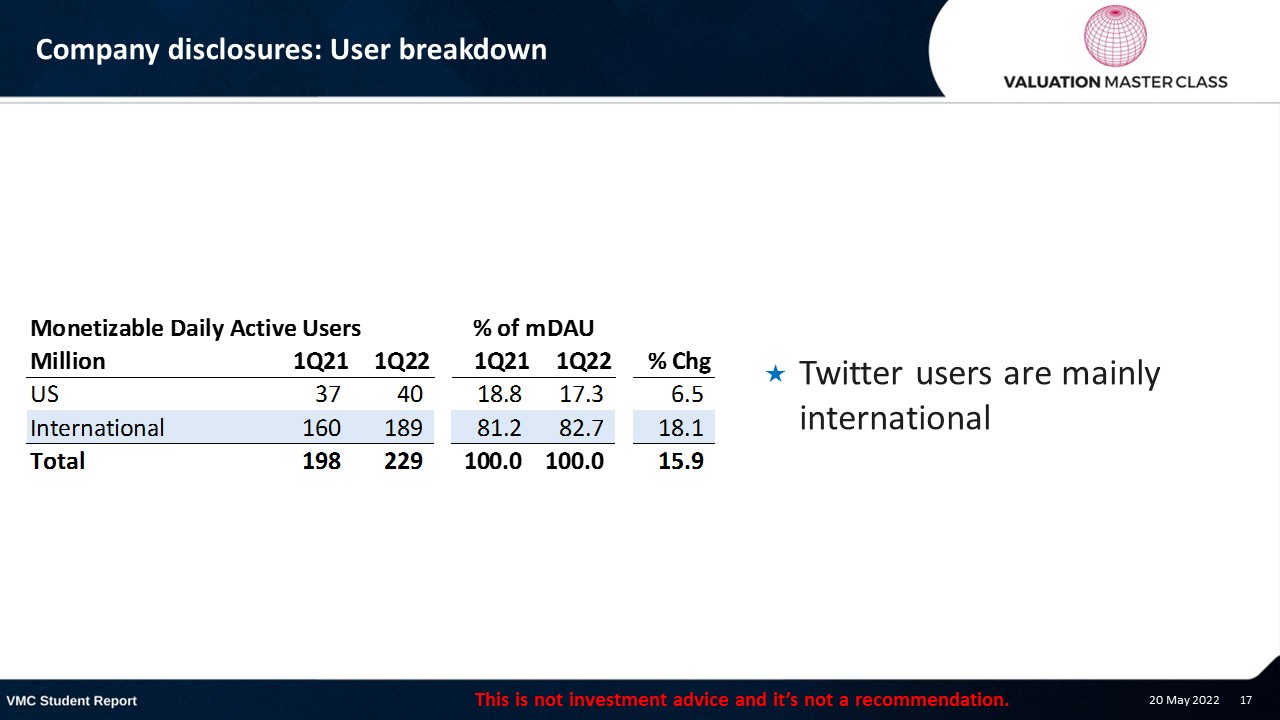

Company disclosures: User breakdown

- Twitter users are mainly international

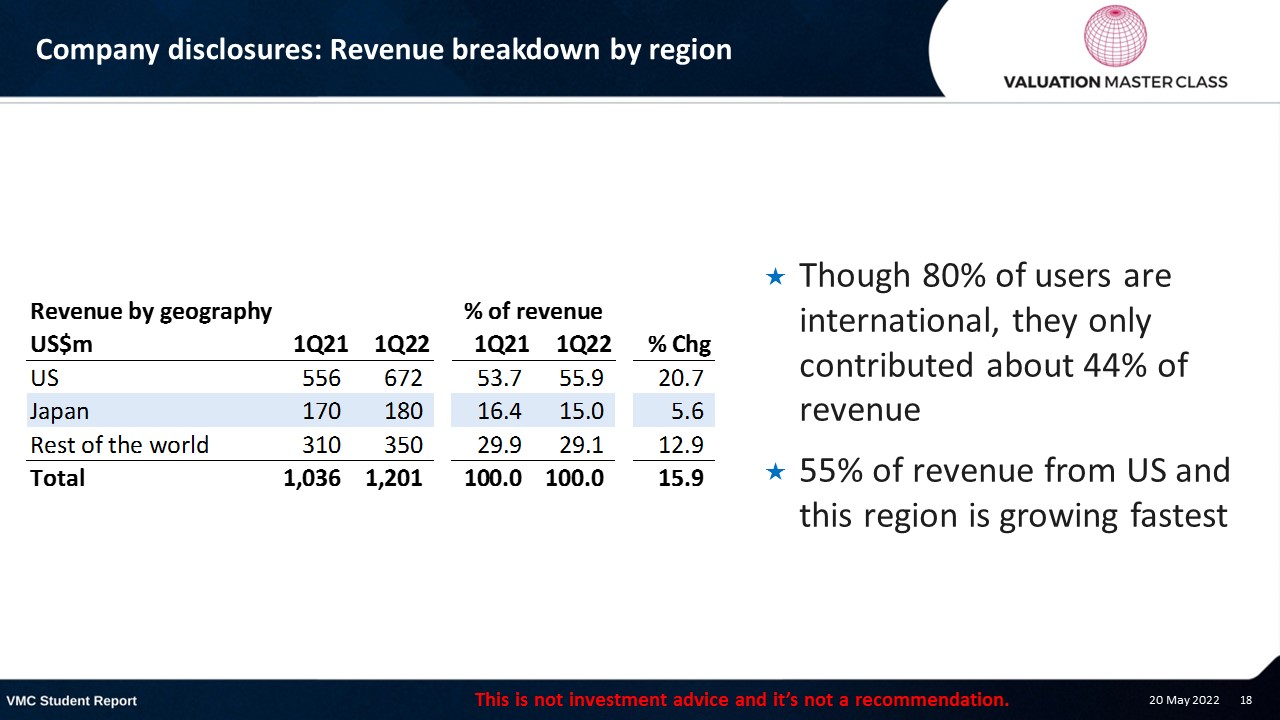

Company disclosures: Revenue breakdown by region

- Though 80% of users are international, they only contributed about 44% of revenue

- 55% of revenue from US and this region is growing fastest

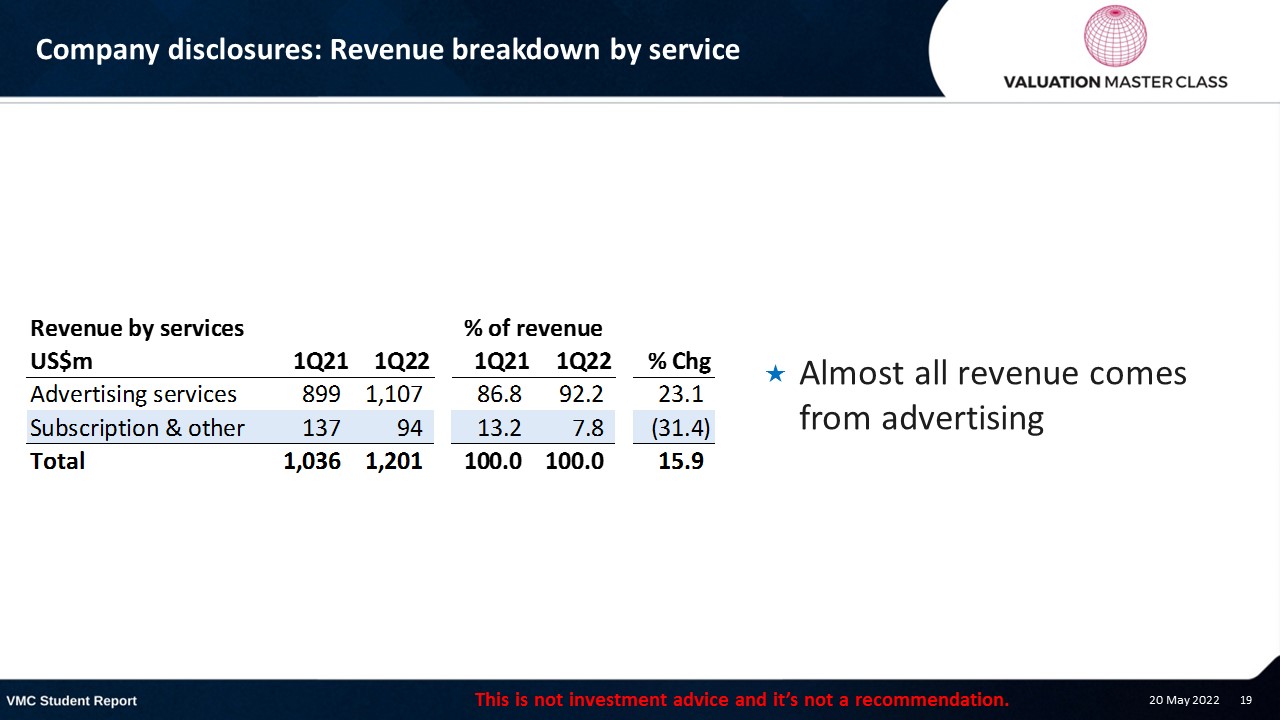

Company disclosures: Revenue breakdown by service

- Almost all revenue comes from advertising

Twitter’s Schedule 14A from SEC.GOV

J.P. Morgan opinion on Twitter

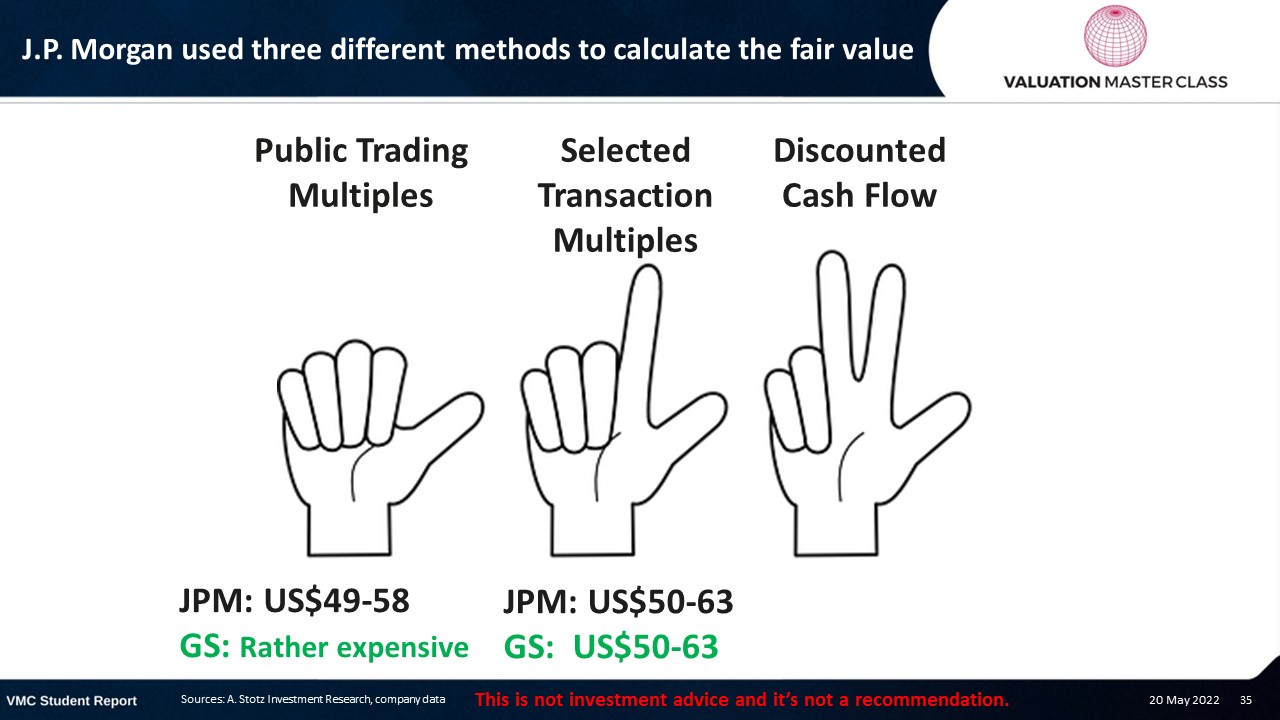

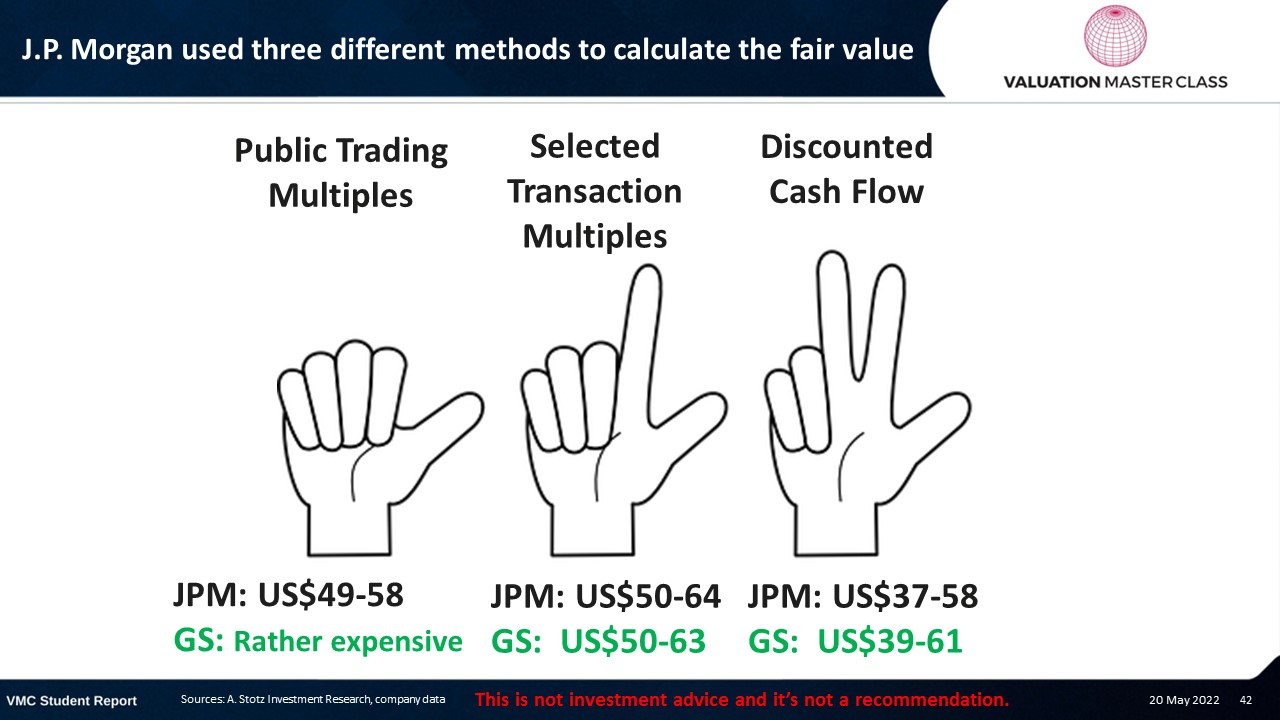

J.P. Morgan used three different methods to calculate the fair value

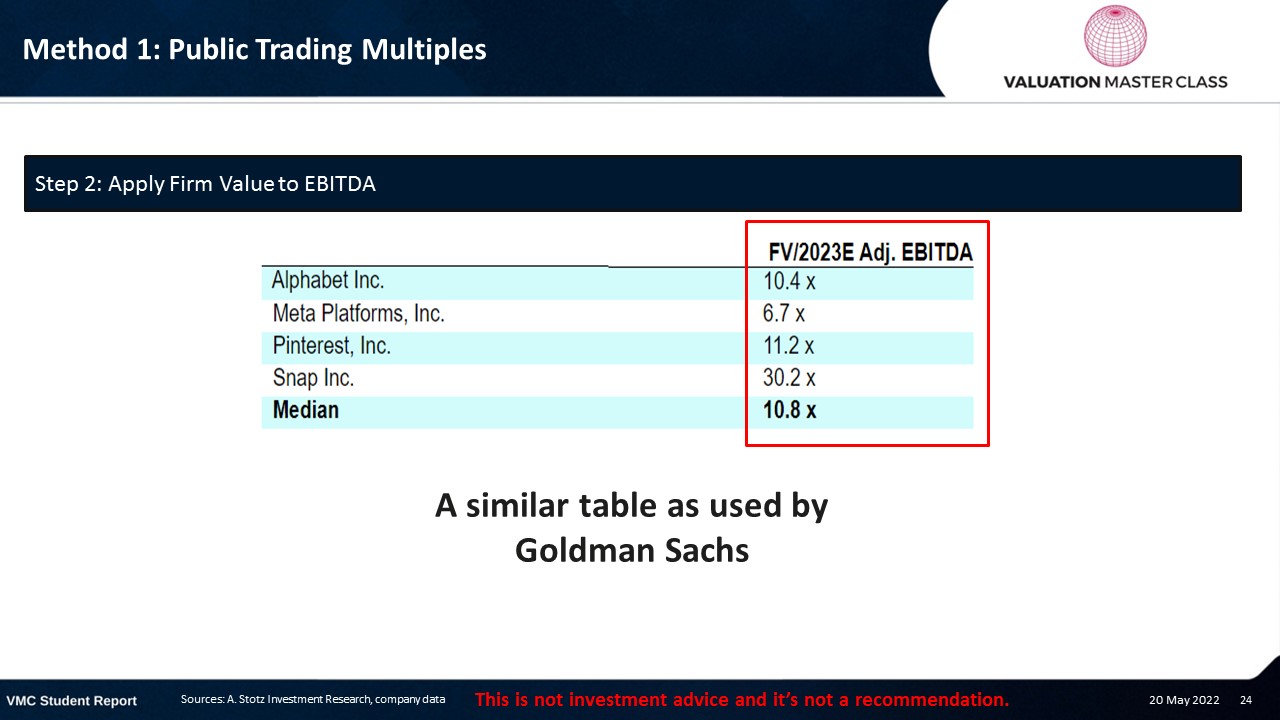

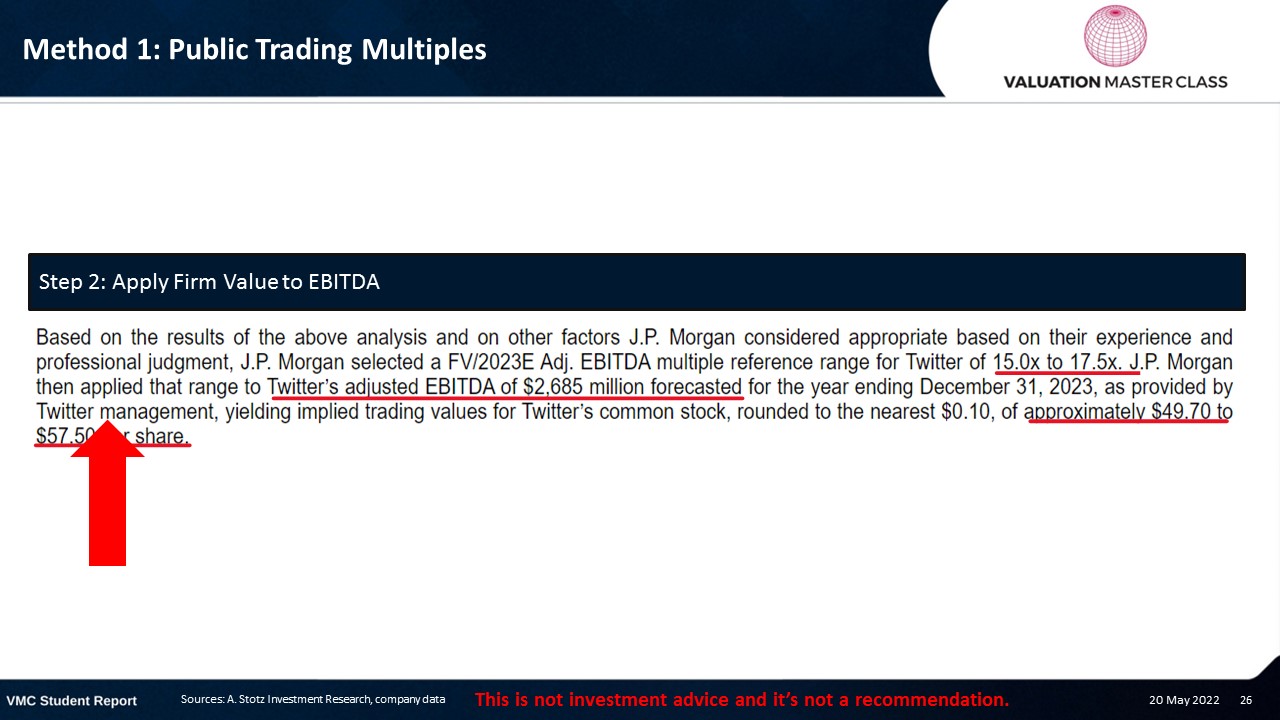

Method 1: Public Trading Multiples

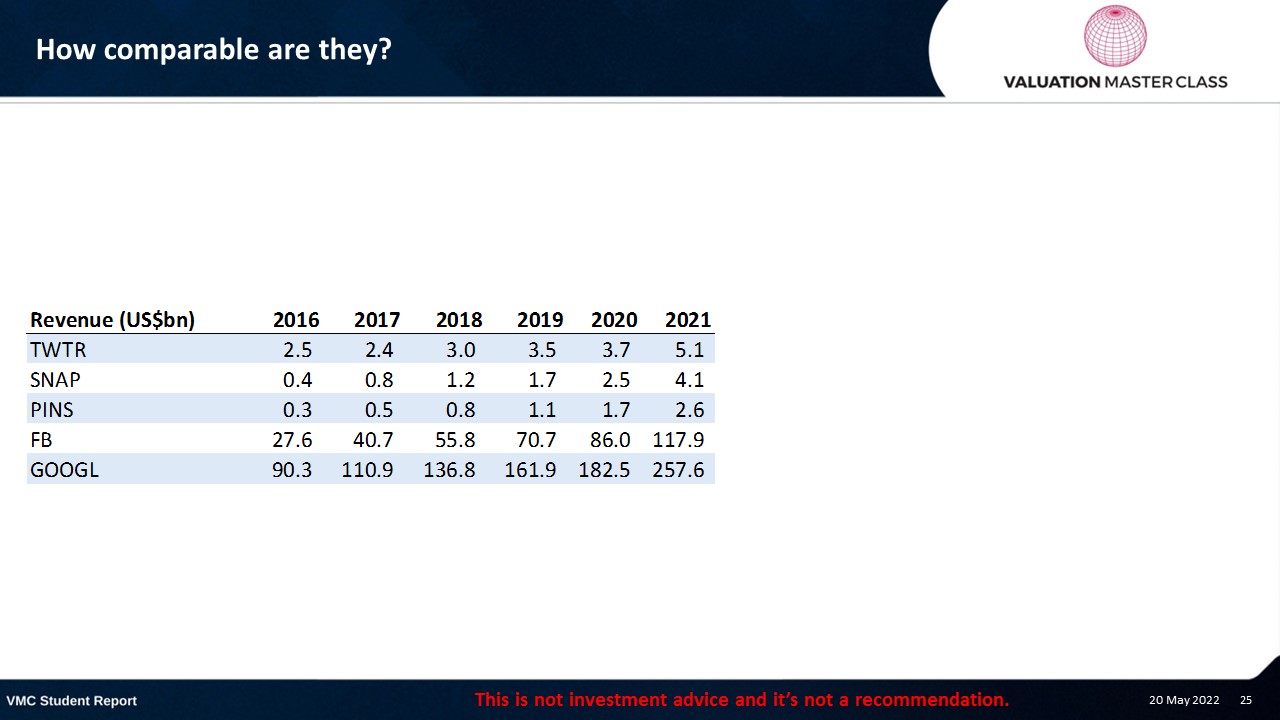

How comparable are they?

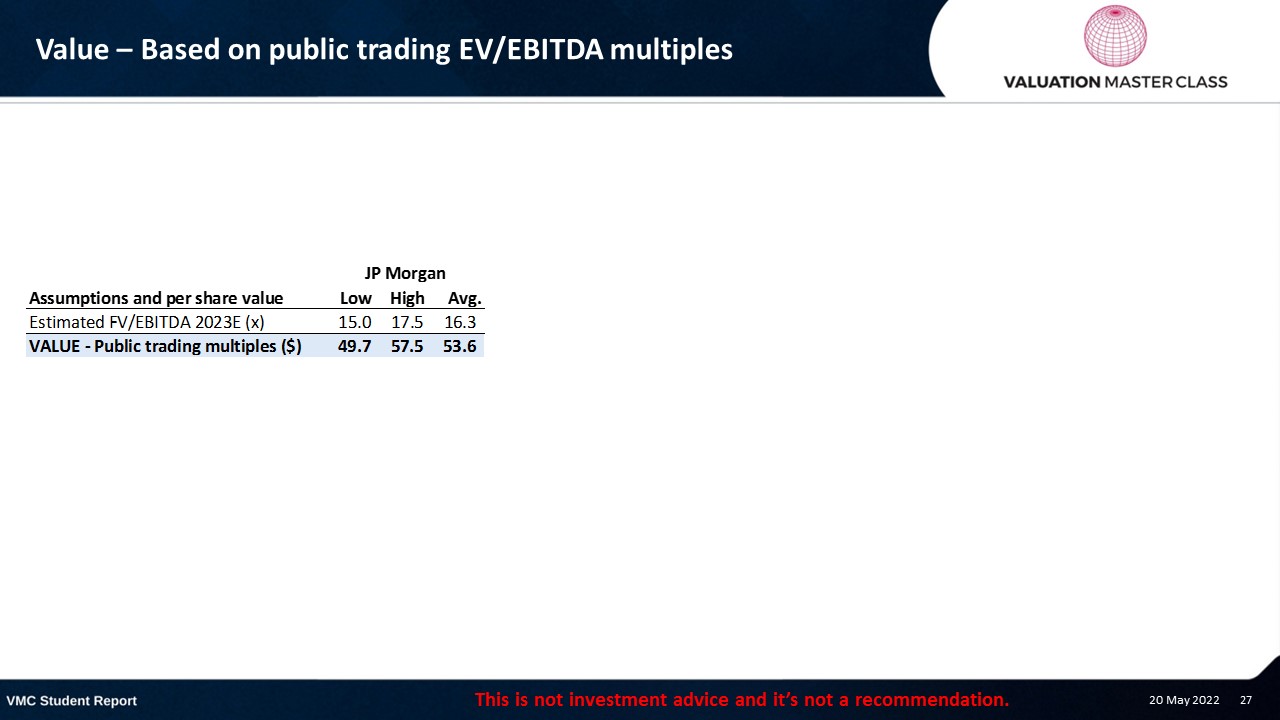

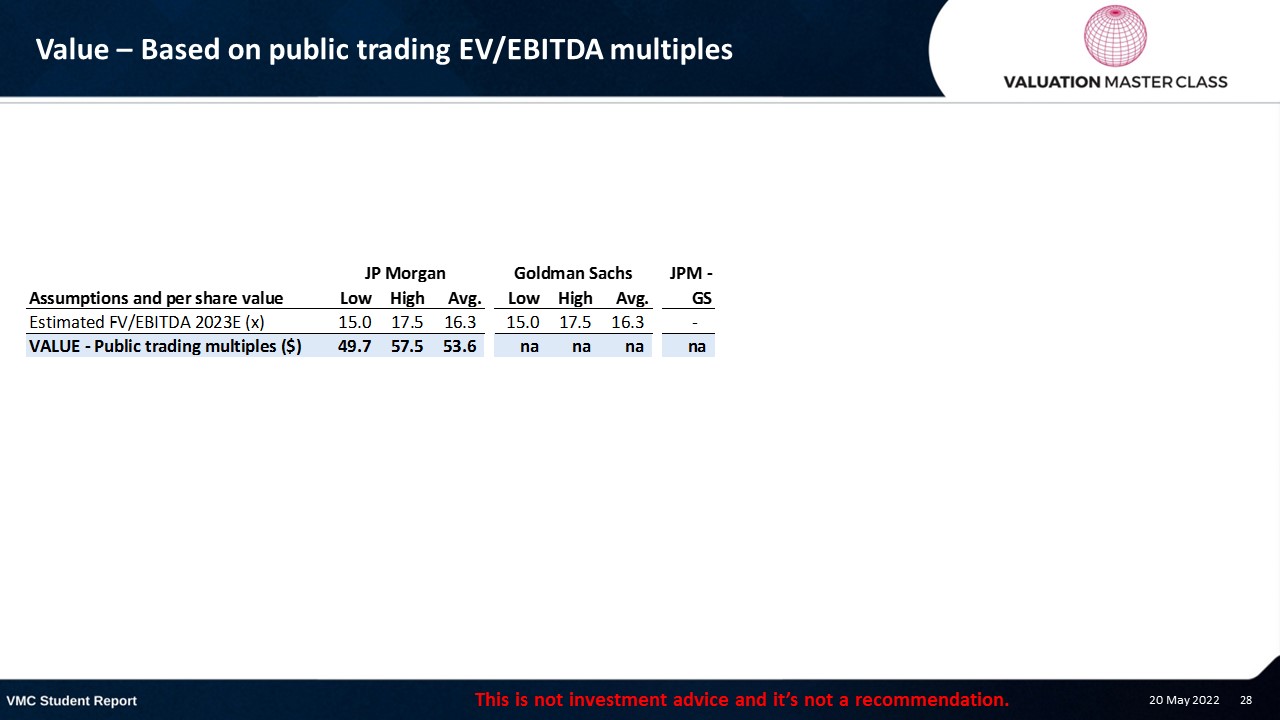

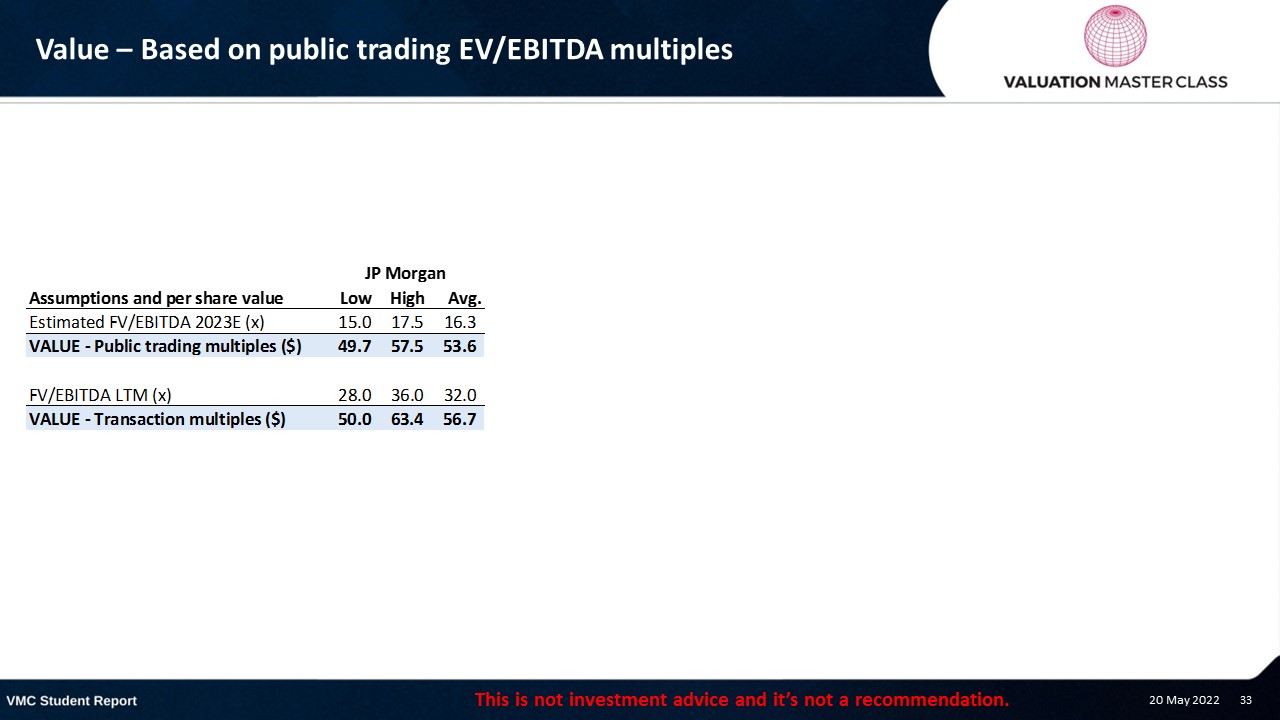

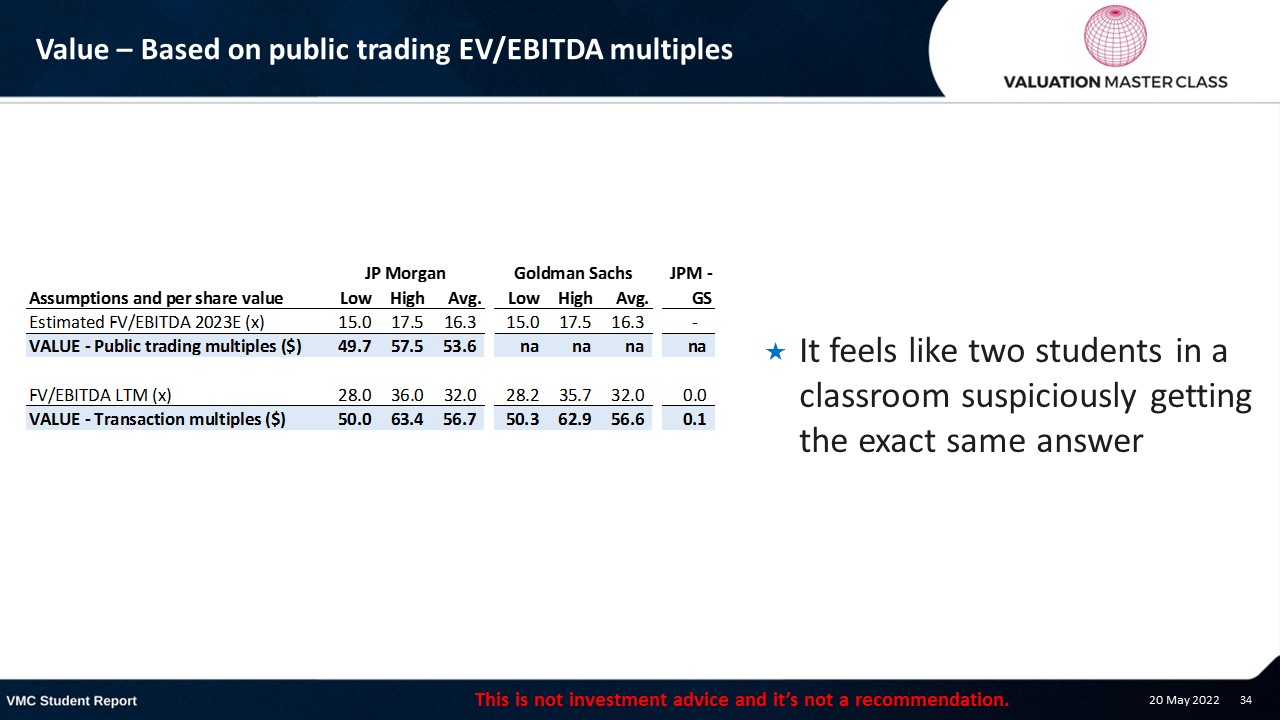

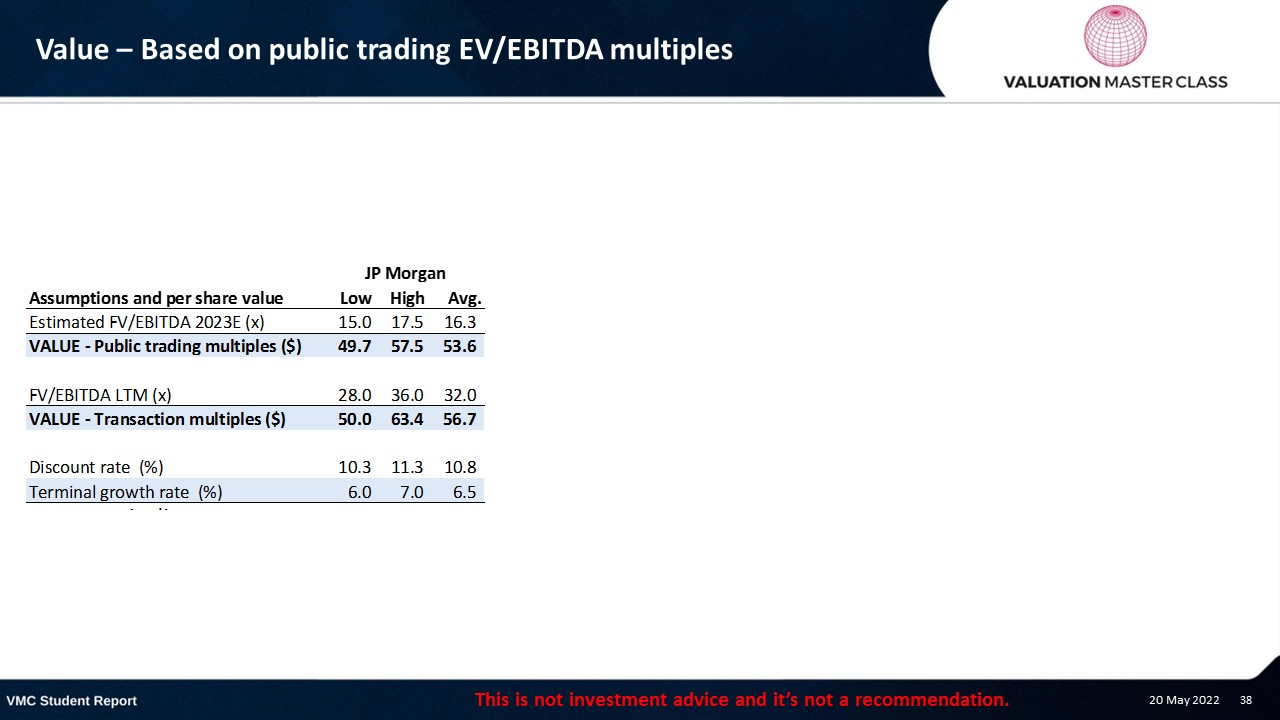

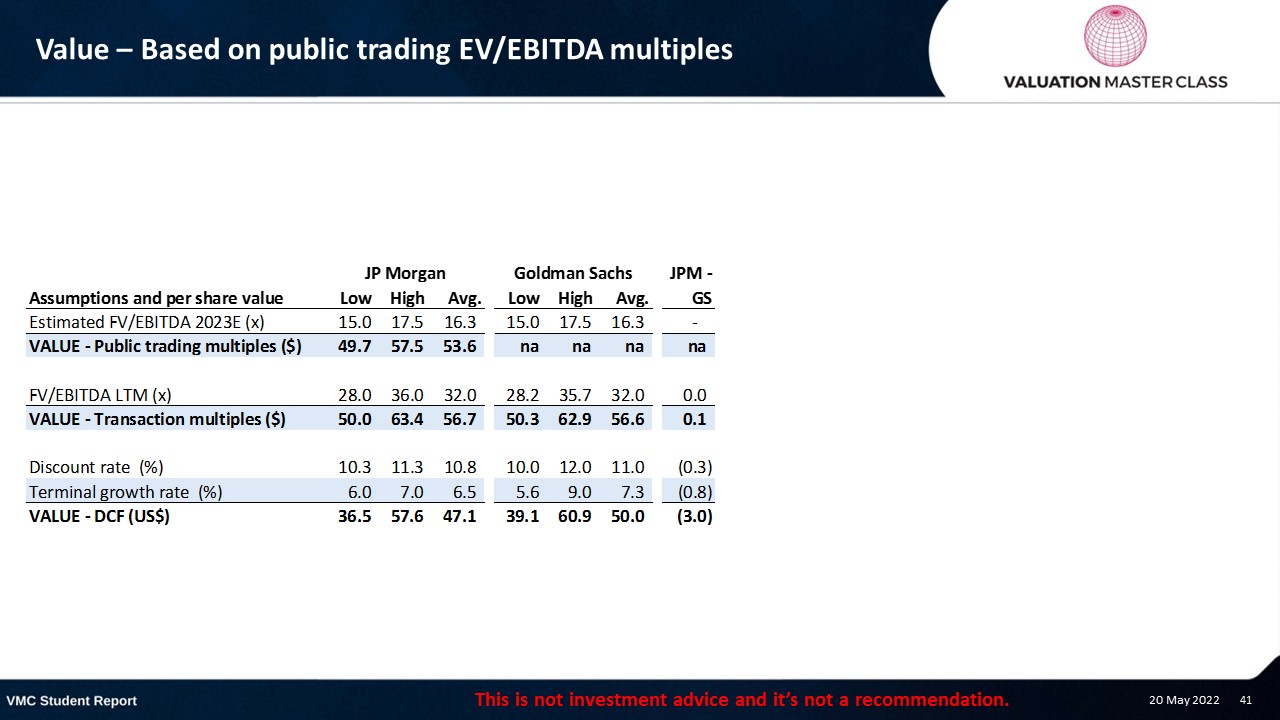

Value – Based on public trading EV/EBITDA multiples

J.P. Morgan used three different methods to calculate the fair value

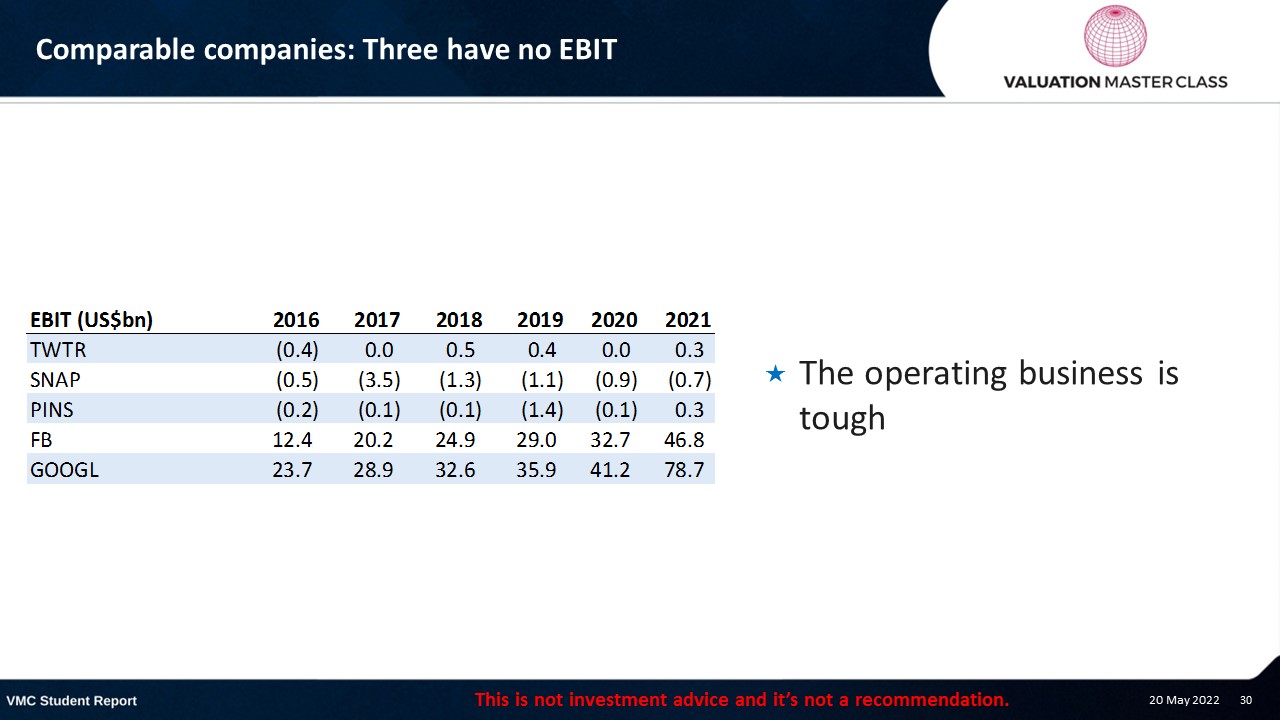

Comparable companies: Three have no EBIT

- The operating business is tough

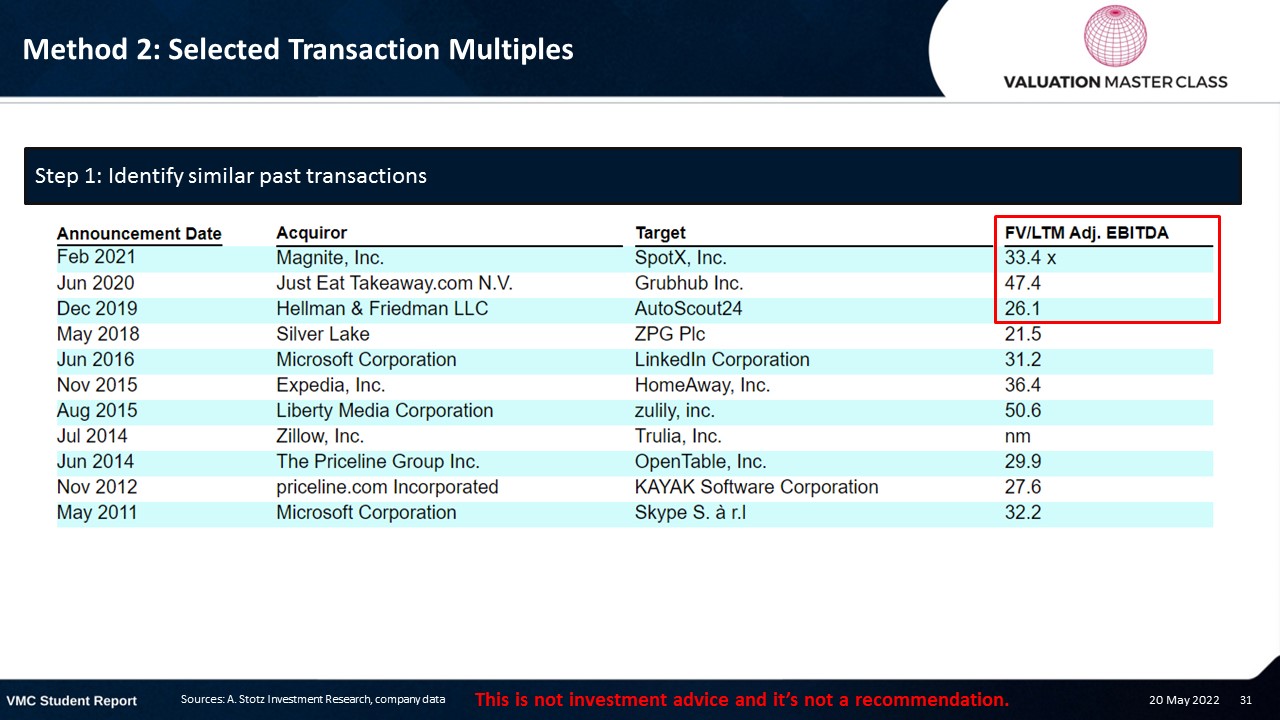

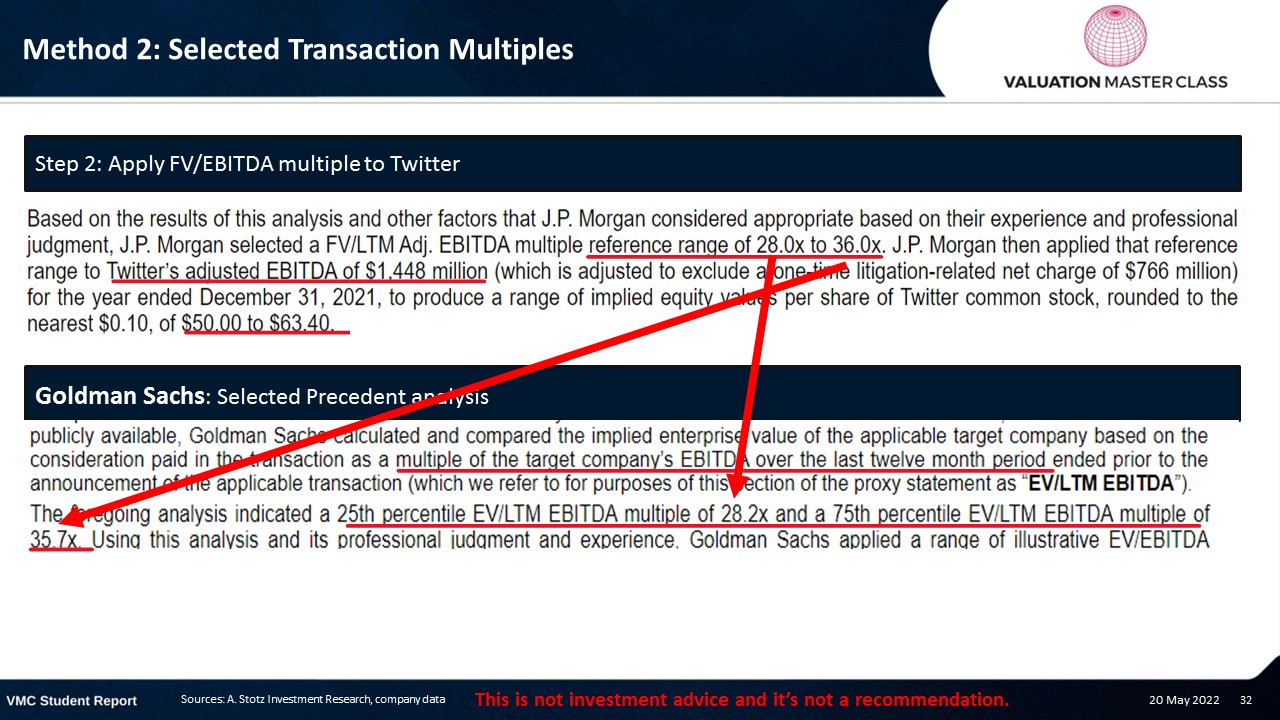

Method 2: Selected Transaction Multiples

Value – Based on public trading EV/EBITDA multiples

- It feels like two students in a classroom suspiciously getting the exact same answer

J.P. Morgan used three different methods to calculate the fair value

Comparable companies: Three are loss making

- 2018/9 Twitter made money

- 2018 US$0.845bn Inc. tax benefit (Release of valuation allowance from Brazil)

- 2019 Income tax benefit of US$1.2bn – Establishment of deferred tax assets from intra-entity transfer of intangible assets

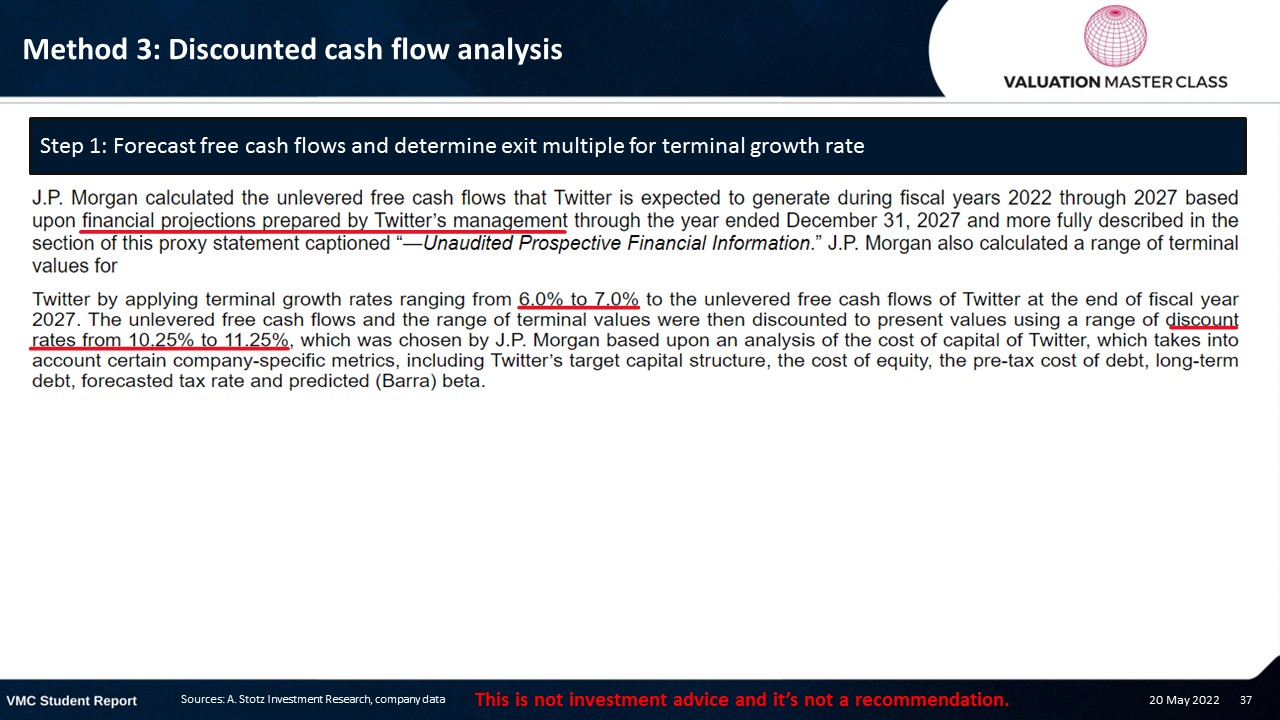

Method 3: Discounted cash flow analysis

Value – Based on public trading EV/EBITDA multiples

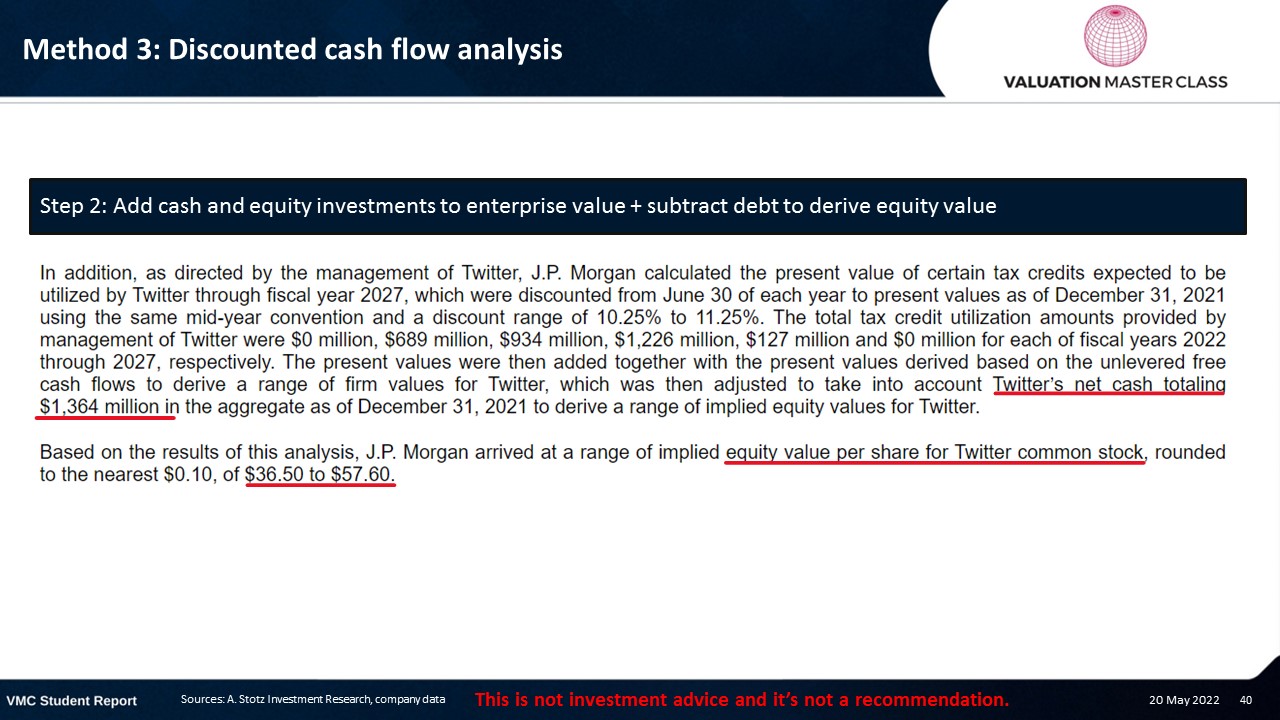

Method 3: Discounted cash flow analysis

Value – Based on public trading EV/EBITDA multiples

J.P. Morgan used three different methods to calculate the fair value

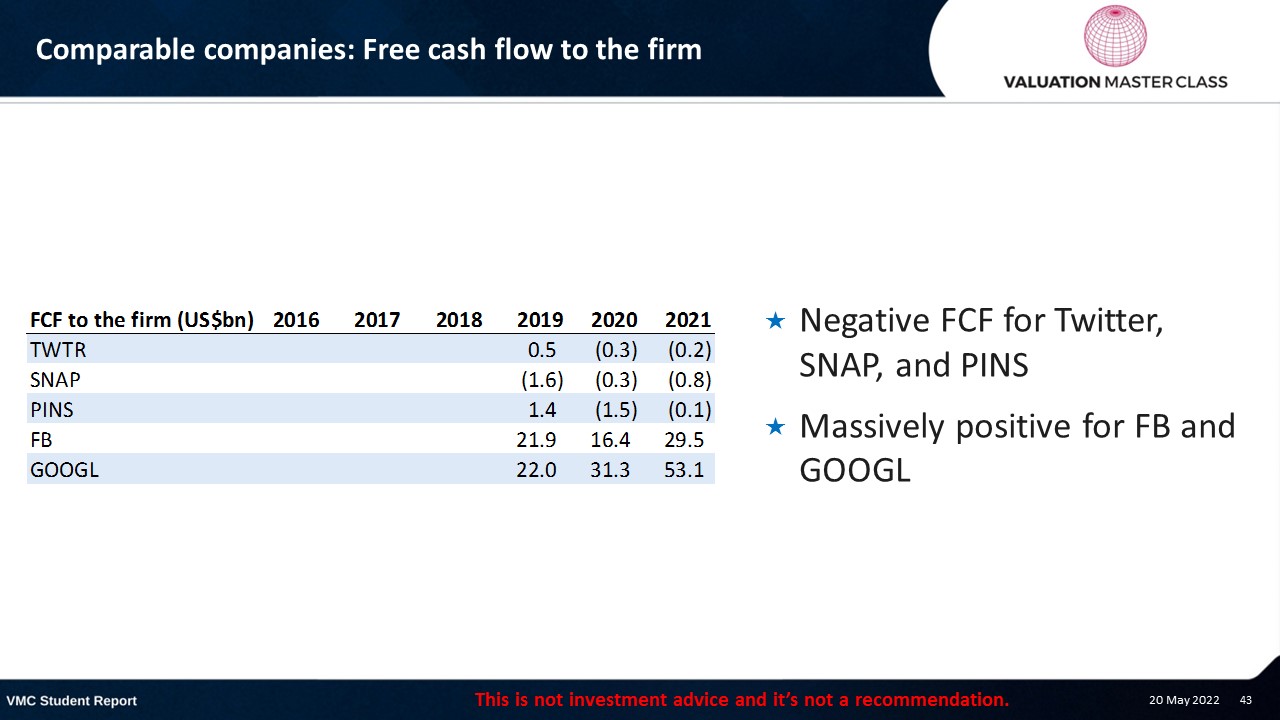

Comparable companies: Free cash flow to the firm

- Negative FCF for Twitter, SNAP, and PINS

- Massively positive for FB and GOOGL

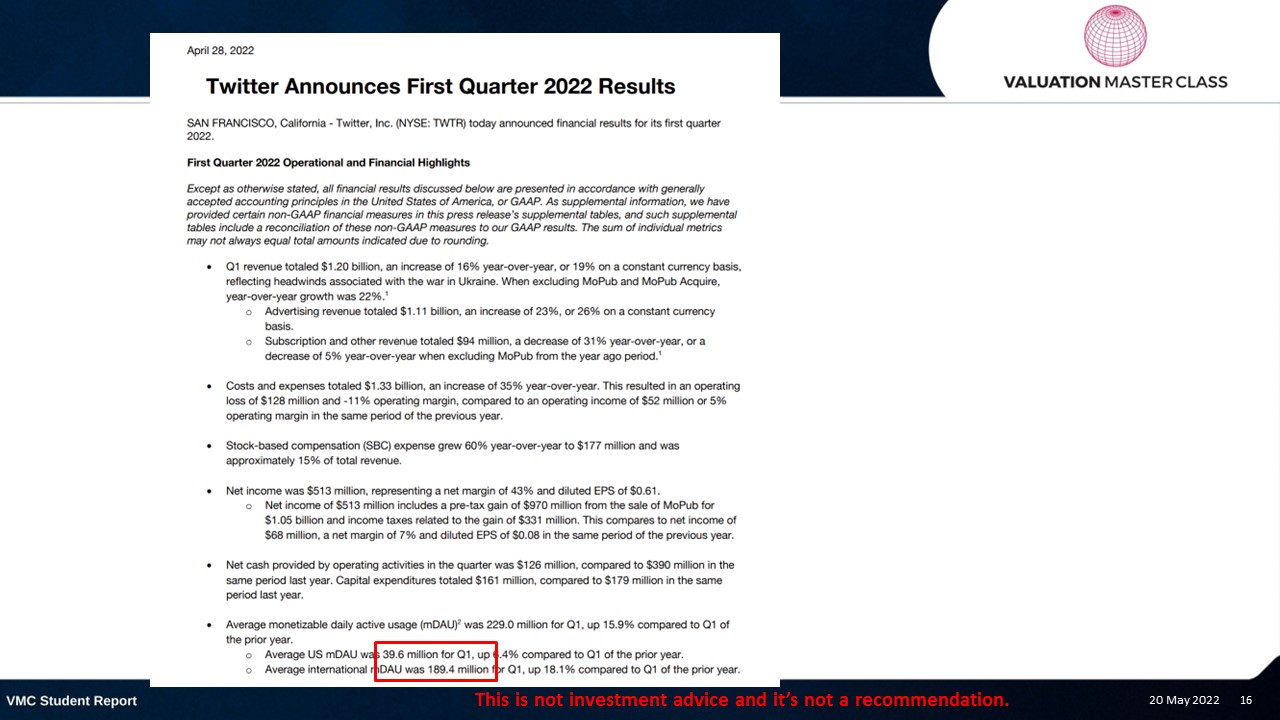

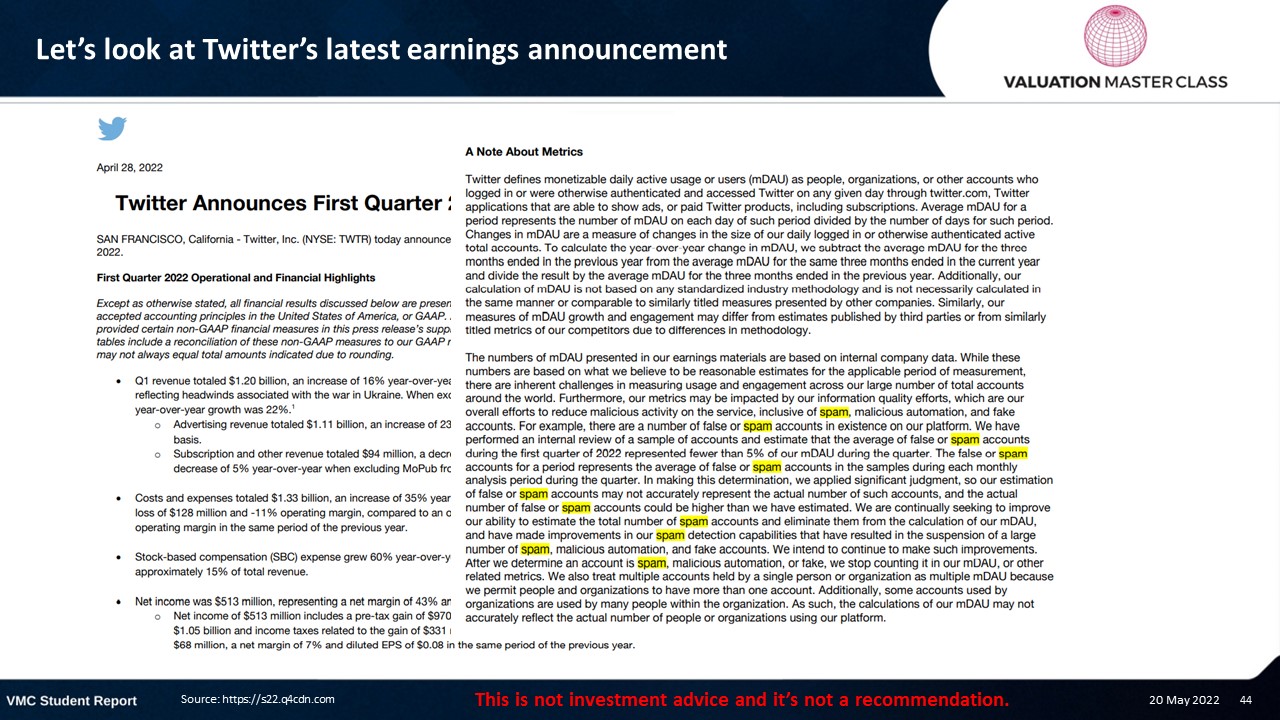

Let’s look at Twitter’s latest earnings announcement

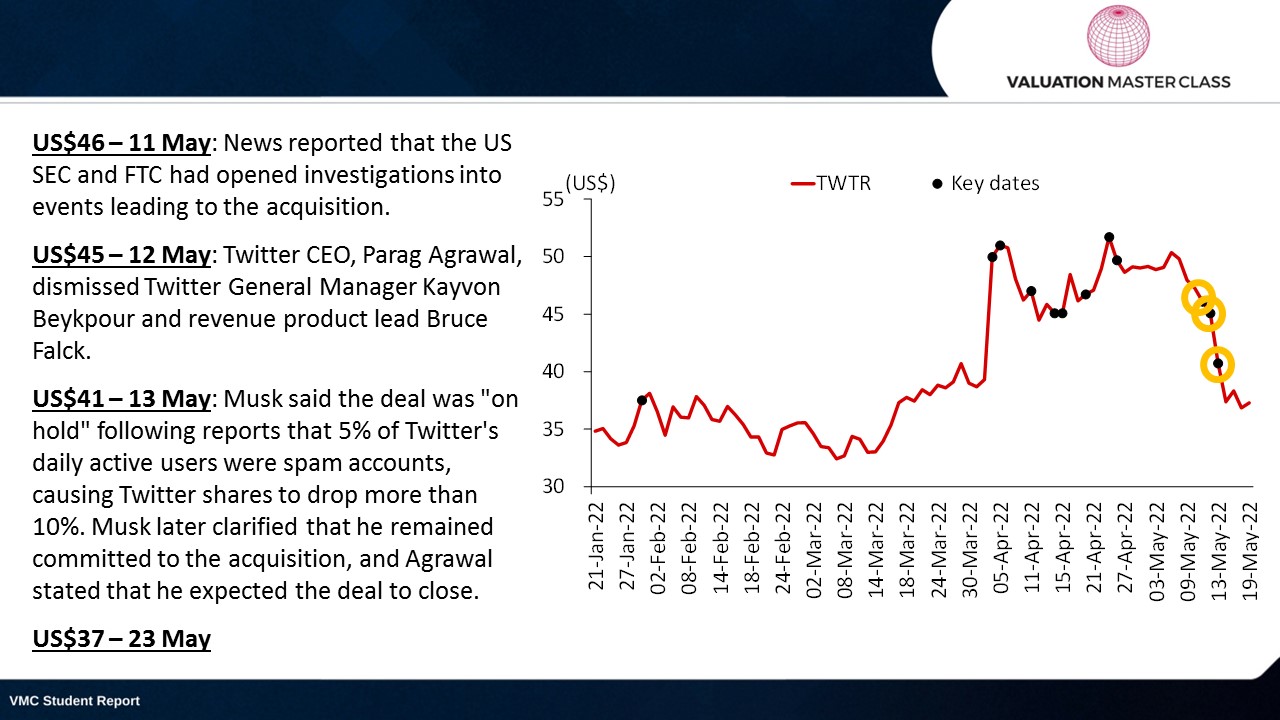

False or spam accounts discussion from 1Q22 release

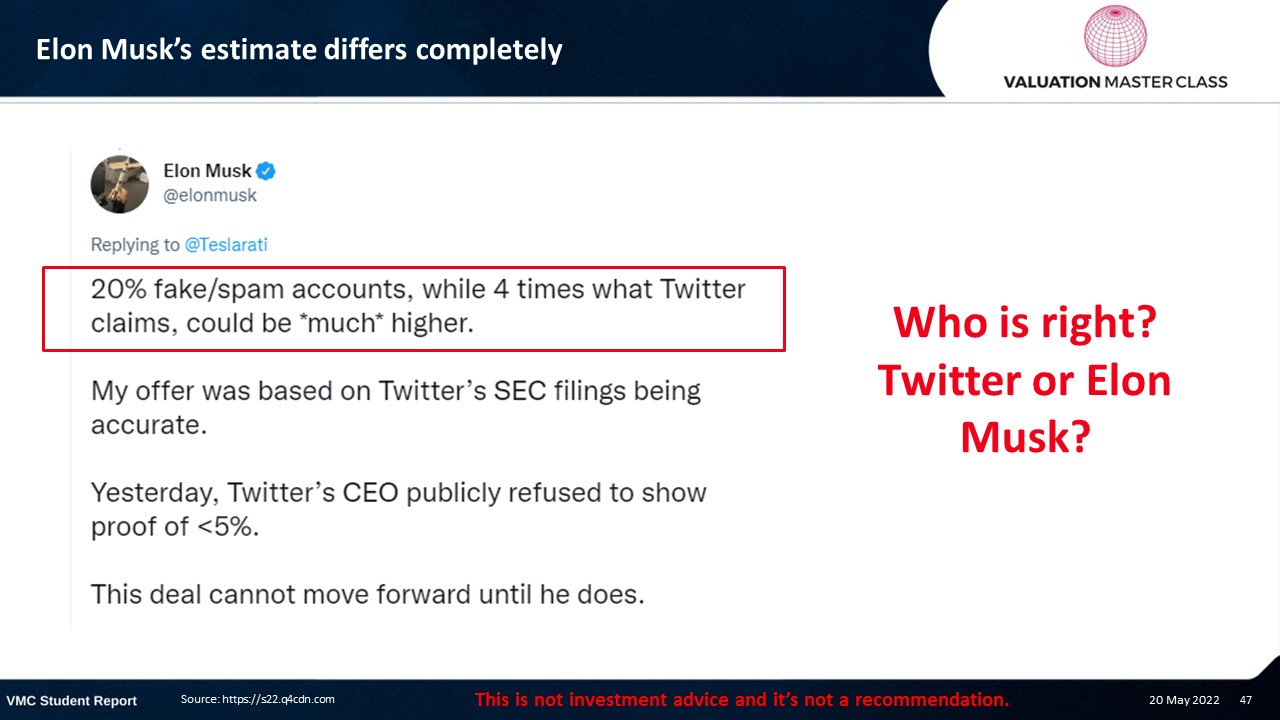

- “(…) there are a number of false or spam accounts in existence on our platform

- “We have performed an internal review of a sample of accounts and estimate that the average of false or spam accounts during the first quarter of 2022 represented fewer than 5% of our mDAU during the quarter.”

- “In making this determination, we applied significant judgment, so our estimation of false or spam accounts may not accurately represent the actual number of such accounts, and the actual number of false or spam accounts could be higher than we have estimated.”

Elon Musk’s estimate differs completely

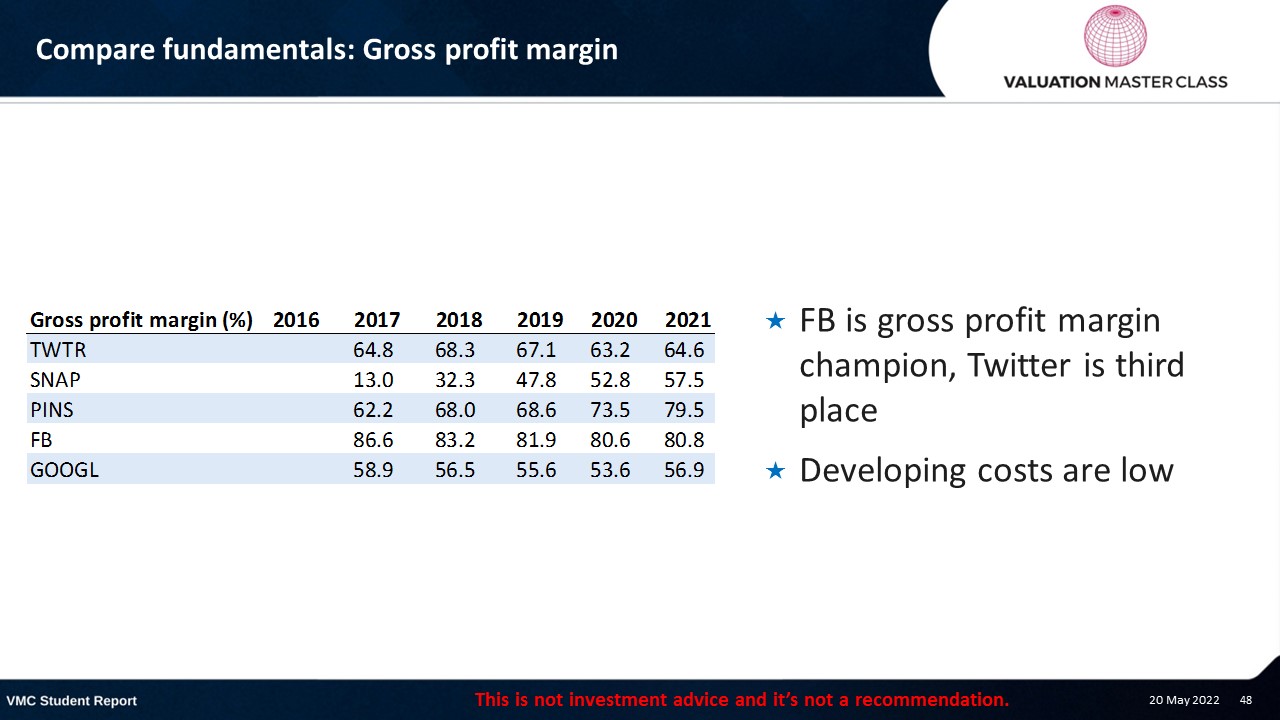

Compare fundamentals: Gross profit margin

- FB is gross profit margin champion, Twitter is third place

- Developing costs are low

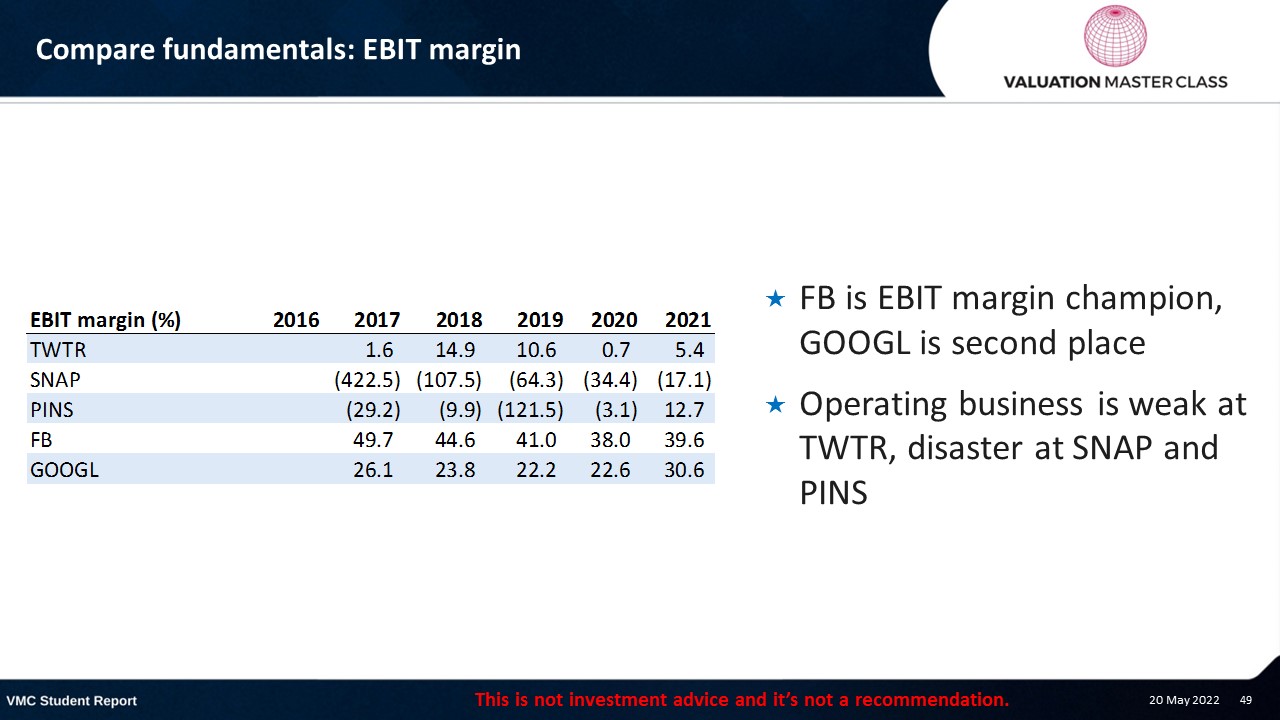

Compare fundamentals: EBIT margin

- FB is EBIT margin champion, GOOGL is second place

- Operating business is weak at TWTR, disaster at SNAP and PINS

Compare fundamentals: Net margin

- SNAP has never made a profit, Twitter only in 2018 and 2019 because of tax adjustments

- FB and GOOGL are killing it

Compare fundamentals: Free cash flow to the firm

- SNAP is bleeding

- Twitter’s return to investors has been tiny

- FB and GOOGL are massive value generators

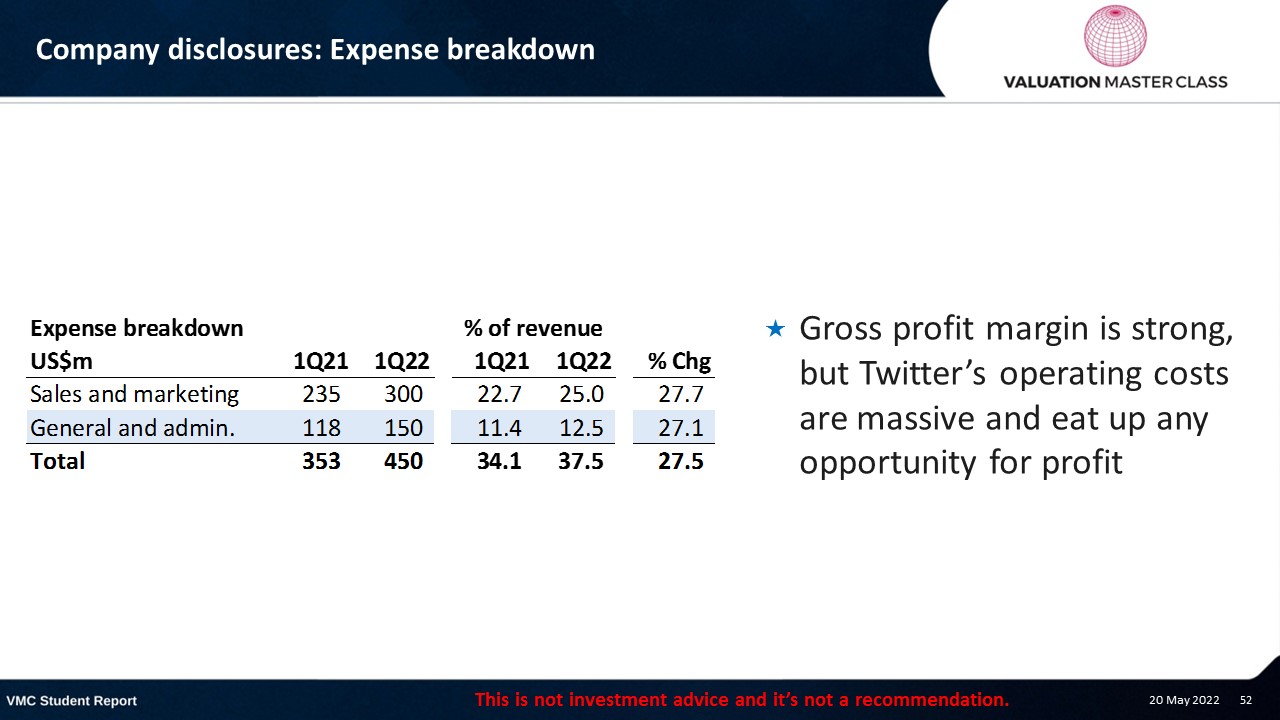

Company disclosures: Expense breakdown

- Gross profit margin is strong, but Twitter’s operating costs are massive and eat up any opportunity for profit

Download the full report as a PDF

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.