Is Snapchat’s Crash Symbolic of the Social Media Fall?

What’s interesting about Snapchat is that its share price is 82% below its Oct ‘21 all-time high

Download the full report as a PDF

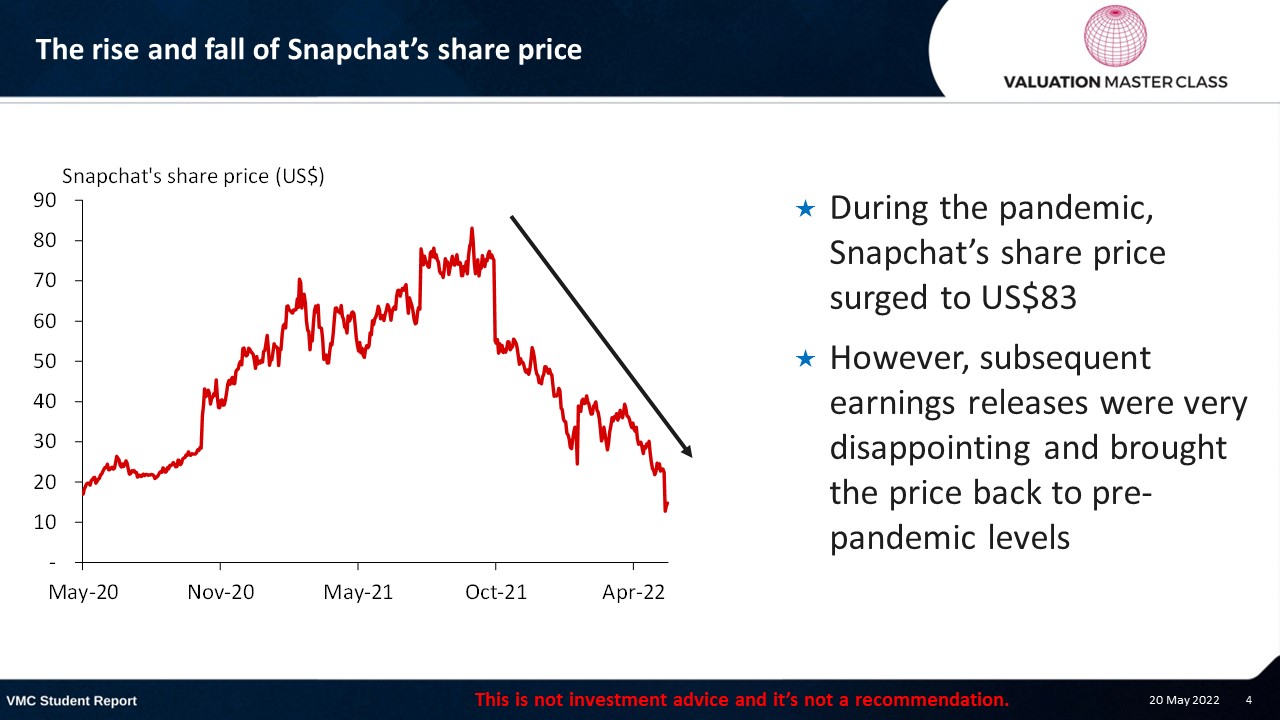

The rise and fall of Snapchat’s share price

- During the pandemic, Snapchat’s share price surged to US$83

- However, subsequent earnings releases were very disappointing and brought the price back to pre-pandemic levels

Let’s go to the latest annual report

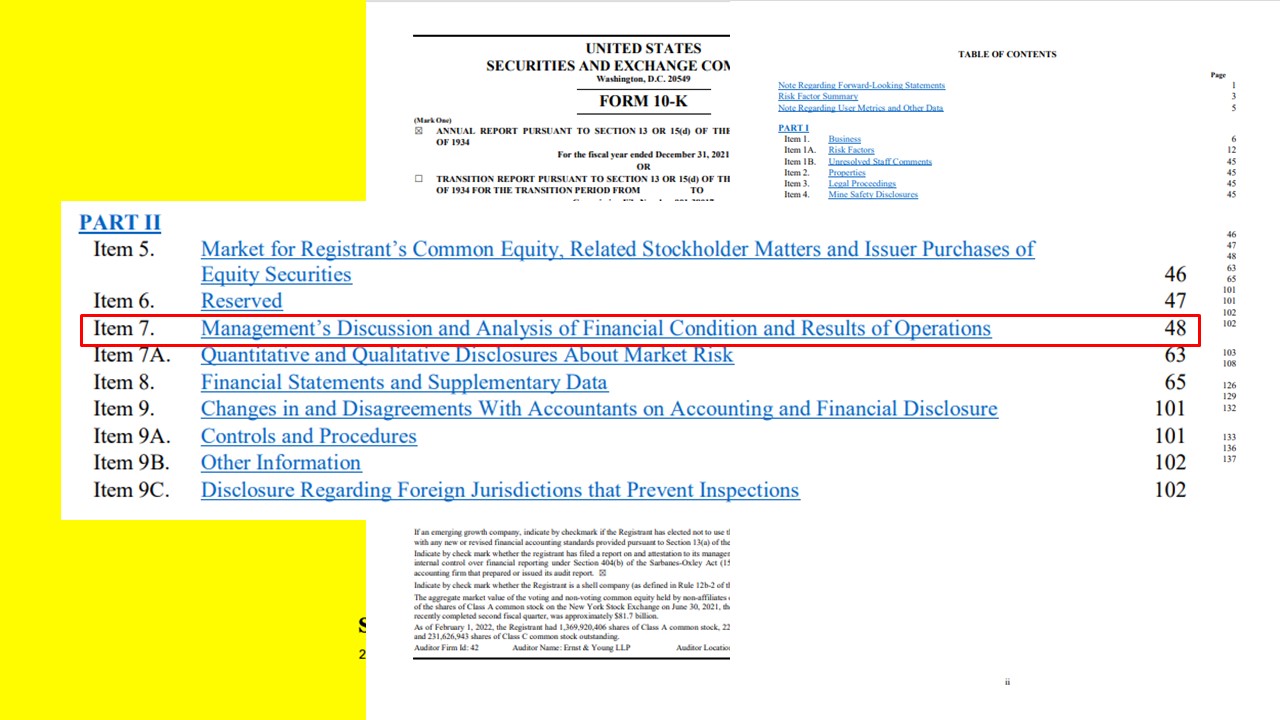

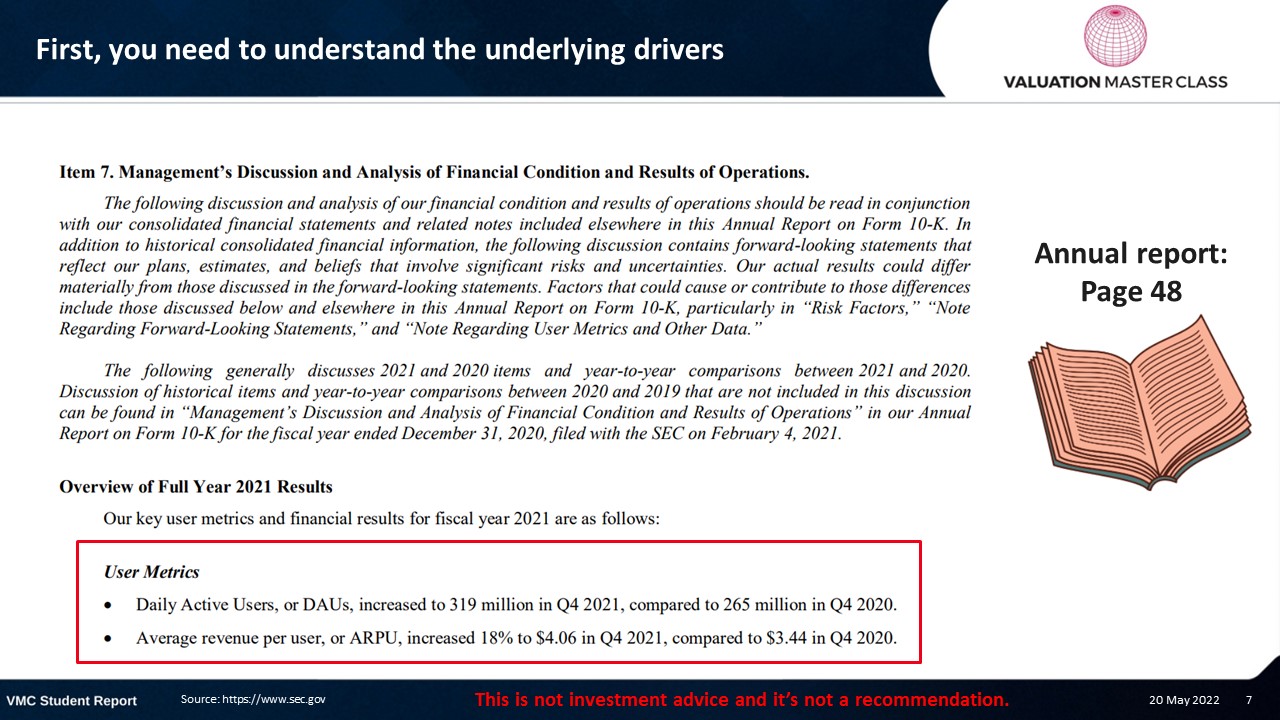

First, you need to understand the underlying drivers

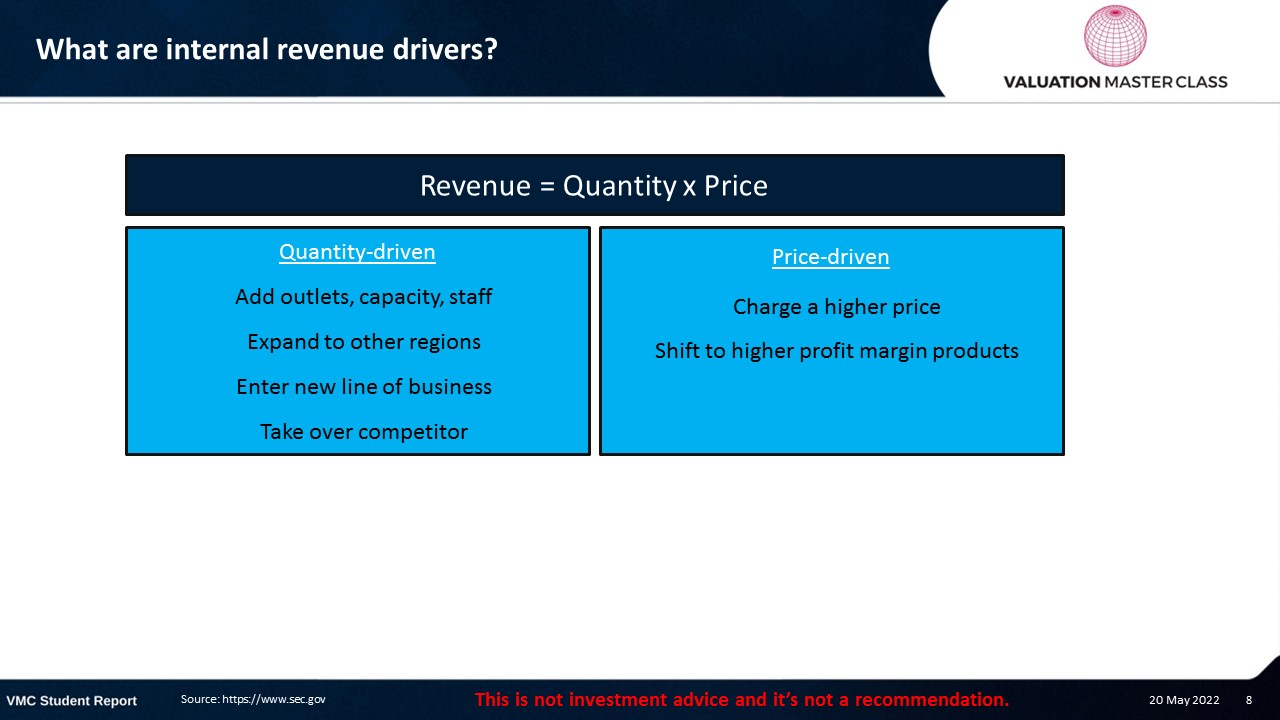

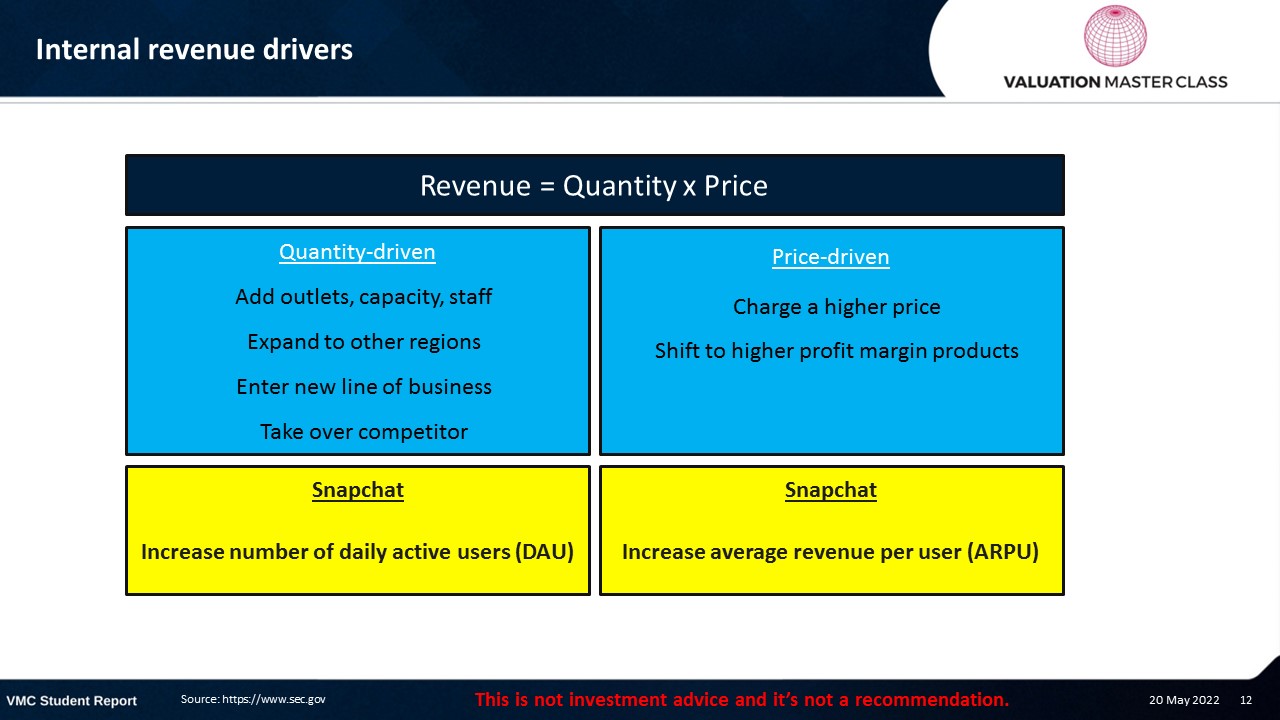

What are internal revenue drivers?

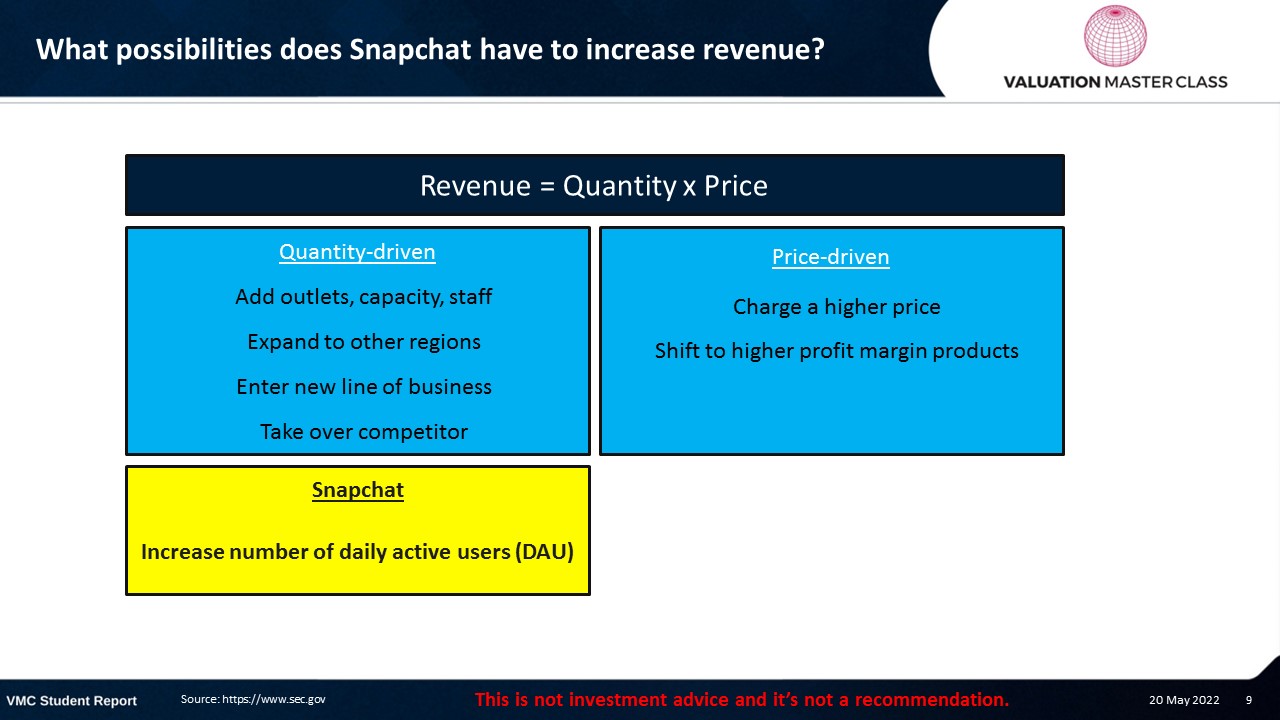

What possibilities does Snapchat have to increase revenue?

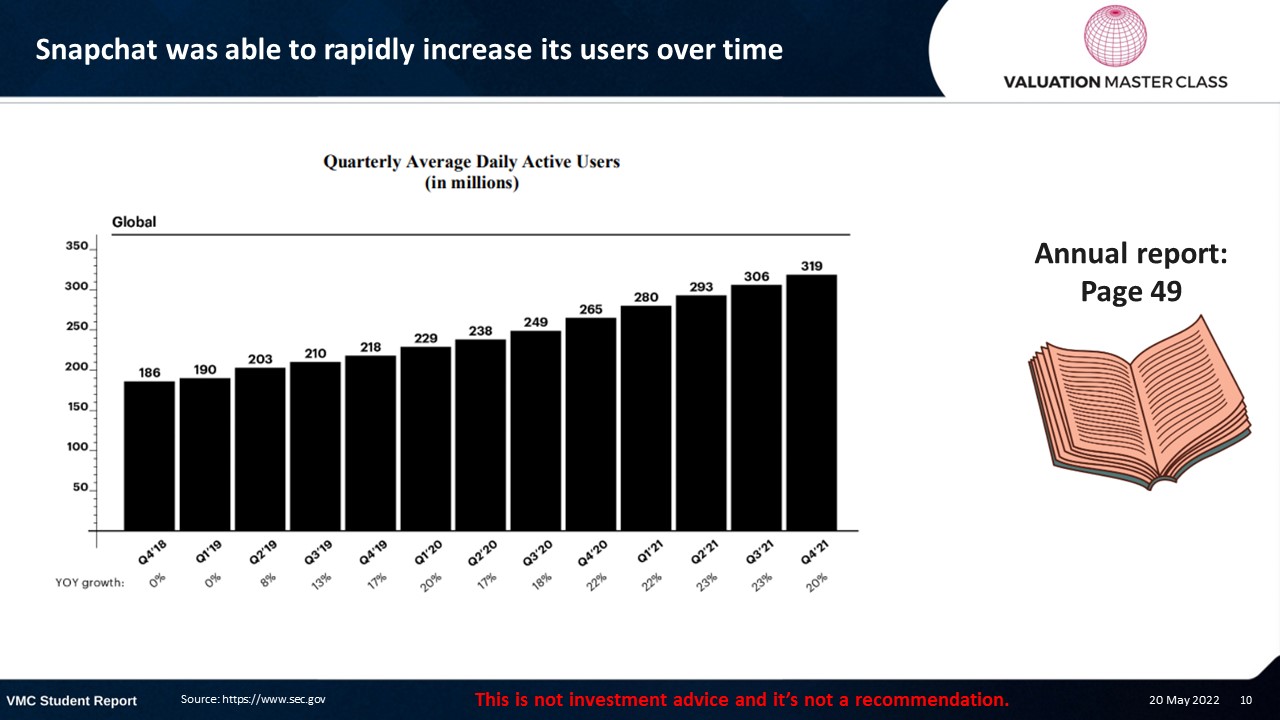

Snapchat was able to rapidly increase its users over time

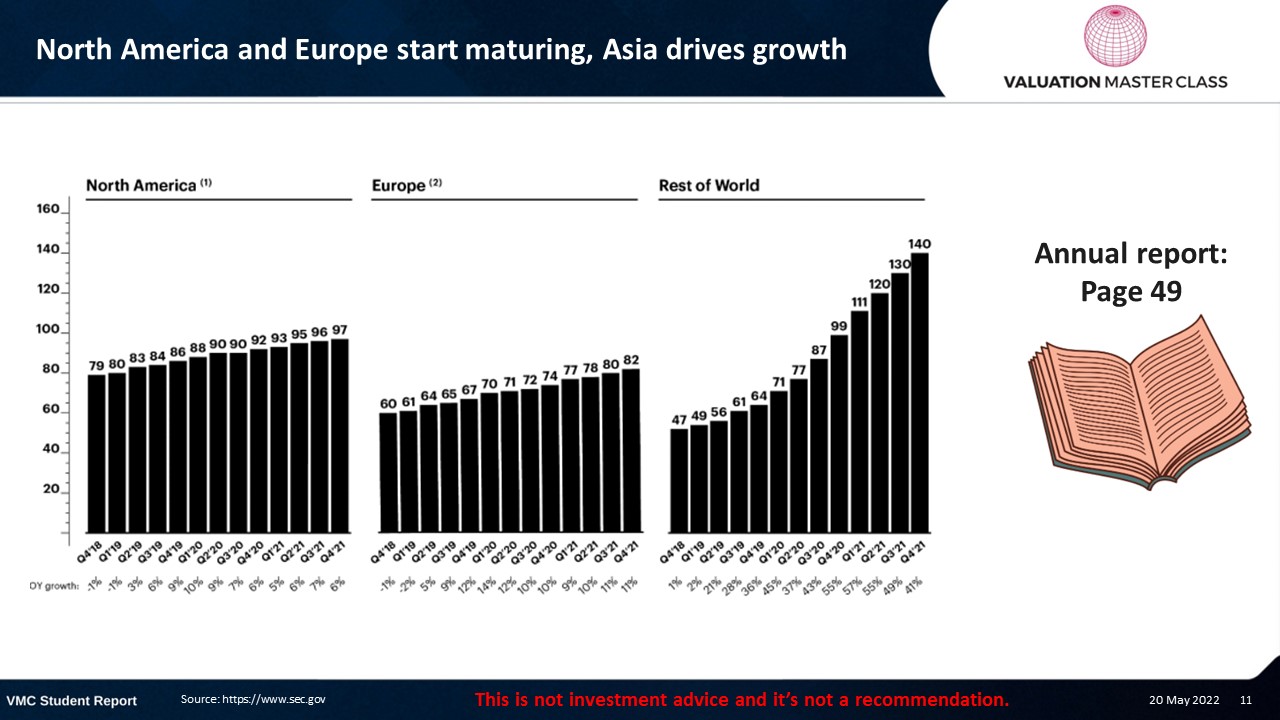

North America and Europe start maturing, Asia drives growth

Internal revenue drivers

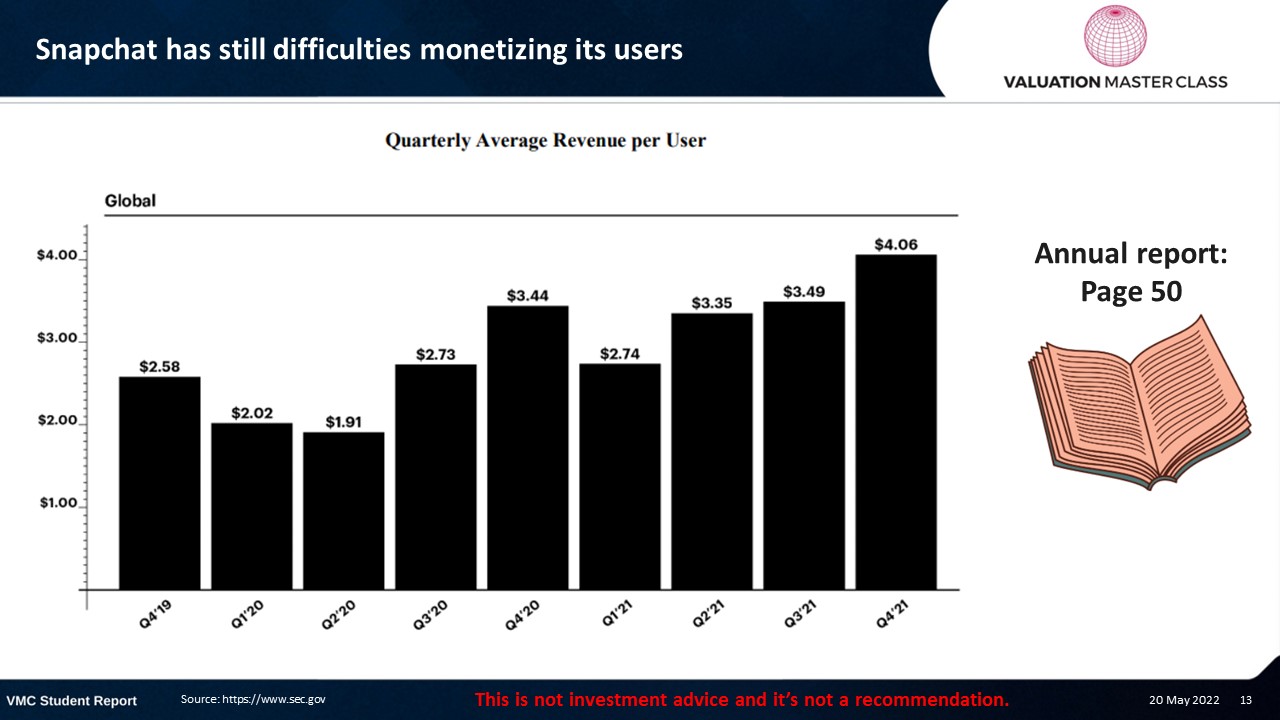

Snapchat has still difficulties monetizing its users

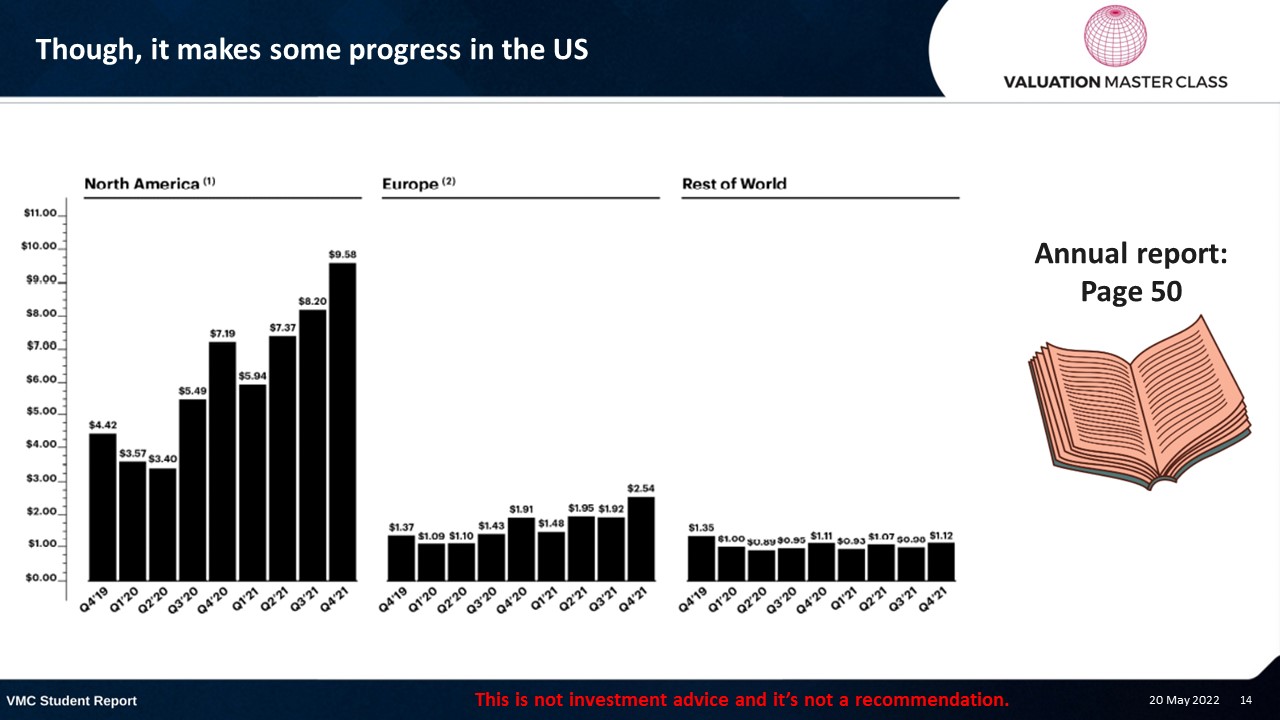

Though, it makes some progress in the US

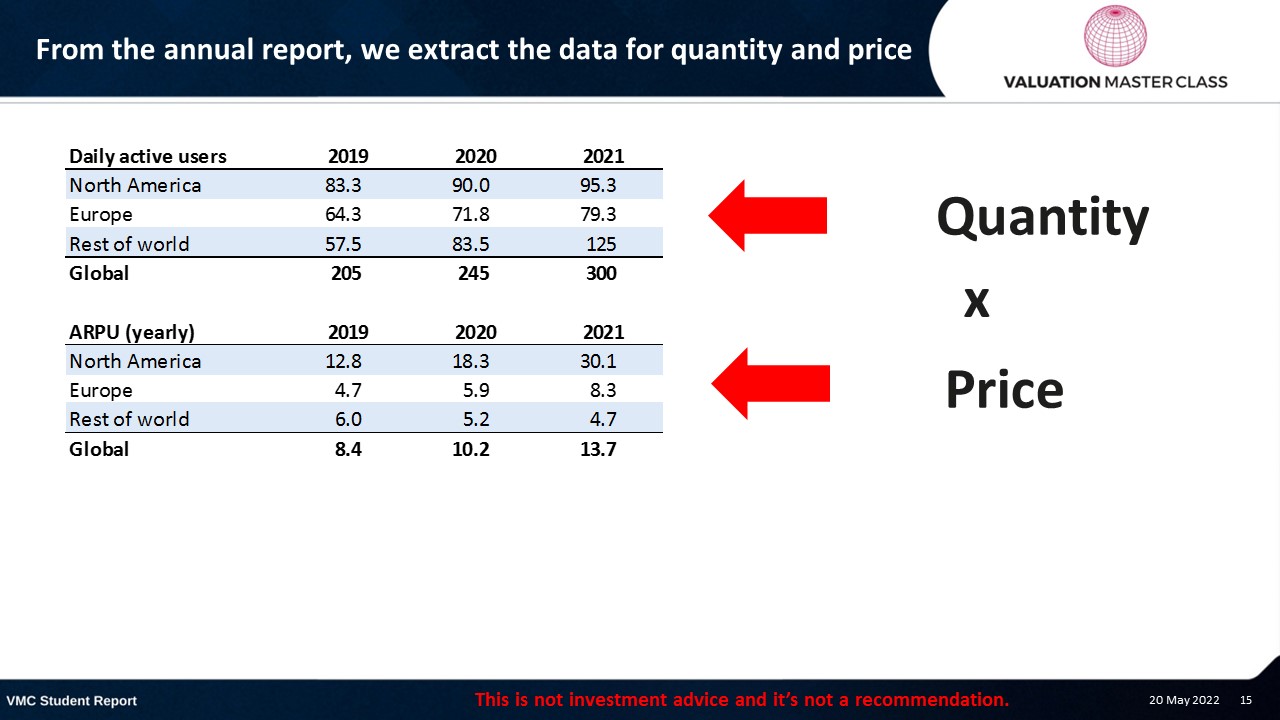

From the annual report, we extract the data for quantity and price

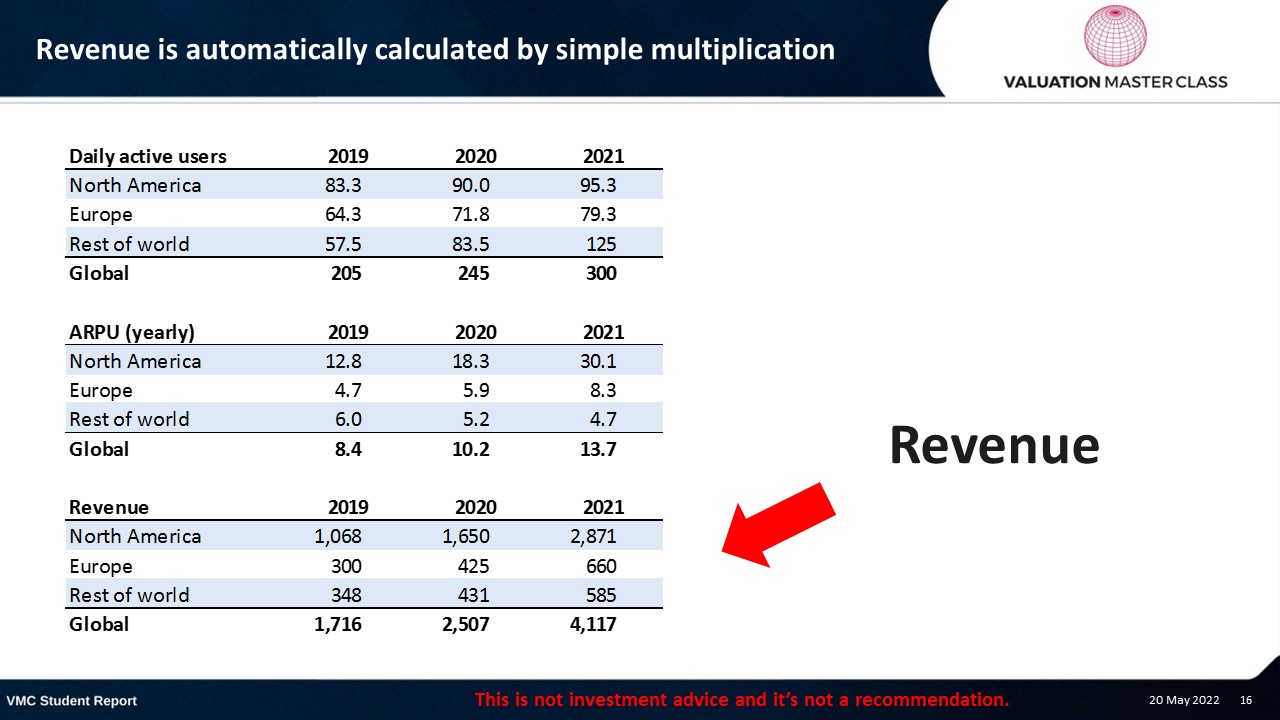

Revenue is automatically calculated by simple multiplication

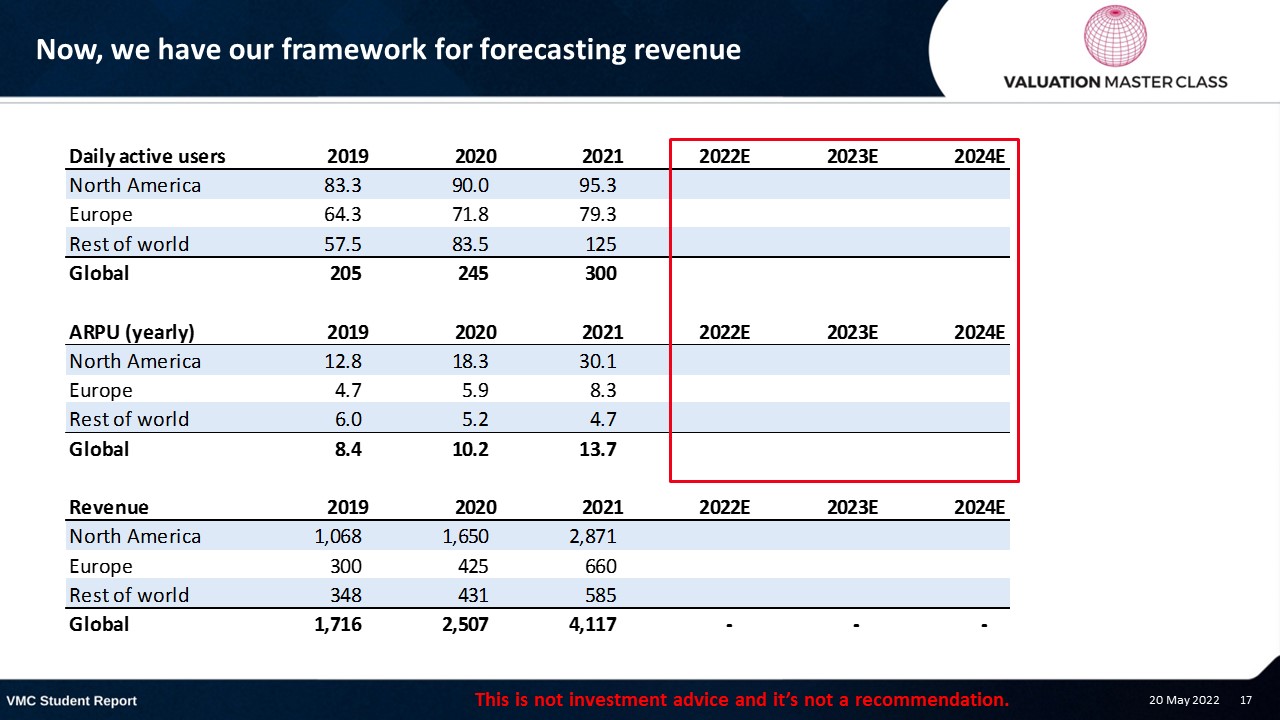

Now, we have our framework for forecasting revenue

Next, we want to understand the latest business developments

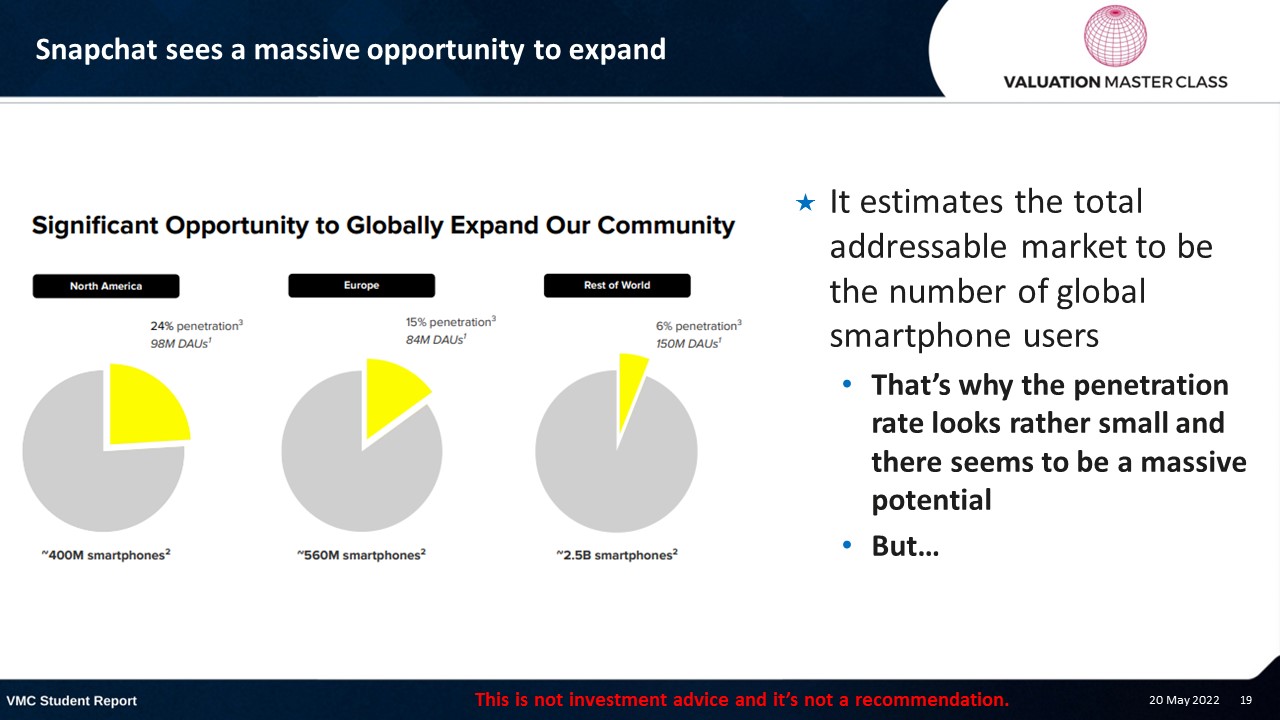

Snapchat sees a massive opportunity to expand

- It estimates the total addressable market to be the number of global smartphone users

- That’s why the penetration rate looks rather small and there seems to be a massive potential

- But…

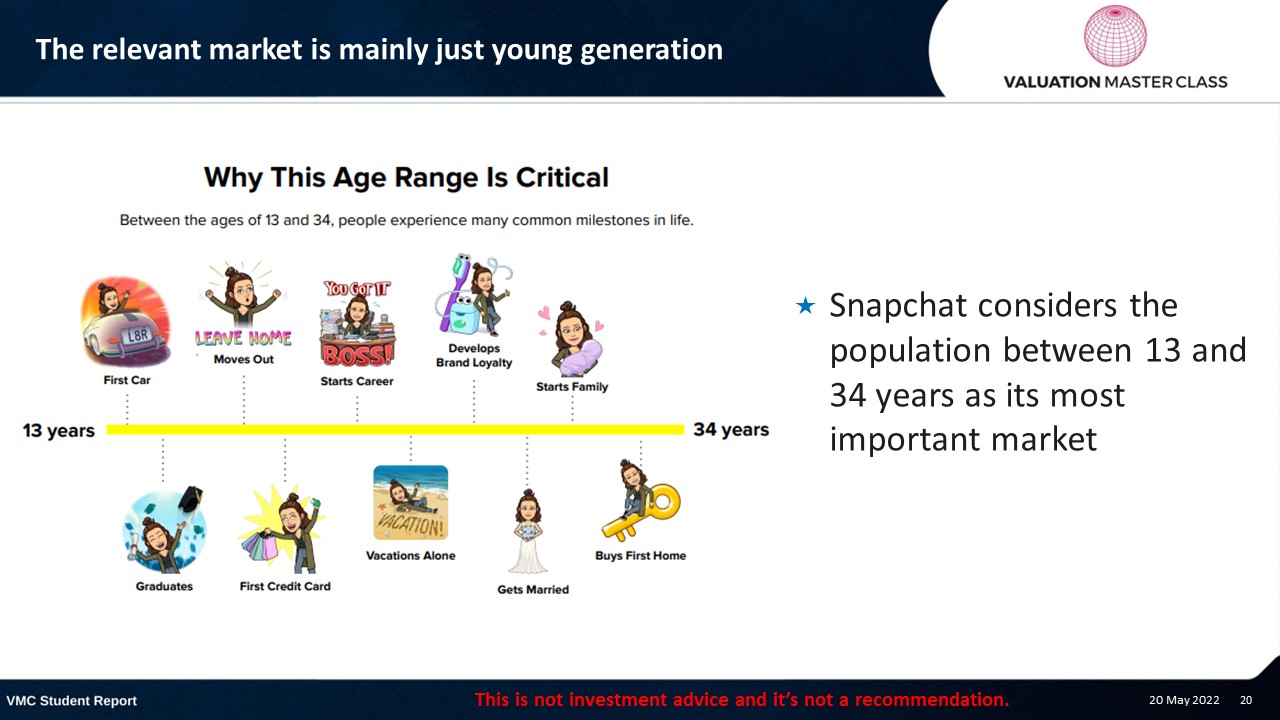

The relevant market is mainly just young generation

- Snapchat considers the population between 13 and 34 years as its most important market

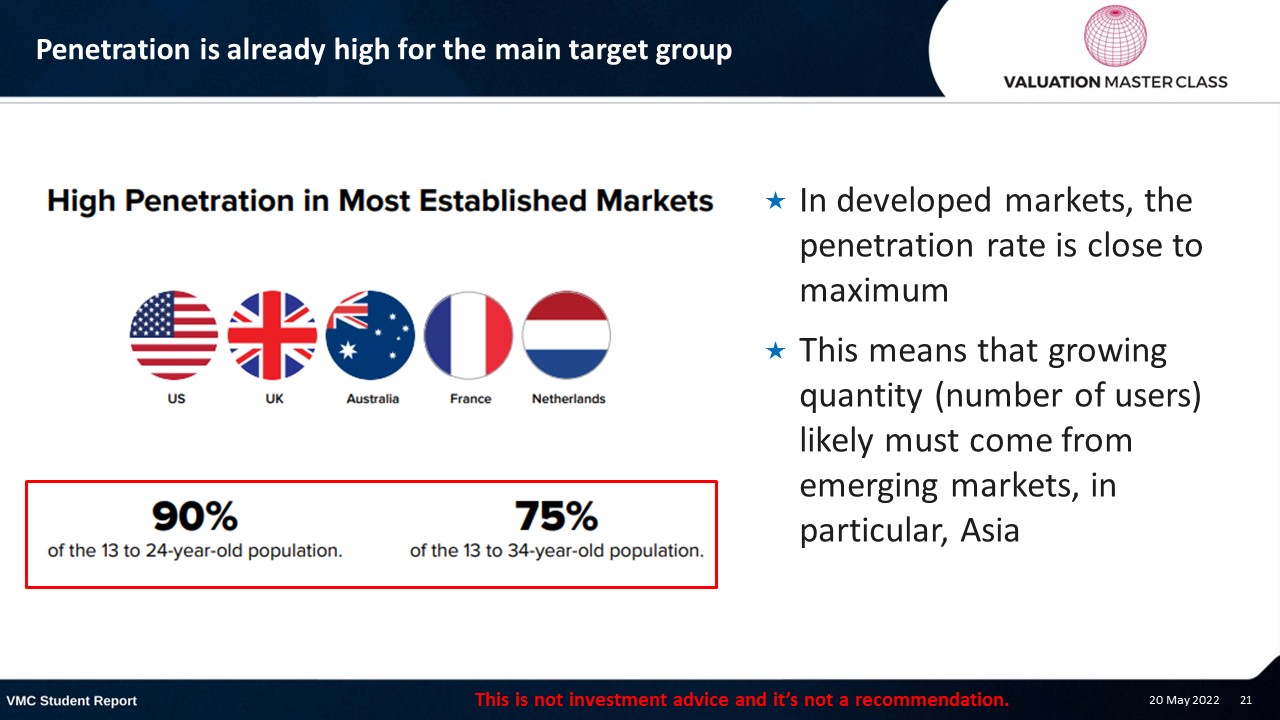

Penetration is already high for the main target group

- In developed markets, the penetration rate is close to maximum

- This means that growing quantity (number of users) likely must come from emerging markets, in particular, Asia

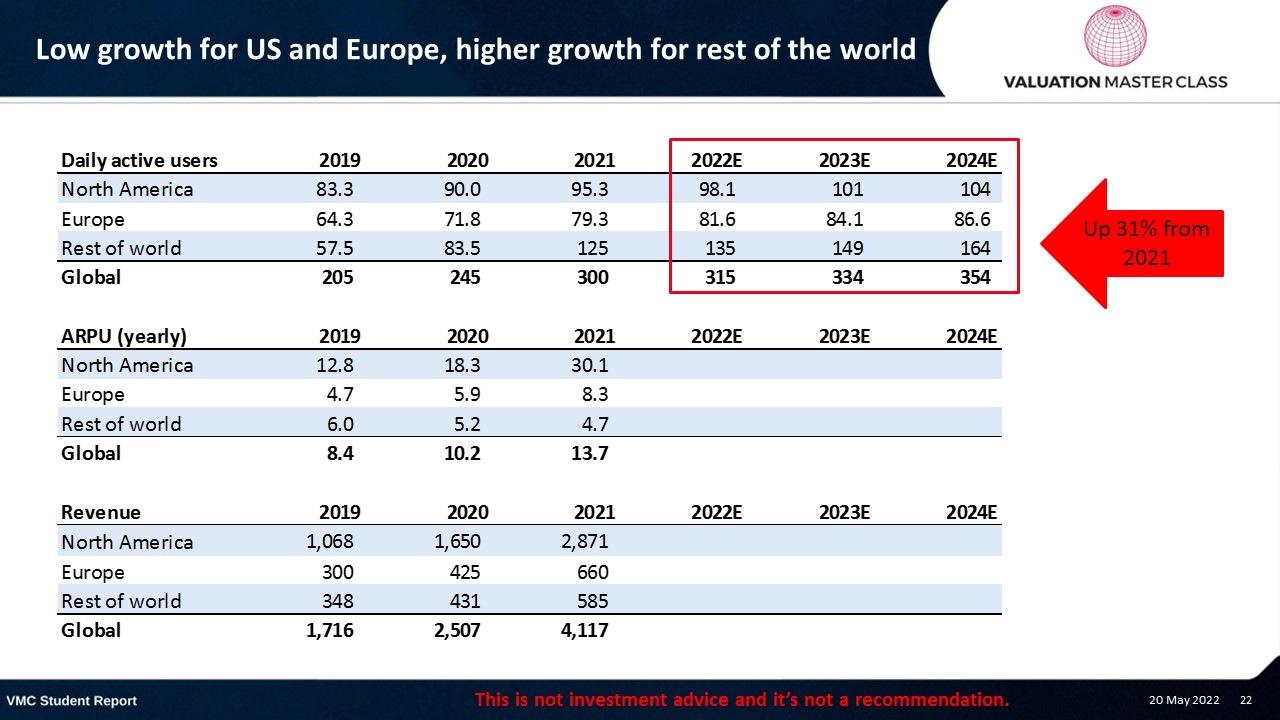

Low growth for US and Europe, higher growth for rest of the world

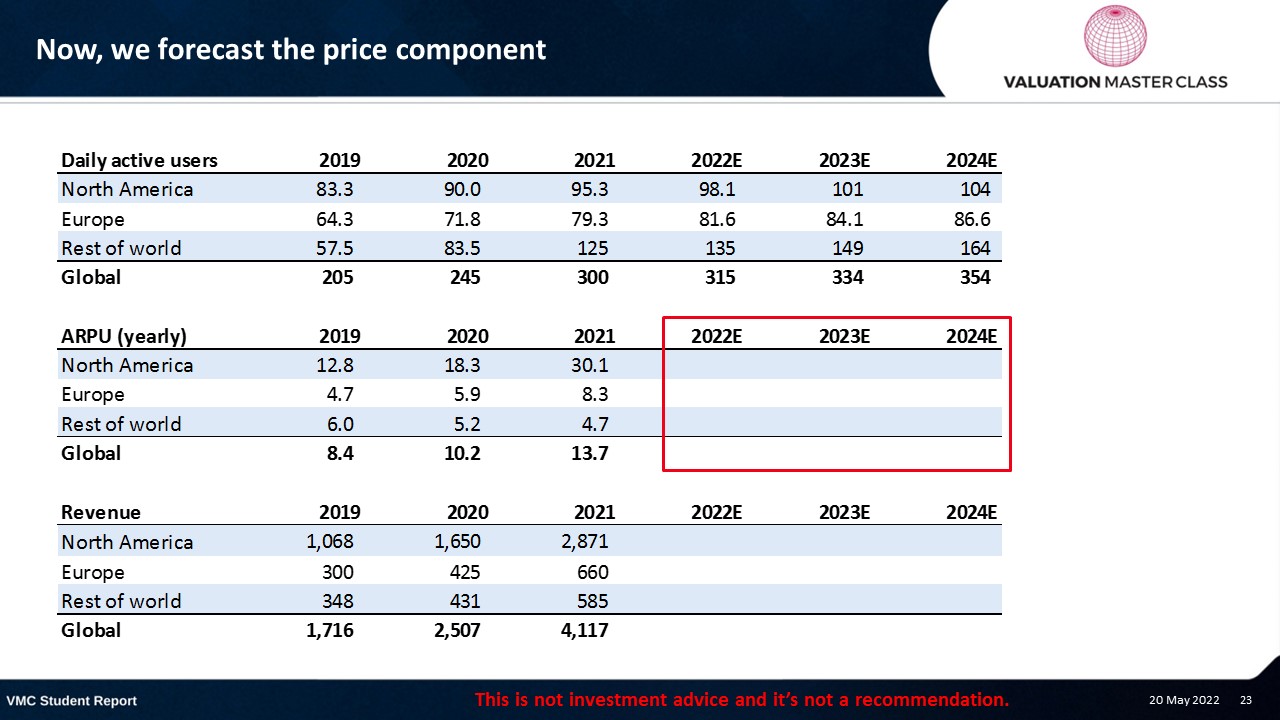

Now, we forecast the price component

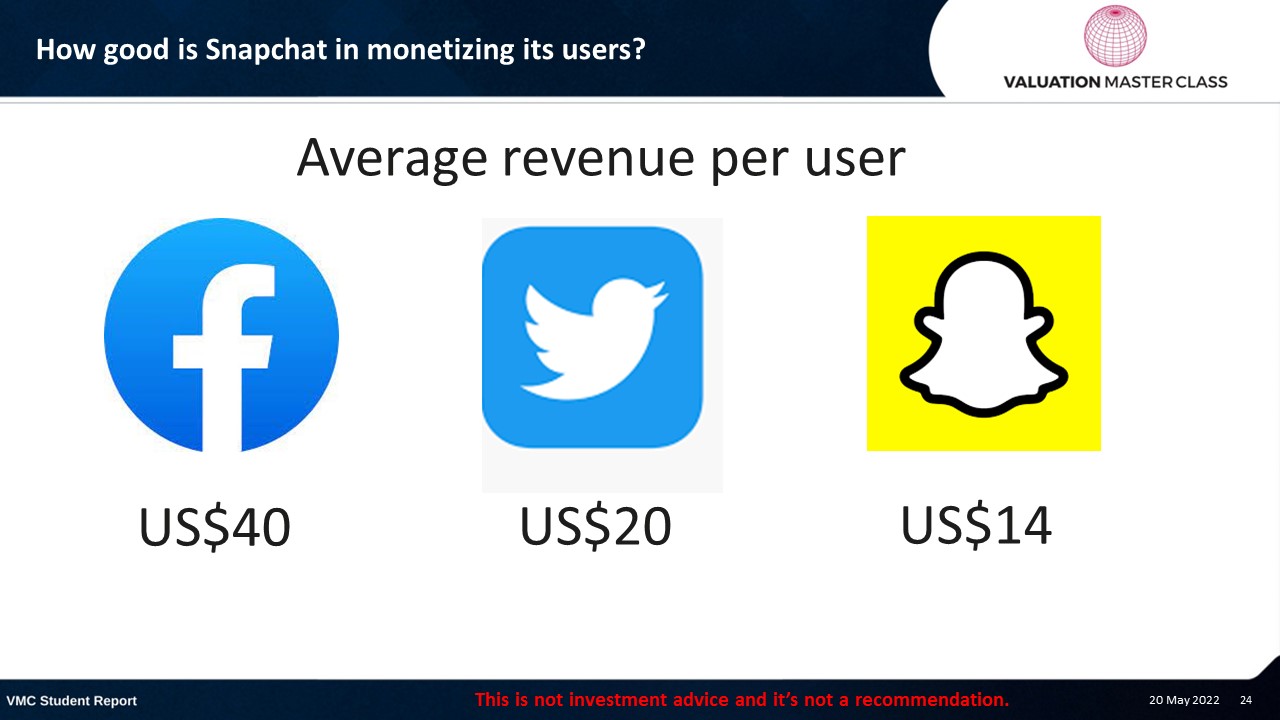

How good is Snapchat in monetizing its users?

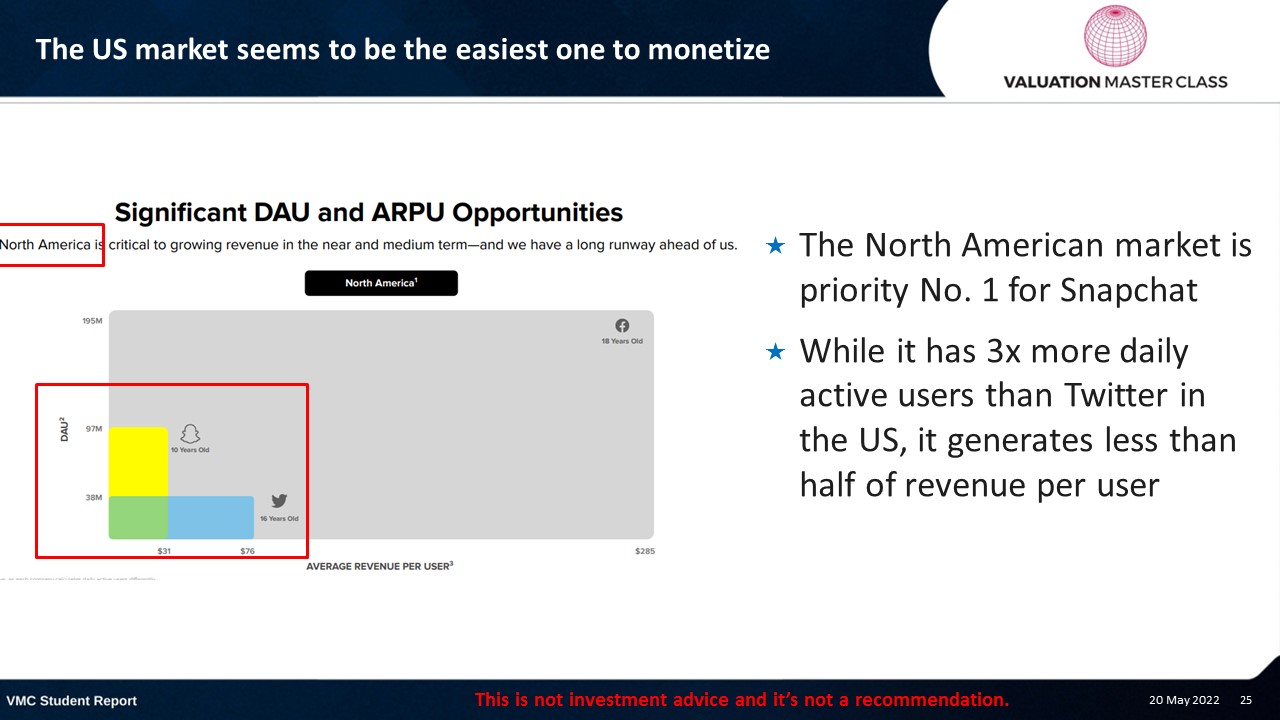

The US market seems to be the easiest one to monetize

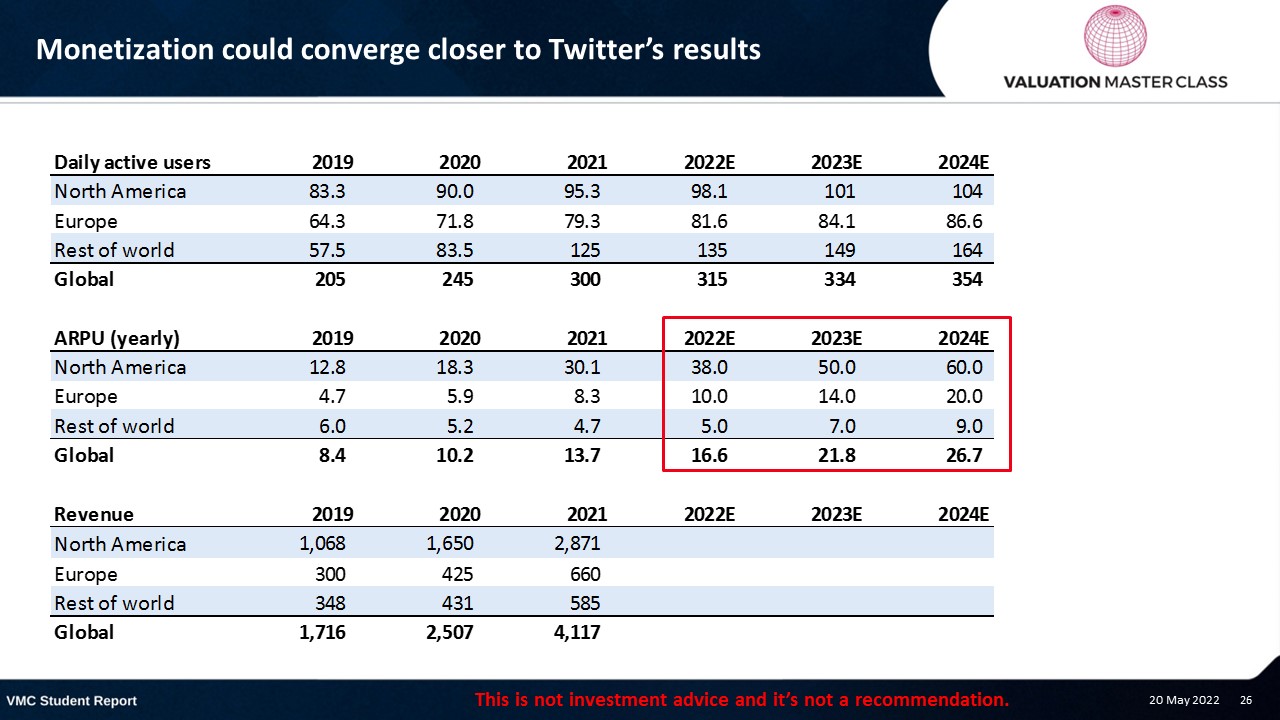

Monetization could converge closer to Twitter’s results

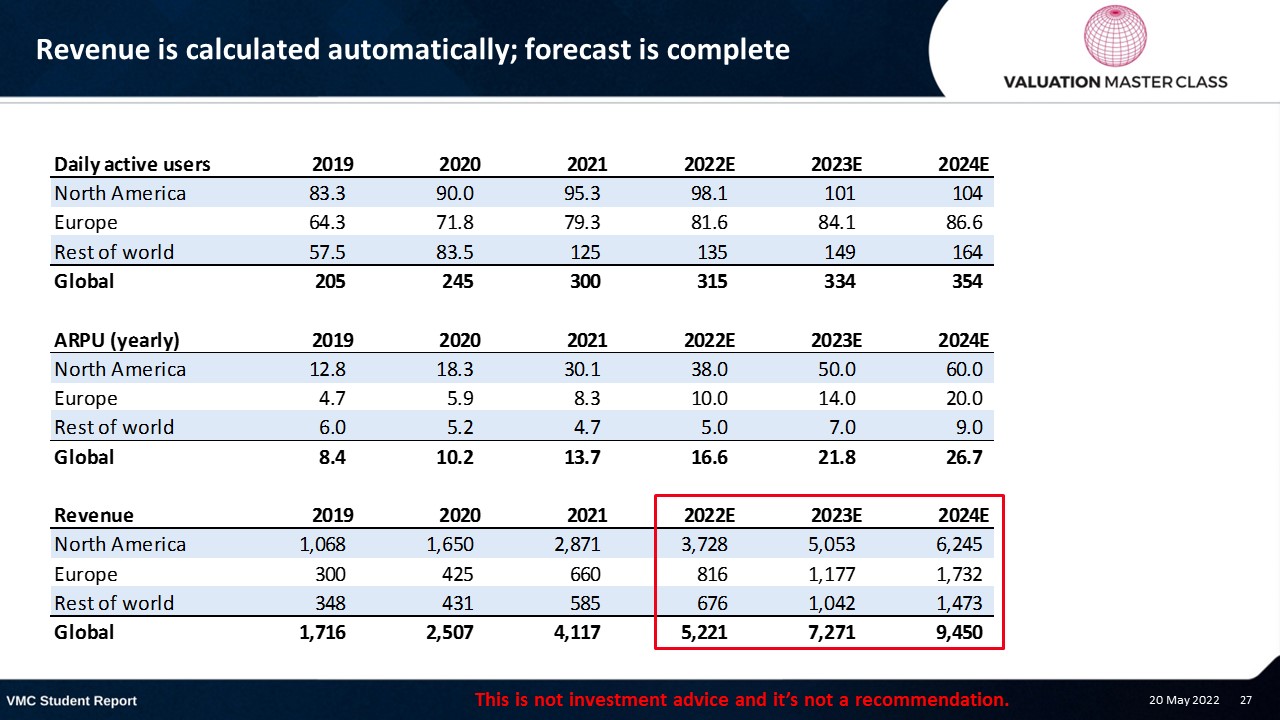

Revenue is calculated automatically; forecast is complete

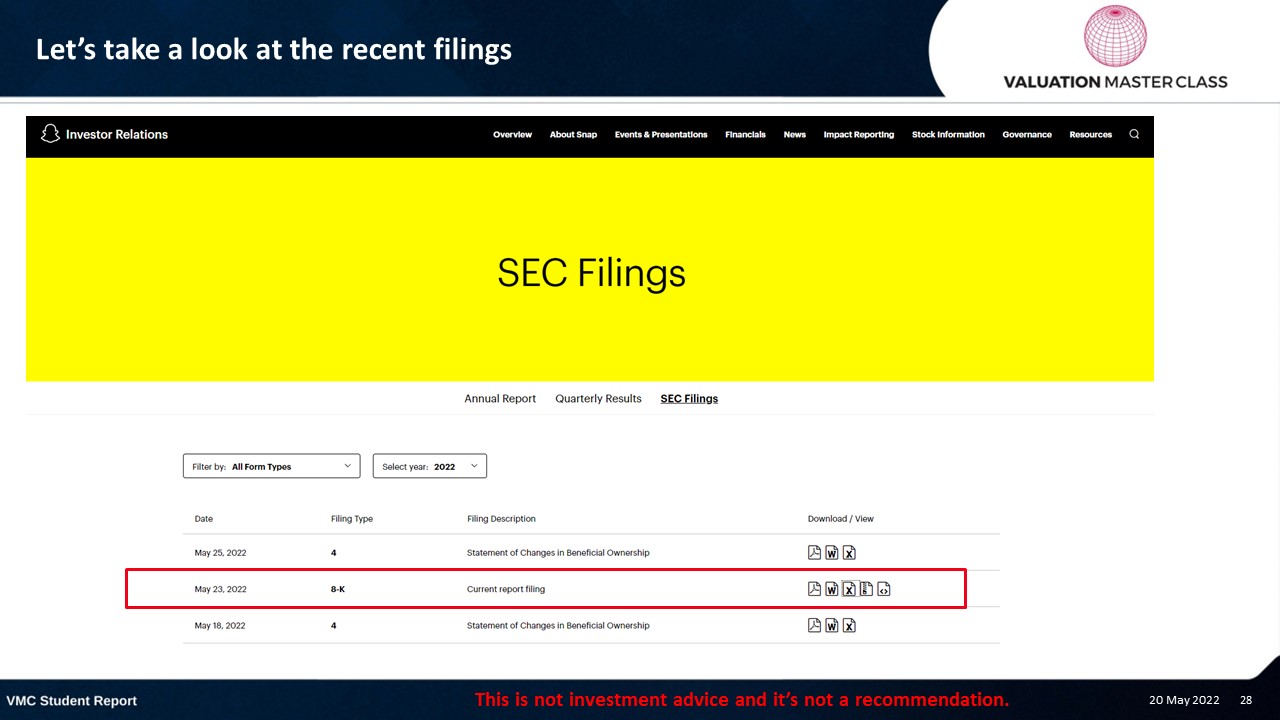

Let’s take a look at the recent filings

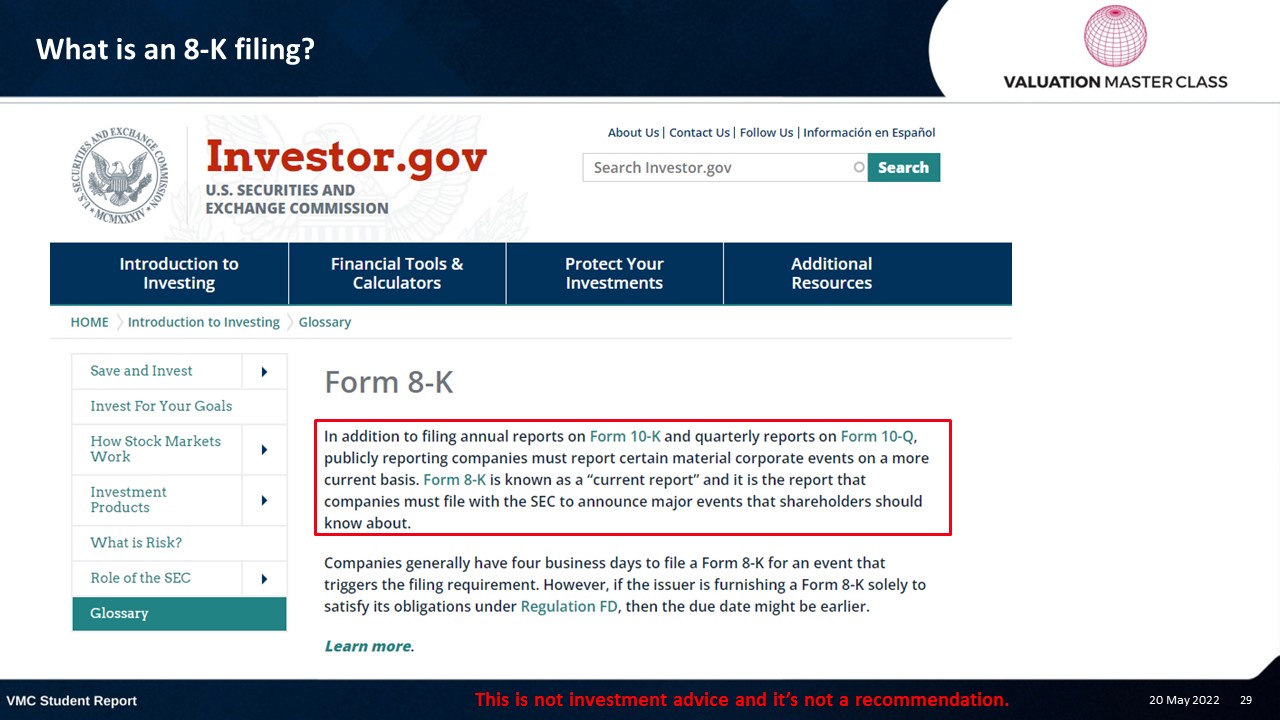

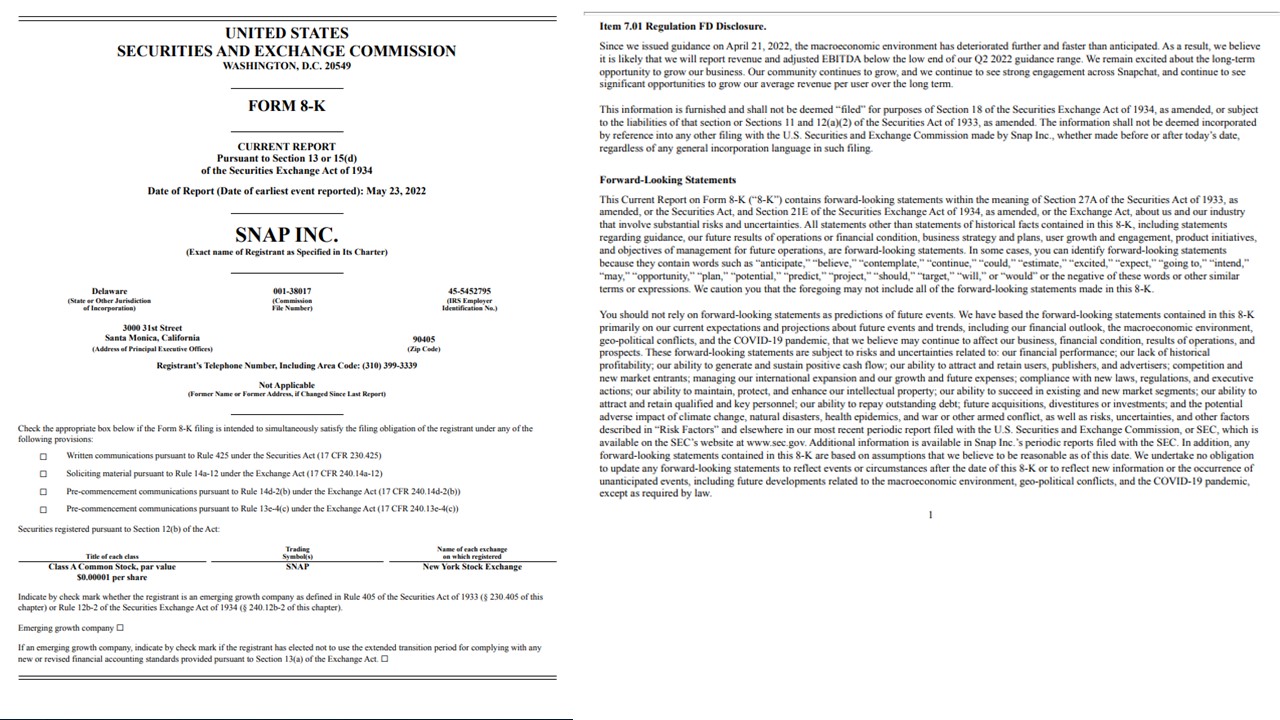

What is an 8-K filing?

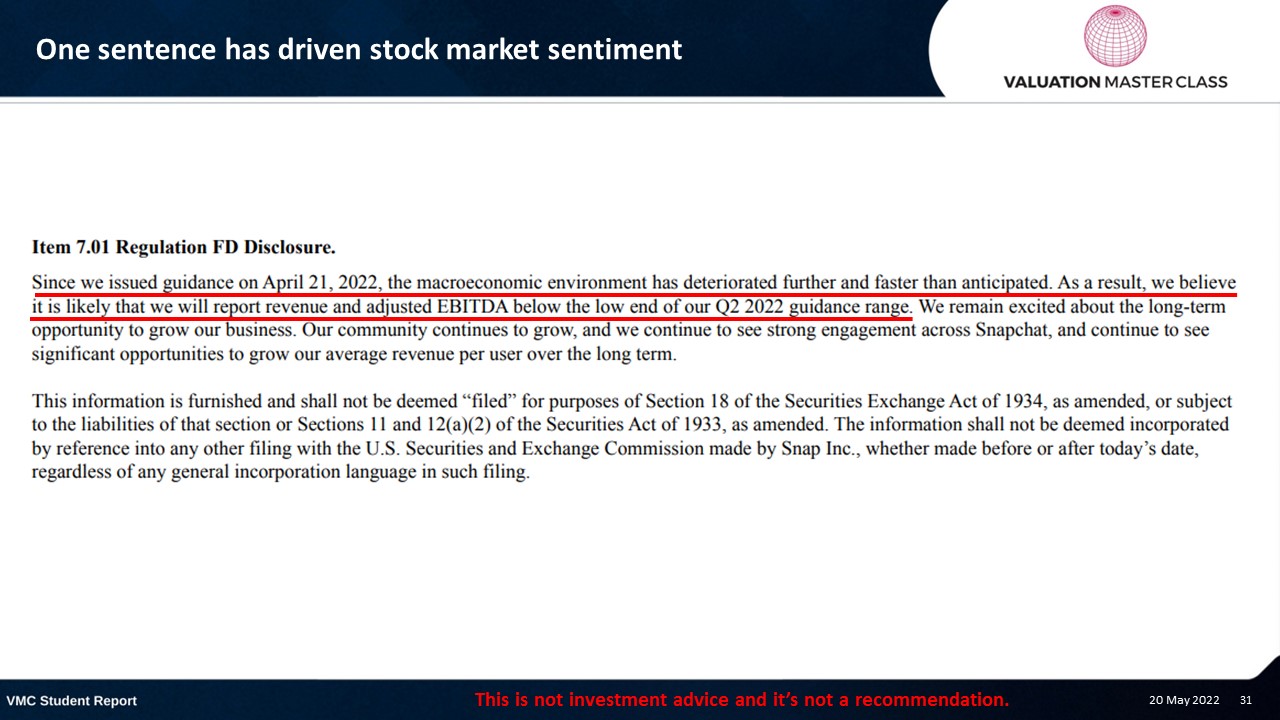

One sentence has driven stock market sentiment

In fact, we are not that smarter than before

- A company always has more information than any investor

- The company did not provide any guidance on how bad the impact actually is

- The only thing we can take away from the company’s statement is to reconsider our revenue drivers

- But if we take a look at Snapchat’s fundamentals, the market correction was just a question of time…

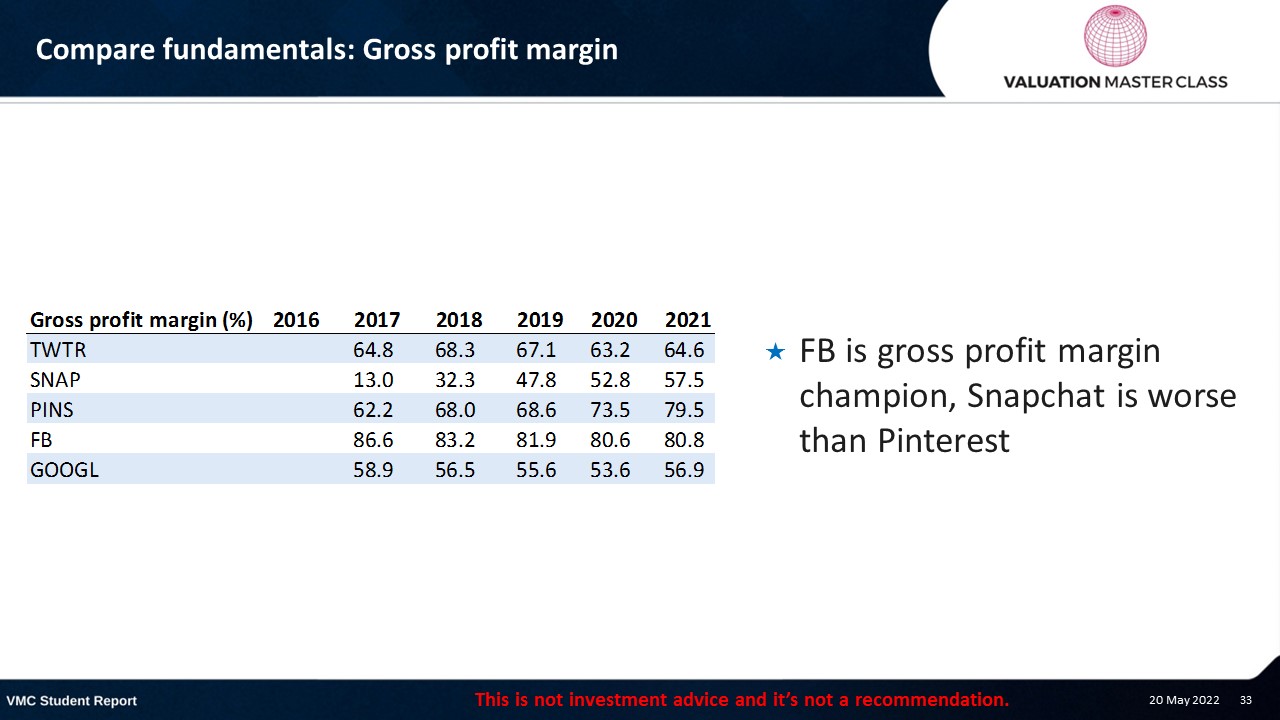

Compare fundamentals: Gross profit margin

- FB is gross profit margin champion, Snapchat is worse than Pinterest

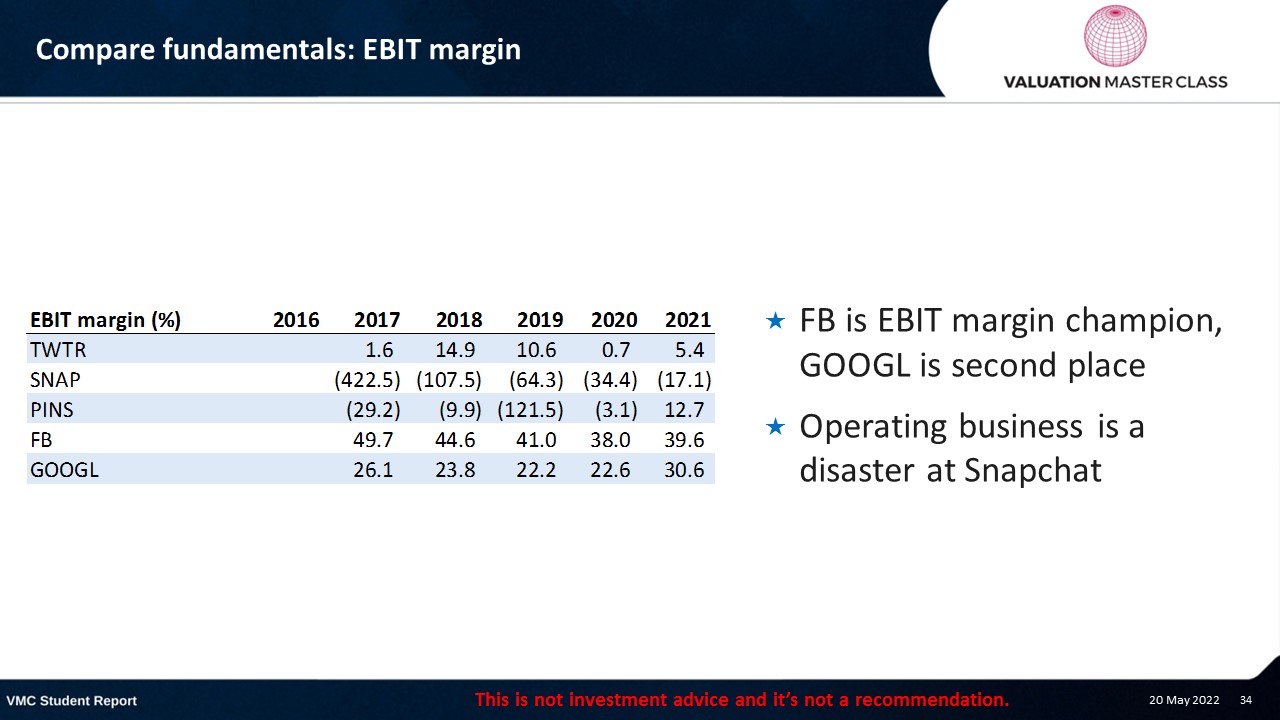

Compare fundamentals: EBIT margin

- FB is EBIT margin champion, GOOGL is second place

- Operating business is a disaster at Snapchat

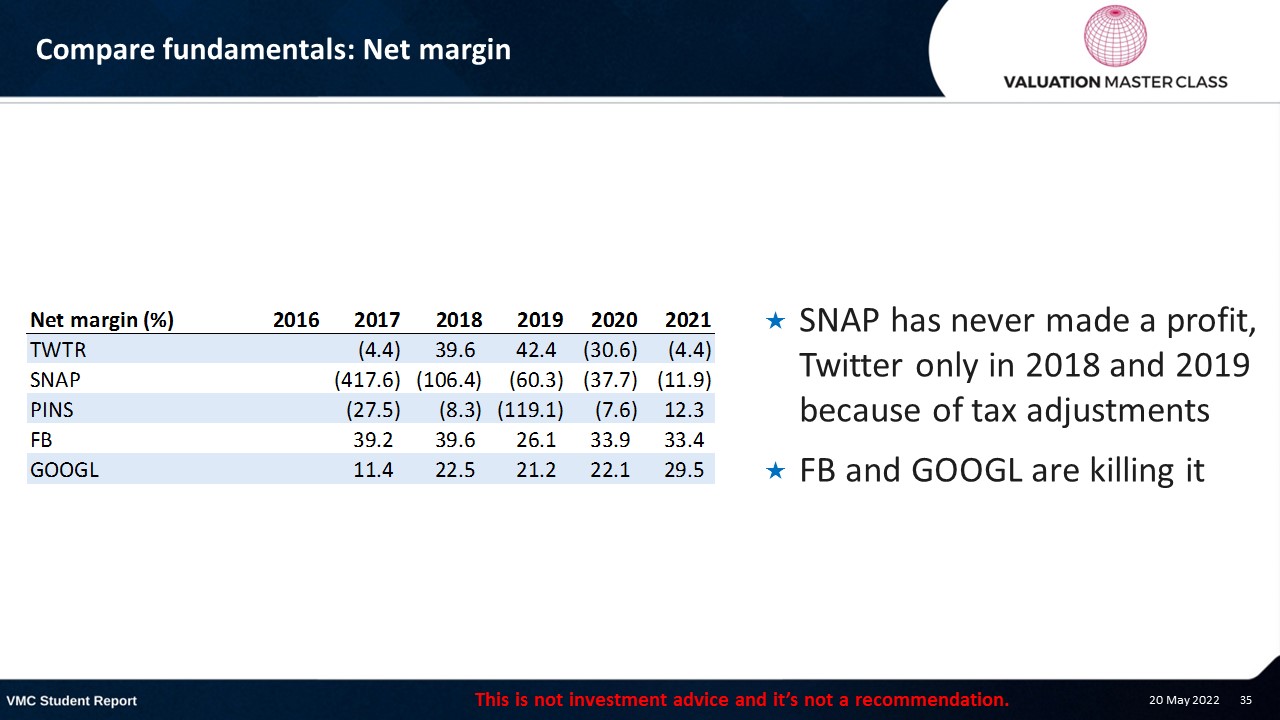

Compare fundamentals: Net margin

- SNAP has never made a profit, Twitter only in 2018 and 2019 because of tax adjustments

- FB and GOOGL are killing it

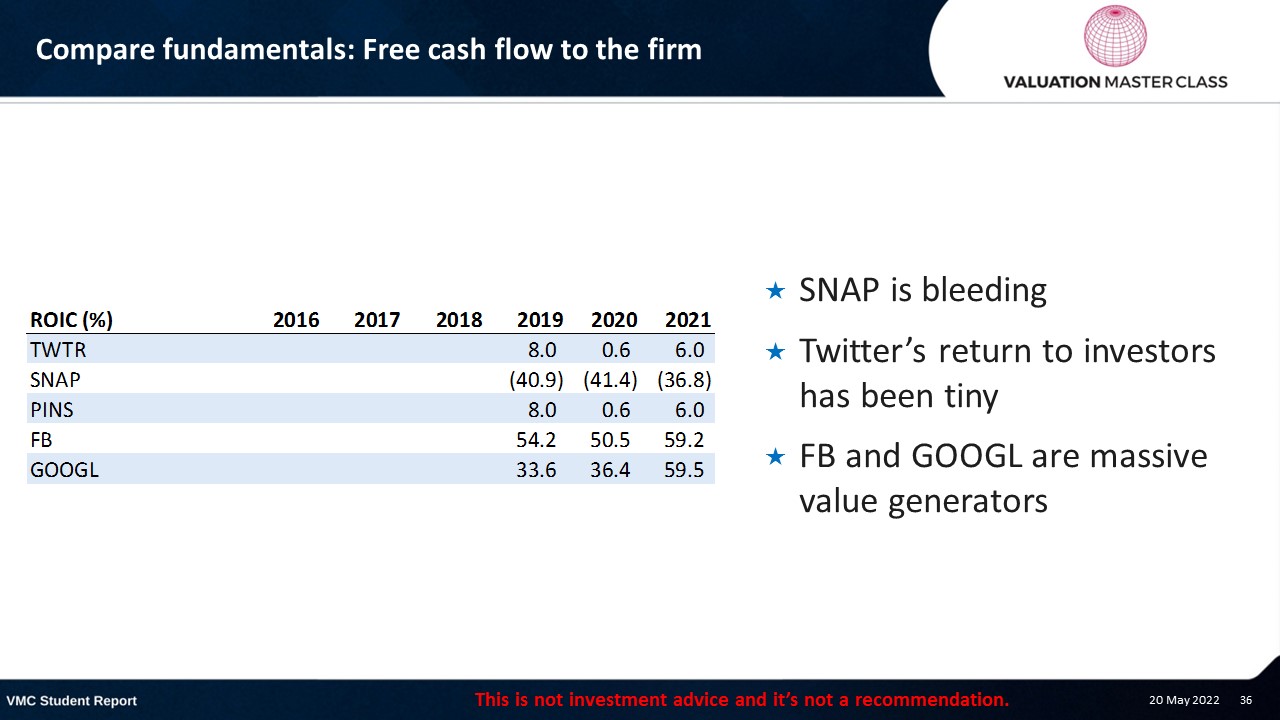

Compare fundamentals: Free cash flow to the firm

- SNAP is bleeding

- Twitter’s return to investors has been tiny

- FB and GOOGL are massive value generators

Download the full report as a PDF

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.