Is Ferrari’s Prestige Enough to Drive Its High Valuation?

What’s interesting about Ferrari is that when they increase the price, demand also rises

Download the full report as a PDF

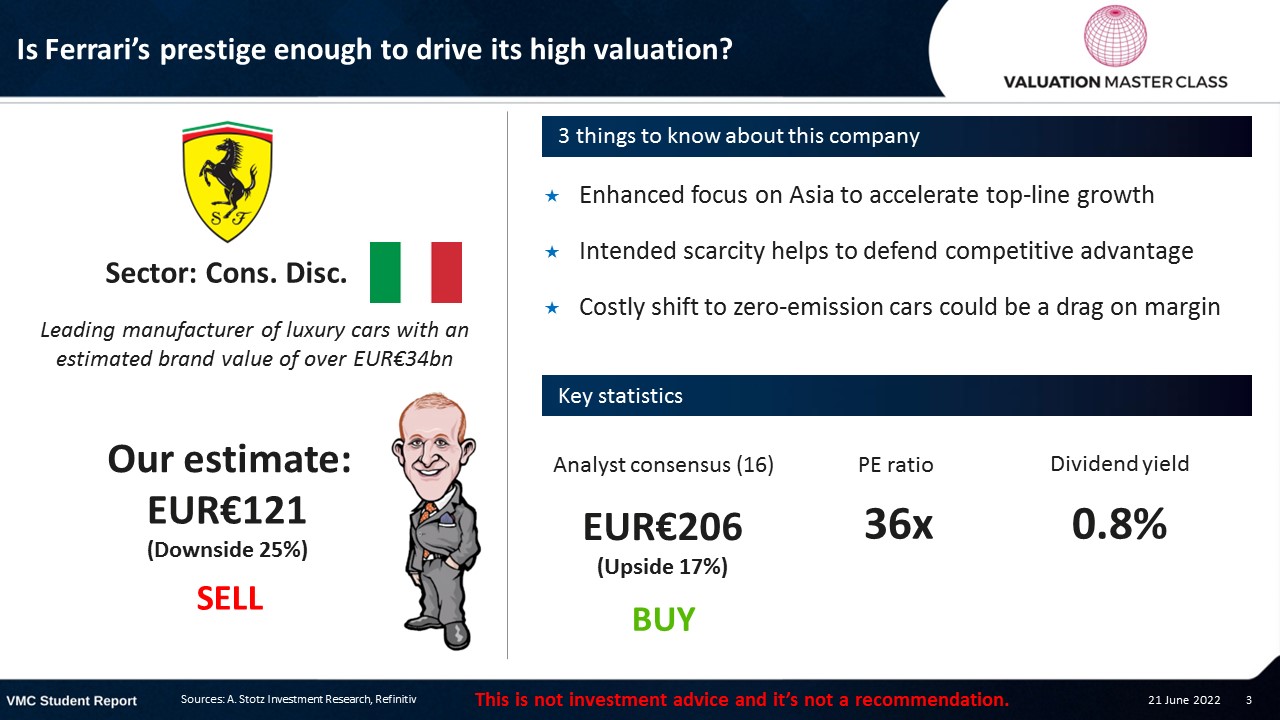

Is Ferrari’s prestige enough to drive its high valuation?

- Enhanced focus on Asia to accelerate top-line growth

- Intended scarcity helps to defend competitive advantage

- Costly shift to zero-emission cars could be a drag on margin

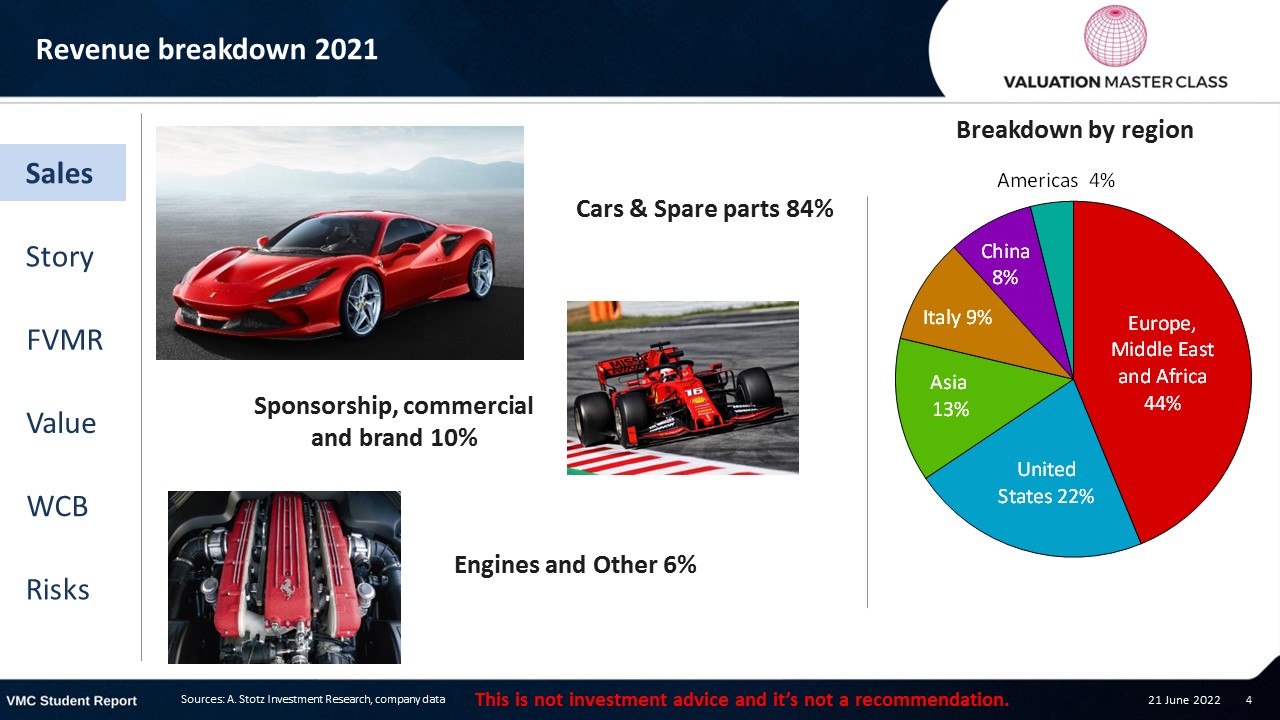

Revenue breakdown 2021

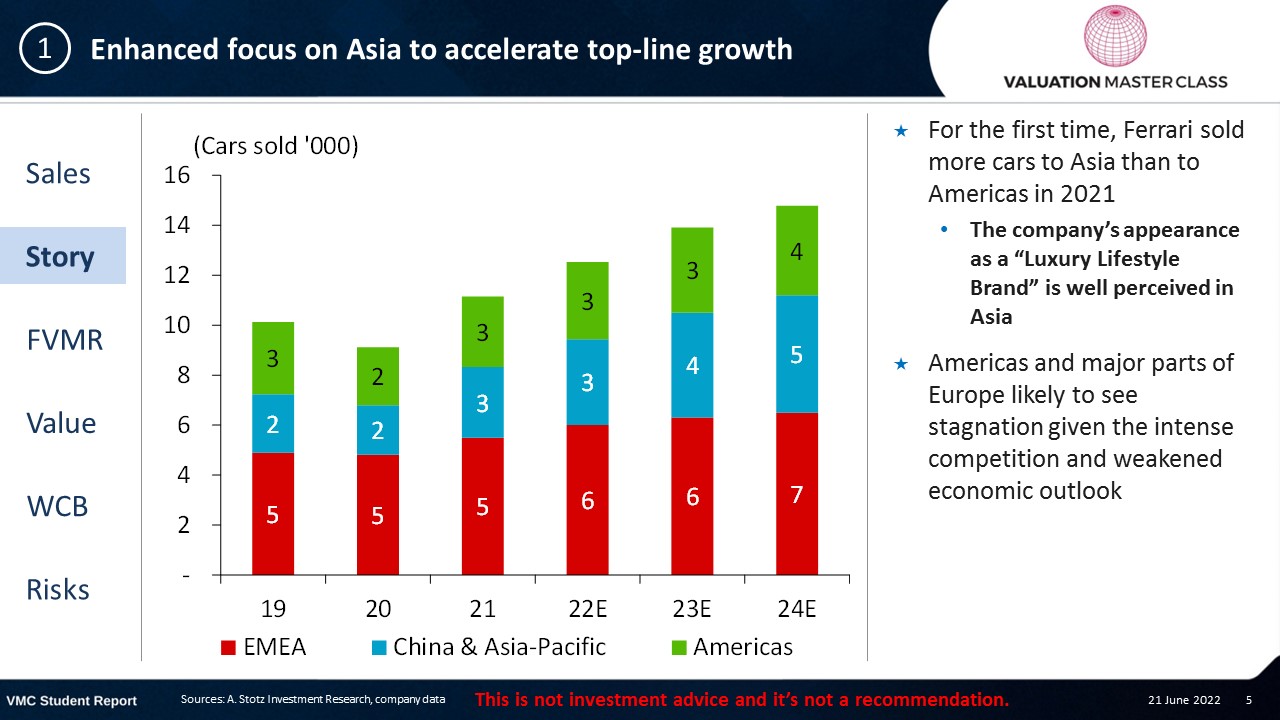

Enhanced focus on Asia to accelerate top-line growth

- For the first time, Ferrari sold more cars to Asia than to Americas in 2021

- The company’s appearance as a “Luxury Lifestyle Brand” is well perceived in Asia

- Americas and major parts of Europe likely to see stagnation given the intense competition and weakened economic outlook

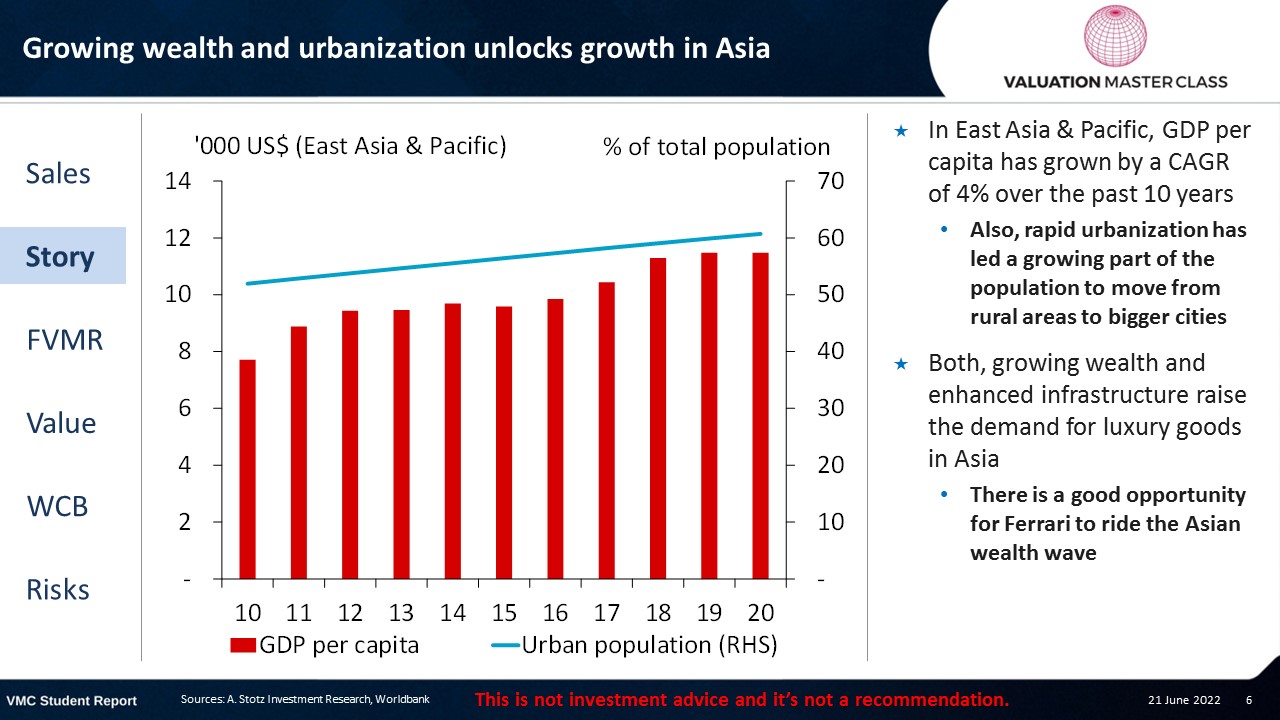

Growing wealth and urbanization unlocks growth in Asia

- In East Asia & Pacific, GDP per capita has grown by a CAGR of 4% over the past 10 years

- Also, rapid urbanization has led a growing part of the population to move from rural areas to bigger cities

- Both, growing wealth and enhanced infrastructure raise the demand for luxury goods in Asia

- There is a good opportunity for Ferrari to ride the Asian wealth wave

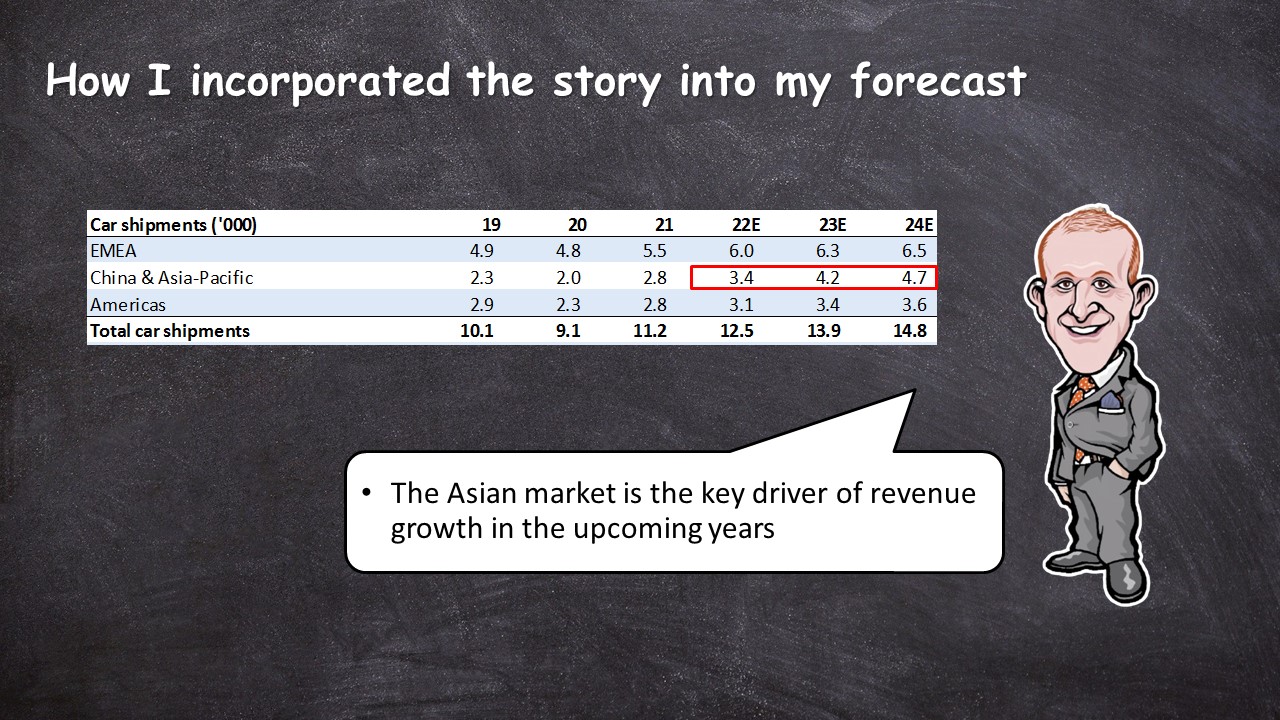

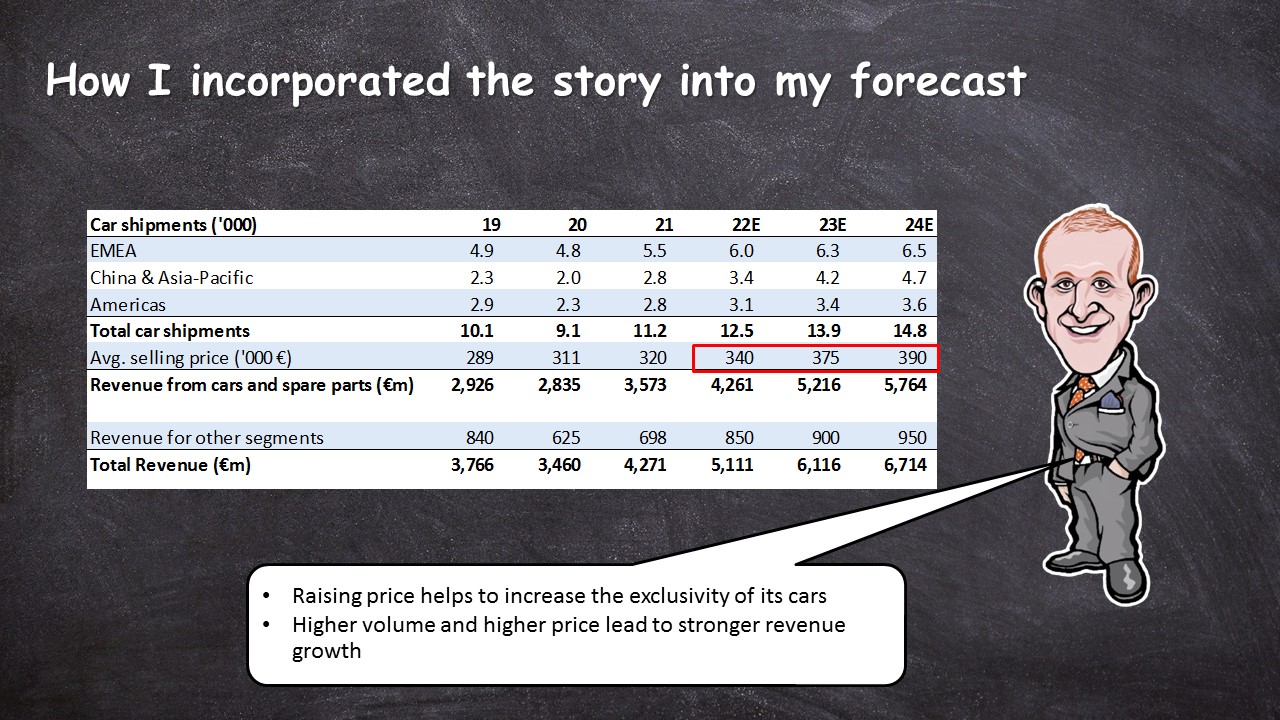

How I incorporated the story into my forecast

- The Asian market is the key driver of revenue growth in the upcoming years

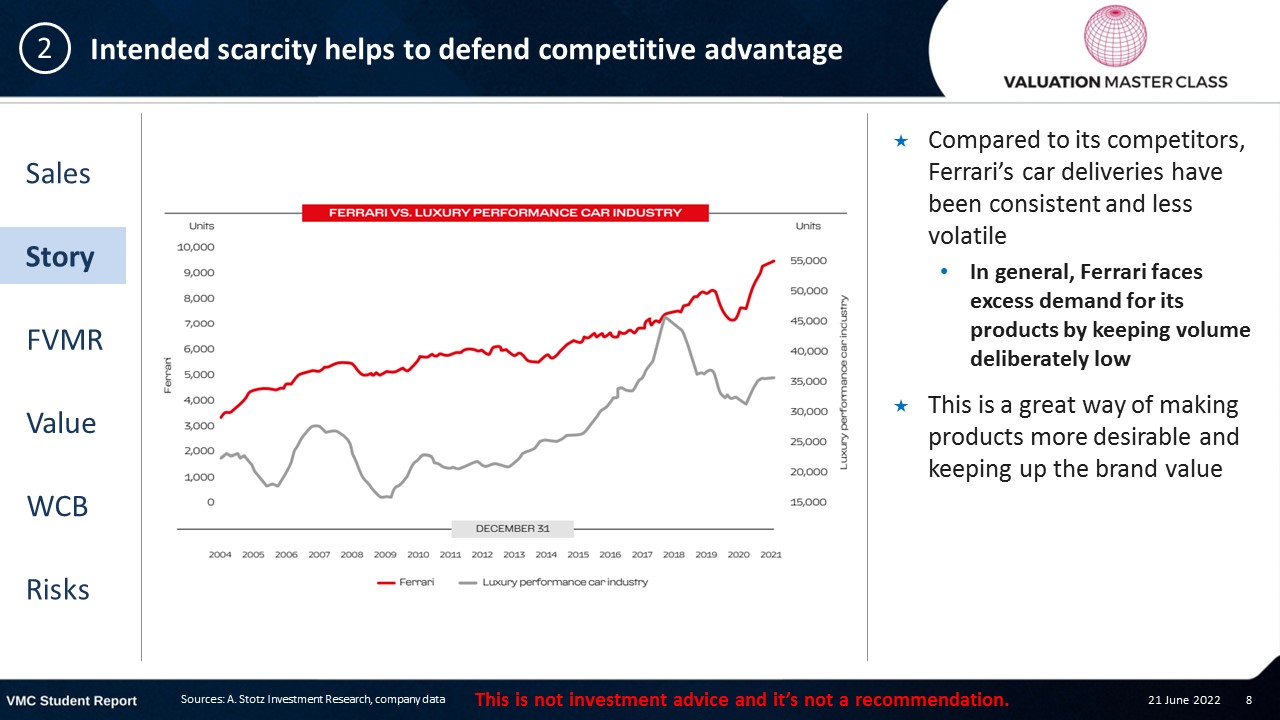

Intended scarcity helps to defend competitive advantage

- Compared to its competitors, Ferrari’s car deliveries have been consistent and less volatile

- In general, Ferrari faces excess demand for its products by keeping volume deliberately low

- This is a great way of making products more desirable and keeping up the brand value

Increasing price to increase demand sounds very odd

- For the majority of goods, we observe that overall demand decreases when price increases

- People tend to switch to cheaper variants or look for substitute products

- However, there are a few products where the law of demand does not hold

- Economists call them “Veblen goods”

- If luxury products become cheap, they lose the premium status as more people can afford it

- Raising the price helps to keep exclusivity

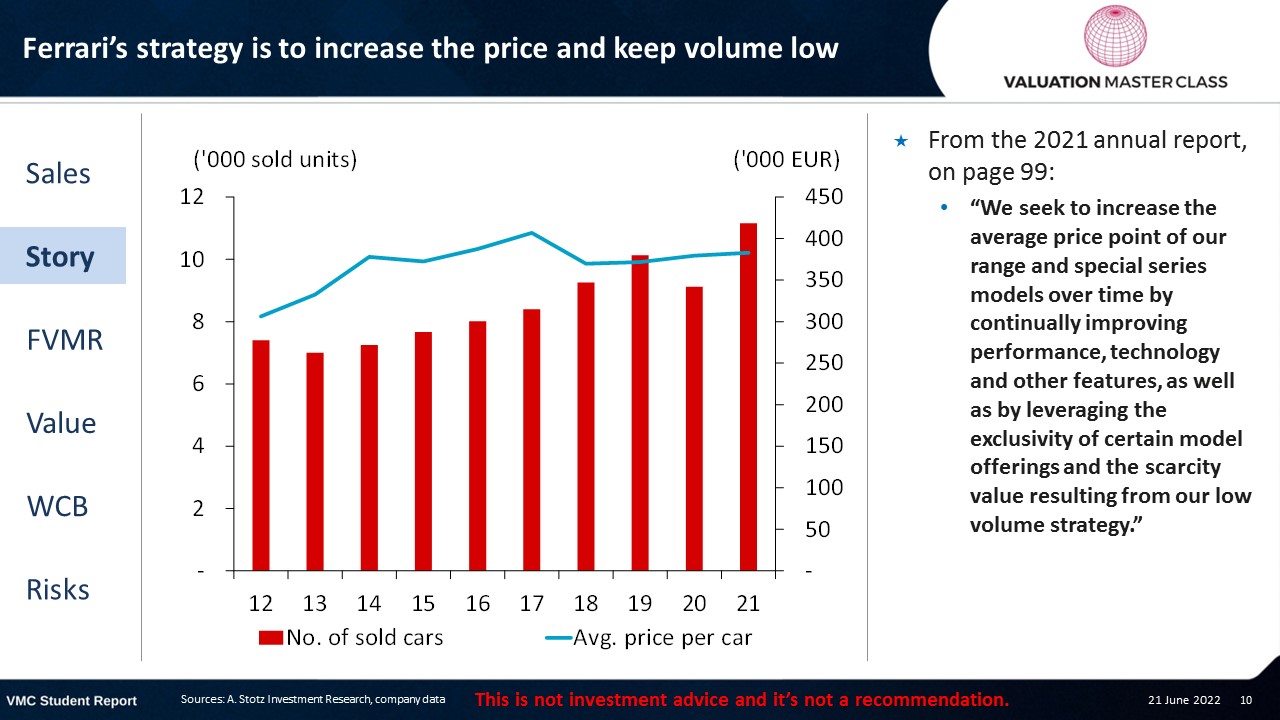

Ferrari’s strategy is to increase the price and keep volume low

- From the 2021 annual report, on page 99:

- “We seek to increase the average price point of our range and special series models over time by continually improving performance, technology and other features, as well as by leveraging the exclusivity of certain model offerings and the scarcity value resulting from our low volume strategy.”

How I incorporated the story into my forecast

- Raising price helps to increase the exclusivity of its cars

- Higher volume and higher price lead to stronger revenue growth

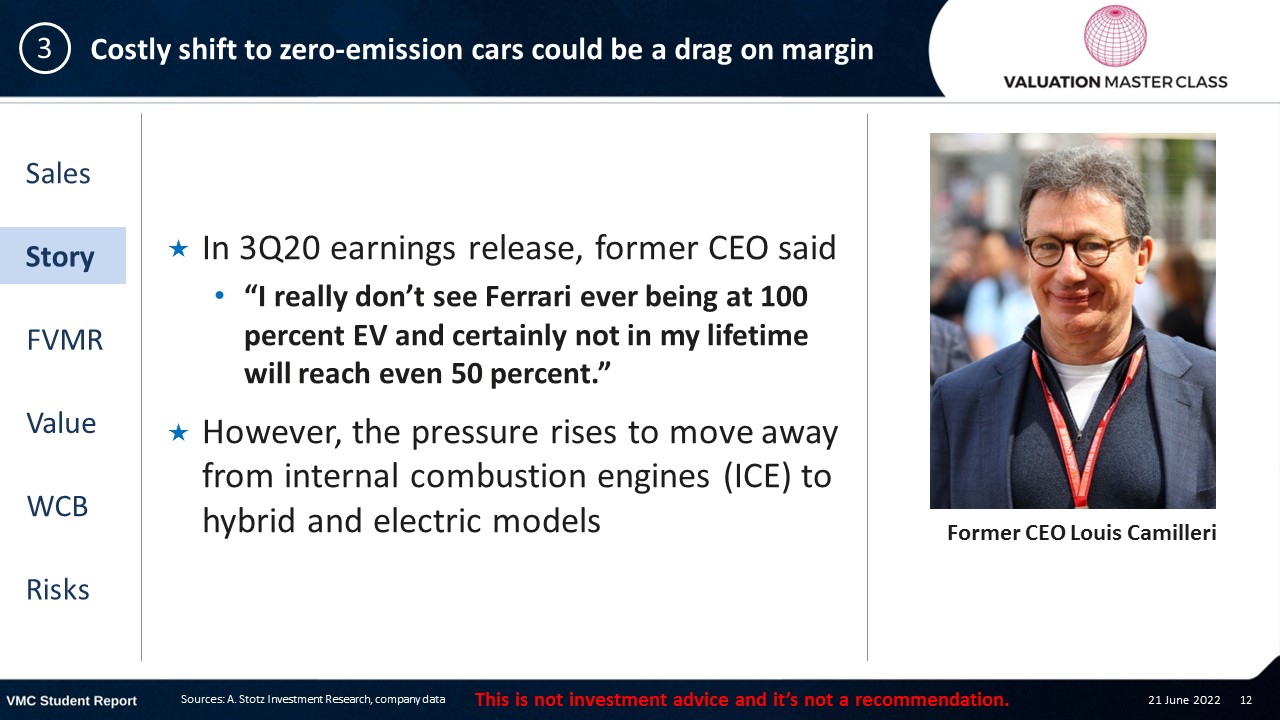

Costly shift to zero-emission cars could be a drag on margin

- In 3Q20 earnings release, former CEO said

- “I really don’t see Ferrari ever being at 100 percent EV and certainly not in my lifetime will reach even 50 percent.”

- However, the pressure rises to move away from internal combustion engines (ICE) to hybrid and electric models

Are customer willing to give up the satisfaction of a great sound?

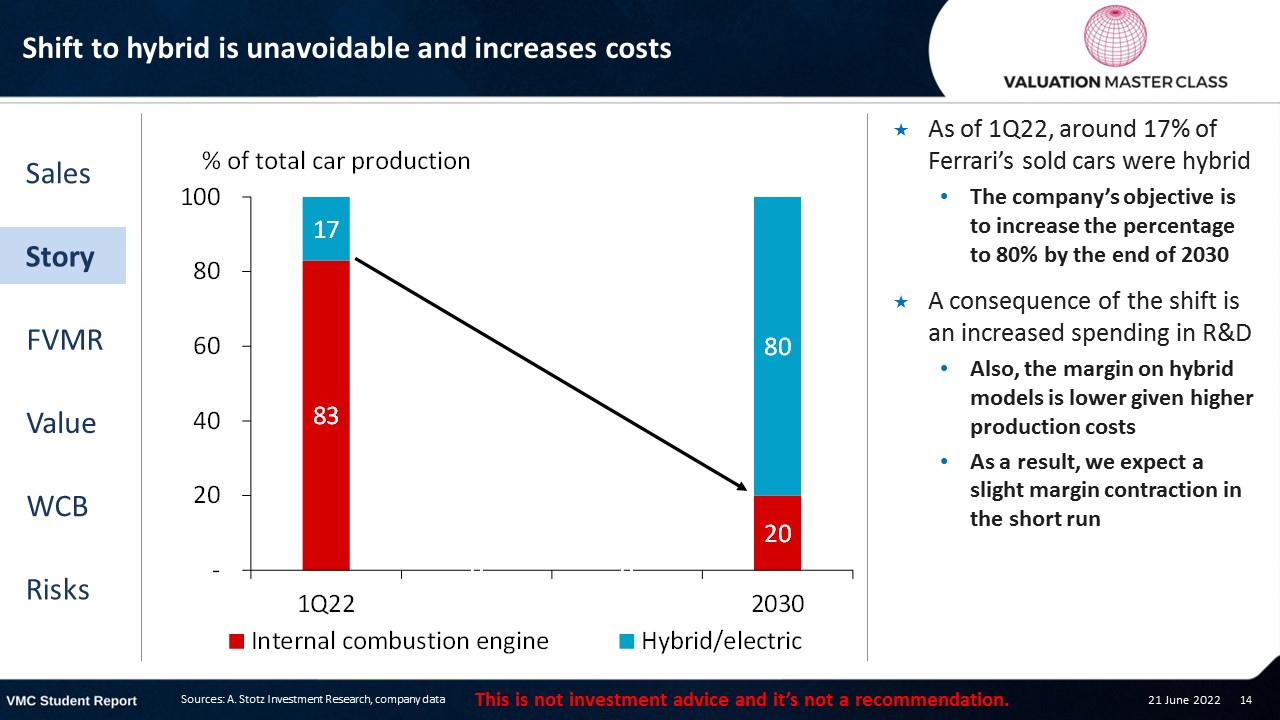

Shift to hybrid is unavoidable and increases costs

- As of 1Q22, around 17% of Ferrari’s sold cars were hybrid

- The company’s objective is to increase the percentage to 80% by the end of 2030

- A consequence of the shift is an increased spending in R&D

- Also, the margin on hybrid models is lower given higher production costs

- As a result, we expect a slight margin contraction in the short run

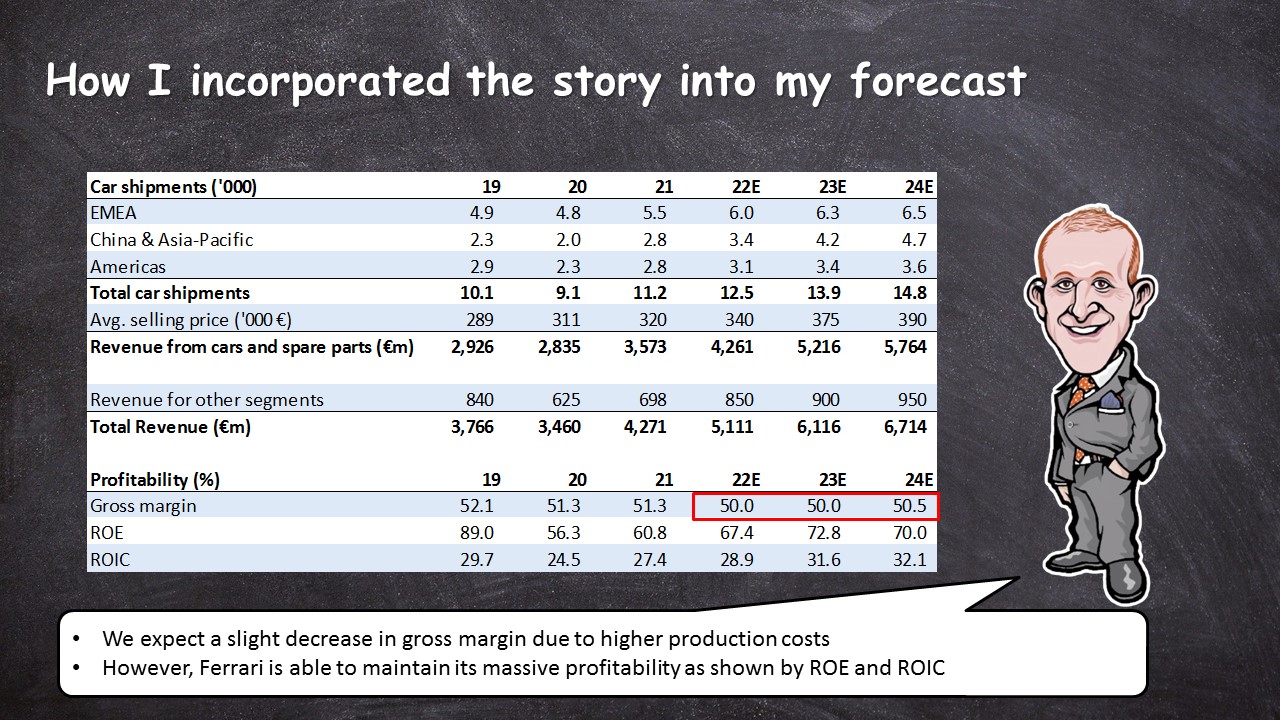

How I incorporated the story into my forecast

- We expect a slight decrease in gross margin due to higher production costs

- However, Ferrari is able to maintain its massive profitability as shown by ROE and ROIC

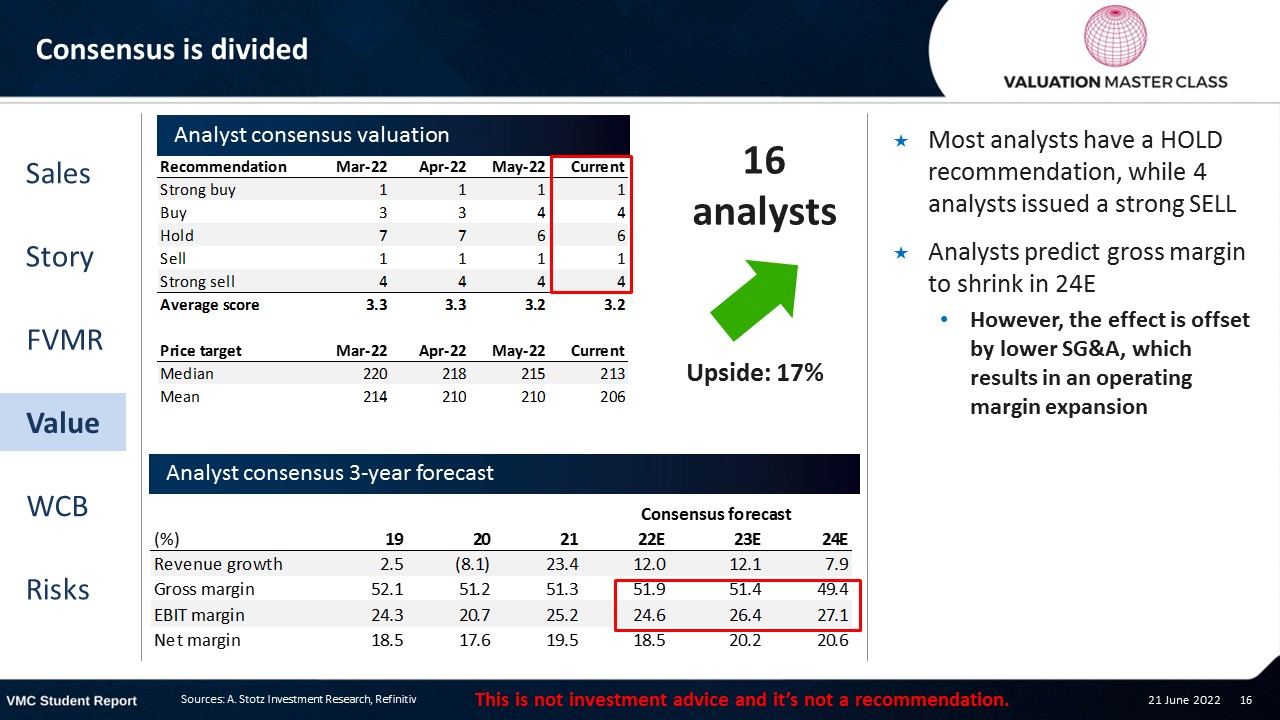

Consensus is divided

- Most analysts have a HOLD recommendation, while 4 analysts issued a strong SELL

- Analysts predict gross margin to shrink in 24E

- However, the effect is offset by lower SG&A, which results in an operating margin expansion

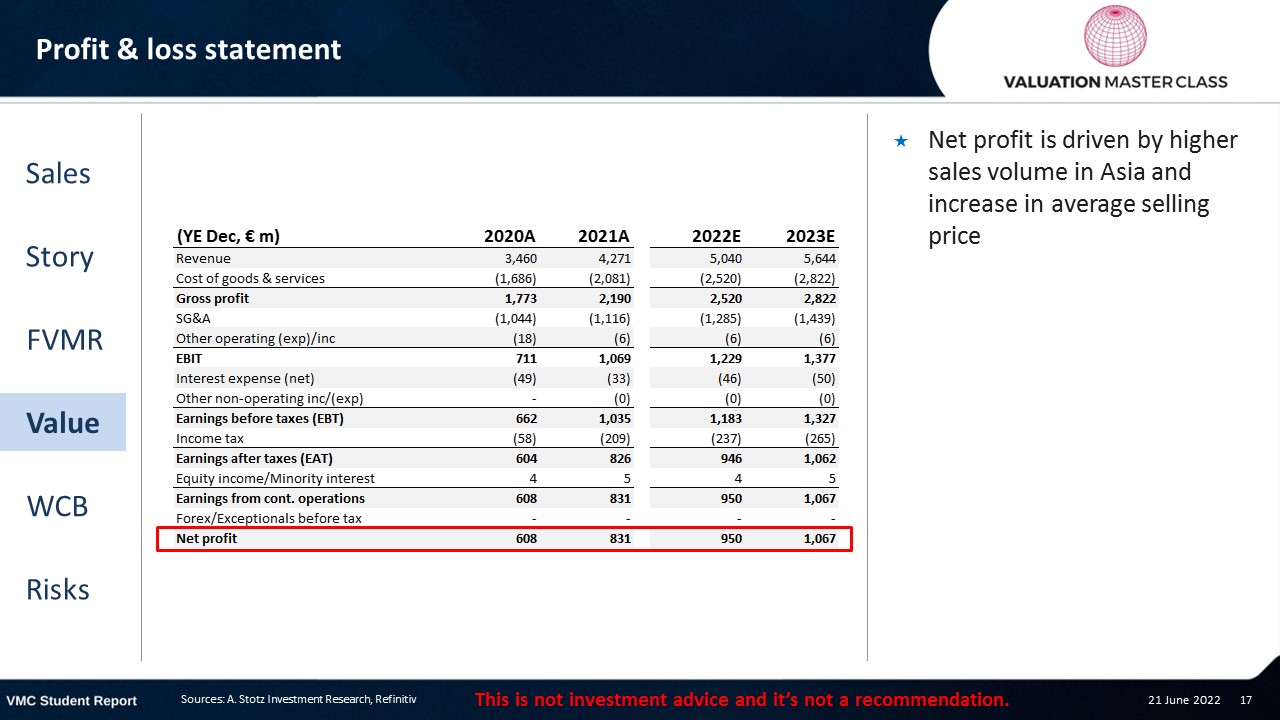

Profit & loss statement

- Net profit is driven by higher sales volume in Asia and increase in average selling price

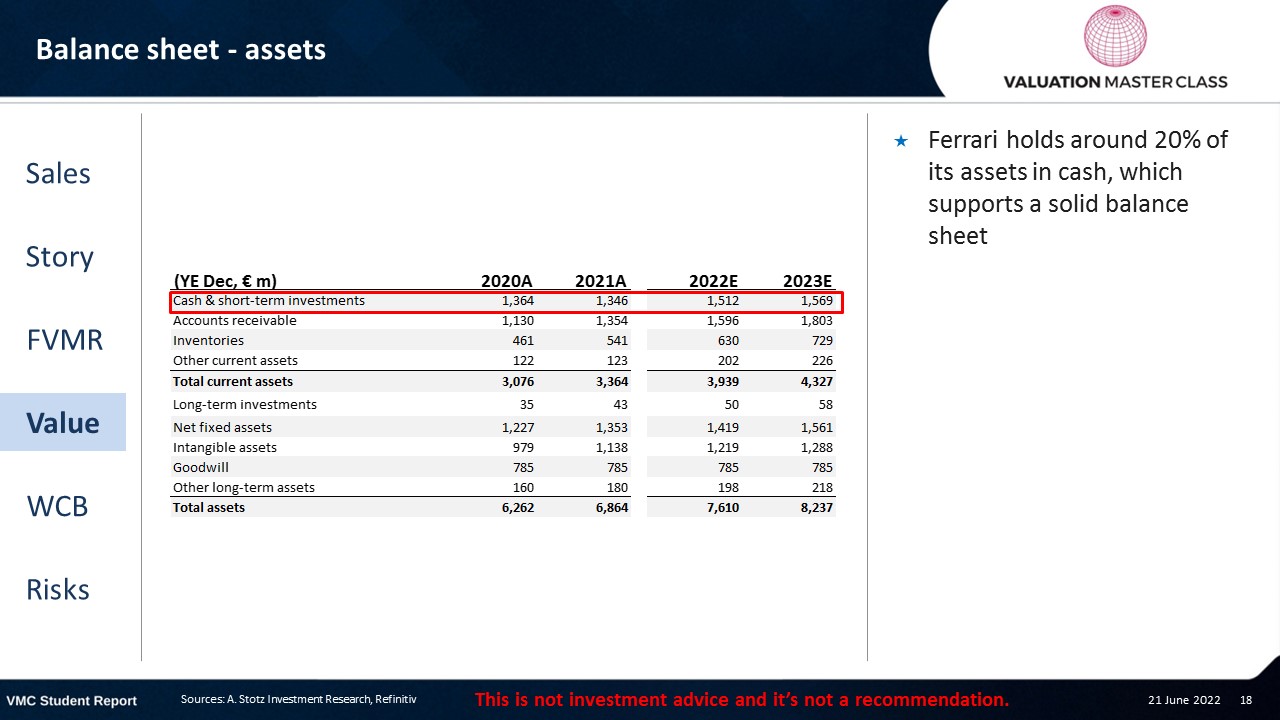

Balance sheet – assets

- Ferrari holds around 20% of its assets in cash, which supports a solid balance sheet

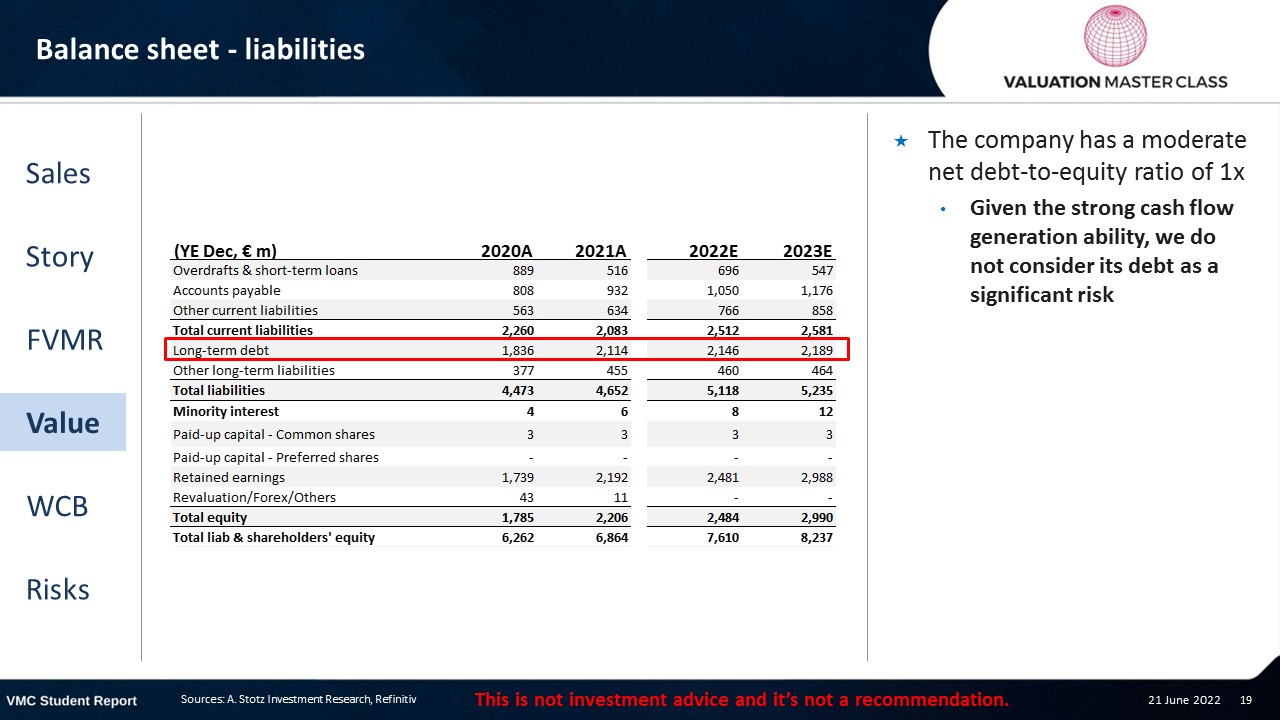

Balance sheet – liabilities

- The company has a moderate net debt-to-equity ratio of 1x

- Given the strong cash flow generation ability, we do not consider its debt as a significant risk

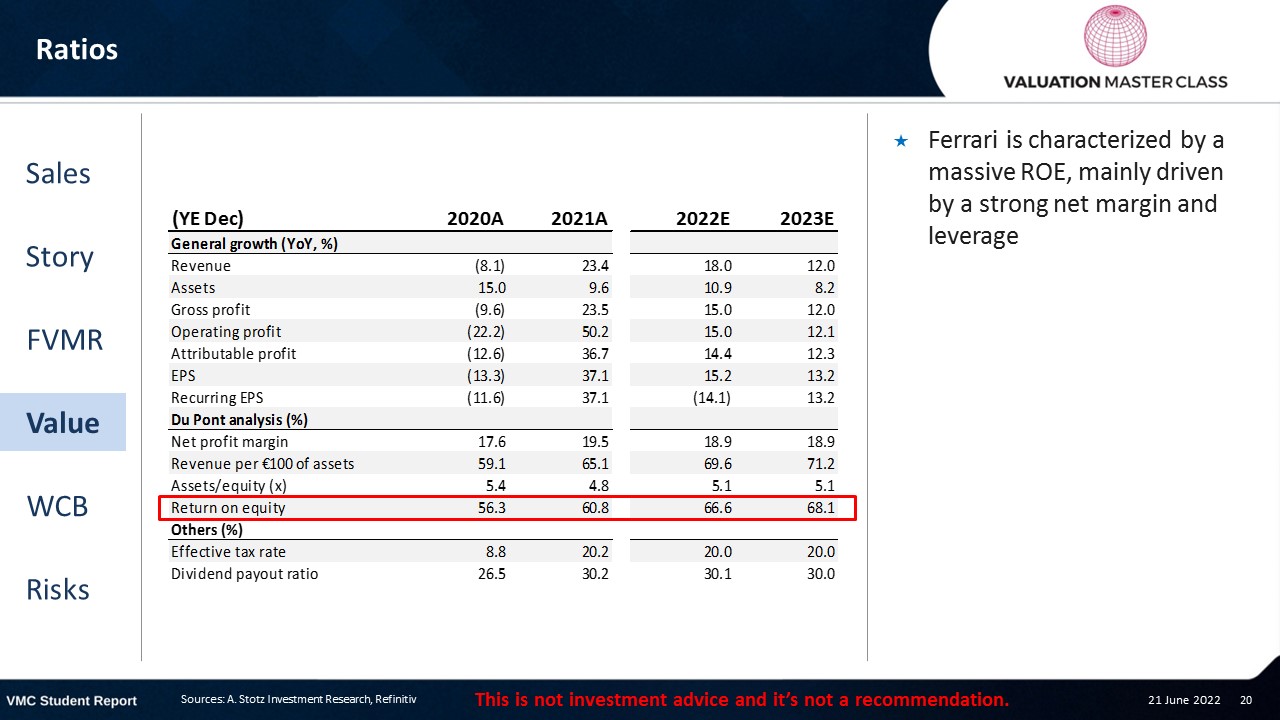

Ratios

- Ferrari is characterized by a massive ROE, mainly driven by a strong net margin and leverage

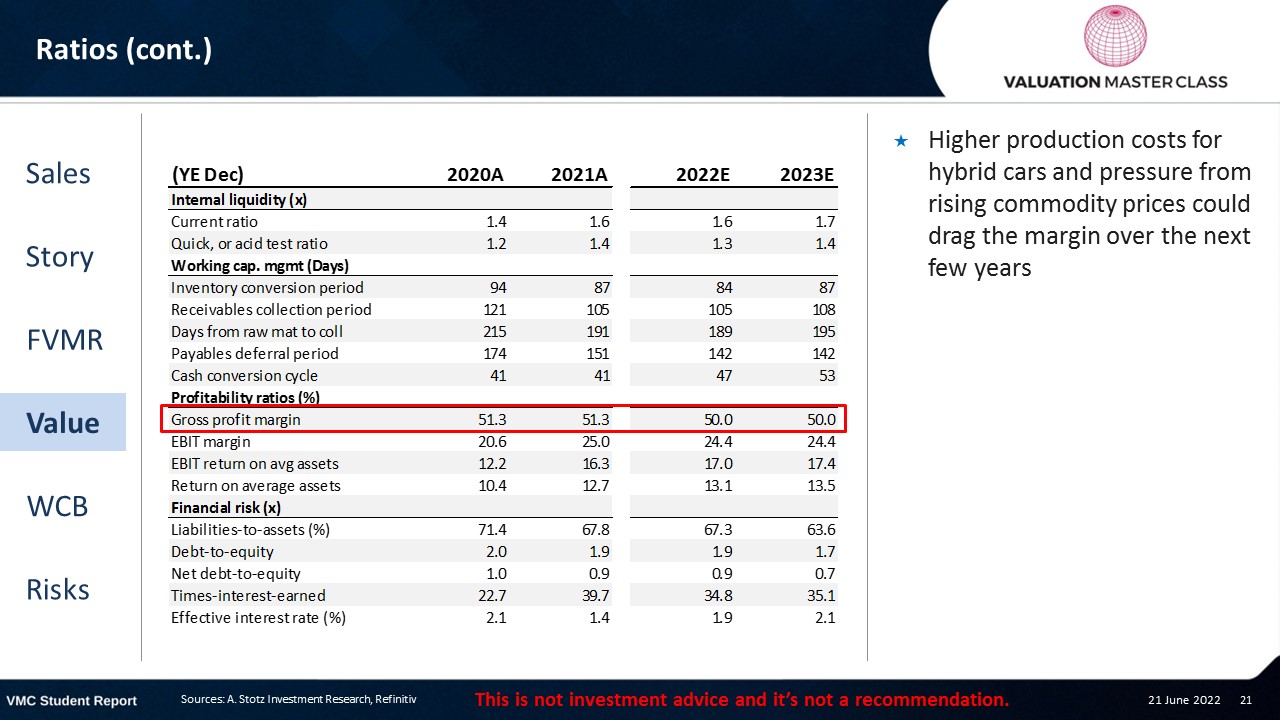

- Higher production costs for hybrid cars and pressure from rising commodity prices could drag the margin over the next few years

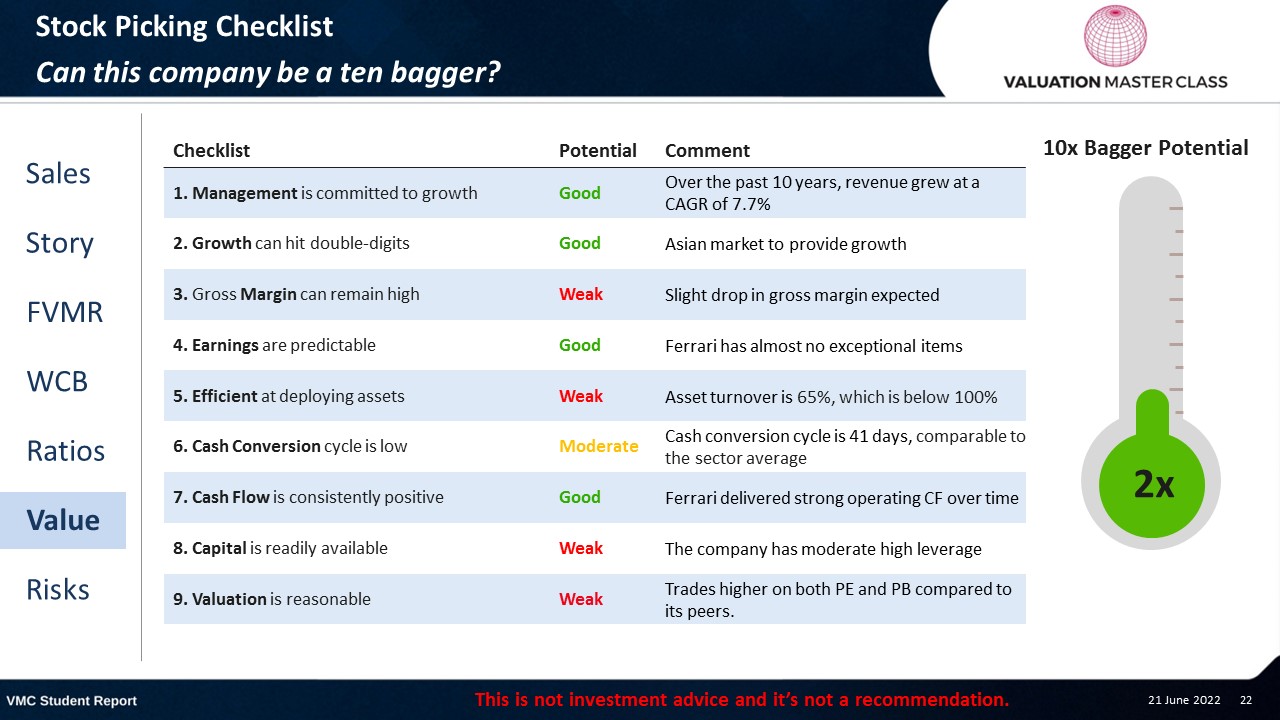

Stock Picking Checklist

Can this company be a ten bagger?

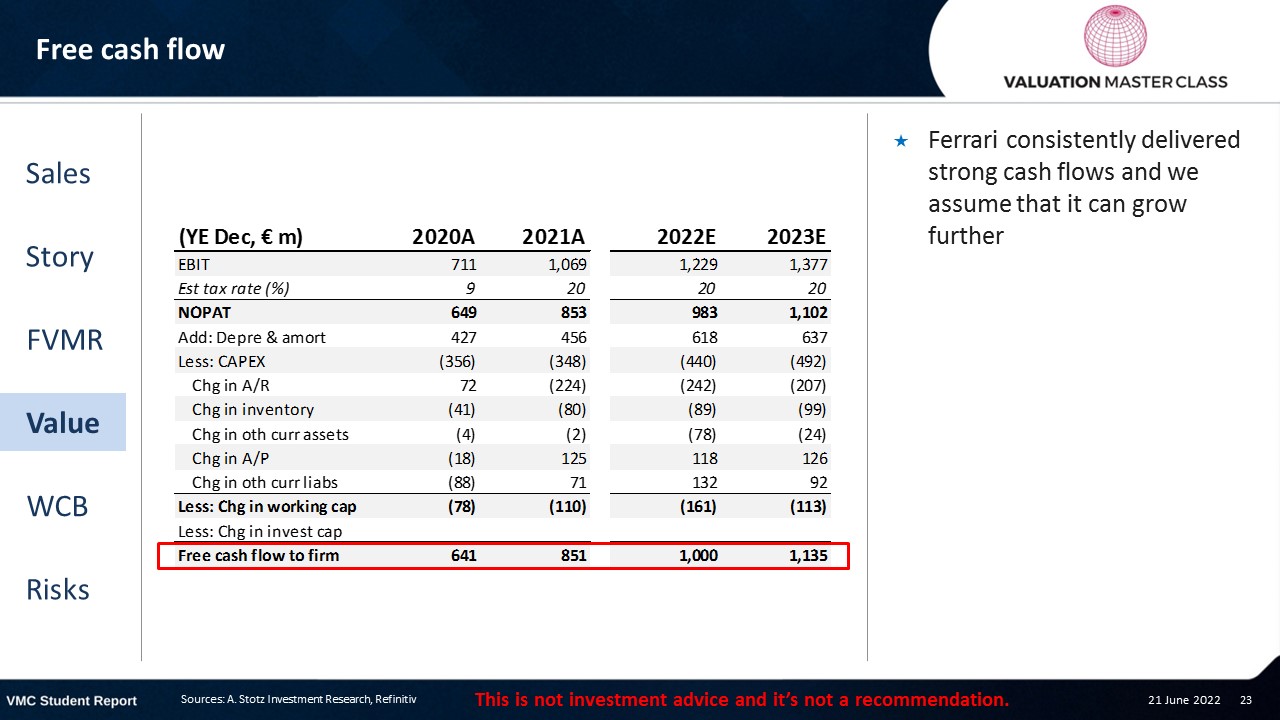

Free cash flow

- Ferrari consistently delivered strong cash flows and we assume that it can grow further

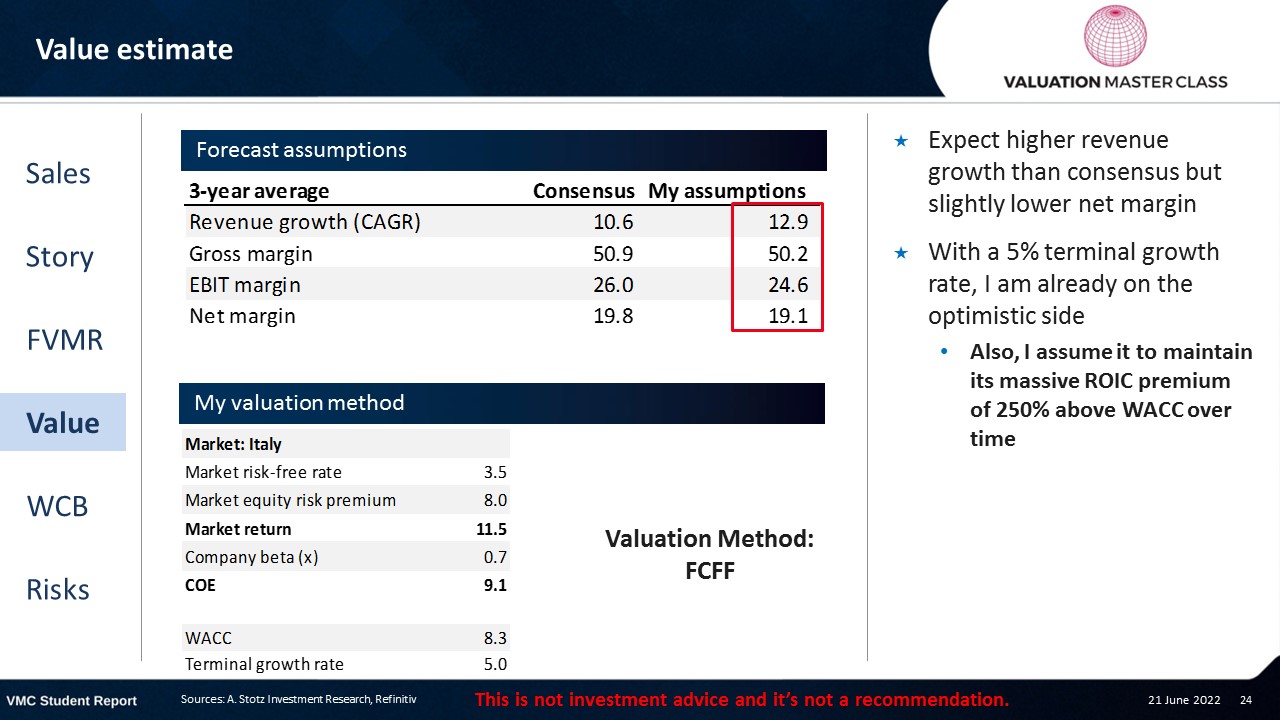

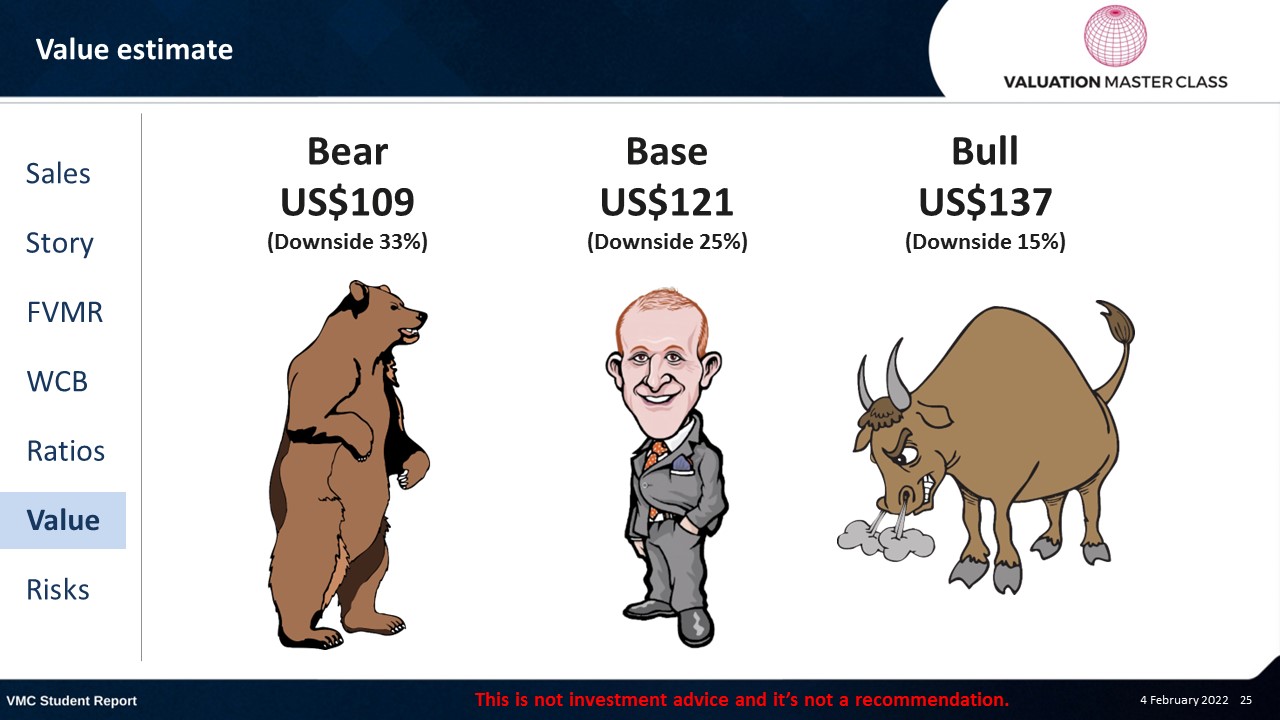

Value estimate

- Expect higher revenue growth than consensus but slightly lower net margin

- With a 5% terminal growth rate, I am already on the optimistic side

- Also, I assume it to maintain its massive ROIC premium of 250% above WACC over time

Key risk is sudden changes in regulations

- Failure to adopt to changing regulatory requirements (e.g., carbon neutral driving)

- Change in collectors’ appetite from overseas market, in particular Asia

- Supply chain risks due to ongoing geopolitical conflicts

Conclusions

- Double-digit growth expected, supported by Asian market

- Competitive moat by maintaining exclusivity and low volume strategy

- Massive profitability but at a high price

Download the full report as a PDF

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.