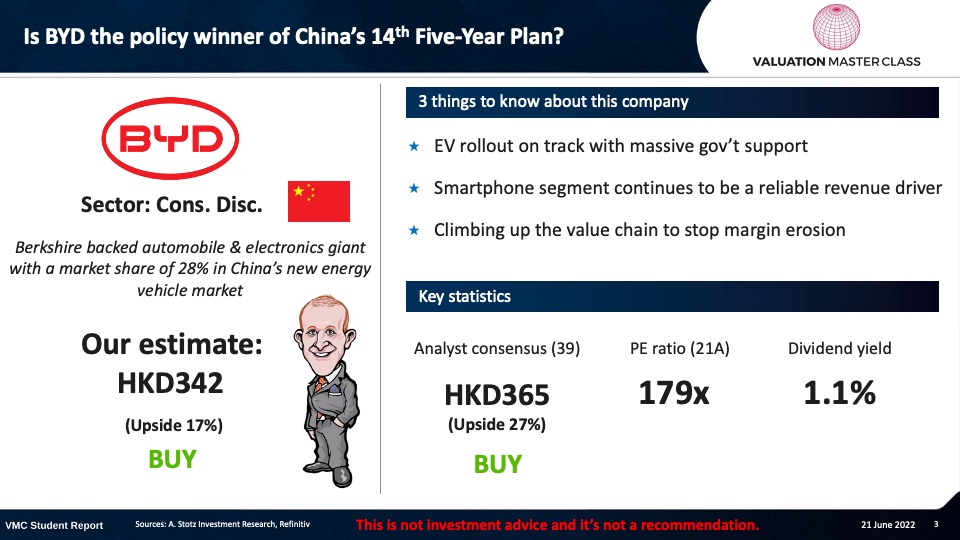

Warren Buffett Owns BYD Auto, Should You?

What’s interesting about BYD is that Warren Buffett owns 20% of its outstanding H-shares

Highlights:

- EV rollout on track with massive gov’t support.

- Smartphone segment continues to be a reliable revenue driver.

- Climbing up the value chain to stop margin erosion.

Download the full report as a PDF

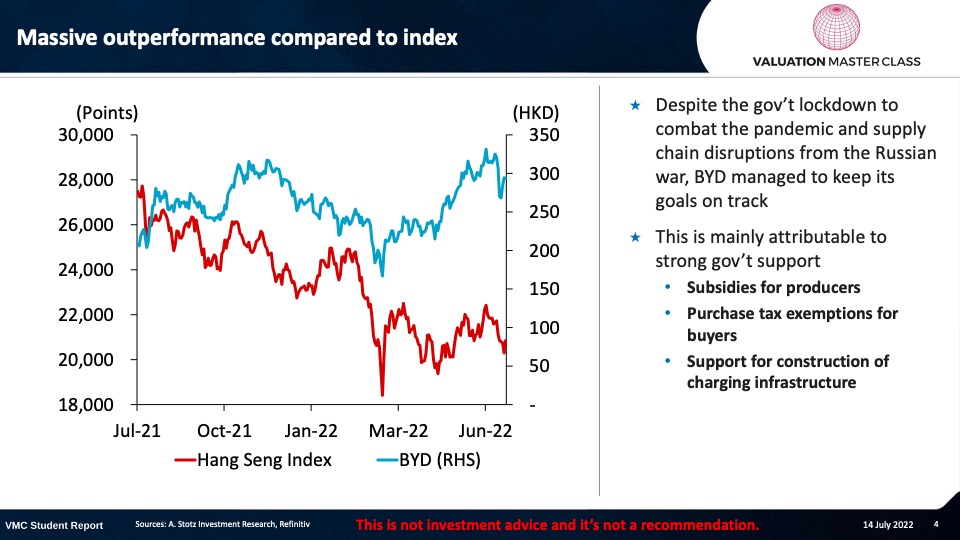

Massive outperformance compared to index

- Despite the gov’t lockdown to combat the pandemic and supply chain disruptions from the Russian war, BYD managed to keep its goals on track.

- This is mainly attributable to strong gov’t support.

- Subsidies for producers.

- Purchase tax exemptions for buyers.

- Support for construction of charging infrastructure.

Why is EV so important for China?

- China is heavily dependent on oil imports.

- Oil consumption in 2021 stood at 15m barrels per day compared to only 4m production.

- Mass adoption of electric vehicles could help to reduce oil imports in the long run.

- China wants to lead the technology race and dominate the EV industry.

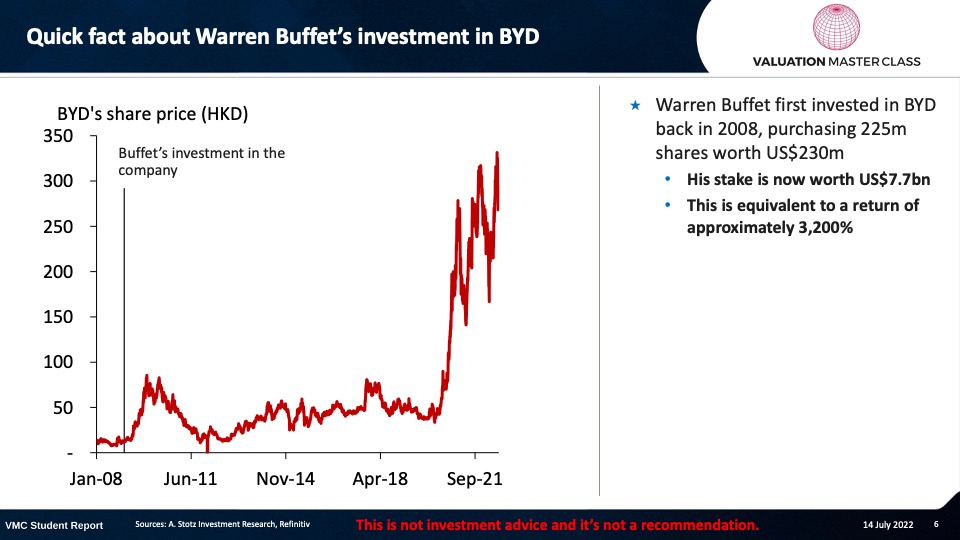

Quick fact about Warren Buffett’s investment in BYD

- Warren Buffett first invested in BYD back in 2008, purchasing 225m shares worth US$230m.

- His stake is now worth US$7.7bn.

- This is equivalent to a return of approximately 3,200%.

It was his friend Charlie Munger who convinced Buffett

- Munger has long been known to have a bullish outlook on China.

- He believed that BYD is well positioned to lead China’s EV transformation.

- Munger had previously praised Wang Chuanfu, the founder of BYD, for being a combination of Thomas Edison and Jack Welch.

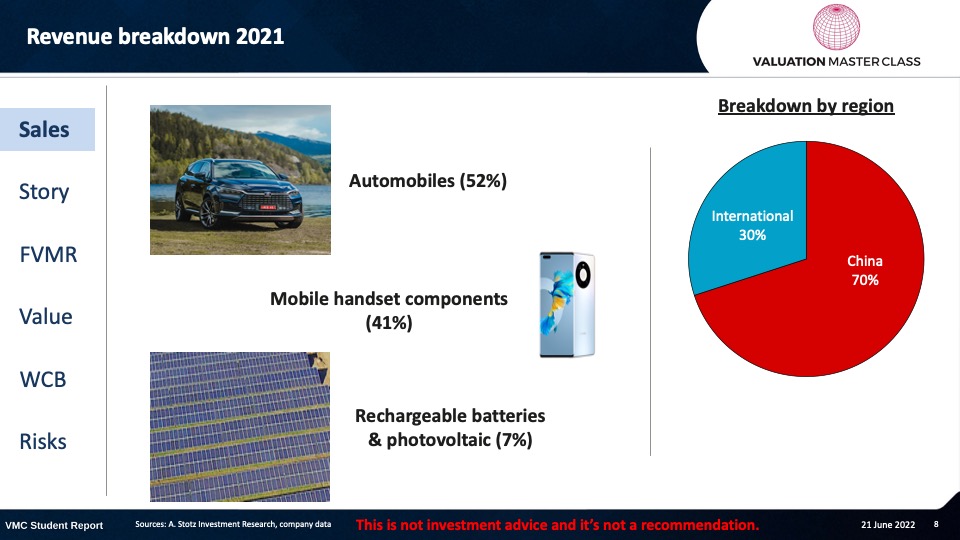

Revenue breakdown 2021

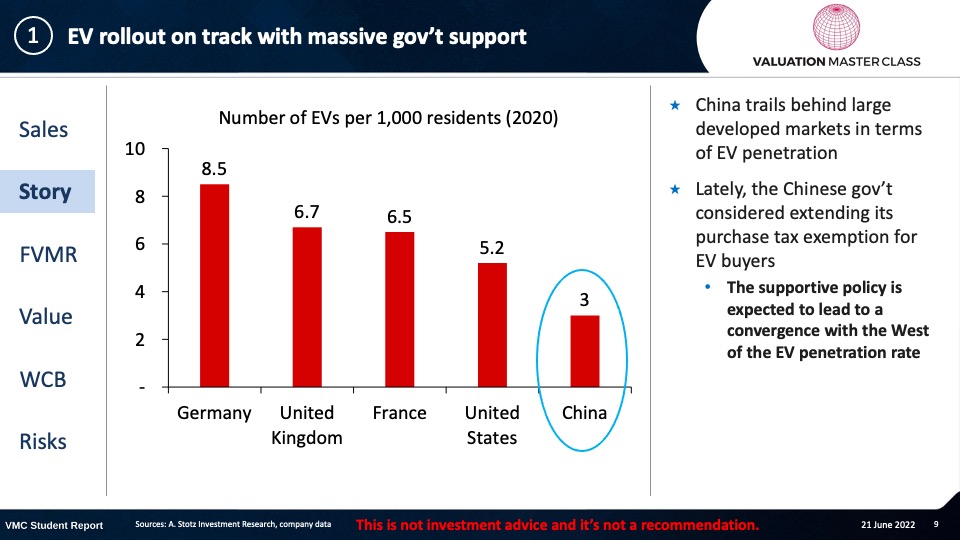

EV rollout on track with massive gov’t support

- China trails behind large developed markets in terms of EV penetration.

- Lately, the Chinese gov’t considered extending its purchase tax exemption for EV buyers.

- The supportive policy is expected to lead to a convergence with the West of the EV penetration rate.

The underpinnings of demand for EV in China

- The Chinese gov’t ambitious target lays the foundation for strong revenue growth.

- In 2021, EVs accounted for 13% of new cars sold in China.

- By 2030, China plans to ramp this number up to 40%.

- This means that the regulatory environment is helping BYD to realize its growth potential.

Smartphone segment continues to be a reliable revenue driver

- Nowadays, BYD is most known for its vehicles.

- However, its mobile phone handset assembly segment doesn’t trail far behind.

- Major clients of BYD include Huawei, Apple, Samsung, Xiaomi, and Vivo.

- As of 1H22, these brands collectively made up 80% of the global smartphone market.

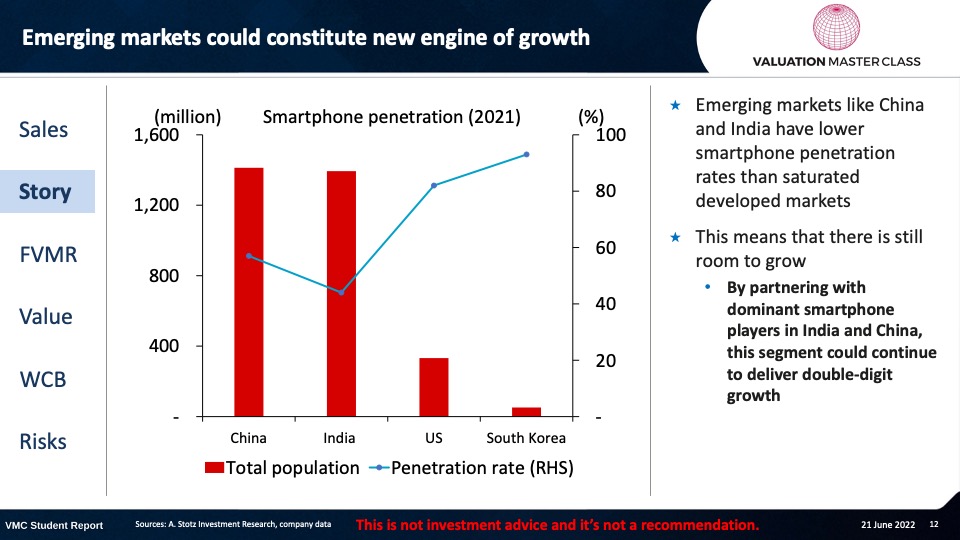

Emerging markets could constitute new engine of growth

- Emerging markets like China and India have lower smartphone penetration rates than saturated developed markets

- This means that there is still room to grow

- By partnering with dominant smartphone players in India and China, this segment could continue to deliver double-digit growth

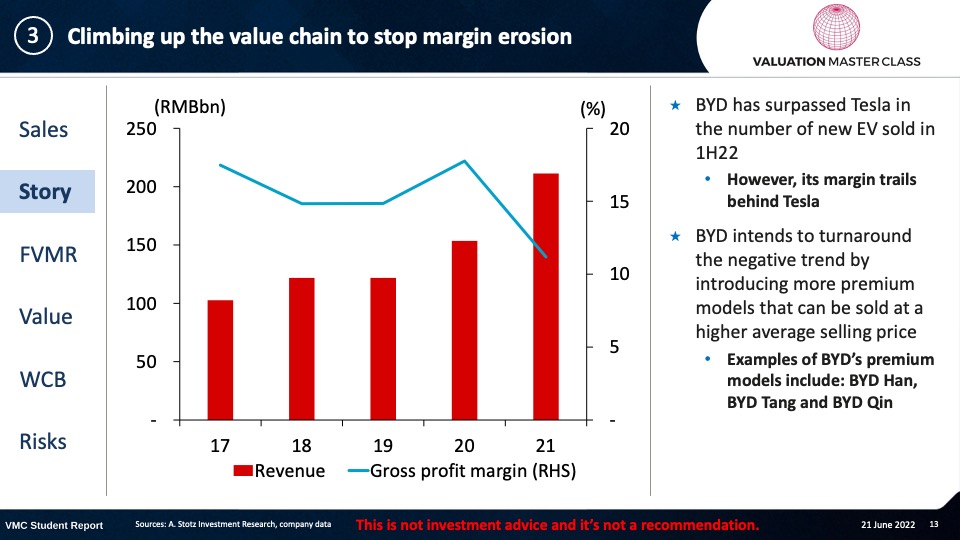

Climbing up the value chain to stop margin erosion

- BYD has surpassed Tesla in the number of new EV sold in 1H22.

- However, its margin trails behind Tesla.

- BYD intends to turnaround the negative trend by introducing more premium models that can be sold at a higher average selling price.

- Examples of BYD’s premium models include: BYD Han, BYD Tang and BYD Qin.

Consensus is bullish

- Most analysts have BUY or Strong BUY recommendations.

- Analysts predict company to maintain double-digit revenue growth.

- This is in line with our forecast due to support for new energy vehicles from the Chinese gov’t.

Get financial statements and assumptions in the full report

P&L – BYD

- Massive EV rollout in China and capturing upside in the smartphone business in emerging markets drives strong revenue growth.

Balance sheet – BYD

- BYD has high level of working capital requirements, accounting for close to 50% of its total assets.

- BYD’s cash generation ability has been improving since 2020, making its financing less reliant on external debt.

Ratios – BYD

- In the past, BYD improved its efficiency and I expect the trend to continue.

- BYD is not highly levered, and the company became a net cash in 2021.

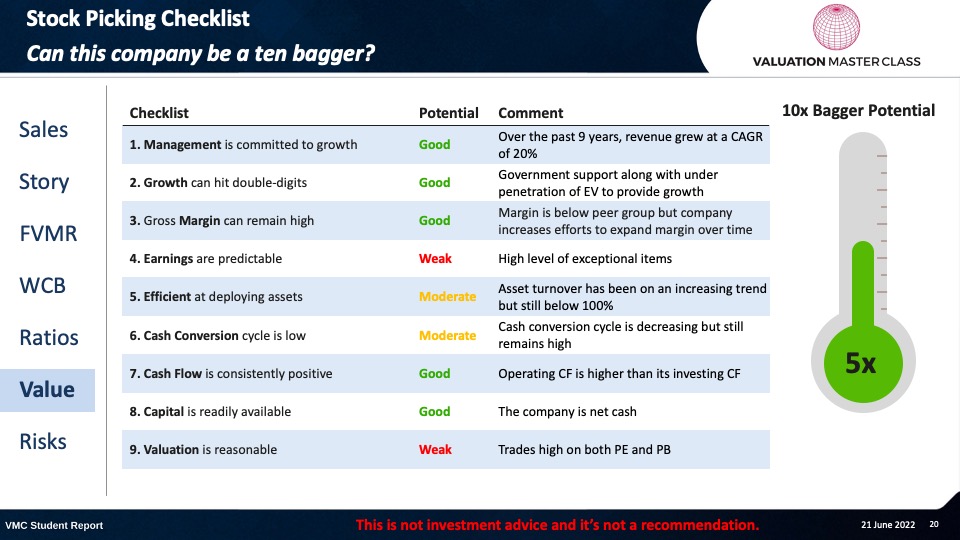

Stock Picking Checklist

Can this company be a ten bagger?

Free cash flow – BYD

- Increasing CAPEX is necessary to lay the foundation for massive growth.

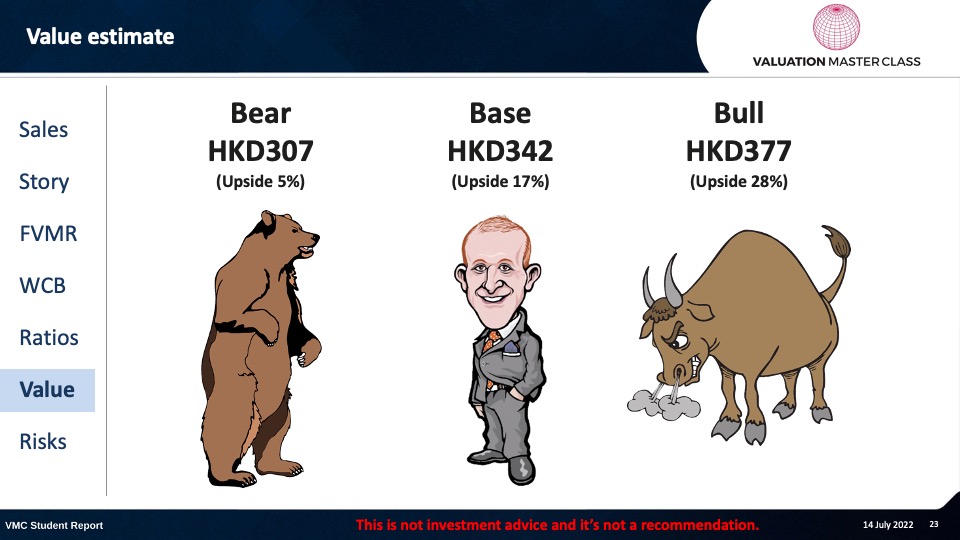

Value estimate – BYD

- My forecast is similar to the consensus, as I expect the gross margin to expand.

- In the long run, I expect competition to rise.

- Therefore, I choose a terminal growth rate of 3%.

Key risk is rising competition

- Increasing number of players in domestic market puts growth at risk.

- Sudden changes in gov’t regulation that could be less favorable.

- Failure to keep up with technological changes.

Conclusion

- China’s ambition to lead EV race unlocks massive growth potential.

- Strong smartphone segment delivers secured revenue.

- Margin expansion could constitute catalyst for the share price.

Download the full report as a PDF

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.