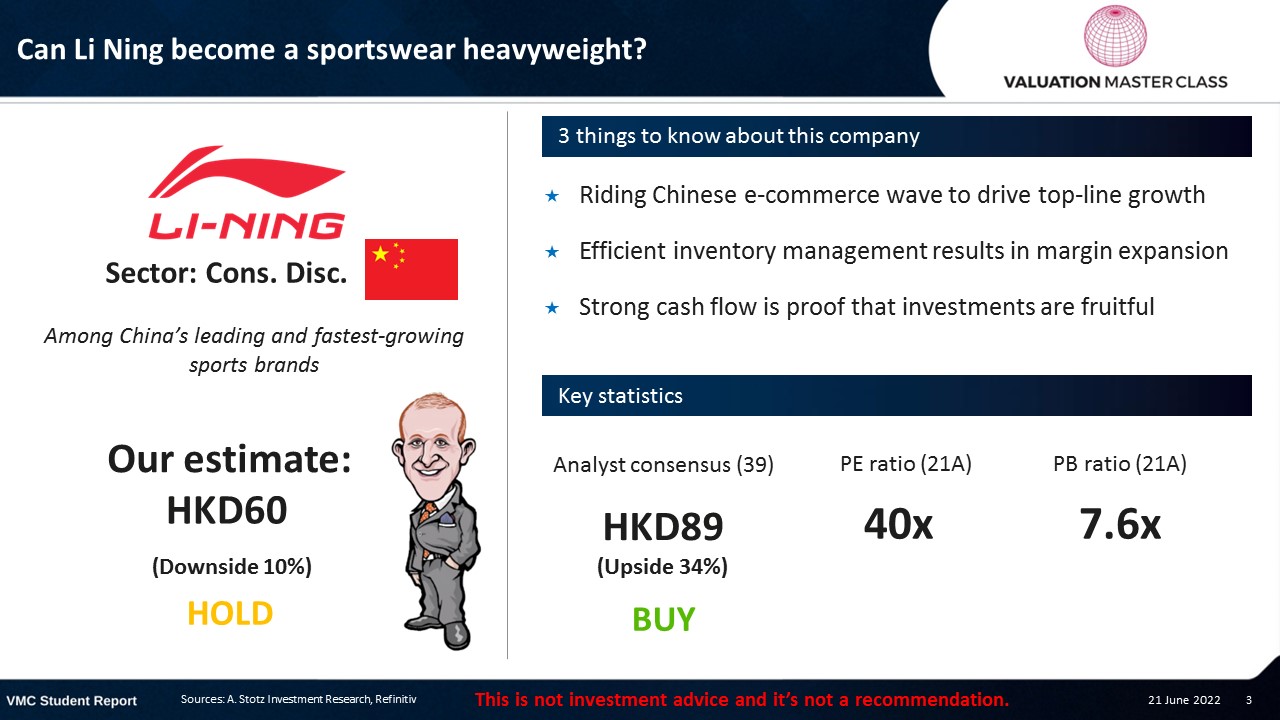

Can Li Ning Become a Sportswear Heavyweight?

What’s interesting about Li Ning is that its net profit in 2021 rose by 136%

Highlights:

- Riding Chinese e-commerce wave to drive top-line growth

- Efficient inventory management results in margin expansion

- Strong cash flow is proof that investments are fruitful

Download the full report as a PDF

A surge in domestic rejection of Western brands

- Public pressure has been mounting on Western brands to stop sourcing cotton from China’s western region of Xinjiang due to concerns of forced labor

- H&M, Nike, and Adidas bowed to this pressure and stopped buying cotton from the region

- China fired back by removing Western brands from major e-commerce platforms and social media

- Also, Chinese consumers started to boycott those brands

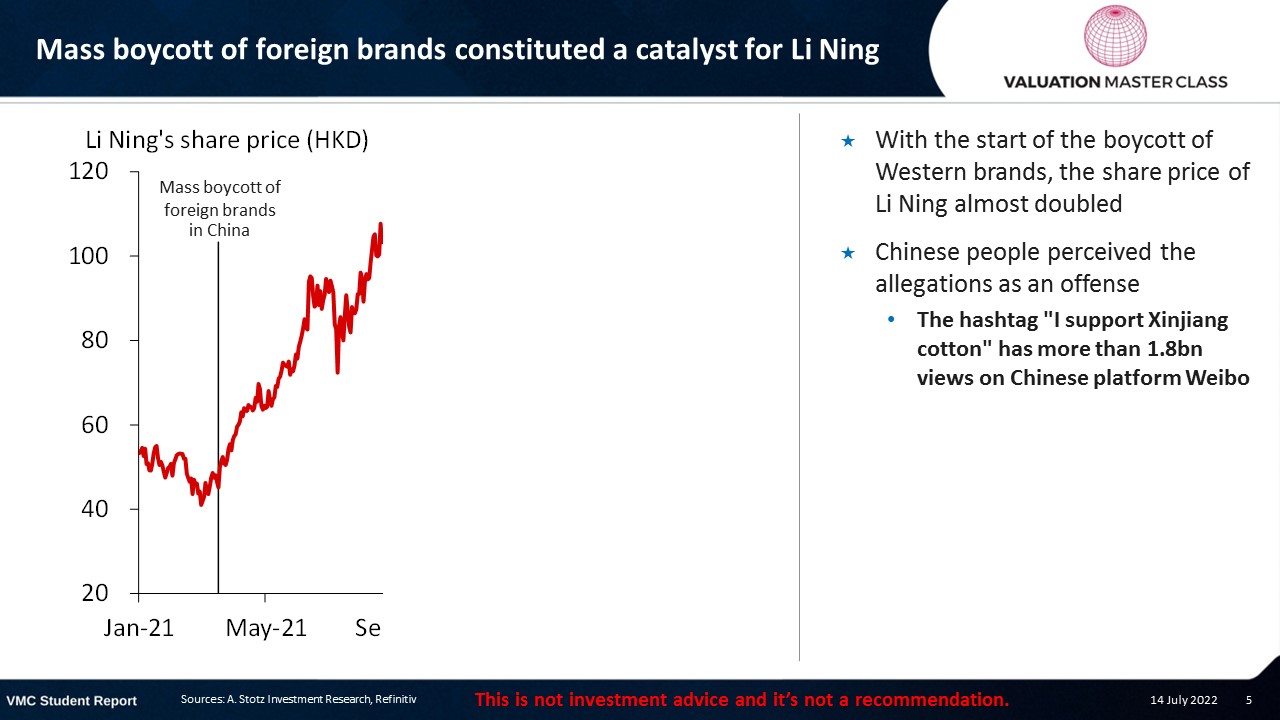

Mass boycott of foreign brands constituted a catalyst for Li Ning

- With the start of the boycott of Western brands, the share price of Li Ning almost doubled

- Chinese people perceived the allegations as an offense

- The hashtag “I support Xinjiang cotton” has more than 1.8bn views on Chinese platform Weibo

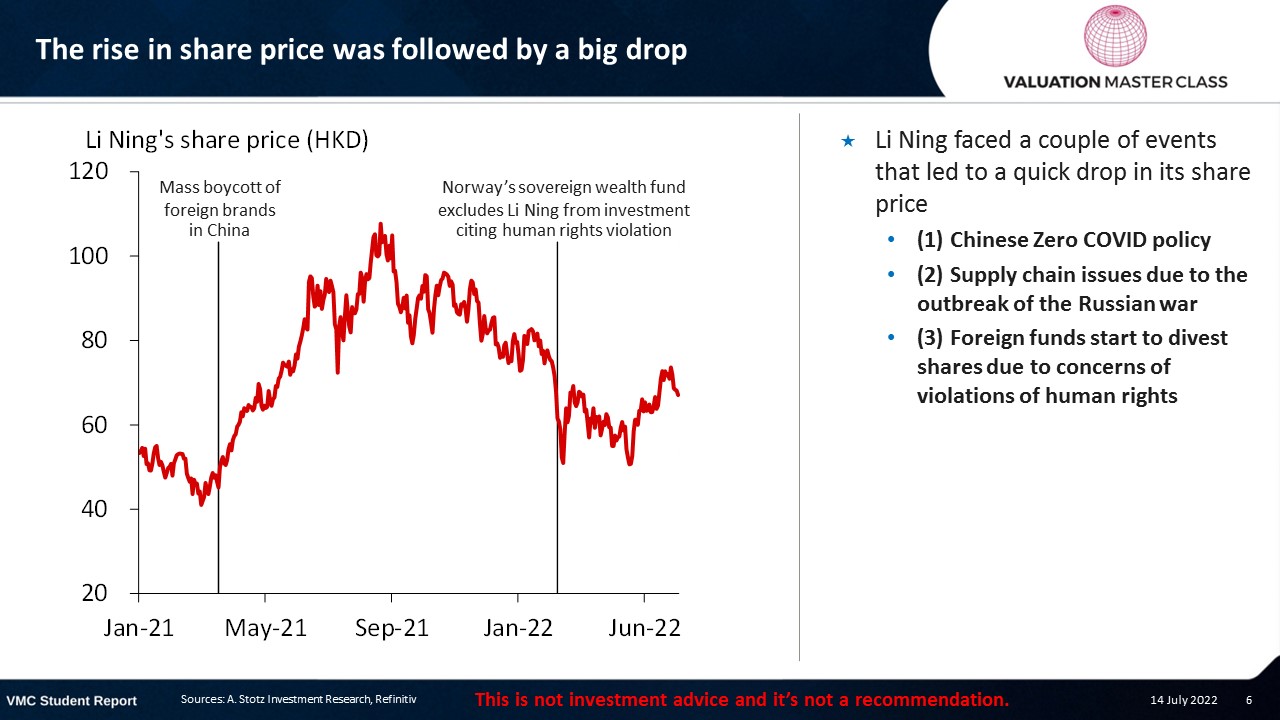

The rise in share price was followed by a big drop

- Li Ning faced a couple of events that led to a quick drop in its share price

- (1) Chinese Zero COVID policy

- (2) Supply chain issues due to the outbreak of the Russian war

- (3) Foreign funds start to divest shares due to concerns of violations of human rights

A political war between West and China

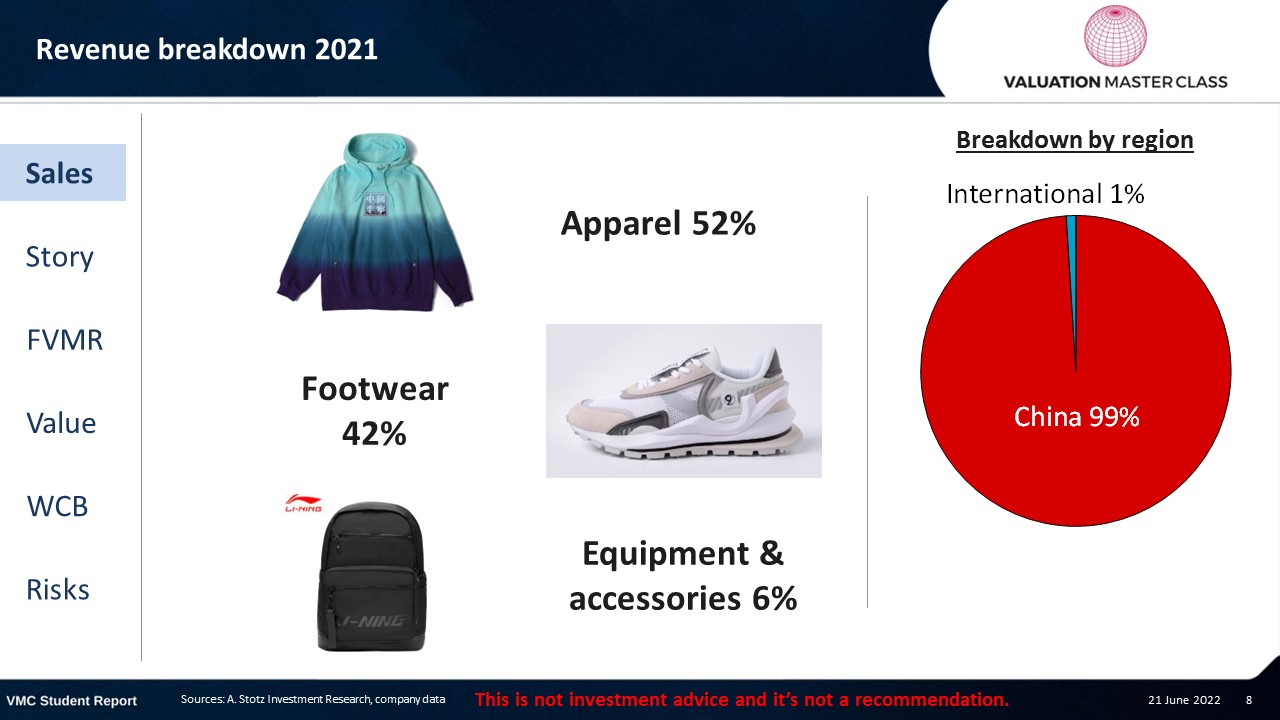

Revenue breakdown 2021

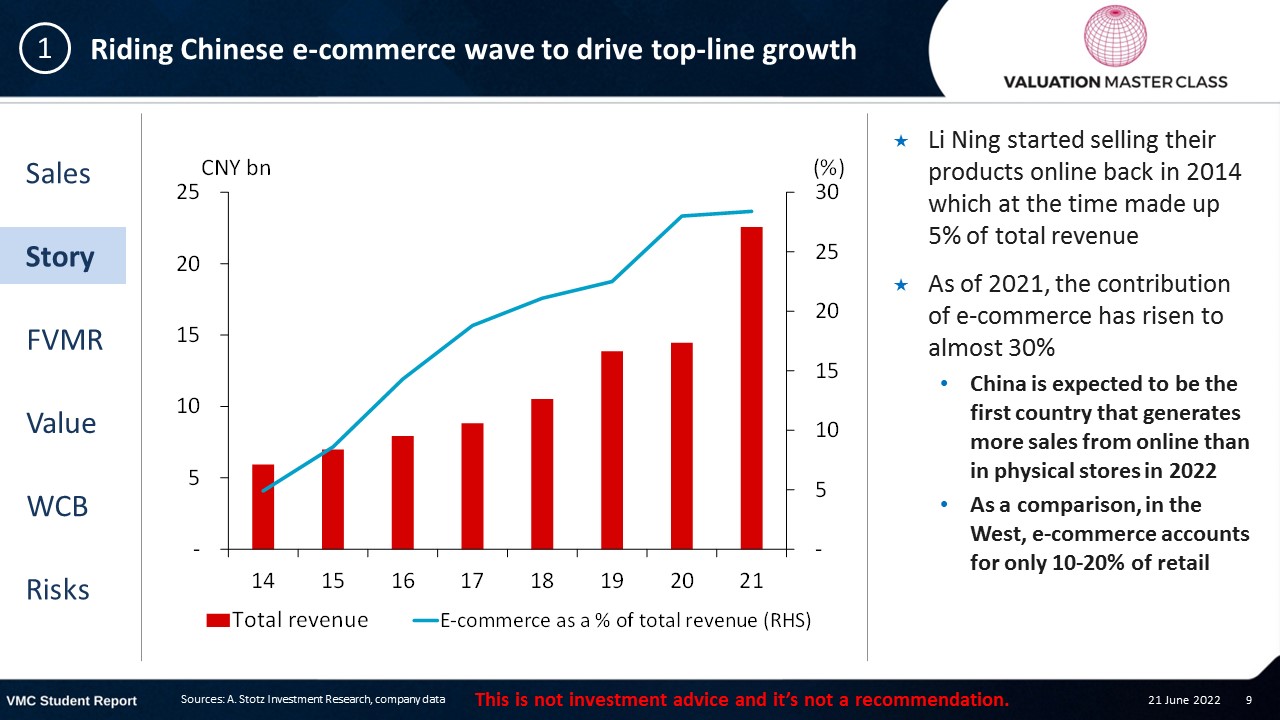

Riding Chinese e-commerce wave to drive top-line growth

- Li Ning started selling their products online back in 2014 which at the time made up 5% of total revenue

- As of 2021, the contribution of e-commerce has risen to almost 30%

- China is expected to be the first country that generates more sales from online than in physical stores in 2022

- As a comparison, in the West, e-commerce accounts for only 10-20% of retail

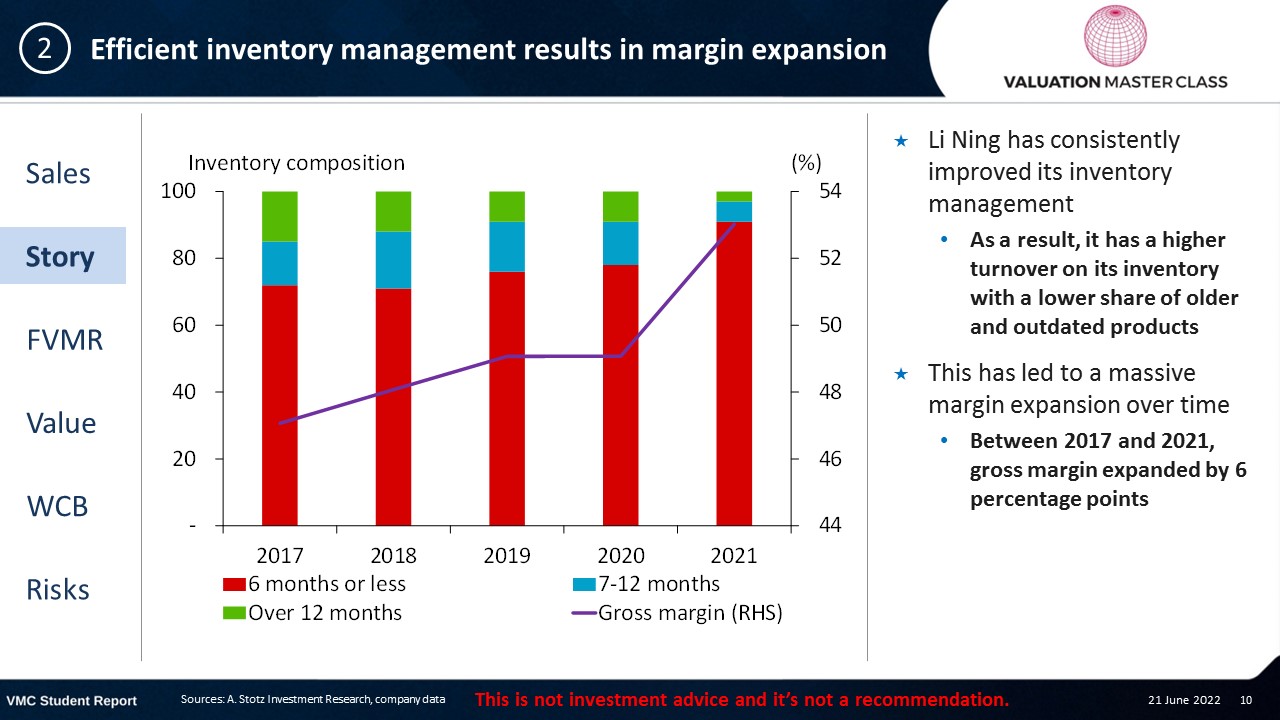

Efficient inventory management results in margin expansion

- Li Ning has consistently improved its inventory management

- As a result, it has a higher turnover on its inventory with a lower share of older and outdated products

- This has led to a massive margin expansion over time

- Between 2017 and 2021, gross margin expanded by 6 percentage points

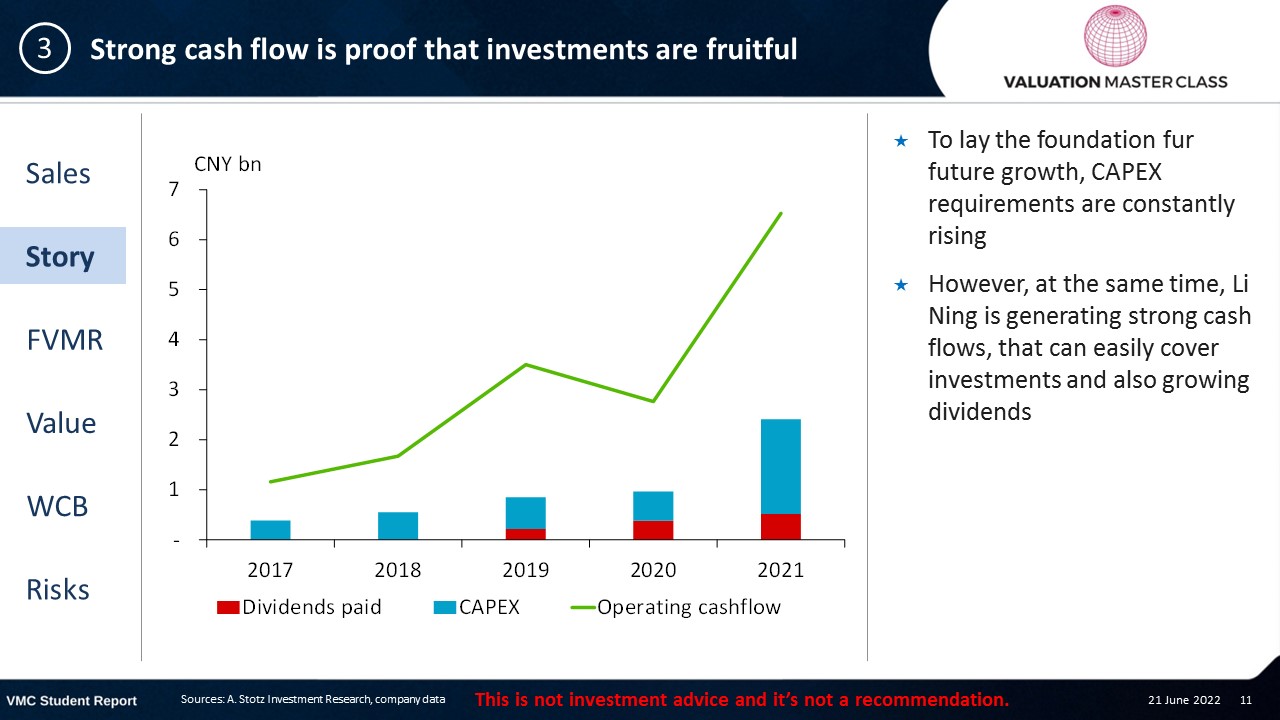

Strong cash flow is proof that investments are fruitful

- To lay the foundation fur future growth, CAPEX requirements are constantly rising

- However, at the same time, Li Ning is generating strong cash flows, that can easily cover investments and also growing dividends

Consensus is bullish

- All analysts are very bullish except one courageous analyst issuing a STRONG SELL

- Analysts predict revenue to continue seeing a strong rally and gross margin to stay high

Get financial statements and assumptions in the full report

P&L – Li Ning

- Gross profit growth is driven by strong revenue growth and efficient inventory management

Balance sheet – Li Ning

- To realize its growth potential, the company must continue allocating a high budget to CAPEX

- Li Ning has a low level of leverage and is net cash

Ratios – Li Ning

- The company has a negative cash conversion cycle as it has strong bargaining power over its suppliers

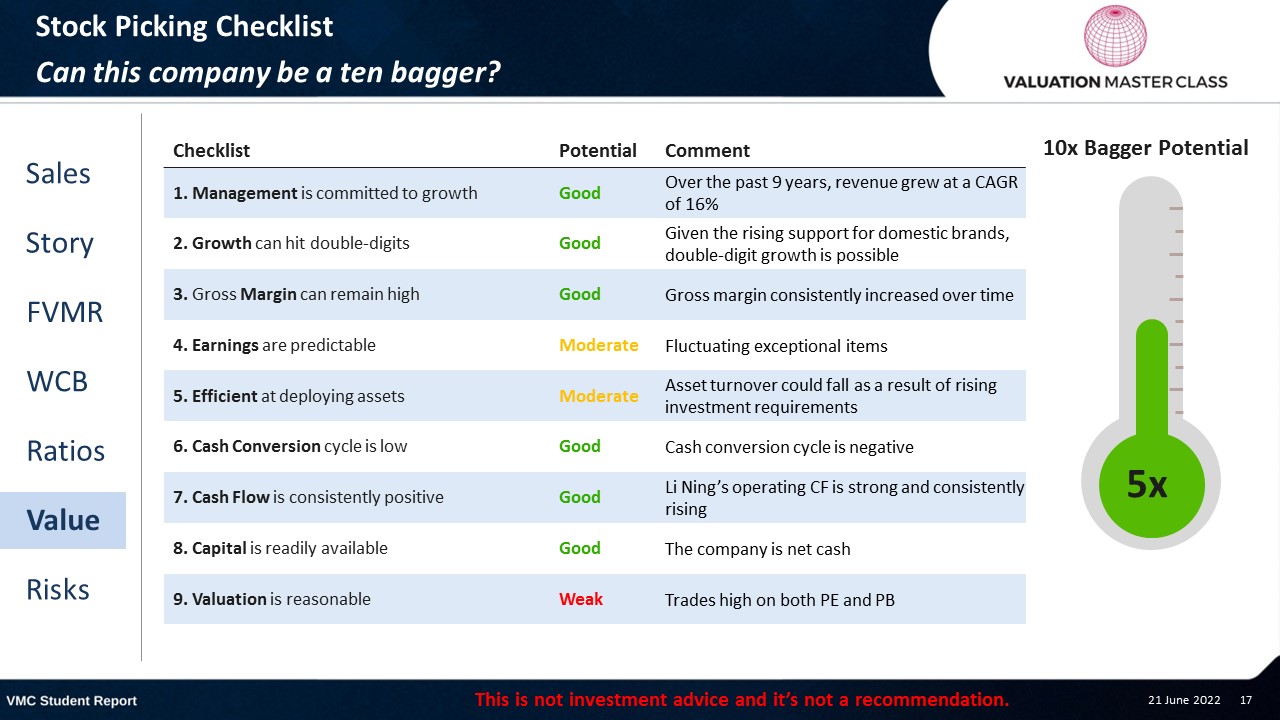

Stock Picking Checklist

Can this company be a ten bagger?

Free cash flow – Li Ning

- Expect strong cash flow generation despite rising CAPEX requirements

Value estimate – Li Ning

- Li Ning has strong revenue potential

- However, I think that consensus might be slightly too optimistic with regards to margins

- I value the company using FCFF with a terminal growth rate of 4%

Key risks is geopolitical conflict

- Geopolitical situation may hinder the company’s international expansions

- Sanctions by Western governments could prevent investors from investing in the company

- Failure to protect its own intellectual properties

Conclusions

- Chinese booming e-commerce to unlock double-digit growth

- Efficient inventory management drives margin expansion

- Strong cash generation supports a defensive balance sheet

Download the full report as a PDF

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.