Should Warren Buffett Sell Coca Cola After 34 Years?

What’s interesting about Coca Cola is that Warren Buffett owns more than 9% of the company

Highlights:

- Centralized portfolio to maintain superior profitability

- Leveraging revenue through organic growth and acquisitions

- A cash cow with stable and growing dividends

Download the full report as a PDF

Do you want to hear a fun fact about Warren Buffett?

Do you want to hear a fun fact about Warren Buffett?

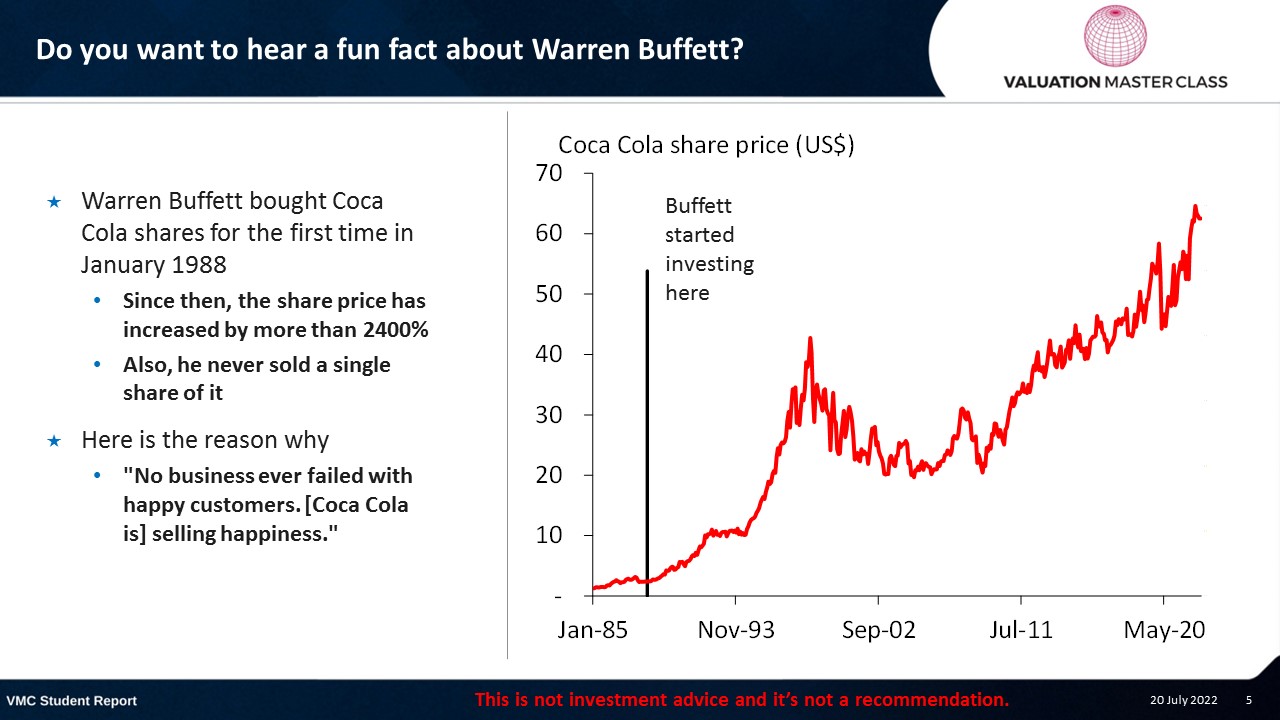

- Warren Buffett bought Coca Cola shares for the first time in January 1988

- Since then, the share price has increased by more than 2400%

- Also, he never sold a single share of it

- Here is the reason why

- “No business ever failed with happy customers. [Coca Cola is] selling happiness.”

Coca Cola has created one of the most memorable commercials ever

Revenue breakdown 2021

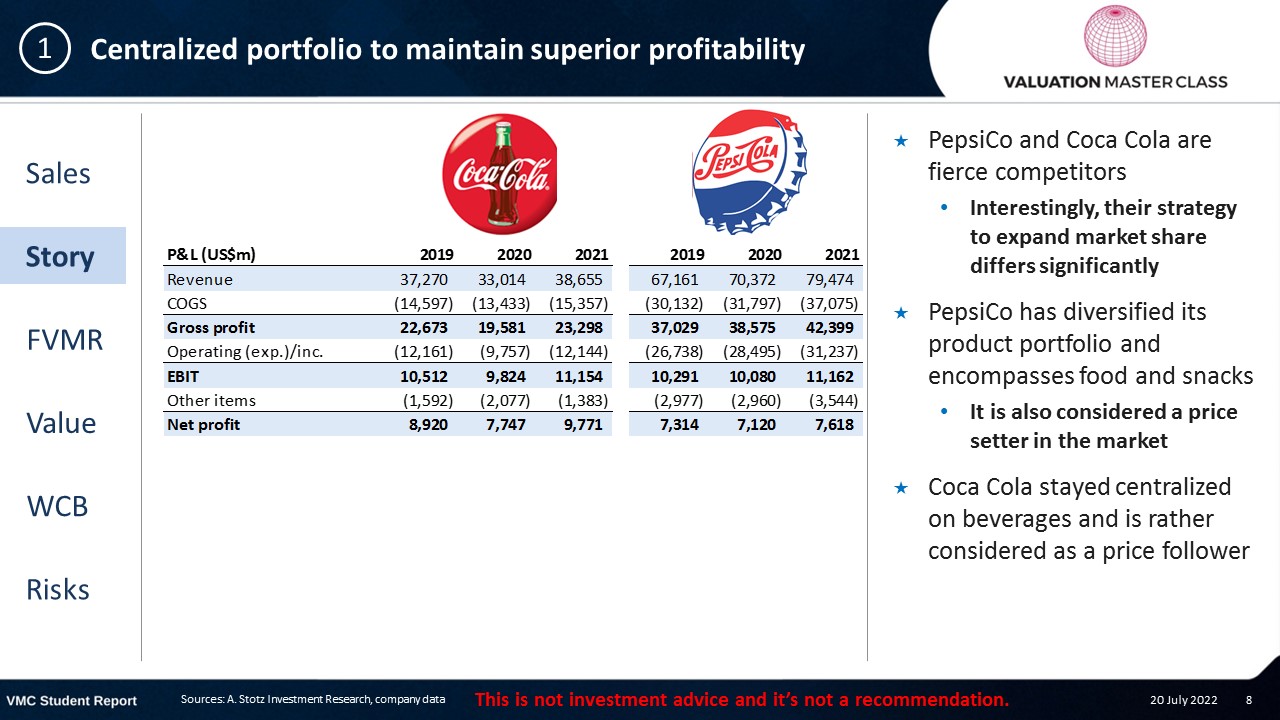

Centralized portfolio to maintain superior profitability

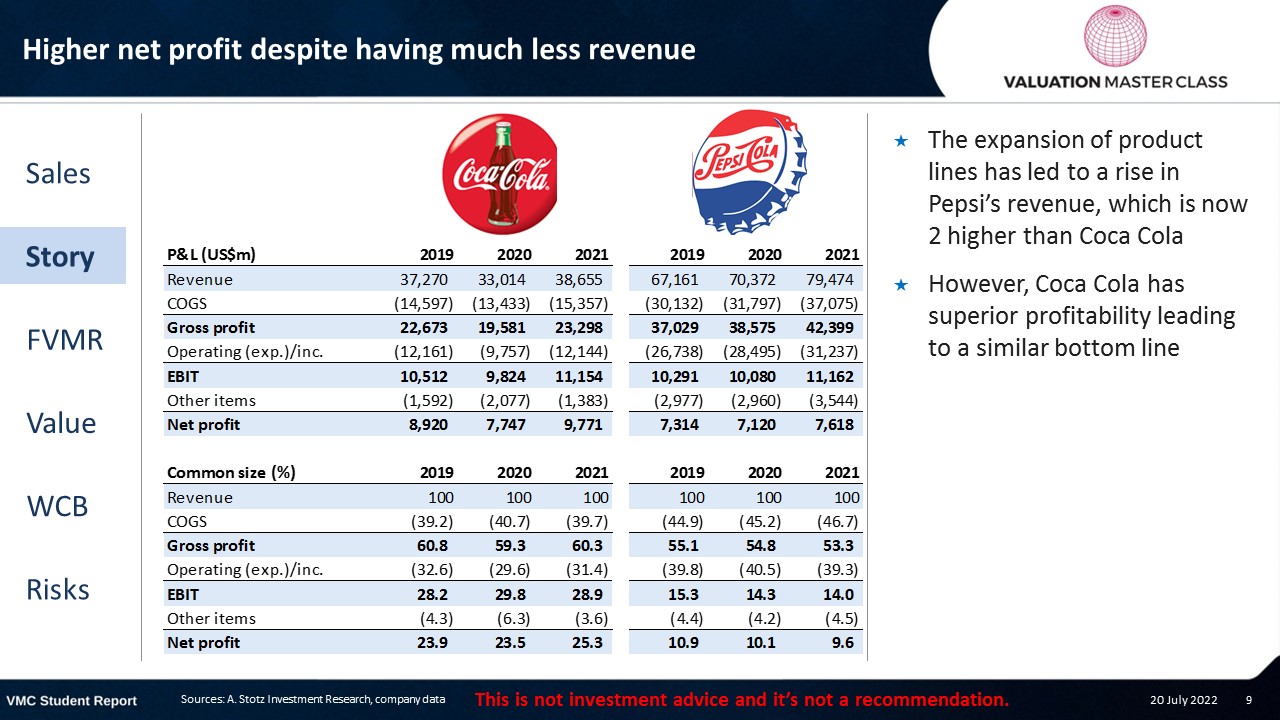

- PepsiCo and Coca Cola are fierce competitors

- Interestingly, their strategy to expand market share differs significantly

- PepsiCo has diversified its product portfolio and encompasses food and snacks

- It is also considered a price setter in the market

- Coca Cola stayed centralized on beverages and is rather considered as a price follower

Higher net profit despite having much less revenue

- The expansion of product lines has led to a rise in Pepsi’s revenue, which is now 2 higher than Coca Cola

- However, Coca Cola has superior profitability leading to a similar bottom line

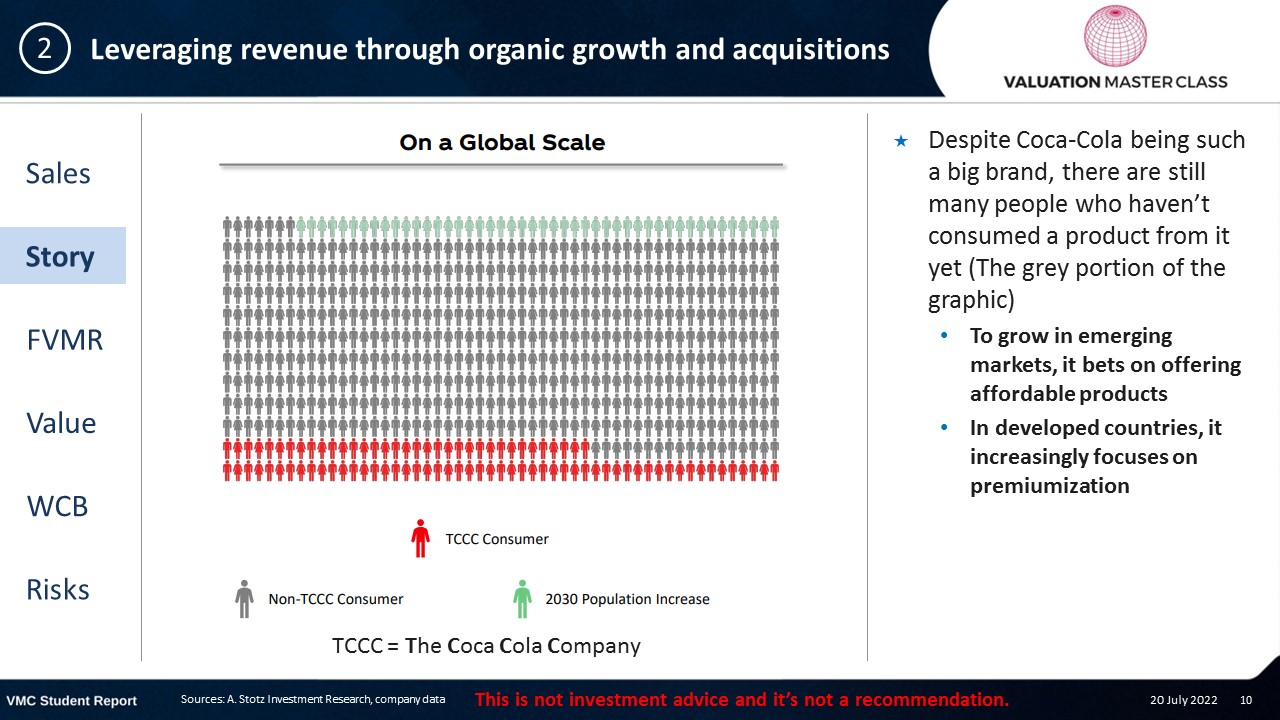

Leveraging revenue through organic growth and acquisitions

- Despite Coca-Cola being such a big brand, there are still many people who haven’t consumed a product from it yet (The grey portion of the graphic)

- To grow in emerging markets, it bets on offering affordable products

- In developed countries, it increasingly focuses on premiumization

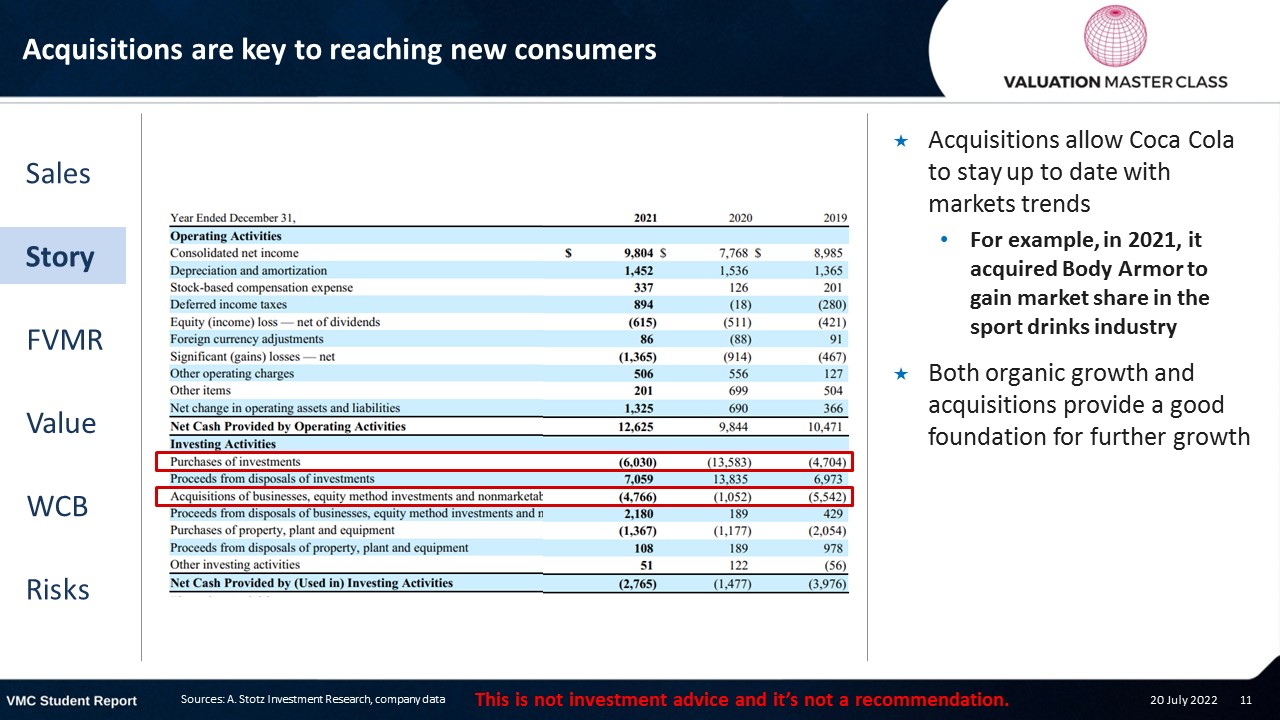

Acquisitions are key to reaching new consumers

- Acquisitions allow Coca Cola to stay up to date with markets trends

- Given the strong cash flow generation, we don’t see a risk that it can’t continue growing its dividends over time

- The company even has massive share buyback programs to return excess cash to shareholders

Consensus is bullish

- Most analyst have a BUY recommendation on the company, but the upside is rather small

- Analysts predict stable revenue growth an a net margin expansion

Get financial statements and assumptions in the full report

P&L – Coca Cola

- Coca Cola has a one-of-a-kind profitability, leading to a super strong bottom-line

Balance sheet – Coca Cola

- Acquisitions are an integral part of the business to drive revenue growth

- The company uses excess cash to buyback shares, providing additional return for shareholders

Ratios – Coca Cola

- High payables outstanding illustrates the bargaining power it has over its suppliers

- Strong dividend payout ratio contributed to a solid annual 3 – 3.5% dividend yield over the past few years

Free cash flow – Coca Cola

- Coca Cola is a cash flow machine and there is no reason to assume differently for the future

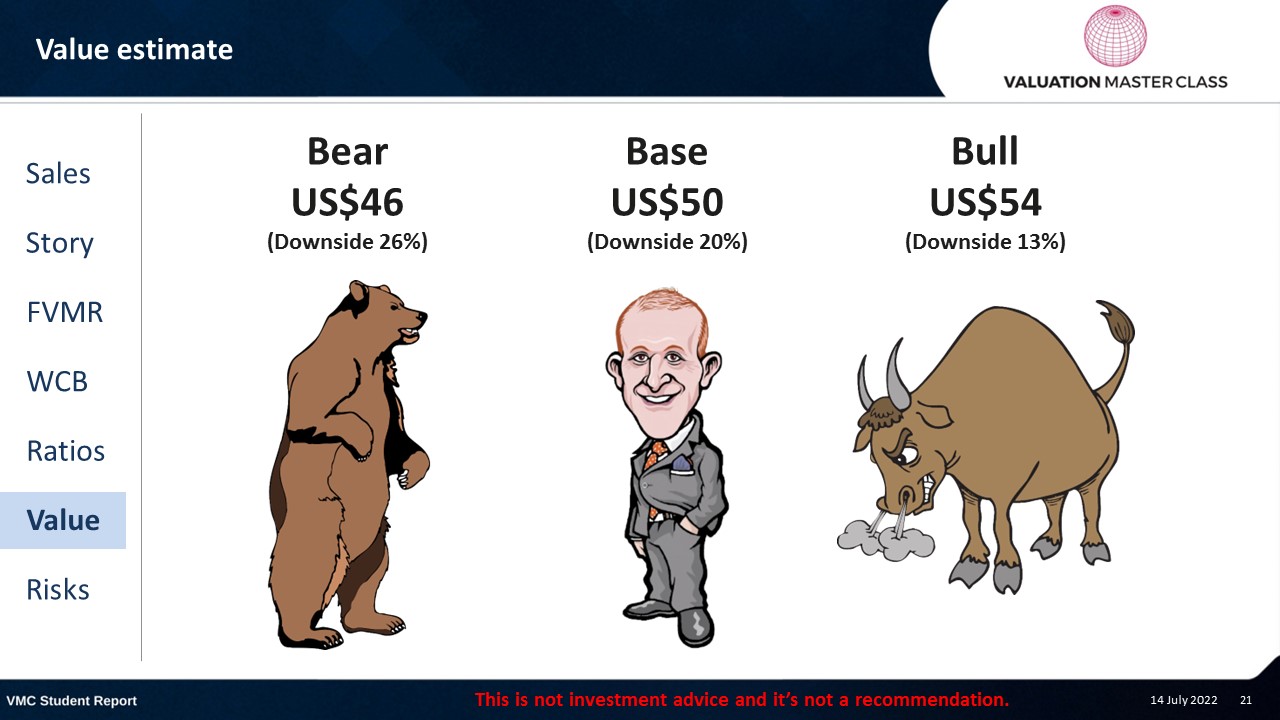

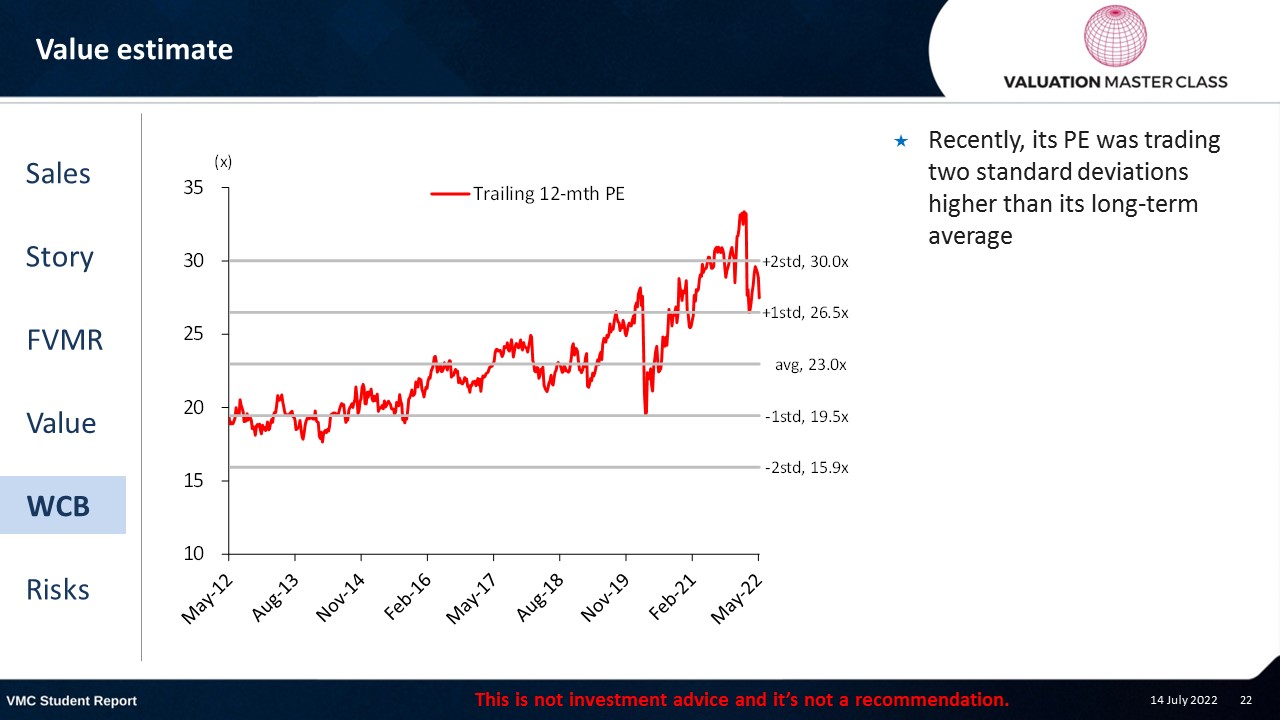

Value estimate – Coca Cola

- Deglobalization trend could result in lower-than-expected revenue

- However, I agree with the consensus that Coca-Cola can defend its massive margin over time

- I value the company by using FCFF and a terminal growth rate of 3%

- Recently, its PE was trading two standard deviations higher than its long-term average

Key risk

- Failure to meet changing consumer behavior (e.g., increasing health awareness)

- Lower-than-expected synergies from acquisitions

- Deglobalization trend could benefit local brands

Conclusions

- Coca Cola is a fantastic brand with a massive profitability

- Shareholders benefit from high dividends and share buybacks

- Though, valuation might be a bit too high

Download the full report as a PDF

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.