Is Snapchat Suffering a Slow and Painful Death?

https://youtu.be/xRJBRhV5bBQ

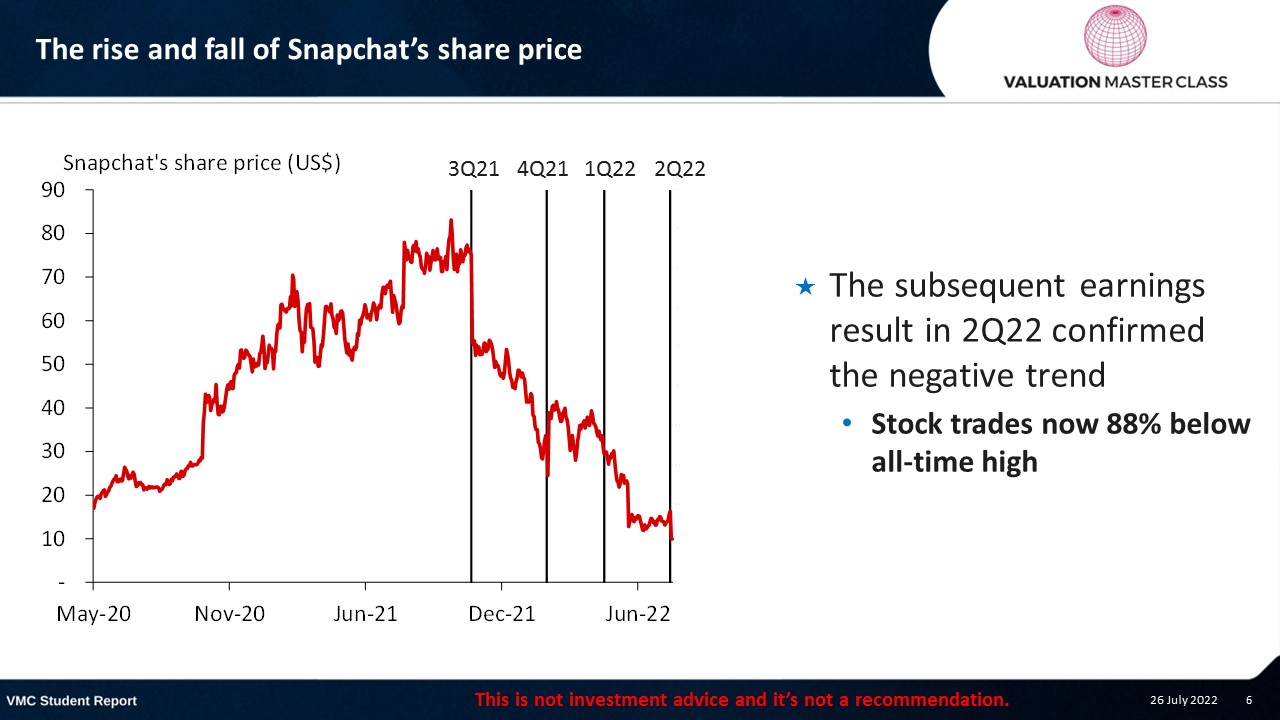

What’s interesting about Snapchat is that its share price is 88% below its Sep’21 all-time high

Download the full report as a PDF

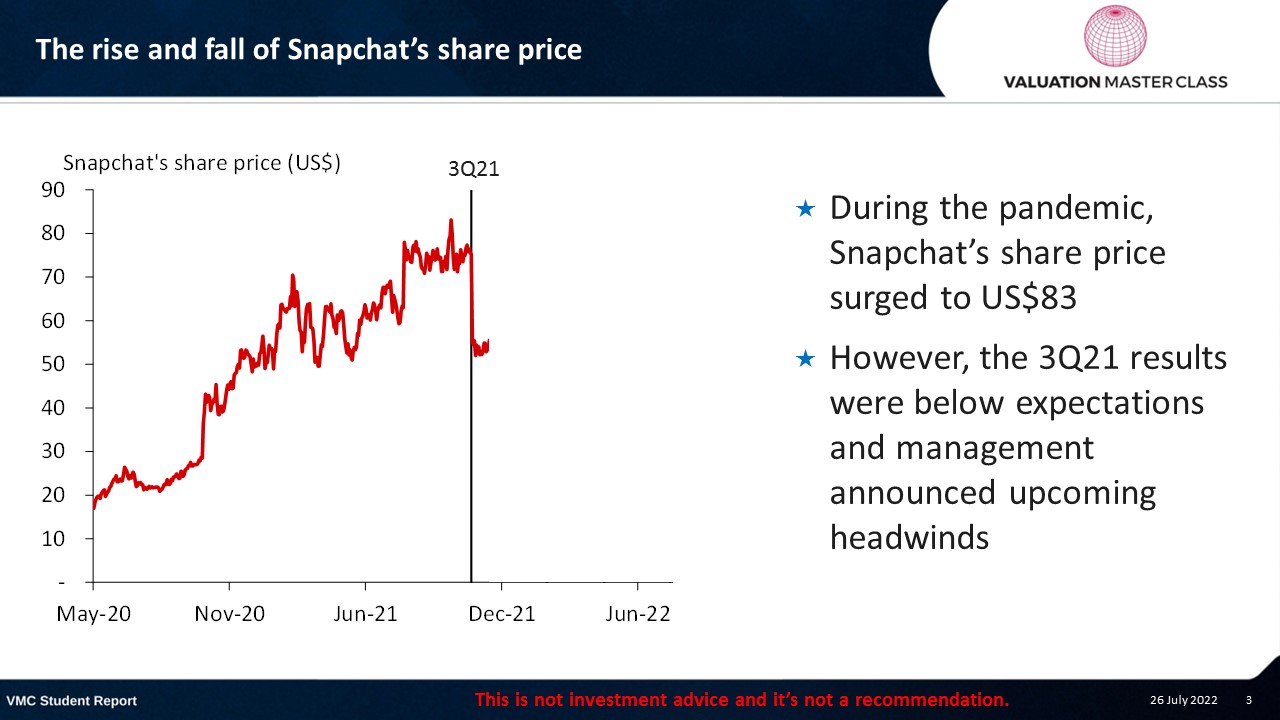

The rise and fall of Snapchat’s share price

- During the pandemic, Snapchat’s share price surged to US$83

- However, the 3Q21 results were below expectations and management announced upcoming headwinds

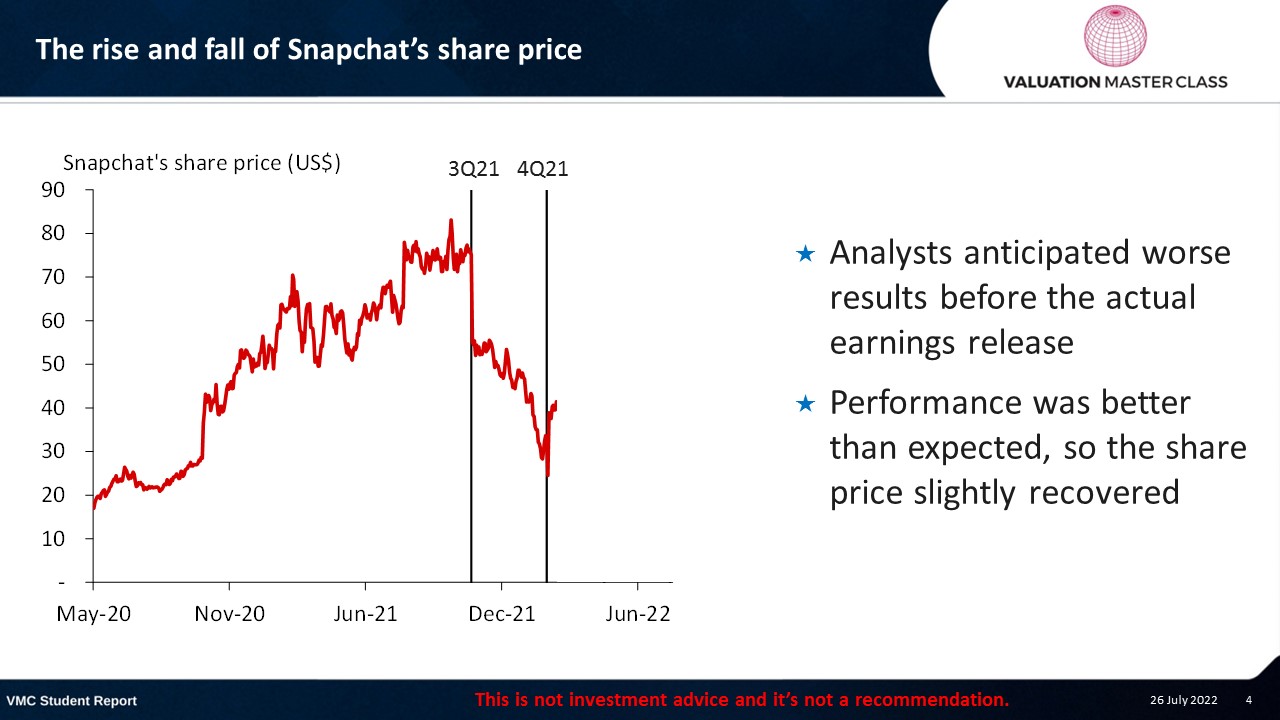

The rise and fall of Snapchat’s share price

- Analysts anticipated worse results before the actual earnings release

- Performance was better than expected, so the share price slightly recovered

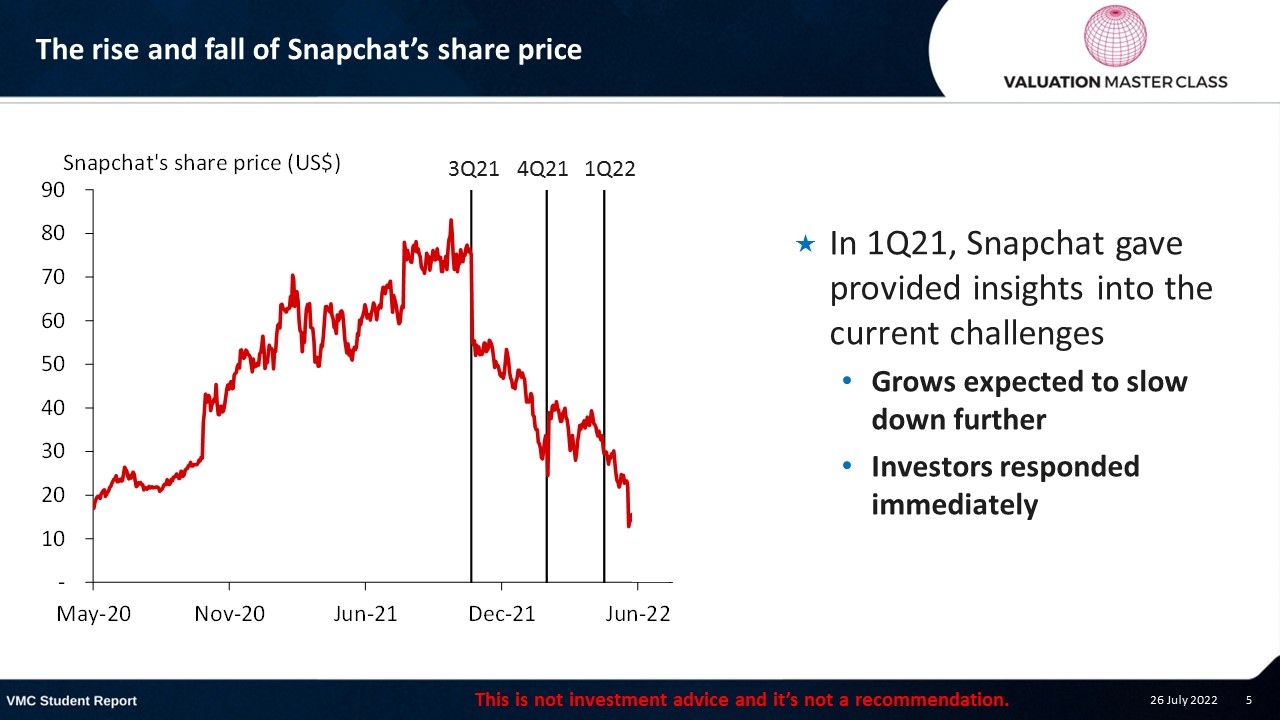

The rise and fall of Snapchat’s share price

- In 1Q21, Snapchat gave provided insights into the current challenges

- Grows expected to slow down further

- Investors responded immediately

The rise and fall of Snapchat’s share price

- The subsequent earnings result in 2Q22 confirmed the negative trend

- Stock trades now 88% below all-time high

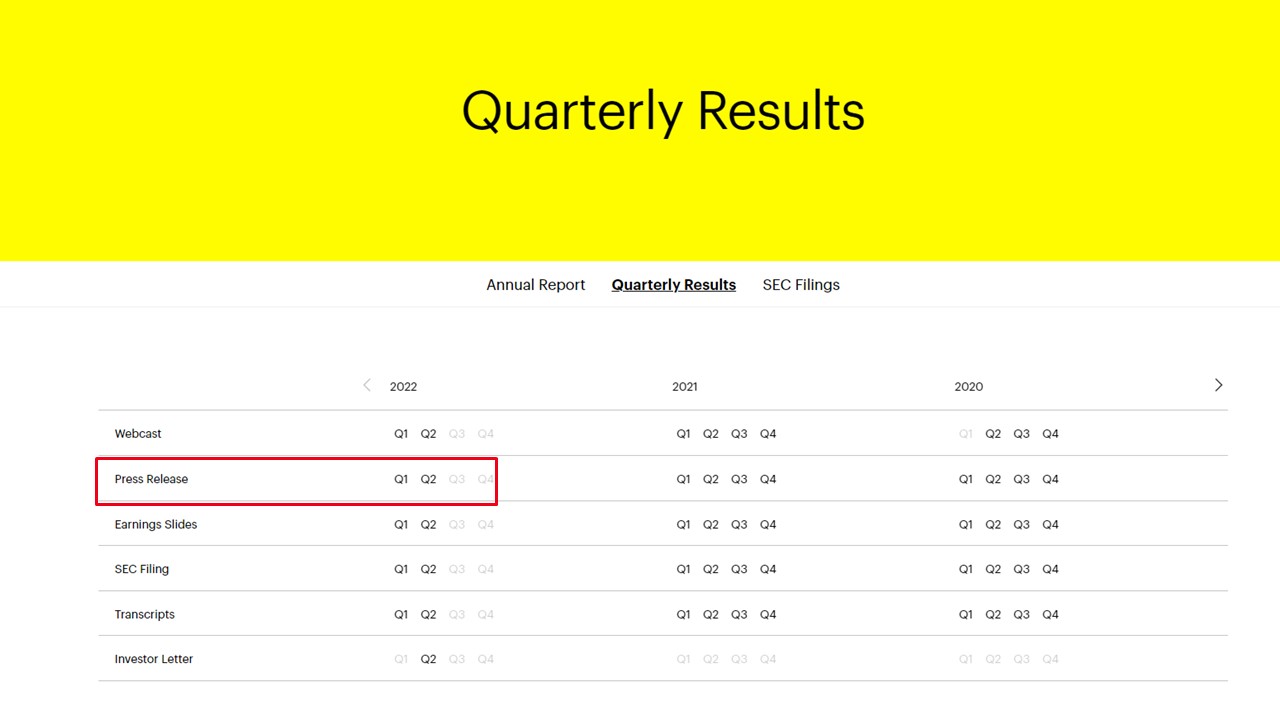

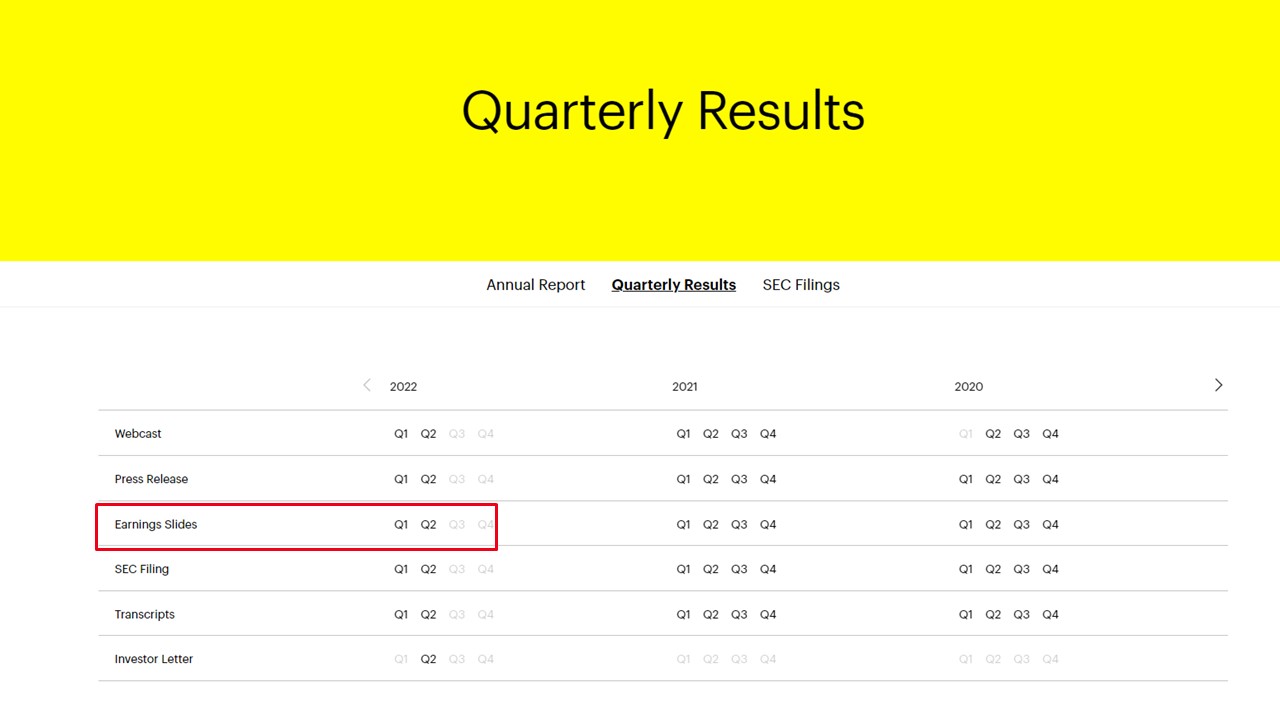

Let’s go to the latest quarterly update

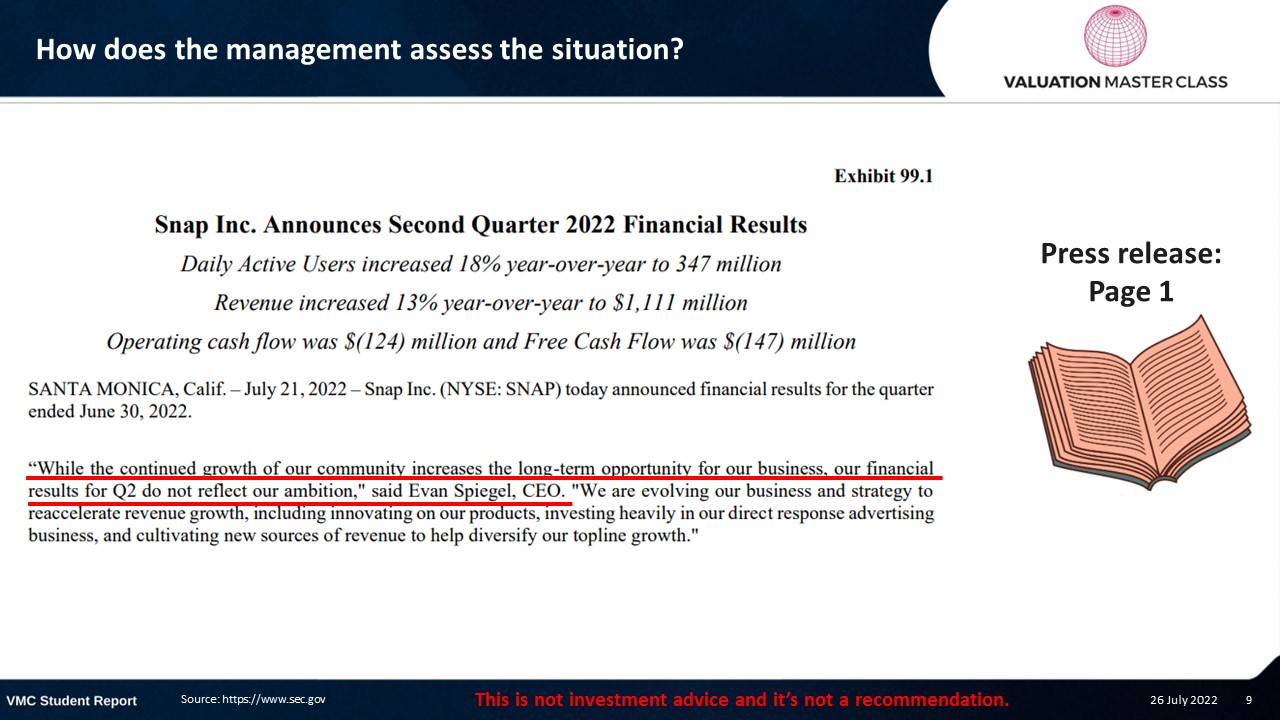

How does the management assess the situation?

First, you need to understand the underlying drivers

Master tip: It is always about the surprise component

- Don’t look at numbers in isolation

- Always compare them with expectations

- Only the unexpected part of an announcement impacts the share price

- This is an important lesson, that many investors fail to apply

- In the case of Snapchat, investors expected much higher growth than 13%

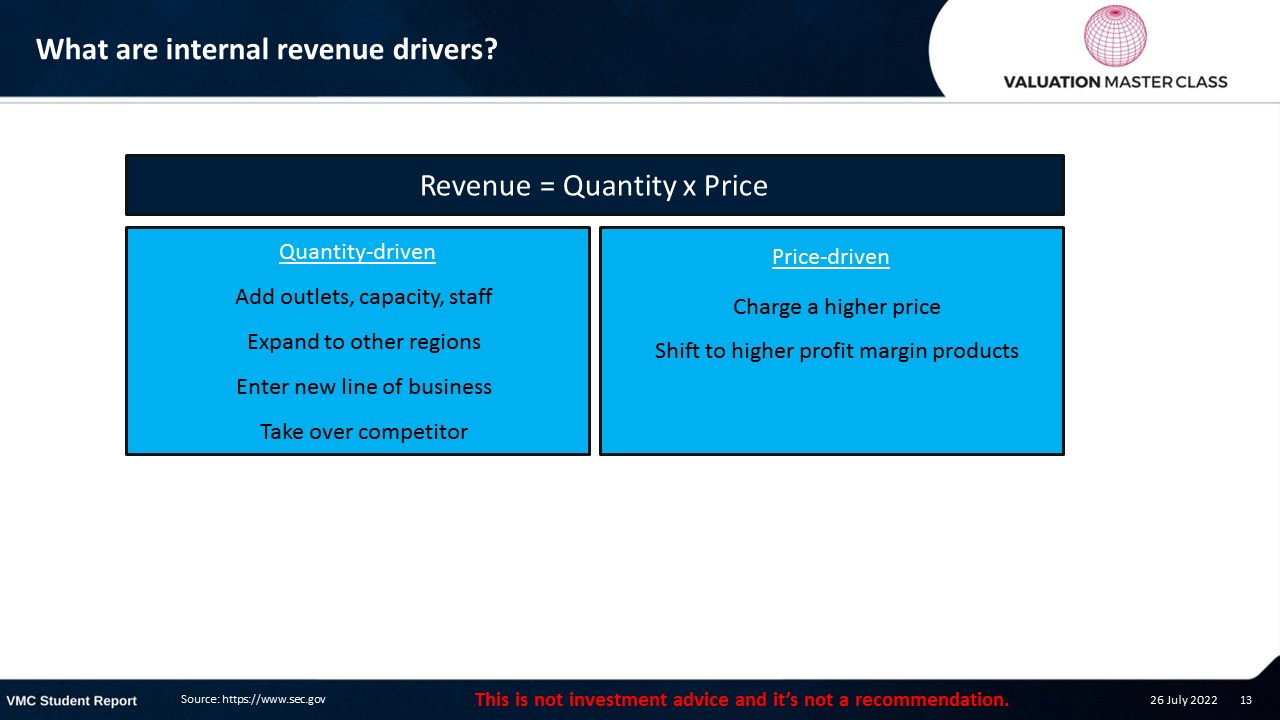

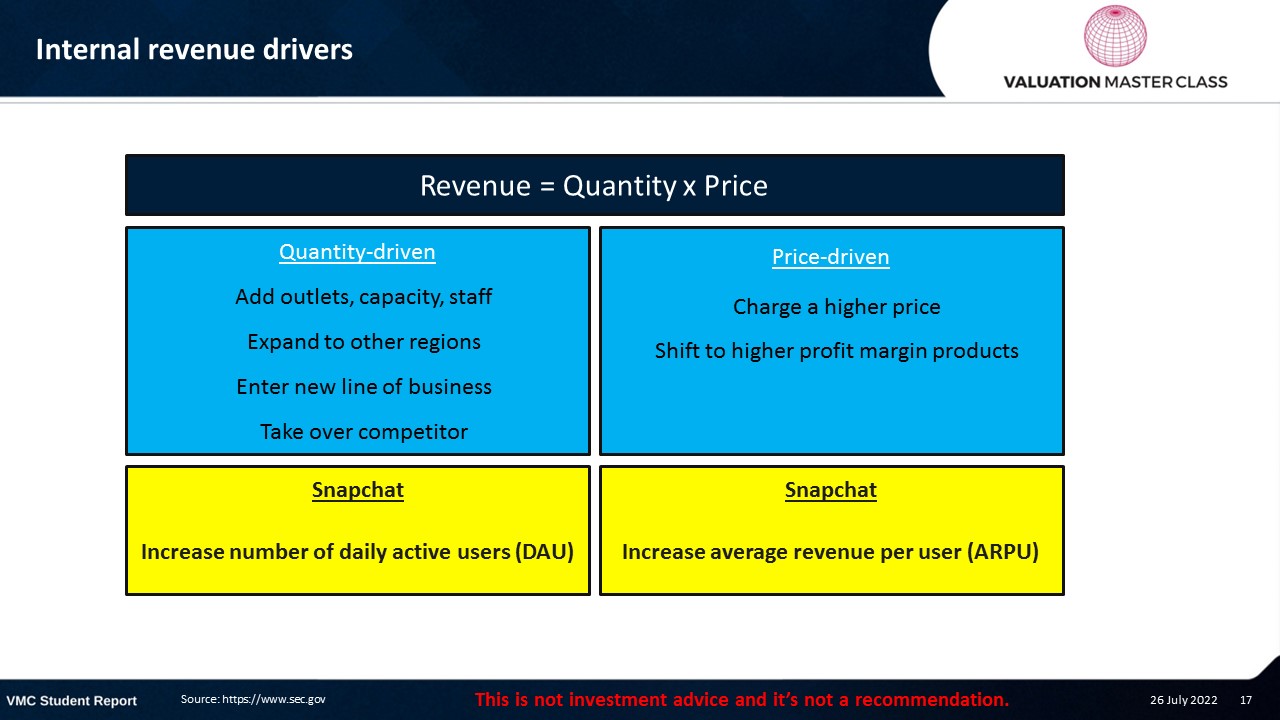

What are internal revenue drivers?

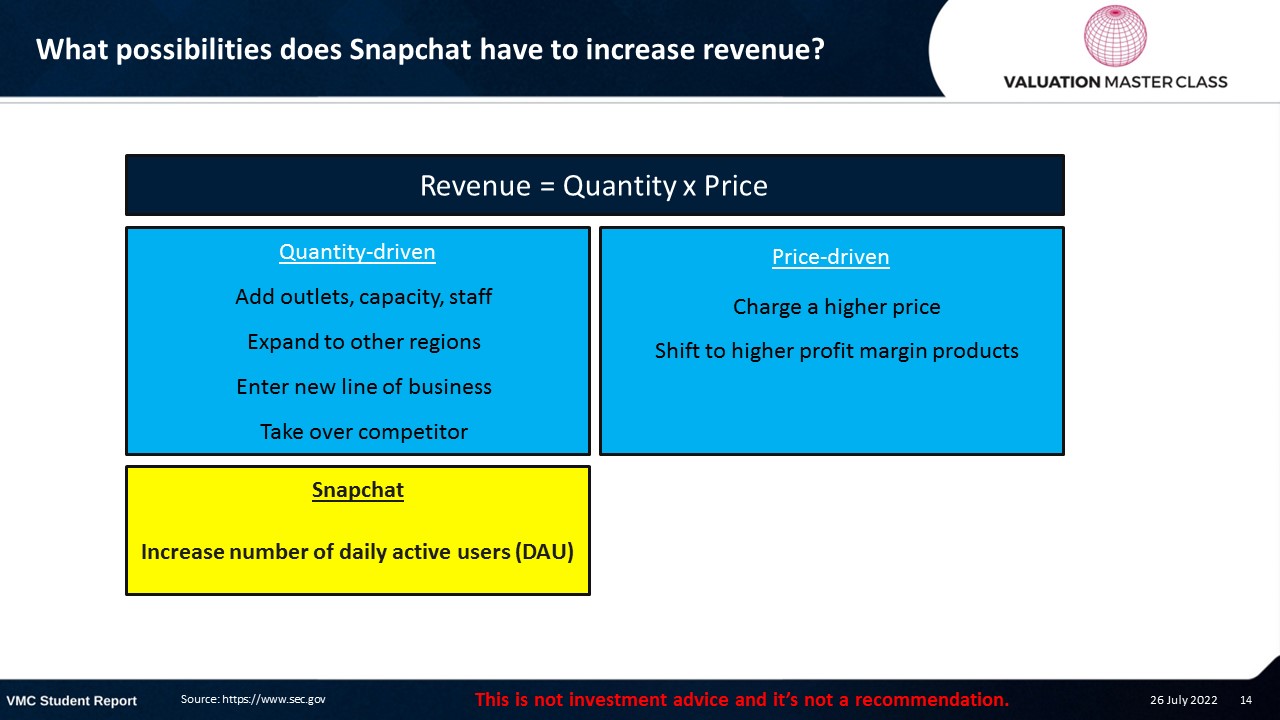

What possibilities does Snapchat have to increase revenue?

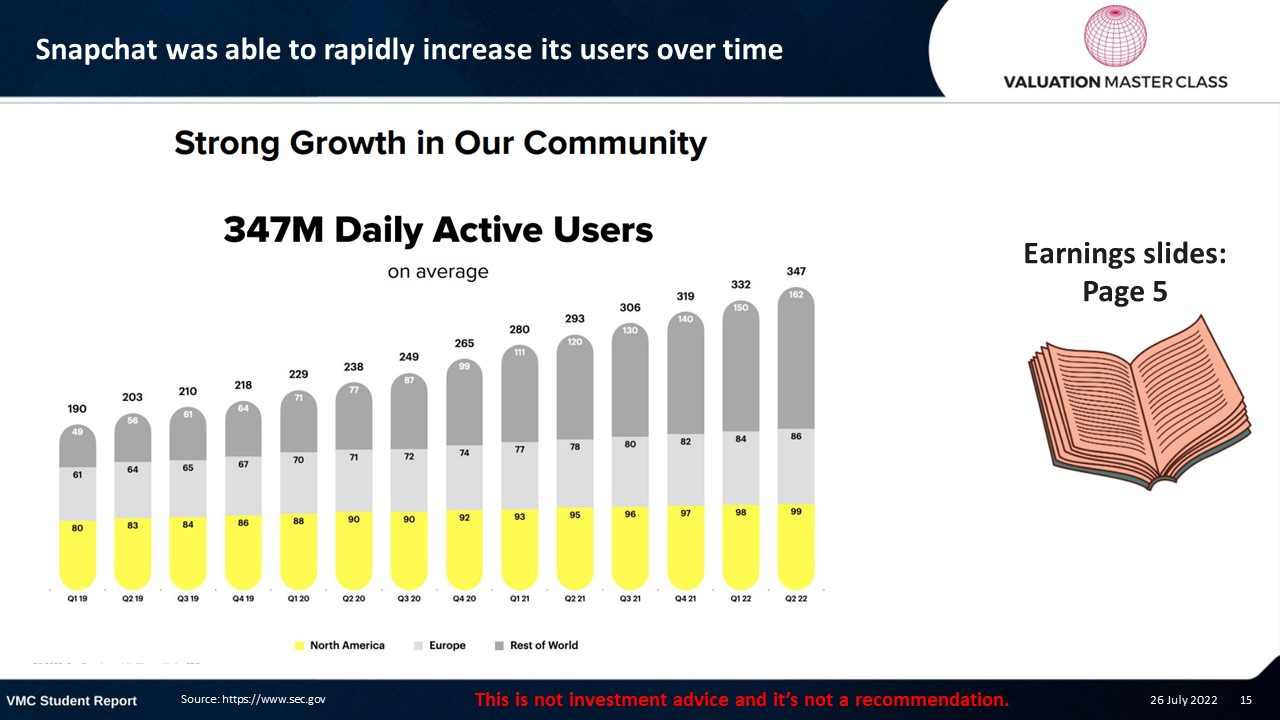

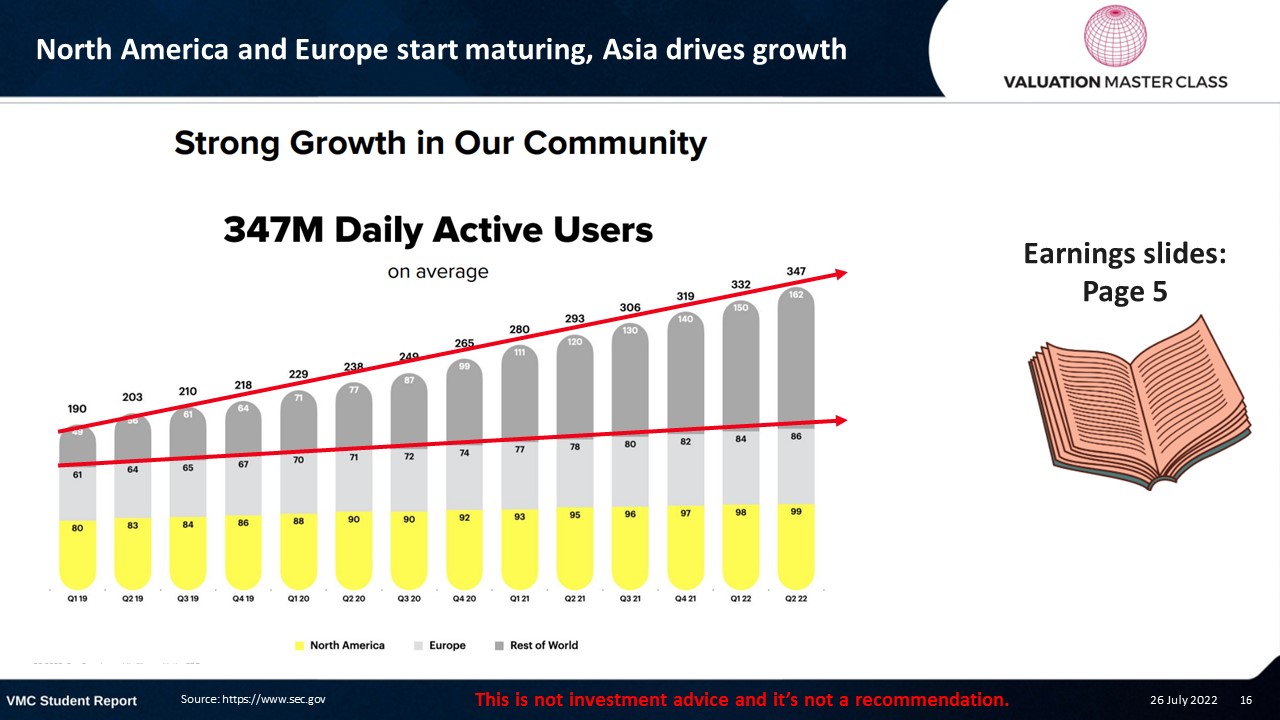

Snapchat was able to rapidly increase its users over time

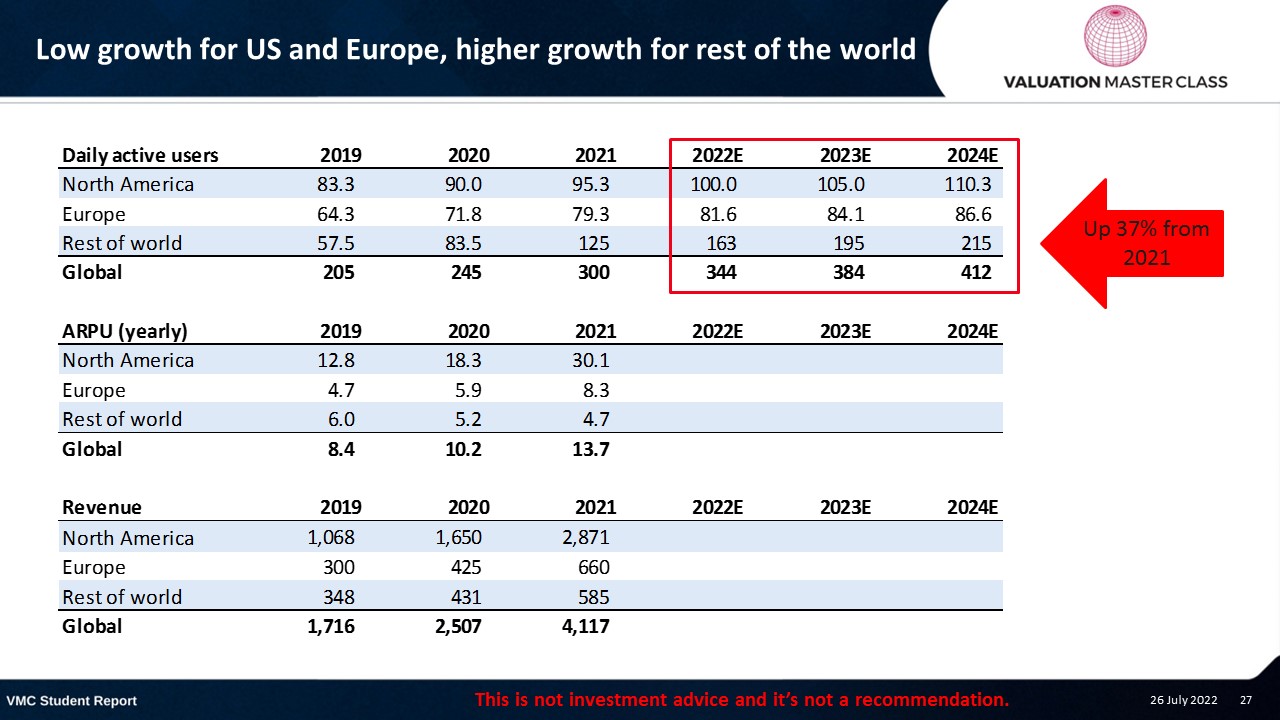

North America and Europe start maturing, Asia drives growth

Internal revenue drivers

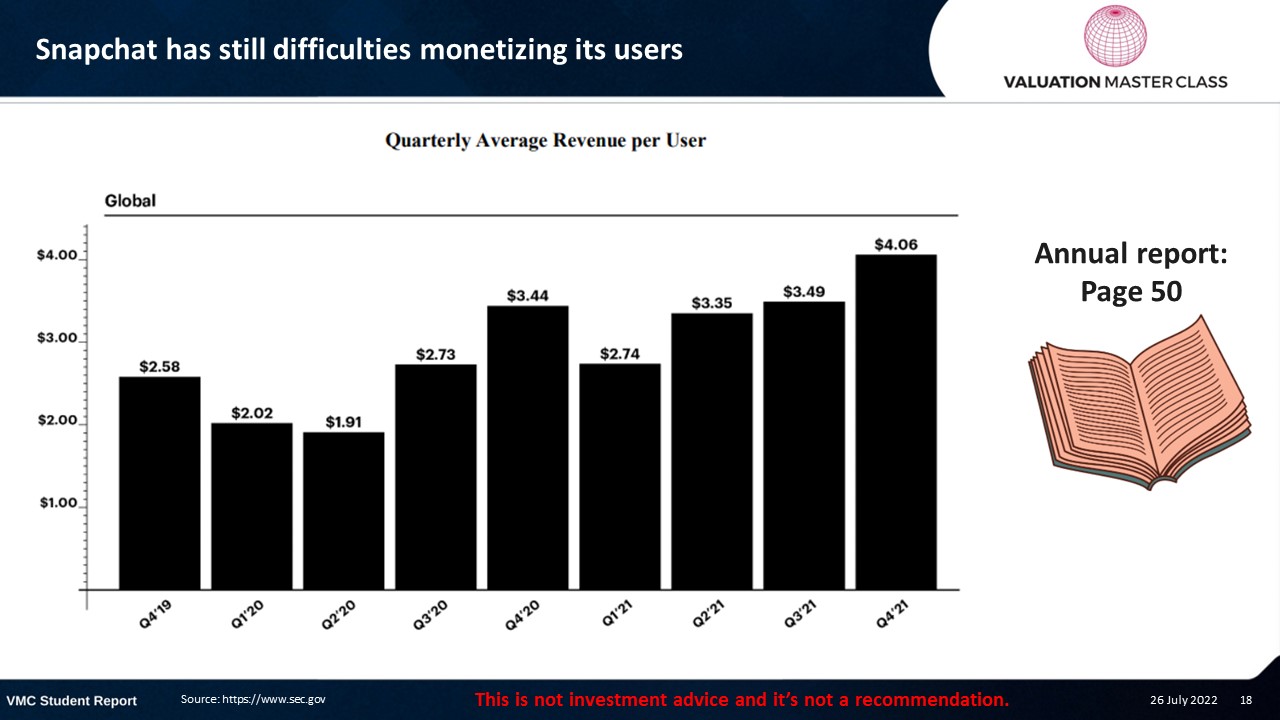

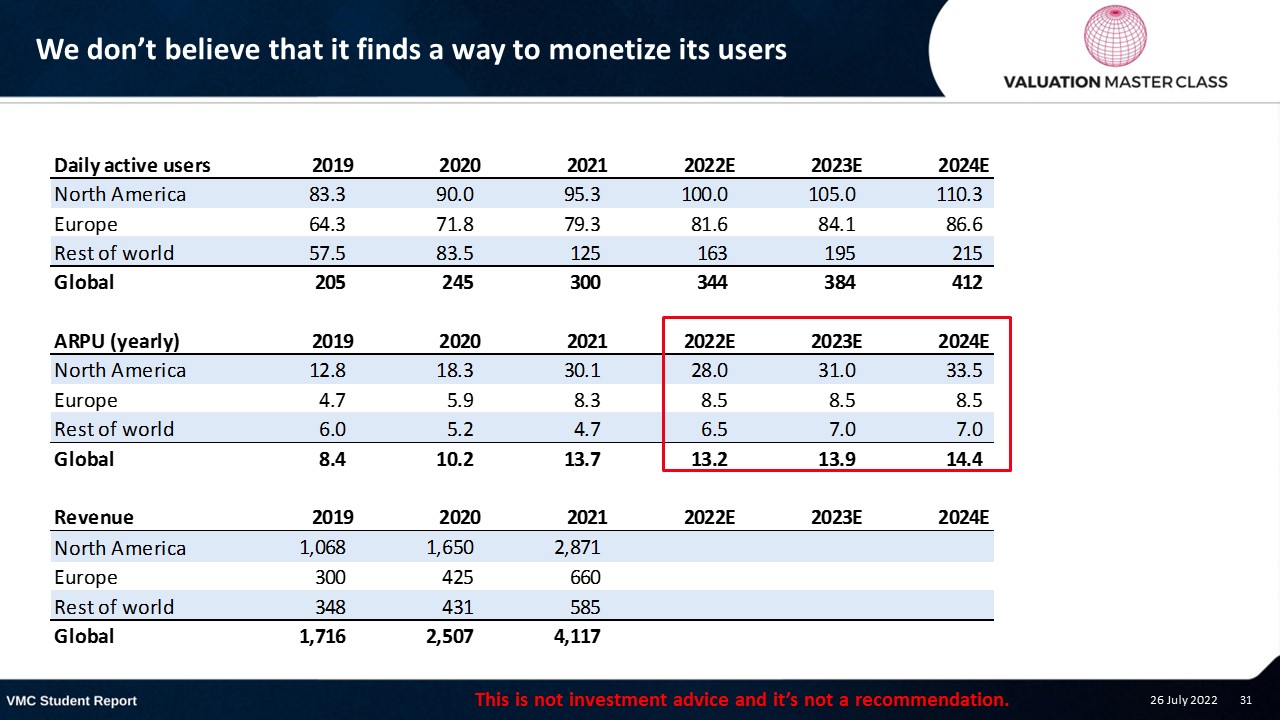

Snapchat has still difficulties monetizing its users

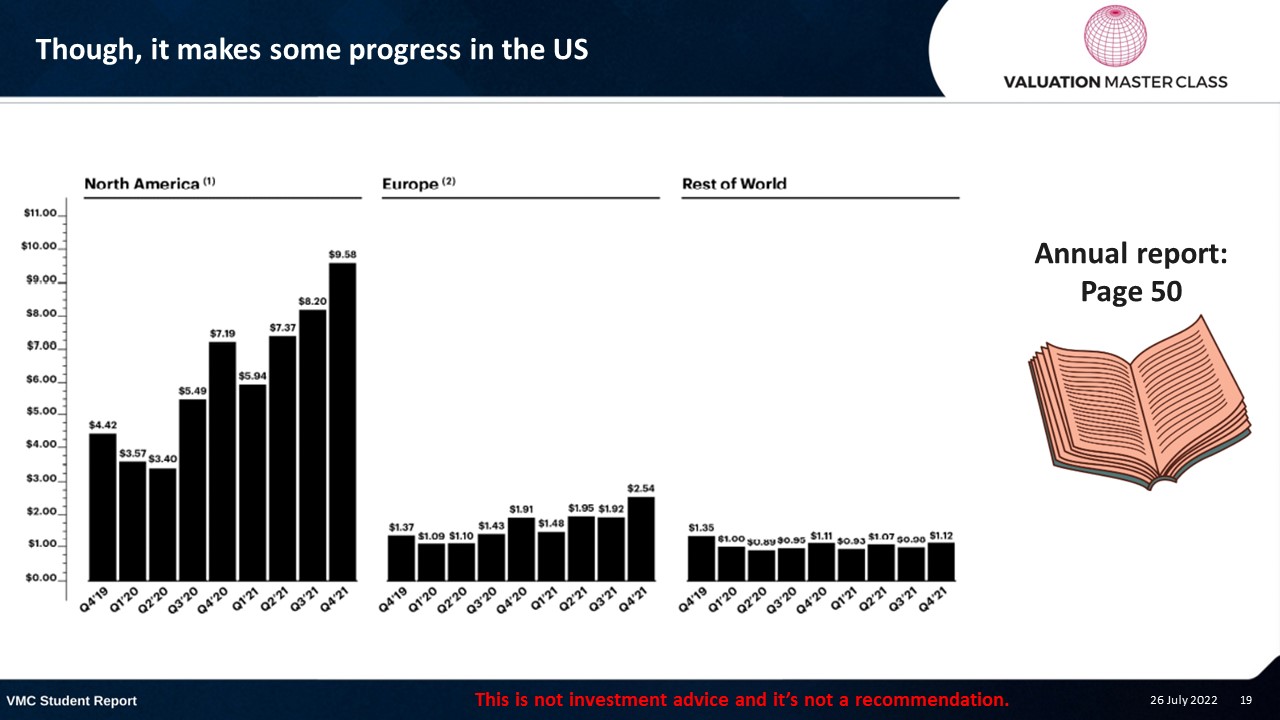

Though, it makes some progress in the US

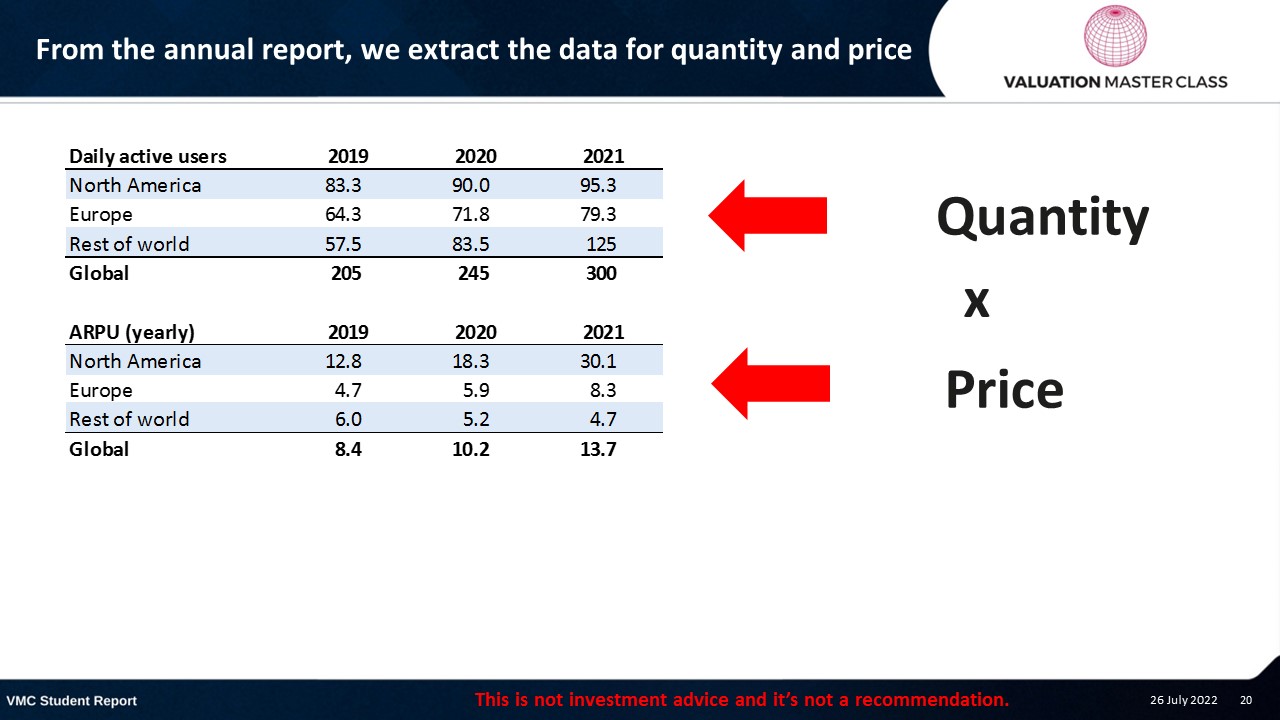

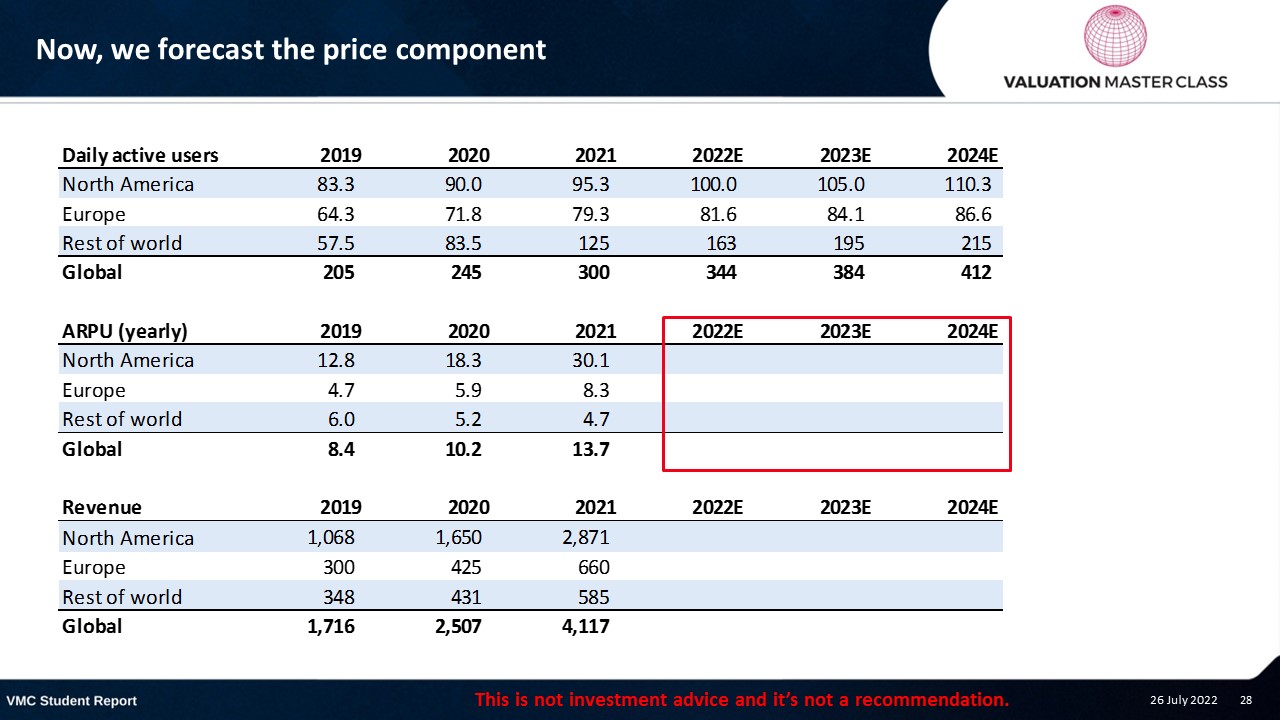

From the annual report, we extract the data for quantity and price

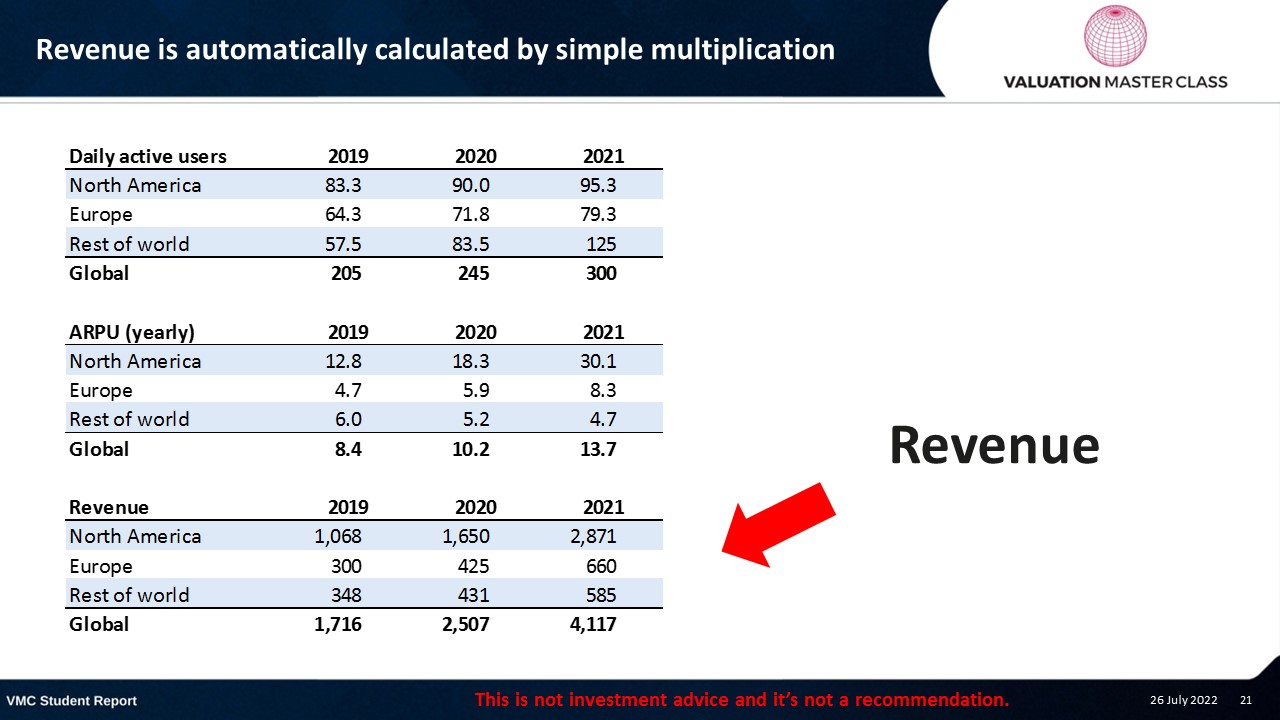

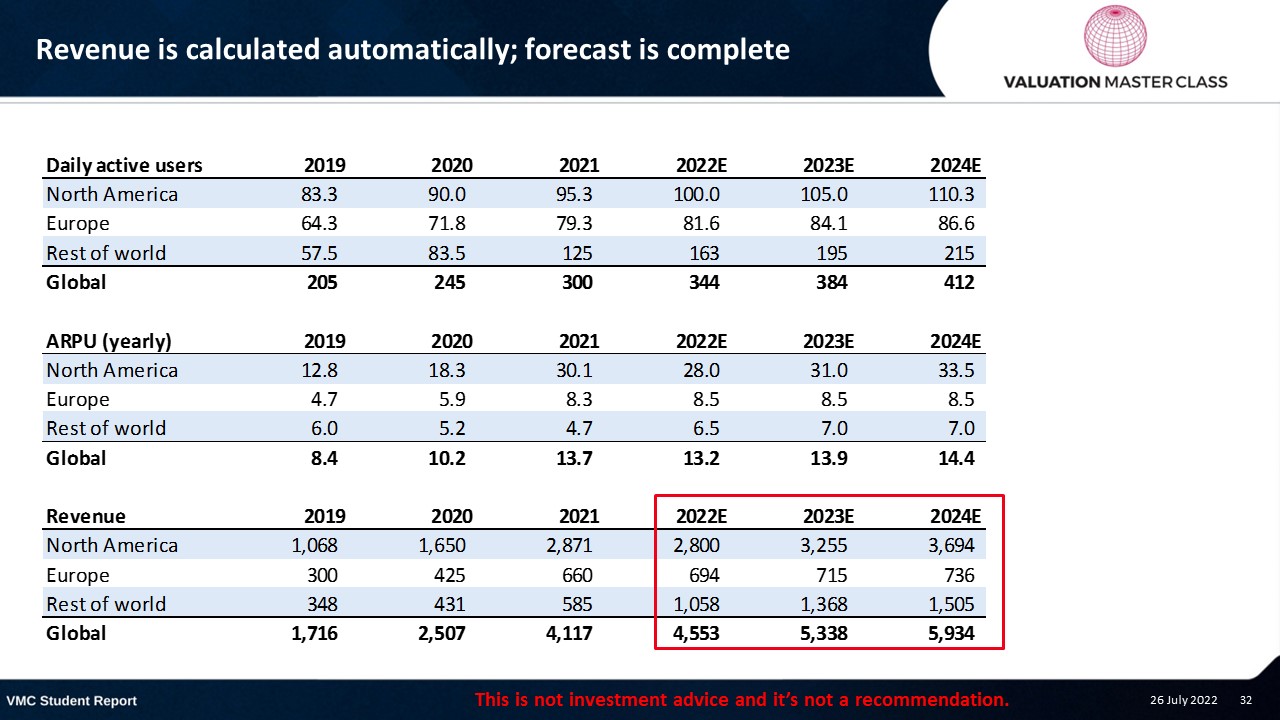

Revenue is automatically calculated by simple multiplication

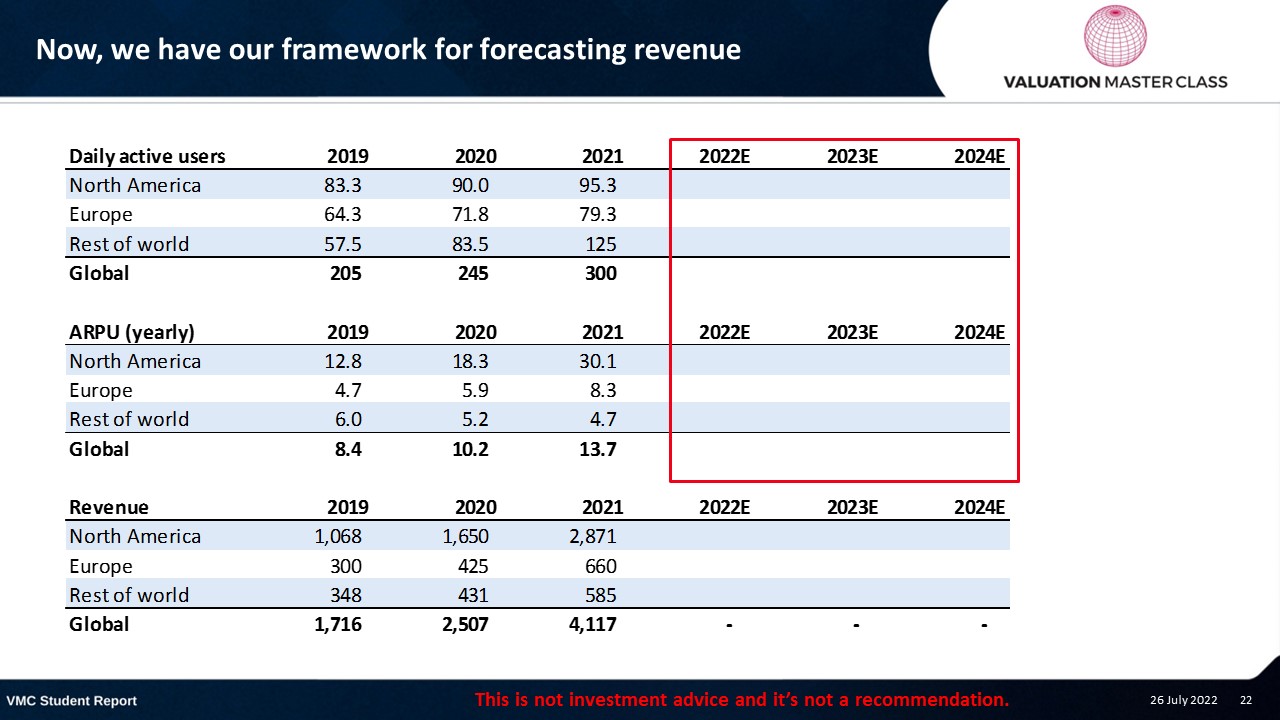

Now, we have our framework for forecasting revenue

Next, we want to understand the latest business developments

Snapchat sees a massive opportunity to expand

- It estimates the total addressable market to be the number of global smartphone users

- That’s why the penetration rate looks rather small and there seems to be a massive potential

- But…

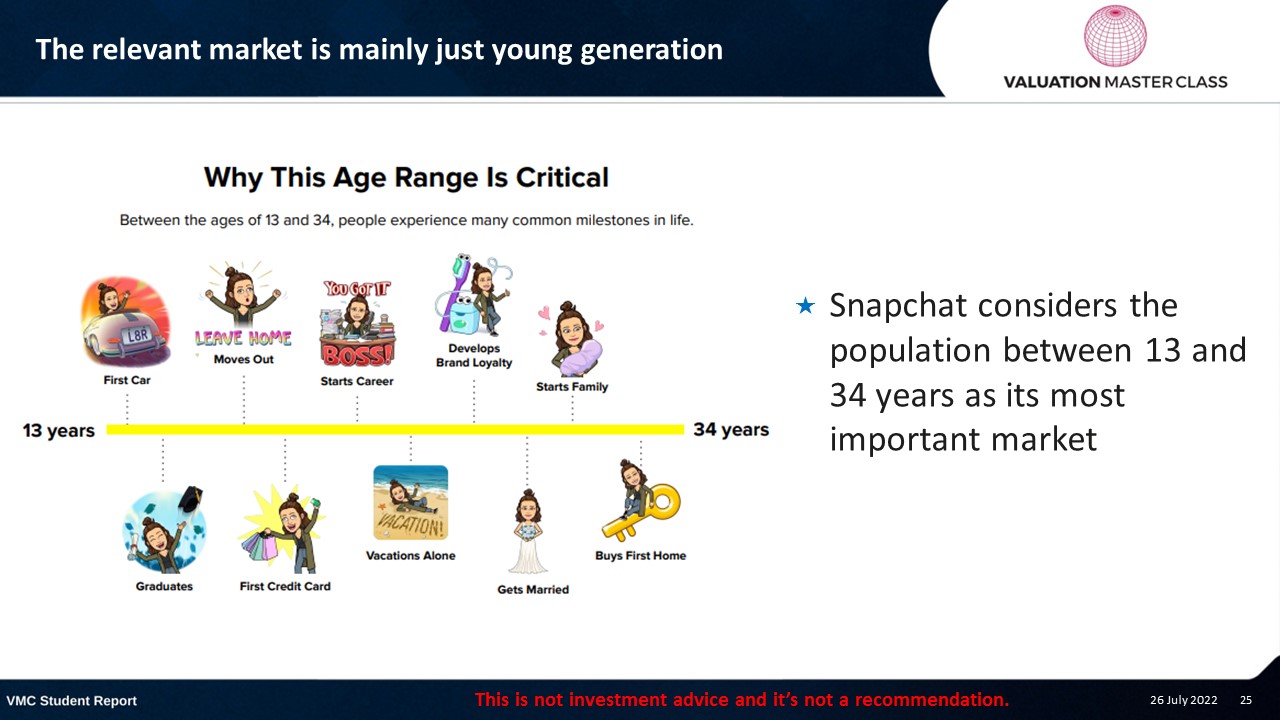

The relevant market is mainly just young generation

- Snapchat considers the population between 13 and 34 years as its most important market

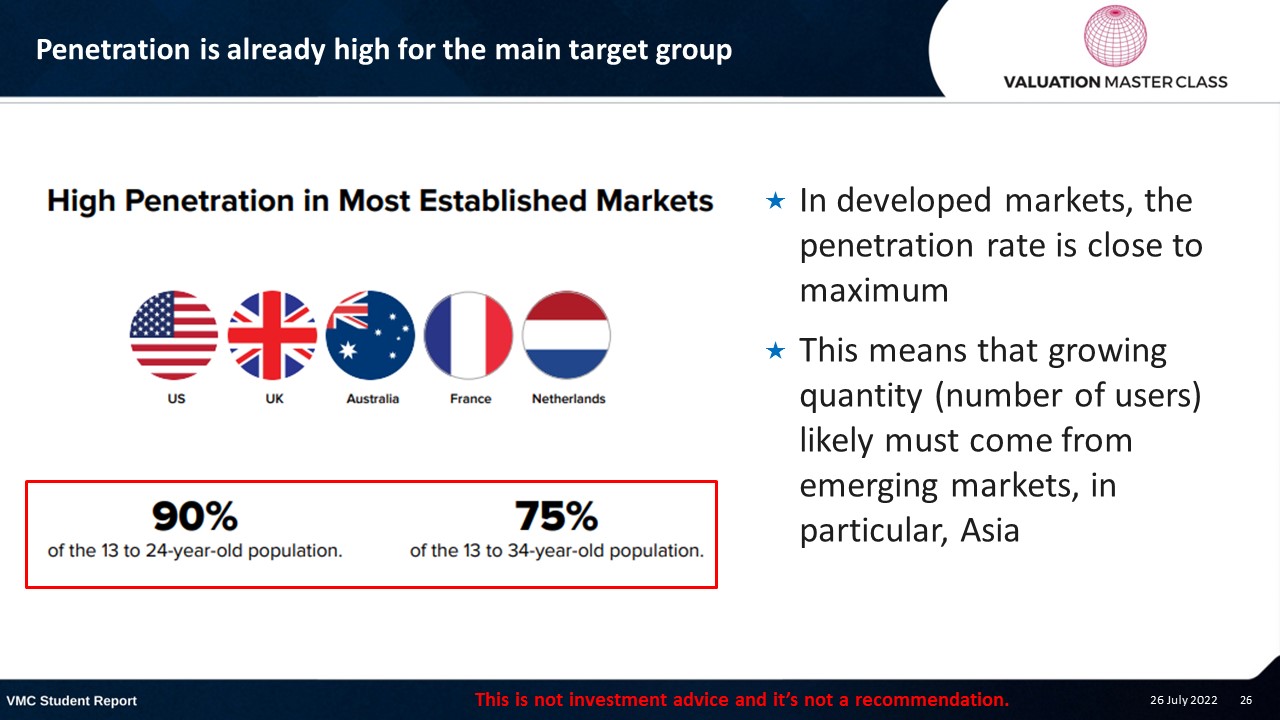

Penetration is already high for the main target group

- «In developed markets, the penetration rate is close to maximum

- This means that growing quantity (number of users) likely must come from emerging markets, in particular, Asia

Low growth for US and Europe, higher growth for rest of the world

Now, we forecast the price component

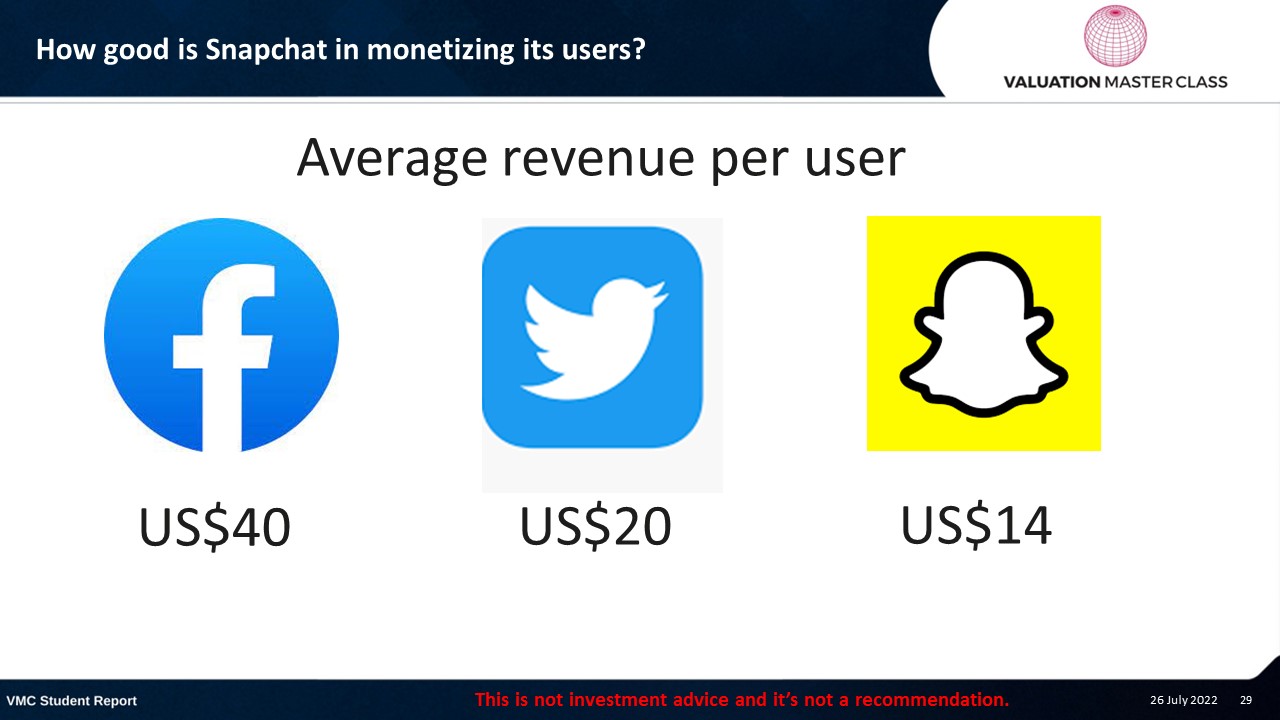

How good is Snapchat in monetizing its users?

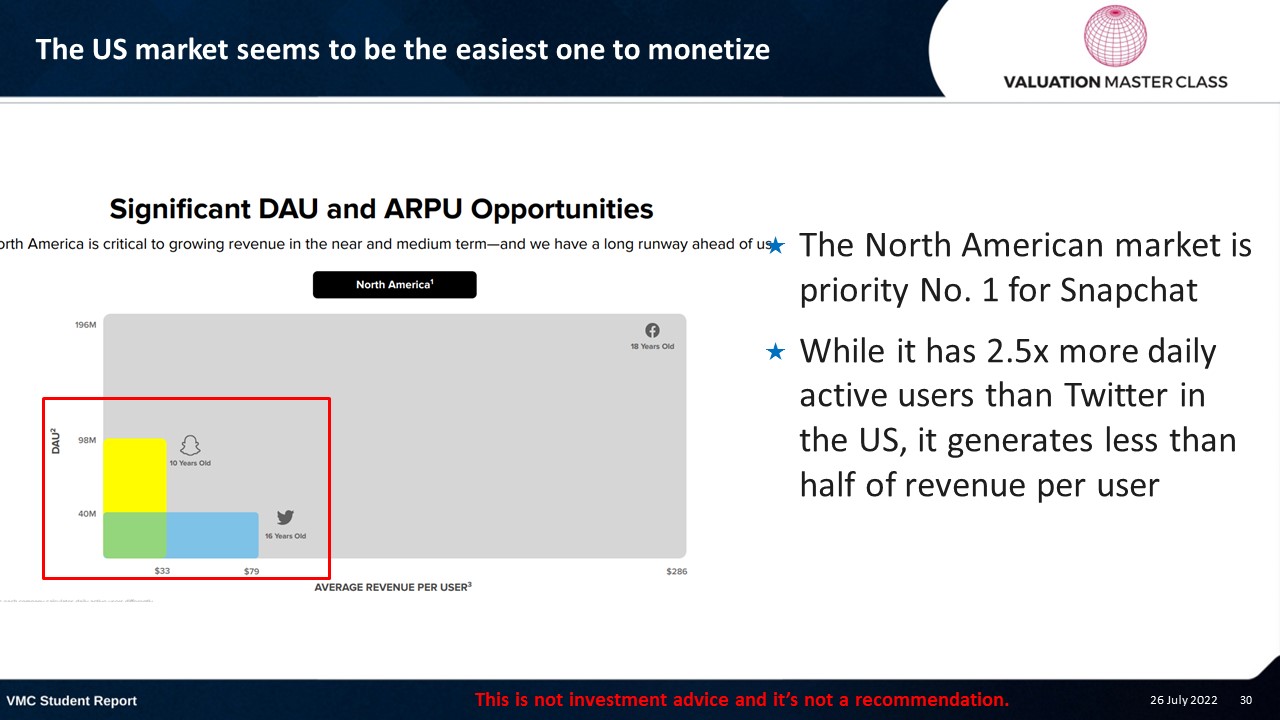

The US market seems to be the easiest one to monetize

- The North American market is priority No. 1 for Snapchat

- While it has 2.5x more daily active users than Twitter in the US, it generates less than half of revenue per user

We don’t believe that it finds a way to monetize its users

Revenue is calculated automatically; forecast is complete

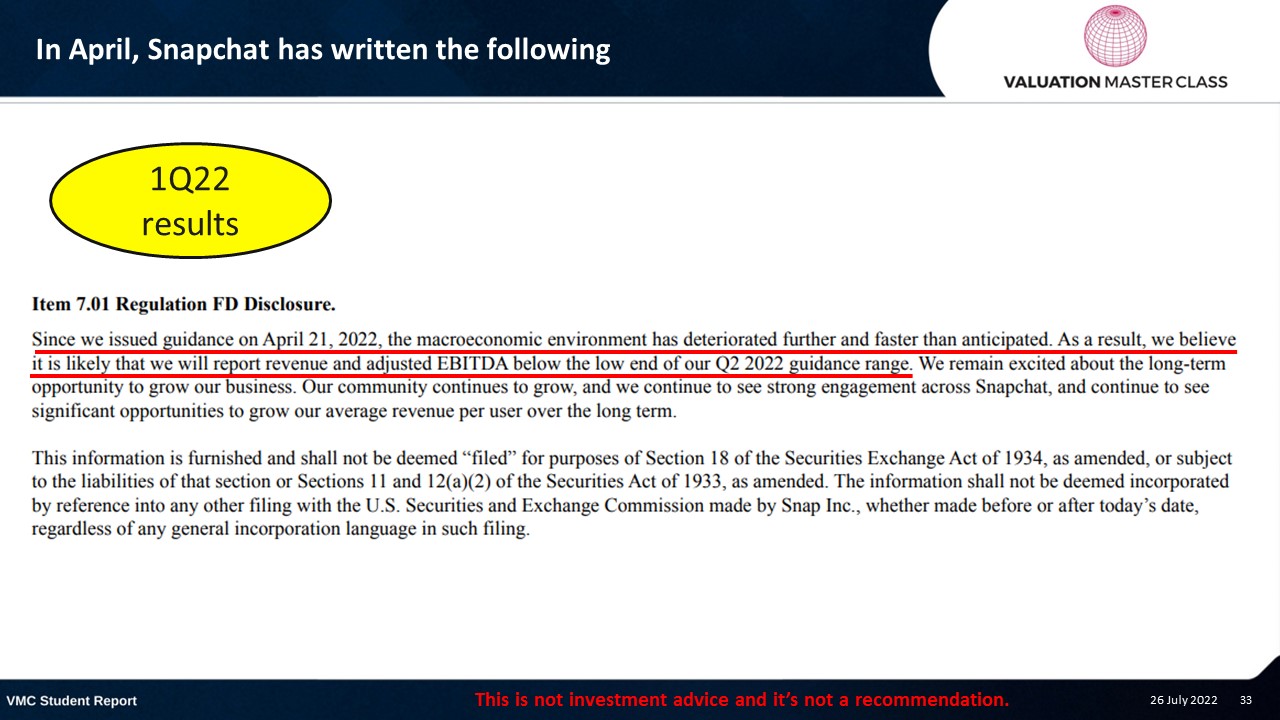

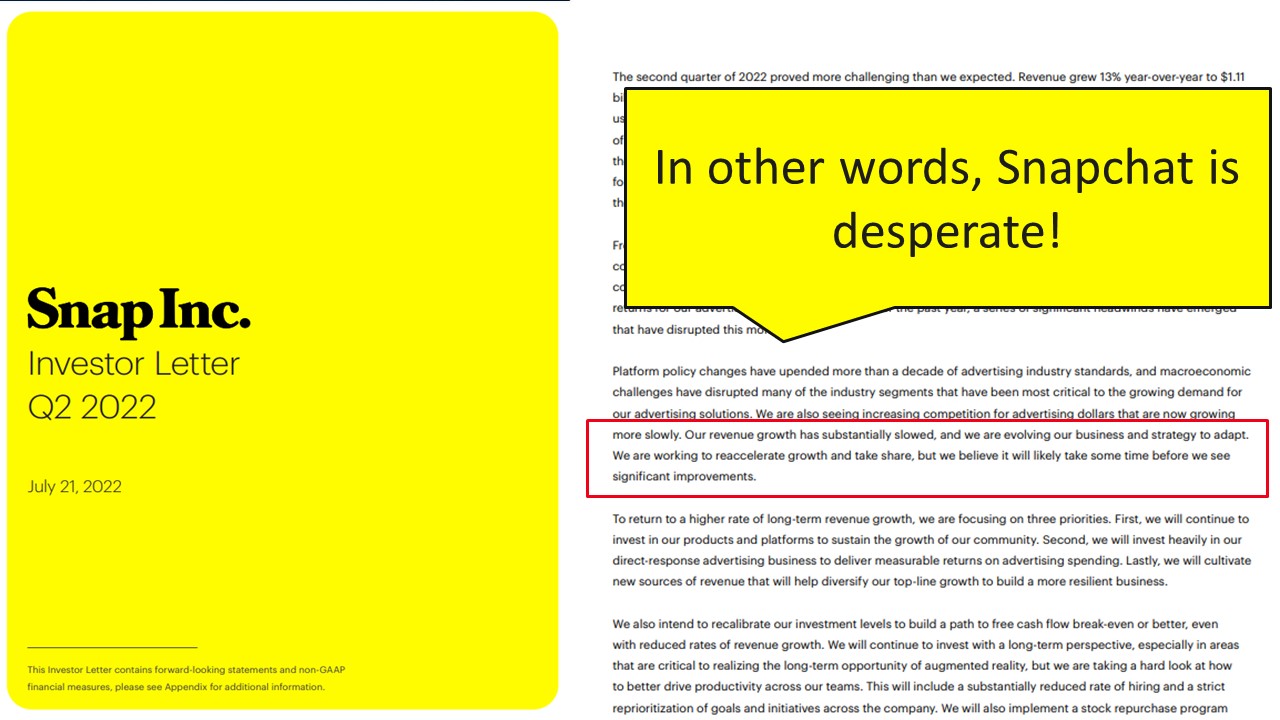

In April, Snapchat has written the following

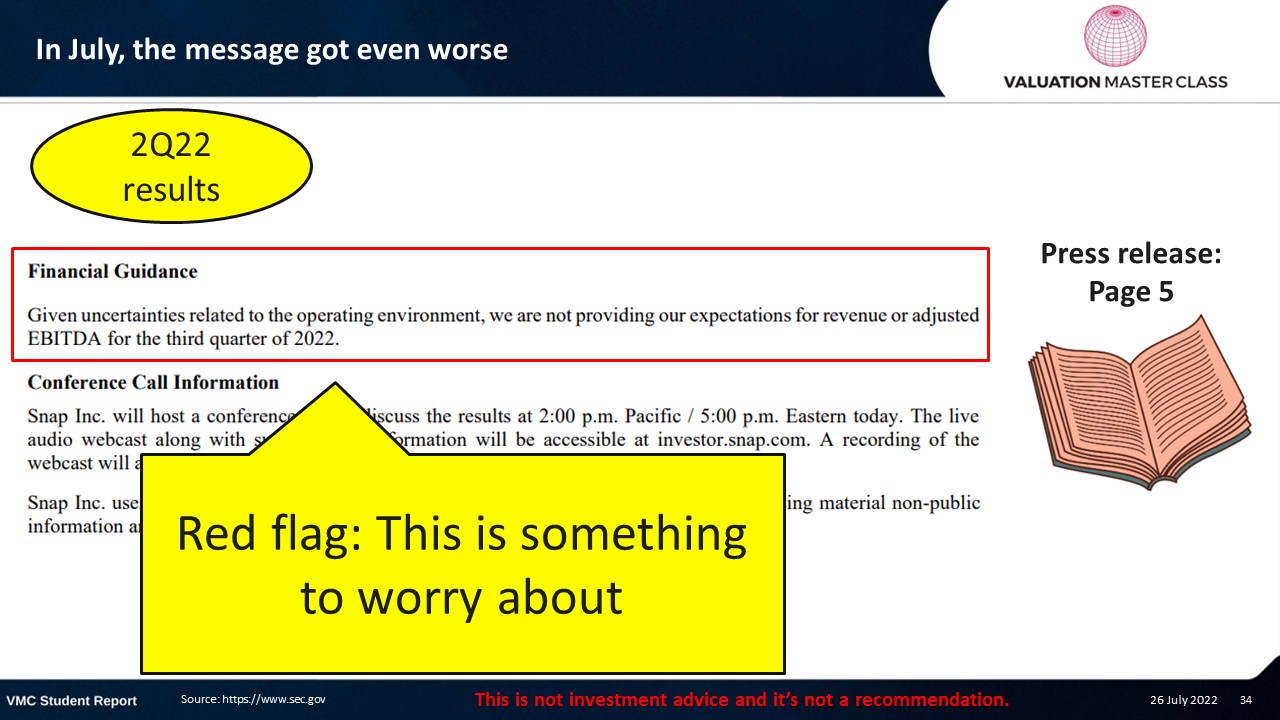

In July, the message got even worse

In fact, we are not that smarter than before

- A company always has more information than any investor

- The company did not provide any guidance on how bad the impact actually is

- The only thing we can take away from the company’s statement is to reconsider our revenue drivers

- But if we take a look at Snapchat’s fundamentals, the market correction was just a question of time…

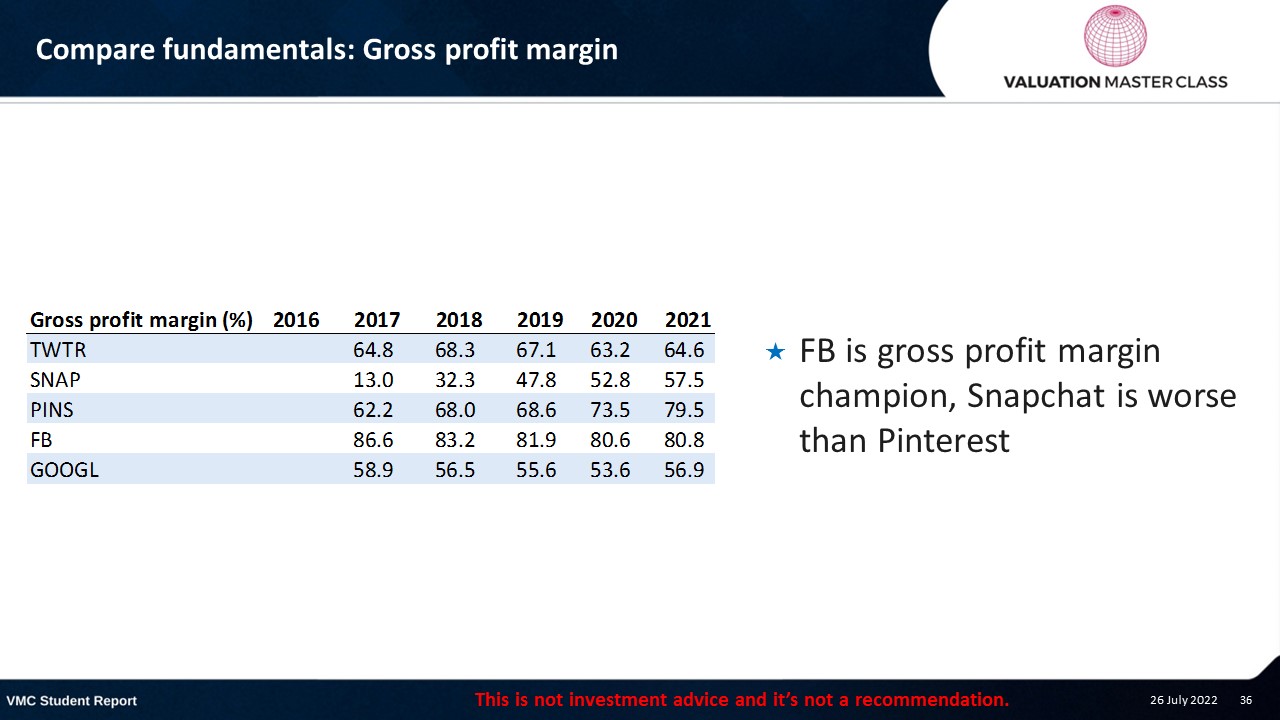

Compare fundamentals: Gross profit margin

- FB is gross profit margin champion, Snapchat is worse than Pinterest

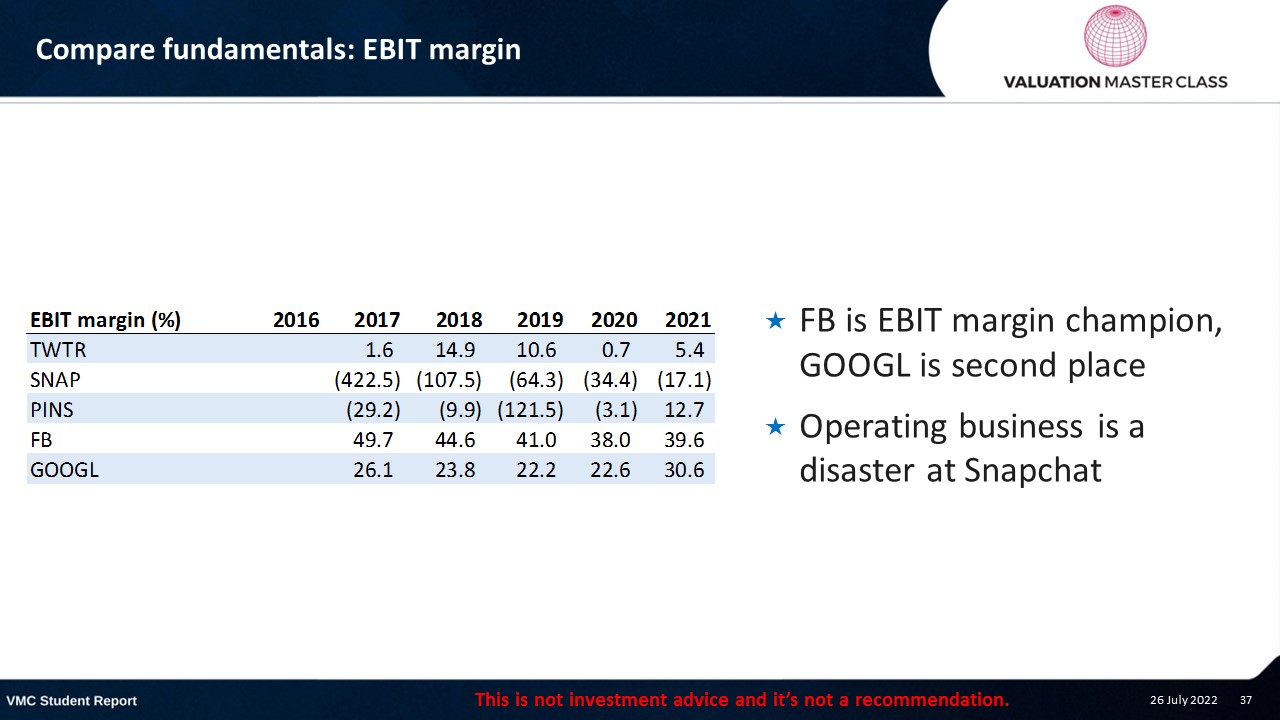

Compare fundamentals: EBIT margin

- FB is EBIT margin champion, GOOGL is second place

- Operating business is a disaster at Snapchat

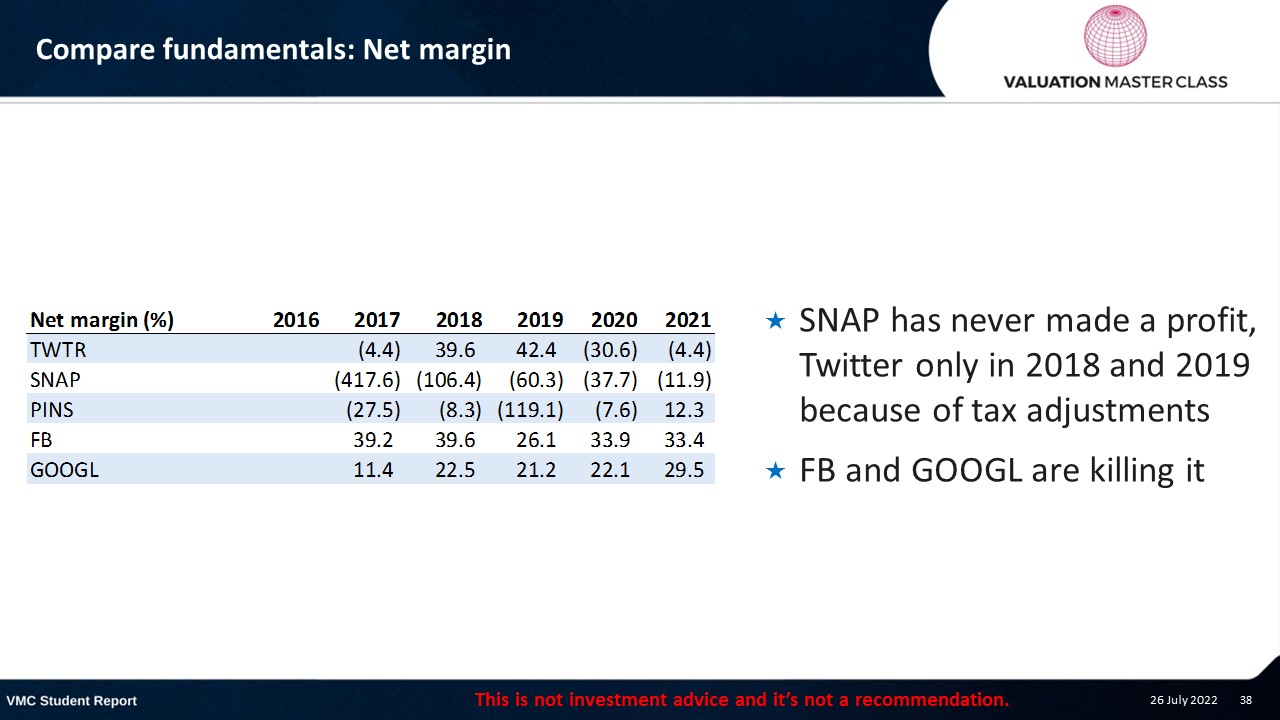

Compare fundamentals: Net margin

- SNAP has never made a profit, Twitter only in 2018 and 2019 because of tax adjustments

- FB and GOOGL are killing it

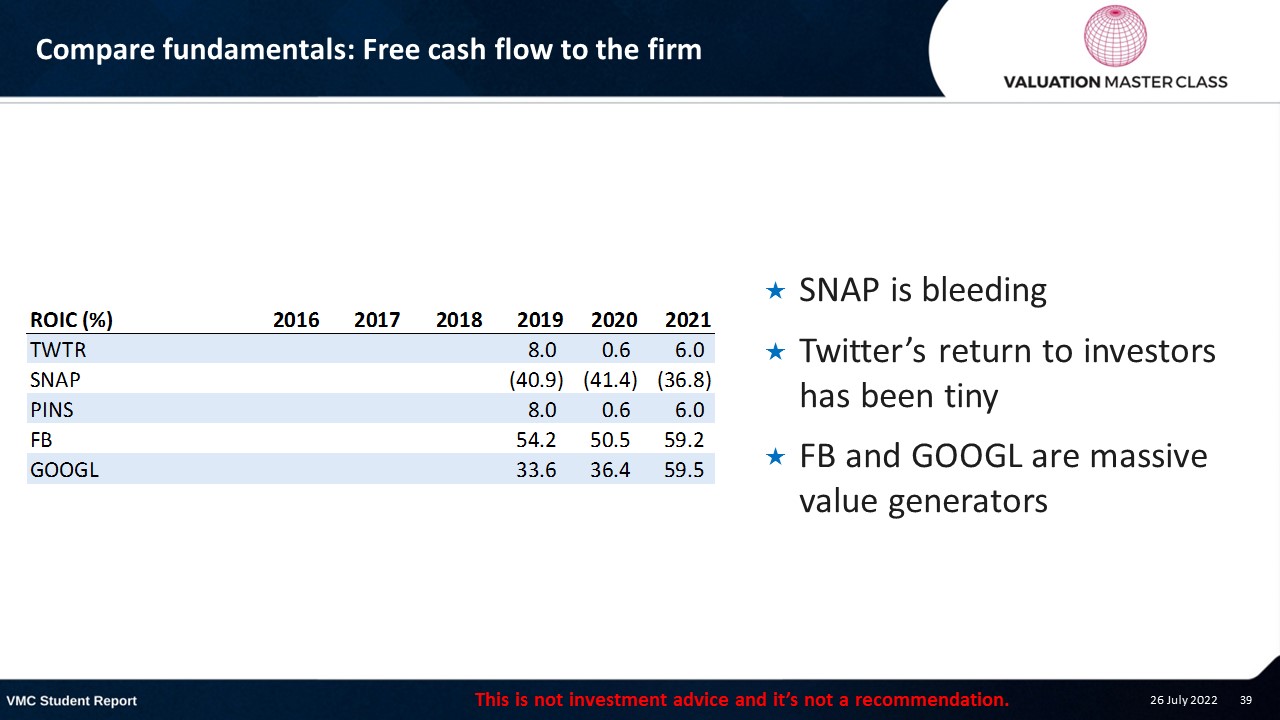

Compare fundamentals: Free cash flow to the firm

- SNAP is bleeding

- Twitter’s return to investors has been tiny

- FB and GOOGL are massive value generators

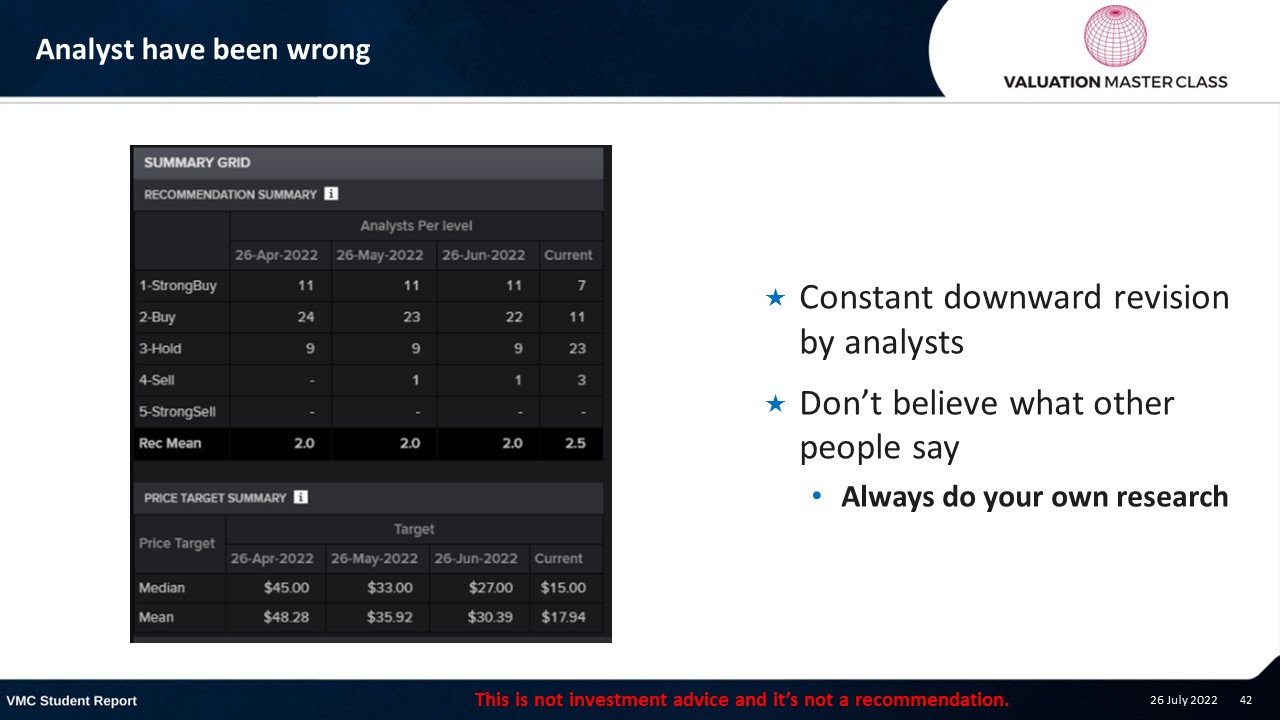

Analyst have been wrong

- Constant downward revision by analysts

- Don’t believe what other people say

- Always do your own research

Download the full report as a PDF

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.