Issues faced when valuing a declining company

This is a Valuation Master Class student essay by Lim Lee Bin from June 16, 2018. Lee Bin wrote this essay in Module 4 of the Valuation Master Class.

Most valuation models are built for the healthy, on-going company. When used to value a declining company, analysts will face special challenges as the characteristics of a declining company will cause some of the valuation model’s assumptions to break down. In this essay, I will discuss the characteristics of a declining company, the issues when using a discounted cash-flow model, and also a relative valuation model.

Characteristics of a declining company

In reference to Aswath Damodaran’s book “The Dark Side of Valuation Valuing Young Distressed and Complex Businesses,” it mentions that a declining company usually possesses the following five characteristics:

(1) Stagnant or declining revenue

(2) Shrinking or negative margins

(3) Asset divestitures

(4) Big payouts – dividends and stock buyback

(5) Face overwhelming debt burden

When a company becomes more mature, it might share the same characteristics with the declining company. One area to differentiate the company is on the asset side of the balance sheet. From there, we can classify an asset into two main categories: maintenance asset and growth asset. Although both mature and declining companies get most of their value from maintenance assets, the mature company will still get some value from growth assets. Whereas, for a declining company, it will get none or even negative value from its growth asset. It is common for declining companies to have negative value form their growth asset, especially when the declining company reinvests at rates below their cost of capital.

Another area to differentiate is on the liability side of the balance sheet. The declining company tends to over-leverage and usually doesn’t generate enough earnings to service its debt. Consequently, the declining company will face more distressing consequences from their debt burden, for example, higher debt servicing costs in contrast to the mature company.

Issues when using a discounted cash-flow method

The two most beloved valuation methods are discounted cash flow method (DCF) and the relative valuation method. As these valuation models are designed for a healthy company, it will pose unique challenges when used for declining companies.

Quoted from Wall Street Oasis.com, it describes discounted cash flow (DCF) process by estimating the total value of all future cash flows (both inflow and outflow), and then discounting them (usually using Weighted Average Cost of Capital – WACC) to find a present value of the cash flow.

Wall Street Oasis.com further outlines the DCF process as follows:

- Project Future Cash Flows – this is usually done from a 3-statement projection model or by using simple assumptions about Revenue, Tax, Depreciation, Amortization etc and calculating free cash flow from there

- Calculate the Discount Rate – this is either taken to be a simple percentage or is calculated using WACC

- Discount Future Cash Flows – either by using the Mid-Year discount or a simple discount period, it is fairly simple to calculate the present value of future cash flows

- Estimate Terminal Value – Terminal Value is then estimated either by using a terminal exit multiple (usually an EBITDA multiple) or with a Terminal Growth Rate (Gordon Growth Method)

- Find the Net Present Value – to find the net present value simply discount the terminal value (again using WACC or a simple %) and then add that to the sum of the discounted cash flow values

Using the above process illustration, we can observe that projecting future cash flow is one of the essential steps in the DCF process. But due to , projecting future cash flow for a declining company is not as straightforward as it seems in contrast to a healthy company. From the earlier paragraph, we know that the asset might be earning less than the cost of capital for a declining company. This characteristic of value-destroying asset is not a frequent scenario that analyst faces every day. Due to unfamiliarity, it might lead to valuation errors.

Another common characteristic for a declining company is it ends to divest its assets. From a valuation perspective, divestitures of assets create discontinuities in past data. This causes difficulties in future performance forecasting since there is limited or no comparable historical information.

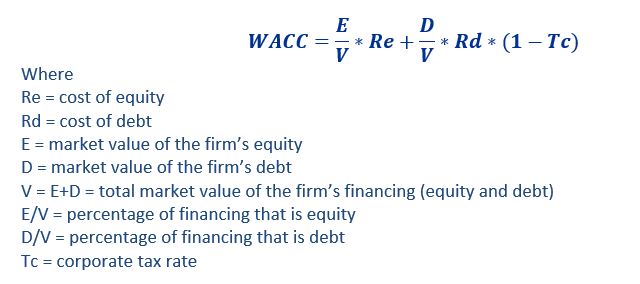

Next, we move on to the next component of the DCF — Weighted Average Cost of Capital (WACC). According to Investopedia.com, the formula for WACC is as below:

One of the characteristics of the declining company is that there are big payouts, either by dividends or stock buyback. This action will cause fluctuations in the overall value of equity and debt ratio. From the above formula, we observe that the equity and debt ratio is an essential component of WACC. If equity and debt ratio fluctuates, WACC will become unstable, which in turn impacts DCF.

Another common declining company scenario that can cause fluctuation in equity and debt ratios is when debt Is not repaid proportionately to the debt increase. The subsequently higher debt ratio brings instability to the company.

When default risk increases, the cost of debt will also increase. Likewise, the cost of equity will also increase because of the increase in earnings volatility. However, due to the lagged nature in reflecting the cost of equity changes, an analyst might face an unconventional scenario where the cost of equity is lower than the pre-tax cost of debt in WACC. Both these issues (1) instability in equity and debt ratio (2) cost of equity lower than the cost of debt add complexity in WACC calculation.

Another DCF concern happens when the analyst wants to determine the terminal value of a declining company. In DCF, we assume that the company being valued is an on-going basis and will grow at the country’s economic growth rate plus inflation rate during a steady-state stage.

This assumption might not hold true for the declining company. The declining company might go out of business before it reaches the steady-state stage, which puts this DCF assumption into haywire. Even if the declining company does survive and reaches the steady-state stage, it tends to grow at below economic growth rate plus inflation rate and sometimes even in a negative growth rate. These concerns add intricacies to the terminal value computation.

Issues faced when using a relative valuation method

Now, let look at the obstacles analysts face when valuing a declining company using a relative valuation method. With a declining company, earnings and book value can become inoperative very quickly. Due to the irregularity of its financial figures, the choices of multiple measurements become limited, especially if multiple measurements are in the negative territory that is very common for declining companies.

Another obstacle when using the relative valuation method is finding comparable firms for declining companies. There are two scenarios analysts face when valuing a declining company. The first scenario is when the declining firm is operating in a healthy growing industry, and the remaining companies are enjoying sound growth. The challenge here is how much discount we need to attach the declining company when comparing it to those healthy companies.

The second scenario is when the comparable companies are also in decline. We expect the company in high distress to trade lower than those in relatively lower distress. Unless adjusted for distress factor, we tend to undervalue the company in high distress and overvalue those in low distress.

Conclusion

The characteristics of the declining company — include negative growth rates, unstable equity, and debt ratios, and potential failure added complexity to the traditional valuation methods. Analysts need to be extra careful when valuing a declining company as any issues that skew DCF will also skew relative valuation. These complexities pose extra challenges that normally won’t be found when valuing a healthy company.

References

Aswath Damodaran – The Dark Side of Valuation Valuing Young Distressed and-Complex Businesses

https://www.wallstreetoasis.com/faqs/what-is-a-discounted-cash-flow-dcf

https://www.investopedia.com/terms/w/wacc.asp