Will Adobe Continue to Disappoint Expectations?

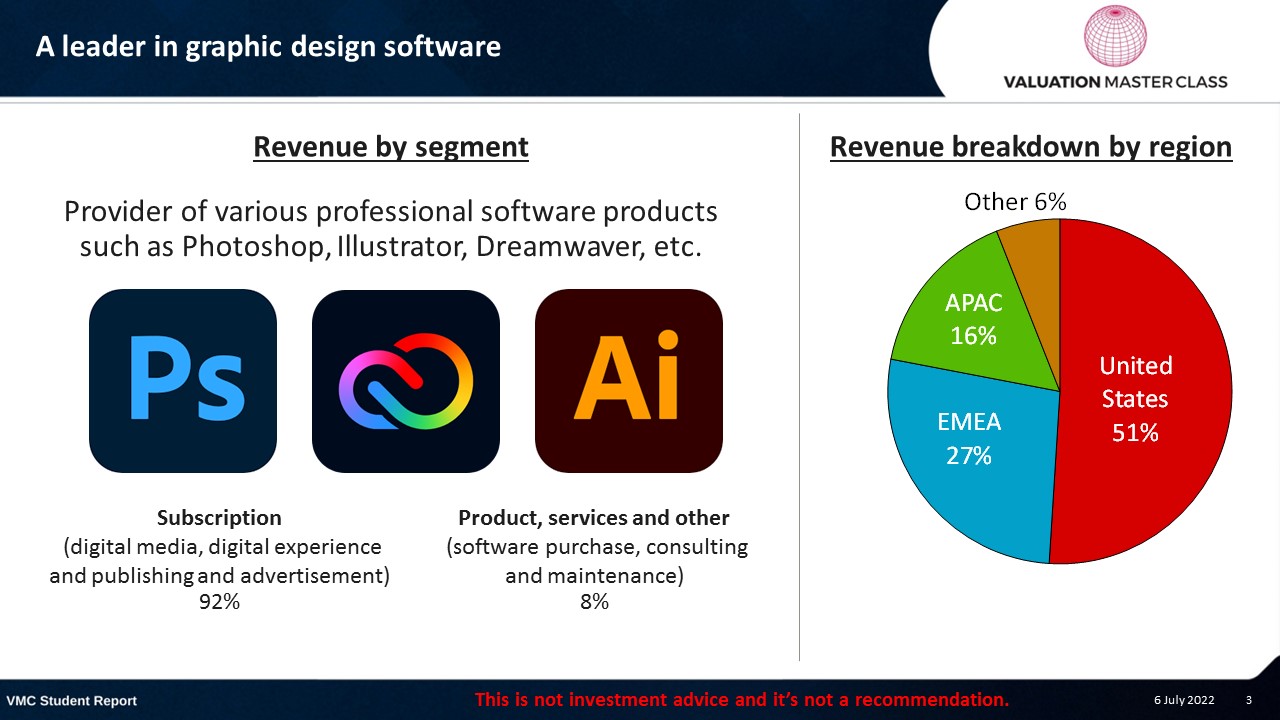

What’s interesting about Adobe is that >90% of the world’s creative professionals use its software.

Download the full report as a PDF

A leader in graphic design software

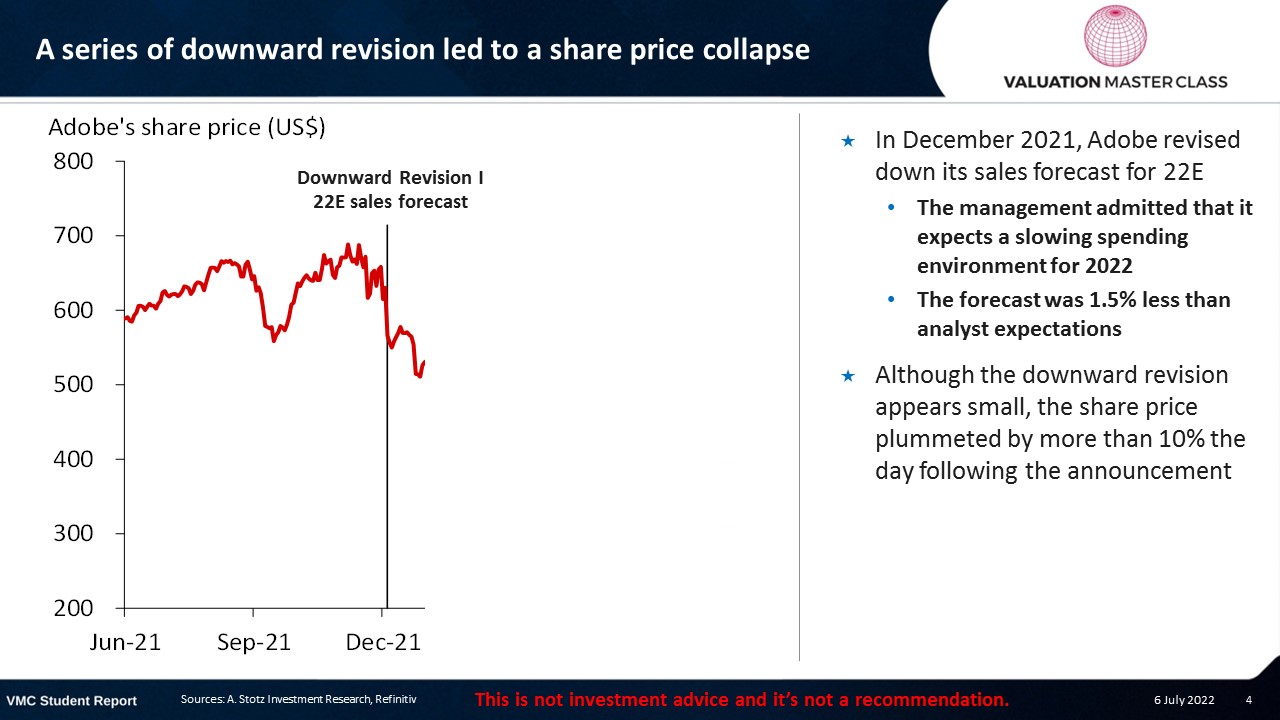

A series of downward revision led to a share price collapse

- In December 2021, Adobe revised down its sales forecast for 22E

- The management admitted that it expects a slowing spending environment for 2022

- The forecast was 1.5% less than analyst expectations

- Although the downward revision appears small, the share price plummeted by more than 10% the day following the announcement

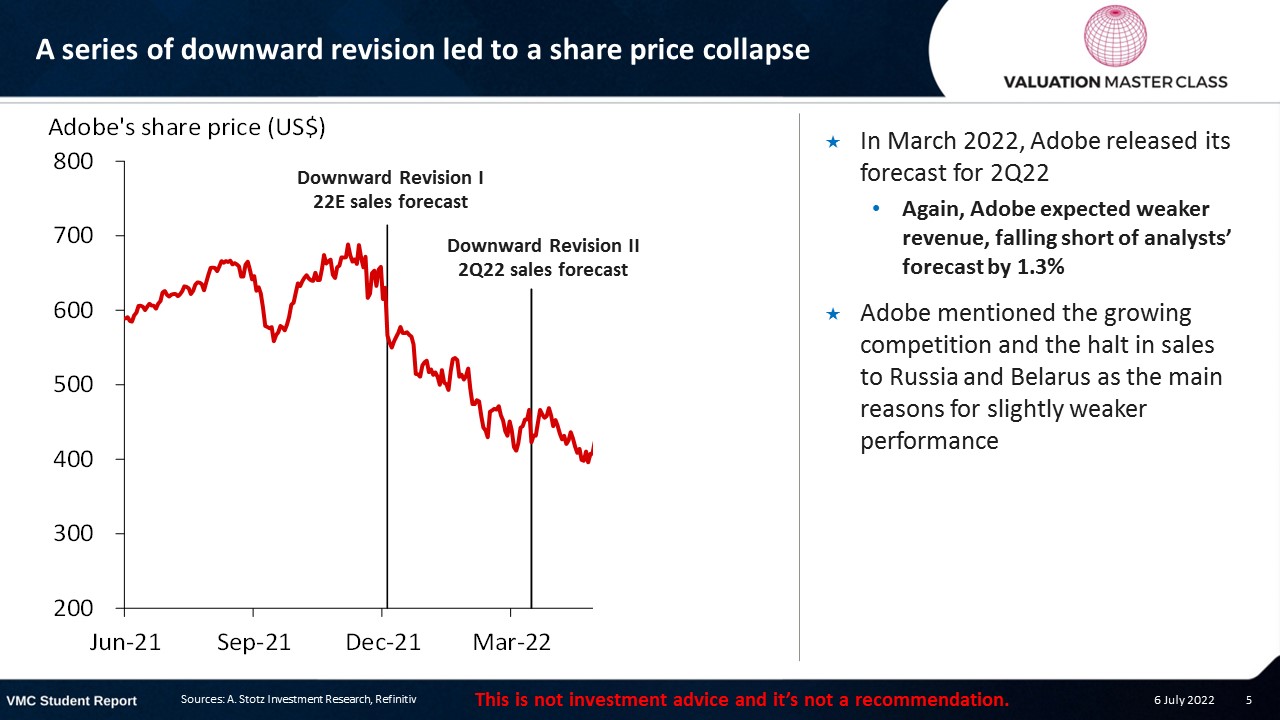

A series of downward revision led to a share price collapse

- In March 2022, Adobe released its forecast for 2Q22

- Again, Adobe expected weaker revenue, falling short of analysts’ forecast by 1.3%

- Adobe mentioned the growing competition and the halt in sales to Russia and Belarus as the main reasons for slightly weaker performance

A series of downward revision led to a share price collapse

- The latest earnings announcement was not great news for the investors as well

- While Adobe delivered a strong 2Q22, the company revised down its full-year forecast by another 1%

- Overall, Adobe’s share price has collapsed close to 50% since its highest point in November 2021

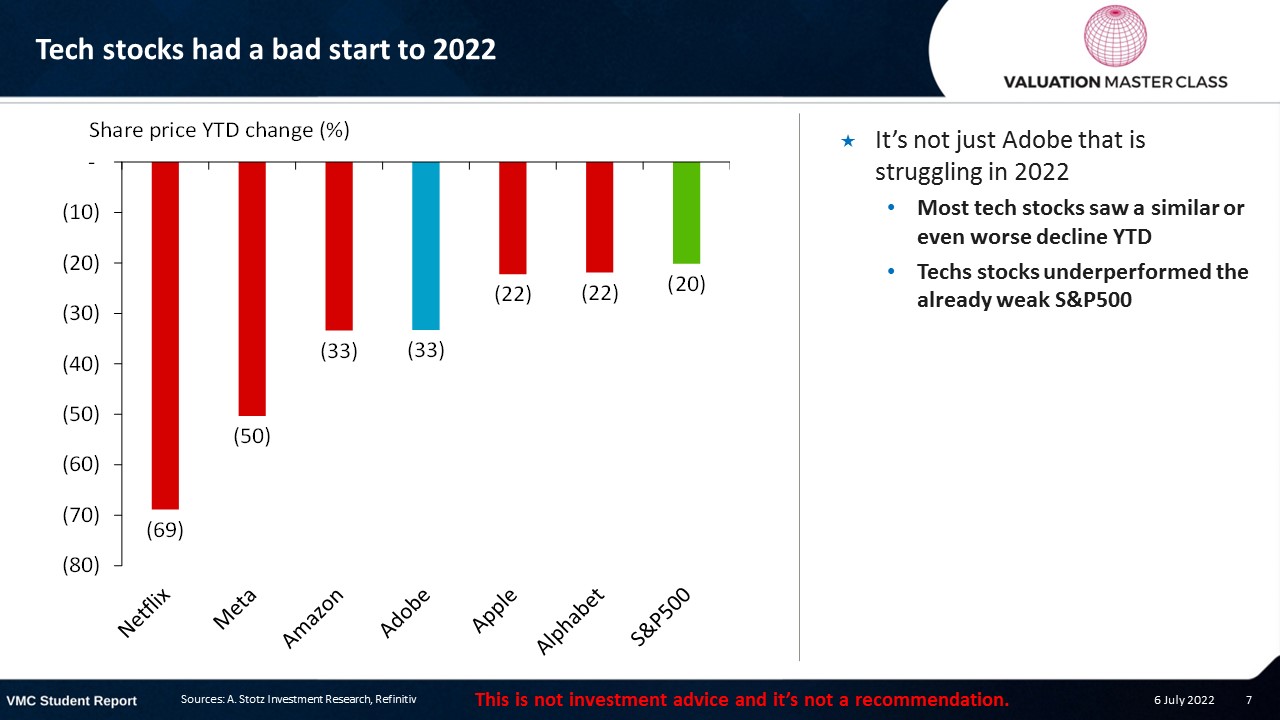

Tech stocks had a bad start to 2022

- It’s not just Adobe that is struggling in 2022

- Most tech stocks saw a similar or even worse decline YTD

- Techs stocks underperformed the already weak S&P500

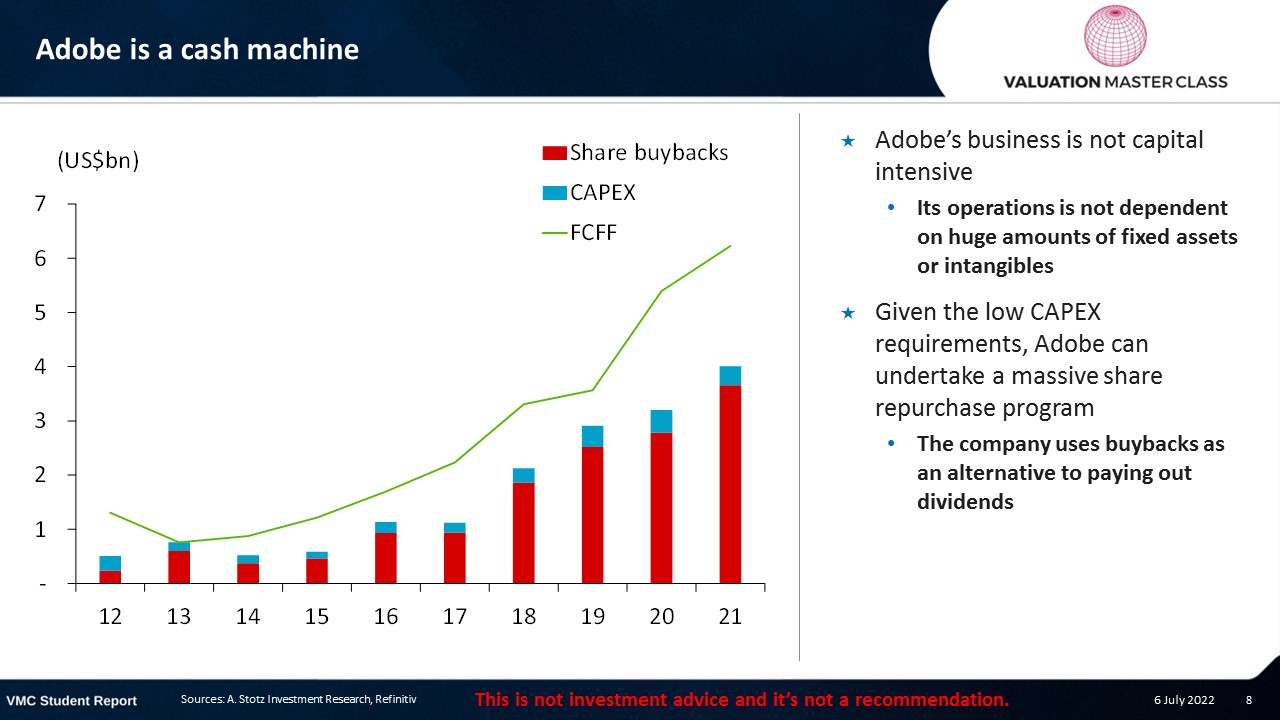

Adobe is a cash machine

- Adobe’s business is not capital intensive

- Its operations is not dependent on huge amounts of fixed assets or intangibles

- Given the low CAPEX requirements, Adobe can undertake a massive share repurchase program

- The company uses buybacks as an alternative to paying out dividends

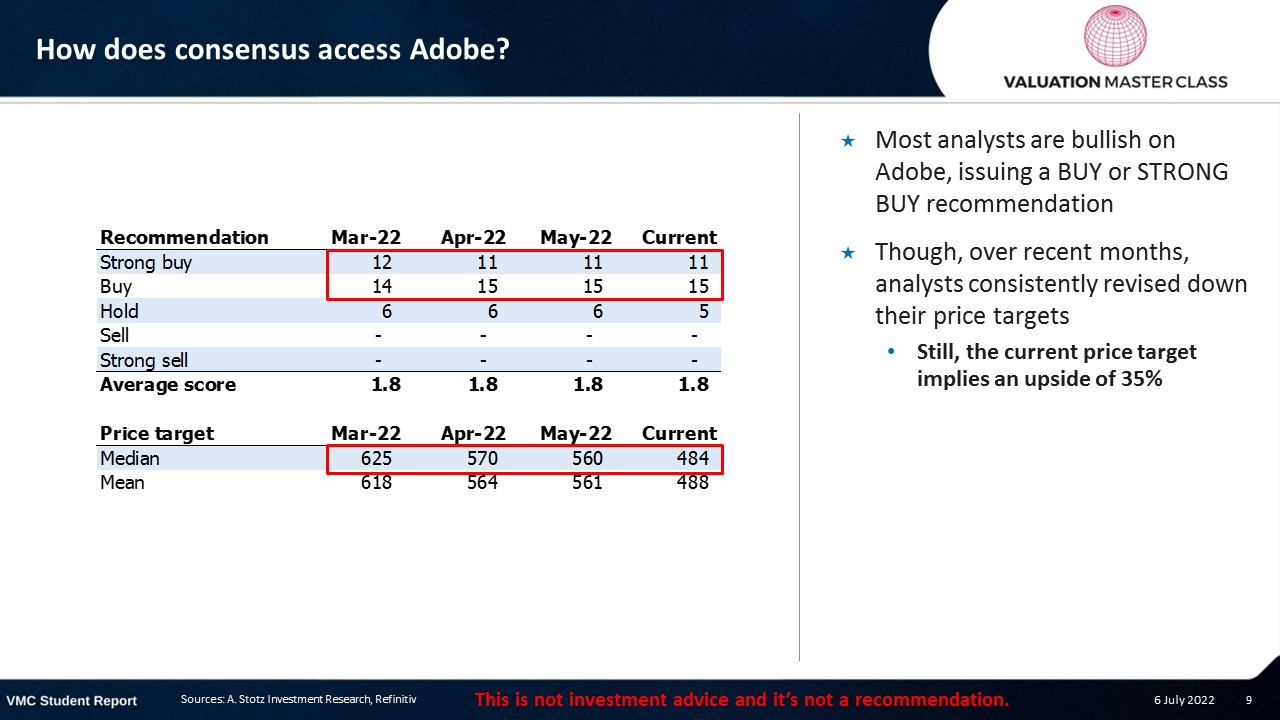

How does consensus access Adobe?

- Most analysts are bullish on Adobe, issuing a BUY or STRONG BUY recommendation

- Though, over recent months, analysts consistently revised down their price targets

- Still, the current price target implies an upside of 35%

Download the full report as a PDF

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.