Would You Bet on China-Backed SMIC to Win the Semiconductor Race?

What’s interesting about SMIC is that it’s the 5th largest chipmaker in the world

Highlights:

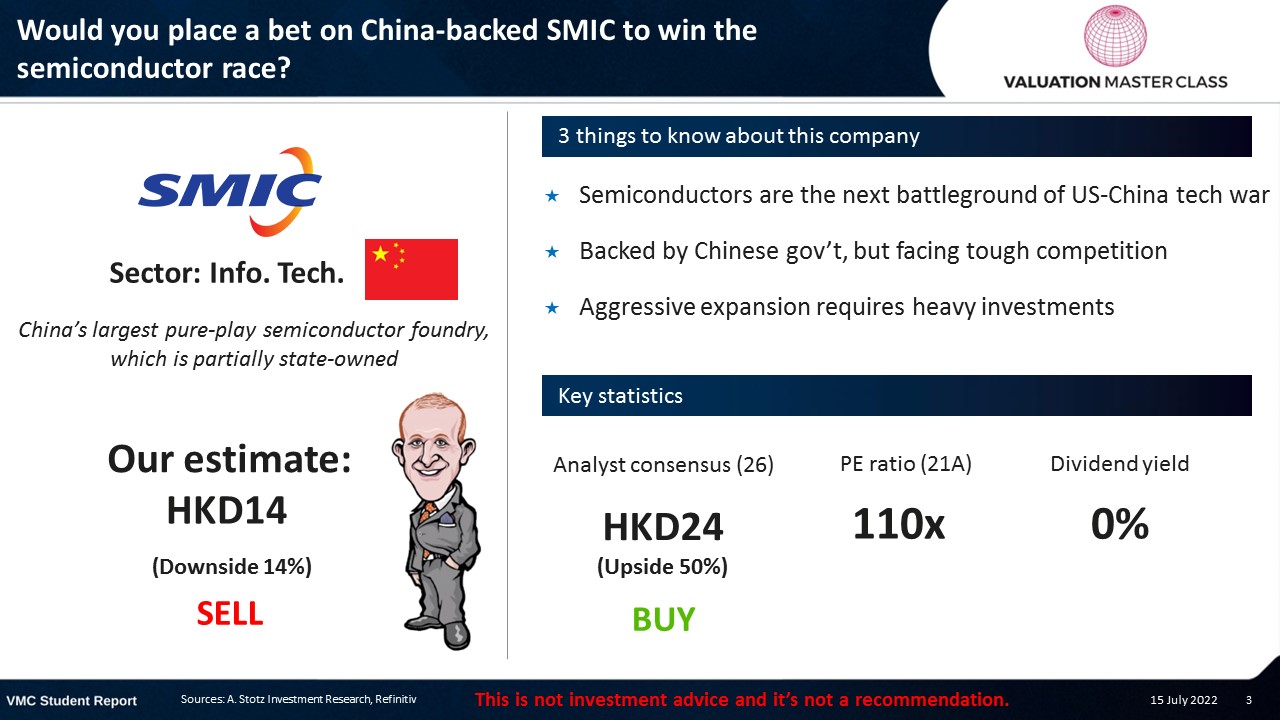

- Semiconductors are the next battleground of US-China tech war

- Backed by Chinese gov’t, but facing tough competition

- Aggressive expansion requires heavy investments

Download the full report as a PDF

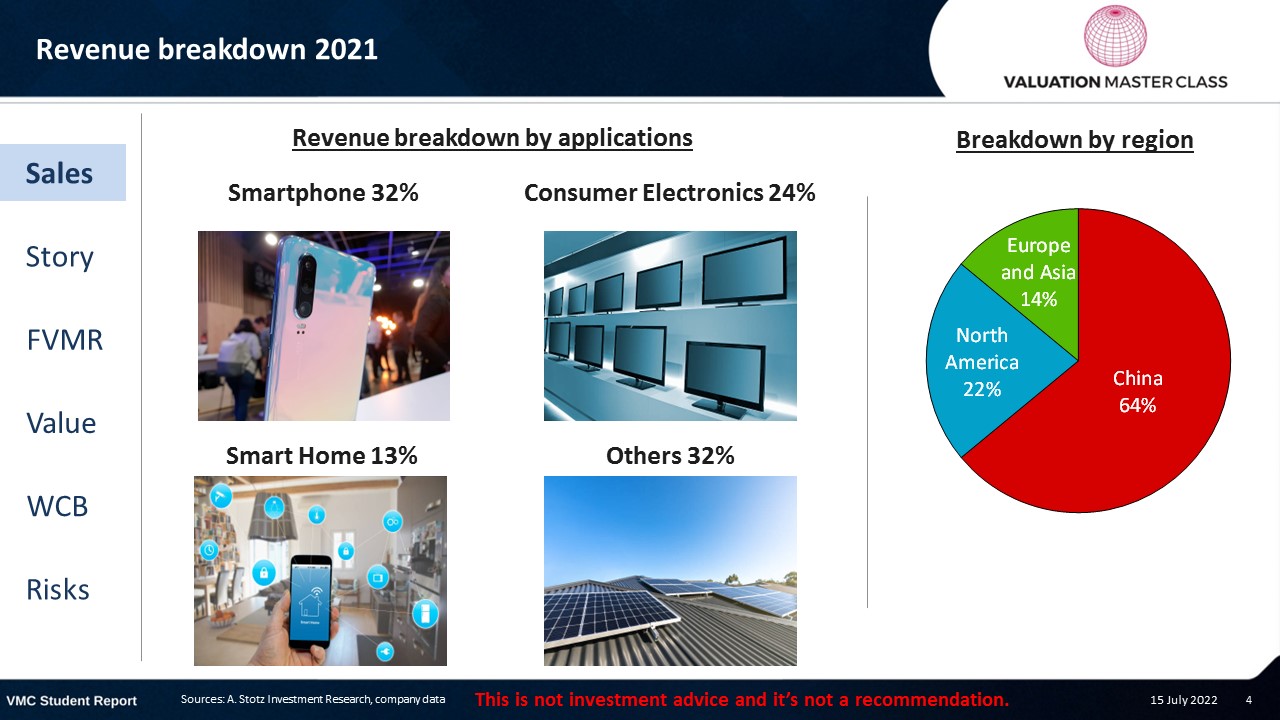

Revenue breakdown 2021

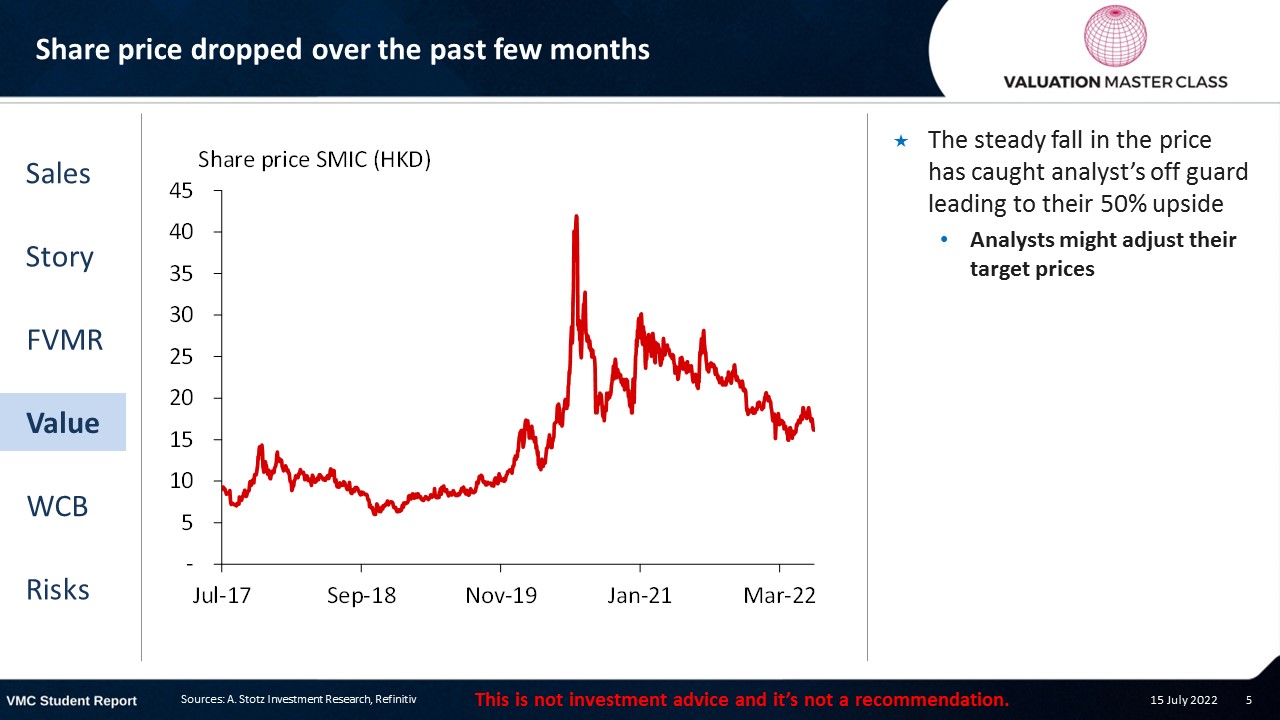

Share price dropped over the past few months

- The steady fall in the price has caught analyst’s off guard leading to their 50% upside

- Analysts might adjust their target prices

Semiconductors are the next battleground of US-China tech war

- In 2020, the US gov’t placed SMIC on the Entity List, which bans the export of US technology to the companies on the list

- Former US Secretary of Commerce Wilbur Ross said

- “We will not allow advanced US technology to help build the military of an increasingly belligerent adversary”

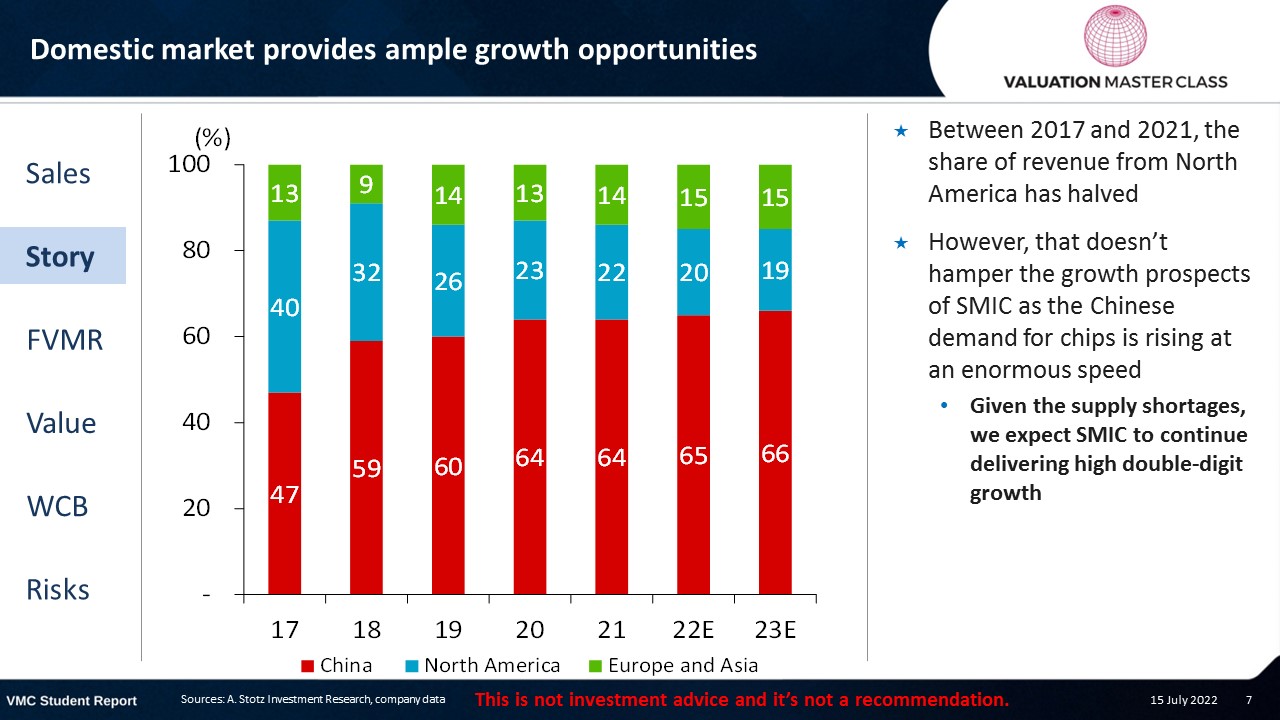

Domestic market provides ample growth opportunities

- Between 2017 and 2021, the share of revenue from North America has halved

- However, that doesn’t hamper the growth prospects of SMIC as the Chinese demand for chips is rising at an enormous speed

- Given the supply shortages, we expect SMIC to continue delivering high double-digit growth

Backed by Chinese gov’t, but facing tough competition

- China attempts to become self-sufficient in semiconductors for domestic consumption

- It aims to ramp up self-sufficiency rate to 70% within the next 5 years (currently 20%)

- To reach that goal, SMIC secured several fundings from the gov’t to accelerate the rollout of new factories

- On top of that, China granted a corporate income tax break for 10 years

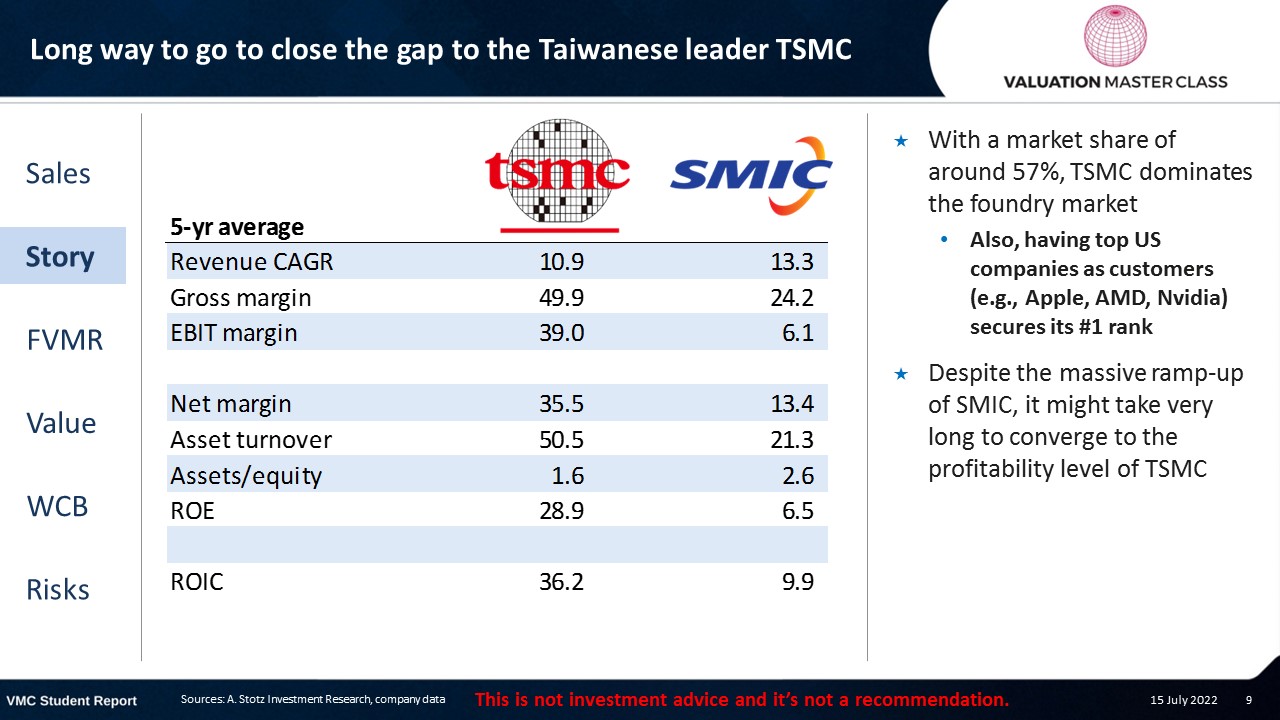

Long way to go to close the gap to the Taiwanese leader TSMC

- With a market share of around 57%, TSMC dominates the foundry market

- Also, having top US companies as customers (e.g., Apple, AMD, Nvidia) secures its #1 rank

- Despite the massive ramp-up of SMIC, it might take very long to converge to the profitability level of TSMC

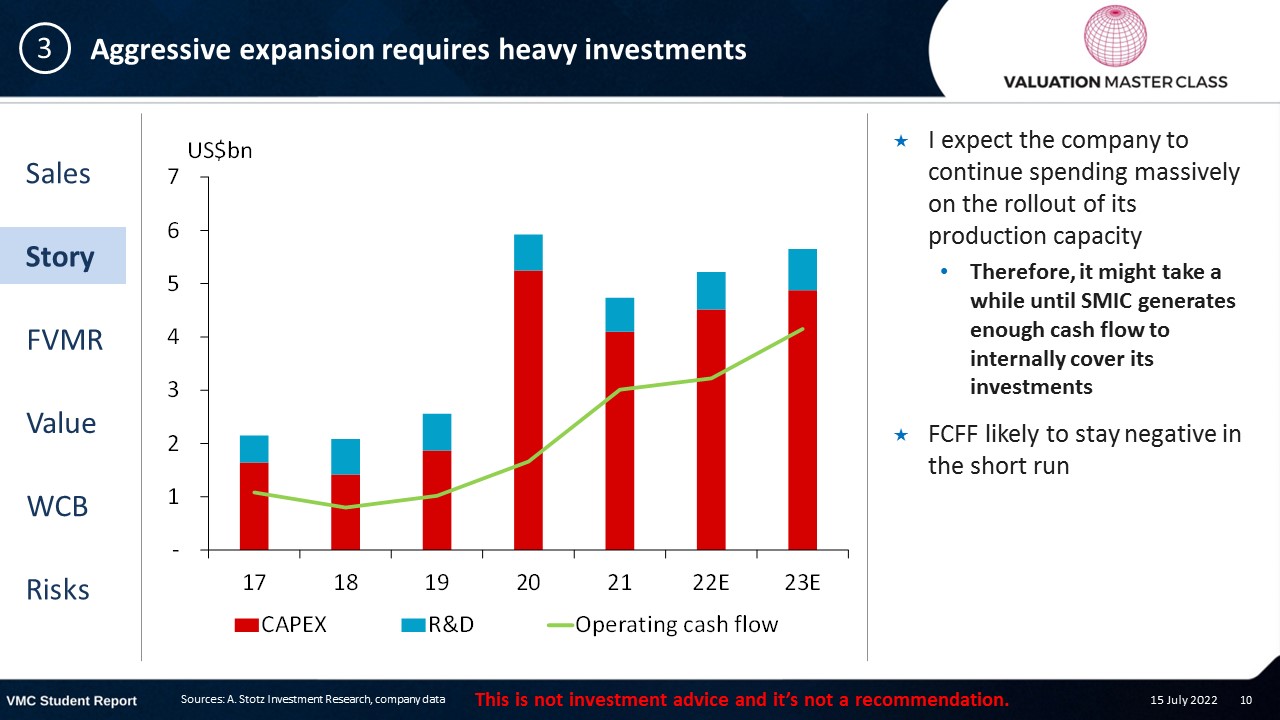

Aggressive expansion requires heavy investments

- I expect the company to continue spending massively on the rollout of its production capacity

- Therefore, it might take a while until SMIC generates enough cash flow to internally cover its investments

- FCFF likely to stay negative in the short run

Consensus is divided

- While 13 analysts have issued a BUY recommendation, many analysts stay cautious on HOLD

- Analysts predict stronger gross margin but a decline in net margin

- This is in line with our forecast due to increasing R&D expenses which are captured in SG&A

Get financial statements and assumptions in the full report

P&L – SMIC

- Despite strong revenue growth, we are likely to see stagnant net profit due to an increase in R&D and SG&A

Balance sheet – SMIC

- Net fixed assets continue to grow at a rapid pace as SMIC expands aggressively

- SMIC has moderately low leverage and being backed by the Chinese gov’t means financial risk is low

Cash flow statement – SMIC

- Rising dividends following the management’s announcement to increase dividend per share

Ratios – SMIC

- The effective tax rate continues to stay low as the company was granted tax exemptions in the context of China’s race for self-sufficiency

- The company holds 1/3 of its assets in cash, making the net debt-to-equity ratio negative

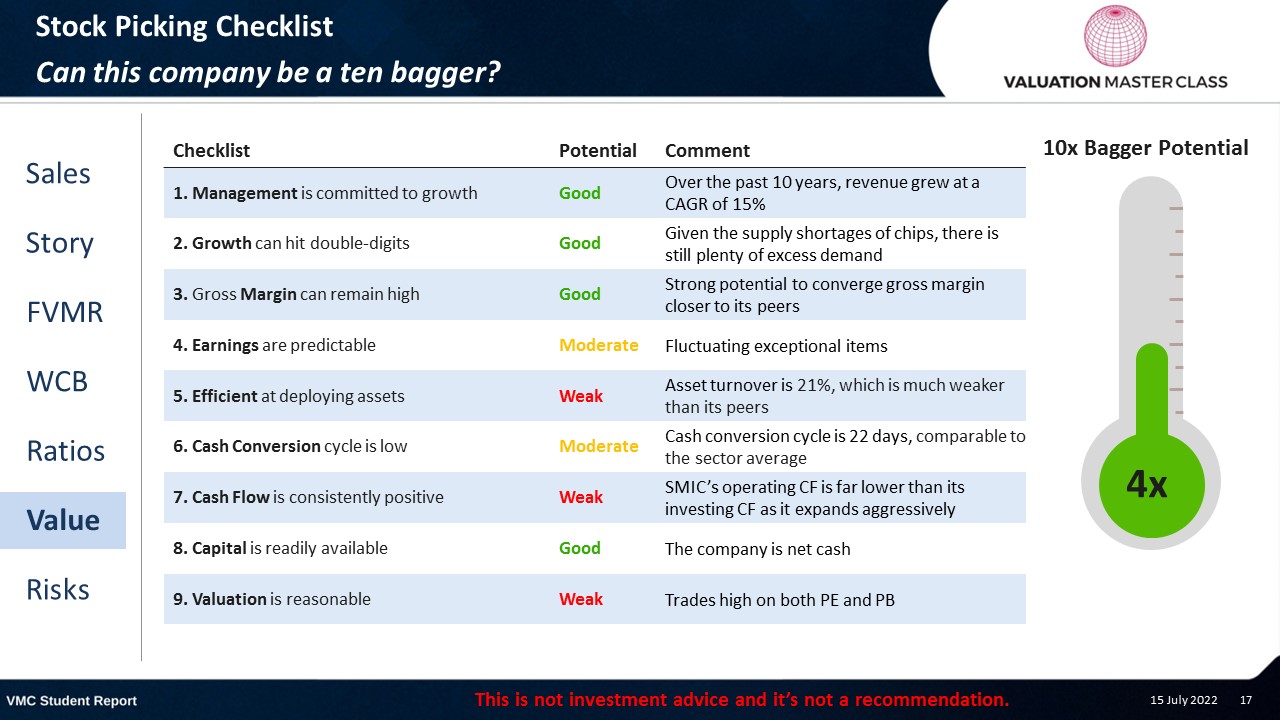

Stock Picking Checklist

Can this company be a ten bagger?

Free cash flow – SMIC

- Heavy CAPEX requirements means that the company is likely to continue seeing negative FCFF

- However, I think that the company can deliver a positive FCFF in 2024 for the first time

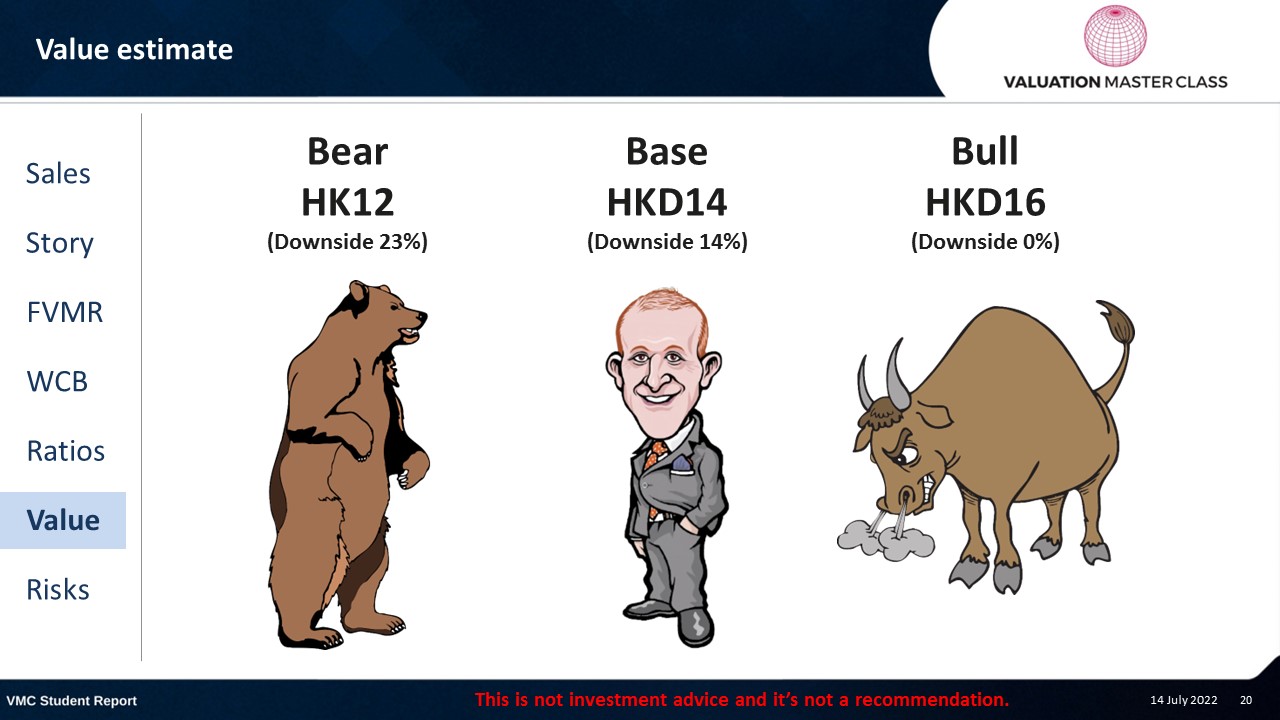

Value estimate – SMIC

- Similar to consensus, I expect that SMIC can realize its growth potential

- Plus, I assume that SMIC can increase its ROIC to 20% from 7% over the next decade

Key risk is geopolitical conflict

- Geopolitical situation may put the company’s access to raw materials and equipment at risk

- Change in preferential tax policy could adversely affect the company’s bottom-line

- Failure to keep up with technological changes and falling behind competitors

Conclusions

- Double-digit growth and backing from the Chinese gov’t

- Aggressive expansion plans could lead to ongoing negative FCFF

- Placing a bet on SMIC might turn out fruitful but it’s risky

Download the full report as a PDF

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.