Investment in Commodities

This is a Valuation Master Class student essay by Kitipop Sriparn from March 6, 2020. Kitipop wrote this essay in Module 2 of the Valuation Master Class.

Commodities are alternative investments. They can provide significant benefits to the portfolio’s diversification as well as inflation protection. They can also be used to trade based on the macroeconomic view of traders, such as arbitrageurs or speculators. And, of course, some producers have exposures on commodity prices considering hedging their risk, leading the commodity markets are sometimes said fascinating because of the mixture of traders. These traders drive the market by simple equations introduced in the context based on their view and how well they are informed.

What are commodities? Who are the leading market participants?

Commodities are goods that are either consumed or processed and then resold, such as crude oil, aluminum, corn, hogs, or sometimes it can be used as a store of value such as gold. These products are typically driven by demand and supply of economy in any given economic situation. From this point, the price of commodities is used as indicators to assess the overall economy or healthiness of a specific industry. For instance, when economic is healthy, demand for oil typically rises due to increasing consumption in household sectors, which required manufacturers to expand the business, in which oil-related products are used to facilitate the business in a supply chain process.

Although there are some spot markets on crude oil, they are less liquid. Most commodity markets are forward markets as the products take time to process, and naturally, they are bought ahead to reserve needs. Commodity markets have not only hedgers who are considered as informed investors as they either produce and use the commodity. They use the position in forwarding contract to manage their risks, but some traders are speculators- seeking to exploit information to profit and arbitrageurs- seeking to profit from the differences between spot and future prices (when the difference is too large, arbitrageurs can buy and store the commodity and sell it as its high future price).

Commodity valuation

Commodities products are unlike financial products since they are physically delivered with custom terms, meaning that they have to be processed, stored, and transported before settlement. Also, they have no cash flows; hence they cannot be valued by discounting future value to present value like stocks or bonds (capital assets). Instead, we do a simple valuation as

Net carry refers to financing costs, storage, shipping, and insurance. Recall that since it has no cash flows, thus there is always a negative carry in the commodity world, meaning that theoretically, forward prices should always be higher than spot prices. However, in reality, it is not. Introducing the convenience yield, which sometimes used to explain the concept of backwardation, a form of the calendar spread where near term forward price is higher than further (F1>F5), convenience yield is defined as “the premium that a consumer will pay to take delivery of the commodity now rather than in the future” which now bring an equation into

The equation suggests that the convenience yield is high when the market is in backwardation, and be zero when the market is in contango, where further date forward price is higher (F1<F5). This is known as the “Theory of storage.”

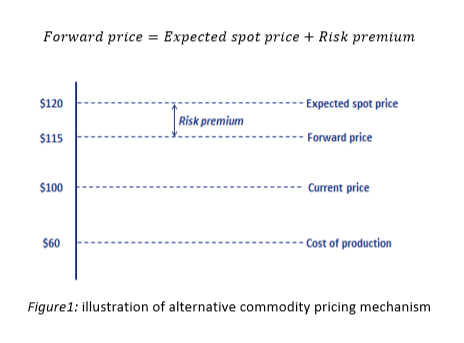

As usual, pricing is not as easy; there is an alternative view of the commodity pricing model. Suppose that we stay at the start of the year, and the market believes that the spot price will increase to $120 / BBL by the middle of the year. This is an expected spot price. Now, we go to sell our production forward to a speculator who offers only $115 / BBL as if the market is correct; he will make $5 / BBL. The speculator then earns a premium of buying relatively low and sells at market price. This is a reward for him to take the risk (see figure1). All of this discussion contributes to the new equation introduced by Keynes as an “Insurance Theory” and often referred to normal backwardation where the future price will be less than current spot price to provide a return to a speculator who buys from producers who sells the products forward because of fear of uncertainty.

Beneficial aspects of investing in commodities

Inflation hedge, commodities are driven by demand and supply. Now, think about when demand is more than supply (business firms demand commodities to produce). Commodity prices typically rise to reflect, leading to inflation in the economy. Consequently, if we invest in products, we can appreciate the accelerating of inflation.

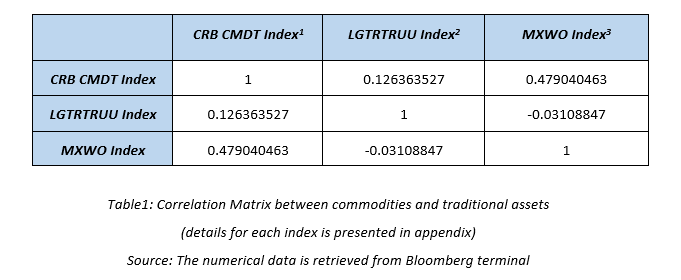

Furthermore, it is evidenced that commodities have low correlations with traditional asset classes (see Table1).

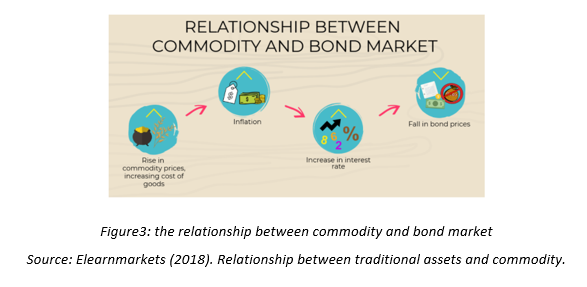

Rising inflation will cause the interest rate to increase, which mitigate the value of coupon received periodically, leading to bond devalued. Hence, there is an inverse relationship between both.

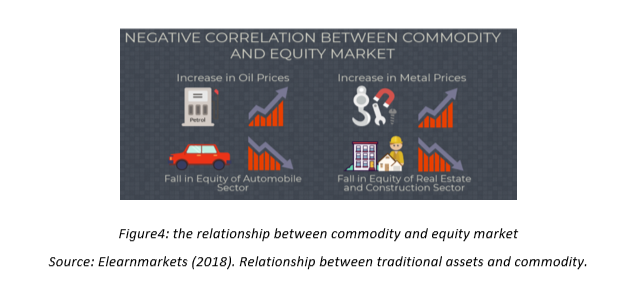

Despite the incremental price of commodities appreciated by oil producers, numerous stocks dislike this. The business that uses commodity as inputs will exhibit higher production cost, which deteriorates the company’s profit, which as a whole drive down the index.

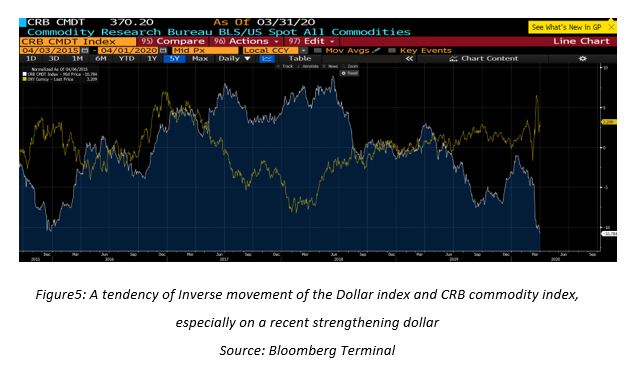

Lastly, simultaneous USD and commodity trade, since commodities, global assets, are quoted as USD, meaning that if the dollar weakens, buyers of commodities are required less of local currencies for buying. Hence they want to buy more, contributing to the higher price of commodities. In this way, speculators who participate in both FX and commodity markets may use this as an opportunity to trade. They can conduct an FX trade through buying a commodity to store and resell when dollar strengthening. For another alternative, which is probably more advanced, is conducting geographic arbitrage by combining commodity valuation formula with FX rate to estimate net carry on a particular strategy.

Investment in commodities is somewhat fancy, but required both theoretical and practical knowledge, and may also require investors to analyze further on the specific products when making a decision to invest. Investors are encouraged to identify current investment whether the portfolio is a well-diversified portfolio or whether it is protected from rising inflation. If not, commodities could be an answer.

References

Bodie, Z., Kane, A. & Marcus, A. (2014) Investments, 10th International Edition, McGraw-Hill, New York

Fama, E. F., & French, K. R. (2016). Commodity futures prices: Some evidence on forecast power, premiums, and the theory of storage. The World Scientific Handbook of Futures Markets (pp. 79-102).

Schofield, N. C. (2011). Commodity derivatives: markets and applications (Vol. 570). John Wiley & Sons.

Geman, H. (2009). Commodities and commodity derivatives: modeling and pricing for agriculturals, metals and energy. John Wiley & Sons.

Yau, J. K., Schneeweis, T., Robinson, T. R., & Weiss, L. R. (2007). Chapter 8: Alternative Investments Portfolio Management. CFA Institute Investment Books, 2007(4), 477-578.

Saloni Sardana. (2019). The relationship between commodities and traditional assets.

Elearnmarkets. (2018). Relation between equity bond and commodity.

Chuck Kowalski. (2020). How the Dollar Impacts Commodity Prices.

Bloomberg L.P. (2020). Total Return Index. Retrieved March 3, 2020, from Bloomberg terminal.

Bloomberg L.P. (2020). CRB Commodity index and CPI YOY index chart. Retrieved March 3, 2020, from Bloomberg terminal.

Bloomberg L.P. (2020). CRB Commodity index and dollar index chart. Retrieved March 3, 2020, from Bloomberg terminal.